Over the past year and a half, my wife and I have accumulated hundreds of thousands of points and miles from the strategic opening and use of credit cards. These points and miles have served us well, allowing us to do a ton of traveling over the past year that we otherwise wouldn’t have been able to do. I’ve got a sort of grand plan to do 12 trips over the course of 2018 while also working a full-time job, and so far, I’m on track to do that – all thanks to credit card points.

Looking back, I still find it hard to believe that up until 2017, I’d completely avoided this whole credit card and travel hacking world – it’s now such a part of my life that I can’t even imagine a time where I wasn’t doing this. I still remember back in 2016 when everyone was jumping on the Chase Sapphire Reserve for the 100,000 point bonus and I refused to do it, even when people explained to me why it made sense.

The thing that held me back was fear. I didn’t really understand how travel hacking worked. The explanations were way too complicated for me to understand. And I didn’t understand what you were supposed to do with the card after you were done with it. What would have really helped me out is if someone just showed me what they did and basically let me copy them – a roadmap, essentially.

This post is an attempt to give you that roadmap by showing you the exact credit cards my wife and I have been getting over the past two years. My plan is to keep updating this list so that anyone reading this can look over what I’m doing and get an idea about what cards might work out for them. I’ll also try to share why I got each card, since there’s usually a logical reason for each card I get. You don’t need to copy me exactly (and the way I do things isn’t necessarily the best way for you to do things), but it’s at least something that you can learn from and maybe use as an example.

One thing to note is that the world of credit cards changes incredibly fast. Some of the cards I’ve gotten no longer exist. Others don’t offer the same signup bonus that they offered previously. Still, I think this list will help you, especially if you’re following along in real-time.

And, as my offer to you, if you ever have any questions about credit cards and which ones you should get, just hit me up – I’ll do my best to share whatever knowledge I have.

So with that said, let’s take a look at my credit cards for the past two years and see what’s been going on.

What’s In My Wallet

Below is a list of all of the recent cards I’ve held, along with the month and year I opened the card, the signup bonus I got with the card, the annual fee for the card, and what the current status of the card is (i.e., open, closed, or product changed). I’ve created the same chart for my wife as well.

Hopefully, this list will give you a nice concrete example that you can look at when doing your own credit card strategy.

List Last Updated: 7/1/2019

My Cards

Card

Date Opened/

Date Closed

Bonus

MERRILL+ Visa Signature

Still Open

Chase Sapphire Preferred®

Still Open

American Express Starwood Preferred Guest®

Still Open

Chase Sapphire Reserve®

Still Open

Chase Ink Business Preferred

Still Open

Southwest Rapid Rewards® Business Premier

Still Open

American Express Starwood Preferred Guest® Business

Still Open

Gold Delta SkyMiles® Business Credit Card

Still Open

Chase Ink Business Preferred (#2)

Still Open

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Still Open

Platinum Delta SkyMiles® Business Credit Card

Still Open

Marriott Rewards® Premier Business Credit Card

Still Open

American Express Business Gold Rewards Card

Still Open

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® (#2)

Still Open

Barclays AAdvantage® Aviator® Business Mastercard®

Still Open

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® (#3)

Still Open

Chase Ink Unlimited

Still Open

Amex Business Platinum Card

Still Open

Barclay’s Arrival Plus Card

Still Open

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® (#4)

Still Open

Chase IHG Premier

Still Open

My Wife’s Cards

Card

Date Opened/

Date Closed

Bonus

Chase Hyatt Card

Still Open

Southwest Rapid Rewards Plus Card

Still Open

Southwest Rapid Rewards Premier Card

Still Open

Chase Ink Preferred

Still Open

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Still Open

Hilton Honors American Express Business Card

Still Open

Chase Ink Preferred (#2)

Still Open

Amex Blue BusinessSM Plus

Still Open

Chase Ink Unlimited

Still Open

Gold Delta SkyMiles® Business Credit Card

Still Open

Overview Of These Cards

Before we get deeper into the specifics of each card, I need to provide a bit of an overview about these cards and my general strategy. You’ll notice that my first four credit cards were all personal cards, and since then, I’ve only grabbed business cards.

I’ve gone with this strategy for two reasons:

- In order to leave me with the option of getting more Chase cards due to Chase’s 5/24 rule; and

- In order to reduce new cards appearing on my credit report.

I’ve written posts about the 5/24 rule and about the advantages of business cards, so make sure to check out both of those posts if you want more in-depth information. As a brief recap, Chase’s 5/24 rule is a rule that Chase has which limits you to getting 5 total credit cards from any company over a 24 month period. It’s important to keep this rule in mind if you’re looking to optimize your credit card opening strategy.

As for business cards, they have a nice advantage in that, in general, they do not appear on your personal credit report, essentially making them invisible credit cards. This makes them very valuable, as they allow you to get more credit cards without impacting your 5/24 status, or really, impacting your credit report at all. Remember, if you earn any money outside of your day job, you are a business and are eligible to get business cards (and if you don’t earn money outside of your day job, what are you waiting for!?).

In terms of when I open up new cards, my general goal is to always have a minimum spend requirement to work on. As a result, I tend to open up a new card each time I hit a minimum spend requirement on a prior card. I also open up new cards whenever I have a big purchase that I know is coming up. This typically means I open up one new card about every three months. I think this is pretty reasonable for most people to do.

Why I Got These Cards

Now that you’ve got a little background, here’s some general insight into why I got some of these cards:

-

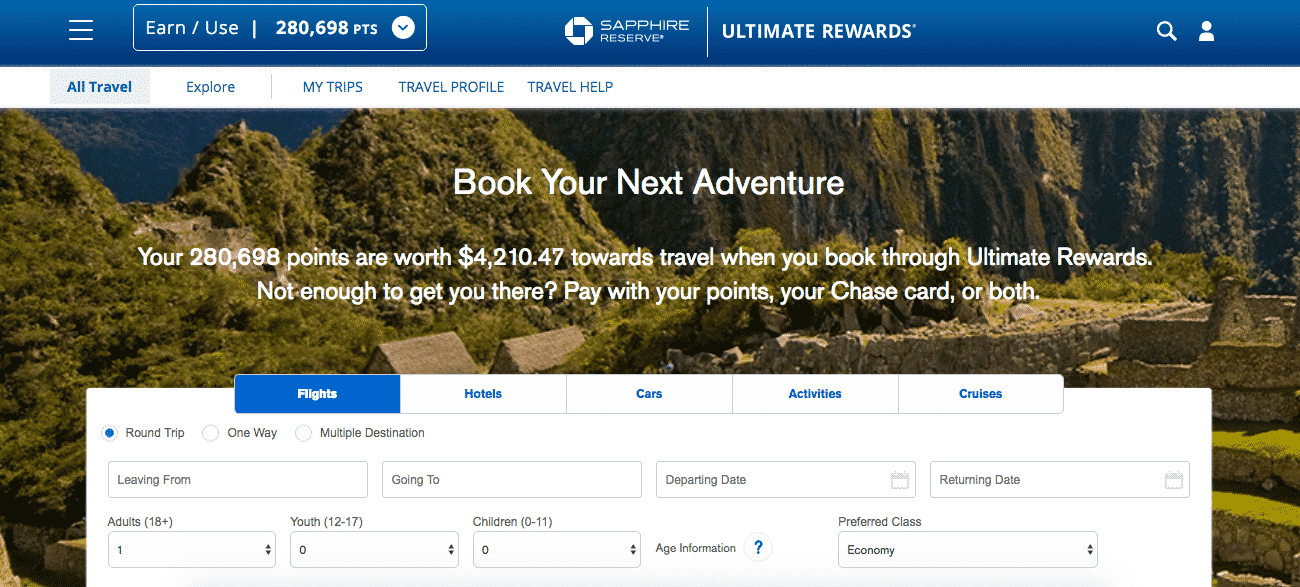

The Chase Sapphire Reserve and Chase Sapphire Preferred both made sense for me because they had valuable signup bonuses. Chase Ultimate Rewards Points are the best point currency you can get, so its always worth getting as many Chase points as possible. At the time I got these two cards, the One Sapphire Rule was not in effect. Today, it’s still possible to get both cards, but you’ll need to open them both on the same day. Check out my post I wrote a while back about the One Sapphire Rule and what it means for you.

- The AmEx SPG cards were both worthwhile because they had an all-time high signup bonus at the time. SPG and Marriott finally completed their points merger earlier this year, so the SPG cards don’t exist in the same form anymore.

-

The Chase Ink Preferred (CIP) card is the best business credit card you can get (and possibly the best card you can sign up for right now). You’ll notice that I opened two of them. I got my first CIP by applying for it using my Social Security number as my business ID. I then got a second CIP a few months later by applying for the card using an EIN number as my business ID. Everyone can do this same thing to get two Chase Ink Preferred cards. Even better, you can refer yourself for the second Chase Ink Preferred card, which means you’ll get 100,000 total Chase Ultimate Rewards Points as the signup bonus on your second CIP (you’ll get 20,000 Chase points for referring yourself, plus 80,000 Chase points as the standard signup bonus).

-

I got both Delta business cards because they were offering all-time high signup offers at the time. Delta miles never expire, plus I live in a Delta hub, so they make sense for me to have. In general, if the Delta Gold Business card is offering 60,000 Delta miles, then it’s worth snagging. If the Delta Platinum Business Card is offering 70,000 Delta miles, then that’s worth grabbing.

-

The American Express Business Gold Rewards Card is my first foray into American Express Membership Rewards points. This is a transferable currency like Chase Ultimate Rewards Points. What really appealed to me about this card, however, was the $1,500 GSuite credit. I prepaid the $1,500, and my plan is to see if I can get a refund on it next year. If it works, the signup bonus on this card will basically be 50,000 points plus 1,500 dollars.

-

The CitiBusiness® / AAdvantage® Platinum Select® World Mastercard is a special card, and at the moment, is basically the only card that you can truly churn these days. The normal rule for Citi cards is that you can only earn a signup bonus for a card once every 24 months. However, Citi randomly sends out mailers with a signup offer that doesn’t contain this restriction. As a result, it’s possible for most people to close out their old business card, reopen a new one using the code from the special mailer, and earn the signup bonus again. I’m currently churning my second CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®. Whether this loophole will continue to exist remains to be seen. (don’t tell Citi about it!)

For my wife, the reasoning for what we did was a little simpler.

- She got the Hyatt Credit Card because we were going to New York and I wanted to use her signup bonus for the Park Hyatt New York.

- We had her snag two Southwest Credit Cards in order to earn the Southwest Companion Pass. It’s probably the best perk we’ve ever gotten from cards.

- We grabbed a Chase Ink Preferred for her because we wanted to get more Ultimate Rewards Points.

- She recently opened up the CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® because she’s buying a practice and needs business cards to separate her expenses. We’ll be getting more business cards for her once we figure out what her monthly business expenses will be and how much she can put on cards (dental practices have crazy overhead, so it’s a travel hacker’s dream to own a dental practice).

- We also just grabbed her a Hilton Honors American Express Business Card, just because we have some spend we need to hit and they had an enhanced signup bonus.

Closing Thoughts And Strategy

I hope this post was helpful to you. At a minimum, it can give you a little insight into how I do things on the credit card front.

A question I get from a lot of people is where to start with credit cards. That’s a tough question to answer since there are a lot of ways you can go and a lot of different needs people have. Still, there is an answer that I think can help.

For most people, the best ways to get started are to either go for the Chase Sapphire Preferred or Chase Sapphire Reserve, or attempt to get both of them at the same time. Chase limits you to getting one Sapphire card per person, so if you’ll either have to decide on one of them or do a strategy called the “double dip” and get both of them at the same time (this basically requires applying for one card, then applying for the second card using an incognito browser). You can read more about the Chase Sapphire brand of cards and the “double dip” strategy in this post.

The other option is to get the Chase Ink Preferred card, which is the credit card that is currently offering the best signup bonus. You’ll need some sort of business if you want to get this card, but most of you reading this probably have a business of some sort, and if you don’t, it’s not hard to start up something that is technically a business (remember, if you earn any money outside of your day job, you have a business).

So that’s my list of credit cards. If you find this post helpful and want to support the site, feel free to use any referral links where I have them. Before using any referral link, always make sure that it’s offering the highest signup bonus you can get (sometimes referral links offer worse signup bonuses compared to the public offer, other times it’s higher than the public offer). If you’re not sure, ask me!

I’ll continue to keep updating this list as I add new cards to my lineup. And again, if you have any questions about this, feel free to shoot me a message on my contact page. I’m always happy to help out however I can.

Thanks for your post! I’ve been getting REALLY into points – and like you, I am also disheartened that I started this late in the game (although I am only 22). I already opened up a Chase Ink Business card and a Sapphire Preferred card. Which business and personal card do you suggest I go for next?

Also, can you explain what it means to downgrade a card? You mentioned that we should do this if we don’t want to pay annual fees. Do we get to keep those points if we downgrade?

Additionally, does closing a card effect credit score? I’m assuming it does. So what should we do after the annual fees are no longer worth paying for?

Thanks in advance,

Financial Cub

Hey Guy,

Hit me up by email and I’ll get some info from you and give you some suggestions. This is a good idea to maybe add free credit card consultations or something since I think that could help folks out.

Downgrading a card means asking to change the card to a card with no annual fee or a lower annual fee. It depends on the card whether you can do this or not. Also depends on the card whether you lose the points or not. Chase cards you don’t lose the points if you downgrade. They just stay there and you can upgrade if you ever need to use them.

Closing a card can impact your credit score, but not in the way that you think. This is too long to fully explain in a comment, so maybe I’ll write a post about this sometime. The short of it is that there are two things that matter when you close a card – credit utilization and age of credit.

Credit utilization means how much credit you use each month. If you close a card, it could impact your credit utilization if you don’t have much credit, but if you’re travel hacking, this likely will have no impact to you. I have over 100k of available credit generally, so whenever I close a card, it doesn’t impact this metric.

Age of account is also not much of a factor. Most people don’t realize this, but when you close an account, it doesn’t disappear from your credit report for 10 years and it continues to age for 10 years until it falls off your account. In other words, closing an account does not actually impact your age of credit for a decade, at which point you’ll already have lots of older accounts anyway.

Hello – so I’m new to your blog, but I am finding it very intriguing. I have a question about the credit cards – am I reading this correctly? Between you and your wife, you hold 22 open credit cards? I understand you accumulated a lot of perks and bonuses but that just seems a little excessive. How do you keep track of all of them? Do you use them? The thought of having 22 credit cards makes me hyperventilate a little bit! 🙂

Haha, yes it takes some work. I actually have opened more than that actually – need to update this page.

The key to keeping track of these is to have a spreadsheet. I have a google spreadsheet and I track when I opened the card, when I closed it, when I earned the bonus, what the bonus requirements are, and any other notes to myself. I’m almost always just working on the minimum spend for one card at a time, so in practice, it’s not actually that hard. Basically, just use one card exclusively, then once I’m done with it, I sock drawer it. Then a year later, I either call and try to get a retention offer, downgrade the card, or just close it.

For cards that I want to keep open forever, I’ll just put a subscription on it. For example, Hulu goes on one card and I pay that each month. My life insurance bill goes on another card, etc. etc.

Hi:

Thank you for publishing your blog. It is quite helpful. I have a question regarding the double dipping for the Chase Preferred sign-up bonus of 80,000 points you referenced in another post. You mentioned it is possible to get the bonus on two cards, one by applying individually and one by applying with an EIN. I have an individual business card and have received the 80,000 bonus.

However, the terms and conditions of the card states the following: I understand that any new cardmember bonus offers for this product are not available to either current or previous cardmembers of this product who received a new cardmember bonus for this product in the last 24 months.

Doesn’t the above preclude double dipping, and if not, can you please explain how so.

Thanks

Hey Zach. When you apply for one card with an EIN and the other with an SSN, Chase treats them as two separate entities for purposes of the bonus. Myself and thousands of others (hundreds of thousands maybe?) have done this for years with no issue.

Love AMEX but the Premier Rewards card seems worthless, the bonus isn’t that great and the $100 credit for airline expenses takes forever to kick in. Dont know if you tried it but the SPG AMEX card is pretty darn good now with an annual bonus of a free night’s stay pretty much anywhere.

Yeah, I got the BGR – Business Gold Rewards. Reason I got it was because I wanted a charge card and a business card, and it had a promotion going on where you get $1500 of GSuite credit. I paid all $1500 for gsuite in one go, and then I might see if I can do a refund later.

I’ve got both SPG cards – personal and biz. Keeping them for now since I got a retention offer last year for the personal which covered the annual fee. Probably will keep for the free night, but will just reassess over the years.

Great list FP!, I’ve been a big fan of Chase cards and have followed more or less a similar strategy. More recently Chase has issued two biz cards – Chase Ink Business Preffered cash and Chase Ink Business Unlimited. They both required $3000 min spent offered 50K points and no annual fee!!!. I got both of them and now I’m ready to move to Chase Ink Business Preffered to snag the 80K points. Thanks again for a great post!

Nice! Remember to take it slow and steady. I’ve been laying off Chase cards recently just because I got a lot of them pretty fast.

Hello Financial Panther, on the topic of credit cards, you mentioned “The other option is to get the Chase Ink Preferred card, which is the credit card that is currently offering the best signup bonus. You’ll need some sort of business if you want to get this card, but most of you reading this probably have a business of some sort, and if you don’t, it’s not hard to start up something that is technically a business (remember, if you earn any money outside of your day job, you have a business).

What exactly will I need to justify that I have a business? I have my normal 9-5pm day job and then I have my side hustle doing deliveries via Doordash, Uber Eats and Postmates. Will this suffice as a business of some sort? If so, what do I state in the credit card application process when asked for an EIN number or nature of my business? Please advise as I would like to venture into this world of travel hacking and just beginning so any pointers would be greatly appreciated as I would like to take my family to Hawaii next summer (2019) so that gives me a year to work on this goal.

Hey Jerry! Great question!

If you’re Postmating and doing other delivery gigs that pay you as an independent contractor, then absolutely, you have a business! When you work as an independent contractor (like with postmates and the other delivery gigs) the government is taxing you as a business too! Indeed, when you pay taxes, the government is outright calling you a business, since they make you pay the employer portion of FICA taxes (social security, medicaid, etc). So, if you are dashing and postmating and uber eats delivering, then, absolutely, you have a 100% legitimate business – as real a business as anyone and you don’t have to justify it to anyone. You have earnings (your money you make for each delivery) and expenses (whatever expenses you have, for example, if you drive, you pay for gas, maintenance, etc).

When you do your application for a business credit card, you use your name as your name as your business. So the card name is Jerry [LAST NAME]. Your business name is also your name: Jerry [LAST NAME]. Your identification number is your social security number (no EIN needed). Nature of the business is up to you, just find one that seems close enough. Make sure you indicate that you have been in business for 1 year when you apply (it’s usually easier when you say you’ve been in business for a year) and I try to make sure my revenue for my business is at least $1,000 (which you probably have made that much on the side nayway).

Hit me up if you have any questions.

Great article and list. I’m wanting to start collecting AMEX points as well, but I’m waiting for a targeted 100K offer on the Platinum card. I passed on it a few years ago, and completely regretted it! Also, the new Chase Ink Unlimited seems interesting to me, especially since so much of my spending goes toward the business.

Thanks Ernest! I’m also going to aim for that Amex Plat biz card once my wife has her dental practice going, At that point, we’ll know what her monthly spend will be.

How do you decide whether to keep a card with an annual fee? I am at the one-year mark with my Chase Sapphire Preferred, but since we plan to continue to open new credit card accounts, is there any value in paying the fee to keep this for another year? It looks like you kept yours beyond a year, so I am curious what your thoughts are. Thanks!

Great question Tabitha! So for me, I’ve decided to keep the CSP only because of the referral bonus. Your CSP lets you refer 5 people per year, and each referral gets you 10,000 points, which is worth a minimum of $100. So, if you can refer just 1 person per year, it pays for the annual fee.

Whether to keep the CSP really depends on whether you have any trips coming up where you’ll need to transfer to travel partners. You can downgrade the CSP after 1 year to a no-fee card like the Freedom or the Freedom Unlimited, but those cards don’t let you transfer your points to travel partners. Only the “premium” cards let you do that (i.e. the Chase Ultimate rewards cards that have an annual fee – CSP, Sapphire Reserve, and Chase Ink Business Preferred).

So, those are pretty much your two considerations, I’d say. Whether you need to transfer to travel partners (and or want to use the travel portal at better than 1 cent per point – remember, the CSP gets 1.25 cents per point through the Chase travel portal), and whether you think you can refer 1 person in a year to cover the annual fee.

This is a good topic for a post, so I’ll probably try to write something on what do you do with your cards after 1 year. In the meantime, feel free to reach out to me with any more questions if what I said wasn’t that clear – I sometimes rush through comments too fast.

Your wallet looks pretty similar to ours! We have been on a quest to rack up 1 million points and last time I checked we were pretty close. Fortunately, most of our travel is a corporate expense so we haven’t needed to dip into our points, but they are there for when we need to.

A million is awesome! Make sure not to hoard them 🙂

Thanks for the detail! I’m planning. A Hawaii trip now. Do you know how soon you can use the Hyatt nights after signing up for the card?

Hi Ashley,

The 2 free nights bonus offer is no longer available on the Hyatt card. The current offer is 40,000 Hyatt points after meeting a minimum spending requirement of $2,000 in 3 months. (Which Financial Panther did note on his spread sheet).

Per FlyerTalk (which is a forum for points and miles junkies): You will receive the 40,000 welcome bonus points typically a day or two after the close of the billing cycle in which you reach spend threshold.

More information here: https://www.flyertalk.com/forum/hyatt-world-hyatt/1124212-hyatt-rewards-card-chase-wiki.html

If you’re going to Hawaii, consider the Bank of America Alaska card. It has an introductory offer of 30,000 miles earned after $1,000 spend, PLUS you get a companion pass ($0 fare but you have to pay the taxes and fees which could be about $22+). AND Alaska allows a free stop over. So you can check out Portland, Seattle, San Diego, or wherever in addition to Hawaii. Just thought I’d put in my two cents because it is something to consider.

Hope that helps!

Hey Ashley, like the Dr said, the Hyatt card is now at 40,000 points, instead of 2 free nights. The number of nights you can with those points will vary.

If you have no cards at all, I’d recommend going with the Chase strategy – the Chase Ink Preferred if you have anything that can be considered a business, or the Chase Sapphire Preferred/Chase Sapphire Reserve strategy. Chase points transfer to hyatt at 1 to 1, so those cards will give you more Hyatt points just by themselves. Hit me up if you have more questions – I’m happy to walk you through it with some more info.

Not a bad list. And I like your strategy. Check out my list of credit cards when you get the chance. (I’ve been doing this for a while, so I have a lot! LOL)

If you’re considering a few more business cards…

Have you considered the Chase Ink Business Cash?

Perks: Business card (doesn’t count toward 5/24), no annual fee, 5x points at office supply stores. I use this card heavily to buy Visa gift cards at Staples at a discount. You can manufacture a ton of Chase points this way and guarantee at least a 5% return on purchases where Visa gift cards are accepted (almost anywhere credit cards are accepted). And if you value Chase points at 1.7 cents per point, that’s a return of 8.5%!

Also worth considering is Amex Blue Business Plus.

Perks: Business card, no annual fee, 2X MR points on any purchases up to $50,000. This is my go-to everyday card for non bonused spend.

And there’s a huge sign up bonus for the Amex Business Platinum card -> 100,000 bonus points

Sure there’s a huge annual fee ($450) but you get it back with airline credits per calendar year (so it’s $200 + $200 = $400), global entry ($100 value), elite status with HIlton and Starwood, and Centurion Lounge access.

Hey Doc, just checked out your post – awesome list of cards! If anyone wants to take a look at his list of cards to get some more ideas, check it out: https://www.drmcfrugal.com/portfolio-credit-cards/

I’m holding off on the CIC for a little bit since I have 4 Chase biz cards right now – pretty much cooling off with Chase for a little while.

Amex BBP will end up on my list once I’m done with the BGR and need a spot to store my MR points.

Amex Biz Plat is one we’ll get for my wife once her practice is off the ground and we know what her monthly expenses will be. It has a huge MSR, so its perfect for a practice owner to use.