Every personal finance expert probably agrees that you should set aside some money as an emergency fund. The amount you should have in your emergency fund is a subject of debate, but the typical rule of thumb is to keep somewhere around 3-6 months worth of expenses. You never know what the future might hold, so it makes sense to at least have some buffer to keep yourself afloat in case something happens.

Since we can all agree that we should at least have some money in an emergency fund, the next important question is where should we put that money?

I basically see five places your emergency fund could go:

- Checking Account

- Normal Savings Account

- Online High-Yield Savings Account

- Super High-Yield Savings Account (aka 5% Interest Savings Accounts)

- Investment Account

There are advantages and disadvantages to each and my guess is that most people will probably have their emergency fund in a combination of all of these accounts.

When I first started my emergency fund, I went with a mix of my checking account and an online high-yield savings account with Capital One 360. About a year ago, I made a switch, storing a small portion of my emergency fund with Ally Bank and keeping the majority of my emergency fund in super high-yield savings accounts earning 5% guaranteed interest.

You know how people are always talking about not keeping too much money in their emergency fund because of the low returns? I don’t worry about that anymore.

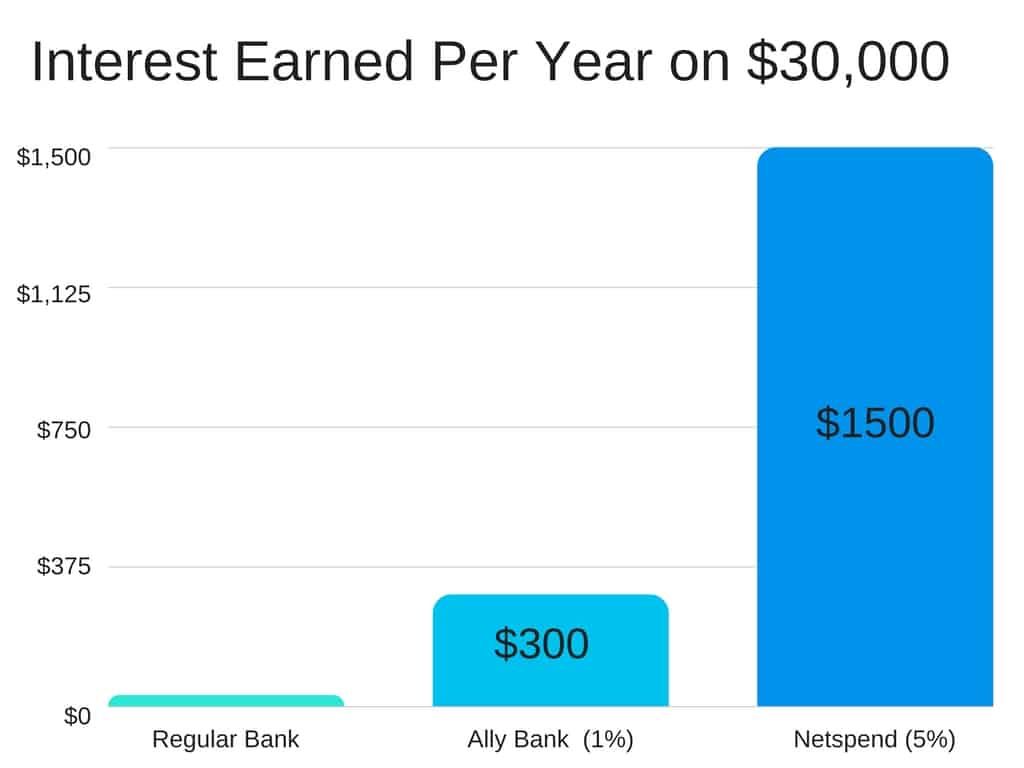

Honestly, it surprises me that more people don’t take a little bit of time to get the maximum yield on their emergency fund. The difference between 0.75% and 1% interest isn’t worth making a switch. But the difference between 1% and 5%? I think that’s definitely worth looking into.

Let’s take a deeper dive into each of these emergency fund savings options.

1. Checking Accounts

Your checking account is likely the inbox of your financial system and is naturally the first place you might keep your emergency fund. If you’re pretty good with your money, you probably leave yourself a little bit of a buffer in your checking account. When you think about it, that’s basically the beginning of your emergency fund.

I definitely wouldn’t recommend keeping a huge buffer in your checking account simply because every dollar you keep in there probably gets nothing in return. Banks should pay you for your money, so if they’re not paying you, you shouldn’t reward them by giving them more money. I personally aim for a buffer of about $500 in my checking account. You could totally do more or less as your buffer. Just make sure to keep whatever amount makes you comfortable.

In terms of which checking account to use, you basically just want to make sure that whatever checking account you use has no fees. There are so many free checking accounts these days that there’s pretty much no excuse for any checking account to charge you a monthly fee.

Another potential option is to go with an online-only checking account. My wife uses Ally Bank as her primary checking account. It’s totally free and they even pay a nominal amount of interest. I also have a secondary checking account with an online-only bank called Simple. Again, totally 100% free.

The one weakness with online-only banks is that it can be difficult to deposit cash. If you’re the type of person that never needs to deposit cash, then you could probably go exclusively with an online-only checking account. Since I sell about $1,000 or so worth of trash every year, I still need to be able to deposit at least some cash into my checking account. Hence why I still have my checking account with a traditional, big bad bank (that doesn’t charge me any monthly fees).

2. Normal Savings Accounts

These are the normal savings accounts that are typically offered by your regular brick and mortar banks.

My recommendation – don’t use these type of savings accounts. They offer ludicrously low-interest rates that are downright insulting. You might as well just keep your money in your checking account if you’re going to do this.

Instead, after your checking account buffer, the next bit of your emergency fund should be going into online, high-yield savings accounts like the ones I list in the next section.

3. Online High-Yield Savings Accounts

Online high-yield savings accounts got really popular in the mid-2000s. I remember when ING first launched its high yield savings account back when I was in high school and it offered something like 5% or more interest. Obviously, those days are done (or are they? keep reading!) but you’ll still get 100 times more interest from an online high-yield savings account compared to a traditional savings account. I’m guessing that most of you probably keep the bulk of your emergency fund in these type of savings accounts.

I personally recommend these banks (all of which have no fees):

- Ally Bank

- Marcus By Goldman Sachs

- Discover Bank

- Capital One 360

Any of these banks will work, although I prefer Ally the most when it comes to emergency funds. Most importantly, they allow you to link up to 20 external bank accounts, which is very important if we want to take advantage of super high-yield savings accounts.

Capital One 360 is also a good choice that I’ve used in the past. It’s where I originally stored my emergency fund (all the way back when online banking was pretty new and it was still called ING Direct). The advantage with Capital One 360 is that it allows you to create multiple sub-accounts, which makes it much easier to sub-divide your cash savings.

Today, instead of keeping my emergency fund in Capital One 360, I use it mainly to hold money for my medium-term goals.

4. Super High Yield Savings Accounts (aka 5% Interest Savings Accounts)

There’s a lot of debate about how much you should keep in your emergency fund. Naturally, every dollar that sits in your emergency fund is a dollar that you can’t invest.

Personally, I don’t have any problem with people keeping a ton of money in their emergency fund. That’s because every single household can earn 5% guaranteed interest on a significant chunk of money in an FDIC insured savings account.

For most people, even a fraction of their money in a 5% interest savings account would be a major improvement. And if you could fund all of the 5% interest savings accounts, you’d have a massive emergency fund that would probably cover any situation.

I’ve written about these accounts previously in more in-depth posts. These posts can be found below:

- Where To Get 5% Interest Savings Accounts

- Netspend Account: Get 5% Interest On Your Savings

- Insight Card: Get Even More 5% Interest Savings

The interest you stand to earn is significant when compared to a normal high-yield savings account. Just take a look at how much more interest you’d earn if you had $30,000 earning 5% guaranteed interest:

And remember, this is guaranteed interest that’s beating inflation by about 2% every year! That’s huge to be able to get that type of guaranteed return on an emergency fund.

If you’re someone who’s into travel hacking or otherwise optimizing your finances, then you should really take the time to understand how these 5% interest savings accounts work. Just like with travel hacking, it can probably seem intimidating at first. But once you set these accounts up, they basically run themselves. Most people will only need to look at their accounts once per year or never if they want.

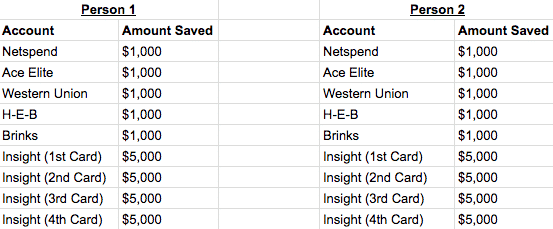

Consider opening up your 5% accounts in this order:

- Insight (First Card = can save up to $5,000)

- Insight (Second Card =can save up to $5,000)

- Netspend (can save up to $1,000)

- Ace Elite (can save up to $1,000)

- Western Union (can save up to $1,000)

- H-E-B (can save up to $1,000)

- Brinks (can save up to $1,000)

If you max out all of these accounts, you’ll be looking at $50,000 earning 5% guaranteed interest in an FDIC insured bank account. The difference between 5% interest and 1% interest makes it well worth it.

The other nice thing about these accounts is that you can get $20 to start your Netspend account just by using my referral link. Once you deposit $40 into your Netspend account, you snag yourself a $20 bonus and I get myself a $20 bonus. From there, you can then refer your spouse to Netspend with your own referral code. That way, you’ll snag another additional $20 referral bonus and your spouse will snag a $20 referral bonus. Altogether, that’s $60 in referral bonuses you can make with pretty minimal work. And you still end up with a savings account earning 5% guaranteed interest.

For more information, be sure to read my in-depth posts about these savings accounts.

5. Investment Accounts

There are some people out there who argue that you should consider investing your emergency fund in a pretty low-risk allocation such as a 50% stock/bond mix. An allocation like this is estimated to return about 5% or so over the long term.

Personally, I don’t think that anyone should invest their emergency fund like this. Why would you take on any stock market risk in your emergency fund when you can already get a 5% guaranteed return on your emergency fund in a super high-yield savings account? It makes no sense.

My guess is that most people who recommend investing your emergency fund either don’t know that 5% interest savings accounts exist or feel that they’re somehow a trick. I’d think investing your emergency fund is more work than just opening up a super high-yield savings account. And if you’re going to get around 5% interest by investing your emergency fund, it’d be foolish to take on the risk of loss when there are already ways to get 5% interest risk-free.

My Emergency Fund System

I’m on a bit of a mission to get people to realize that their emergency fund can actually return significant money in an FDIC-insured savings accounts. Most people don’t need to worry about having too much cash in their emergency fund because they should be earning 5% interest on most, if not all of their emergency fund.

I personally have my emergency fund in three places:

- Super High-Yield Savings Account with Netspend and Insight

- Online High-Yield Savings Account with Ally Bank

- Checking Account with my regular brick and mortar bank

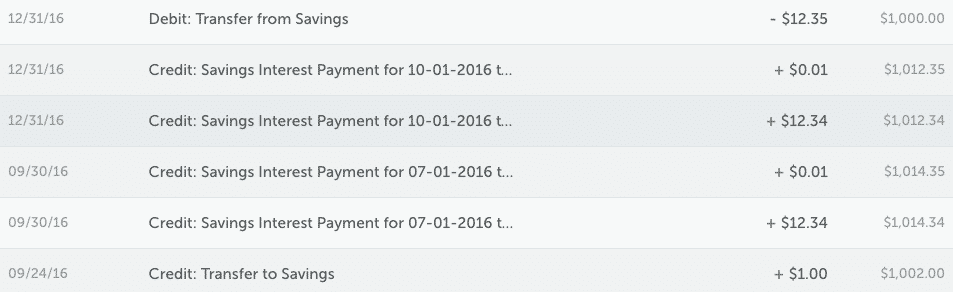

The bulk of it is kept in my super high-yield savings accounts, where I earn 5% guaranteed interest. I set up these accounts once and then I’ve never had to touch them again other than to withdraw the interest I earn each quarter.

I haven’t been able to max out all of my super high-yield savings accounts just yet, but once I do, they’ll give me $1,000 of interest every year (right now I’m getting about $350 per year from my emergency fund based on how much I’ve put away). Couple that with my spouse’s super high-yield savings accounts and we’re looking at $2,000 in interest earned every year. To put that in perspective, we’d need $200,000 saved in a standard online savings account to earn that kind of interest!

The other nice benefit with these super high yield savings accounts is that they make me less tempted to use the money for non-emergencies. It basically puts a little bit of a barrier between myself and my money, so I’m only going to pull that money out when I really need it.

I then keep about $1,000 or so in my Ally Bank account, where I earn 1% interest. I like to have this here as a bit of a buffer in case I need the money really fast and don’t have time to get the money out of my 5% interest accounts.

The remainder of my emergency fund is a $500 buffer I keep in my regular checking account.

Finally, I also keep a chunk of money set aside to use towards bank account bonuses. It’s not exactly passive and does require some work, but once you get the hang of it, it’s an easy way to earn more on your cash without any risk. I wrote the Ultimate Guide to Bank Account Bonuses, which walks you through everything you need to know. Some of the easier bank account bonuses include Chime, SoFi Money, WeBull, and M1 Finance. These posts walk you through how to earn those bonuses.

My emergency fund system has worked out pretty well so far and I’m happy that it’s earning a good rate of return. The 5% interest is even more impressive since it’s risk-free. With that kind of return, I’m not too concerned about the negatives of holding too much money in cash. I basically get the best of both worlds. Peace of mind in having enough cash and a rate of return that’s more than nominal.

Readers, where do you put your emergency fund? Let me know in the comments!

Thanks

The 2020 reaffirmed the necessity of having a nest egg that will allow you to cover unforeseen needs. Thank you for this helpful educational post, that teaches us how to put the emergency fund to work. Thus the money you’ve set aside not only will stay secure but also will be increasing.

Love this article! I had no clue that there were 5% Yield Savings Accounts out there. Thanks for writing!

Have you written any articles about recommended savings strategies for people paying off student loan debt? I know that you have experienced debt, and were able to get rid of it in around 3 years, but that strategy does not seem to be attainable for me currently due to a high amount of loans and a low-ish paying job. I’ve read a lot of articles with a focus on keeping an emergency fund for certain amounts and focusing on putting more money toward getting rid of debt, but i’d love to hear your take on this!

Hmm…I don’t think I’ve written anything about saving strategies when paying off debt. But, one strategy I’m tinkering with is basically to put all of the extra payments I would have made towards student loans into a separate account that I do not touch ever. At some point, you’ll have enough to pay off all your student loans with one payment. It gives the nice benefit of having cash on hand just in case something happens. This requires discipline and willpower though, but it’s what my wife and I are currently doing with her student loans.

Thank you!

Very Educational. Currently I put my emergency fund into my credit union summer saver that pays 4%. I haven’t been able to find anything higher. The only draw back is that you are only allowed to deposit $2000 max monthly for 1 year and once the account is expired the fund are redeposit into your checking account. Then the summer saver account starts again to deposit max of $2000 a month until one year. But you are allowed to withdraw anytime during the year, but not redeposit until the year is over. So only take it out if you have a really big emergency. Do you think this is a good account?

That sounds like a pretty sweet account.

Great writeup, thanks for the detailed explanation!

You mentioned moving away from Capital One 360 towards Ally to connect with the Netspend & Insight card accounts. Do you know if you’re able to do the same thing you’re talking about, but using Capital One 360 as the standard online bank?

I ask because Capital One 360’s interest rate is currently better than Ally’s.

As far as I can tell, you can’t link Insight or Netspend to Capital One 360 (or at least I couldn’t).

The reason I recommend Ally is because it lets you link up to 20 external accounts. Capital One 360 only lets you link 3. If you’re maxing out your Insight and Netspend accounts, you’ll need to link as many as 9 accounts, so that’s why Ally is the way to go.

I wouldn’t worry too much about different interest rates for regular savings accounts. The difference between Ally and Capital One 360 are pretty small.

Thanks a lot for the response! Really appreciate it. Excited to get my emergency fund working harder for me. Keep up the great work.

Ohhh super educational post. I keep mine over at a High Yield savings account at Synchrony, similar to Ally. Once I found out high yields savings accounts are better than any brick and mortar bank savings offerings, it was a no brainer. Thanks for this post

Glad it could help. Definitely consider looking at those 5% FDIC insured savings accounts I write about if you’re really looking to supercharge your emergency fund. It’s not as scary as it looks either.

If you don’t have a house – high interest savings. If you have a house and a mortgage – in the offset to the mortgage. If you own your home outright – high interest savings as the cash component of a balanced investment portfolio of shares/property/cash. All liquid options #cash

Love it!

I keep my EF in my Capital One 360 account. Been with them since they were ING and love how easy it is to have sub-accounts. It’s simple and great for me since I have gig-based work and never know how much I’ll need around.

Yeah, I remember when Capital One bought out ING and a lot of us were freaking out about it. Lucky they didn’t mess with it too much.

I tend to use my Capital One 360 account for more short term goals, and stick to putting my emergency fund into 5% interest accounts. You really can’t beat 5% guaranteed interest.

I received my Insight Visa Debit card yesterday. Activatation went smoothly as did the online account setup and linked my Ally account. Next step is waiting for the test deposits from Ally to appear then I will transfer money into Insight! I plan to use payroll direct deposit to build the Insight balance. So far everything is on track!

Great to hear it’s working out smoothly so far. Let me know if any issues come up. Our household has all 14 accounts set up now, so we’ve been around the block on these 5% savings option!

We have a couple months of cash in a low yield savings account for convenience and instant liquidity. The rest of our “emergency fund” is in I-Bonds. If we don’t tap those bonds, they will become part of our retirement bond ladder at maturity. Certainly not the yield of the 5% accounts, but serving dual purpose for us given our FIRE horizon is less than 10 years away.

Great article!

Thanks Jeff. Any reason not to move some at least a few months of that cash into these 5% accounts? The great thing is that, in theory, if you need instant liquidity, you can still get that by just utilizing the prepaid debit card and taking the fee hit. Not the ideal situation, but you’d still come out ahead given that the interest is so much more. Personally, I don’t see too many situations in which instant liquidity is required. I’d imagine keeping something like $1,000 in a low yield savings account and then putting the rest into 5% interest accounts would cover you in just about any situation.

Oh yeah, no doubt the 5% account would yield more than our savings account. I agree that actually quickly needing to put hands on the cash itself is often not necessary – almost all of our expenses go through our credit cards for the rewards $. I’ll think more about the 5% accounts. I spent two years getting rid of extraneous cards/accounts and adding more isn’t high on my list. BUT, making more money is high on my list, so maybe the 5% accounts would be a good fit. We’ll see.

Makes sense! One thing I can say is that once set up, these accounts take pretty much no work. Most people could look at them once a year at most if they wanted. Since I’m a little bit more obsessive, I like to look at them 4 times per year. And even then, it doesn’t take more than a few minutes to just withdraw the interest earned each quarter.

I agree that putting emergency funds into investments e.g. stocks is a terrible idea. Stocks can fall a lot in the medium term. Had you put your emergency fund into stocks in 2008, those “emergency” funds would have been halved when you needed them most!

Right. That’s why I’m super against “investing” your emergency fund. Especially more so given that a lot of people who invest their emergency funds are hoping to get about 5%, which you can already get, risk-free, if you utilize these 5% interest savings accounts.

Anyone else have trouble applying online for the insight card? For some reason I was declined and directed to see an Insight partner???

Hey Dwayne, did you get that error message on your first Insight card? or was that your second Insight card? Not sure why that error message would come if it was your first one.

For the second card, that error message does sometimes come up. It didn’t appear for me, but it did come up when my fiance signed up for her second card. Our plan at the time was to go to a Walgreens or CVS and get the second card for her, but then it just randomly showed up in the mail anyway. My brother received that same error on his second card and his plan is to just go to Walgreens sometime and snag the second Insight card.

Yes I received that error on my first attempt for my first card. I sent a message to customer service but received no response so far.

So I called a different customer phone number and spoke to a live person. She told me that my card request did process and that I should be receiving my new card in the mail I’m about a week. She had no explanation as to why I received the online error message.

Also I asked her a question about withdrawing funds from the card after I load the card. I specifically asked her if I would be able to avoid using the card, like at an ATM, and just transfer the funds from the insight card back to my online bank, like Ally, essentially just doing a reverse electronic transfer. She said I wouldn’t be able to do that and that once the card was loaded one would have to use the card to get the money off the card. I reviewed the fee disclosure when I signed up for and requested the card and I didn’t not see any mention as to whether or not reverse electronic transfers are allowed. Maybe insight doesn’t allow it but Ally can pull the funds back anyway???

Yep, I’ve had no issues pulling funds back out with Ally. They will say that you can’t, but it’s not true. The general rule of thumb with these cards is to typically ignore anything the customer service folks say about them. Their target market are folks who are actually using the cards. You and I aren’t going to be using them.

Yes that makes sense! The entire purpose of the service is to get us to use the cards so they earn transaction fees. I bet they make a good chunk of money from folks that forget about the loaded cards too. Surely they earn interest on the unused money that is sitting on unused cards. Correct?

Their main thing is making money off the poor and unbanked. Lot of money made off the poor based on overdraft fees, transaction fees, etc.

On the Insight website, there is no place to “push” money out. You can “pull” money in but not “push” money out. In order to get the money out (other than using the debit card), you will have to go to your bank’s website and “pull” the money out via ACH.

Yes that appears to be the correct answer, I’m waiting for my card to arrive any day now!

Let me know how it goes or if you have any questions!

Correct! Check out my article on Netspend too where I detail exactly how to withdraw money from the account. But as you said, you pull the money out using your regular bank account. The easiest way to think about it is that your Insight and Netspend accounts should do nothing except moving money between the prepaid debit card and the 5% savings account. If you’re ever trying to pull money out, it should always be pulled via an outside bank.

Great timing FP! I’m on my last debt payment on April 15th then my focus will be to build my EF.

It sounds like the most optimal strategy for me is to save $1500 then transfer to an insight card – Insight Savings Account until reaching the $5k limit. Then repeat on the 2nd card.

Question regarding the automatic transfer:

So you transfer $1 every two months into your Insight Card. Does this just sit in your Insight card as extra $? Or do you transfer then move right back out (into Ally)? Because if you already have $5k in you savings account you can’t add any more, right?

2nd question: Does withdrawing the interest once per quarter count towards avoiding the inactivity fee? Or is it required that you fund the card to avoid inactivity?

3rd Question: Are the necessary tax forms sent to you by Netspend/Insight each year for saving account interest and potential referral bonuses?

4th Question slightly off topic: I’m looking to buy some property in the next 2-3 years and want to save ~ $30-$40k. What avenue would you use to save this type of money in the timeframe I mentioned? I’m not married and my EF will prob go to an Insight/Netspend account…. Is the best avenue a taxable account doing 50/50 index fund/bonds?

I think that would make sense if you’re looking to optimize your emergency fund savings. For the transfer:

1) I usually just have the $1 sit on the card. I then withdraw that automatic transfer every quarter when I’m taking out the interest I earned. It’s only a buck, so I don’t see a problem with just leaving it on the card. Ms. FP only withdraws her interest once per year because she doesn’t like dealing with it.

2) Withdrawing the interest doesn’t stop the inactivity fee. The inactivity fee requires funding the card, which is why you need to automate that $1 bimonthly transfer.

3) I received all of my 1099s from Netspend back in February. It was kind of funny because we have 10 total NetSpend accounts (five between both of us) and we just got a big stack of envelopes one day. Insight should do the same, but I only opened up an Insight card this year.

4) For a downpayment, I’d probably recommend just sticking that money in a savings account. If you’re needing that money, it’s probably not wise to subject it to the potential ups and downs of the market. Plus, any potential return loss isn’t all that much a big deal since you’re going to be using it soon anyway.

I keep a $2,500 buffer in checking and 8 months of expenses in Ally’s online savings account. I looked pretty in-depth at investing part of my emergency fund, but at the end of the day I came to the same conclusion as you.

Wow, with that much saved up I really think you should consider going for those 5% interest accounts! I imagine you and your wife could max out all those accounts and actually get a real return on your emergency fund

I am making a whopping 1.05% on my online savings account which acts as an emergency fun. Every time you talk about Netspend, I become a little more convinced that I need to get one set up. It’s going higher on my to-do list.

At least start with one account and see how easy it is. Really not that much work once it’s all set up.

I read your post on Netspend but haven’t had the chance to open that account. I think it’s much better than the “high yield” rates the banks offer. While the 1% rates at online banks are much better, it’s still only 1%. Being that I live in a high cost of living area, I sometimes feel the need to keep more money in my “emergency fund” or house down payment fund and it sucks that it earns so little. Will definitely need to re-read the Netspend post.

Check it out for sure! Let me know if you have any questions.

You may want to do some research on reverse-tiered savings & money-market funds. Many of them are offered by credit unions. Most don’t pay as high as 5% but I have found a few that yield up to 3% with a dollar cap. Some credit unions require residence or employment in a certain geographic area or employment by a specific employer but others simply charge a fee ($5 or $10) to join their credit union.

Here is on that everyone (in the US) can sign up for.

https://www.pmcu.org/moneymarket/

In addition to the ones you list in the post, I have another $21,000 invested yielding 2.5% APY. Not as high a yield as 5% but I could boost the yield from 2.5% to 3.16% if I reduced the investment to $10,000 but $21,000 x 2.5% > $10,000 x 3.16%.

Hey Dan! That’s great info and I’ve looked into these type of accounts before as well. I suppose the reason I don’t personally use those type of super high yield accounts has to do with (1) lower rate of return compared to the 5% interest accounts and (2) they often require some work, such as keeping a certain minimum or meeting a certain number of debit card transactions. That strikes me as more hassle than its worth, at least for me. In contrast, these 5% accounts require one time set up, automate a bi-monthly $1 transfer to avoid the inactivity fee, and then basically you can ignore them.

I suppose if you have some medium term savings goal, it might make sense to utilize the type of accounts you talk about.

Are you using those accounts primarily for your emergency fund?

It’s no different than Insight or Netspend.

I know the accounts you are referring to when you say “they often require some work, such as keeping a certain minimum or meeting a certain number of debit card transactions.” I avoid those as well. The accounts I am referring to (including the link) have no such requirements.

Every account I have is the same: I deposit the initial money up to the limit and at the end of the month or quarter, I withdraw the interest. Periodically, I auto deposit some money to avoid inactivity (sometimes there is a fee but escheatment rules apply everywhere).

My response to you is that you have already exhausted the 5% options so now your choice is between 3% and 1%. It’s not logical to keep money in a savings account earning 1% when there is a higher yielding substitute. My goal is to zero out the balance in the 1% savings account (which is my emergency fund) and have everything earning >1%. If I ever achieve that, I’ll bootstrap up; always reducing the balance in the lowest yield account and replacing with something at least 0.5% higher.

Oh, that makes a lot of sense! I think I misunderstood what you were getting at! I suppose you’re right! It’s not much work for me to set up another account and snag 3% interest on it. Now that I think about it, maybe I’ll open up that account and use it to store some of my longer term savings.

From another post I was under the impression that you already had $30,000 earning 5%. Rereading this post, I see that is not the case. If you max out the 5% accounts you should then open the lower yielding accounts I refer to. You should continue depositing to the 5% accounts until maxing them out.

Definitely like that plan!

Some great ideas for putting emergency cash to work! I should take some time to setup one of those insight cards.

You definitely should! Especially since you’re already a travel hacker, you’re probably not too intimidated by putting in a little work. You take 10 minutes, set this up once, and that’s $250 per year of interest potentially forever.

My husband and I use Ally Bank for our vacation savings and used it when we were saving for our wedding, as well.

However, we have a majority of our funds in the stock market that is not necessarily deemed our “emergency fund,” but would serve that purpose if we had an emergency that required a significant amount. The one thing you did not note as a benefit of investing is that you can have a generous income from high dividend stocks that can function similar to a high/interest yielding savings account (depending on the specific stock of course).

I had never heard of NetSpend or Insight prior to reading this post, but you have got me intrigued. I am definitely going to look into these further now 🙂

I think Ally is the perfect account for your sort of “base” emergency fund.

I guess when it comes to investing your emergency fund, it doesn’t make much sense to me. I don’t know of many dividend stocks (or any) paying 5%. And you take on the risk of loss. It seems like if you’ve got an emergency fund, it’s a no brainer to put it somewhere where you’re getting the maximum guaranteed yield. In this case, putting them into Insight and Netspend does that. It’s a risk-free 5% vs. taking on risk in your emergency fund by investing it, right?

I think the problem is that my husband and I both invested money prior to feeling the need to set up an emergency fund (before being married and while still living at home with our parents) and now that we are married and own a home, the idea of an emergency fund has become more prevalent. Hence, as I said before, the investments aren’t technically an “emergency fund,” but would be used for that purpose if ever needed. The money is mainly used for more of a long-term strategy.

I definitely think a guaranteed 5% is a good place to put at least some money, especially because we are planning to grow our family in the next few years. I like the idea of having a good return AND it being more liquid. Plus, we wouldn’t need to worry about long-term/short-term capital gains rates.

Makes total sense! Your investments basically can serve as your backup emergency fund until you’ve got a solid cash one set up. If you find yourself with extra cash, definitely consider trying out these 5% interest accounts. I really think they’re a great spot to store at least some of your emergency fund. If you’re not sure, try setting one up just to see what it’s like.

Nice post! I use Ally for my emergency savings, but that’s only because I haven’t heard of Netspend accounts. Looks like I have some reading up to do!! 😉

— Jim

The great thing is if you already have Ally, getting your Netspend and Insight accounts set up is easy! Trust me, once you have it all set up, you’ll wonder how you were ever okay with just 1% interest on your emergency fund! Feel free to get in touch with me if you have any questions about setting up the super high yield accounts. Always happy to help out.