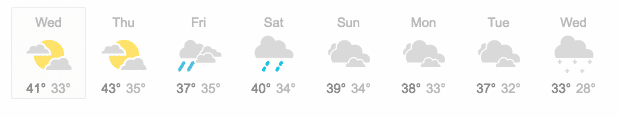

January in Minnesota isn’t always the best place to live. The average high during this month hovers right around 23 degrees, with temperatures occasionally dipping below zero. When temperatures get that low, you really appreciate the days when it gets above freezing. Luckily for those of us who live here, we’re in the middle of a heatwave! Check out the latest 7-day forecast for those of us in the Twin Cities:

Depending on where you live, those temperatures could be either really warm or really cold. If you’re out in Southern California, you might wonder how people even live in such temperatures. On the other hand, here in Minnesota, 40 degrees in January is downright balmy. One golf course even opened up its driving range due to the “rapid warmup” we’ve experienced.

All this goes to show that temperature is relative. What’s a cold snap in one place might very well be a heatwave in another. It has felt so warm here that I’ve been hopping back on my bike and getting the old bike messenger delivery side hustle going again. A person in a warm climate might wonder how anyone can even operate a bike in 40-degree weather.

I think that wealth, much like temperature, is relative too. One person might feel wealthy making a certain amount of money while another person, making the same amount of money, might feel like they’ve only got pennies to their name. Some of us might scoff when a doctor or lawyer says they don’t make enough money and are living paycheck to paycheck. When this happens, we wonder how someone making six figures can spend so much money.

But if you look at where they live, who they hang out with, and what type of persona they have to project to others, you can sort of see how this can happen. A big shot lawyer living in a high-end neighborhood, surrounded by other big shot lawyers and professionals, is necessarily going to feel like they need a ton of stuff in order to keep up with everyone around them. You can’t ride the bus to work when everyone else around you drives. And you can’t live in a modest house when everyone else has a giant house.

Keep adding all that stuff up and suddenly, you might make six figures and just not feel all that wealthy. You might be wealthy in the traditional sense, but you sure won’t feel wealthy.

The good thing is that since we know that wealth is relative, we can all take steps to make ourselves feel wealthier. All we need to do is make sure that we’re living in the right places and comparing ourselves to the right people. If we remember that important fact – that wealth is relative – we can make ourselves feel a lot happier and content with what we have.

Where You Choose To Live Is Super Important

I’ve come to the conclusion that where you choose to live has a huge impact on how wealthy you feel. If you live in a wealthy neighborhood, there’s always pressure to keep up with your neighbors. It doesn’t matter if you don’t care what other people think. Just by virtue of being around all those people, you’ll want to fit in. You’ll need that perfectly manicured lawn and a nice car in the driveway. If you’re not the richest person in your neighborhood, you’ll just feel less wealthy, even if your income is higher than most people. It’s hard to be satisfied with what you have when the lawyer or doctor next door to you has the fancier house and the nicer car.

One solution is to live in a neighborhood where you are doing better compared to the other people in your neighborhood. Despite being a lawyer and a dentist couple, my wife and I still live in a primarily college neighborhood. We’re not rich, but we feel pretty well off simply because we’re not surrounded by wealth. College kids don’t have that much money. They bike or take the bus to class. The houses they live in aren’t super fancy. As a result, I can bike to work and keep our modest house, and I don’t feel like I’m missing out on something. There’s no one around me that I feel the need to keep up with.

This wasn’t done on purpose by any means. My wife just happened to own a house in this neighborhood, so that’s just where we live. But we plan to live in this neighborhood for a while, even when my wife starts her own practice and our household income goes way up. We may move in the future, but for now, it feels good to be doing fine, living in a perfectly modest neighborhood, and not feel the need to keep up with anyone else.

Be the big fish in the small pond when it comes to your neighborhood choice. Wealth is relative, right? You’ll feel much wealthier when you’re not surrounding yourself with wealthy people.

Who You Compare Yourself To Is Also Super Important

I’m convinced that the reason a lot of new lawyers and medical professionals struggle with debt early on is that they feel like they need to keep up with their colleagues. By any objective measure, any young lawyer that lands a big law job, or a doctor or dentist starting out, is going to make themselves a top 5% salary (maybe even top 1% salary) for someone in their age group. And yet, you’ll hear a ton of these people complaining that they have no money to pay towards their loans. Someone making a normal income might wonder how someone making so much money can’t pay all of their loans off right away.

I can see exactly how this happens. A new professional earns their first big paycheck and immediately goes out and gets themselves a high end, luxury apartment. Instead of sticking with a normal apartment, this new professional suddenly feels they can’t live on any less. After a few years (maybe even less), this person goes out and gets themselves a huge house. Maybe they buy themselves some nice cars. As they add more expenses to their life, suddenly all of that income doesn’t feel like very much.

People feel pressured to do this because they think they need to keep up with their peers. The problem is that these people are comparing themselves to other people who are also making a ton of money. A 26-year old lawyer starting their first big law gig can easily avoid this comparison problem by just comparing themselves to a normal 26-year-old, not a big shot 26-year-old lawyer.

This is exactly what I did. I was making six figures a year in my first real job. Most people my age were making probably half what I was making per year. And they were all doing just fine. I knew that if I just compared myself to a normal 26-year-old, I’d probably feel much more satisfied living on less. It’s a mindset shift that can help anyone out. If normal people your age are making half of what you make, all you need to do is act like you’re making what a normal person makes and bank the rest of your income. On the other hand, if you compare yourself to the other big shots in your field, you’ll always feel less wealthy.

Remember That Wealth Is Relative In Order To Keep Your Perspective

I’ve said before that you probably make more than you think. Most people live on much less. If you remember to keep your wealth in perspective, you can be much happier with the stuff you have. So just think:

- Be one of the wealthier people in a modest neighborhood and you’ll feel much wealthier (and more content with what you already have).

- Compare yourself to the right people and you’ll feel the same way. We can all be bummed that some other person has a nicer house and a fancier car. But if you compare yourself to those people, you’ll never feel wealthy.

I don’t make six figures anymore. A lot of lawyers would think I must not be doing all that well income-wise. I think I’m the opposite. With no student loans, a cost of living that is affordable, and an income that is higher than most people my age, I think I’m doing pretty good for myself.

I feel pretty wealthy. How wealthy do you feel?

Human Psychology is an overlooked aspect in business.

You make a good point. Sometimes we just focus on the wrong things. We want to go from making $100k to $200k. But does that really make us happy? In many cases it doesn’t because we tend to spend what we make.

As long as we are disciplined in our saving and investing and focus on the things that really matter will we truly be happy.

Right, spending is a lot like food portion sizes – you sort of just spend whatever is in front of you. That’s why it’s always good to try to keep that perspective in mind. It’s really easy to feel like you’re not making that much if you don’t keep that perspective.

Great points you bring up and all very true. This ties into people being their own worst enemies when it comes to money. Take note of your friends, family, neighbors and work associates. Hear them complain how tough it is and their broke. But then look at their habits and decisions they’ve made. The nice house with 2 newer higher end cars. Kids going to private school or expensive college. Expensive vacations. New iphones etc. But what is the true root cause of it? Trying to live a life very much in excess of what they truly need. I dont have any sympathy for them.

Rather than compare myself with my coworkers on status symbols, I prefer to compare us on time left to retirement 🙂

Thanks for the reminder that we choose which game we’re playing.

That’s a very good way to think about it! I might need to copy that way of thinking! But exactly right, you get to choose what you’re comparing yourself to.

We live in a low to mid income neighborhood. And most of our friends make in the 30k-60k range. Most of the reason I feel wealthy is that our expenses are so low, we have a lot of discretionary income, and we just don’t want for anything. Plus we don’t do work that sucks.

I bet it makes it much easier to live when most of your friends are in the 30k-60k range. The great thing is, you could make double that, and would look totally normal if you were living like you made 60k a year. Imagine how much less wealthy you’d feel if everyone around you was making a ton.

One relative comparison worth making is to folks who came before us.

Even living frugally, we’re living larger today than someone with $100 million 100 years ago, or than kings / emperors thousands of years ago. Technology, medicine, entertainment makes life today absolutely awesome compared to our forebears.

(Though I guess if you’re a glass half empty person you could look with envy to the future!)

That’s definitely true and a really good way to make you appreciate how good we have it. It’s really hard to believe how much information we can get out there with just the touch of a button.

This is something I contend with everyday, and not in a good way. I moved to my neighborhood 15 years ago when it was the cheaper place to live, where I could ditch my roommates and get my own apartment. It was a great and diverse neighborhood near a big park and full of beautiful old buildings and nice convenient subway stops. Well, fast forward 15 years and I am surrounded by millionaires, praying my landlord does not die. But it’s my home and I love it. So I’m here until the forces are simply more than I can withstand. But things like what car people drive, or other status symbols completely evade my notice. The things I pine for are the financial security that comes with home ownership. Or being able to have a large family.

I can’t imagine what the pressures are like in NYC Sometimes I wonder whether everyone there is a millionaire. It’s not possible for everyone to be that rich, right? I feel like it’s a constant upward pressure. I see tons of people who move there who seem to be living large, despite likely not having the income to do that. Just remember that most people in the world aren’t living like the people around you.

Really great thing to keep in mind. We were potentially going to host a holiday here, but I always end up comparing our house to my parents and aunt/uncle who are the other two who host. They have large houses and my wife has to keep reminding me “you are comparing yourself to people 30 years older than you!” It’s a good thing to keep in mind – plus I don’t think they would care that our house is small. Family time is family time.

This is probably one reason that a lot of young folks spend so much money on housing. We see our parents and people way ahead of us and we’re not patient enough to wait for it. You’ve gotta remember how LONG it took for our parents to get to where they are!

Great post FP, I fully agree with the big fish/small pond idea. As parents of three kids, and myself having a career with a moderate amount of responsibility, the last thing my wife and I need is to feel more pressure because of who we spend time with. As such, we focus our energy on friends who share our values, and are at a similar stage in life.

That’s a smart way to live! Now the hard part is probably dealing with the kids wanting to keep up with all of their friends. I know when I was a kid, I was constantly wanting all the stuff my friends had.

To be honest, we’ve actually never dealt with that with our kids, which is funny, because many of their friends certainly have more ‘stuff’. It was the same way for me as a kid. Perhaps they’ve felt it internally, but they’ve never really expressed as much, so it’s been a non issue. Thankfully. I hope that my wife and I have instilled in them the things that really matter in life, but you never know I guess until they are older. They’re 16, 14 and 10. 🙂

I have to admit that it’s 48 degrees outside right now and I’m inside with a space heater keeping me warm 🙂 I am not built for the cold.

I really try not compare my situation to others and usually think people are doing better than they really are. I live in a mature neighborhood with a lot of older people so I try not to worry about keeping up with retirees 🙂

Although in a couple of years we plan to move and I’m sure there will be some pressure to keep up with my son’s friends. But hopefully we can stay discipline enough to avoid that.

It’s definitely best to try not to compare, but I think it’s just inevitable. The key I think is just feeling like the big fish in the small pond, instead of the other way around. Just a simple way to try to reduce the problem of feeling like you’re missing out on something or depriving yourself of something.

I like the comparison! I think you’re mostly right that weather is relative, just like income. But we do have what’s called the Poverty Line and in terms of weather, Minnesota is definitely below the Poverty Line. It sounds like you guys just got an unexpected tax refund this week. 🙂

Haha, it’s been a nice little warm up for us over here.

Thanks for the great perspective reminder FP! One challenge is balancing this advice with the idea you become the average of the 5 people you hang out with most. Would be curious to hear your thoughts on managing this balance.

Have you ever seen American Psycho. If you have, I’d say you don’t want to be hanging around those type of people, or else you’ll always feel like crap.

To be honest, I’m not sure how to balance that. If you’re closest friends are all big shot living in huge houses and spending all their cash, I don’t really know how you can avoid the comparison trap. All I can say is, if you hang around that type of crowd, you definitely want to constantly remind yourself that this is an anomaly, and not the norm. Most people aren’t living in gigantic houses and making huge sums of money. Considering that the median salary in the US is something like 50k, most people aren’t able to spend 100k or something per year. If you can constantly remind yourself of that, you can help get yourself out of thinking that you’re missing out on something. Just a thought anyway.

We feel pretty wealthy. And yet, compared to our neighbors we own the crappiest car on the block but I would dare say our net worth is higher than most in our subdivision…maybe it’s a sign of age but we no longer compare ourselves much to anyone anymore. Perhaps when we were struggling it was more natural to be envious. Having everything we need right now, and having retired recently, we’re in a pretty good place.

Good for you and Mrs. FP for still living in a college neighborhood. And I think your plan to continue to live there even after Mrs. FP opens her own practice is smart.

You and Mr. Groovy are killing it! No doubt, once you’ve got some life experience, you probably don’t give a darn what other people think! For us millennials, we just naturally can’t help ourselves! And I think it’s especially true of doctors, lawyers, dentists, etc. Those folks entire careers are built on comparing themselves. What residency did you get? What firm are you going to? Etc, etc. It’s hard to shake that comparison trap. Even me, I sometimes get bummed out that I went to a regular law school. But then I just have to remember that there are 100 law schools technically ranked below mine, so I’m still doing pretty well.

Great pointers FP.

This “relativity” comes up often when I talk about benefits of being a cop in California. Just by working here you will be among the best compensated law enforcement in the nation (especially in the Bay Area!). On the other hand, expect nosebleeds from the absurd cost of real estate, even post bubble!

If you try and keep up with your neighbors (especially after an IPO) it wil be the tortoise and the hare all over again. Still, there are ways to capitalize on the system, by retiring from here and moving elsewhere, or just being fiscally smart and saving a lot.

Going back o your original point, what should not be neglected is a conscious understanding of how lucky you are! My baseline understanding of the world was crafted in the Marine Corps, essentially a communist camp. We all had the same gear, the same schedule, and the same pay (by rank). With free clothes, provided meals, and regular pay, I was already living a life most of the world can only DREAM about.

My time in Afghanistan furthered this belief. When you have opium farming families living in a mud house with a steel door and the best medicine around being injections of vitamins…well, we are blessed.

Realizing that relativity is central to finding contentment with your lot. It’s like a cross country race. Most people freak out about being first. The geniuses realize they are truly just running against themselves. It’s your inner ability and desire against the makeup of the course. Everyone else is just a distraction. Their moving faster or slower doesn’t change that the race is about your journey.

Being in the military I’m sure helped you out with your sense of perspective. I like that point about the fact that you’re racing yourself. That’s a great way to think about things. It’s hard to tune out everything around us though, which is why I’m big on trying to make sure that when you do compare yourself, to compare yourself to the right people.

“Comparison is the thief of joy” Living in NYC is tough because there are many wealthy people, but fortunately I live in the outer-boroughs and work in the suburbs so I don’t see the flashy cool things. Many of my co-workers brings their lunch and have credit card debt…if I worked on wall street where everyone had Armani suits and ate out…I’m sure I’d be depressed.

Exactly right. I’ve noticed the same thing since I’ve switched over to government work. People are just much more humble and less flashy, as compared to folks working in the big law firms. It’s way easier to be content with what you have when you don’t have all this stuff around you all the time.

Interesting enough a study I about a decade ago found suicide tended to be more prevalent in wealthier neighborhoods. Intended to be the poorer people living there and the authors postulated that it was because they compared themselves financially to others in their neighborhood which contributed to their unhappiness. I try not to compare myself to others, but if you have to do so to the average. It’s such a low bar that if your doing things right you should be above it. That should give you the boost you need and also remind you how lucky you have it.

That’s an interesting study! It wouldn’t surprise me at all. It’s sort of a first-world problems type of thing. Like you said, best to compare yourself to more average people so that you remember how good you really have it.

Very good point. Wealth is relative. Someone making 50K/year will feel wealthier in a 20K/year neighbourhood than someone making 100K/year in a 500K/year neighbourhood.

That being said, one of my favourite quotes is “comparison is the thief of joy”. And it’s so true. Life is too short trying to keep up with the Joneses. I mean, ultimately, if people choose to do that, it’s their prerogative, but personally, I REFUSE to trade up my happiness and freedom just to fit in. Because at the end of the day, if you need to derive your happiness from what other people think of you, you will NEVER truly be happy. Because you can’t control what other people think of you. Once you let go of that, life becomes so much easier.

Totally agree that comparison isn’t something that you should do. The thing is, I think no matter what, we all can’t help and compare ourselves. It’s just part of being in society. We’re constantly bombarded by all sorts of stuff hitting us in the face that it’s all subconsciously in our brain now.

The key I think is making those right comparisons. Some high earning doctor or lawyer might see spending 40k per year as impossible to live on. But you spend 40k a year and are living amazing! I’m sure that living overseas has helped your perspective on how much people really need to spend in order to be happy.

Yup. Perspective is the key. It’s hard not to compare but once you gain perspective by getting out of your comfort zone, it gets WAY easier.

Relative is spot on. Prior to entering a medical career, I would see offers in the tech industry with 6-figure bonuses on top of a 6-figure salary. This is with kids straight out of college. The caveat was that this was in the Bay Area. The tech salary was insanely good for a 20-year old, but only moderate for the wealthy area.

Moderation is key.

Imagine if those 20 year olds acted like they were making 50k instead of 200k. They’d be living exactly the same as everyone else their age, but banking 100k per year easily. Keeping that income in perspective makes a huge difference in how you view it.

Ha ha! This reminds me of early in my career, when I got my first salaried position and my pay finally hit a point that made me think “I’m rich!” but then I had friends who swore it was near poverty. Then, when I started my masters, the career office at my graduate school said no MBA should be working for that amount. Sometimes people just don’t know how to celebrate! My family always had very little, so for me at the time, it felt like a lot. Anyways, it’s all perspective and a mix of where you came from, your environment and what you expect out of life.

Btw, I’m in Florida, and I would totally bike in 40-degree weather. At 20 degrees I’d stay in 😉

Exactly right. Perspective is key.

Also, haha, I see 20 degrees as pretty warm too. Not balmy like 40 degrees, but comfortable!

Nice break on the weather. It’s been unseasonably warm here too, and I don’t mind at all 🙂

We live in a blue collar neighborhood, and I certainly think it helps us stay happier with what we have. No matter how much you have there will always be some you can be jealous of if you let yourself. And you will definitely be happier if that’s not something you’re chasing.

Great stuff, and enjoy that balmy weather 😉

Thanks man! Seriously, I’ve been sweating since it’s been so warm.

When I worked on Wall Street, I remember hearing about people being angry or disappointed when they got their bonuses in January. 99% of people would be thrilled with some of the “low” bonuses these people received. It’s important to always keep things in perspective. Thank you for the reminder.

The wall street example is a great example! I remember reading in an article somewhere about someone who got something like a six figure bonus and was disappointed because other people got more. It’s a big 1% problem. Imagine how much money those wall street people could save if they just compared themselves to normal people!

A recent study named Minnesota as the only state that was worse than Michigan (my home state) in the winter, so I’m a little stuck on the relative weather comparison, lol!

While I wouldn’t think to advocate for comparing yourselves to others in your personal finances, this is an excellent point in this context. I know for sure that it saves us a lot of money by hanging out with people that spend in similar ways to us, even though I’d venture to guess that we make a significantly higher income.

I bet 40 degrees is a heat wave for you too then!

No doubt, we shouldn’t compare ourselves to people. But it’s so hard not to do that. The thing is, we feel like we’re being deprived of things because of what we see around us. I think that when you’re making the most in your neighborhood, you’ll never really feel like your depriving yourself of anything, since you won’t see other people around you with that stuff.

Great post. I agree with all of this! To me, personal finance is 90% psychological. The 10% is just figuring out what you need to educate yourself on, but if you’re not mentally ready, you’ll never get to that step.

It is indeed very hard not to get influenced by the people around you. It can be anything from having a coffee with colleagues at SB that you might not be doing otherwise, to comparing who has the fancier car. Many people should look at national statistics in order to realize how wealthy they actually are…

Exactly right. Someone making six figures a year is loaded by almost any measure. But if that person is surrounded by wealth, its easy to end up feeling like you’re not doing that well. The good thing is that we can control where we live and what type of people we compare ourselves to.

What you’re describing is a social psychology concept called relative deprivation:

https://en.m.wikipedia.org/wiki/Relative_deprivation

Having lived in Washington DC I can attest that this is a real phenomenon.

I knew there had to be a scientific name for this! Thanks for sharing that link.