One of the things I always tell people about debt is that there isn’t any secret to paying it off quickly. There’s no magic method that will make your debt disappear, no secret tricks that will crush your loans any faster. And you probably shouldn’t count on someone else paying your debt off for you.

In the end, paying off debt really just comes down to a single basic principle. Live on less than you earn and use what’s left to pay off your debt. The more you have left to pay towards your debt, the faster it’ll be gone. It’s really that simple.

As I’ve been thinking about this topic some more, I’ve come to the conclusion that maybe I was wrong. In fact, there is a secret way to pay off debt. And if you do this, I guarantee you’ll pay off your debt faster.

What’s the secret to paying off your debt fast?

You have to be a weirdo!

Debt Isn’t Weird

Having debt these days isn’t a weird thing. Take student loans, for example. Around 70% of millennials graduate with them. And this is probably even higher for those of us who went after professional degrees. Indeed, around 40% of all student loan debt is attributable to graduate student loans.

Your average lawyer now graduates with around $140k of student loan debt. Your average doctor comes out with $161k of student loan debt. And holy crap did anyone see that there’s $1.3 trillion of student loan debt floating around out there!?

What this means is that debt is totally normal for the vast majority of people. We’ve got folks with great income potential graduating with a mortgage worth of debt. Then they go on and live normal lives with their big incomes. Throw in a mortgage. Throw in some cars. Add a bunch of stuff that you buy to fill up the house and the closet, and suddenly, you’ve got bills coming from all over the place.

This is how a family ends up doing perfectly fine, but never really getting ahead. This completely normal family will just keep working to afford all the stuff they’ve bought.

And it’s not a shameful thing for this normal family to do. We all have debt, after all. It’s totally normal!

You Have To Be A Weirdo To Pay Off Debt Fast

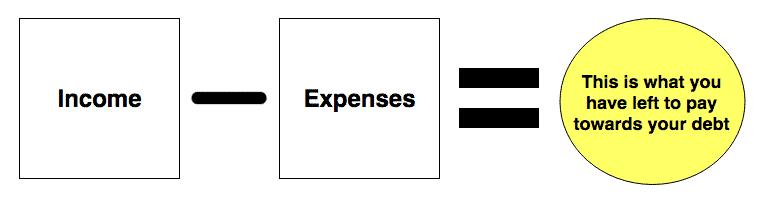

So why is being a weirdo the secret to paying off debt? Let’s look at the basic formula for paying off debt.

To get that money circle bigger, you have to get weird! Sure, you could make a ton of money and have that income square be huge. But for most people, when income goes up, expenses go up too. Think about anyone you know that makes a ton of money. They probably live in a huge house and drive a nice car. Now imagine if that same person lived in a modest house and drove a normal car. You wouldn’t think they’re being normal, would you? You’d think they are being weird.

I always like to look at Ryan Broyles as an example of a guy who must be a total weirdo. He’s a former NFL player who made millions during the course of his short career. Instead of spending it all as most NFL players do, he voluntarily chose to live off $60,000 per year.

For a majority of people, living off $60,000 would be more than adequate, especially since your average household in the US doesn’t even make that much money. But when you look at a guy making millions, it’s a super weird thing to do. Ryan Broyles didn’t choose to be a normal NFL player. He chose to be a weirdo.

Paying Off Debt Is Weird

I recently wrote about how you can pay off debt if you reject the “it isn’t possible” mentality that a lot of us fall into. As I’ve thought about this more, I realize that the one common denominator with anyone who pays off debt quickly is the fact that they’re totally nuts!

I like to look at myself as an example. As I’ve detailed before, I paid off $87,000 in student loans in 2.5 years. Sure, I made a six-figure salary during that time. Negative people tell me that because of this income, my feat was easy. They say that anyone can do this if they made that type of money.

And yet, the fact is, not everyone can do it! The law world is a great place to see this fact in action. At a large law firm – like the one that I was working at – every associate makes the same amount of money for the first few years of practice. We’re all working with the same amount in that income square. Our expenses should have been pretty similar. After all, we all lived in the same city, worked in the same job, made the same money, and almost all of us were millennials without children. If paying off debt was a simple feat to do, then everyone in a similar situation to me should have been able to share this same story.

But that’s not what happened. Very few of my colleagues, if any, paid off their student loans the way I did. Most will keep them around for a decade or more. These folks are being normal big shot lawyers. And normal big shot lawyers aren’t paying off their student loans just a few years out of school. Do you know what they’re doing? They’re living like normal big shot lawyers! They aren’t being weirdos at all.

You Can Be A Weirdo Too

Let’s face it. All of us who are really into personal finance are weirdos. Personal finance isn’t a topic that your normal person cares about, so the fact that we care about this stuff a lot makes us weird right from the start. If you’re reading this, you’ve already got an advantage.

So if you’re paying off debt right now, think about what you’re doing. Are you living like a normal person? If you are, it’ll probably take some time to get through your debt. But, if you’re doing something that really seems out of the ordinary, then you’re on the right track! You understand the true secret to paying off debt quickly is to be a weirdo.

Remember, you have to do something that is extraordinary in some way if you want to pay off debt quickly. Your debt won’t just suddenly disappear if you aren’t taking deliberate action with it. The only way to get rid of your debt quickly is to be a weirdo.

Hi FP,

Super relatable and “weirdly” positive take on being a financial weirdo, I love it!

How would you advice in my current situation?

I have about 20k remaining on my student loans (no other debt), and recently came back to the US after living abroad.

Currently in a 9-5 office job that earns 50k that I don’t really enjoy and looking to do a career change – but this is likely to cost about 7k for the courses.

As much as I want to aggressively tackle my remaining student loan balance, should I put a hold until the career change and I feel more settled in my job?

Hey Sarah,

My thought is to pursue what you think will make you happy. $20k of student loans is not that big of a deal. If you already have a $50k per year job, my guess is you can get another $50k per year job anytime. Adding an additional $7k for a career change really isn’t that much money.

Yes, tell me how much of a weirdo I need to be to pay off 160k on a 46k salary. This is a joke. I won’t be paying a dime. And quite frankly, neither should anyone else.

Just a few thoughts. First, I agree that 160k debt on 46k salary is not going to happen – you just don’t make enough money. My question is, why take out so many loans for that and is there really no way to make more than 46k per year if you paid 160k for your education? 46k per year is $23 per hour. A receptionist at my wife’s office makes more than that. And I literally can make more than that walking dogs and doing bike deliveries.

I’m not sure what you mean by no one should pay their student loans off. I do agree that the student loan situation is nuts. Yeah, if we could wipe it all out, I’d probably be for that.

Weirdos rock! 😉

Totally! It’s good to be weird!

“Negative people tell me that because of this income, my feat was easy. They say that anyone can do this if they made that type of money.”

We posted the story of how you paid off all that debt in 2.5 years on FB, and people said the same thing…which is really quite ridiculous. Law school also costs much more in general, so you probably had a lot more debt than people complaining they can’t pay off their $40k student debt without a six-figure salary. It’s all about perspective and a lot of self control.

I won’t deny it, making more money is a necessity when it comes to paying off debt. If you’ve got 40k in student loans and make 20k a year, you’re going to have trouble.

But as we lawyers say, a good income is necessary, but not sufficient. That is, a high income in itself doesn’t make it so that you can pay off your student loans fast. It still takes a lot of work. I made a low six figure salary. But, after taxes, I was still paying well over 50% of my income towards student loans. If it were easy to do that, you wouldn’t see tons of high earning professionals struggling with debt.

I had a fun time imagining wildly responsible and successful people as weirdos, but in our current America’s set of norms defined by mass media, I guess we are. What people don’t know, is that all great leaders start as unknown weirdos somewhere. These unique weirdo’s just have a unique likability factor, and they get results. So if you want to be a leader, you have to start by embracing the weirdo side of yourself first. Embrace the weirdo side of yourself, and you will find yourself, your wealth, and your true calling! God bless!

Really true Bill. You’re right about that. Anyone who does something extraordinary has to be a weirdo somewhere along the line.

I’m a weirdo too even though I’m not paying off debt. I make a high income…higher than my friends, yet the other day they were all telling me about these crazy upcoming trips they were taking, even after many of them have taken multiple crazy expensive trips this year already. I feel unglamorous. You can’t “show” saving money. You can’t wear it or taste it. You can’t instagram it. So in that moment I felt weird and lame compared to my friends. But I want to see their faces when I say “adios!” to the 9-5 working world and not HAVE to work another day in my life if I don’t want to. I have to keep that in the back of my mind in those moments.

It’s totally weird to not spend all your money! The thing is once you can say adios, you’ll be even more of a weirdo!

I love this post because it’s totally “uncool” to sock away large portions of your paycheck and live below your means. I recently downsized from a really nice one-bedroom apartment in a complex to a 3 bedroom apartment in a triple-decker house with 2 roommates because the rent was next to nothing. The idea was to save the extra rent money and live there a few years and be able to put a down payment on a house. Most people didn’t like the decision, especially my family, but I’m really glad I did it. I never used the pool or other amenities my old apartment complex had, and I pretty much treat my current apartment as a temporary place to sleep until I can save enough up to buy something nice. I’m not there yet, but I hope to be within the next year. My bank account is thanking me for being weird!

That’s awesome! I know everyone probably thought you just “had” to live in the nice apartment complex because that’s the only way to live, but you are a clear example of the possibilities you have if you just don’t live normally. And once you’ve got a ton of cash, you can do anything you want! If you’re already working a ton anyway, there’s nothing wrong with finding a modest place to live. All you need is a place to sleep.

Thanks for the interesting article.

While I agree that paying off consumer debt is a great idea, I wonder what your advice is in the following situation….what if the highest interest on your debt is 4% and you have an opportunity to invest your money in an asset that would make 8%. Do you still recommend paying off that debt or would you recommend investing?

So here’s my thinking on the invest vs. payoff debt debate. My thinking is, if you get rid of all your debt fast, it really gives you quite a bit of flexibility later on. That’s because you no longer have to dedicate a certain portion of your income to paying debt. But, if you keep your debt around, that likely means you need to keep earning a certain amount of money in order to keeping paying your debt. So that’s why I prefer paying off debt. It gives me freedom to know that I don’t have to keep earning a certain type of income in order to live.

From a mathematical standpoint, I really can’t argue against investing. If you’re getting 8% and your debt is 4%, then just basic math will tell you that you’re going to have more money at the end by investing. Of course, there probably isn’t any asset out there that is guaranteed 8%, so you’d have to factor in any risk of loss.

So in the end, I still go with paying off debt. If you take a few years to do that, you can quickly play catchup later and end up in the same position.

But personal finance is personal, right?

It’s not about being a weirdo or not. It’s about hustling hard when your young and not carrying the weight of your debt for too long. It’s better to get it over with quickly – have 2-3 years of no-name-brand products and then you’re free.

Definitely agree with that. I do think that when your young is the best time to really crush your debt. You usually have less responsibilities at that point and best of all, your friends are all probably broke too! Tear that debt off like a band aid.

I definitely appreciate this statement at the end: “Remember, you have to do something that is extraordinary in some way if you want to pay off debt quickly.” If you’re having trouble getting rid of debt you aren’t magically going to start paying off massive amounts of it. You need to make some adjustments in one of the two boxes.

Exactly right David! There isn’t any magic way to get rid of debt other than making more income or decreasing expenses, and throwing all of the excess into your debt. It totally requires getting weird to do it. You can’t be normal and pay off debt real fast, because paying off debt fast isn’t normal.

I love being a weirdo! That’s why I’m so drawn to the pf community of weirdos. I’m grateful to have chosen to live differently because, in my opinion, it’s exponentially more fulfilling.

I love being a weirdo too! It’s a weirdo group we hang around with on the interwebs.

Love your blog and this post! Fun meeting you last weekend too!

Thanks Mary! It was great to meet you as well and thanks for stopping by!

I had $160k loan from Pharmacy school and paid them off within 3 years by working crazy hours, one fulltime and two partime jobs. Many of my classmates bought nice cars and houses, but I lived in a tiny studio and kept my over 10 year old car and drove it until I paid my loans off. I was a weirdo but no regret at all.

That is awesome! I’m glad to see that you crushed those pharmacy school loans so fast! Pharmacy is probably no different from the other professional occupations. It’s really easy to think of the debt you have as being normal, and then falling into that lifestyle trap. I’m sure you’re one of the only people in your class who’ve paid their loans off that fast. What kind of income were you making during those three years?

As Dave Ramsey says, “normal” means being deep in credit card debt, having a car payment, and living paycheck to paycheck. Here’s to being weird!

You said it DS! We gots to be weirdos.

It pays to be different. Its weird that I am sitting on my deck enjoying this beautiful day instead of working.

Cheers to being weird!

It’s very weird and boy do I envy you!

FP, way to be an excellent “weirdo” role model for others! Your ability to pay off $87k of debt in 2.5 years is impressive. The same weirdo ability to pay off debt will serve you well on your investments and journey to financial freedom. 🙂

Thanks Michael! It pays to be weird!

For me it’s quite weird that most of the people have no idea at all how their own mortgage, student loan etc. work. Making extra contributions towards debts are super weird. Review interest rates from time to time? No way! It’s just a monthly cost that you need to pay for 20-30 years and you can’t change that. This seems to be the normal…

But for all the weirdos out there this is actually good. You have to be weird to think that buying stocks in 2009 is a good idea. Or buy your home when everyone wants to sell and not when all your friends does. Or pay off your student debt. If these were the standard, you would need to find other financially weird things to become a weirdo (or may I say successful…?).

The concept of interest definitely isn’t a thing a lot of people understand. The idea of interest is there, but seeing it work against you isn’t so obvious.

Like how you pointed out that basically, being a financial bad ass requires being a weirdo. If you act like everyone else, you’ll never really get ahead.

I was browsing Reddit the other day and found a post about someone who had 70k in debt. There was a reply that said credit card debt is bad but Student Loan and Car Loans are “normal” and most people have them. It made me chuckle that there is “normal” debt now.

I think Millennial Money Man tweeted the other day that it’s common for Millennials to say “#adulting” for paying interest on a depreciating asset also.

I hope for a day when #aduting will trend for maxing out our IRA/401k, saving 50% of income, or paying off debt; rather than buying a new Car or House we can’t afford.

See, the problem is that debt is often seen as just another bill. It’s like paying utilities. I really hope that most people will start to understand that it doesn’t have to be normal. Would love to see more recent grads throwing down on their debt first, instead of letting it linger around.

Aren’t the weirdos the ones that actually change the world. I’m sure when Steve Jobs proposed a computer in your hand that made phone calls or Elon Musk with a reusable rocket that people thought they were weirdos too.

Just imagine if people would embrace their weirdness to reach the goals that they want in life. I think we’d all be a lot happier 🙂

Totally good point MSM. Weirdos are definitely the ones that change the world. Just trying to make the world a happier place, one weirdo at a time.

Such great points! You have to be weird or do things that the mainstream isn’t doing to truly pay off a lump sum of debt. True, you had a high income when paying off debt but there is such thing as lifestyle inflation. You could have spent more money when earning more money.

Paying off debt simply comes down to income and expenses.

Exactly right Tia. There isn’t really any secret other than controlling those two inputs. The thing is, most people aren’t very weird. They basically are just normal. And normal isn’t enough to pay off debt fast!

I’m sorry, I know its horrible, but i was sure you were going to follow “paying off debt really just comes down to a single basic principle.” With “pay off principle.”

Great points on the need to be wierd to pay off the debts. With the American standard being to carry many debts, its almost “un-American” to not. Further proof of your thesis!

Dang! Now I wish I had said that line first, haha! And it’s completely un-American to not have debt. How are you supposed to stimulate the economy after all?

It pays to be weird!

I think it’s unfortunate that being in debt is considered “normal”. It’s normal to have new car payments. It’s normal to have tons of credit card payments. And, unfortunately, it’s normal to have student loan payments.

The doctor world is pretty similar to the law world. Lifestyle creep can definitely become an issue for some docs.

Totally agree about the doctor lifestyle creep. The same thing happens with dentists. Ms. FP has classmates graduating with hundreds of thousands in student loans, and then the first thing they do is buy a huge house. No one blinks an eye because these dentists are making good money. But now they’re stuck to the paycheck.

Lifestyle creep is perfidious! I previously serve some of the most famous people in California. Now I serve some of the wealthiest. In both cases, happiness is far from assured.

It sounds wierd, but this is why I love learning the violin. The best violin in the world would sound atrocious in my hands unless I invest the time and effort into learning it. Most of the people I ran across were too tied to their careers or too tied to their debts to enjoy themselves. Tragic.

Hooray for the weirdos! Love it, Panther. Nice work. 😀

(Also check the typo in the title. You may want to do a new URL and redirect, if you can figure out how to do that.)

Wait, it’s not “I” before “E” except after “C”? And this is why you gotta read the titles again…because I never do that. Thanks for pointing out that mistake!

For everyone who didn’t see, I spelled “weird” wrong in the title originally. Yes, I am ashamed…

That’s why the word “weird” is weird itself, because it violates the I/E rule. Hehe

Don’t worry, no one ever reads URLs anymore these days! 🙂

I hope not!

Tru ‘dat, Panther. Nice work.

Keep FI weird!

Thanks FL. That’s what we all aim to do I think!

That is a great point about the professional community you are in. It’s hard to buck the trend, no matter your income. I think often people want to write off someone else’s accomplishment because the situation is different. But each situation has pros, cons and social pressures. No matter your income level, you have to do things differently than your peers to have a different outcome.

That’s very true. Our outputs are all of a product of our inputs. So whatever we do, we get those results. If we act normal, we get normal results. Getting abnormal results requires abnormal inputs, which by definition, means you’ve got to be weird, right?

Exactly! =)

Won’t lie, anybody trying to get out of 9-5 before legal retirement age is most likely a weirdo, but in a terrific way. Sure we do not have as many glamorous moments like many others do when they are younger but we will have a lot more when they are working and we are doing whatever we want!

I like that line – weirdo in a terrific way! Being weird doesn’t have be bad! We might not be balling now, but we can still live well without balling. It’s just figuring out what we care about.

Can you be a saving money weirdo too!? 🙂

I think you can be any kind of weirdo. Maybe really, the key to any sort of personal finance is to be a weirdo!