GO2Bank is currently offering new users a $50 signup bonus when opening an account using a referral link and meeting a few requirements. To earn your GO2Bank referral bonus, you need to do the following:

- Open a new GO2Bank account using a referral link (here’s my GO2Bank referral link).

- Complete a direct deposit of $200 or more within 45 days of account opening.

- Your bonus will post within 48 hours of meeting the direct deposit requirement.

For the most part, this is a simple bonus to complete. There are a few things to be aware of when opening this account, however, which we’ll go into more detail about in this post.

In the remainder of this post, we’ll walk through exactly how to earn your GO2Bank referral bonus, as well as discuss some other tips and strategies you should know.

GO2Bank Referral Bonus Step-By-Step Guide

Here’s exactly how to earn your GO2Bank referral bonus:

1. Open Your GO2Bank Account Using A Referral Link. The first thing you’ll have to do is open a GO2Bank account using a referral link. Here is my referral link if you’d like to support this blog.

Opening the account is straightforward. You can either do it on your phone or you can do it on your computer. I opted to open the account on my computer. You’ll need to upload a picture of your driver’s license, but you can do that on your computer by taking a picture with your phone and then saving it on your computer.

The application process is straightforward and most people should get approved immediately after submitting their application. There’s no minimum funding amount, so you don’t need to immediately fund the account when you open it.

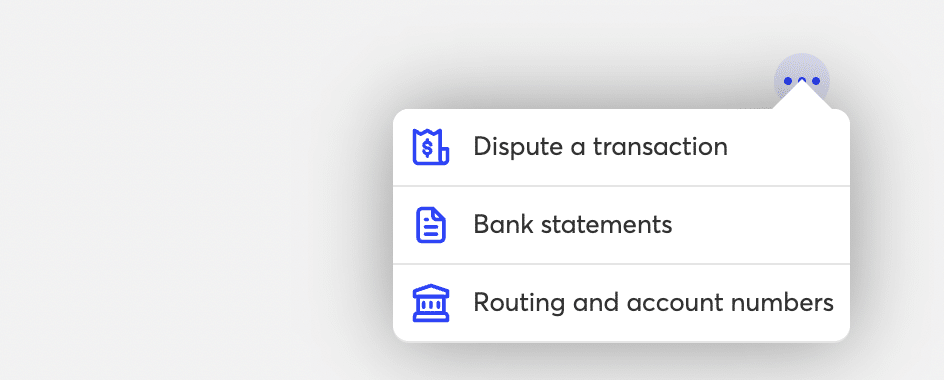

2. Complete A Direct Deposit Of $200 Or More Within 45 Days Of Account Opening. Once you’ve opened your GO2Bank account, the next thing you’ll need to do is complete a direct deposit of $200 or more within 45 days of opening your account. To do this, you’ll need to get your account number and routing number, which you can find on your account page.

At the moment, it looks like you’ll need a real direct deposit to trigger the bonus. My wife uses Gusto for her payroll system, so we’re easily able to change her direct deposits to different banks. If you have a similar payroll system that makes it easy to switch where your paycheck goes, then this bonus is an easy one that you can do.

Unfortunately, at the moment, there doesn’t seem to be any easy way to get around the direct deposit requirement. If I learn of any, I’ll update this post. For now, you should assume that you need a real direct deposit to qualify for this bonus.

3. Your Bonus Should Post Within 48 Hours Of Meeting The Direct Deposit Requirement. The bonus terms state that your bonus will post within 48 hours of meeting the direct deposit requirement. However, some people have indicated that their bonus didn’t post within the 48-hour timeline and they ended up having to message customer support.

That being said, when I completed my direct deposit, the bonus posted automatically within 2 days from when my direct deposit hit my account.

If you did a real direct deposit and don’t see your bonus post within 48 hours, I’d send a message to their customer support people. They should immediately post your bonus to your account. Obviously, if you didn’t do a real direct deposit, don’t contact them.

Earn $1,500 Per Year Of GO2BankReferral Bonuses

One nice thing about GO2Bank is they give you referral bonuses for referring new users. On the referral page, you’ll see your referral link, which you can give to your friends and family.

You can earn up to $1,500 of referral bonuses per calendar year, which is pretty nice if you have a bunch of people you can refer. If you’re a two-person household, I recommend opening your GO2Bank account first, then referring your partner using your own referral link.

Other Things To Know About GO2Bank

Here are a few things you should know when opening a GO2Bank account:

There Is A Waivable Monthly Fee. One negative with GO2Bank is they charge a $5 monthly fee unless you have a monthly direct deposit into your account. Notably, however, the direct deposit can be for any amount, so even a $1 monthly direct deposit will waive this monthly fee.

I’ve set up a $1 direct deposit with Gusto to avoid this monthly fee. If your payroll company lets you do direct deposits for small amounts like this, then that’s an easy way to avoid the monthly fee.

You Can Close The Account Anytime You Want. Some banks require you to keep your account open for a set amount of time, but GO2Bank doesn’t have that requirement. If you want, you can simply close your account after getting your bonus and moving the money out of the account.

The reason you might want to keep your account open is to be able to refer other people, but if you don’t have an easy way to avoid the monthly fee, you might not have a choice and I’d recommend closing the account as soon as you can.

To Withdraw Money, Link GO2Bank Using Your External Bank Account. There doesn’t seem to be an easy way to transfer money out of your GO2Bank account from the GO2Bank app or website. However, this doesn’t matter, as you can easily link GO2Bank with your external bank account.

To do this, go to your regular bank’s website, then link GO2Bank to it using your GO2Bank account number and routing number. Then initiate your withdrawal from GO2Bank using your regular bank’s website.

This Isn’t A Good Bank. I want to be upfront that I don’t consider GO2Bank to be a good bank account. The fact that some people have had issues with the bonus not posting automatically is annoying. I find when banks do this, it’s because they hope some people will forget about the bonus.

In addition, the fact that GO2Bank charges a monthly fee unless you have a monthly direct deposit is a dealbreaker for me in terms of using this account as a regular bank account. My rules for any bank account that I’m actually going to use is it has to be completely free and have no minimum balance requirements. GO2Bank fails on that front since they charge a monthly fee, albeit a waivable one.

Final Thoughts

GO2Bank is an easy bank bonus that I recommend people take advantage of if they have an easy way of meeting the direct deposit requirement. I like that it’s easy to open the account and that the bonus pays out quickly. There are a lot of banks out there that can be a pain to open and that take months to pay out.

A 2-person household should consider taking advantage of this bonus because of the referral option. By opening an account and then referring a partner, you can more than double your earnings.

I hope this guide was helpful. If you have any questions or data points you’d like to share, please feel free to leave them in the comments below.

Please remove the Go2bank. Its a terrible bank. Completed the requirements but wont honor the bonus. Their cs support is a nightmare.

Hey this happened to me too. After 48 hours I was told that they don’t know what I’m talking about – the reward is now $75 and it seems that they don’t pay.

My boyfriend opened an account and sent me a referral link. I opened my account using his link he received an email telling him i opened my account and that as soon as I received my direct deposit we both would get the $50 in 48 hrs.

I opened my account on the 9th Oct. He got that email on the 11th and I got my direct deposit of over $1400 on the 31st. We never got and money and we both tried using the chat but they were guessing and had no idea how to help us.

I the referred person have called several times they keep saying their opening a ticket they opened one on the 3rd and closed it same day without ever emailing either of us and no resolution. I called again and was told that was closed and she would put in for follow up but that’s not good enough at this point I’m getting angry she never did that anyway. I called again trying to get a supervisor or someone who knows what their talking about but could not again they open another ticket with a new number so they said but neither of us got the email she said we would get confirming this case. So does anyone know how to get a person that knows about this program? I get a different answer every call we did everything it asked and we still have no rewards he’s going to close his account and so will I if this is fake I closed another account to open this just to help him out and to claim this offer which now seems bogus.

This worked in July 2023. I did a direct deposit into my account, and then I also did a DD into my spouse’s account (who used my referral code). Although the fine print suggested that one person couldn’t DD into two different accounts, we both got the bonus within 48 hours.

I couldn’t get GO2Bank to link with my credit union, and even when I linked it from the credit union side, it wouldn’t let me transfer money out. But I was able to use the bill pay feature (seemingly only available on the app, I couldn’t find it on the browser version) to pay a credit card bill and empty my account that way.

Opened an account using your referral link, but I was told by customer service it wouldn’t work unless I gave a name and email of the person who referred me.

Send me an email. Thanks.