One of the things I enjoy about the current state of the side hustling world is just how easy it is to fit various side hustles into your day-to-day life. We live in a really unique time in history where it’s actually possible to piecemeal a few bucks here and there whenever you want.

When you think about it, even just 10 years ago, things were vastly different. All of these gig economy and sharing economy apps didn’t exist yet and if you wanted to make extra money, you basically had to find a part-time job or create your own side hustle. A part-time job meant that you had to work shifts with no flexibility or ability to incorporate whatever you were doing into your day-to-day life. And creating a side hustle often required capital and time to actually build it up so that it earned income.

The big thing was that you couldn’t just go out and make 5 or 10 bucks randomly when you felt like it. Contrast that with today’s world, where I can literally turn on my phone, step out of my front door, and make 5 or 10 bucks with a few minutes of work using any of the sharing or gig apps I have on my phone.

There’s a lot of power in being able to earn income in small, piecemeal chunks like this. Not all of us have the time to go out and work several hours a day on some side project in the hopes that it generates an income eventually. But I bet most of us can spare thirty minutes or an hour each day doing something from one of the many sharing economy and gig economy apps out there. In fact, many of us can probably fit these different gigs into the things we’re already doing.

And if you’re willing to do this, you can literally become a millionaire and financially independent without doing anything else. You just have to take advantage of something you could call, the Reverse Latte Factor.

The Latte Factor Versus The Reverse Latte Factor

The Latte Factor is something that many of us in the personal finance community have heard about. Initially coined by David Bach in his book The Automatic Millionaire, it basically tells you to cut out small, frivolous expenses in your day-to-day life, invest the savings, and over time, you’ll have a lot more money simply due to the power of compound interest.

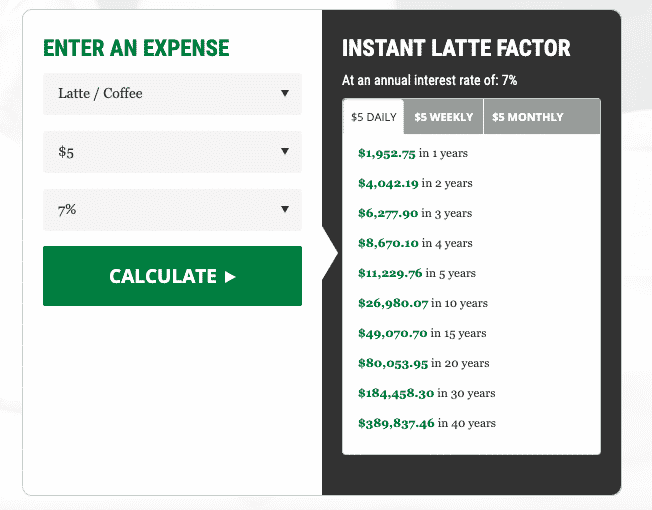

Bach has a calculator on his website that shows you just how powerful saving small amounts on a daily basis can be. For example, according to his Latte Factor Calculator, saving $5 per day at an annual return of 7% adds up to over $180,000 over the course of 30 years.

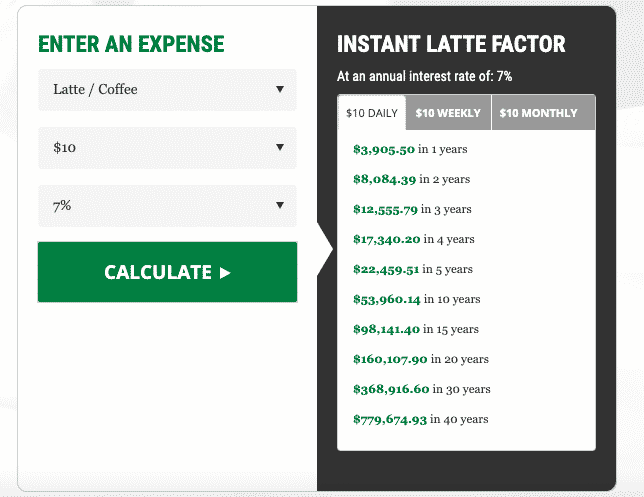

Double that to just $10 per day and naturally, you double what you’ll have in 30 years – to over $360,000.

The latte factor is a bit of a contentious topic because, for many, it’s not these small expenses that are hindering financial progress, but rather larger issues, such as stagnant wages and the high costs of education, housing, and healthcare.

I totally agree with that assessment, but I think a lot of the latte factor hate misses the point that it’s really making – that consistency matters. Small things by themselves don’t mean much. But small things, done consistently over time, well, that means something.

The thing that always confused me about the latte factor was how it emphasized all of the lost opportunity that comes with daily frivolous spending, but never seemed to consider the opposite – that is, the lost opportunity that comes with not going out and earning extra income on a consistent, daily basis.

This is a much more interesting way to think about the latte factor. Because if saving small amounts of money each day adds up over time, what happens if we go out and earn small amounts of money each day?

There’s an opportunity cost with not going out and earning extra income on a consistent basis. And all of us have the ability to do this. When we choose not to, we’re really missing out on something.

We can call this the Reverse Latte Factor. And here’s how impactful it really is.

The Reverse Latte Factor And What It Means

Below is a chart showing what you could have in 30 years if you consistently make an extra couple of bucks every single day and invest all of it (the chart assumes a 7% average annual rate of return, which I think is a reasonable assumption).

| Amount Earned Per Day | Total in 30 Years |

|---|---|

| $5 | $184,458.30 |

| $10 | $368,916.60 |

| $15 | $553,374.90 |

| $20 | $737,833.20 |

| $25 | $922,291.50 |

| $30 | $1,106,749.80 |

The math is pretty amazing because if I’m looking at this right, what it means is that a mere $10 per day of extra income comes out to over $300,000 over a 30-year period. If you double that to $20 per day, you’re looking at over $700,000. Triple it to $30 per day, and you’ll be a millionaire literally from doing random, low-level gigs that most people will think are pretty stupid.

This is pretty incredible to think about. Depending on where you live and what’s around you, an extra $30 per day is completely possible. Most people, with a little bit of practice, can make that in an hour or a little over an hour just by taking advantage of gig economy apps.

Just looking at how I typically make an extra $30 or more per day:

- Earn $16-$25 by grabbing four to six Lime scooters in the evening, charging them up overnight, then dropping them off in the morning on my way to work. This is easy for me to do because there are usually dozens of scooters all around my neighborhood at the end of the day.

- Earn $10-$20 delivering food on my bike on my way home from work. And since I’m doing my deliveries on a bike, I’m getting the added benefit of exercising too – which is something I have to do anyway.

- Earn $11 to $16 walking some dogs with Wag during lunch. This isn’t difficult for me to do since my coworking space is downtown and there are a lot of apartments within blocks of me. And like with biking, it gives me exercise, which I have to do anyway.

To understand what an extra $30 per day means, that equals just $913 of extra income per month. This is totally doable for most people given the current landscape of the sharing and gig economy. Indeed, over the past three years, I’ve regularly earned between $1,000 and $3,000 per month just by doing these different, sometimes silly sounding, gigs.

Heck, even just an extra $10 per day adds up to a significant sum over time – and I don’t think it’s unreasonable to think that anyone can do that with 30 minutes or less of work each day. If we believe that our daily latte can cost us hundreds of thousands of dollars over our lifetime, the same is true for those of us simply unwilling to go figure out ways to earn a few extra bucks each day. In other words, the Reverse Latte Factor really means something.

Takeaways

The Reverse Latte Factor is an important thought experiment about how impactful small amounts of extra money added up consistently over time can be to your finances. And the beauty of the Reverse Latte Factor is that it doesn’t require you to give up all of the little pleasures in your life.

I have so much fun doing all of these different gigs. And my guess is most of you reading this can probably find something that makes you money that you also find fun to do. Cutting stuff from our budget though, where’s the fun in that?

To sum it all up, earning an extra $5 each day might not seem like a big deal. But keep doing that every single day, and suddenly, it means something. It costs us much more than we think to sit around and not take advantage of all of the ways to earn extra income each day.

If you understand this, it might make the Reverse Latte Factor something that you really need to think about more.

Are there any examples of sharing or gig economy apps that you have used or would recommend to earn extra income through the Reverse Latte Factor?

Recently, I’ve been trying to land gigs on freelancer websites, but to no avail. What do you think is happening please?

I read you have a saving account with 2.1% return? If I read correctly, please let me know how to sign up for this account at 2.1% return! Thanks

“The thing that always confused me about the latte factor was how it emphasized all of the lost opportunity that comes with daily frivolous spending, but never seemed to consider the opposite – that is, the lost opportunity that comes with not going out and earning extra income on a consistent, daily basis.”

Yessss!

I’m planning to use one stream of side income for investing 🙂

I agree with your assessment of doing more side hustles. One of the funniest side hustles I’ve seen during the pandemic is a guy working another full-time job from home, just because he can and has a lot more time and productivity.

I worked on Financial Samurai for 2 years 9 months, then I broke free in 2012. You never know!

Sam

I have only been reading the panther report for a few weeks. As an older, retired adult, I am very impressed at what I have read this far. The whole concept behind the side gig economy just really points towards entrepreneurship and a willingness to work beyond what others expectations might think you’re capable of.

It’s interesting – I’ve always thought of this gig economy world as a young person’s world, but I’ve found that a lot of older, retired folks take advantage of the gig economy as a way to generate some income and really for the fun factor of it. The more I think about it, the more it makes sense.

Impressive side hustling! I have chronic fatigue, so I don’t do side gigs as my main job and blogging take up all of my energies. But I do throw any blog income at my SEP-IRA now that I finally have one. It’s not $5 a day (alas), but it’s something, right?

Is it possible to do any of these side gig apps in London, or anywhere else overseas?

Yes, these gigs exist in London and overseas as well, but I have no idea how flexible they are over there. I know when I was in Paris over Christmas, I saw a lot of people biking around doing deliveries for Deliveroo and Uber Eats. I also saw people charging Lime scooters. No clue what the rules are over there though.

Check your 401k plan to see if they allow after-tax contributions. My plan allows me to withdraw after-tax 401k contributions without restrictions such as not being able to participate in the pre-tax portion of 401k plan. Convert the after-tax 401k contribution to a traditional IRA and convert that to a Roth using the back door methodology. This process is commonly known as a Mega Backdoor Roth IRA Conversion.

Social Security & Medicare contributions are capped. Depending on how much you make at you “full-time” job, you probably max out the contributions.

Do you have Health Reimbursement Accounts at work? If not, can’t you set one up as self-employed.

I love your blog and so many of your posts really resonate with me, particularly the ones that touch on the legal profession (fellow lawyer here). I’m so excited to follow along your self employment journey! Your side hustle reports really sold me on the ‘reverse latte factor’ before I even had a name for it, but the issue I’ve had is finding a way to minimize taxes on gig-economy type income. My marginal tax rate is really high at about 43% (love/hate relationship with living in California), maybe even higher (I think I need to double my social security and medicare taxes on 1099 income, right?), so earning an extra $10 in the gig economy is actually only pocketing me $5.70, which is kind of discouraging as sometimes my hourly earnings after taxes fall below minimum wage. I can’t do the Solo 401k because I already max out my 401k at work and I can’t do a SEP IRA because as I understand it, that would preclude me from being able to do the backdoor roth IRA due to the aggregation rule around IRAs. Do you have any other suggestions besides aggressive deductions?

Right, so that is exactly the problem with side hustle income because it’s essentially being taxed at your highest marginal tax rate. This is why it’s really important to take advantage of tax-advantaged accounts when you’re side hustling. Remember, you can still make an employer contribution to your solo 401k. There are calculators out there that show you how much you can contribute as an employer contribution. It should be about 20% of your profits, which can be significant depending on what you make.

The other thing is, remember that you can pay taxes using a credit card (I’ll write a post about that soon, because I need to pay some taxes soon). If you open up some cards for signup bonuses and then hit the minimum spends with credit cards, you are at least getting something back for your tax payments (an example is the Chase Ink Preferred currently gives you $1,000 worth of points – so if you make a tax payment of $5,000, you’re getting back $1,000 tax-free).

Finally, my last thought is simply that I don’t let the tax dog wag the income tail. If you got a raise at work, you wouldn’t decline it just because you’ll now owe more taxes on those last marginal dollars. It’s the same thing with side hustling.

My main problem with the latte factor is applying an annual return much less an annual return of 7%. That assume that you are taking your $5 saving and investing it into the stock market (market indice ETF?) daily. Since there is often (but not always) a commission when buying an ETF, it is inefficient to buy $5 of an ETF every day a week. More likely, you would aggregate the $5 in zero interest checking account until you got to $25 or for me $100. That’s 20 days.

However, that misses the nature of one’s day-to-day cash flow. In reality, the $5 I save from the latte is spent elsewhere or allows me to avoid moving money into my checking account (which is where most of my expenses are paid from). At best, the $5 would have a 0% annual return. $5 x 365 = $1,825 per year. Let’s look at the 30 year return. $1,825 x 30 years = $54,750 compared to $368,916.60 in your table. $54 K is still significant but the “savings” is reduced by nearly a factor 7. Of course, the price of lattes will go up so $54 K is understated but that also means $368,916.60 is also understated.

Realistically (for me) the rate of return is 2.1% max. When my checking account runs low, I pull from saving account earning 2.1%. When my checking account balance is high, I transfer some of it to the same saving account. However most months, I don’t make a transfer in either direction.

I would ask you to track your side gig money closely. Are you transferring it to an ETF ASAP or are you letting it sit in your checking account for awhile?

The interesting thing is with fintech today, you can actually buy ETFs every single day with no fee. So you can literally invest the $5 or $10 daily if you want. I wrote about how I do that with my guide to longer-term savings goals. I use WiseBanyan, which is 100% free, but you could also do the same thing with M1 Finance or SoFi Invest (both allow you to invest on daily or weekly basis with no fees and buy fractional shares of ETFs – and they’re robo advisors so they do all of this automatically).

In any event, even if you let it sit and invest it all as a lump sum once per year, it doesn’t change the long-term rate of return. I fund my Solo 401k once per year after I’ve done my taxes. Many people do the same with Roth IRAs. The daily investing factor doesn’t change the long term rate of return. What changes the rate of return really is how much you mess with it.

Investing $1,825 once per year vs. investing $5 daily – my guess is that the difference long term is going to be pretty negligible.