One of the keys to being successful with money is to have a strong money system in place. You’ll find that once you’ve done that, money seems to build up without you even realizing it. I don’t really budget, and to be frank, I’m not really all that frugal either. And yet, every month, I seem to have more money than I did before.

That’s because my money system is heavily automated. I’ve always maintained that saving isn’t about willing yourself to save more – it’s about having the right systems in place so that money gets saved without you even realizing it. You probably already do this to at least some extent – automatic contributions into your 401k and other retirement plans, saving money to various savings accounts, etc.

I do all of this too, but I also like to push myself to save a little bit more by using fintech apps that run in the background. These apps help me squeeze just a bit more savings out of my budget each day.

I go through a ton of fintech apps and most of them end up unused on my phone. It’s a pretty big deal to me when I find an app that I actually use. And if I write about it, it means I think it’s especially useful. The app I’m talking about today is called Albert – and it’s one that I think you should consider adding to your money system.

In this Albert app review, we’re going to go over how Albert works and the way I recommend using this app.

Using Microsavings Apps To Improve Your Money System

Before jumping into what Albert is and why you should use this app, I’d like to first explain a little bit about how my money system works.

As part of my money system, I like having apps that run in the background, monitoring my transactions, and figuring out ways to automatically save more money for me. In my view, when money is in front of you, you’ll figure out a way to spend it. So, it’s important to keep your money moving and out of your grubby hands.

Microsaving apps are what I use to help get more money out of my hands. These microsaving apps monitor my spending and save small amounts of money for me daily. It’s a small enough amount that I don’t notice it, but over time, I end up with a surprising amount of extra money saved. By themselves, microsaving apps aren’t going to be enough as a savings vehicle, but when you add them on as an extra layer to an already well-run money system, they can work magic.

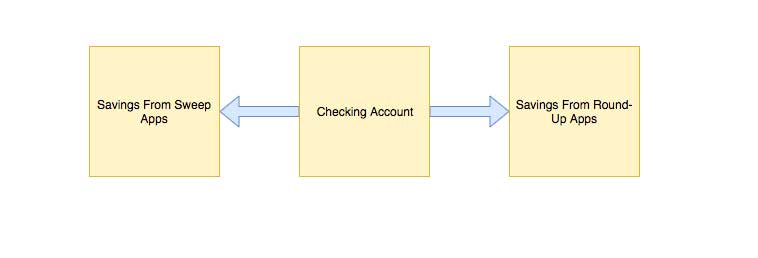

There are two types of microsavings apps that I incorporate into my money system. These include the following:

- Round-Up Apps. These are apps that monitor my credit card transactions and round up each transaction to the nearest dollar. They then take the spare change and put that money into a separate savings account. Think of these apps as an online piggy bank for your spare change. The app I currently use as my round-up app is Peak Money. If I spend $1.50 on something, Peak rounds up that transaction to $2, pulls 50 cents from my checking account, and saves it away in a separate, FDIC-insured savings account. Check out my Peak Money App Review for more information about Peak and how you can use it.

- Sweep Apps. These types of apps monitor my bank account and, using smart algorithms, save small amounts of money for me each week. Unlike round-up apps, “sweep” apps aren’t tied to any specific transactions. Instead, they just analyze the money that I have in my checking account and see if I have extra money to spare. If the app thinks I have money to spare, it moves it out into a separate savings account. I’m a big fan of sweep apps because they keep my money from sitting idle and sort of force me to live on less since I end up with a smaller stash of cash in my checking account.

Below is a diagram that shows how these two types of apps work together in my money system.

The original “sweep” app I used was an app called Digit, which served me well for about two years until it started charging a monthly fee. On principle, I don’t believe that you should pay a fee to save money, and since switching between these sorts of apps only takes a few minutes, I made a switch, going over to another app I found called Dobot. Dobot did essentially the same thing as Digit, only for free. Of course, as luck would have it, Dobot also started charging a fee soon after I switched to it. As a result, I dropped Dobot and went on the search for another app that could do what Digit and Dobot did, but without a fee. Albert fit the bill for me.

Albert App Review

So what exactly is Albert? It’s a full-featured financial monitoring app like Mint or Personal Capital. You link up all of your accounts in the app and it can then track your net worth and account balances for you. This is a very useful feature that will help you keep your finances organized.

Albert also has a feature called Albert Genius, which acts as a financial advisor. Albert Genius is not free and instead, works on a pay-what-you-want model. I’ve never used this feature and I don’t plan to, but it is something that you may find useful depending on your situation.

Another interesting addition to Albert is Albert Cash. This is a free checking account with no minimum balance requirement. Funds are kept with an FDIC-insured partner bank, so your funds are safe. I don’t use Albert Cash, but I have opened an account and I wouldn’t have any problem using it as my primary checking account.

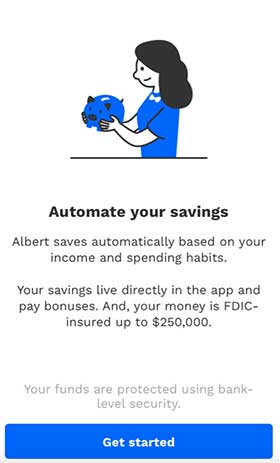

The best feature that makes Albert worthwhile – and the only feature I really care about – is the Albert Savings feature. When you activate the Albert Savings feature, Albert will monitor your transactions and save small amounts of money for you every week. It works the same as Digit, but without any monthly fee.

At the moment, Albert is the only free app that offers this service and it’s why I highly recommend Albert. Let’s take a look at how the Albert savings feature works.

How Albert Savings Works

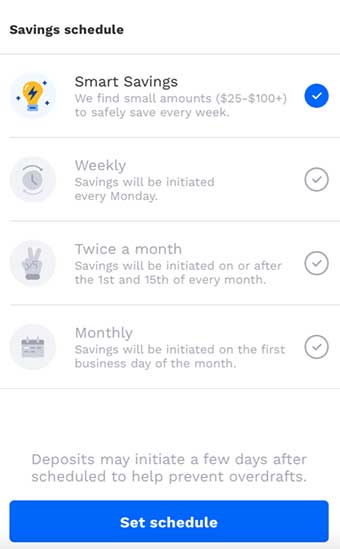

Albert’s smart savings feature analyzes your spending and determines how much you can save each week. If you are using the free version of the app, Albert will initiate one savings transfer per week, typically between $25-$100.

To figure out how much it can automatically save for you, Albert uses a special algorithm. Their algorithm analyzes your spending, income, predicted account balance, and upcoming bills. With that information, it will determine how much it can safely save for you.

If you’re someone who doesn’t have too much cushion in your bank account, here’s what Albert says about that:

To avoid overdrawing your account, we do not initiate a savings transfer when your bank balance is too low. We determine Smart Savings amounts at the time of transfer.

To activate Albert’s smart savings, link your checking account to Albert, then activate the smart savings feature. If you prefer, you can also have it set up to just save a fixed amount each week, but I prefer the Smart Savings features since that’s the point of using an app like this.

Over the time that I’ve used Albert, it’s been able to save me several hundred dollars – not bad at all. It typically saves $45 to $70 per week. Over a month, that’s about $200 I’m able to save without even noticing it. And this is all on top of the normal saving I’m already doing, which makes it a nice compliment to my money system.

You also get a slight amount of interest on your savings, so it’s not as if your money sits idle in your Albert savings account. At the moment, free users get 0.1% interest. It’s obviously not a lot of interest, but it’s better than nothing. I generally think of this money as short-term savings, so the interest rate isn’t too big a deal to me anyway.

Like most fintech apps, Albert uses bank-level security. You link your accounts to Albert using Plaid, which is a secure bank connection tool that is used by all major banks. Importantly, any money in your Albert savings is kept in an FDIC insured savings account with Albert’s partner banks. In other words, you don’t have to worry about losing your money.

If you’ve used Mint or Personal Capital or were previously a user of Digit or Dobot, you shouldn’t have a problem using Albert.

Albert $150 Signup and Referral Bonus

Albert is currently offering a $150 referral bonus if you open a free Albert Cash account, complete a direct deposit of $200 or more, and spend $100 using the Albert debit card. I wrote a step-by-step guide on how to earn your Albert referral bonus here. Check that post out if you need more direction.

At the moment, it appears that you need a real direct deposit to trigger the bonus. If anyone is able to trigger the bonus without a real direct deposit, please let me know. You can use my Albert referral link here.

Final Thoughts – Albert Is The Best Free Alternative To Digit And Dobot

I’ve been using Albert for years and have had no issues with it. It’s a great app. And now that Digit charges a monthly fee and Dobot has shut down, Albert is the only free app left that has an automated savings feature that can analyze your accounts and save small amounts of money for you each week.

There are a lot of ways you can use your Albert savings, I personally use most of my Albert savings as a part of my travel fund. Another good way to use Albert is to let your Albert savings build up over time and then fund part of a Roth IRA with the money it saves you. The beauty is that you can choose how you want to use your savings – whether it’s to save for the future or to use your savings for fun things.

Ideally, you use both Albert and Peak Money together – Peak should round up transactions you make, and Albert should sweep away a little bit of excess money for you each week. This is a way to add a passive layer to your money system. And it costs nothing to do and takes only a little bit of time to set up.

If you’ve used Albert before, let me know what your experience has been like. I think they’ve really improved the app a lot over the years and I wholeheartedly recommend it.

Terrible customer service!

Someone opened an account under my name, I never received an email on this but did receive an email on a statement notification. I reach out to their pointless customer service who tells me a scammer must have created an account using my info yet I pay Experian a monthly fee to keep my info locked and Albert refuses to tell me when the account was opened. I think they are in on it and allow scammers to work under their name. They also kept trying to tell me I can’t open anymore accounts under my email yet they can’t seem to understand that I never opened one to begin with. The way they handle this policy, unlike all major banks, is a filled with red flags, even their replies were all from different people using a script while I kept repeating my issue. They clearly don’t care if someone opens a fraudulent account which again makes me think they are in on it.

fyi – it seems as of 1-Feb, savings is no longer free. must have genius subscription (min $8) to use their savings feature

!!! DO NOT USE ALBERT!!!

I decided to try sober to help save money and try investing. I made a $150 investment, and put $400 in savings, starting out adding $10 every week, moved up to $25 a week and then $50. Well along the way one day I wasn’t able to access my account, said my email and password changed, which I never did, I tried the forgot password setting which they send you a email to change you password. Well I never received the email, tried doing it through my phone number which never changed never received a text to change it either. I tried contacting them through email, as THER IS NO CUSTOMER SERVICE PHONE NUMBER, they were never able to find my account which I had for months. Several old emails and text messages proving that I had an account with them, and STILL weren’t able to locate my account. Horrible customer service!! If I’m trusting you with my money you should have a phone number to contact you at if I’m ever having an issue accessing my funds. Now I’m out $500, and nothing I can do about it. Luckily I didn’t decide to invest thousands of dollars with them . Don’t make the same mistake I made , do not use Albert!!!

I downloaded Albert App Mid June, should of known better that the App and a contest were on a computer site I received from a staff member of the complex That I reside in after the electrical system in my apartment fried my gaming PC. I decided to switch from Chime; the add advertised Albert Bank receive $150.00 sign up bonus and take a $250 payday loan a month with a qualifying deposit.

After I joined I instantly got messaged that I had won a sum of BitCoin on FaceBook Messenger and to claim the cash pay out I had to pay one fee of $300 and then a fee of $800. These people that did this to me typing seemed very familiar. Could not place it until after I was scammed out of $800, I pulled the plug after I had given them $800, they wanted another $700. I instantly contacted Apple Pay which is Green Dot Bank, they gave me Scam Report IDs and marked the person account as unseeable. Was told that would be enough with other screen shots that my financial institution to return my money through disputes.

Boy they were wrong, I have been fighting with Albert and Green Dot Bank since July 07th, 2022 (the actually theft by swindle was on June 29th, 2022). Albert is refusing to grant my disputes because I was able to cancel a payment of $200 (or the scammers would of gotten $1,000) that signified to Albert that Apple Pay returned one of the payments of the money stolen from me; I was then told to go back to the merchant to request my funds be returned. They also said I could submit more documentation to their disputes department but there was no promise that the disputes would be reopened.

Now I am searching for a lawyer to sue both Albert and Green Dot Bank for the month of torture I have had to endure and the fact playing catch up has ruined this months finances. Don’t even have all my bills paid currently or rent.

After all that I have been through with this Albert Application or I think the companies true name is Albert Investments; I realized after one of the Albert Customer Service Reps through text typed an exact phrase like the scammers typed to me. This company is a bunch of thieves, liars, and scam artists.

If anyone knows a mass action lawsuit happening for both or either companies, any information would be greatly appreciated.

Thank you for your time in reading this,

100% Disabled Individual who has a therapy pet that he is trying to raise his credit to save his pet/son’s life by getting. Loan

Let me know if you have any luck or info in syringe this company. Invested over $500 with them and had money in savings and got locked out on my account, saying I changed my email and password, which never happened, no I can’t access my account of funds. The customer service is a joke, no phone number to call only email and text and they can’t help my gain access to my account. Any I for you have on this matter would be greatly appreciated! Thanks

I don’t know what this is but they took money from my account. Trying to reach customer service is a nightmare. Said they would refund my money but never did. Now they want me to send in all this information and said they would send me a check. Will be disputing with my bank

They steal your money little by little. When you call customer service they read you a script instead of giving you a straight answer. I will definitely be canceling this card.

How do I contact someone about my money on a closed account

Maybe file a complaint with your state AG?

I deactivated my account and my check was sent to that account and now no one is responding!..how do I get my money it’s not letting me log in or nothing

I just did it for easy $75. I like the 20% cash back at Walmart, Whole Foods, etc. Will try to use it like you do for saving money. This looks like a keeper for 20% back at stores again though not my main account.

Twice now, I have had to file complaints with the Better Business Bureau about this company. Despite canceling within hours of downloading the app, They took about $60 dollars out of my account before the first BBB complaint and now, having filed a second, I am waiting for a refund of $50. If you look carefully at their reviews on the Apple store, you will see one star reviews followed by three or four five star reviews. I can only assume these are puppet reviewers. There are way too many one star reviews followed by five star reviews, presumably to swamp the one star reviews. Save yourself the headache. Today alone, I’ve wasted HOURS communicating with Albert and their demand that I send screen shots of my checking account, double checking amounts they owe me, (which, btw, they have low-balled every time) and just the all around annoyance factor. I’m about to waste an addition $32 to put a hold on this company’s ability to make any future ACH withdrawals from my account. Save yourself the trouble and please, whatever governing body handles oversight of these “financial advising” apps, this one needs a detailed investigation.

I’ve been using Albert for over a year and it’s been great. I set it up to take a specific amount out to pay a big quarterly bill and it’s nice to already have the money set aside without any concerns. It takes about two days to get the money but it’s not meant to be withdrawn like an ATM. I’m very happy with this app. I have Albert Genius, it’s nice to see the analysis and monthly review but I can review that by simply looking at my bank statements now. I even get bonuses in my account from Albert for using it, usually around $10-$20 bucks every few months.

It’s a great app and I highly recommend it!

I’ve been using it for six months myself and love it for all of the reasons you stated and more. I do use Genius and it actually has offered a few helpful tips, including ways to lower my bills and some tracking of monthly payments I forgot I had signed up for. I tested their bill lowering abilities with Comcast. They use Billshark and actually lowered my Comcast bill by $100.00 per month and I never had to speak with Comcast. It did cost me 10% of my first years savings, but heck that’s work it. They’re now offering an investment option, which I’m going to give a shot. I’m with you. I like it so far.

Will Albert be able to link to your credit cards as well for spending alaysis?

I believe so, but to be honest, I use Mint and Personal Capital for that.

It will track your credit card spending as well.

I signed up for Albert and got enrolled in their Albert Genius service with no real chance to back out of it. On the day I was trying to get out of it I was charged 44 dollars. Albert offers no customer support phone line and is hard to contact. I know I’m going to get my money back in 2-3 days. However, this has been nothing but stressful for me as I was not expecting this charge and began to run the risk of not having enough money for my bills and other expenses. I will NOT be recommending this service.

I’ve never used Albert Genius and I don’t tell people to use it. Sorry that happened to you.

How do you find a phone number for this company? They automatically link your bank account information, start pending withdrawals for “savings,” but won’t let you delete your account or unlink your bank account information. There’s no customer service contact information. Only a text message, which they do not respond to.

Hey, I’m thinking of joining Albert. I saw that you said that you aren’t concerned with the security of this app but I was wondering if you sent an aberration opt-out notice. Do you recommend doing this or would it be better not to?

Do you mean arbitration opt-out notice, cuz otherwise I don’t really know what you mean. In any event, I don’t think you really need to do that. This app is totally legit.

Hi I am looking for an app to use for the first time. Would it be better to start with Albert or Qapital app like a sweep.

I would recommend using both.

Use Qapital as your “round-up” app. Make it so that everytime you buy something, it rounds up the transaction to the nearest dollar and saves the change for you.

Use Albert to “sweep” out excess money.

So, just found out today that Qapital is now charging a monthly fee to new customers. So Qapital is out now. I don’t have an alternative yet, but use Albert for sure.

This app is horrible! It didn’t tell me anything about my bank account that I didn’t already know and the “savings” it auto drafts states it takes at least two business days to return back into your account to use. I never received my “rainy day fund” savings from the app at all! And when I tried to delete the app, it told me I couldn’t when transactions are pending. After 3 business days I deleted the app and hope this review saves other people from losing money. Its funny how the app is advertising to help you save your money, and it does nothing but take money out of your account!

Sorry you had a bad experience, but it’s counter to my own experience that’s been very good.

Two business days to get your money between bank accounts is very normal. Not sure why that’s a concern for you. If you can’t wait two business days for cash, then using a savings app like this is definitely not something to do and you probably need to work on giving yourself some buffer first before messing with savings apps.

Not sure what you mean by you didn’t receive your rainy day fund. A bank cannot steal your money. If you have an issue, I recommend contacting Albert, and if that fails, contact the CFPB or Attorney General’s Office. I think you need to first look into whatever issue you have before jumping to conclusions that some company is trying to commit outright theft in plain sight.

Love Albert. Have used it the past few months and have saved without even realizing it. The small deposits are literally invisible to me and it’s been fun checking in from time to time to see my totals (I’ve set up 3 different savings goals). Love the concept/methodology.

Glad it’s worked out for you! I just hope it doesn’t go to a fee model one day!

I downloaded albert and it automatically changed all my account info what can I do

I don’t know what you mean. Like Albert can’t change your account info. It’s just an app that links to your accounts.

Did you ever resolve this problem? the exact same thing has happened to me. And how long did it take? Albert is a trash application. My account was literally wiped. They are keeping me in an endless loop. Genius is trash. Not a solid customer service. Not even a number to call a normal representative. They are thieves.

my daughter has this app and it’s cost us $50 now in 2 overdraft fees, so it’s not so careful about taking it out. LIVID!

Ah bummer. I’ve never been close to having my account overdraft – I believe Albert tries its best not to overdraft, but of course, it can only do so much – so my advice is don’t use Albert if you’re the type that runs your bank account close to 0 (I always have a small buffer myself, just because that’s the type of person I am).

I’d also recommend calling your bank and asking them to waive the overdraft fee. Assuming you don’t regularly overdraft, they should waive your fee. If they won’t, then close your account with them. Any bank that won’t waive your overdraft fee is not a bank worth banking with. I personally use Simple Bank, which actually charges no overdraft fees at all.

Seriously I can’t believe this app is legal! I was never returned my “rainy day fund”!

You know a company cannot steal your money right? Have you tried contacting Albert and having them make things right? Your money was in an FDIC insured and heavily regulated bank. It’s clearly somewhere…

Stuck with IOS 10.3 (iPhone 5) and it is “incompatible with this device.” Bummer 🙁

As a previous Digit and Dobot user I’ve been searching for an app that did the same thing and was unsuccessful (maybe didn’t try hard enough). I’m gonna give Albert a shot, I just hope they don’t end up following the path that Digit and Dobot followed charging people money to save.

Yeah, I wonder whether they’ll do the same thing. The great thing with an app like this is that it’s easy to pivot out of it. It literally took me 5 minutes or less to close my Digit account or my Dobot account when those started charging. So, take advantage of it now while you can, and pivot to something else later if it changes for the worse.

Just saw in the comments that Albert is only available for iOS. Blah. I would try it with one of my bank accounts that often gets pretty slushy with extra funds. Might as well sweep that money into savings instead of using it to cover excess spending in my regular checking.

Yeah, I totally didn’t even think about the fact that it’s iOS only. I’m so used to my apple products that I just assume everyone has that. Total Apple fanboy here.

Thanks for the review, Kevin. Does Albert only sweep your money into a savings account? Can it also sweep your money into a money market account of a brokerage firm?

Yeah, it’s like how Digit or Dobot works. If you wanted to invest it, an easy thing to do would just be to periodically pull that money back out and put it into a brokerage account. You could basically just do that once a month or once a week, and it would take you like 30 seconds to do on your phone.

Bummer, Albert is only available on iOS for now. They did offer a “text me when the Android option” is available. (Which I did) I hope they have it soon. Thanks as always for all the cool stuff you share!

Totally didn’t even think about whether it works for Android! Thanks for letting me know!

It’s available for Android now!

I have a android and it does work

I have heard about these sort of apps to round-up or sweep, and now I understand it a bit better. Thanks for the informative article. I had no idea the sweep account can help save that much more.

Hope it helps! They won’t make or break you, but I think these are nice apps to have working in the background for you.

This app sucks , they have took my money off my card after I unsubscribed it to the app and now no one is responding after h Th e time they are supposed to be open . I’m not happy this morning

First, file a dispute with your credit card company. Not that hard.

Second, why are you even paying for Albert? Use the free service only.

DO NOT RECOMMEND ALBERT

Let me start by first saying I love testing new checking accounts. No overdraft fees, savings programs, cash back rewards, and more all entice me so I was excited to try Albert. HOWEVER, never has a checking account been so terrible.

First off, their customer support is terrible. I have both emailed and texted and have never gotten an actual response TJ my questions.

Second, I signed up for Albert genius to test it out for the investing and other benefits. TERRIBLE! I agreed to pay $66 for twelve months. I notice a charge of $22 AND $66 that I did not agree to. I even have proof that I agreed to only $66. So they literally scammed me for $22 and have still never gotten a response about why I was charged this.

Third, I am qualified for the $75 bonus since I used my debit card and was curious when I would receive this. I texted and emailed and I still have yet to see this $75.

And fourth, I meet all the qualifications for the instant deposit and was hoping to use it. But no, they have tech issues they are not willing to fix so now I don’t even have that benefit.

DO NOT USE ALBERT

I have a bank on my account i no longer have but Albert won’t let me remove it. Having that account on there is not letting me withdraw my rainy day funds cause they want me to reconnect a darn bank i no longer have. I’ve been trying for over a month

Are you referring to the annual financial planner fee that they charge if you signed up for that service or is it the weekly withdrawal?

If its the fee just call your card company and tell them you deactivated the account prior and they will refund your money. If it was a withdrawal then just request the money from Albert back into your account, its your money.

Also, just deleting the app doesn’t deactivate your account.

He probably set a certain amount to be deducted automatically from his account on a certain day and when he canceled it they probably continued deducting it. That’s what I’m assuming anyway. I could be wrong.

Same thing is happening to me now

Yep they ripped my account off collected on a advance then I was paid up in full did not take another and they collected again from my account dont use Albert there a scambiggestvrip off ever

Im having the same issue right now. Albert had 2,000 of my money right now. Ive been reaching out for two weeks and gotten no help. I verified my information so many times and they would stop responding. Im locked my app and their telling me my account is closed. Is there anything i could do at the moment

Took money off my card 4 times now after canceling months ago. Canceling my bank account