One of the big benefits of side hustling is the ability to bring in extra income that you don’t need to spend. Arguably, you might need every last bit of your day job income in order to survive.

But if you’re already making ends meet with your day job income, that means that every single dollar you make on the side can be saved. It might not seem like that big a deal to make a few extra hundred bucks a month. But the power of saving the entirety of that money shouldn’t be underestimated.

Everyone Can Make Money With A Side Hustle

Most side hustles are exactly that – something you do on the side. After all, most of us have day jobs that take up the majority of our day, and not all of us are brave (or foolish) enough to just up and quit the safety of a steady paycheck.

This probably means that your side hustle won’t bring in a ton of money – at least not at the beginning. You just won’t have the time necessary to make the big bucks from your side hustle.

But that’s okay! Not all of us want our side hustle to overtake our regular day jobs anyway.

Still, it’s fairly easy to find a side hustle where you can make a few hundred bucks a month. This is especially true with the plethora of sharing economy and gig economy apps out there. Now, anyone can start their own little side hustle business with basically no start-up costs at all. And the amount of time you have to put in per month is fairly minimal.

As documented in my side hustle reports, I’ve been able to make well over $1,000 per month basically doing things I’m already doing or using resources I already have. I’ve rented out a room on Airbnb, hosted dogs on Rover, and delivered food on my bike through apps like DoorDash, Uber Eats, and Grubhub. I even sell trash I find on the street.

If I can make over $1,000 per month doing these types of gigs, I’m positive you can find a way to make a few hundred dollars per month on the side as well.

A Small Amount Can Really Add Up Over Time

Here’s where your side hustle income can really add up. Since we’re not spending that money, it means that we can save the entirety of our side hustle income.

As an example, let’s take everyone’s favorite stealth retirement account, the Health Savings Account (HSA). In 2021, the max a single person could put into an HSA was $3,600. Thus, in order to max out an HSA, a single person would need to contribute $300 per month.

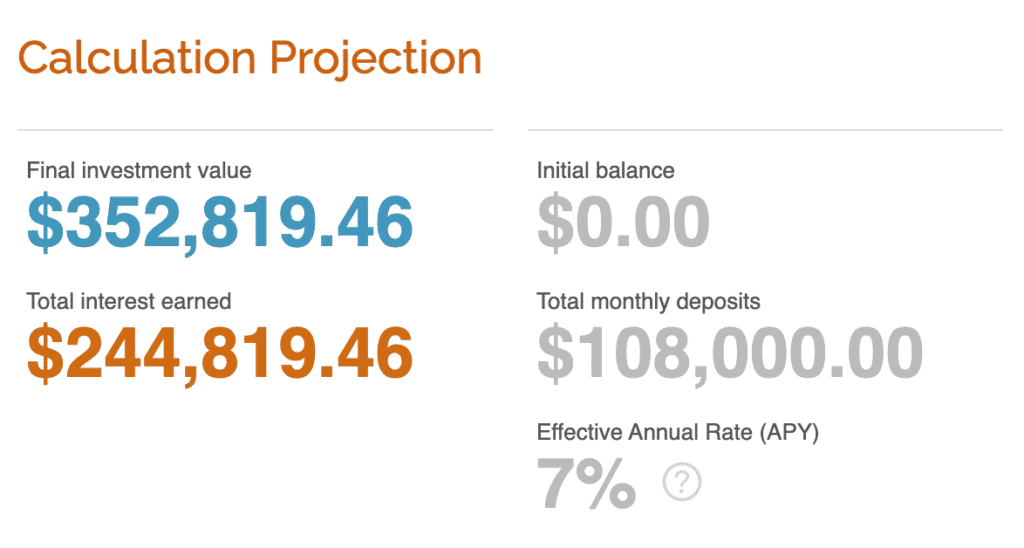

What if you made $300 per month from a side hustle and put it all into an HSA (assuming you have access to one)? Below is a graphic showing how much a $300 per month investment can grow over a 30-year period, assuming an annual rate of return of 7%.

Wow! Just earning an extra $300 per month in side hustle income and throwing it all into an HSA yields over $300,000 in a 30 year period! Your tiny, couple hundred bucks per month side hustle doesn’t seem so small now. And the great thing is that this is money that you otherwise wouldn’t have had. You won’t even notice it being saved.

The interesting thing to note is that by year 11, the yearly returns on your side hustle income equals what you’ve been earning from actually performing your side hustle. Your side hustle eventually creates its own side hustle!

What If We Increased The Savings?

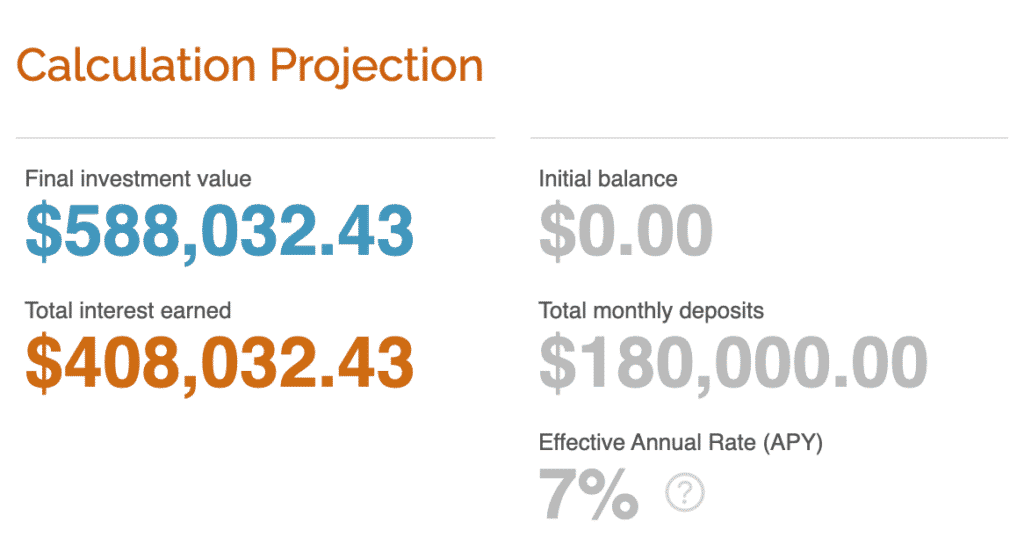

What if we tried to up our side hustle income to meet the IRA contribution limits? The 2021 IRA contribution limit is $6,000. In order to max that out, a person would need to put away $500 per month. Here’s what that amount looks like over a 30-year period.

Again, that figure is pretty astounding! That’s half-a-million dollars just from doing random side hustles!? Can you make between $300 and $500 per month from a side hustle? There are tons of ways to do it that don’t take up a ton of time and I bet there will be many more in the future.

Where To Save Your Side Hustle Income

An added benefit of saving all of your side hustle income is the ability to limit your tax liability now. Instead of paying taxes at your highest marginal tax rate, you’ll instead only have to pay self-employment taxes on it.

Getting tax free growth is a huge part of being able to turn that side hustle income into huge dollars later. I recommend stashing your money away in these types of accounts:

Solo 401(k)

A Solo 401(k) is a great retirement account for folks making 1099 income. With a solo 401(k), you can basically put all of your 1099 income into tax advantaged savings.

The unique thing about a solo 401(k) is that it allows you to make contributions both as an employer and an employee. If you’re having trouble maxing out your 401(k) at work, this is a great way to beef up your 401(k) contributions without feeling a pinch on your regular paycheck. If you are like me and happen to have a 457(b) at work instead of a 401(k), you’ll be able to put all of your 1099 income away as employee contributions, since 401(k) contribution limits and 457(b) contribution limits are separate.

A solo 401(k) is also particularly beneficial for future high-income earners like myself. Unlike a Sep IRA, having a solo 401(k) won’t mess up your ability to do backdoor Roth contributions. As a downside, income that comes from “passive activities” – such as Airbnb or rental income – cannot be contributed to a Solo 401(k), so you’ll need to figure out another way to stash that type of money.

Related Solo 401k Posts:

- The Solo 401k: The Side Hustler’s Bonus Retirement Account

- Fidelity Solo 401k: A Step By Step Guide To Setting Up Your Self-Employed Retirement Plan

Health Savings Account

If you happen to have access to an HSA, this is another great place to stash your side hustle money. Depending on your income level, it might make sense to contribute to your HSA directly through payroll deductions, as doing so allows you to avoid paying FICA taxes.

However, keep an eye out for which HSA provider your employer uses if opting for payroll deductions! For example, my employer uses an HSA provider that has really terrible investment options, so I opted to go with my own provider. The two HSA brokerages I recommend are Fidelity or Lively. Both are free and have excellent investment options.

Related HSA Posts:

- Lively HSA Review: The Best Free HSA For People Pursuing Financial Independence

- The HSA: The Perfect Retirement Account For Millennials

- Questions To Think About When You’re Setting Up Your HSA

Your Side Hustle Can Make A Big Difference

It’s so easy to start a side hustle these days that everyone should consider doing it. Even earning a little bit more per month can add up to a large sum of money over the long term! If you’re maxing out all your tax advantaged savings already, then starting up a small side hustle is a great way to squeeze out just a little more in tax advantaged savings.

Ultimately, don’t underestimate the power of your side hustle, even if it’s a “crappy” little side hustle. Earning a few hundred bucks a month might not look like much today. But don’t worry. Keep saving it! Some day, you’ll look back and see a lot of zeroes in there.

I couldn’t agree more, side hustle income may seem small, but it is bigger than you think when it adds up.

I totally agree! Pocket change makes a whole lot of difference. Saving these extra cents on the dollar can gradually build up your savings account.

I was doing research for my own post on valuing side hustles and found this article. Nice work! I approached it from the opposite direction of, if I have X in daily side hustle income, how much less do I need invested to reach my income goals. I also love the opportunity when side hustles intersect and their respective earnings power is multiplied. Then there’s the diversification away from financial markets, the joy of creating, and so on.

https://smartdevpreneur.com/how-much-is-your-side-hustle-worth/

Thanks for sharing this post! I totally agree with you, this is what really happening in my case. Instead of just keep sitting the money my bank account I invested the money in some place I know I can benefit more than other banks do. I carefully studied it in the first place, it is quite pricey if it is coming in my day job. I have to have a side hustle because of my investment in the first place. I plan of doing this for the next 10 more years.

I have recently started my side hustle and within a year I’ve made around $2500. All I do is find clearance items like at Target and Lowe’s and resell them. I recently found a $369 tool chest for $50 and sold it for $250.

This is very motivating! As a newbie at side hustling, I’m not sure how things will turn out. But as I move forward, I’m definitely going to keep your points in mind!

Awesome! Glad it’s motivating for you. Make sure to check out my side hustle reports so you can see just how possible it is to make extra cash side hustling.

Love this post! I am considering starting to drive with Uber when I am heading in a certain direction and make money to just go where I am anyway. And you are correct, every little bit helps. Use it for vacation, pay bills or just save it and watch it grow. Thanks for sharing!

-Brian

Thanks Brian! Definitely no problem just signing up for Uber and grabbing rides if your going in a certain direction. It’s not like you’re forced to do it. You can just pick and choose basically. Just make sure to do a ride like once a month or something so that your account doesn’t get deactivated or something. That’s what I try to do with my delivery gigs during the winter (I really don’t do as many bike deliveries when it’s cold out).

Great point about investing the side hustle money. I think side hustles are a great addition to your financial portfolio and a good income diversifier. Even just a few hundred $ a month can add up to 2 or $3,000 a year without too much effort or time. And year after year that can really add up. Plus, it can really be more fun than a regular job with less stress etc. Another good point is if you want to retire early, you could still keep your part time hustle. That income can really help the math with withdraw rates etc with your portfolio. I dont mind working. I just dont like the commitment of working 40 or 50 hrs a week which doesnt leave much time to really enjoy life the way you would like to.

I totally agree that the side hustle income can be used to bolster your early retirement. It’s easy to just pick up some minor side hustle if you’re in a position where you want to early retire, but might need a little bit extra per year. Wouldn’t be hard to make some money doing Uber or something like that on the side if you needed the money.

And totally agree on the fun! I have a ton of fun watching dogs or biking around town delivering food. Getting paid to do it is a nice little bonus.

I wasn’t sure how much I could make so this year, my side hustle money has gone into savings. Looking at paying taxes on it, I am now looking into solo 401k vs SEP etc that Vanguard offers to tax shelter my funds next year. Great recommendations in this post.

Thanks Jacq. Definitely take a look at a Solo 401k. It’s a good way to reduce your tax burden and save your money.

If we use the 4% rule, every 100$/month you make is basically worth 30k of savings you would have needed to earn that in retirement… Now if you are able to consistently make 1000$ a month out of your side hustles, that’s like 300k less you need in your nest egg!

Of course, this has the risk of your side hustle dying but it’s just like any other employment… just not 40h a week 😛

That’s a great way to put it. No doubt, your side hustle can definitely die, but the great thing is, it’s a side hustle! It’s extra money that you could save. And if one way to make money dies, there’s always hundreds of other ways to make a bit more.

Every little bit helps. A side hustle can be one way to justify / cancel out spending that would otherwise seem induflgent and unnecessary. Like $6 beers at Surly, for example. I only let you buy me one because I knew about your side hustles. 😉

Side hustles can be fun, too. Finding, refurbing, and reselling tossed aside furniture can feel like a game. Watching dogs could be fun, too, depending on the dog. The side hustle of writing and running a blog is rewarding as well.

Cheers!

-PoF

Haha, good thing I had some side hustles going so I could afford that beer. I owe you another one next time you’re in town.

Great post!

Small amounts of money really do add up. I find it strange that a lot of people don’t see the value in saving small chunks of money over time. It’s great that you were able to chart the potential of a side hustle.

And it’s cool that you document all your side hustle income too.

Thanks Graham! I think the benefit of putting away your side hustle money – especially if you can do so in tax-advantaged savings – is huge. You basically can up your savings right by a huge amount just by taking a small amount per month. I’ve enjoyed documenting the side hustle income as well. It’s not a huge amount by any means, but I find it interesting that I’m able to earn a pretty decent chunk of change with very little capital output by using all these on-demand apps.

Side hustles really do add up and can make a huge impact on your overall finances. We’ve been using the extra income to pay off our debt and are really starting to gain momentum. I enjoy the freelance writing and even clicking things to earn a few gift cards is much a better use of time than just scrolling through Facebook again.

That’s the beauty of it. It’s money that you absolutely don’t need. The only thing to remember is, don’t forget taxes on your side hustles. That’s why I like being able to save it away in tax-deferred savings. It gives you a way to earn that money and avoid much of the tax hit as well.

Love this post! I was thinking about this the other day, that even though my side hustle may start out being a few hundred dollars, it can be a very powerful few hundred dollars if it’s all disposable income. I love the calculators as well. Goes to show what can happen if you are smart with how you ‘dispose’ of that income! : )

Exactly right. You literally don’t have to touch any of this money you are earning on the side. If you just act like its not even there, you’re basically giving yourself some extra retirement money down the line. Even if you were to early retire, it seems like it wouldn’t be hard to just keep earning a few hundred bucks a month forever. Really gives you some cushion down the line if you suddenly find yourself with an extra 300-500k.

Excellent use of Homer Simpson… “Your side hustle eventually makes its own side hustle. Woo Hoo”. Love it! Truly shows how powerful it is. This makes me less worried about the decline of the middle class long term. As you pointed out, side hustles are so easy to start up now and they’ll only get easier. Traditional work is going away, but more and more opportunities for side income are popping up. I just have little doubt people will figure it out.

Whether the rise of this 1099 economy is a good thing or not is really up for debate. I’m a bit on the fence, but I do like the flexibility for myself of being able to do all these little gigs. If you want a little more information about this on-demand/sharing economy, you might want to check out a book called “Raw Deal: How the Sharing Economy and Runaway Capitalism are Screwing American Workers.”

Also, great to see a fellow Minnesotan! Do you draw all those pictures on your blog yourself?

Side hustles are so powerful! That’s a great point about postmates. With the on-demand economy these days, I’ve been thinking of getting in the food delivery business or on Fiverr. An extra $100 dollars in a month really makes a huge difference in the end, can’t argue with that!

The thing is, I also find these side hustles fun! It also teaches you a lot about being humble. I’m a lawyer, graduated near the top of my class, but here I am going around delivering food to college kids. It’s funny because the people I deliver food to have no idea.

I agree with you, 100%. Some people think that pocket change doesn’t make a difference, but when compound interest is added in there, then pocket change makes a huge difference long-term. We wrote an article a few weeks back on how if a parent put away $50 a month, for 18 years, then by the time a child retires, he/she is looking at some major money, when the base investment was only $600/year, $10,800 total.

http://www.piggybanknomics.com/kids-college-fund-vs-retirement-fund/saving-for-college-vs-retirement-fund/8/26/2016

The really big thing with side hustling is the fact that you can increase your savings tremendously. Since side hustle money is money you didn’t necessarily need to live, you can easily increase your savings rate tremendously. It can be hard to cut hundreds of dollars from your budget to save. But it’s quite easier to just make those couple hundred dollars and squirrel it all away for the future.

It’s powerful motivation! My friend just launched an app to let people deliver items, like groceries. If you are going to be shopping at Costco anyways, why not pick up some groceries for an elderly lady? It all adds up!

That’s a really cool idea with the app and groceries. Has it had much success?

I actually signed up to do deliveries for Instacart earlier this year. It’s basically an app that lets people order groceries online. Someone from Instacart then does the shopping for you and delivers it to your house. Ultimately, I did one delivery and then decided it wasn’t for me, simply because you had to use a car in order to do it. Since I hate driving, it just didn’t feel like a great use of my time and I was putting wear and tear on our one car. But the great thing about these type of apps – since it wasn’t for me, I just stopped doing it. No harm, no foul!

If your friend’s app is one where you could incorporate your own shopping while doing grocery shopping for someone else, then that sounds like it could be useful to build up a little side money doing something you’re already doing! That’s initially what I thought I could do with Instacart, but the nature of how the app works made it so that wasn’t really possible.