Update (11/8/24): Netspend is in an interesting spot right now. They recently updated the Netspend account to offer 6% interest on up to $2,000. This is a good rate, especially since interest rates on other high-yield savings accounts are starting to fall back in to the 4% range. If rates continue to fall, Netspend may become more attractive. Wierdly enough, the other flavors of Netspend accounts (i.e. Ace Elite, Western Union, H-E-B Prepaid, and Brinks) are still doing 5% interest on up to $1,000.

If you’re someone who likes to optimize everything, then getting the regular Netspend account opened may be worthwhile to gain access to 6% interest on up to $2,000. Whether it’s worth the hassle to open up the other Netspend-branded accounts is up to you.

Outside of Netspend, I’ve also been using Raisin, which is a free high-yield savings option that you can set up in minutes. Check out my post on Raisin here.

Most people don’t believe it, but you can earn 6% interest on money sitting in an FDIC-insured savings account. It does require a little bit of legwork to set up, but once you’ve done it, the entire account is completely automated.

For most people, a 6% interest savings account is a perfect place to store your emergency fund – it’s where I store mine. And depending on how much you like to keep in it, you could potentially have your entire emergency fund earning a good rate of return each year.

You’re probably pretty skeptical right now, and I admit, I was pretty skeptical too. But now that I’ve had these accounts for over three years, I can confidently say that they work exactly as I hoped they would. I get 5% or 6% interest on my emergency fund, I never have to look at the accounts, and I’ve never paid any fees. If you take a little bit of time to set these accounts up now, you can have a great spot to store some or potentially all of your emergency savings.

For a list of all the ways that you can maximize your high-yield savings accounts, be sure to check out the following post: Where To Get 5% Interest Savings Accounts.

As a bonus, if you sign up for Netspend using my referral link, you’ll get a $20 signup bonus once you make your first deposit into your Netspend account of $20 or more. That means you get a 6% interest savings account and a free $20 to start! It’s a no-brainer, in my opinion.

- What Are Netspend Accounts?

- What Are The Limitations?

- Step By Step Directions

- Quick Recap

- In What Order Should You Open These Accounts?

- How To Withdraw Money From Your Netspend Account

- Other Things To Note About Your Netspend Account

- DCU: An Additional 5% Interest Savings Account

- Why Doesn’t Everyone Use A Super High-Yield Savings Account?

- Get Yourself A 5% Interest Savings Account With Netspend

- Comments

What Are Netspend Accounts?

First, a little bit of background on what these accounts are. The 6% interest savings accounts are provided by a company called Netspend. They’ve been around for over a decade and deal in prepaid debit cards. As a product, prepaid debit cards are bad. They typically prey on low-income people who can’t get access to traditional banking.

Luckily for us, we can sort of fight back by signing up for a Netspend account and using it only as a savings account. Each Netspend card comes with access to an FDIC-insured savings account that pays 6% interest annually. The FDIC insured part is important – it means the money in your Netspend savings account is treated exactly the same as money in any other FDIC insured bank. And remember, we’ll never pay any fees to Netspend because we’ll never actually use the prepaid debit card for anything.

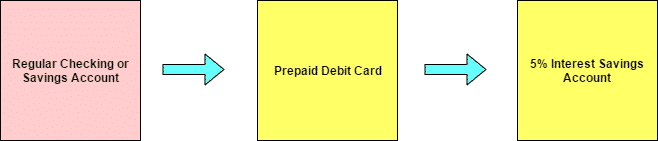

It’s easiest to think of a Netspend account as consisting of two parts:

- A prepaid debit card (we don’t want to use this!)

- A 6% interest, FDIC insured savings account (this is what we want!)

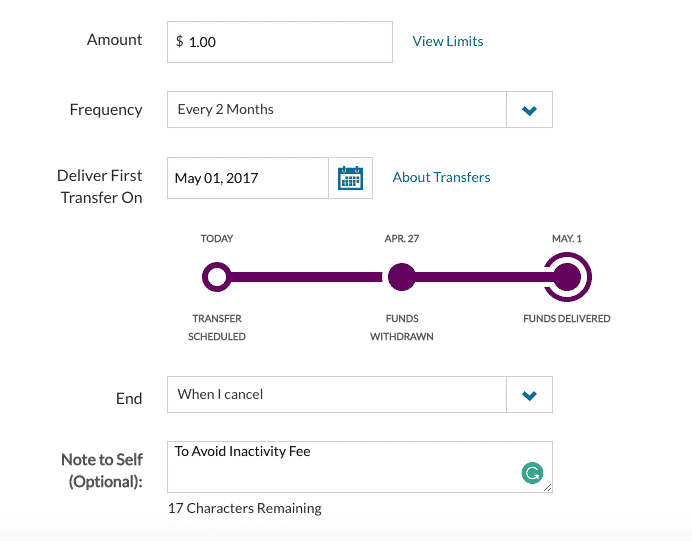

To get the money into the savings account, we need to first move the money from our normal bank into the prepaid debit card. From there, it flows into the 6% interest savings account. You can think of the process of getting your money from your bank into your 6% interest account as looking sort of like this:

The thing we need to remember is that the prepaid debit card is a tool. We need to have it in order to get the savings account, but we’re not going to use it for anything other than as a temporary stop on the way to the savings account.

What Are The Limitations?

The main limitation with the 6% interest savings account from Netspend is that you’re limited to 6% interest on the first $2,000. Anything above $2,000 will earn 0.49% interest.

This means you don’t want to have more than $2,000 in your Netspend savings account. The optimal thing to do will be to keep it as close to $2,000 as possible.

In addition, Netspend allows you to have up to 5 total Netspend accounts. Unfortunately, the other Netspend-branded accounts are limited to 5% interest on the first $1,000. So, if you do want to optimize these accounts, you’ll need to put $2,000 in the 6% account, then $1,000 in each of the 5% accounts.

Step By Step Directions

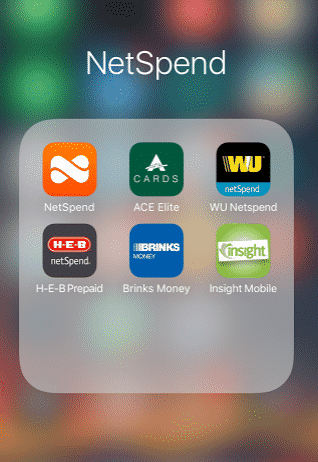

In order to open up five Netspend accounts, we’re going to need to open up multiple prepaid debit cards. Each prepaid debit card is tied to a specific company, but they all have the same underlying platform with Netspend and each one works exactly the same. Here are the five prepaid debit cards you’ll need to open:

-

- Netspend Prepaid Debit Card

- Ace Elite Prepaid Debit Card

- Western Union Prepaid Debit

- H-E-B Prepaid Debit Card

- Brinks Prepaid Debit Card or Netspend MLB Prepaid Debit Card (some people have found that they can’t activate the savings accounts with Brinks, so in that case, use MLB if that happens)

Below, I’ve listed step-by-step directions on how to set up your savings accounts with Netspend. It might look like a lot of steps, but it really isn’t as complicated as it looks. The process of opening up all of the accounts will take some time, but the actual work of setting up the accounts only takes a few minutes. Most of your time will be spent reading this post or waiting for the cards to arrive in the mail.

The most important thing is don’t rush it! Follow these steps carefully, enjoy the process, and avoid the urge to skip ahead or do multiple steps at once. This is a money hack, and if you skip ahead or try to do multiple steps at once, you could end up causing more headaches for yourself, making the process harder and taking more time than it needs to.

Again, take it step-by-step, exactly as I’ve laid it out below, and you can’t go wrong.

1. Set Up An Online Checking Or Savings Account With A Normal, Online Bank.

You’ll first need to have an online checking or savings account that lets you transfer money to the prepaid debit card. I use Ally Bank. It’s a completely free online bank that offers a good, high-yield savings account. The really good thing about Ally is that it lets you link as many external bank accounts as you want, which makes it a very valuable hub bank account to have. Some banks, such as Capital One 360, limit you to linking 3 external bank accounts. Since we need to be able to link at least 5 external bank accounts, Ally is my preferred choice.

*Note: my experience with Netspend is entirely through linking it and doing transfers through Ally. I can’t guarantee that everything works perfectly when done using any other bank. Ally is a totally free bank, so if you don’t have an account with them, it’s easy enough to just open up an account and use it just for your emergency fund purposes. If you opt to use another bank as your normal bank account, the steps should still be the same, but your mileage may vary. Just make sure that your bank has free ACH transfers in and out of the account.

**Additional note: I recently discovered that Capital One 360 won’t link with Netspend. As a result, you can’t use Capital One 360 as your transferring bank.

2. Sign Up For Your Netspend Account.

Next, you’ll need to sign up for a Netspend account. If you use my link here, you’ll get a $20 bonus to start off your account once you deposit $20 or more (note, I’ll also receive $20 as a referral bonus – it helps me run this site). Make sure that the code 1450481187 is in the Referral Code section of the sign-up form in order to qualify for the $20 bonus.

Once you sign up for a Netspend account, you can then refer other members of your household and snag yourself another $20 bonus. All you need to do is sign up for a Netspend account, collect your $20 referral bonus, then refer your spouse or partner to open up an account using your own personal referral code. They’ll get $20 and you’ll get another $20.

Unfortunately, you can only get the $20 bonus on the first Netspend account that you open. The other accounts you open won’t be eligible for a bonus.

3. Wait For Your Prepaid Debit Card To Arrive In The Mail And Then Activate It.

After you’ve signed up with Netspend, wait for the prepaid debit card to arrive in the mail. It probably took about a week before my Netspend card arrived. The packet will have a bunch of stuff that every bank has to send. Think of things like the fee schedule, truth-in-lending act documents, etc. I pretty much just shred all of that stuff.

Also included in that packet will be your routing number and account number (just like with a regular bank). Make sure you keep this information somewhere because you’ll need it in order to link your bank account with your Netspend account. My recommendation is to scan it with your phone and save it in Google Drive or Evernote.

Now, follow the directions to activate your card. You should default to the “pay-as-you-go plan.” Stay on this plan since it has no monthly fees. We don’t care about the usage fees because we’re never going to use the prepaid debit card. Make sure that you’ve also activated your online banking account as well.

Once you’ve activated the card, put it in a safe or a drawer for safekeeping. You’ll never use that card again, but you’ll still want to keep it just in case.

*IMPORTANT: Do not try to link your Netspend account to your bank before you’ve received the card and activated it. Your bank will likely deny the transaction, and then you’ll have way more of a hassle to deal with.

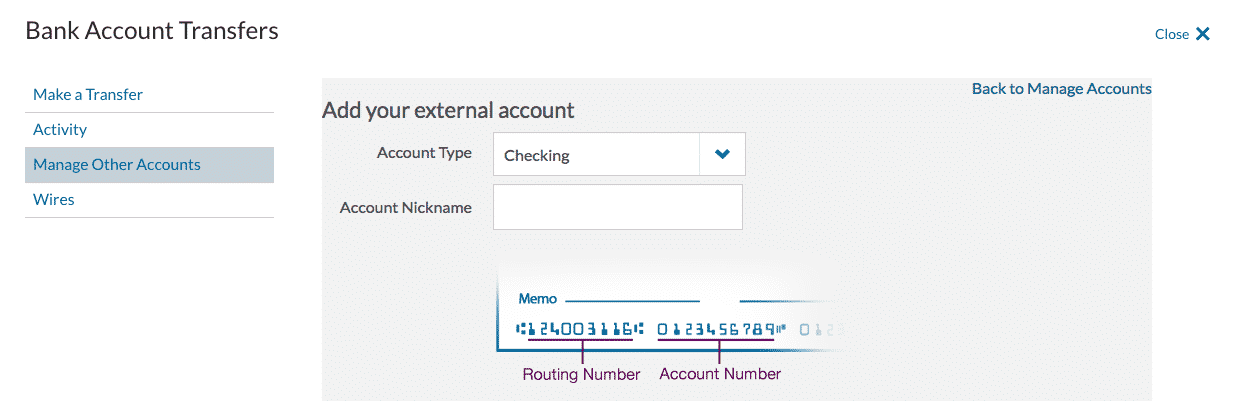

4. Link Your Bank Account With Your Netspend Account.

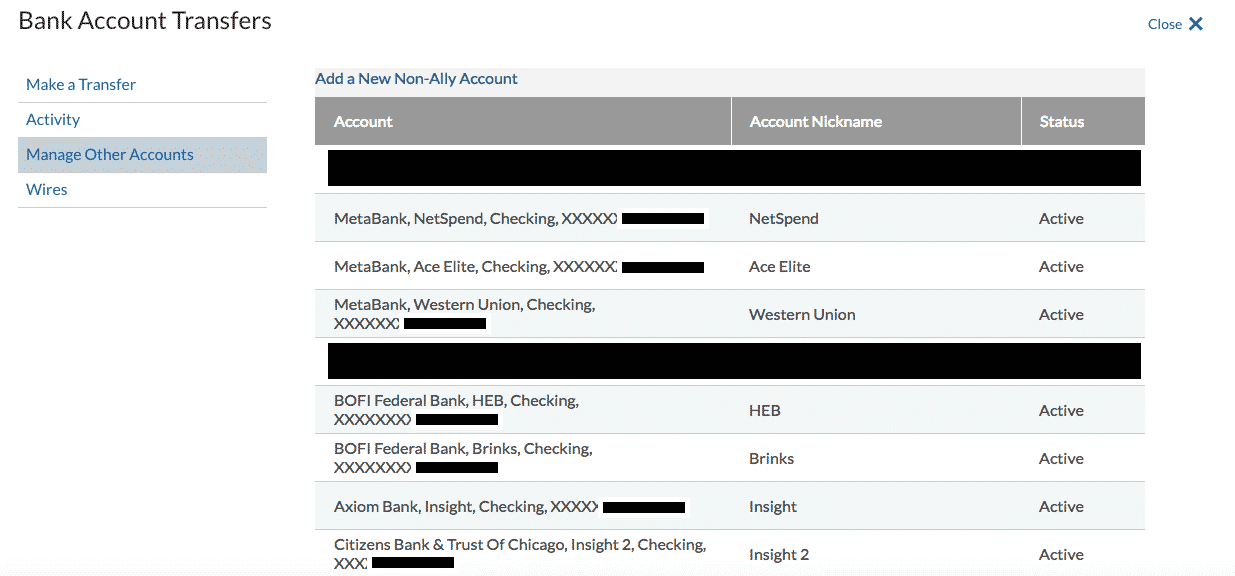

Now that your Netspend account is activated, we’ll need to link it to your regular bank account. For Ally bank account holders, go to Transfers in the top bar of your Ally bank account. Then click on Manage Other Accounts. Then click Add New Non-Ally Account. For account type, choose Checking.

Then enter an account nickname and the routing number/account number for your Netspend account. For the nickname, I typically name it by the brand of card I received (i.e. Netspend, Ace Elite, Western Union, etc). Your external bank account screen should look something like this once you’ve linked all of your accounts:

Once linked, your bank will probably send some test deposits for you to confirm. When the account is confirmed, you’ll be able to transfer money from your bank account onto your Netspend prepaid debit card.

*Note: While uncommon, a small number of people have had issues with linking their bank account to Netspend. I think this can sometimes happen when your bank tries to pull the trial test deposits back before they actually make it onto the card. This results in the transfer getting rejected for insufficient funds, and then your bank might block Netspend as a security measure. There are a few solutions around this, which include:

- Use another bank that lets you automate small monthly or bi-monthly transfers; or

- Use a bank that doesn’t do test deposits, put some money onto your Netspend card, then link your bank with the primary bank you want to use (like Ally).

I’ve personally set up ten Netspend accounts and have never had any issues with linking Ally to Netspend, but some folks have, so it’s something to think about.

5. Transfer Money From Your Bank Account Onto Your Prepaid Debit Card.

Next, transfer money from your bank account onto your prepaid debit card. For the Netspend, Ace Elite, Western, Union, and H-E-B card, the savings account should become available once you transfer any amount of money onto the card (remember to transfer at least $40 on your first card in order to snag the referral bonus).

For the Brinks card, you’ll need to transfer $500 in order to activate the savings account. Some people have reported that the Brinks card no longer has the savings account option, so if you find that to be the case, use the Netspend MLB Prepaid Card, which has no transfer requirement to activate the savings account. Since we can get 5% interest on up to $1,000, I recommend putting the full $1,000 onto each card, if possible.

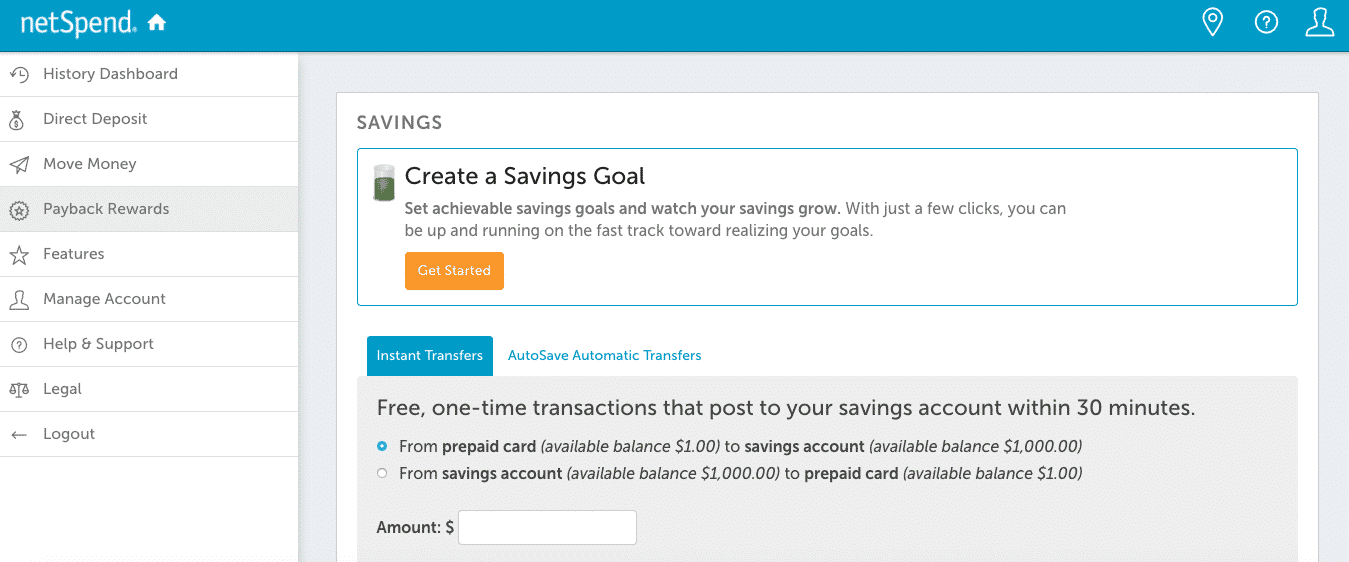

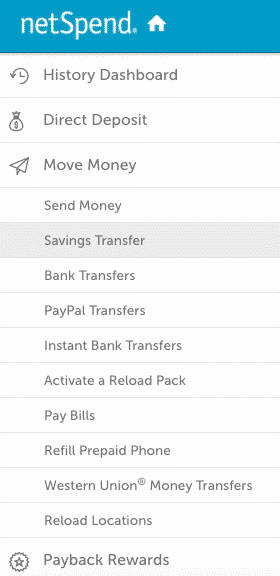

After you’ve transferred money to the card, you should now be able to gain access to your savings account. In your Netspend account, go to Move Money in the sidebar, then click on the option that says Savings Transfer. There should be an option to activate your savings account. Remember, the money in your savings account is FDIC insured, so your money is subject to the same protections as any other bank.

*Note: When you first move money onto your Netspend card, they might send you an additional Netspend “Premier” Card in the mail. Don’t activate that card. Just stick it in a drawer once you receive it and ignore it.

6. Transfer Money From Your Prepaid Debit Card Into Your 6% Interest Savings Account.

You’ve now got money in your Netspend account, but it’s still sitting on the prepaid debit card. Now that we’ve activated the Netspend savings account option, we just need to transfer the money from the prepaid debit card into the savings account.

Go to Move Money, then click Savings Transfer, and then transfer all of the money from your prepaid debit card into your savings account. Your savings account should now have a balance of $1,000. Your prepaid debit card should have a balance of $0.

7. Set Up An Automatic Transfer of $1 Every Month Into Your Netspend Account To Avoid Any Inactivity Fees.

Success! You’ve now got money in your FDIC-insured savings account earning 6% guaranteed interest! Now you don’t need to feel so bad that your money isn’t working for you.

We’re not done yet, though! The only fee we need to worry about is an inactivity fee. Netspend charges an inactivity fee if there’s no activity in your account for 60 days. They don’t count withdrawals as an activity, so we’ll need to set up an automatic transfer of $1 onto the prepaid debit card at least every 60 days in order to avoid that fee.

To be on the safe side, I set up an automatic transfer of $1 at the beginning of each month. To set this up in Ally, log into your Ally account and select Make a Transfer. Then schedule a transfer of $1 from your Ally account into your Netspend account. For frequency, set it to transfer the $1 every month. By doing this, we’ll never have to worry about any inactivity fee because there will be a $1 deposit onto the debit card every 30 days or so.

One thing to remember is that, if you’re automating your $1 transfers from a savings account, your bank may limit you to 6 transfers per statement period. As a result, if you’re using a savings account to do your automatic transfers, you’ll need to stagger them out over different months so that you don’t hit 6 transfers in one month (i.e. do 5 transfers in 1 month and 4 transfers in another month).

The easier way is to do your automated $1 transfers from a checking account. You can set one up in Ally at the same time you set up your savings account. I set up an Ally checking account and have all of my $1 transfers scheduled for the first business day of every month.

In addition, I also automate that same $1 transfer back to my Ally account at the end of each month. That way, I don’t have the money sitting in the account doing nothing either.

8. Repeat The Above Steps With Each New Account.

With where things currently stand, I think you only need to get the Netspend card and get the 6% interest account.

However, if you want to get all of the Netspend branded cards, you”ll need to do the above steps four more times if you want to put the maximum amount possible into Netspend. You’ll need a different username for each account, so what I recommend is using the username for your first Netspend account, then putting a different number at the end (i.e. username1, username2, username3, etc).

Here are the remaining four cards you’ll need to open:

- Ace Elite Prepaid Debit Card

- Western Union Prepaid Debit Card

- H-E-B Prepaid Debit Card. The one thing to note about the H-E-B card is that it comes with a $2.95 activation fee. They deduct this right out of your account, so the account starts off in the negative once you sign up. The $2.95 activation fee is worth it because we’re going to get much more back in interest. (Update: folks have told me that there is no longer an activation fee for H-E-B cards, which makes this even better).

- Brinks Prepaid Mastercard. They require you to deposit at least $500 to activate the 5% interest savings account. (*Note: Some users have reported that the Brinks card no longer offers a savings account. If that’s the case, use the Netspend MLB card as your 5th card).

- Netspend MLB Prepaid Debit Card. This is another “flavor” of the primary Netspend card. Some people have stated that the Brinks card no longer has the 5% interest savings account, so you’ll instead want to open this Netspend MLB card as your 5th card if you find the Brinks card doesn’t work.

Remember that while it might take a little bit of time for all your cards to arrive, the actual process of setting up each account only takes a few minutes or so. It won’t take you long to set all these up.

If you’re a two-person household, you can have your spouse follow the same steps at the same time as you do. Start with the first card and move on down the line.

*Troubleshooting. A few readers have indicated that they sometimes get stuck when trying to get a 4th or 5th card. The solution, according to folks in the comment section, is to apply for the 4th and 5th cards with your browser in incognito mode.

*H-E-B Debit Account. The H-E-B Debit Account is a debit card from H-E-B that comes with a 6% interest savings account. You’ll earn 6% interest on the first $2,000 in your account. Importantly, the H-E-B Debit Account is considered a separate product from the H-E-B Prepaid Netspend account. That means you can have both the H-E-B Prepaid Netspend account AND the H-E-B Debit account.

If you’re opening the Netspend accounts, you should also open the H-E-B Debit account to gain another $2,000 of mega-high-yield savings. Follow the same steps as with the Netspend accounts (including automating a bi-monthly or quarterly transfer into the account to avoid inactivity fees).

Here’s a post with more detail about the H-E-B Debit Account and how it works: The H-E-B Debit Card 6% Interest Savings Account.

Quick Recap

To quickly recap the process of setting up your 5% interest savings accounts with Netspend:

- Set up an online bank account with a bank like Ally.

- Sign up for your Netspend account.

- Get your Netspend debit card in the mail and activate your account.

- Link your bank account with your Netspend account.

- Transfer money from your bank account onto your Netspend debit card.

- Transfer money from your Netspend debit card into your 6% interest savings account.

- Automate a $1 transfer to the debit card scheduled for the beginning of each month.

- If you don’t want the money sitting in your Netspend account, automate that same $1 out of the Netspend account for hte middle or end of each month.

- Repeat the same steps with the remaining four cards.

- If you have a spouse, follow the same steps with your spouse.

A quick pro tip. One easy way to keep track of your Netspend accounts is to download each mobile app to your phone. That way, you can easily see your balance in one spot. I put them all into one folder that looks like this:

In What Order Should You Open These Accounts?

There is one 6% interest savings account and four 5% interest savings accounts you can open per person.

In terms of the order in which you should open these accounts, I recommend the following:

- First, sign up for a regular Netspend card, fund it, and snag your signup bonus. If you use my sign up link here, you’ll get a $20 bonus once you deposit $40 or more (note, I’ll also receive $20 as a referral bonus). Make sure that the code 1450481187 is in the Referral Code section of the sign-up form in order to qualify for the $20 bonus. At this point, you can put away $2,000 earning 6% interest.

- Second, use your Netspend referral code and refer your spouse or partner to Netspend. If you do that, you’ll get another $20 referral bonus and your spouse will get a $20 signup bonus. You’ll now have a total of $4,000 earning 5% interest.

After the first two, I think it’s optional whether you want to open the others. If interest rates for regular high-yield savings accounts stay around 4%, I don’t think it’s worth opening the other cards. If interest rates drop below that, then it becomes more worthwhile to open the other ones. So, here’s what you would want to do.

- First, open up an Ace Elite prepaid debit card.

- Second, open up the Western Union prepaid debit card.

- Third, open up the H-E-B prepaid debit card. The one thing to note about the H-E-B card is that it comes with a $2.95 activation fee. They deduct this right out of your account, so the account starts off in the negative once you sign up. The $2.95 activation fee is worth it, though, because we’re going to get much more back in interest.

- Fourth, open up the Brinks Prepaid Mastercard or the Netspend MLB Card as your fifth card.

- Finally, repeat the Ace Elite, Western Union, H-E-B, and Brinks or Netspend MLB cards with your spouse or partner.

If you don’t have a spouse, then just ignore the steps involving a spouse and do the steps that apply only to you.

Remember, take it slowly. Don’t open up the next card until you have the previous card fully set up. If you have every account set up and maxed out, it should look like this:

How To Withdraw Money From Your Netspend Account

If you want to withdraw money from your savings account, you need to do the following steps.

Any money in your savings account must flow through your prepaid debit card first. Remember how we saw the money flow into the Netspend savings account? It should flow the opposite way when you’re withdrawing money from the account. Think of it as looking like this:

The other key to remember is to do the withdrawals from your normal bank account. The only action that should happen in Netspend is transferring money from your savings account onto your prepaid debit card and vice-versa. Any money being pulled out of the account should always be pulled from an external bank account.

An example will help to explain it:

Let’s say we want to take out the full $1,000 from one of our savings accounts. First, I’d go into my Netspend account and transfer $1,000 from my Netspend savings account onto my Netspend prepaid debit card. Then, I go into my normal bank account (Ally bank in this case), and schedule Ally to withdraw $1,000 from my Netspend prepaid debit card. That’s it.

Just make sure if you’re withdrawing money that the money has been moved out of the savings account and onto the debit card. Your bank can’t pull money directly out of the savings account. If you attempt to pull money without any money on the debit card, you’ll probably get hit with a fee for insufficient funds.

Just think of the debit card as a funnel. Any money that you want to pull from or put into the savings account must first flow through the prepaid debit card.

If you want more information, I also wrote this post that goes into a bit more detail about how to withdraw money from Netspend: How To Transfer Money From Netspend To Bank Account.

Other Things To Note About Your Netspend Account

A few other important things to note:

- Interest Is Paid Quarterly. That means you’ll see interest post around January 1st, April 1st, July 1st, and October 1st of each year. The account terms also state that if you close the account before the interest is earned, you lose the interest for that quarter. If you want to close the account, try not to do it before you’ve collected the interest for the quarter.

- There’s No Hard Credit Pull. Netspend doesn’t do anything with your credit. No soft pull. And nothing appears on your Chex reports.

- Do Not Use The Prepaid Debit Card For Anything! Put it away and never use it. The only thing I did once I received it was to activate my account.

- Use Your Regular Bank Account If You Want To Withdraw Any Money. Remember, the prepaid debit card account acts as a funnel. Any money going in or coming out must go onto the prepaid debit card first. Don’t do anything in the Netspend account other than move money between the prepaid debit card and the 5% interest savings account. When you want to get money out of your Netspend accounts, you need to make sure the money is on the card, then initiate the withdrawal from your regular bank.

- You Can Only Earn 6% Interest On The First $2,000 In Your Netspend Account. The Netspend savings account is limited to 6% interest on the first $2,000 in the account. Anything above $2,000 in each account earns just 0.49% interest. If you want, you could just keep the interest in there. It won’t destroy you to have a little extra in the accounts. What I like to do is each time the interest posts, I withdraw all of it and bring each account down to $2,000. If you wanted to make it easier for yourself, you could just withdraw all of the excess money once per year (that’s what my wife does).

- The Other Netspend-Branded Cards Are Still Limited to 5% Interest On Your First $1,000. Given that the other cards are only at 5% interest, I don’t think it’s worth the hassle of opening them unless interest rates on regular high-yield savings accounts drop below 4%.

DCU: An Additional 5% Interest Savings Account

One other mega-high-yield savings account that I’ve opened to complement my 5% Netspend accounts is a DCU Primary Savings Account. This account offers a 6% interest rate on up to $1,000, has no monthly fees, and has no hoops to jump through. The account is with a normal credit union, so it’s just a normal savings account with a really high-interest rate on up to $1,000. Since it’s a totally free savings account, it’s also a good place to park some more of your emergency fund money. I would recommend everyone also set up a savings account with DCU in order to get a little more return on your extra cash.

There are a few things to note about DCU:

- First, to sign up for DCU, you’ll need to make a one-time, $10 donation to Reach Out For Schools (this is the cheapest donation you can make to join this credit union). You don’t have to pay this donation each year – only the one time when you set up your account. This isn’t too much of a barrier, but it essentially means you’re paying $10 to get access to this savings account.

- Second, DCU allows you to fund your account with up to $250 from your credit card. This can be helpful if you need to hit any credit card spend.

- Finally, DCU is a soft pull on your credit report, so you don’t have to worry about any hard pull.

If you’re already setting up the five Netspend accounts, you should also set up a DCU savings account to maximize your 5% interest savings accounts.

Here’s a post I wrote with step-by-step instructions on how to open your DCU account.

Why Doesn’t Everyone Use A Super High-Yield Savings Account?

One thing I’ve noticed is that a lot of people are interested in getting more interest on their savings but still won’t take the step of actually setting up these 5% interest accounts. Here are the most common reasons why people don’t utilize these accounts and my counter-arguments:

Reason 1: This looks like a lot of work. This is probably the number 1 reason most people don’t use these accounts – they think it’ll be a lot of work to set up. The thing is, the real work is done in what you’re doing right now – reading and understanding these accounts. Once you’ve done that, the actual process of setting up each 5% interest account doesn’t take up much time.

For me, the actual time I invested in setting up each account was 10 minutes or less. I literally got all of my accounts set up faster than it would take me to watch a dumb YouTube video. It’ll take you longer to plan your next vacation than it will take you to set up these savings accounts.

Reason 2: I don’t want to juggle multiple bank accounts. Another common excuse. A lot of people tell me that they don’t like the idea of having so many bank accounts. Yes, it’s true that you’ll need to open up multiple accounts in order to maximize your 5% or 6% interest savings. However, since you should be using these accounts to hold your emergency fund, you’ll never actually have to mess with the accounts other than if you want to withdraw the interest or if an emergency actually comes up. Remember, if you’ve followed the steps outlined above, then everything is already automated. You can basically treat all of these savings accounts as one big savings account.

I personally look at my accounts four times per year in order to withdraw any excess interest. Most people can probably just look at them once per year or even never if they want. Even the excess interest you earn will still earn 0.5% interest, which is still good enough for most people, especially if the rest of your emergency fund is earning 5% interest.

Reason 3: I’m scared about being charged fees. I never really understood this argument. The only fee anyone would ever actually have to worry about is the inactivity fee, which you’ll never be charged if you’ve set up an automatic monthly transfer. Even if you were to somehow get charged a fee, you’d still come out ahead given the interest you can earn.

Reason 4: This sounds too good to be true. It’s not. I’ve already explained how I do it and it’s worked out great for me. There are tons of other people out there doing the same thing. Plus, I’ve literally listed the exact step-by-step directions you need to follow if you want to do the same thing.

Reason 5: This type of interest rate can’t last. Another common reason that I’m not sure how to react to. I guess my thought is, why wouldn’t you take advantage of something while it’s still there? In any event, there’s nothing to suggest that these savings accounts will disappear one day. They’ve been around for over a decade now. They don’t take that much work to set up. And, once they’re set up, they take no work on your end.

Get Yourself A 6% Interest Savings Account With Netspend

And that right there is the definitive guide on how to earn 6% interest on your emergency fund with Netspend. It might look like a lot of work, but trust me, it’s not. The only real work is reading this post to understand how this process works. The good thing is that I’ve synthesized everything for you so that you don’t have to figure it out yourself like I did.

Some takeaways:

- The Perfect Emergency Fund Account. I think this is the perfect account to use for an emergency fund. Since your emergency fund is money you don’t need regularly, it’s helpful to have it earning the best rate possible.

- It’ll Help You Avoid Using Your Emergency Fund In Non-Emergencies. The good thing about keeping your emergency fund here is that you’ll be less tempted to use it unless there’s a real emergency. It just adds another small layer between you and your emergency fund, yet it still remains liquid and readily accessible.

- Your Money is Still Liquid. If you’re worried about liquidity, keep a base emergency fund (maybe $500 or $1,000) in your normal savings account. That way, you don’t have to worry about waiting a few business days for your funds to arrive.

Yes, it takes a bit of time to set these accounts up. You do have to sign up for them and then wait for the cards to arrive. But the actual time you have to spend activating and setting up these accounts is pretty minimal. And once set up, you never really have to touch the accounts again. The extra interest can make it worth the effort it takes you to set these up.

Ready to try it out? Sign up for a Netspend card here and get a $20 signup bonus.

So it looks like the NetSpend 6% APY $2000 is for the Debit card with a monthly $5 fixed plan fee.

The NetSpend prepaid does not even mention a savings account option, but it does have the pay as you go fee structure that the instructions at FP informed us to select. I suspect the prepaid is still 5% APY with $1000 max that you can only open once you fund the card.

Card Fee Comparison: Debit vs Prepaid

https://www.netspend.com/fees

Debit Card 6% APY w/ $2000 max savings option

https://www.netspend.com/savings-account

Well I just checked my quarterly Netspend savings account statement today and nothing has changed. It still says 5% on $1,000. So it looks like they are not going to update existing users to the new rate. Either that or the 6% is only for those having the “all access” account. It would be nice if their customer service would clarify this rather than sending me to their FAQ section which does not address this concern.

I heard that it is possible to get another H-E-B 6% on $1,000 card however so I may try for that next.

Are traditional savings accounts really the best option, or are people missing out on higher interest rates by not using high-yield savings accounts like Netspend and DCU? What are the limitations and drawbacks of these accounts that may be preventing more people from taking advantage of them?”,

“refusal

Hi Kevin it looks like they might be changing the rate on Netspend accounts to 6% on $2,000 now like the H-E-B card. They also have a Netspend “all access” account that pays 6% but that one has a mandatory $5 monthly fee which takes the rate down to 3% and nerfs the deal. It’s a bit confusing because both Netspend cards say 6% on $2,000 now so I emailed customer service and got a totally canned response directing me to their FAQ page. One Netspend card is a Visa and one is a MasterCard. I was wondering if you have any new information on this change and which cards qualify. Also with the FED cutting rates these cards have now become relevant again particularly if we can get 6% on $2,000.

Interesting. I’ve been pushing people away from Netspend because with rates where they are, no point going through the hassle unless you already have the accounts open. I do need to make some updates on this post, and probably time for another update post where we go over the options out there. Basically, the ones that are at 6% are still useful. At 5%, I’d probably pass unless we see rates dropping below like 4% or so on normal high yield savings accounts.

I’m going to do some more research here and see what’s up. It says 6% on the Netspend site, but for the other Netspend branded cards, it still says 5%.

This is strange the Netspend site says 6% on up to $2,000 yet when I login to my account it still says 5% on $1,000. As far as I know we can only have one regular Netspend card. I asked customer service to update my savings with the new 6% on $2,000 rate and they just refer me to their FAQ page. The terms and conditions for the optional savings account have not yet been updated and are dated July 1st 2016. Are you getting 6% on $2,000 on your regular Netspend? Maybe this new 6% rate is for “new customers only? Or possibly we will get updated on the next quarterly interest cycle? Oh and the FED just cut rates another .25% so looks like most savings accounts will head south of 5% fairly soon making these Netspend accounts a good option again. Oh PiBank is still paying 5.5% APY but it’s via an app only and uses Plaid. We’ll see how rates shake out this Monday. A new post on current rates would be great maybe wait another week for banks to update rates after this latest FED move.

Where does the NetSpend app tell you specifically that your savings is still earning 5%? Or are you just doing the math to determine that your latest interest earnings are at 5%. My interest earnings amounts haven’t changed so I’m assuming it’s still 5%.

I get the current interest rate and tier level from the quarterly statement online. The monthly statement does not post this just the quarterly when the interest actually posts.

The plain Netspend accounts are 5% up to $1000. The HEB debit card accounts are 6% up to $2000. I still have four regular Netspend accounts and two HEB debit account combined using my name and my wife’s name on the accounts.

These accounts absolutely pay the adverstised interest rates. I have had them for multiple years and never got rid of them even when interest rates spiked on “normal” savings accounts. Inevitably, interest rates were always going to crash. I have a Popular Direct savings account that was paying over 5.5% at one time that is now down to 4.65%. It’s just a matter of time before it dips below 4%.

The small Netspend accounts are a great place to squirrel away money and get reliable interest on a quarterly basis. Right now the best intereset rate advertised on Raisin.com is 4.62%

Anyone else get the $5 dollar deposit to one o their NS accounts? I got a text on 19 Sep from Roy S. CEO but without disclosing who it sent it.

The text said: We appreciate you! As a thank you, we have added $5 to your account for you to use on your next purchase. Sincerely, Roy S., CEO

I looked up the short code number of the text and it shows that is was sent from NS. I had to search all 6 NS accounts until I found the $5 posted to the MLB NS account. I moved it to the savings instead of leaving it in the spend account.

When the interest rates drop below 5% APY I will refund all the 5% NS savings accounts. The only NS account I left funded is the H.E.B Debit $2000, 6% APY account.

I just received a secured message from Netspend that their fees are changing effective 5/18/2024. The one that is of interest to us is their inactivity fee, which now requires an activity every 60 days (instead of previous 90 days).

“Inactivity Fees: While the Inactivity Fee will remain the same at $5.95 per month, the

timeframe to begin assessing the fee will decrease from 90 days to 60 days of inactivity.

You can avoid this fee by using your Card or Card Account for transactions, withdrawals

or loads”

Time to update the article, @Financial Panther 🙂

Thanks for the heads up. At this point, Netspend is obsolete now with rates where they are now. 4% or more with regular high-yield savings accounts from Ally, Discover, or Marcus by Goldman Sachs. 5% or more using Raisin (in-depth post about Raisin here)

I still have my Netspend account open and have money go in and out of it to avoid fees, but I don’t have any money in Netspend anymore.

I’m not sure I follow why you’re saying they’re obsolete? Aren’t they still getting 5%? I thought that they were, though now that I check mine and P1’s earnings from this most recent quarter, it looks like they got the full 5% and I got something less…which is odd. But I don’t recall getting any notification of a drop in interest rates.

It still gets 5% but it’s not worth the hassle of setting up when you can get close to 5% with no work with a normal high-yield savings account, and can get over 5% with Raisin with no limits. If you’re already set up and aren’t doing anything with it, then its fine, but I wouldn’t recommend anyone go through the hassle of opening a Netspend account if they haven’t already done it.

The fine print says they’re not going to allow Bank Transfers anymore, but it’s vague and I don’t know if they mean incoming, outgoing, generated from the Netspend side, or generated from external (via Ally for instance).

Can’t see how they can legally disallow bank transfers initiated externally though. Pretty sure all the banks have to let you withdraw if initiated via the ACH system.

This is what the notice says about money transfer. Seems like they are going to charge a fee if you initiate a transfer from an external bank or am I reading this wrong ?

– Money Transfer Service Fee: We will implement a new $3.00 fee for outgoing money transfers from your Card Account initiated through a third-party service such as Venmo, CashApp, PayPal, Western Union or other similar money transfer services. Money Transfers under $20.00 will only be assessed $1.50. This fee is charged in addition to the signature purchase transaction fee.

It’s the opposite of what you are stating. It’s a fee for non-bank transfers – they make it clear that this involves third-party apps. So, you want to put in Venmo – pay a fee. You want to transfer from Netspend to Bank Of America, no fee.

Thanks! Assume if you initiate a pull transfer via Bank of America – so using BofA to pull money from Netspend to BofA – you’re still reading that as outside of this new fee? Thanks again for your take.

Yes, I don’t interpret anything where fees are connected to a standard bank transfer.

As an aside – I understand where FP is coming from with these accounts. The have limits and are a bit quirky. I have the vast bulk of my money in Popular Direct which was 5.4% and is now 5.15%. BUT, these savings rates in standard brick and mortar banks will not last forever. Once the prime rate comes down so will interest rates. So, having these Netspend buckets available for the future is still good practice, IMO.

Watch your HEB debit card account, i got an unauthorized charge and I have never used my HEB card anywhere. Another website someone said the same thing. I reported it stolen online and it just deactivated the card, hopefully they can’t touch the savings portion.

I had the same experience

Looks like this is for an “all access” debit card and not the regular card which is the one I have. So you’d have to apply for a new card. I wonder if there are any fees associated with the new card. Talking to Support was a bit of a nightmare so I gave up trying to get more information.

Yeah, from the Deposit Account Agreement document for the card, the fees look pretty similar as the other cards. The biggest difference looks like the “all access” debt card has is a $5 monthly usage fee.

The netspend savings account from netspend.com now shows on their website it earns 6% if you have $2,000 or less. The fine print says the APY is accurate as of July 1st, 2023 so I think it’s a recent change. I think that means the MLB savings account is the same too. It looks like Western Union, HEB prepaid, and Brinks is still 5% up to 1,000.

IT looks like the 6% $2k is for the NetSpend ALL ACCESS account not the regular account.

Navy Federal now has a 15-month CD at 5% APY. Can open with as little as $50 up to a maximum of $250,000 and can add funds at any time.

“The Special 15-Month Certificate (Share Only) has a $50 minimum balance and a $250,000 maximum balance. Additional deposits are allowed at any time, subject to the maximum balance. Dividends earned are not included in the maximum balance allowed. Once the promotional rate is applied to a purchased certificate, it will remain in effect for the length of the product term. Penalties apply for early withdrawals from certificate accounts. Other restrictions may apply. “

For those that use Current app, wondering if you’re supposed to get a 1099-INT form for gained interest or you just report it from the bank statements. I never got a 1099INT form, but thought they were supposed to if gained interest is above $10. They mention a 1099-MISC and say it’s given if you received $600 or more in bonuses, but nothing about a 1099INT form. I thought all banks had to give 1099INT forms for gained interest of $10 or more. Do you add up gained interest from the account statements to report on the tax return instead since they don’t provide a 1099INT form?

I just went through the run around with Current online chat. They just repeated that they weren’t a bank. “Current interest is not a annual percentage yield or a savings account. Current Interest will be reported on

IRS Form 1099-MISC (or Form

1042-S, if applicable)”. I said then why can’t I get that form mailed and they said they just don’t do that basically (for less than $600 interest). I told them every other bank seems to email one out even for very low amounts of interest, but that didn’t go anywhere (they’re not a bank, yadayada). So if we want to know if (and how much) it was reported, then I guess we’ll have to contact the IRS. I’m pretty sure Current uses Choice Financial. I don’t know if we could get it from them.

I had the same thing – a run around with them (theyliterally had no idea what I was talkingabout and kept repeating what was on their website) and then I asked IRS – technically they are not a bank and so they do not have to send out a 1099-INT. So if you don’t get a 1099-INT you don’t have to report it – is what IRS told me.

I have been having the issue with getting Ally to link to my NetSpend accounts since early fall. I have 4 accounts each for myself and my husband, but I haven’t been able to get the 5th one to link and have had numerous emails into Ally Customer Support with no resolution. I did get the accounts funded from other bank accounts, but I don’t seem to have an account where I can pull funds from NetSpend like Ally allowed me to do. How do I avoid the inactivity fee?

I had (most of) my netspend accounts connected successfully to Ally for years and they were fully automated to avoid inactivity fees. Now, last week, Ally closed my account and I can’t even open a new account with them!? They would not tell me a reason and customer service did not have one but I am guessing that they did not like that I had netspend accounts. Every connected account was in my name and all transactions were legitimate but now that option is gone 🙁 Has anyone found other good hub banks? Most of my checking accounts won’t even connect, let alone to more than 5* accounts maximum. Any feedback would be much appreciated, I’m looking for a free checking that will connect with at least most of the netspend accounts for transfers and serve as a hub. Thanks.

Trust me open CCU acct. and you will have no problems. I have over 10 acct. Connected, no problems. I even schedule transfers that go from one bank to another using this bank! They refund all ATM fees at the end of the month so you can take out money from anywhere. They give interest on your checking account balance. They also have a cool holiday savings account. Trust me can’t go wrong….

Consumers Credit Union

I seem to be having an issue finding a bank where I can take the money out.

I added money through a local bank, but that bank doesn’t let me do the ACH in reverse. I have tried Ally, PNC and another local bank. Each one will not let me add the Netspend accounts.

Are there any other ways to move the money out? Even if it costs, I could just do it once a year and eat some of the earnings.

Not that I know of. Banks have been having issues with Netspend accounts. If the ones you tried won’t work, others likely won’t either. Sounds like new Netspend accounts have been flagged for some reason. Maybe the bank can tell you why. It shouldn’t cost you anything. At some point, banks may figure the issue out.

Just want to add that I tried to link my Ally account with my Netspend account and kept getting error messages from the Ally site. After doing some googling, it looks like Ally no longer links to Netspend accounts! At least Ally has some good savings and CD rates.

Just saw UFB Direct with 4.11 APY with Best Money Market Account, no fees and no minimum and the rate is good up to 100K. Not sure if I have missed any fine print though, still looking into it myself.

Their reviews don’t sound very good when I looked it up on google.

wow – yeah – Nerdwallet was fine but enough individual experiences that makes it seems less than ideal.

So, the Netspend accounts now seem to be hit or miss when connecting to another bank. I can no longer connect Netspend to my Ally hub, but, I was able to connect a new MLB Netspend account to a legacy bank (Citizens First Bank, where I also got a $300 new account bonus).

I already have four other Netspend accounts attached to Ally, but honestly, I have been mostly dumping larger sums into iBonds and into Current at 4% because of the $6000 max.

Current just changed requirements. To keep the 4% you have to auto deposit every month (payroll deposit). It’s not a lot but I decided to remove my entire $6k from Current. Ally works fine with no auto deposit and the difference in interest rate is negligible at this point.

Some banks I think are having issues with setting up the Netspend external bank account transactions. I had mine set up with Ally a while ago, but any new ones may have issues. I tried linking it to another local bank I have and was having issues setting it up recently. I had to call them and tell them it is a legitimate account of mine with Pathward. They have been having problems with Pathward accounts, which is used by Netspend, Western Union, and HEB so they disable the external account when trying to set it up. Should be able to call them and let them know you do have a legitimate account with Pathward.

Ally won’t allow me to link to my netspend accounts at all.

I have mine linked to Chase.

Navy Federal Credit Union has 12 month CDs at 4.85% APY, and 7 year CDs starting at 4.2% APY, in case anyone’s interested.

I really appreciate all of this great information. Thank you for putting it all in one place.

I have a few questions about the Netspend accounts.

I think that the Netspend account charges a $5.95 fee for inactivity. Am I reading this wrong?

Inactivity Fee $5.95

Per month. Fee applies if there are funds in the Card Account and the Card Account has had no activity, i.e., no purchases; no cash withdrawals; no load transactions; and no Balance Inquiry Fee, for ninety (90) days. If enrolled in the Monthly Plan and your Card Account has had no activity as described above, this fee applies instead of the Monthly Plan Fee.

Is there another way to avoid this and just leave the money in the account? I know that I would make more from interest but would still like to avoid this and not pay any fees if possible. $5.95 x 5 x 4(quarterly) would eat into the overall interest accrued if I just leave the money in the account for a year.

Is this avoided by transferring money out and paying that $1.95 fee for bank to bank transfers? Is there another way to avoid this and just leave the money in the account? I know that I would make more interest

Bank Transfer – Outbound $1.95

Per transfer of funds via ACH from your Card Account to your bank account at another financial institution. This is a third-party fee and is subject to change.

Most people just set up an automatic ACH transfer initiated from another bank like ally to the netspend account for like a penny (in my case a dollar) every two months. That takes care of the inactivity fee. Haven’t received an inactivity fee since I opened it well over a year ago.

Thank you very much! I see that in the article now. Don’t know how I missed that.

Discovered recently that my Brinks Netspend account was locked due to one of their fraud prevention policies. If they detect login attempts to more than four different Netspend accounts from the same device on the same day they will lock the fifth and subsequent attempts.

This came up because I was doing a periodic interest sweep from all 5 of my Netspend savings accounts to transfer the accumulated interest into another interest-bearing account. I didn’t quiz the representative regarding ways to get around this check, but she did ask whether I used a VPN, etc during her validation checks. So, a word to the wise, either stagger your login to that fifth account by a day or use a different device to avoid this headache.

Don’t you have to be a T-Mobile customer?

I should also note that Eric pointed out that Ally’s savings account is a higher %age rate (just checked, it’s at 3.3%) and they’ve waved limiting accounts to 6 withdrawals and the fees accociated with that. So it sounds like that’s even better. I finally have a reason to try Ally.

Just thought i’d mention it was well.

No. You don’t have to be a T-Mobile customer to have a T-Mobile Money checking account. The rate as of December 22, 2022 is 2.50% APY for ALL accounts.

There is a higher 4% APY rate for people who are T-Mobile customers and want to jump through hoops to get it. But the 2.50% APY is on ALL account.

Ally has a higher 3.30% APY right now. But I cannot get it to link to any of my NetSpend accounts, so I’m going to give up trying. I’ve been using T-Mobile Money to transfer to all my NetSpend accounts for years. The only option is to transfer monthly though, as they don’t have an option to send bi-monthly (every 60 days) or more.

Other than the ability to set up transfers every other month, I don’t understand why so many people are using Ally. While it is a convenience not to have to think about the account for 60 or so days, it seems to me that interest is what we’re all about. With T-Mobile Money, the interest is 2.25% on a CHECKING account – with no hoops to jump through. No minimum balances. No direct deposits required. No using debit cards for a number of transactions. And it’s a CHECKING account, which means we’re not limited to the 6 withdrawals a month that savings account are limited to.

So am I missing something?

Most of the issues you list don’t apply with an Ally Bank savings account. There is no minimum balance, no direct deposits required, and no debit transactions required. There is a 6 withdrawal limit per month on their savings accounts, but they are currently refunding the fee per: https://www.ally.com/bank/online-savings-account/

Their online savings account is currently offering 2.35%, but they also have a special deal where newly added money left there for a few months is effectively earning over 6% for a few months: https://www.doctorofcredit.com/ally-bank-bonus-earn-up-to-500-1-of-deposit-new-existing-customers/.

Ally savings account is making 2.35% right now. I don’t need more than six transfers out of savings a month, but I do need larger transfer sizes which Ally beats everyone else I have tried with. They have very high limits on your transfer amounts like $250,000 a day but just in the last month (week?) they seemed to have changed how they post these limits. They use to have a small chart. Now you have to go somewhere else (that looks temporary) and it just says “higher limits up to 250k”.

Ally also lets you connect with more banks (like 20) than places like WELLS FARGO as far as I can tell. And WELLS FARGO transfer limits can be like $5000. I’m not sure but Wells Fargo may have raised their posted daily and monthly limits recently (I’m seeing 15000 and 25000 daily and monthly limits respectively right now, depending on the transfer type; maybe it has been these amounts for a long time). These are general limits and not specific to my account.

Ally phone support!:

Recently I’ve experienced multiple phone support wait times on Ally of like an hour and a half! A little worrying.

And T-Mobile does have hoops to jump through: must register for perks and make at least 10 qualifying transactions per month using their T-Mobile MONEY card and/or instant payments to friends.

No, that’s only to earn the 4% interest rate. It is now 2.5% APY for all account holders. The hoops you’re talking about is only for those who have T-Mobile accounts besides, and are willing to jump through those hoops to get the higher %age rate.

(I haven’t checked Ally today to see if they’ve increased their again too).

As it turns out, my Ally Savings Account has an interest rate of 2.35%. No hoops to jump through. No minimum balance. No direct deposit required. No using debit cards for a number of transactions. Technically limited to 6 withdrawals but they have now waved the fee for going over 6. Looks like the only thing you’re missing is that extra 0.1% interest. 🙂

Discover is currently not accepting new applications for checking accounts, which is what they are calling their Cashback Debit account. You mentioned the $25 minimum for transfers but Discover also notes a $30 fee for outgoing wire transfers. Would these $25 periodic transfers to Netspend in order to avoid inactivity fees be considered wire transfers and subject to the $30 wire transfer fee? You can open a Discover savings account but I would think your subject to the limit of 6 transactions per month.

This happened to me, too, after already linking accounts previously. I spoke with Ally and they indicated that the bank associated with the routing number has been flagged by Ally as being open to possible fraud. They further explained that it doesn’t have the safety and fraud prevention measures in place that they deem necessary. That is why the routing number is coming up as invalid. There is nothing that can be done to override it or anything. Trying to validate the account through small deposits won’t work. I asked how this can be since I already have accounts linked and they said that they won’t de-link accounts but you won’t be able to link any going forward to that routing number, at least using Ally. Any ideas if there are other routing numbers that these cards can be issued against?

When Ally hasn’t worked, I’ve used Discover. Transfers have be minimum of $25 there, but its easy enough to set up a bi-monthly $25 transfer in, then $25 transfer out.

I opened a third account using MLB Netspend. No issue opening account, card arrived within a week and no trouble activating the card. However, when I tried to set up Ally to link I received an error message – this happened multiple times. I also noticed that Netspend no longer uses Metabank, the bank is now listed in my Ally account for the other Netspend accounts as Pathward, National Association.

I don’t know if this is having any impact, but I’ve never had any prior trouble. The routing number is the same as before and the account number has the same basic format. I also tried to connect with my main legacy bank (TD Bank), but it wouldn’t even recognize the routing number.

I’m going to try and make a small deposit from my payroll account and see if that works.

Hi, does anyone know if all these banks provide 1099INT forms to report on taxes for any gained interest? It’s my first year doing it so wondering if they send one out. Thanks!

Yeah, they all send 1099s

Confirming availability of the 5% Savings account on Brinks Prepaid MC. It was activated for me after the first $100 test transfer.

Question: The savings account agreement states that 5% is paid on the first $5,000, not the $1,000 stated in the website footnotes. Can anybody confirm which limit actually applies?

Same success with Ally sending a penny to my maxed out savings accounts. Never any issues at all.

Has anyone tried recurring ach transfer of 1 cent to the prepaid cards to prevent the inactivity fee? I am trying this with Tmobile money but was wondering if it worked for sure.

As long as you can link it, you’ll be fine. Just give it a shot and if it doesn’t work, try again with a different bank.

Yea, that’s what I do with Ally bank and it’s been fine.

Thanks for the confirmations. I have been able to link with Tmobile money and can do recurring transfer of 1 cent.

I have Netspend and Elite set up so far and now processing Western Union without issue yet. I’m curious to see what order people have been opening the cards and that ends up triggering something on their end to close accounts.

I’ve heard one of the cards on the list was switching to metabanks which would make 4 of cards with the same bank going over the 3 card limit. I only remember reading this on doctor of credit so I cannot confirm. And it was not about Porte. I will look to see what I exactly read.

I guess it read about the change earlier in this thread.

Also Elements high interest checking account is able to link with these accounts without issue and can send a penny.

Had trouble linking one of the Netspend accounts to my Ally accounts. Kept on getting an error telling me the routing number was invalid. Called Ally who told me that the bank associated with the routing number has been flagged by Ally as a frequent source of bank fraud so Ally won’t allow you to link it. So now I have an activated Netspend account with no way to transfer money to it. Has anyone else had this problem? Any other banks that people have successfully linked to their Netspend bank account?

On a related note, Ally customer service also told me that there is in fact a 20 account limit for the number of linked accounts you can have. Has anyone else heard of this?

I have four Netspend accounts and have never had any issues at all either opening them up or linking to my Ally hub account. It seems so hit or miss for people who have trouble with Netspend. I have never tried to link Netspend with any other bank, but I was aware that Ally as a 20 account limit.

I got a call from Ally Fraud Prevention the other day asking about all the $1 Metabank transfers. I explained the situation and he indicated he’d heard the same from multiple customers that morning. Now that Ally knows what’s going on, perhaps they’ll “unflag” Metabank and start allowing accounts to be linked again? Not sure. They didn’t unlink my existing accounts or block my transfers, though…

Wanted to add a data point for Penn Community Bank. The following were required:

1. Open a free checking account with $25

2. Make $1000 in real payroll direct deposit within 60 days

I completed the two requirements and a juicy $350 bonus was delivered to my account in four business days.

The account must remain open six months.

Easy as could be. It seems you may have to be a Pennsylvania resident (based on another reader’s experiences) but that is not stated in the small print.

https://www.penncommunitybank.com/CashBonus400/

The site says it ends 7/23 but that is wrong. An ad in local paper last week for this with a new end date.

I couldn’t disagree more. Initial setup took a couple hours. Then it’s 15 minutes every three months. Wife and I have 26 of these high interest savings accounts and we earn around $1,800 a year in interest. I don’t know about you but $1,800 for an EASY hours worth of work sounds TOTALLY worth it.

Eric, if you don’t mind me asking, what comprises your 26 accounts? I assume you and your wife each have the 5 Netspend accounts (5 being the most accounts Netspend will let be open per social security number) plus the H-E-B Debit, which would be 12 of the 26 accounts. I understand that Insight has shut down the 5% accounts so what are the other 14?

4 Digital Credit Union (one for each of our two kids) – $4k at 6.17% APR

4 Service Credit Union – $2k at 5%

4 Blue Federal Credit Union – $4k at 5%

2 Current – $12k at 4%

2 Workers Credit Union – $2k but their interest is only 3.56%

Thanks for sharing this Eric. For people who complain about difficulties with Netspend the easiest way to get started with these types of account is is to simply open a Current account and right there you have $6k to work with at 4% – if you have a spouse now you have $12k. That’s a great place to start an emergency fund.

blue federal is not $4k at 5%. It’s only $1k at 5% and the tiere go down from there.

i see i misread the comment. but i don’t see a way to remove mine. so….

To complicated. Not worth all the nonsense and hip-hops to get this done. Laughable really that people actually have the time for this. By the way this comment will not be posted. No counter narrative need apply.

For some reason i can’t link my Ally bank account to Netspend, any ideas? i tried Schwab and it said not supported and I got discover to work but they have a high minimum transfer so I couldn’t just do a dollar

For me I have Ally bank take the money out of Netspend. Not the other way around. Doing it through Ally, I’ve had no problems.

Sorry if I was not clear, all of these were from the other banks not netspend. When on Ally’s website and trying to add netspend it says “cannot be verified”

I’d try different things to troubleshoot it. If you have to enter a password, make sure it’s the right one. I think you can also go another route to set up where they send micro deposits in 2-3 days to verify. Before that you could try using a different browser. That could be an issue.

I’m having the exact same problem. I enter in the routing number and it recognizes Pathway, enter in the account number and click continue, get the message about sending two small test deposits, but as soon as I click submit, immediately a message comes up that tells me it cannot verify the info.

I can’t get past the H-E-B Prepaid card. I try and sign up for it and I get a response that my submission can’t be approved at this time. Anybody else get this and, if so, how do you get around it? I tried incognito mode but that didn’t work.

I was having this issue too. I thought it might be because I had already opened the HEB Netspend account. I tried again more than 30 days after, and it let me open the HEB Prepaid account. Hope this helps.

I have a question that I’ve long been wondering if I’m doing things correctly. So, first, thank you is long overdue – so thank you!

Now, I’ve been doing $1 transfers to each of my cards once a month since that’s the way my bank works. Then I wait a day or two to see it appear in the prepaid card balance. I then transfer it into the savings connected to the card and wait another day, because I’ve always assumed we had to do that in order to qualify to get the interest, and to avoid fees. But I’ve always wondered if I have to do that step. Is it enough just to transfer the $1 to the prepaid card without transferring it to the savings, and then retrieve it again from my bank’s website? Or have I been doing it right all along by transferring it to the preapid card, then to the savings, waiting a day, and then transferring it back to the prepaid card to retrieve it back from my bank?

Yes, you only need to transfer to the prepaid card in order to avoid the inactivity fee. Not savings.

I use Ally and transfer $1 every 60 days. Then quarterly when I login in to transfer the interest from Savings to Spend account. After that I pull out the interest + transfered amount. The most each account would have minus the interest is $2.

HI,

YOU MENTIONED THAT YOU WERE ABLE TO USE DISCOVER TO MAKE DIRECT DEPOITS TO OPEN THESE SAVINGS ACCOUNTS. PLEASE EXPLAIN HOW I CAN ALSO DO THAT.

THANKS, GLEN CRUZEN

I AM AWAITING YOUR REPLY.

Wow. 22 minutes after your question? Patience is a virtue.

As of June 2022, it seems that the Western Union prepaid card has an outbound transfer fee of $1.95 for ACH transfers, which I did not find out until receiving the card, activating it and reading the terms upon trying to initiate a bank transfer (does not appear in the fee schedule on the website). It’s unclear to me if the outbound fee is assessed if the transfer is initiated from another bank, but it’s not worth it to me to find out, especially if I’m automating transfers in and out to avoid inactivity fees. I haven’t opened this card, but the Brinks Prepaid Mastercard also has a $3.00 per transfer fee for ” Transfer of funds via ACH from your Card Account to your bank account at another financial institution.” However, I have been able to open two separate accounts via the regular Netspend Prepaid Card, activate them, and deposit money into savings without issue, so maybe that’s a workaround for the cards with outgoing fees. I’ve also opened the Netspend MLB account that has the same terms as the regular Netspend account.

Also, both the H-E-B Debit card and Western Union cards have an incoming and outgoing limit of $300 per day and $500 for any 30 day period, just something to be aware of if using this as an emergency fund. Although, I mistakenly thought the $500 limit was per calendar month and not for every 30 days, so I was actually able to deposit $1000 to the H-E-B Debit in less than 30 days and the transfer went through (initiated external transfer from my credit union). I did email them to ask if the limits only applied to transfers initiated via their website and not to transfers initiated externally, but they never replied… Haven’t yet tried any outgoing transfers.

Thanks for a very informative website! Feels good to finally build a proper emergency fund and actually have it earning some interest!

FYI, there’s no fee if you initiate the transfer from an external account, per the directions in this post (i.e. doing an ACH pull). Hundreds of other people have done the same too without issue. Have had this account for 6 years now and have never paid a fee. This isn’t a new fee – they’ve had it since the account was created over a decade ago. But it doesn’t apply to ACH pulls.

Ah, gotcha! Thanks for the quick reply, I did not realise the fee didn’t apply to ACH pulls. In that case I’ll keep the account and initiate all transfers externally. Appreciate the help and the informative website!

PS: Here is what I was referring to about 5% on $5,000…

Rate Information

Variable Rate

• Interest Rate -Tiered Variable Rate

• If your average daily balance is $5,000.00 or less, the interest rate paid on the entire balance will be4.91% with an annual percentage yield of 5.00%.

• An interest rate of 0.49% will be paid only for that portion of your average daily balance that is greater than $5,000.00. The annual percentage yield for this tier will range from 5.00% to 0.54%, depending on the balance in the account.

My guess is it’s a typo. But if someone wants to try and then do the math for us, I’d be more than happy to be proven wrong!

I just opened my Brinks Card and was activating the Savings account today when I noticed something that caught my eye. The Truth-in-Savings disclosure says in one place that 5% interest will be paid up to $5,000 in average daily balance (not $1,000). See language below.

Of course, at the top of the agreement, it does say only $1,000 will be paid 5%, so I don’t know if this is just a typo/sloppy editing or has anyone actually got paid 5% on more than $1,000 in balance?

Thoughts, @Financial Panther @Kevin?

Where can I find account number for Netspend savings account? I want to setup transactions from Ally directly to Netspend savings account

You cannot link your Netspend Savings to Ally. Instead, you will link your Netspend Prepaid account with Ally and then push your funds from Ally to Netspend Prepaid account. Once the funds are in the Prepaid account, you will need to do an internal transfer from Netspend Prepaid to Netspend Savings. That transfer is instantaneous.

When you’re in your Netspend account, go to “Account” tab on the left of the screen. On that page it will have the routing and account number needed to set up transactions.

When you’re in your Netspend account, click “Account” tab on the left of the screen. On that page you’ll see the routing and account number needed to set up the transaction.

Not sure what the deal is, but my husband’s accounts with Netspend have been very difficult to activate. The first Netspend was okay and we got the bonus and saving account setup, but the second (H-E-B) and 3rd (Ace Elite) have triggered some kind of security issues. We have to call them, then upload documents (driver’s license, utility bill, AND ss card), then call them again, then verify more data. I doubt we’ll try another one, I’m afraid they will close them all! Plus, like others, I don’t like the ss card requirement. I wouldn’t email any of the documents, but they finally gave me a link to upload them securely. The DO have such a link, even the one customer rep insisted that they did not.

I have tried to follow the instructions to set up the Netspend and 4 other related accounts. When I fill out my information, pick my card design, and click sign up, the cursor just turns into a spinning wheel and (so far, at least) never goes to a confirmation page. I waited to see if it went through and I would get something in the mail despite the page not loading, but no luck so far. Any suggestions? Has anyone else had this happen? Is this just not really an option anymore through the Netspend accounts?

I have opened four accounts with the most recent in January. I have had no issues at all.

I haven’t had that issue. Only issue has been for one card they locked my account for some reason so I couldn’t activate it. I just moved on to another card and was fine after that and have 2 cards activated so far. I’d try another browser such as Safari, Chrome etc. That can sometimes be an issue. Can also try to move on to sign up for another NetSpend card to see if it goes through.

I had the same issue. Spinning into the abyss. Try using a different web browser to request the card. The brave browser did not work for me. Google chrome did not work for me. Microsoft edge did not work for me. I have done four of then via my iPhone thru the safari browser.

HS – nice to know that it should still work.

Oh, I hadn’t thought about the browser, JJ! I will try that.

Anon, I’m using Brave. I’ll try Safari first since that’s what worked for you.

Thanks, all!

Update: Using Safari on desktop, I was successful opening the Netspend, Ace Elite, and HEB Prepaid accts. For MLB and Western Union, I got the message, “We are unable to complete your request at this time,” even when I tried it in a Safari private/incognito window. With the HEB Debit acct, I was unable to complete the signup process (creating username, password, etc) in Safari, but it gave me a different message saying that I had already requested a card and it would arrive in 7-10 days, so I’m not sure whether that one went through or not… Right now, I’m thinking I’ll try the ones that didn’t work again in a day or two and see if they go through then. Fingers crossed!

I was able to link my Mango card as a funding source inside my Serve account, pull money from Mango, then push it to my checking account without any fees.

I’ve also read that you can avoid the $3/mo fee by not leaving any funds in your card account, but I have not confirmed this yet.

Hi, looks like I somehow got two Netspend accounts. Not with Elite, Western Union etc. yet. I activated the two Netspend back account, but can you have to Netspend bank accounts with different account numbers earning 5% interest? And can you get 5 Netspend bank accounts with different account numbers earning 5% or have to go the route of using Elite, Western Union etc.?

Thanks

Has anyone had success transferring their money back to their Chase Checking account?

I need the money in order to pay off some of my bills right now and tried using the method noted in the article above:

1) I moved all but $25 (randomly decided to leave $25 in each account) from my 4 Netspend accounts from Savings to my never used Prepaid Debit accounts.

2) I requested 4 separate transfers from these accounts to my Chase Checking account via Chase, but these were marked as failed and Chase froze access to my Checking and Credit Card accounts until I called in today.

When I spoke to Chase on the phone, they told me I’m not able to do this and that it would cost me a $25 transfer fee. Does anyone know a workaround or at least the “lowest fee” way to get my money back into my Chase Checking?

Thank you!

It has been widely suggested to use a hub account, such as Ally, to move money back and forth from Netspend (or other high-yield accounts) back to a traditional account. I have never had any problems using this procedure to move money in either direction and have never had a charge.

Okay thank you! I read about that above but was wondering if Chase wasn’t being fully honest with me. Will try that!

I think they are catching on to people doing this because I only got two of the extra cards to work when applying. A third one worked but now says my account has been locked. My wife could not get any of them to work after doing the initial Netspend account. Has anyone else had this issue? I am hoping the two cards I do receive will activate so I can at least have those accounts to gain the interest from. We will see once they arrive.

I was on my second card with Elite and once I got it, I tried to activate it, but said my account was locked. I called and they want me to send SSN, ID, and address to verify something. Not so sure it that’s safe to do over email.

Agreed – definitely not safe! I brought that concern up to Netspend multiple times in email and over the phone and said no other financial institution has asked me for sensitive information without an safe encrypted option. They did not ever address the concern, and literally kept repeating a script asking me to send my info. I was curious what others thought. I have decided I won’t be risking sending sensitive info through email.

I won’t either. I moved on to see if setting up other cards will work. Got the Western Union recently and that worked so not sure what the issue with Elite was.