If you’re into personal finance or financial independence, you probably know about the HSA (Health Savings Account) and how you can use it as a sort of extra tax-advantaged retirement account. The government gives you a limited number of tax-advantaged accounts, so it generally makes sense to take advantage of as many of them as we can.

The beauty of the HSA compared to other tax-advantaged accounts is that it’s one of the few accounts that provides you the opportunity for triple tax-advantaged savings – that is, money going in tax-free, money growing in the account tax-free, and money that you can take out tax-free. The catch is that in order to get those triple tax-advantages, you have to use your HSA funds for qualified medical expenses. This generally isn’t a problem since most of us are likely to spend significant money on healthcare at some point in our lives.

It’s important to note that the HSA isn’t an account that everyone will have access to. In order to contribute to an HSA, you have to have a High-Deductible Health Plan (HDHP), which is a specific type of health insurance with higher deductibles and (generally) lower premiums. Your insurance company will tell you if your plan makes you eligible to contribute to an HSA.

I’ve had an HDHP in two of my last three jobs. My first two jobs, in biglaw and government, both had an HDHP, and I opted to max out my HSA during those years. My most recent job, at a small non-profit, did not. That meant that I couldn’t contribute to an HSA during the years I was working there.

When I made the move to self-employment this past year, I specifically signed up for a health insurance plan on my state exchange that qualified me for an HSA. I’m a pretty low user of healthcare and I also have a lot of cash set aside to cover deductibles, so it makes sense for me to pay less in health insurance premiums and give myself access to another tax-advantaged account.

With the new HDHP in hand, I thought it would also make sense for me to switch out of the HSA that my funds have been sitting in since I left my government job years ago. The HSA I had wasn’t terrible, but there were some details with it that made it less than optimal. After doing some research, I finally moved my funds over to Lively, a newish HSA company that I’ve been wanting to check out since I first heard about them.

In today’s Lively HSA review post, I want to share what my experience with Lively has been like, why I made the move to it, and whether you might want to do the same thing.

The Important First Question: Which HSA Should You Use – Employer Or Your Own?

Before getting into my experience with Lively, it’s important to understand exactly how HSAs differ from other employer-related tax-advantaged accounts and how this will impact whether you should use an HSA company like Lively.

The major difference is that unlike a 401k, 403b, or 457 plan, HSAs can be opened with any HSA company. A 401k is different. There, you don’t have any choice – you use whatever company your employer uses.

While you can open an HSA with any HSA company, most employers will have some sort of preferred HSA provider that you can contribute to via payroll deductions. When I was in biglaw, my employer’s HSA was through Fidelity. I can’t remember exactly, but I believe that Fidelity back then charged $72 per year in administrative fees. That wasn’t great but it wasn’t terrible either.

When I moved to government work, my new employer used an HSA company called Further. This HSA required me to keep $1,000 in cash earning essentially no interest. Everything above that could be invested in a roster of low-cost index funds. The investing portion of the HSA charged $18 per year in administrative fees and then the cash portion charged me $1 per month. Luckily, my employer paid these fees, which made it worthwhile for me to use this HSA. The only downside was having to keep $1,000 in cash since I’d prefer to have that money invested rather than sitting idle.

The point of this background is that there are differences between HSAs. Whether you go with the one your employer uses or an HSA like the one I’m using now will depend on you and your circumstances. In some situations, you might want to stick with your employer’s preferred HSA company and contribute via payroll deductions. In other situations, you might want to open your own HSA, contribute with after-tax money, and then deduct those contributions from your taxable income.

Here are the questions I would ask when making this decision:

- Does your employer contribute to your HSA? Many employers will contribute something to your HSA each year as a sort of company match. Getting this match will almost always require you to use your employer’s preferred HSA company. My employer contributed $800 per year to my HSA when I was working for the government. This was free money, so it made a lot of sense for me to use my employer’s preferred HSA company.

- Do you care about reducing FICA taxes via payroll deductions? HSA contributions have an interesting feature where if you contribute to your HSA via payroll deductions, the money goes into the HSA without you having to pay FICA taxes on it. This is unique to HSAs, as there’s no other way to reduce FICA taxes. Whether this matters or not will really depend on your situation. If you’re already making over the social security tax limit, then contributions via payroll deductions won’t do anything (reducing the amount you pay to social security taxes also reduces your future social security benefit, so it could be a wash). You’ll save a little bit on Medicare taxes regardless of your income, but the amount you’ll save in taxes is negligible to the point that it really doesn’t matter much.

- What are the fees and who’s paying them? HSAs typically cost something in administrative fees. Often, your employer will pay any administrative fees for you while you’re working for them. You will want to take this into account when deciding which HSA makes sense for you.

- How simple do you want to make things? If you’re looking for the best of all worlds, it’s actually okay for you to open up multiple HSAs. You could open up your employer’s preferred HSA just to get any company match, then make the rest of your HSA contributions to your own HSA. Whether you’ll want to do this will depend on whether your HSA has any administrative fees and your own personal preferences on how complicated you want to make things.

Why Use Lively?

Moving my HSA over to Lively made a lot of sense. My old HSA charged me $30 per year in fees and it also required me to leave $1,000 in cash. The $30 in fees and $1,000 in cash drag wasn’t the end of the world, but it wasn’t necessary, especially when I could easily move my HSA over to a new company without too much hassle.

In contrast to my old HSA, Lively has the following advantages:

- It charges no fees. This makes Lively an obviously good choice for your HSA.

- There’s no cash requirement to use Lively. This reduces cash drag since you can have 100% of your contributions invested.

- Lively also has free investing. The investing is done through TD Ameritrade. There are some annoying things about TD Ameritrade’s investing interface, but the important thing is that there are good, low-cost investment options that you can use for long-term investing.

- Lively itself has an extremely intuitive interface. A lot of HSAs seem pretty low-tech, are hard to navigate, and have bad apps. Lively probably has the best interface of any HSA company I’ve ever used.

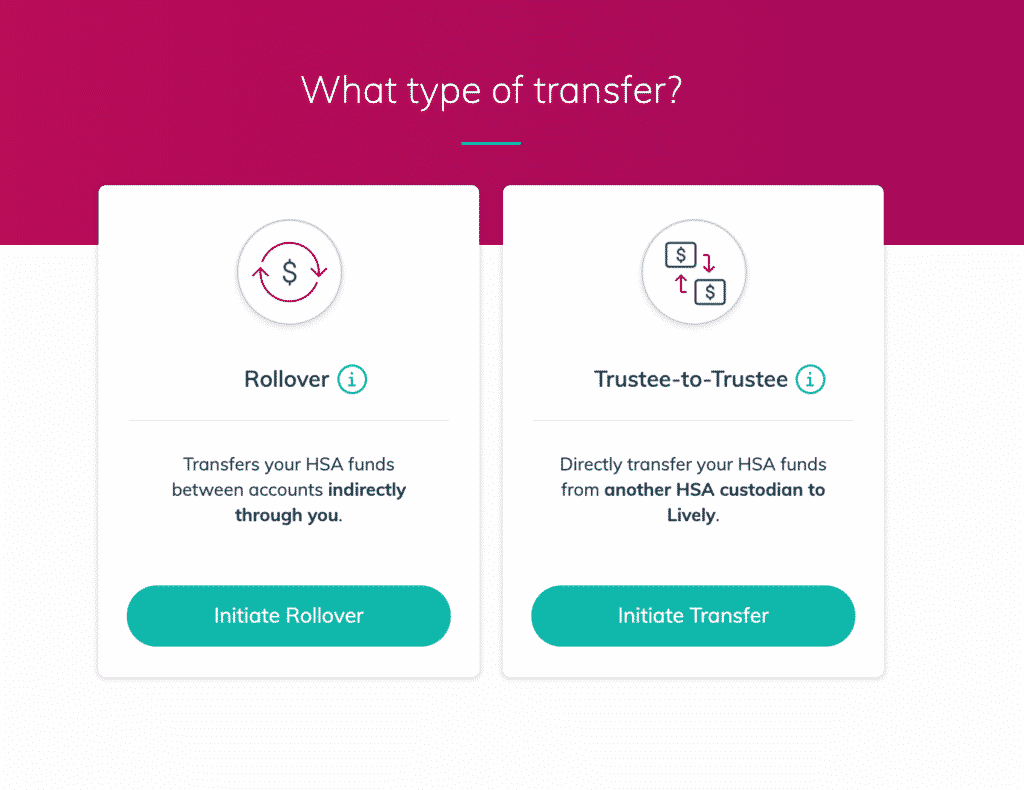

Perhaps the most surprising thing about Lively was its extremely easy rollover process. Friction is the reason why a lot of us procrastinate when it comes to taking care of our finances. When I opened my Lively account, I was surprised at how seamless they made the whole rollover process. Instead of having to print out a bunch of forms and mail them off, Lively makes it so you can do it all online.

The Best Way To Use Your Lively HSA

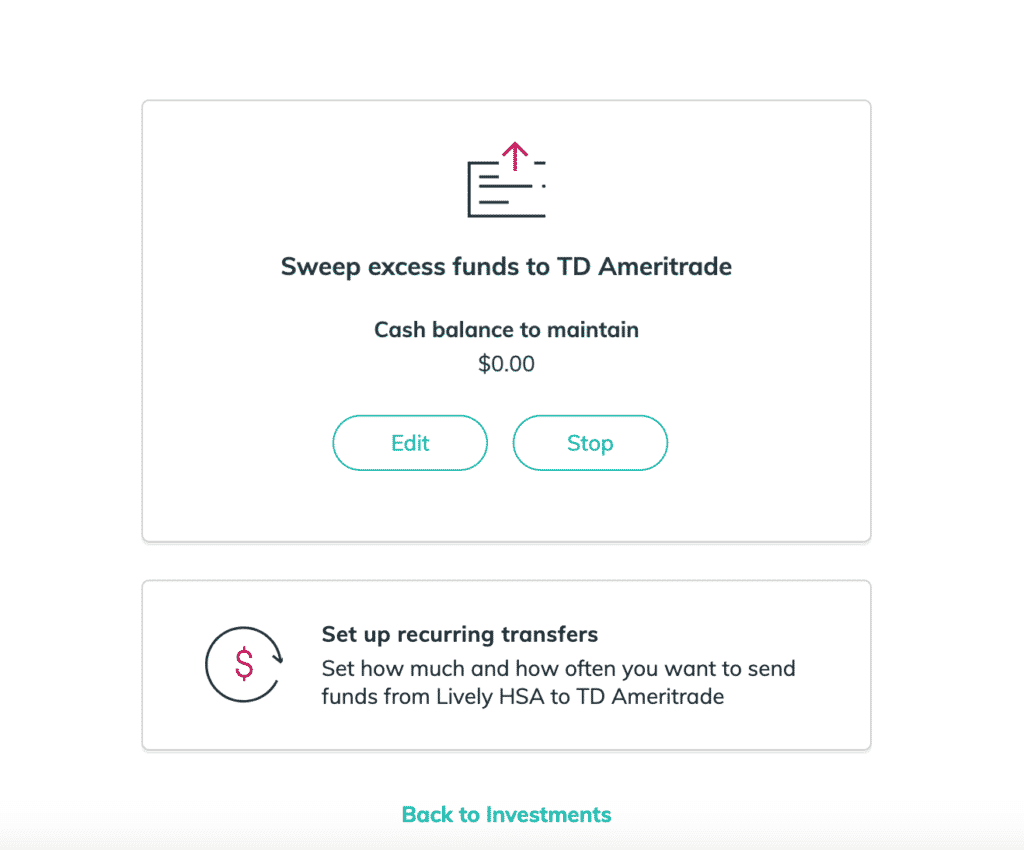

The absolute best way to use your HSA is as an extra tax-advantaged retirement account. Lively is great for this because it offers you free investing through TD Ameritrade. Transferring my funds over to the investment portion of the account was a simple and straightforward process that involved clicking a few buttons. Within a day, my funds were all sent over to the investment portion of my HSA.

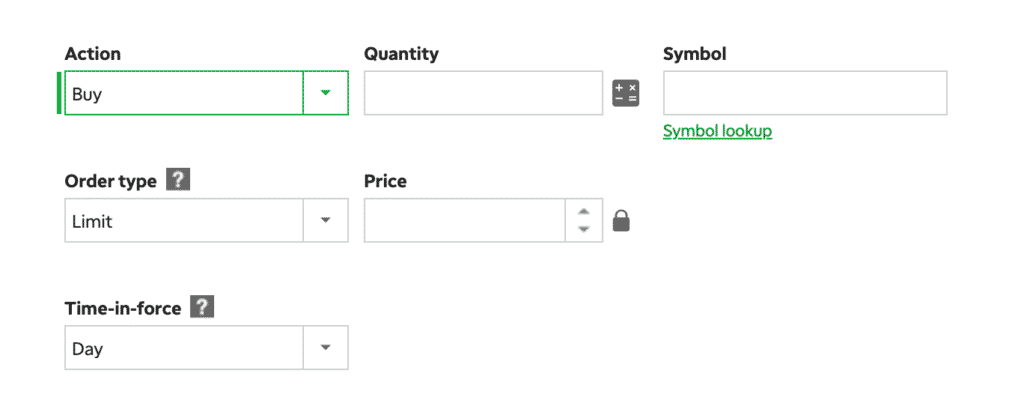

The investing portion itself, however, is a little bit complicated. TD Ameritrade is exactly like every other big brokerage company, which means they do not make investing easy. This is true of all the big companies, Vanguard and Fidelity included. Take a look at what I mean:

Since TD Ameritrade is a full brokerage, you can actually buy any mutual funds or ETFs that you want, although those will come with a fee. I opted for the commission-free ETFs that they offer since I hate paying fees to invest my own money.

The commission-free ETFs are good. The one downside is that since these are ETFs, you can’t buy them in fractional shares and as a result, I have a few dollars that are sitting in cash. I’ve set it up so that when I get dividends, my account will automatically reinvest all of the available cash that it can into the ETF I bought.

In terms of what to invest in, I opted to put all of my HSA contributions into the SPDR® Portfolio S&P 1500 Composite Stock Market ETF. The ticker symbol for this ETF is SPTM. It’s not exactly a total market index fund, but it’s pretty close, and I think I can do just fine with my entire HSA invested into this one ETF. And with an expense ratio of just 3 basis points (or $3 per year for every $10,000 I have invested), it’s extremely cheap.

If you’re not comfortable with investing it all into one ETF, you could also set up a simple three-fund portfolio with domestic, international, and bond ETFs. The Bogleheads Wiki for TD Ameritrade lists all of the good commission-free ETFs, so it’s worth checking that page out for more info.

Specifically, if you’re looking to make a three-fund portfolio using TD Ameritrade funds only, I’d recommend dividing your contributions between the below three ETFs (the percentages in each one will be up to you to decide):

- S&P 1500® Composite Stock Market ETF (Ticker: SPTM)

- Developed World ex-US ETF (Ticker: SPDW)

- Aggregate Bond ETF (Ticker: SPAB)

Addendum: I didn’t realize it, but TD Ameritrade actually removed commission charges for all domestic ETFs. This means you could throw your entire HSA into a Vanguard Total Market ETF like VTI and call it a day. I’ve been investing my HSA funds in VTI – every two weeks, I buy VTI and then just continue to do that.

If you’re like me and you schedule regular transfers into your HSA, you can also automate it so that Lively sweeps your HSA contributions into your investment account. I set my HSA to keep $0 in cash since I treat my HSA as an additional retirement account. Each week, my contributions are automatically sent over to TD Ameritrade, where I can then invest it into ETFs.

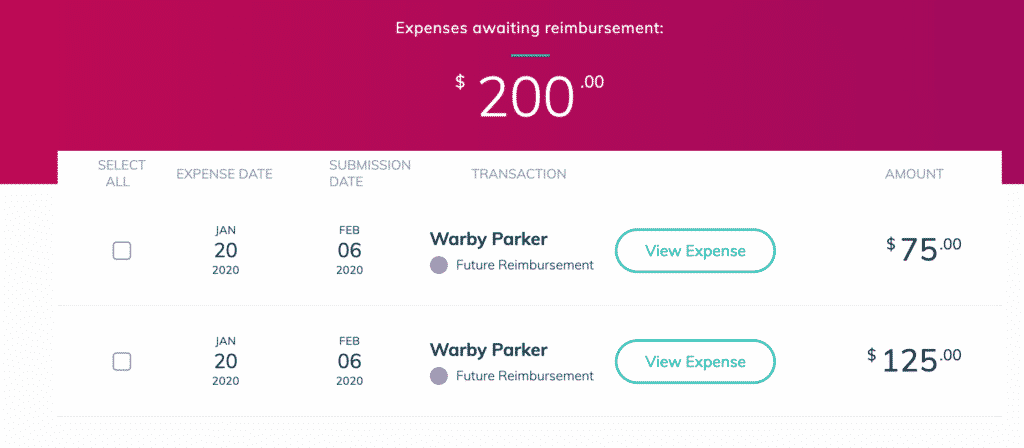

Tracking Unreimbursed Expenses

A final feature that makes Lively great to use as an extra tax-advantaged account is that it has a feature that allows you to track your unreimbursed expenses. One secret of the HSA is that it does not require you to pay for medical expenses in the same year that you incur them.

What this means is that the best way to use your HSA is to pay for qualified medical expenses out-of-pocket and save the receipts. You then leave the money in your HSA to grow and compound over the years. In the future, you can then withdraw money tax-free as a qualified medical expense. So long as you have the documentation to prove it, you won’t have any trouble.

For example, if you spend $1,000 on qualified medical expenses in 2020, you can then save those receipts and pay for your medical costs out of pocket. You then leave the $1,000 in your HSA and allow it to grow over the years. In the future, you’ll be able to withdraw $1,000 tax-free, while at the same time having the benefit of letting your $1,000 grow into much more over time.

Lively must know that this is the optimal way to use an HSA as they have a feature where you can record your qualified medical expenses and upload the receipt. Lively then stores this information away for you in an organized way. This is very useful for anyone using their HSA as a long-term savings vehicle.

Final Thoughts

A while back, HSAs were kind of crappy with high fees and bad investment options. Competition has changed that though, dramatically reducing fees and providing better, lower-cost investment options.

In my opinion, Lively has the best HSA of all the HSA companies I’ve seen. Its interface is definitely the best of all the HSAs I’ve seen, and really, there aren’t any downsides that I can see from using Lively other than if you don’t want to deal with the hassle of moving your HSA to another company.

If you’re already using a company like Fidelity (which also offers a free HSA), then you won’t need to use Lively. But if you’re using an HSA company that charges fees of any sort and you have no reason to use that HSA, then using Lively for your HSA makes a lot of sense. The fact that they are a completely HSA focused company really seals the deal for me.

If it makes sense for you, you can open a Lively HSA here.

And if you’re looking to learn more about HSAs and why they make a lot of sense, you can check out these posts here:

- The HSA: The Perfect Retirement Account For Millennials

- Questions To Think About When You’re Setting Up Your HSA

For an additional resource, I found this great website, HSA List, which provides a list of everything that is and is not an HSA eligible expense. Of course, be sure to check with your own tax professional, but this is a great list that’s worth saving as a reference.

Question – I also have an FSA. Let’s say I picked up my medication at the pharmacy, copay is $30. Can I use my FSA to pay for the $30 and then also upload that receipt to my Lively HSA account as an unreimbursed expense that i can pay myself back for in later years? Or is that considered double dipping?

You can’t double dip the FSA and HSA. Gotta pick one.

My wife an I just switched to a HDHP. While researching HSAs, I came accross Vanguard’s page, where they list “Providers that allow you to open an HSA with Vanguard funds”: as B of A, HealthEquity, and HealthSavings Administrators. I think I rushed it, as I just started an account with HSA with the intent of investing in VTSAX. Looking at their fees, I am wondering if it would make sense to just pay the rollever/ account closure fee of $25 and start over with Lively or Fidelity? What do you suggest?

HSA Admin Fee: $45

HSA Custodial Fee: 6.25 basis points per quarter

https://personal.vanguard.com/us/whatweoffer/overview/healthsavings,

I’d move it even though it costs $25. Considering the fact that the admin fee is $45 per year, you’ll recoup that cost back in a year. The 0.25% custodial fee is also not worth it.

Turns out Lively also made all ETFs commission-free, so you can invest in Vanguard ETFs with Lively (they use TD Ameritrade for their brokerage).

As of October 2019, all US/Canada-listed stock, ETF, and options trades at TD Ameritrade have no commissions. So feel free to use whichever ETFs you prefer (such as VTI).

Thanks! I didn’t even know that. In that case, that makes Lively even better. Looks like the expense ratio for SPTM is the same as VTI, but maybe I’ll move it over into that now that I know this.

I have heard that HSAs can also be passed down to heirs in a will and you can also help pay health care costs of people other than yourself. These would be two bigs reasons in my opinion to have one if you can.

Haven’t thought about the estate planning purposes of HSAs. I need to look into that because I don’t know.

Great Post! IMHO HSA offered by Fidelity is the best; it offers everything that Lively provides and, in addition, you can buy virtually any stock, etf, MF out there including some Target date funds that otherwise require $1M in minimum investment. Lively, through TD Ameritrade, offers comparatively fewer investment options.

Samosa,

Does Fidelity let you upload receipts and store them to reimburse yourself at a later date?

@Kyle, I don’t know as I am using HSA as a savings/investment vehicle and have never withdrawn money. FWIW, I was once told by Fidelity CSR that Fidelity doesn’t ask for receipts and one can choose to use their debit card to pay directly for medical expenses, or one can reimburse himself/herself by simply transferring money from Fidelity HSA to a non-HSA account (with any bank). Per CSR, its between HSA owner and IRS to decide whether a paid/reimbursed expense was qualified or not, Fidelity has nothing to do with it. This makes me think that Fidelity may not provide the option of uploading and saving receipts but honestly I don’t know the answer. What I do know that Fidelity is known for their excellent customer service and they should be able to answer this question even if one asks them prior to opening an account with them.

I also agree with Samosa- Fidelity has a much easier to use interface. Also! Zero funds- they have no fees at all. Otherwise you can pick basically anything, only fees would be on ETFs from their expense ratio. I also haven’t needed to submit yet but it really doesn’t look like they check much- there’s a link to a page saying basically “these services are covered” and how to reimburse yourself (ACH or check, or have a check written out from your account to the provider). Personally what I’m going to do is have a cloud backup of any medical expenses I accrue, though I doubt there will be many. I really can’t see what the advantage of Lively is over Fidelity at all now that they have fee-free trading, although prior to that, Lively was maybe the best.

Side question with the FICA taxes- how do those come into play if you are self-employed? I have my HSA through a marketplace plan, and am self-employed. Would I still be reducing them?

I think Fidelity and Lively are pretty close and are clearly better than any other HSA out there at the moment. If you have Fidelity, no need to switch. If you don’t have either, the advantaged with Fidelity is a much easier rollover process – the easiest I’ve ever seen.

I also recommend keeping a cloud backup of any receipts. I’ve been storing my healthcare receipts in Evernote in a special folder I created. I also have a spreadsheet where I record the relevant info as well.

If you’re self-employed, you’re not going to get any FICA tax deduction since you’re likely contributing with after-tax money and then deducting it on your taxes. Getting that HSA FICA tax deduction requires a Section 125 cafeteria plan, which I don’t really know what the legal definition of that is but I’m guessing you don’t have that when you’re self-employed.

Yep, I’ve got no beef with Fidelity either since they have a totally free HSA too. I had a Fidelity HSA about 4 years ago during my first job, but back then, they charged quarterly administrative fees (I think it was $18 per quarter or $72 per year). I ended up rolling that HSA over to a new HSA when I switched jobs. I think I mentioned this at the end of my post, but if you’re already in Fidelity now, then yep, no need to use Lively. I’d just stick with Fidelity in that case. I will say that Lively has an easier rollover process compared to Fidelity (it’s really just click and esign with the Lively HSA, which I found super surprising because I’d never seen a rollover be that easy).