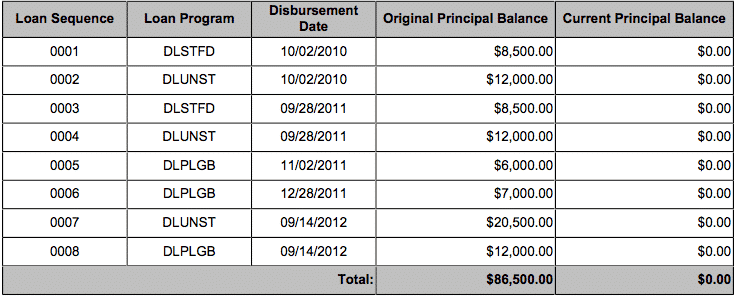

One of the first blog posts I ever wrote was a post which broke down exactly how I paid off $87,000 worth of student loans in just 2.5 years. It’s proven to be one of my most popular posts – probably because so many people are looking for guidance on how they can pay off their student loans too.

When I look back at it, one of the main reasons I was able to pay off my student loans as fast as I did was because I took the time to refinance them to a lower interest rate. At the time (back in 2015), student loan refinancing was sort of a new thing – companies like SoFi, Commonbond, Earnest, and others were only a few years old or had just started.

Naturally, with student loan refinancing being a pretty new thing, I didn’t know much about it and so, I didn’t refinance my loans when I graduated. I ended up spending the first year of my debt payoff journey paying my student loans at the ridiculously high-interest rates of 6.8% and 7.9% – the default rate that you get on student loans from the government.

It wasn’t until my second year of repayment that I finally refinanced my student loans, first refinancing them to a 4.3% interest rate, then refinancing them again all the way down to a 1.93% interest rate. As you can imagine, the lower interest rates led to huge cost savings for me and helped me crush my student loans much faster than if I had been paying them like a normal person. Considering how beneficial refinancing your student loans can be, it’s a little bit surprising to me how many people either don’t do it or wait way too long to do it (to be fair, I did the same thing).

I think what holds a lot of people back from refinancing their student loans is confusion. There are a lot of things to think about. Which company should you refinance your student loans with? Should you refinance them at all? How does refinancing work exactly? With so many questions and without a clear path to follow, most people follow the path of least resistance and opt to do nothing.

After going through the student loan refinancing process multiple times (and still going through them again now that my wife is paying off her student loans), I’ve figured out what I think is the optimal way to refinance your student loans for maximum value.

What follows is a guide that I’ve put together to help walk you through refinancing your student loans in what I think is the best way possible to get the most bang for your buck.

What Is Student Loan Refinancing?

First things first, some of you might wonder what student loan refinancing is. It’s pretty simple. Essentially, when you refinance your student loans, you’re taking out a new loan and paying off your old loan with that new loan. After that, you now have a new loan – ideally at a lower interest rate. Your old loan is now paid off and should have a balance of $0, while your new loan has whatever amount you took out to refinance.

So, for example, if you have a $100,000 student loan, and refinance that loan, you now have a new loan for $100,000 and your old $100,000 student loan is now paid off with a $0 balance. You now make all your payments towards your new, refinanced student loan.

The thing most people don’t realize is that refinancing your student loans doesn’t cost you anything. It’s not like a mortgage where you have to pay closing costs, origination fees, and things like that. When you refinance a student loan, there are no closing costs, no origination fees, and no prepayment fees. What you’re doing is literally getting a new loan, paying off your old loan with that new loan, and then making your payments towards your new loan instead. Since your refinanced loan should have a lower interest rate, more of your payment will go towards principle, which means that: (1) you’ll pay less interest, and (2) you’ll pay off your debt faster.

The other thing most people don’t realize is that refinancing your student loans is not a one-and-done deal. You can refinance your student loans as many times as you want. If a rate you get with one company isn’t as good as you want it to be, just refinance it again! It costs nothing to do that. What’s important here is that since we can refinance our student loans as often as we want, we can optimize our student loans by refinancing with different companies in order to gain access to the perks or collect signup bonuses.

Should You Refinance Your Student Loans?

So who should refinance their student loans? Obviously, everyone’s situation is unique, so you need to think about whether it makes sense for your particular situation. In general, I think that you should refinance your student loans if the following two things apply:

- You aren’t going for any sort of federal loan forgiveness program; and

- You’re planning to pay off your student loans as fast as possible.

For most people, refinancing your student loans will make sense. Really, the only people that I think shouldn’t refinance their student loans are people who are planning to work in public service for a really long time or medical people who are doing a really long residency. For almost everyone else, it probably makes sense to refinance and pay those student loans off as fast as you can. That’s what I did and I think it has worked out well for me.

The Optimal Student Loan Refinancing Strategy

Now that you’ve decided to refinance your student loans, here’s the way I recommend you do it.

1. First, refinance your student loans with SoFi. I’ve personally refinanced my student loans with the three biggest student loan refinancing companies and SoFi is the company that always stands out above the rest. Here’s why.

In the grand scheme of things, student loan refinancing companies are all pretty much the same. As long as you’re getting a good interest rate, there’s really not much to differentiate each company from the other. Since they’re all pretty much the same, you have to look at the perks that they offer.

SoFi does something that no other student loan refinancing company seems to do – SoFi events. Over the past three years, I’ve received literally thousands of dollars worth of free food, drinks, tickets, and travel from attending events hosted by SoFi. These include:

- Going to multiple fancy dinners at restaurants in my city (each dinner would easily cost $100 per person)

- Attending happy hours hosted by SoFi at fancy cocktail bars

- Attending a debt payoff party in New York City

- Going to the Big Ten Championship in Indianapolis and watching the game from the SoFi suite (and chowing down on free food and drinks in the suite and in the VIP pre-game area)

- Tickets to see the X-Games, along with free food and access to the SoFi VIP lounge

- Tickets to see West Side Story at the Guthrie Theater, along with free drinks and food before the play

- A Halloween Party at Mill City Museum, along with free access to the museum after hours

I’ve gone to so many SoFi events that I can’t describe all of them in detail, but I’ve written about my experiences attending some of these SoFi events before and you should definitely read these posts if you want to learn more about what these events are like. Long story short, these SoFi events are legit.

- A Weekend In New York City, Compliments of Hyatt and SoFi

- How I’ve Received Thousands Of Dollars Worth Of Free Stuff From Refinancing My Student Loans With SoFi

The amazing thing is that, even after you’ve paid off your student loans, you’re still eligible to attend every single SoFi event. That’s because SoFi says that once you’re a SoFi member, you always remain a SoFi member. In my opinion, at a minimum, you should refinance your student loans at least once with SoFi so that you can gain access to all of these SoFi events. If later you find out that you’re not happy with the rate or want a lower rate, refinance your loans again with another company (more about that below).

I haven’t had a SoFi student loan since 2015 and I still go to SoFi events every time they host an event in my city. Refinancing with SoFi was definitely worth my time when you think about all of the free stuff I’ve received from them and it’s the reason I tell everyone to refinance their student loans with SoFi first.

As a bonus, if you refinance with SoFi using this link, you’ll get a $100 signup bonus.

2. Once you’ve refinanced your student loans, use Credible to see if any other student loan refinancing company can offer you a lower interest rate. As mentioned previously, most people don’t seem to understand that you can refinance your student loans as many times as you want – and really, you should refinance your student loans multiple times in order to get the lowest interest rate and the most signup bonuses.

As I mentioned above, I personally refinanced my student loans three times over the course of a year in order to get as many signup bonuses as I could and to make sure that I got the lowest interest rate possible. That’s why my student loan interest rate went from 6.8% and 7.9%, down to 4.3%. and then down again to 1.93%.

A great way to get the lowest possible interest rate is to use a student loan search engine that can get you rates from a variety of different student loan refinancing companies. Credible is a search engine that gathers quotes from every student loan company – think of it like the Kayak or Expedia of student loans.

The benefit of using Credible is that you can be pretty confident that you’re getting the lowest rate possible since it’s able to check student loan interest rates from multiple companies. Credible also gives you a $300 bonus if you refinance a loan using their search engine, so there is a legit benefit to refinancing your student loans using their platform. Refinance your loans using Credible and get a $300 bonus

So, that’s my student loan refinancing strategy. To quickly recap, I think most people should do the following two things in order to optimize their student loan refinancing:

- First, refinance your student loans with SoFi and get a $100 signup bonus and access to all of the SoFi Events. When you refinance your student loans with SoFi, you’ll not only get a lower interest rate than what you’re currently paying, you’ll also gain access to all of the SoFi member events, which can result in thousands of dollars worth of free stuff – way more than any other student loan refinancing company offers. Remember, you get to keep going to these events even after you’ve paid off your SoFi student loan, so it’s very worth it to refinance your student loans with SoFi at least once. Plus, you get $100 if you use my link.

- Second, if you think you can get a lower interest rate, refinance your student loans using Credible to get a $300 signup bonus. Student loan interest rates change pretty regularly, so it’s worth using Credible to see if there are lower rates out there. Plus, why not snag a little extra signup bonus money by refinancing again? Remember, even after you’ve refinanced your student loans, you’ll still be able to go to all the SoFi member events, so it’s in your interest to refinance your student loans as many times as you need to in order to get another signup bonus and possibly a lower rate.

Things To Remember When Refinancing Your Student Loans

Here’s a final list of things to keep in mind when refinancing your student loans:

It’s A Hard Credit Pull Once You Actually Submit An Application. For all of these companies, checking to see what interest rate you’ll be offered is a soft pull that has no impact on your credit. The hard pull only comes into play when you actually pull the trigger and submit an application to refinance your loans. For most people, this won’t matter too much. A couple of hard credit pulls won’t really mess with your credit very much and they only affect your credit score for a year. I’m really big into travel hacking and get 8 or more hard pulls every year and my credit score has never noticeably changed (my credit score always fluctuates between high 700s and low 800s). After a year, you’ll forget that you even had a hard pull. That’s not to say hard pulls don’t matter, but they aren’t as big a deal as some people might make you think they are.

Remember To Pay Off Your Old Loan. Student loans accrue interest daily. As a result, it’s sort of hard to figure out exactly how much you need to borrow for your student loan refinance. Remember that when you refinance your loan, you’re basically taking out a new loan and paying off your old loan with that new loan. Every time I refinanced my student loans, I was always left with a few bucks outstanding on my old loan. Just make sure to pay that off so that your old student loan balance is actually down to zero.

Don’t Keep Extending Out The Life Of Your Loan. A lot of people only look at the monthly payment. You could definitely keep refinancing your loans and make your monthly payment smaller and smaller – but that’s sort of missing the point. Student loans suck. Instead of extending out the life of your loan, just use the lower rate to make more of a dent on your loan.

Be Careful If You’re Going For Any Sort Of Loan Forgiveness. If you’re going for some sort of loan forgiveness program, the answer is pretty simple. Don’t refinance your debt. If you’re a doctor with a ton of debt and doing a long residency, you may want to keep your federal student loans and go for public service loan forgiveness. For most other professions, public service loan forgiveness might not be worth it unless you’ve got some ridiculously high student loan balance.

Federal Protections Are Probably Overrated. One of the most common arguments I hear to not refinance your student loans is that you want to keep those “federal protections.” I suppose it’s true that, if something happens to you, federal loans will allow you to go into forbearance or deferment for a while. The thing is, since I think most people should pay off their debt quickly, you’re basically paying extra for something you probably don’t really need. In addition, these student loan refinancing companies also offer benefits if something like a job loss were to happen.

It Costs Nothing To Refinance. I think this is something that really confuses a lot of people. Refinancing a home mortgage costs money, so most people assume that it must cost money to refinance a student loan. In fact, it costs absolutely nothing to refinance your student loans – no origination fees, no closing costs. Nothing! Basically, you have no reason not to refinance if it makes sense for you.

I hope this student loan refinancing strategy guide was helpful. Feel free to hit me up if you ever have any questions.

– Kevin (aka Financial Panther)