Anyone who knows me knows that I’m a big fintech geek. And there are some really awesome fintech apps out there today. You’ve probably already read reviews about some of the big players in the fintech world- apps like Mint or Personal Capital. I thought it’d be helpful to share reviews about some of the lesser-known fintech apps that I personally use and that might be useful to you. One such app that I use is a bill management app called Prism. In this Prism app review, I’m going to go over what Prism is, how it works, and why I recommend it.

While I’m a big fan of automating your finances, I still like being able to look at my bills before I pay them. There’s something comforting to me about being able to make sure that my bill looks right before I pay it.

At the same time, I don’t want to spend a ton of time logging into every biller’s website. I also don’t want to ever forget to pay a bill. And I definitely don’t want to get caught paying any late fees.

With that in mind, I was looking for a solution that would let me see all of my bills in one place and allow me to basically automate and manually pay my bills at the same time. Prism served as that solution.

What is Prism?

Prism is a bill management app that lets you see and pay all of your bills from a single app. I like to think of it as similar to Mint or Personal Capital, but dedicated solely to managing your bills. The app only works on your phone and there’s no web app for it at the moment.

The steps to set up Prism are pretty straightforward. First, you link all of your bills with the app. When I signed up, I linked my electricity, gas, cable/internet, water/trash, and credit cards.

Next, you link your payment accounts – i.e. the accounts you will use to pay your bills. I linked my checking account and my credit cards. I typically pay my bills with a credit card if possible in order to earn points and miles, although not every biller allows you to pay in that way.

With your billers and payment accounts linked, Prism will now monitor all of your bills for you. When a new bill is available, Prism sends a push notification to your phone letting you know that you should schedule a bill payment. You then go into the app and either pay the bill immediately or schedule a payment for some time in the future. Since Prism doesn’t use a third-party payment platform, you can pay any bill right away without any delay if you want. That’s perfect if you suddenly realize a bill is due.

Most importantly, Prism is completely free. If the payment method is free with your biller, then it’s also free with Prism.

How Prism Works

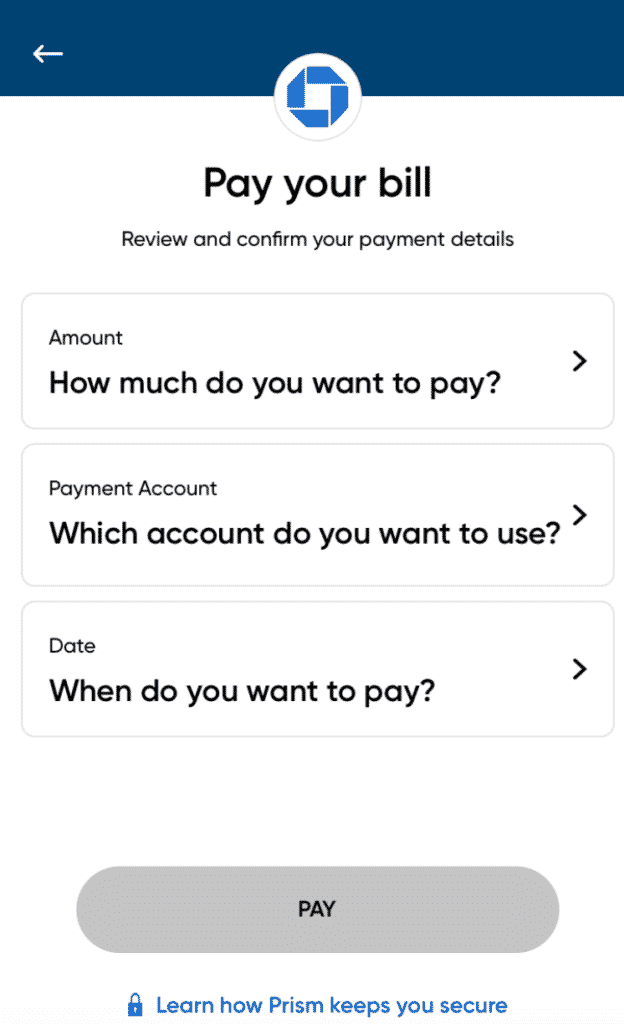

When a new bill comes in, it brings you to the bill pay screen. Prism change its interface in 2021, so this is what it now looks like for your typical bill:

There are three parts to this screen. The top row lets you pick how much you want to pay towards your bill. You can either pick the full amount, the minimum payment, or a custom amount. Of course, I always recommend you pay the full amount due on any bill.

The second row allows you to pick which payment account you’ll use to pay your bill. Some billers charge a fee if you pay using a credit card or some other payment method. Prism warns you in advance if you use a payment method that has a fee. My tip is to use the bill payment method that doesn’t cost you anything.

Finally, the last row lets you pick the date you’d like to pay your bill. I generally like to pay all of my bills on the first of the month, but do what works best for you. My advice is to always give yourself a day or two of buffer time just in case there are any issues with your payment.

Finally, when you’re ready to pay, you simply swipe click the pay button to schedule your payment. That’s it! Prism notifies you that your bill payment has been scheduled and it handles the rest from there.

Security

The big concern for almost everyone when using a fintech app is security. After all, you’re giving this company information and access to your private accounts. I don’t think you need to worry about Prism though. The app maintains robust security features to avoid any unscrupulous people accessing your information. As explained on Prism’s website:

- “All communication is encrypted.”

- ‘Sensitive information is firewalled.”

- “No sensitive information is stored on your device.”

In addition, I’m willing to bet that most people reading this already pay their bills online. (Does anyone write checks anymore?). If you’re already paying your bills online, then using Prism is really no different in terms of security. In fact, Prism maintains that it’s actually more secure to pay your bills using Prism when compared to a normal payment website. As explained by Prism:

“Prism runs as an app, which is inherently a much more secure environment than a desktop program or web site. All of the sensitive information exchanges with your services (i.e. transmission of account information and credentials) occur through our secure cloud service. We confirm the authenticity of every connection we make, and we take steps to ensure that your account information is never transmitted to the wrong party or via an insecure protocol.”

The other good thing is that you’re really only sharing access to your billers. I honestly don’t really care if someone got a hold of the login credentials for my electricity or gas bill.

With respect to your payment accounts, you simply provide your checking and routing number of your bank. When paying by card, you provide your credit card information. Again, if you’ve ever paid a bill online, then other bill payment platforms already have this information. At least with Prism, you get the benefit of seeing it all in one spot.

Other Features

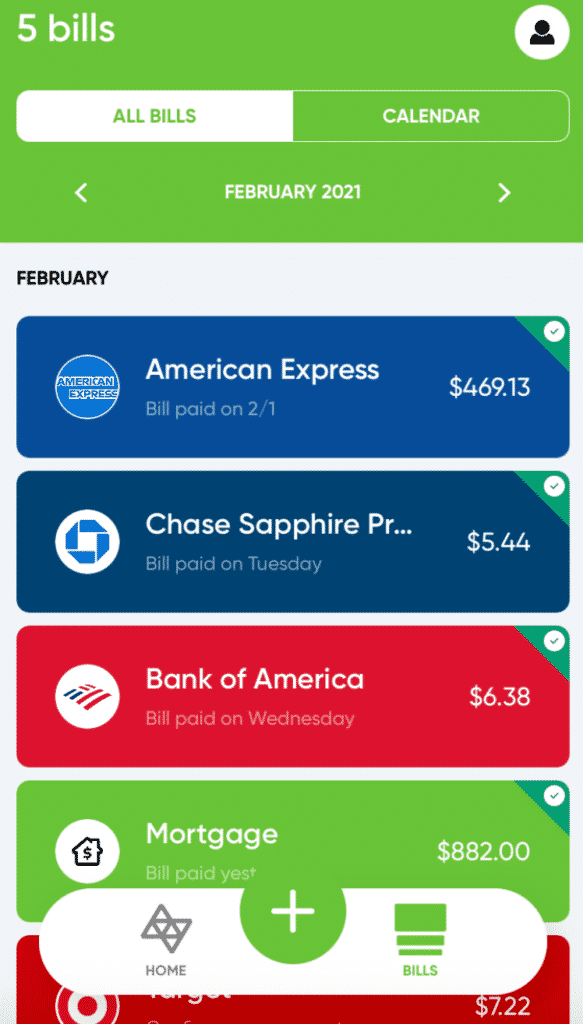

I like being able to see all of my expenses in one spot. Since I pay for almost everything using credit cards, Prism gives me an accurate picture of my total monthly expenses. Here’s what it looks like on my main screen:

You can also input your paydays to track when you get paid in comparison to your bills. While not necessary, I find it does help you to make sure you are keeping enough money on hand to cover your bills.

Another nice feature – Prism notifies you if your bill looks out of the ordinary. For example, if your bill is suddenly much higher than it was in the previous month, Prism will let you know and recommend that you double-check the bill. It’s a good way to make sure, at a glance, that your bills are accurate.

Finally, Prism keeps a history of all your bills so you can easily look back and see what you’ve paid each month. You can also view your statements within the Prism app. This can be helpful for most people.

My Experience With Prism

I’ve been using Prism now for over five years. For the most part, I haven’t had many issues, especially early on before it got bought out by BillGo.

I’ve found it useful for my own money management system to be able to see all my bills in one spot and easily pay them using the Prism app. Whenever I get a new credit card or some other new biller, I always add it to Prism so that I have it all in one location that’s easy to see.

Years ago when I first downloaded the app, I had an incident when I paid a bill using my credit card and found out that I had been charged a credit card processing fee by the biller. Prism hadn’t notified me of that fee in advance, so I had assumed that paying the bill with a credit card was free. When I contacted Prism about this fee, they immediately acknowledged the mistake, noting that the biller must have recently added this fee and that the app hadn’t caught it yet. They then apologized and reimbursed me for the fee immediately.

The New Prism App Makeover And Issues

Prism has gone through a few interface changes over the years. When I first downloaded Prism back in 2014, the app had a different look. Then I think sometime in 2016, they changed the interface again. Each of these changes has always required a bit of an adjustment period, as tends to be the case whenever any app makes updates.

The most recent update occurred in 2021 and if you look at the comments in this post, you’ll see that a lot of people are not happy with the changes. I definitely can relate because I also preferred the previous iteration of the Prism app. It’s important to remember that the app still does the most important thing, which is to allow you to pay your bills in one spot using a single app.

That said, I agree there are some current issues with the new iteration of the Prism app. For me, one issue I’ve noticed has to do with the payment dates. In the old version of the app, I could make a payment based on business days before the due date. So, for example, I could select to pay my bill one business day before it was due. The new version of the Prism app seems to have removed this feature, which means when I pay, I need to look at what day it’s due and then manually select my payment date. It’s a small annoyance for me, but it’s still something that makes me wonder why they changed that feature.

The other issue I’ve had is linking Prism to American Express. It used to work fine, but I’ve had issues for a while now where it seems like my American Express account doesn’t play nicely with Prism. At this point, I’ve given up on using Prism for my American Express payments, so I now pay those bills directly on the American Express website.

I know others are having issues with the app, at least compared to when it first launched years ago. Prism has said that they’re hearing the complaints and are working on addressing them. It’s also worth remembering that whenever any app makes changes, there’s always some initial uproar before things settle down and people get used to it.

Conclusion

If you’re looking for a great bill management app, I highly recommend using Prism. It’s without a doubt one of my most used fintech apps and one that I’ve been using for quite some time now without any problems. Seriously, give it a shot and see if it’s for you.

Let me know if you try it out! Prism doesn’t offer any referral incentives, so you can be assured that I’m writing this post solely because I find the app useful.

If you’re interested in other app reviews, be sure to check out some of my other fintech reviews below:

- Albert App Review – The Ultimate Review and Everything You Need to Know About This Savings App

- Peak Money App Review – A Free Goal-Based Savings App (And The Best Alternative To Qapital)

| App Type | Bill Pay |

|---|---|

| Cost | FREE |

| Available On | iOS (iPhone, iPad), Android |

After prism was aquired by billgo its been destroyed and i dont see it coming back. This app is in its right 100% garbage now thanks to the refresher. They keep trying to brush it off as if you’ll eventually forget about the old version and love this new abomination. Currently its doesn’t deserve a 1 star and you can see how its ratings dropped to nearly 1 star. Its crap plain and simple and we can thank billgo for that. Billgo you embarrassed yourselves and showed people what to expect when you touch great working systems. Billgo will forever hold the world record for destroying a 5 star app.

Is anyone else having trouble with Prism? It doesn’t seem to be working correctly right now. I keep getting error messages.

While this program does work, the new “refresh” of it made it just a shadow of it’s original greatness/usefulness. It went from an efficient app that showed lots of information easily on one screen to an app that is focusing more on eye candy and lots of wasted space with lots of little bugs here and there. The top 3 pictures on this webpage show what Prism was originally like. You could easily see 7-8 bills on one screen that had color coding that indicates what was coming due. The picture in the “Other Features” section shows what both the Home and Bills screen looks like in the “refresh” version of the app. You can only clearly see 4 bills at a time and it introduced a lot of new bugs that were non existent in the old version. If you haven’t used the old Prism, then it’ll probably work well for you because you won’t know what a downgrade the refresh version is. If you did use the old program you’ll probably be quite disappointed by the new layout and new bugs it introduced. This is evidenced by the old Prism previously having a 4+ rating. At this time the new refreshed Prism has a 2.4 rating (on GooglePlay). One thing I can’t talk negatively about is that they respond quickly to issues. Usually it’s in the same day and they’ve been quite helpful with resolving my issues. Will I still use this? Yes. It still does work and I may get used to the new layout. But unlike before, I’m no longer ruling out other apps to replace it.

Right, I fully agree that I prefer the old version of the app. But before the previous version of Prism, there was another version of Prism if I recall and that one worked out really well too. Eventually, we all just sort of forgot what the first version was like and got used to the new version. My guess is that eventually, we’re all just going to get used to this version too.

But if you do find an alternative, please let us know. I’m definitely not against trying out something new.

Loved this app until the update. The update was a disaster and it’s still a disaster after the supposed response to customer feedback. I find it virtually unusable. I’m going to look for a different app because I can’t depend on prism anymore.

If you find any other app, be sure to let us know. I’m not against trying out another app – but I’ve never found another bill pay type app.

Until they changed the app Prism was my favorite for paying my bills. The new upgrade is not as user friendly as before.

Check it out.

The only thing about the upgrade, I did like, is they put bills in order by due date.

I wouldn’t give it any Stars.

I 💯 agree! They made a great app terrible!

Prism was great right up until….it wasn’t!! They have rolled out a new version and not only does it have a ton of glitches, it’s clear they have designed this to implement paid subscriptions. Everything is gone except your bills. No more links to cash, credit, investments. Etc. Guessing access to this will not require a paid subscription. Understanding that it takes time to tweak new rollouts, this is quite disappointing even for what is left of Prism.

I completely agree with Ann. Prism was the best but now it is so difficult to use.

Hey Ann, yeah, they just updated their app, but it looks like they’re adding some of those features back. It still does what I need it to do and it looks like they definitely heard some of these complaints.

I came across this review and wanted to add that I have been using Prism Money for nearly three years now, and I absolutely love it. No more late fees, and I get really helpful and timely reminders . All of my utilities and bills (including Netflix and Amazon Prime, which are automatically paid but I like seeing when they’ll be paid) are entered into Prism Money. The push notifications are a great feature as well.

Glad its worked out well for you. I’ve also got some stuff on autopay but I still like that Prism can track it for me.

Why pay your bills via Prism when you can pay them directly from your billers accounts for free? When paying from your billers accounts,, it’s posted much faster than through a third party. So what’s the advantages of b paying via Prism?

Just easier for me to have all my bills organized in one place instead of through a bunch of different websites. Not a necessity by any means, but it’s something that works for me.

Is it possible to use Prism to create a reoccurring ACH payment? Some rewards checking accounts require one of these per month to meet a set of requirements to attain a certain % rate . Looking to see if this app can automate the process.

Yeah you can automate a payment each month with Prism.

I have most of my Bill’s paying automatically through my bank. Several, like geico & life insurance take it out automatically themselves. How do I make sure prism doesn’t pay them, just tracks them? Will it still advise me what is coming up?

If you have it on autopay, it’ll just track those bills and say when the autopay is happening. Prism can see you have scheduled a payment outside of the app.

Thats the issue. If I set up auto pay on the biller website, I can’t pay the bill before the due date.

Thanks

I have a auto loan and a couple of credit cards that I want to have on auto pay. I can put the loans on auto pay on the banks websites but the choices of the dates I have to pay is the due dates of the loans. I want to pay the loans before the due dates. Does Prism allow me to set my auto pay loans on the dates I prefer? Also, as with everyone else, I’m very skeptical about putting my personal info out there on Prism with all the high tech hackers out there, but so far, I haven’t read about anyone having their information being compromised while using Prism. As an added layer, I do also have Life Lock which makes me feel a little better as well.

Thanks

Yeah, you can set it up to pay for the dates you want. But if you’re doing autopay, you might just want to set it up through your biller’s website directly and just have Prism track it for you to make sure it gets paid. Prism will see it gets paid outside of their app.

Whether you want to put your info out there with Fintech apps is a personal decision that only you can decide. No company can guarantee your stuff won’t get hacked, including literally the US Government. I’m not worried too much myself, but at this point, I’m pretty desensitized to all that now.

I am trying to find the best app for me. I think so far prism is best but I can’t find a way to add notes.

I’ve been using Prism for several years and have found it very helpful. The only issue that I have had is recently they are having issues accessing Capital One accounts, but they do notate it well within the app so that you can still pay it on time on the Capital One site.

Also, I have had a very recent problem with Spectrum bills showing up, but the said they had issues with certain Spectrum bills and were working on a solution. Sometimes when billers change something on their bill pay, it takes a little while for it to be caught in the Prism app, but I like the fact that you have support like that within the app.

All in all, its a great app and it is one of my most used apps. I would highly recommend it to anyone looking for a good way to manage all their bills in one place.

Thank you for all your great financial help! If my Android phone has backup turned on for backing up automatically to Google Drive, will all of my data be protected if the Prism app accidentally deleted all my information? Does frequency of automatic backup to Google Drive in Android phones vary? Is backup often enough for a financial app? How often would my phone need to be backing up to be keeping Prism up to date? In other words, how can I avoid mishap someone wrote about? Thank you.

Not sure what you mean. You don’t back up anything from Prism. It’s just a bill manager that does it all via the cloud.

Just gave a shot today. Still does not support Amazon two step login so I cannot add my Amazon account. If this type of logins do not supported then it will be hard to add all your merchant/billers. I like overall UI but sometime I simply cannot click! As an example in messages tab, I tried to click on a message about 10 times and all what it did slide message. This is probably because of a technology they used, as I can see this is Cordova based app, not native. On iOS 12 with Apple password manager it is not possible to select account/password when you link your biller. So you have to type all of them again. Also if account for merchant (like Amazon) requires that you enter email as your login ID, app does not show proper keyboard layout for entering email. All these small frustrations forced me to delete account and app itself.

Sorry guys, if you do not care about UI and other stuff for a long time, you gonna loose.

Hmm…guess Prism isn’t a good app for you. Haven’t had any issues on my end.

Me and my roommate downloaded prism and set our bank accounts up to them and I paid the bills woth my account but it’s taking the money out of her bank account instead of mine for some reason

Sounds like you used the wrong payment method Also, don’t share Prism accounts with someone else. It’s not made for that.

Hey, I had a quick question. I’ve been looking for a great bill tracking app and your article has me thinking that Prism is for me, HOWEVER…my issue that I’ve had with apps in the past is that when I have to wipe my phone or get a new phone all my information within the app is gone! My due dates my account information and everything else, and I have to go in and try to remember everything and re-enter it. With this app do they back up your data? Can I back it up with a Drop Box? How can you make sure that all of your data can be backed up and recovered if need be?

I feel like Prism is all saved into the cloud, which means that when you download it onto a new phone, all of your stuff should still be there. If I remember correctly, on my latest phone, all of my stuff was still saved when I downloaded Prism, and I didn’t have to do anything else when I redownloaded it.

I’ve used prism for a couple years now amd loved it! Then yesterday for NO Reason all my stuff was gone! Went on to pay a bill and my account was GONE! Prism won’t answer me as to why or what happened! I don’t understand what happened, it just wiped it out! Not happy!

Dang, that sucks. I checked my Prism account and things still appear to be working fine on my end. Keep badgering them until you find out what happened. The only time I ever had a problem with them was one time when they charged my a fee for a payment method that said it was free. They explained that the utility company must have added a fee and immediately refunded the fee to me. So my experience is that their customer service is good, but I’m sorry you’re having these issues.

Just started using prism this week and I am grateful for this app, I use to pay by computer for some bills and would forget passwords. Thanks to prism all my bills info is all in one place and super fast and convient to pay all my bills.

I’ve used this app for a little over 30 days, and am so grateful for your good review and info. It just makes it so easy and saves so much time. I love that it is on my phone, it’s always with me. Late pays aren’t an issue for me, but the ease of seeing it all in one place…. priceless.

That’s awesome Amanda! I’m glad it’s working out for you. Three years of using Prism now and I’ve never had any issues yet. For me, it’s the same thing – I just like being able to see every bill I have for the month in one spot.

Hey, is paying with your checking account instant like a debit payment or does it take two days?

It pays it out of your bank account literally the same way you pay your bill through your biller’s website – so as instant as that is I guess.

I LOVE IT…IT TAKES THE HASSELS OUT OF CALLING, AND GOING ON A BUNCH OF DIFFERENT WEBSITES JUST TO PAY BILLS!

Prism now has a web application. I signed up last year and was a little weary of using it. After reading the reviews here, I feel much more confident in the security of my information.

Helpful review, thanks. I’m looking for something to simplify the process of dealing with the fallout of a credit card breach. I use autopay everywhere I can and I use one credit card for virtually everything. So while the cash back rewards are nice, the downside is I’m now faced with giving 20+ billers my new credit card info, which is a major pain. Am I correct that Prism might be able to help with this? Seems to me I could/should turn autopay OFF with each of my billers, and instead use Prism to pay each bill manually via app using my new credit card. It’ll be a bit more manual, having to swipe Pay Bill each time (#FirstWorldProblems), but – and here’s the kicker for me – should my credit card become compromised again 3 months from now, I could simply add that new card to Prism, remove the old one, and Prism would then use the NEW card for every payment. Without me having to notify each biller. Does that sound right? Sounds promising. I suppose the only billers that WON’T work with, is vendors like Netflix who require a credit card on file. Or is there a workaround for those billers? Thanks for any input!

I use Prism exactly like this – basically, everytime I get a new card, I link it to prism, then pay my bills manually. It’s all tracked in one place.

Netflix and stuff won’t work with Prism because they’re not really “bills” in the same manner as utility bills or cable bills. But for those, if your payment method doesn’t work, you’ll know about it and can fix it right away.

So glad to see this review! About 6 months ago I was looking for an app to do exactly what Prism does. Prior to downloading the app I always had at least one bill that was forgotten and got paid late. Since I’ve downloaded the app, I’ve never missed a payment and have even noticed that I have extra money in the account I use to pay my bills. I was skeptical at first so I started with just a few bills. Since then, I’ve added all of them and now just have to sit down once or twice a month and pay all of my bills in just a few minutes. I love this app!

Glad to see it’s working out for you. I’m going on three years now with Prism and like being able to see everything in one spot. It helps me stay on top of my stuff.

Do you have a prism vs mint article on can you tell me how this compares to mint?

I’ve actually never written a Prism vs. Mint article. Here’s the easiest way to think about it:

Mint tracks all of your financial accounts for budgeting purposes.

Prism is for tracking all of your bills and paying them all in one spot.

Does that make sense?

I downloaded the app but haven’t entered my bank acct info yet. Also, we are self-employed and my husband doesn’t make the same every week. Do I put an average amount and can you change the amount on a weekly basis? Please advise!

Hey Nicole! I’m not quite sure I understand what you mean. Prism’s for bill payment, so your bank account info is just so that you can actually pay your bill through the app. You don’t need to add in any specific amounts or anything from your bank account into the app.

This person is mostly worried about fluctuating income, as opposed to a regular paycheck. This is a problem for many freelancers, who are often desperate for help with money management. She’s trying to figure out if Prism would be really helpful for her.

Thanks for clarifying that. I think Prism is fine for anyone. You have to pay your bills anyway, even if you have fluctuating income, so still helps to have your bills all in one spot.

Yes, within the app where it has your payday information, you can change the amount for that payday. I would put in the average amount the checks normally are and then correct it to the exact amount once that information is known.

Hi, Thanks for all the infoe. It put my mind at ease. I downloaded the app 2 weeks ago and was afraid to actually enter my banking info. Is there a way to add a 2nd income? My husband and I pool our money topay the bills.

Thanks again

Are you talking about in terms of tracking those pay days so you can get a sense of what type of income you bring in each month? I’d say the easiest way is to just add both of your paychecks together and put them together as one pay day. So if you get $1000 per paycheck and your husband gets $1000 per paycheck, just add them together and put the payday as $2,000 per paycheck. Might not be exact, but it’ll give you an idea at least, right?

I’m glad to hear the app is working out for you!

You can actually set up another paycheck for your husband, this is what I do. This way his paydays show up with for portion of the bills and mine show up on my paydays.

I have been using my bill pay option offered by my bank but am looking for something better. I stumbled on the Prism app was interested and downloaded it with the intent to use it. I started to enter my bills but was frightened by the fact that they not only wanted the biller information as would be expected but they also wanted all my user names and passwords. I guess they need this information to access my accounts but it frightens me to give out this information. Should I be concerned? Is it safe?

I don’t think you should have any concerns. If you’ve ever used any financial aggregators like Mint or Personal Capital, it’s basically the same thing. Here’s their entire page on the security they use: https://www.prismmoney.com/about/security.

You’ll note that they don’t store any of that login information. It’s basically just so that they can actually pay the bill.

They don’t store your credentials on your phone, but do store it on their servers… I’m not sure if that’s any better.

This review of Prism has been a big help! Still, I am concerned that if I were to stop using the app Prism still has access to my accounts (as stated in their privacy policy.) Which makes me question why I should give them access in the first place. Not only am I giving them all of my credit card information but also my banking information as well.

Why would my information be accessed if I am not longer using their services? And more importantly, why would they be monitoring any of my accounts if I opt out?

Is this something that I shouldn’t be concerned with? Or am justified for the red flag?

That’s an interesting question. As I understand it, if you no longer wish to use Prism, all you’d have to do is delete your Prism account and it would wipe out all of your data. In the privacy policy, it also says that you can request that they delete all your information and they’ll do it within 30 days as required by law.

I wouldn’t be too concerned about any unauthorized charges. All Prism is doing is aggregating your bills for you and then passing the payment along. It’s really no different then paying any other bill online (most companies are probably not actually collecting the payment directly from your bank account or credit card – they probably use a third party platform to help facilitate this).

I personally wouldn’t be too worried, but definitely always good to look into these things.

Thanks a lot for this detailed review. I hope it’s okay if I link to it so that my readers can use it as a resource as well.

I’m glad this was helpful for you. You can definitely link it!

Great review of Prism. Thanks for introducing me to it. I can see why a lot of people would find this helpful. I’ve got everything set up in autopayment, but I’m still considering setting up this app as a way to see information all in the same place. I like the idea of having it all in your phone.

It can definitely be used just for that as well. If you’ve got autopay scheduled with your billers, it recognizes that and will just list your bills and note that its already scheduled to be paid.