Upgrade is a free checking account that’s currently offering a $200 referral bonus if you open an account using a referral link. To earn your Upgrade referral bonus, you have to do the following:

- Open an Upgrade checking account using a referral link (here is my Upgrade referral link).

- Receive direct deposit(s) of $1,000 or more within 45 days of opening your account.

These bonus terms are easy to meet, so it’s well worth doing this bonus as soon as you can. It’s unclear when this bonus will end or if it will get reduced to a smaller amount (that being said, I recommend signing up for it now while you can).

In this post, I’ll briefly go over what Upgrade is and walk you through exactly how to earn your Upgrade referral bonus.

What Is Upgrade?

We won’t go into too much detail about what Upgrade is, but a bit of background on it should be helpful so you know what you’re getting into.

The first thing you should know is that Upgrade is a fintech bank account. In this case, Upgrade partners with Cross River Bank, which is an FDIC-insured bank. Any funds you have in Upgrade are held for you with Cross River Bank, so your funds are safe and secure.

What makes Upgrade good for bank bonus purposes is that it has no fees or minimum balance requirements. This makes it a good bank bonus – especially for beginners – since you don’t have to worry about managing the account to avoid fees.

In terms of features, the most interesting to me is their high-yield Premier Savings Account. They currently offer a 4.81% interest savings account with no limit on how much you can have earning that rate. That makes Upgrade a bank you could use to store cash or your emergency fund.

Upgrade also offers cashback on their debit card, which could be useful, since most debit cards don’t offer cashback. Specifically, you’ll earn 1% cashback on all purchases and 2% cashback on purchases at convenience stores, gas stations, restaurants, monthly subscriptions, and utilities. There aren’t many bank accounts that offer cashback like that, which makes Upgrade a potential option if you have certain purchases that you can only pay with a debit card.

Upgrade Referral Bonus: Step By Step Directions

With that background out of the way, let’s look at how to earn your Upgrade referral bonus. Here’s what you need to do:

1. Open An Upgrade Account Using A Referral Link. The first thing you’ll need to do is open an account using a referral link. Here is my Upgrade referral link so you can earn your bonus.

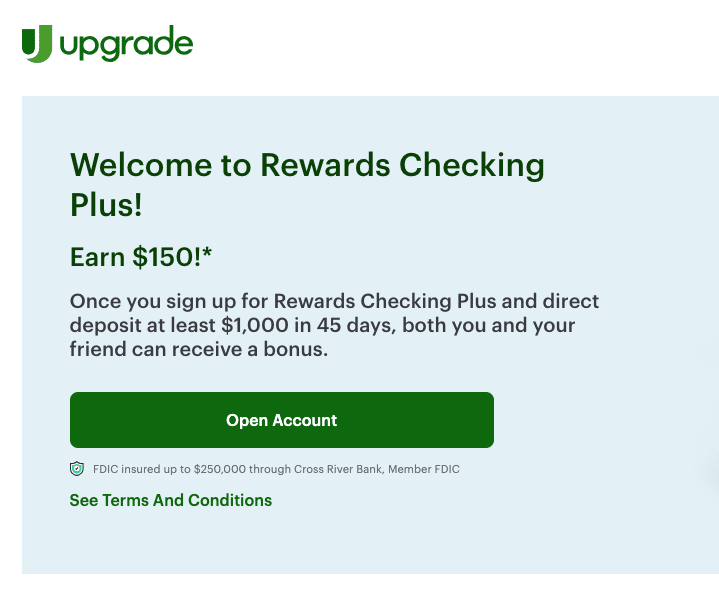

When you click the referral link, you’ll see a screen like the one below.

Opening the account is straightforward. When I opened my account, it took me a day to get approved. A friend of mine opened it and was approved instantly. I’m not sure why mine took a day and his account was immediate.

I recommend downloading the Upgrade app, as that’s the easiest way to manage your account. You can also manage it on your computer if you prefer.

2. Complete Direct Deposit(s) Of $1,000 Or More Within 45 Days. The terms state the following:

An “Eligible Direct Deposit” is a recurring deposit to an account by Automated Clearing House (“ACH”) from the account holder’s employer, payroll, or benefits provider, or gig economy payer OR a deposit by Original Credit Transaction (“OCT”) from your gig economy payer. One-time direct deposits, including tax refunds, bank ACH transfers, bank verification or trial deposits, peer-to-peer transfers from services, such as PayPal or Venmo, merchant transactions, mobile check deposits, and cash loads or deposits are not “Eligible Direct Deposits.”

The plain language of the terms suggests that you would need to complete a real direct deposit to trigger the bonus. If you can do a real direct deposit, that is your best option to earn the bonus.

Refer Others To Upgrade

When you open your Upgrade account, you’ll also get a referral link that you can use to refer other people to Upgrade. You’ll find your referral link on the main page of the app.

Each person you refer will earn $200 (offer seems to vary from person to person, ranging from $150-$200 referral bonus) if they meet the requirements. You’ll also earn $100 for each person you refer. If you’re a two-person household, that means you can earn an easy $500 with just a few minutes of work.

First, you’ll open your own Upgrade account using a referral link. Then you’ll want to refer your spouse or partner using your link. If you do this correctly, you’ll earn $200 for opening your account, your spouse will earn $200 for using your referral link, and you’ll earn another $100 for referring your spouse.

The terms state you can earn up to 10 referral bonuses per year, so there’s room to earn quite a bit if you have other people you can refer.

Final Thoughts

Upgrade is an interesting, free cashback checking account offering a good, easy referral bonus. The account has no fees or minimum balance requirements, which makes it a particularly easy bank bonus to earn. I recommend getting in on it as soon as you can. They keep extending this promotion, but it’s always possible that it will end eventually.

If you want to learn more about bank account bonuses and how they work, be sure to read my in-depth post, The Ultimate Guide to Bank Account Bonuses. This is required reading for anyone interested in learning how to make extra money from bank account bonuses.

I hope this post was helpful. Feel free to leave any questions or comments below and I’ll do my best to answer them.

Can you post an updated referral link? The current link is expired. Thank you!

Thanks for pointing that out. The referral link has been updated now.

When clicking on your link it says no referral link available through the upgrade webpage…what is your referral code?

I just updated the link. Here it is: upgrade referral.

Important note: IF YOU CLOSE your Upgrade Rewards checking account after getting your bonuses, you CAN’T REOPEN one, not even with a different email. I opened mine last July and closed it last Nov. Now I wish I’d kept the cashback debit card.

How do you find the refer link

Seems the referral program is currently disabled.

Referral program is currently disabled, so you can’t refer people if you don’t already have a link. If you have a link already, the referrals are still valid. They’ve just made it so you can’t generate new referral links anymore.

Hopefully you got your referral bonus from this bank via my successful sign up. Thanks for the tip & writing up this information for everyone.

The signup bonus is now $200. Is that correct?

If you get a personal loan too they kinda hide that. Max is $100 without loan – only with a reference/ referral code… Mines up there lol <3

It is Tueaday, Sept 27th, 2023. I just now signed up. Is there a minimum to deposit? I will put in $20. I did not see a referral name ANYWHERE when I was signing up. Usually if you are following or clicking on a link that contains the referral code, it is done

automatically. I didn’t see that either.

I will go ahead and do more referrals and try to give an update in a week or so.

Justin.

There’s no minimum deposit, but you’ll eventually need to put something in if you want to earn the bonus.

In case anyone doesn’t trust this promotion or too good to be true. I can vouch that I opened an account through Kevin’s link, waited for my card, deposited $100, made my three transactions on a Vegas trip I recently went on. I received my $100 this is a legit deal.

Data Point –

Signed up in 5 minutes and transferred $50.

Waited about a week to get the debit card.

Made 3 $5 purchases at a nearby convenience store.

$100 bonus posted 3 days later (as a Refer a Friend reward).

This was a very easy bonus to get.

I signed up and everything looks ok for now… I have no way to fund the account and what currently shows is:

WE HAVE EVERYTHING WE NEED FOR NOW. CHECK BACK FOR FOLLOW-UPS. WE’LL EMAIL YOU WITH UPDATES.

It appears I have a Rewards Checking Account Number. There is also a note that this program is now set to expire on 8/31/22. I guess I’ll jus sit tight and wait for an email.

Also… FP mentioned buying three small Amazon gift cards to cover the three purchase requirement. The Ts & Cs say that is a violation, but I’m not sure if the bank just sees an Amazon purchase and not specifically a gift card:

What Purchases Are Eligible. For purchases to be eligible, the transactions must have settled. Certain transactions are not eligible, including: money transfers, including wire transfers and transfers made through Apple Pay, Google Pay or similar services; manual cash disbursements; ATM transactions; the purchase of checks, financial products, promotional merchandise, gift cards, foreign currency, money orders, other monetary instruments, or similar; debt repayment; account funding; transactions executed for the sole purpose of transferring funds to another account maintained or controlled by the same consumer; refunds or other card credits; or disputed or fraudulent transactions.

I referred a friend earlier this month and they received the same message. For whatever reason it took them 4-5 days to get full approval and access to the app.

For purchase requirements, I always find it easy and safe to just go to a CVS and make 3 small purchases at a self checkout machine.

Yes… everything has worked out fine.

Account was funded properly, I eventually got the debit card, made three small purchases as the grocery store self-checkout and my bonus is one the way.

They requested a bunch of documents from me to open this account: Most recent two years federal tax return

W-2

4506-T Upgrade will follow up with you via email on next steps for submitting your 4506T form

Photo of Yourself (Use Mobile Device)

Government Issued ID – Back (Use Mobile Device)

Government Issued ID – Front (Use Mobile Device)

I just opened the account thru your link. It looks the acct was approved but I did not see where I can fund the account. I thought all steps have to completed during setup.