Not that Albert now costs $8 a month to use, so this is no longer an app I recommend.

Albert is a cash management and financial budgeting app that is offering new users a signup bonus of $100. To earn your Albert referral bonus, you have to open a free Albert Cash account using a referral link, complete a direct deposit of $200 or more every 30 days for 90 consecutive days, and spend $100 using your Albert debit card every 30 days for 90 consecutive days. Here’s my Albert referral link if you’re interested.

I first wrote about Albert almost four years ago, before the app had even moved beyond its seed funding (you can read my Albert review post here). Back then, I was recommending Albert even though they didn’t have any referral bonus – I literally never received anything from Albert for recommending them.

My experience with Albert over the years has been excellent. It’s helped me keep better track of my finances, and importantly, helped me to save more money thanks to its smart savings feature. Recently, they launched a referral program where new users can get a signup bonus after opening an account using a referral link. That makes now a perfect time to sign up.

In this post, I’ll walk you through the exact steps to earn your Albert referral bonus.

What Is Albert?

Albert is a full-featured financial monitoring app. It’s similar to Mint or Personal Capital. You link all of your accounts in the app and Albert will track your net worth and account balances.

The best feature Albert offers – and the main reason I use it – is the Albert Smart Savings Feature. This is a feature where Albert will monitor your transactions, and using a special algorithm, Albert will then save small amounts of money for you each week. Apps like Digit have similar smart savings features, but Albert is better because it doesn’t charge a monthly fee.

The most recent addition to Albert is Albert Cash, which is a free checking account with no minimum balance requirement. All funds in your Albert Cash account are kept with an FDIC-insured partner bank, so your funds are safe and FDIC-insured (currently, Albert has a partnership with Sutton Bank, so all funds in your Albert Cash account are held with Sutton Bank).

If I was looking for a new bank account, the Albert Cash account is one I would be completely comfortable using as my primary bank account. One interesting feature of Albert Cash is its cash-back promotions. These give you pretty significant cashback if you use your debit card at certain stores.

Finally, Albert has a feature called Albert Genius, which gives you access to some premium features and a financial advisor. Albert Genius is not free and instead works on a pay-what-you-want model. I’ve never used this feature and I don’t plan to, but it is something that you may find useful depending on your situation.

Albert $100 Referral Bonus: Step-By-Step Directions

With that background out of the way, let’s get into the referral bonus. Here are the step-by-step directions you can follow to earn your Albert referral bonus:

1. Open a free Albert Cash account using a referral link. The first thing you’ll need to do is open an Albert Cash account. This is a free bank account that you can open when you sign up for Albert.

To open your account, first, download the Albert app using a referral link. Here’s my Albert referral link. The referral link doesn’t show the referral bonus at first, but once you start going through the signup process, you’ll see several screens that confirm the referral bonus.

The signup process to open your Albert Cash account is very simple. You’ll just follow all of the steps as they come up in the app. Just like with any bank account, you’ll need to provide information such as your address, SSN, and all of the other things that are legally required to open a bank account.

There are a few decisions you’ll need to make during the signup process as well. First, you’ll reach a screen that asks if you want to set up an investment account. I haven’t signed up for the Albert investment account, so I can’t speak to how good it is. You have to sign up for Albert Genius if you want to invest using Albert, so I recommend skipping this option by clicking “later.”

You’ll also get to another screen that asks if you want to sign up for Albert Instant Cash. This is a service they offer that lets you get access to a $250 loan. I don’t recommend using this service, so probably best to click “later” when you reach that screen as well.

Next, you’ll need to decide if you want to activate Albert’s smart savings feature. This is a feature I actually use. You link your credit cards and bank account to the app. Albert will then monitor your transactions and using that data, Albert will withdraw money each week that it doesn’t think you need and put it aside in a savings account.

It’s a free feature and a nice way to increase your savings without really noticing. I personally use Albert’s smart savings feature as part of my microsavings strategy (to learn more about my money system, check out The Financial Panther Money System). Apps like Digit and Dobot used to offer similar features, but either switched to a monthly subscription model or shut down.

The last thing you need to do is decide whether you want to sign up for Albert Genius. This is a monthly subscription service that will help you create financial plans and give you access to a financial expert. The subscription works on a pay what you want model, but you have to pay something per month if you want to gain access to it. I personally do not use Albert Genius and don’t understand the value it provides. When you get to the Albert Genius screen, set the monthly payment amount to $0 and the app won’t activate Albert Genius.

And that’s it! Once you’ve gone through those steps, your Albert Cash account should be set up and ready to go. You also won’t have to worry about any fees since you didn’t activate Albert Genius.

2. Complete A Direct Deposit of $200 Or More Every 30 Days For 90 Consecutive Days. Once you’ve set up your Albert Cash account, the next step to earn your Albert referral bonus will be to complete a direct deposit of $200 or more every 30 days for 90 consecutive days.

The terms have this to say as to what qualifies as a direct deposit:

The qualifying direct deposit must be made by the referred individual’s employer, payroll provider, or benefits payer by Automated Clearing House (ACH deposit). Bank ACH transfers, federal, state, or local tax refunds or credits, federal or state unemployment or short-term disability benefits, mobile check deposits, peer-to-peer transfers from services like Cash App, Venmo, or PayPal, or other similar deposits are not qualifying direct deposits.

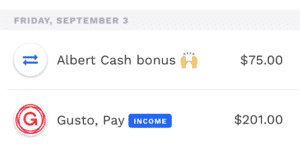

The plain language of the terms would suggest that you need to do a real direct deposit. I was able to easily meet the direct deposit requirement for my wife’s Albert account because she uses Gusto for her payroll, which allows her to easily change her direct deposit information. Unfortunately, at this time, I’m not sure which other options trigger the direct deposit requirement. The initial data points seem to suggest that you’ll need a real direct deposit to trigger the direct deposit requirement. This is a new referral program, so we’ll likely have more data points in the future as people try different options and we see what works. Doctor of Credit has a good thread where people put data points in the comments, so you may want to check that out here.

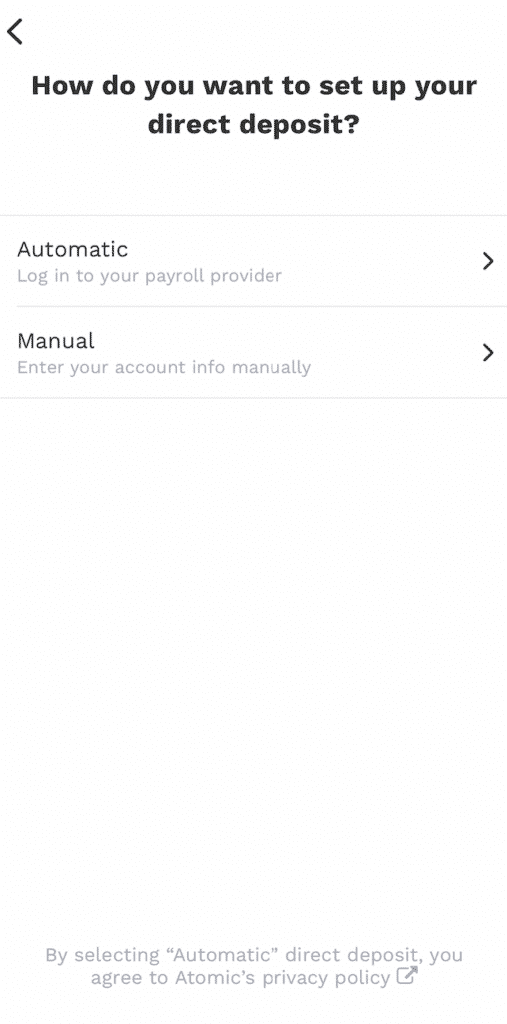

To set up a direct deposit, you’ll need to get your account number and routing number. To do that, click on one of the buttons in the Cash account to set up a direct deposit. Then when it asks how you want to set up your direct deposit, click “manual.” It’ll then take you to a screen that shows you your routing number and account number.

3. Spend $100 On Your Albert Debit Card Every 30 Days For 90 Consecutive Days. Previously, Albert didn’t require you to spend anything on the debit card, but they updated their terms to require you to spend $100 on the Albert debit card every 30 days for 90 consecutive days to earn your bonus. It’s an annoying new requirement if you’re trying to earn the bonus. Your best bet is to pay a bill using your debit card. Utilities or your phone bill are easy ways to meet this requirement.

4. Your Bonus Will Post Immediately Once You Meet The Direct Deposit And Spending Requirements. After you complete your direct deposit, your Albert referral bonus should post immediately. The good thing is that since the bonus posts quickly, you’ll know whether your direct deposit worked. If your bonus doesn’t post, then you’ll need to try another direct deposit option.

Refer Your Friends And Family

Albert has a referral program that allows you to refer people using your own referral link. The person you refer will earn a referral bonus once they meet the requirements and you’ll earn a bonus for referring them once they meet the requirements.

This gives you a lot of opportunities to increase your Albert referral bonus earnings. For example, if you’re a 2-person household, you can sign up for an Albert Cash account using my referral link, then refer your spouse or partner. You’ll earn $100 for signing up with my link, then your spouse or partner will earn $100 for using your link and you’ll earn $100 for referring them. That’s $300 in total that you’ll earn – assuming you can meet all of the requirements.

The app makes it easy to track the status of your referrals also, so you won’t have to wonder whether your referrals worked or not.

You can increase your earnings even more if you have additional friends and family members you can refer. Albert allows you to earn up to $1,500 in bonuses, so I recommend taking advantage of your referrals while this program exists.

Final Thoughts

Albert is an excellent fintech app – it’s one I personally use every day. Indeed, I’ve been using and recommending Albert for years, even before they offered any sort of referral bonus.

Assuming you can meet the direct deposit requirement, Albert is a decent way to earn $100 without doing a ton of work. If you’re a two-person household, you can refer your spouse or partner and increase your earnings.

If you’re interested in learning more about how you can earn money from bank account bonuses, check out my post, The Ultimate Guide to Bank Account Bonuses. It’s a huge, in-depth guide that will help you understand how bank account bonuses work and how you can earn money from them.

I’ve also written an in-depth review about Albert and how I use it. Check it out here – Albert App Review: The Ultimate Review and Everything You Need to Know About This Savings App.

Thank you for this blog. I have found it very helpful. I just want to let you know that this page is out of date. I used the referral link and there was never any information about getting a bonus, so I don’t think the link is working anymore. Also, if I refer someone now that I have an account, the bonus is only $100 and the required spending is $200 every 30 days for 90 consecutive days. Also, it says that bill payments don’t count toward that spending. Overall, this bonus seems like too much trouble to me with the changes they’ve made.

Thanks, I’ve updated the post with the new info.

First, I want to thank you for all the information and tips you provide. This is so awesome! I have been thinking about these bonus referrals and how to trigger them for awhile but I just now am starting the process and looking into them and putting in action. So when I came across your site I am amazed at your work and information provided for this. Who knew there be stuff like this on the internet? Haha I guess I am just little behind on times. My question I have though is I do have a business checking account thru bluevine when I go thru there and do send ach payment is that direct deposit with Albert? If not I know you said gusto payroll how do you initiate deposits thru a payroll service without having to enter tax info, hours and set up has to be done in advance? I am needing to initiate bonus soon because of my financial situation. I would greatly appreciate any advice information on this. Again thank you so much for information you have already provided!

The auto savings feature is great I didn’t even notice next thing I knew there was almost $500 in less than 4 months. But, another AWESOME feature this post never mentions and def a reason you would def want to dep some money into acct. is for the deals it offers at places that you shop at. Since you link up all your accts, it knows what you spend money on. I started using at the beginning of Nov. and just finished calculating cash back $48.00!! You do have to activate the offer before making your purchase.

Example

Shell gas $5 instant reward

Starbucks balance reload I do $25 every week $2.50 instant reward. This is why it is worth setting up that direct dep aside from bonus. You can unlock more savings such as 20% Walmart purchase.

pp!!

Thanks for pointing that out. I believe I do mention it in my Albert review post, but yeah, it’s another good reason to open an Albert account.