Everyone is looking for ways to make or save extra money, so I thought it’d be a good idea to share all of the best cashback apps I use to help me optimize my everyday spending. If you use all of the apps I write about in this post, you’ll put yourself in a pretty good position to optimize your everyday spending.

Before we get started with all of the best cashback apps that I use, let me first talk a little bit about how I approach spending. My philosophy with spending money goes like this – anytime I have to spend money on something, I want to do so in a way that will get me the most return on my spending. That’s one of the main reasons that I open up a new credit card every few months. By doing that, I’m able to get money back in the form of hefty credit card signup bonuses, which I can then use for free travel, all while spending the same money I’d already be spending anyway.

Perhaps the easiest way I optimize my spending is by using a plethora of apps that run in the background. These apps give me cash back when I spend money at certain places – either in cash, credits, or gift cards. What’s great about all of these apps is that they’re entirely passive and run in the background without you even noticing them. In short, they’re a great way for you to optimize your financial life just a little bit more.

Note that the apps I talk about in this post differ from the receipt apps that require you to take a picture of your receipt to earn cashback. I’ve always found that those kinds of apps – Ibotta, for example – took me too much time for what I was getting in return, plus I didn’t like the fact that those kinds of apps required me to buy specific things at the store. However, I do use and recommend using ReceiptPal, ReceiptHog, and FetchRewards to take pictures of your grocery store receipts – I find those apps very easy to use since they let you take pictures of any receipt, and the money you earn from those apps surprisingly adds up over time.

With all that out of the way, let’s take a look at the best cashback apps that I think everyone should use.

The Best Cashback Apps

If you’re just looking for a list of the best cashback apps, here’s what I recommend (I use every single one of these apps personally). Make sure to read through the rest of the post to learn more about why I recommend each of these apps.

Best Cashback Apps:

- Drop (Get 1,000 points when you sign up using my link)

- Dosh

- Rakuten (Get $40 if you sign up using my link)

- Freebird

- ReceiptPal, Receipt Hog, Fetch, Coin Out, Amazon Shopper Panel

- Capital One Shopping and Honey

- Upromise (Get $30 – Receive a $5.29 bonus when you sign up and $25 when you link a 529 plan)

Honorable Mention Apps:

1. Drop

The first app I recommend is Drop. Like other cashback apps, you link your credit cards to Drop, and then you earn points that you can redeem for gift cards. 1,000 points are worth $1. It’s not a ton of money, but again, it’s money you’re earning for the money you’re already spending anyway.

When you first sign up for Drop, you’ll have to choose five primary stores that you can earn points at. I picked Chipotle, Uber, Walgreens, Target, and McDonalds as my five base stores. Other stores include Whole Foods, Trader Joe’s, and some clothing stores that I don’t really shop at very often. My advice is to pick the places that work for you.

Drop also offers special deals which allow you to earn more points for certain purchases. These are rotating categories that you technically have to activate, so every once in a while, you’ll need to go into the app and activate these deals.

It only takes a few minutes to sign up for Drop and get everything set up, so it’s definitely worth the time to set things up. Again, don’t change your spending habits just because of this app, but it’s not bad to just have Drop passively running in the background for you.

If you sign up for Drop using my link, you’ll get 1,000 Drop points to start your account.

2. Dosh

Another app I’ve been using to get a little bit of cashback on my everyday spend is Dosh. It’s a mobile-only app that tracks your spending and gives you cashback for purchases you make at certain restaurants and stores. I’ve been using Dosh for over a year now to earn cash back on my spending at various restaurants and breweries around me.

What makes Dosh really great is that it’s completely passive once you set it up. You just link your credit cards to Dosh, and if you spend money at a participating business, you automatically get cashback to your Dosh account. You can then cash out your earnings to your regular bank account once you hit the minimum cashout requirement.

In my time using Dosh, I’ve found that it instantly recognizes when I spend money at a participating place and then credits my Dosh account immediately. It’s pretty crazy how fast it works. For me, Dosh has worked out really well simply because a lot of breweries in my neighborhood seem to offer 5% or more cash back. When you combine that with the credit card rewards that I earn (typically at least 2% back), I’m basically snagging myself a 7% discount at most breweries – all without having to do anything!

I wouldn’t recommend you go out of your way to eat or drink at places you wouldn’t normally go to, but you should definitely link your cards to Dosh to give you a little bit of return on spend for random places you might happen to go to.

3. Rakuten

Rakuten (formerly Ebates) is pretty much a no-brainer Google Chrome extension that everyone should have in their browser. With Rakuten, you get cashback on almost any purchase you make online – typically around 2-5% back, but often more depending on the store and the time of year.

The extension only takes a few seconds to set up, and once it’s in your browser, it’ll automatically notify you if you’re on a website where Rakuten offers cashback. From there, you just activate the extension and continue with your purchase as normal. Rakuten then tracks your purchase and gives you whatever percent cash back you earned.

If you’re wondering how Rakuten can pay this cashback, it basically gets a referral fee from the store when someone buys something with Rakuten activated. Rakuten then shares this referral fee with you. The alternative would be that you don’t use Rakuten, in which case you’re just not getting back anything at all – so naturally, Rakuten makes a lot of sense to use.

You get paid by Rakuten once per quarter, so it’s a nice little bonus when you get a Rakuten check in the mail. In my time using Rakuten, I’ve earned back several hundred bucks – all while spending on stuff I was already going to buy anyway. And all I had to do was take a few seconds to set up the Rakuten Google Chrome extension.

If you combine Rakuten with the return you’re getting on your credit cards, pretty much any purchase you make online should be worth at least a 5-10% discount. Basically, if you buy anything online, you should make sure you have Rakuten set up – otherwise, you’re just missing out on free cashback.

If you use my link, Rakuten will give you a $40 signup bonus once you signup and make your first purchase using the Rakuten browser extension!

4. Freebird

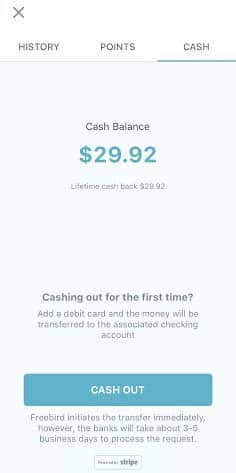

Freebird is an app I found that I’ve now added to my best cashback app list. If you ever use Uber to go anywhere, this is a must-have app that you need to download. Here’s how Freebird works.

A lot of people are taking Ubers to go to various places. At the same time, there are hundreds of restaurants looking to find ways to get people in the door. Freebird partners with restaurants to offer cashback if you take an Uber to that restaurant. For the restaurant, it’s basically a marketing expense – if you take an Uber to their restaurant using the app, the restaurant pays you something, which is worth it for them since it gets a customer through the door. Below is a video from Freebird that explains how it works:

So, basically, instead of ordering Ubers through the Uber app, you should instead order them using the Freebird app. It’s the same thing as ordering an Uber, but by using the Freebird app, you at least get cashback on your rides.

I’ve found that cashback rates tend to be about $4 for the restaurants near me, so if you go to a restaurant that’s not too far away, you can basically subsidize or completely cover the cost of your Uber ride. If you order an Uber to go to a non-participating place, you earn points. 5,000 points in the app equal $10 cashback. I’ve already used Freebird a few times to try it out, and it’s worked out great for me.

5. ReceiptPal, Receipt Hog, Fetch, CoinOut, and Amazon Shopper Panel.

One easy way to get cashback is by taking pictures of your receipts. This is a simple way to get a little something back for the purchases and receipts that you’re probably already getting anyway.

I use five apps to do this – ReceiptPal, Receipt Hog, Fetch (2000 points), CoinOut, and Amazon Shopper Panel. ReceiptPal, CoinOut, and Amazon Shopper Panel give you cashback for any receipts. Receipt Hog and Fetch both give you cashback for taking pictures of any grocery store or convenience store receipt. Amazon Shopper Panel is the best one right now and gives you $1 for each receipt, up to $10 per month (and they can be receipts for anything).

I recommend downloading all five of these apps and incorporating them into your day-to-day life. Whenever I get a receipt, I quickly snap a picture of it using these apps before I toss the receipt. It takes me a few seconds and allows me to earn a few extra dollars every few months without much work.

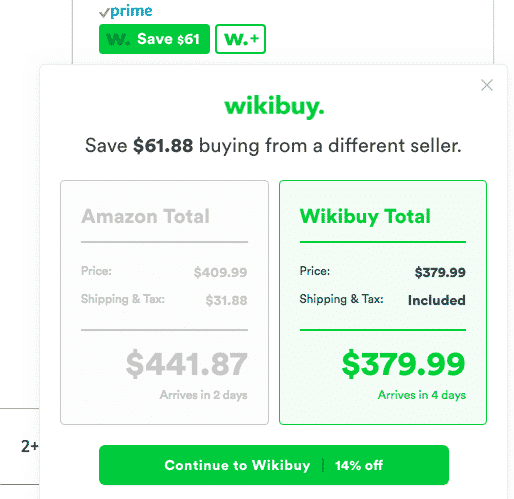

6. Honey & WikiBuy

My next set of apps are two Chrome browser extensions that will help you make sure that you’re paying the lowest possible price for whatever you’re buying. I’ve put them both in the same section because they work very similarly and it makes sense to have both of them installed in your browser.

- Honey works by scanning for coupons and promo codes whenever you’re checking out from your online purchase. By using Honey, you’ll always know that you’ve used every possible coupon or promo code out there. If you sign up for Honey with my link, you even get $5 when you use Honey at checkout.

- WikiBuy works similarly to Honey, but its best feature is that whenever you buy something on Amazon, it will automatically tell you if Amazon is offering the lowest price, or if you could find that item for a lower price somewhere else, such as on eBay or another site. WikiBuy works entirely in the background and integrates right into Amazon, so you should definitely have this app installed.

One thing to note is that both Honey and WikiBuy have a cashback thing similar to Rakuten on some websites, but these won’t stack with Rakuten. Most likely, if either of these apps offers cashback, Rakuten offers it too, and I’d recommend using Rakuten for your cashback (but obviously, use whichever one gives you the most cashback).

7. Upromise

The last cashback program I use is Upromise. Like with Dosh, Drop, and Uber Offers, Upromise tracks your credit card spending in the background and then gives you cash back on eligible purchases.

The main difference is that you’re supposed to use the cash back that you earn through Upromise to pay student loans or to fund 529 plans. I’ve just been putting the cash into my own 529 plan that I set up for myself a few years back.

I haven’t earned a ton of money through Upromise and it seems super slow in actually applying your cashback to your account. Still, it requires no work on your end other than linking your credit cards, so you might as well have it set up.

Also, use my link and receive a $5.29 bonus when you sign up and $25 when you link a 529 plan.

Honorable Mentions

I have a few other apps that I have included here as honorable mentions. I think these apps are worth setting up just to squeeze out a little bit more cashback. These include the following apps:

1. RebateKey

RebateKey is an interesting website I found where you can search for items offering a rebate on their website, buy the items from Amazon, submit the purchase information to RebateKey, then get the rebate check in the mail about a month later. The rebates vary but typically range from 50% to even 100% of the purchase price.

Based on my research, the purpose of RebateKey is for Amazon sellers to boost up their sales – most likely to improve their Amazon search rankings.

I’ve used RebateKey several times now and have received my rebates each time without any issue, so I can say that this website is legit.

You’ll need to search the RebateKey website to see if anything is interesting to you, but if you’re looking to buy random things from Amazon for very cheap (or even free), you should try out RebateKey.

If you feel like supporting this blog, feel free to use my RebateKey referral link.

2. Trunow

Trunow is an app similar to the receipt apps discussed above, except it only applies to gas station receipts. It gives a small amount of cashback for all of your gas station receipts, so it’s worth just quickly snapping a picture of your receipt before you get rid of it.

Takeaways

There are a lot of apps out there that can save you money or give you some cash back on your everyday spend.

You obviously won’t get rich from these apps, but it’s at least something. And none of this requires you to change any of your spending habits. You’re basically adding a cashback component to your financial life that runs passively in the background.

It literally takes a few minutes to set up all of these accounts. Most of you could probably read this post and set up all these apps in the next 15 or 20 minutes. And once set up, you can sit back and just keep doing what you normally do.

What do you think of my best cashback apps list? Any other cashback apps that you recommend?

A question about Upromise? I don’t understand its usability now that some cards offer 2% cashback on every purchase. Why would I use Upromise card and earn a lower cashback, or I am missing something?

Don’t use a Upromise card. Just link your Upromise account with your current cards. It can see the transactions and you’ll sometimes get cashback.

I love this article. I have share it with many friends. I started using a couple. Just this week I made 325 with Iveiuit. Thats not the norm with that app, but it was amazing. Thanks so much.

Don’t see cash back for amazon purchases in Drop, Dosh and Pei.

I’m loving RebateKey!

Thanks for the great post. Some of these apps I already know. But few others like Free bird is good to know. I will surely try to use it next time.

I have been using Verso myself for cashback. It gives you cashback in crypto and has the best cashback rates out of all cashback apps because they take no commission.

https://get-verso.com/

How can I redeem the rewards of Trunow? Thank you.

Hey, thanks for the extra tips. Rakuten is only offering $20 with your link, not $40. Any suggestions?

Oh that was an old offer during the holidays. I forgot to update the post but have now done so. Unfortunately, there’s no way to know when Rakuten increases the bonus. When I signed up long ago, it was $25. Then it dropped down and around the holidays, it tends to go back up. Your options are to either wait until the referral goes back up, or grab it now. There is an opportunity cost in waiting obviously if you’re planning to buy anything.

Can I ask why no Ibotta? If you use it right I have seen people get thousands back

Hey Sara, I mention this in the introduction, but I don’t include Ibotta because I find it’s too much work for me. Mainly having to buy specific things in the app. I prefer the receipt apps that don’t care what I buy because they feel more passive. My issue with Ibotta is that it requires me to plan the things I buy in advance, which isn’t really how I shop.

I just like these all apps and i suggest that you can Add Paribus , TopCashBack and Swagbucks. These all apps are also amazing for Cash-back. And i personally use Swagbucks app and i like it. This addition will be informative for your readers. Thanks and keep posting!

I just used your link and installed Drop. I was only allowed to pick 2 stores, not 5. At some point do I get to choose 3 more, or has the program changed?

Lots of good info, thank you!

Hmm – possible they changed it. I’m not sure, to be honest. I signed up for Drop a long time ago.

My favorite app is the Life app. It is not technically free but you do get your initial cost back in credits. It works very similar to Ebates and the like. You shop at participating retailers and get cash back on your purchases. The difference is that you get your cash back immediately, no waiting for a payout. You also earn trip credits for cruises or other travel. The initial cost is $30 but you get that back in trip credits. They have hundreds of retailers, my favorites are Joann’s craft, Home Depot and Groupon. The cash back percentage varies depending on the retailer. You can also stack the cash back with other discounts like coupons (some available on the app itself) and sales. Our best deal to date was stacking a sale price discount with my husband’s military discount and a sizable cash back amount on insulation for our home. All the discounts together netted us almost %20 cash back. This is definitely my go to app.

Do “participating retailers” include Amazon, Target, Walmart, and many leading online shops? Cruises? Which cruise lines? So say one did a cruise (I assume it includes for all the major ones) for $800, what would be the cash back?

For my purposes it seems I can use either Pei or Dosh. I buy a lot of items locally and online from retail sites like Amazon, Target, Walmart. Which one would be better for these? Is there a list available of stores that each supports?

Pei is better in my experience.

I have been on the skeptical side for years with these after talking to a CPA. I thought it would be more of a hassle trying to keep up and report the additional income aspect of these. How and what is given for reporting purposes?

These cashback apps are treated as discounts or rebates and accordingly are not taxable since you only earn them by making purchases. There’s no reporting at all. If a CPA told you otherwise, they are wrong or didn’t understand what you meant.

I just started using an app called GetUpRise to get cashback on gas. Looks like I’ll be able to get about 7-10 cents a gallon in my area. Could be a good addition to this list if you don’t already shop somewhere that gives gas points like Kroger. We shop at Aldi for groceries.

I’ll check it out. I use a receipt app called trunow which isn’t great, but better than nothing. Admittedly, I drive so little that I barely ever buy gas.

Love all of these, but I don’t use them all. I mostly use Drop, Pei, a new one called Bumped, and another new one called Hooch. I have Dosh, but in my experience it’s been pretty useless for me. Just doesn’t support enough businesses. PEI is by far the best one in this list for sure!! Not really a sleak app, but man they cover a whole heck of a lot of brands!! Just my 2 cents.

“referral fee from the store”. So in other words, the store has to jack up the price to accommodate this fee. Just like they have to factor in losses and theft, no different. Stores want to make the most money possible, they will not lose money. So please don’t tell me that these cash back deals haven’t affected our stores prices.

Why are we all falling for this???

Umm…okay. You pay more for your Coke because Coke has to spend billions per year on ads. And the same is true for credit cards too, where stores raise prices to cover credit card transaction fees. This is how the world works.

Your solution is to just pay the extra and get nothing back?

Hi Kevin! What’s your Drop referral code? The code doesn’t populate when I use your link.

Thanks!

I don’t think you need one to get the bonus. But we do have the promo, FinancialPanther, assigned to us so you can try that. Let me know if it does anything.

I used your link for Drop and didn’t receive any referral bonus

Did you link a credit or debit card? I haven’t heard of anyone else having a problem with this.

I used your referral code for Pei and it didn’t give me anything 🙁

So Pei just changed their referral program for this month. You now will get $15 after you use your linked card at a Pei merchant. I regularly get cashback from Pei because they have so many popular merchants, so you should be able to hit this easily.

& just curious, have you or anyone you know that uses Pei, ever had issues with their card that they linked? Any fraud or unauthorized purchases happening to your account after linking your cards?

No, I’ve never had issues. Pei connects to your cards via a service called Plaid, which is the same service used by pretty much every financial organization in the world.

This is a great list of apps! I’m definitely going to download pretty much all of them, but my question is, am I supposed to link my credit card to these apps or my debit card? I don’t make purchases that often on my credit card.

I believe you can use debit or credit card.

Totally hype for Drop I’m signing up now! Also think Ibotta is a good choice. I haven’t earned much but I scan my grocery reciepts with their offers and earn cash back. I just spent $94 and got 25¢ back but it’s been better on average.

That happened to me too I think there’s something that won’t let you double dip

I have been using dosh, drop and Pei and it seens like if they both giving cash back In something one of the app will give you cash back and the other won’t ! And sometimes I won’t get cash back from any of them !! So I think you we can not double dip with these apps if what do you think ??

I haven’t had too many places where I could double dip, but Dosh doesn’t use the same tracking network as Drop or Pei, so you can definitely double dip those. So far, it seems like Drop and Pei are still working for me to double dip.

Hello, I just signed up for drop, dosh, and pei and so far I have only received points for dosh. It appears they aren’t stacking for me. I’m not sure where the empry network is coming from that you mentioned as I signed up using “plaid” on both dosh and pei. Thoughts?

Hmm…to be honest I haven’t been anywhere in a while that has all three places at once. The data points I’ve found on Reddit and Doctor of Credit seem to say that they should stack, but obviously, your mileage will vary. If they don’t double dip anymore, then probably pick the one that’s more useful to you.

So you’re using dosh, drop and pei and getting cashback from all 3?

I haven’t had an overlap between Dosh and the others in a long time, so I’m not sure. Drop and Pei seem to be double dipping with no problem though.

DO NOT COUNT ON DROP. I was using DROP and had accumulated a very nice amount of points (several hundred thousand). Then all of a sudden, I stopped getting additional points. I contacted drop staff and was assured that it was an issue with my card company, it was being resolved, etc. Fast forward many months, not only did I not get any of the points I earned legitimately during that time period, DROP froze my account and has not allowed me to cash in my points that were already through the system. Do not give these clowns connection to your credit card, because they think nothing of hosing you over in the end.

Dang, that sucks. I typically pull my earnings pretty much as I earn them just to avoid that sort of situation.

What’s their rationale for holding your points? I’d keep pressing on that and maybe even consider reaching out to regulatory agencies if need be. If you didn’t do anything wrong, doesn’t seem like they have any reason to hold your points.

Same thing happened to me with Drop. No points since March. Finally got a reply that my account was flagged for “business use or manufactured spend”, neither of which took place. Requested a review, decision pending.

That sucks. Keep us up to date on what they do.

What is your Dosh referral code? I want to make sure you get the credit.

Can you post your referral link for the Drop App? I used your weblink and it did not give me bonus points

Sure, try my promo code: j6d3y

Hello Kevin ! This list quite helpful and extensive! I have used a few of these apps after reading your article. As I was looking for cahsback apps on the play store I came across another cahsback app called pei. It offers automatic cashback on purchases I make with credit or debit card, very similar to dosh. All you have to do is link your bank account to the app. I just wanted to know if you have used the app and what your opinion is of the app when compared to other apps like Dosh. Let me know your thoughts !

Hey, so that Pei app uses the Empyr network backend, which is the same one used by Dosh and a lot of other cashback apps. You can only link your card to one of those apps, so if you link with Pei, it’ll unlink your card to Dosh. Up to you to decide whether Pei has more options for you, but my experience is they’re all pretty similar, except Dosh you at least start out with some cash by using someone’s referral link.

I use Idine for restaurants and bars. It works well for me bc you get credit for your total bill including tax, tip, alcohol. Also you still get credit if the place is doing happy hour or a a prefix menu. When you hit the 2nd level you get 10% back and they send you an Amex gift card once you get over $20. You can register up to 12 credit cards and gift cards. Do you know if DOSH will conflict? I know Yelp and Idine do.

If Idine conflicts with Yelp, then yeah, it should also conflict with Dosh. My guess is that idine uses the empyr network, which is what Yelp and Swagbucks both use also.

Are there more businesses on Idine compared to Dosh? My experience is that they all have the same businesses, so really not much difference between all of them except for whether they give you some cash to start.

What about someone who cannot afford to make purchases?

I guess if you cannot afford to make purchases, then yes, these are not good apps for you to use.

I apologize if this question has been asked … Having had my credit card and personal info compromised resulting in identity theft, were you concerned about giving your info to these companies? I would love to feel confident that I won’t have to go thru another painful identity theft situation again. It has/will forever affect my credit and realize I am overly cautious but my info was stolen from a large shopping corporation and imagine they had similar software and security like these. Of course our debit and credit cards repay what was stolen, in most cases, they don’t do the work of calling the credit bureaus and most will remain on my credit report forever making reports on me show up bad or want me to pay higher interest when I have always had excellent credit score. Of course I’ve researched hacking and the chances of it happening again in my lifetime are higher then it not as I was told by a government employee who deals with identity theft daily and would love nothing more then to participate in these types of programs with your confidence.

I have really little fear, especially with credit cards. You’re using the bank’s money, not your own, so you have no liability issues. As for identity theft issues, that’s also something I don’t worry about because I sign up for multiple apps that monitor my credit report for free. Anytime something new happens on my credit report, I know about it. Make sure to download Credit Karma, Credit Sesame, Wallethub, and the Experian app. You get real-time notifications if someone opens something in your name, so nothing will ever get by you.

What no TopCashBack?

Haven’t used them. You recommend it? Is it the same as ebates?

I signed up for Drop not too long ago and it actually has been working really well. Do you know if Dosh uses the same network or can I double dip?

You can double dip. They use different networks. It doesn’t seem like they do a lot of overlap though to be honest.

Thanks your quick response! It’ll still be nice to get something back at certain stores that Drop doesn’t cover.

Hello Kevin! This is a great list, thanks for sharing this! Your positive endorsement convinced me to try Dosh.

I DO have a question though. Do you know if you’re able to use Ebates and Dosh simultaneously? In other words, if I were to purchase something online with my Ebates Cash Back Button activated, but also used my linked credit with Dosh (to a store that is partnered with Dosh of course) , would I be able to get cash back from both Ebates and Dosh?

Thanks so much for your help and advice on this.

Yes, you should be able to double dip. Dosh uses its own system and Ebates has its own system, as far as I can tell.

I’m a fan of Swagbucks and Groupon+. The Swagbucks Chrome extension lets me know when I can activate cash back. I’m not shopping too much so it’s only gotten me $1.40 worth of points thus far. The Groupon+ cash back offers are pretty rich for restaurants, sometimes up to 25% cash back. However, they don’t work if you order delivery from the restaurant through a third party.

I know of the Groupon one, and maybe that’s worth adding to the list – I haven’t used it yet is the only reason I didn’t throw it down here.

I’ve always had mixed feelings about Swagbucks. Seems confusing to me for some reason.

I need to do a better job of keeping up with these money savers. Thanks, man!

I do a pretty good job of stacking up new credit cards though. I’m using my Home Depot and Wayfair credit cards to pay for a crap load of Airbnb setup items on 12 month no interest plans.

The great thing about any capital costs is that you can earn lots of points just by opening up strategic cards. It’s a nice way to get a return on your spend.

Nice post. I don’t use any of them, but I like the concept and will give them a try. I don’t see anything to lose. What’s in it for the apps? How do they make money? Tom

For most Cashback apps, they basically get a referral commission, then pass on some of the money to you. Ebates, for example, has affiliate agreements with tons of companies. If you buy something through their portal, Ebates get a cut, and then to entice you to buy using their portal, they give you a portion of the commission they receive.

For Dosh and Drop and Uber Visa Local Offers – I’m guessing it’s either some sort of marketing thing (i.e. marketing cost to get you to buy from those places) or they sell the data for marketing purposes.

Awesome! Just signed up for the Dosh, Drop and Uber one’s. It really is awesome to find out about these passive strategies. Thanks for highlighting them (even if you don’t have a referral link)!

Glad to help! I’m always keeping an eye out for things like this, but these are easy wins. No, you won’t get rich from them, but it takes basically no work to set up.

I have used Upromise for years and have added around $6K to my daughter’s 529 through their program. I charge everything to my Upromise card and then pay it off at the end of the month. However, what I have noticed is that if I try to use another cashback option, it won’t let you. So in other words, you can’t double dip. So I can’t shop through Upromise and then try to use Honey for coupon codes. Have you noticed that with any of these? Do you use say Dosh and Upromise simultaneously and get credit from both?

Hmm…to be honest I’m not quite sure. I’m fairly sure you can double dip your Dosh and Upromise credits since if they used the same network, it wouldn’t let you link your cards anyway to both programs. I’ve got my cards linked to both and haven’t heard otherwise.

Upromise has went to crap. It’s not worth the hassle anymore. I earned $300 dollars last year but with their new program, I’ll be lucky to earn 50 on the same spend this year.

Eh, is it really a hassle to just put your credit card in it? It’s like 5 seconds and you don’t have to do anything else. I never base my decisions on where to spend money based on these apps – I just set them up and leave them.