Editors Note: Some offers mentioned below are no longer available. View the current offers here.

Ever since I discovered the world of credit card points and travel hacking, I’ve been obsessed with learning everything I can about this hobby. With a little bit of knowledge, it’s possible to accumulate hundreds of thousands of points and miles just by opening up new cards and putting your normal, everyday spending on them. Even a fairly casual credit card user should be able to earn at least 1 free flight per year with what I think is very minimal work.

The secret weapon in the points and miles game has got to be business credit cards. Most people know what personal credit cards are, but it seems like fewer people are aware of business credit cards and what they can do for your travel hacking adventures. If you’re looking to optimize your spending and travel for free, you absolutely need to be taking advantage of business credit cards.

To demonstrate the importance of business cards, you can just look at my own credit card history. Over the past 12 months, I’ve opened up 4 personal credit cards. In that same time period, I’ve opened up 7 business credit cards (with more to come in the future). I don’t do this just for the heck of it – I opt for business cards when I can because of how advantageous they are for what I’m trying to do (which is to accumulate as many points and miles as I can so that I can travel for free).

Today’s post is going to serve as a guide as to what business credit cards are, why you should be signing up for them, and how you can qualify for one. Business credit cards might sound intimidating at first, but really, they aren’t, and most people reading this should be able to get business credit cards without any problem.

Read this post, learn more about how business cards work, and you’ll be racking up points and miles in no time.

What Is A Business Credit Card?

In the credit card world, there are basically two types of cards – personal cards and business cards.

A personal card is exactly what it sounds like – it’s a personal credit card that you can get for yourself if you have a decent enough credit score. Like any credit card, it appears on your credit report, so anyone that pulls your credit report will be able to see that account. Most of you reading this probably have at least one personal credit card in your wallet.

A business credit card, by contrast, is a credit card that (surprise, surprise) is made for people who have businesses. The typical reason someone might get a business credit card is to help track their expenses and to keep their personal spending separate from their business spending. It’s much easier to track your business expenses when you’re putting them all on one card. At the end of the year, all you have to do is pull up what you spent on that card, and you know exactly what your expenses are for the year.

It’s important to note that, while business credit cards are for people with businesses, you don’t actually have to use those cards just for business expenses. It’s perfectly fine to mix personal spending on a business card and indeed if you’re getting business cards for travel hacking purposes, you’ll most likely have to put some personal charges on your business cards in order to hit the minimum spend requirements. That’s totally fine to do.

Advantages of Business Credit Cards

Now that we know what business cards are, the question then becomes, why do we want to get them? It comes down to one big reason – business credit cards, in general, do not appear on your credit report. American Express, Chase, and Citi, for example, all do not report business credit cards to credit reporting agencies.

Since these companies do not report business cards to credit reporting agencies, in essence, when you get a business card, it’s like you’re getting an invisible card. You get all of the benefits of a new card and the signup bonus that comes along with it, but risk no impact on your credit score other than the temporary hard inquiry you might get. The only downside that can come with a business credit card is if you fail to pay your bill, which is obviously something that you’re not going to do anyway if you’re reading this blog.

Getting a new credit card, but not having it reported on your credit report is extremely beneficial for a variety of reasons. These include:

1. A business credit card won’t impact your 5/24 status. The number one rule that any travel hacker should know is the 5/24 rule, which essentially states that if you have 5 or more new credit card accounts from any company in a 24-month period, you will not be eligible for new Chase credit cards. For those of you that don’t know, Chase credit cards are widely considered to be the best credit cards to get and are the ones that you should start your credit card journey with.

The advantage of getting business cards, then, is that since they don’t appear on your credit report, you can continue to get new Chase credit cards even when you have more than 5 credit cards in a 24-month period. If you look at my own credit card history, I’m currently sitting on 11 new cards in the past 12 months, yet my credit report only shows 4 new credit card accounts during that same time span. This gives me a big advantage as I plan out my credit cards in the coming months.

Note that with respect to 5/24 status, it’s important to know that while a Chase business card won’t count towards your 5/24 status, you are not eligible to get a Chase business card if you’re over 5/24. Keep that in mind as you plan out your strategy.

2. Business credit cards have almost no impact on your credit report. One of the reasons a lot of people don’t get into travel hacking is because they’re afraid that opening up new credit cards will mess up their credit. I felt the same way before I got into this world. It’s the reason I resisted travel hacking for so long – I thought for sure that opening up new cards meant my credit score would plummet (pro-tip: I was wrong, opening up new cards doesn’t mess up your credit – in fact, my credit score has basically stayed the same during these past 12 months).

If you’re the type of person that’s scared that opening up new credit cards will mess up your credit, then business credit cards are a perfect way for you to still earn points and miles. You’ll get the card, but nothing will appear on your credit report. When you apply for a business card, the only thing that might show up on your credit report is a hard inquiry, which only has a temporary impact on your credit score and no impact at all after 1 year.

3. Business credit cards give you more opportunities to earn signup bonuses. The other reason you should be looking at business cards is that they give you more cards that you can open to earn signup bonuses. For example, most personal cards have a business version of the same card. By getting both the personal and business version of a card, you can essentially double up your signup bonuses. As an example, last year, I signed up for the American Express SPG card (this card no longer exists) and the American Express SPG Business Card (this card also no longer exists). Since I got both cards, I was able to earn more points than I otherwise might have if I opted only to get personal cards.

How To Get A Business Credit Card

The main objection I get from a lot of people about business credit cards is the belief that they can’t get one because they don’t have a “real” business. The first thing to realize is that most people underestimate themselves. If you earn ANY income outside of your day job (which the vast majority of people do in some fashion), then you have a business. In other words, unless 100% of your income comes in the form of a W-2 from an employer, you have a business in some fashion – even if you don’t think you have one.

A lot of people make the mistake of thinking that a business is some official thing. They think that businesses are supposed to be some sort of big company with a bunch of employees. In fact, most businesses aren’t like that – they’re small businesses or side businesses run by regular people like you and me.

To qualify for a business credit card, the only thing you need to do is earn some sort of income outside of your day job. So what are some examples of real, 100% legitimate businesses? Just as an example, the following would qualify as real businesses:

- Renting out a room on Airbnb

- Dog sitting (either on Rover or just doing it on your own)

- Walking dogs (either through Wag or just walking dogs on your own)

- Babysitting

- Selling stuff you find on eBay

- Doing Uber, Lyft, Postmates, DoorDash, Uber Eats, Caviar, or any other rideshare type app

- ANY work where you have to pay self-employment tax

It might not seem like a business to you, but if you’re getting paid and it’s not an employer paying you, then you’re a sole proprietor – essentially a business of you. I think almost everyone probably earns some sort of income outside of their day job, and if you don’t, you definitely can.

Another way to think about it is this way. If you pay self-employment taxes (i.e. you pay social security and Medicare taxes on your earnings), then the government has explicitly decided that you are a business. You’re literally paying the taxes a business pays.

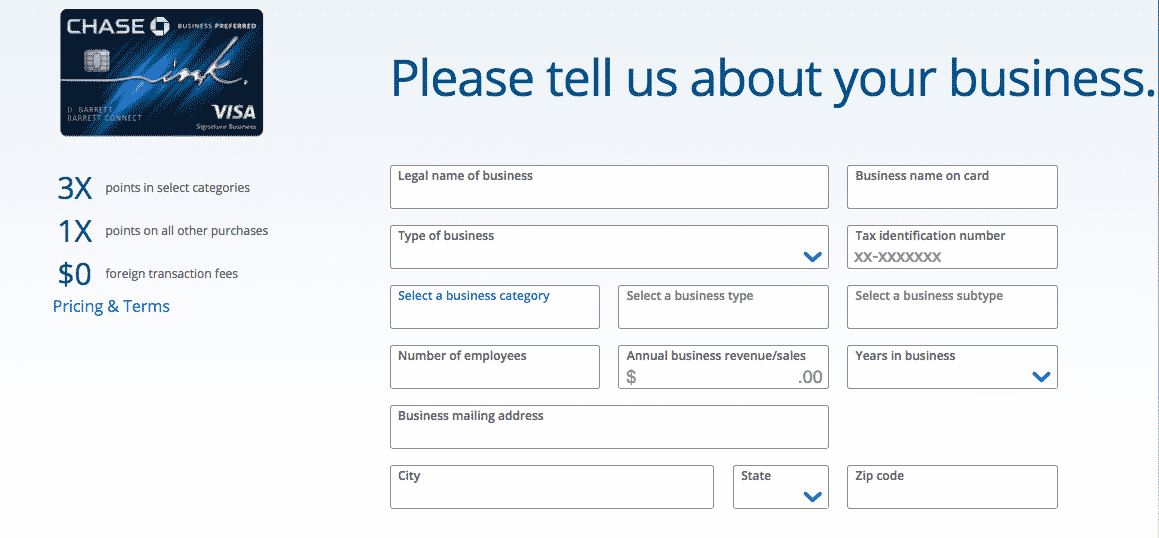

I’m not going to go into the exact specifics of how to apply for a business card in this post, but in general, when you apply for a business card, you’ll need to provide some info about your business. For example, here’s what the application screen looks like for the Chase Ink Preferred card.

When filling this form out, there are some important things to remember.

- Under Legal Name of Business, put your full name. Unless you have actual paperwork showing that you have a business with a different name (like an LLC or a corporation), then your business name is just your full name.

- For Business Name on Card, put your name.

- Under Tax Identification Number, put your social security number. If you want, you can get an EIN fro the IRS website in a few minutes. It’s up to you whether you want to do that, but using your social security number is perfectly fine.

- For Type of Business, Business Type, and Business Subtype, search and see what fits closest to the type of business you are doing. This doesn’t have to be exact, so don’t worry too much about this.

- For Annual Business Revenue, you can estimate this if necessary. I typically recommend putting a number that is more than zero. Ideally, at least $1,000 will make it easier for you. Most people doing Uber, Lyft, or anything like that can make that much in a year, so it’s fair to put that as an expected or anticipated annual business revenue.

- For Years in Business, it’s usually best to have this be at least 1.

Again, remember, businesses are not just corporations. If you’ve done anything to earn income outside of your W-2 job, you can legitimately say that you are a business. When I apply for business cards, I typically apply using my Airbnb business, which generates somewhere between $7,000 and $15,000 per year. I’ve applied for other business cards using my Rover business, my Wag business, or my Postmates/DoorDash/Uber Eats income, all of which only generate about $1,000 to $3,000 of income each year.

The Best Business Credit Cards

In general, most people should start with one of the Chase business credit cards. I recommend picking one of these three business credit cards to start with:

Chase Ink Preferred. The Chase Ink Preferred offers the highest signup bonus at 100,000 Chase Ultimate Rewards points. The downside is that it has a very high minimum spend of $15,000 in three months, which makes it out of reach for most people. If you happen to have a lot of spending that you need to do, then I’d get this card – but make sure you have the ability to hit the minimum spend requirement.

Chase Ink Cash. The Chase Ink Cash has a signup bonus of 50,000 Chase Ultimate Rewards points. This card has no annual fee and gives 5x back on purchases made at office supply stores and on internet, cable and phone services. It also gives 2x back on gas stations and restaurants.

Chase Ink Unlimited. The Chase Ink Unlimited also has a signup bonus of 50,000 Chase Ultimate Rewards points. This card also has no annual fee and gives 1.5x back on all purchases. This is the card I’d recommend if you’re looking for a daily card that you don’t have to think about too much. My wife uses this card for her business since it gives her the most return on her spending.

Takeaways

For pretty much anyone who is into travel hacking, business credit cards are something that you should be taking advantage of. If you’re a regular reader of this blog, you probably already have some side hustle going on. Remember that you are a business when you do that – a business of you. So use that to your advantage to get business credit cards as you need them. You’ll be amazed at just how many points you can accumulate when you start taking advantage of these products.

Travel hacking is definitely something that you need to take the time to understand, so be sure to do your due diligence before jumping into this world. I have a few posts that are good starting points:

- Chase 5/24 Rule – Maximize Your Travel Hacking

- An Amateur Travel Hacker’s First Experience With Travel Hacking

- What You Need To Know About The Chase One Sapphire Rule

Make sure that you know how you’re going to hit the minimum spend on any particular card. It’s best to time opening new cards with when you’re making major purchases. Weddings are a great example of when you should be opening up a ton of cards. Or think about when you’re going to buy a new phone or a new computer.

If you’re going to pay for something, you might as well get something in return too. Now get out there and start traveling with all of your points!

Thanks so much for such informative post. I did take advantage of this info back in February and opened a Chase Biz Ink Pref for my side business and got 80K points after spending $5K+ by May. In early March, I referred myself for a second Chase Biz, this time in my own name and I got the 20K bonus miles too when the second Ink Pref was issued. 🙂

Then I slowed down in spending and by early June I was at $3K instead of hitting $5k for the second card. I called Chase and they said I would have some more time and that it is important to hit the $5K even it takes longer (he never mentioned the 115 days rule). Now, I could have bought some giftcards which could have been used later for the biz and I also had the money to payoff my Biz card even if I had spent the $5K right them. I only got to $4K yesterday and got drifted away and due to combination of hectic schedule, and a bit of slacking, I still did not spend the money until I received some bills today. But when I called Chase today, they said the maximum allowed number of days to hit $5K was 115 days from the account opening day. It burned me because I was just a couple of days over that limit but a supervisor left a note and looks like I am out of luck despite calling twice.

On the personal side, over the past few month I hit the spend limit on AMEX Plat (100K after $5K) and AMEX Gold (50K after $1K?) and Cap One Venture for myself and Chase Sapphire Preferred (60K after $4K) for my spouse .

Since we have Biz expenses ($10K+) coming up, I wanted to refer my spouse for Chase Biz Ink Pref to get 2*20K=40K and the hopefully getting 2*80K=160K through the spouse’s Ink Pref. Now, I am pissed off at myself and irritated at Chase for being inflexible towards me being two days late. I can easily spend that remaining $1K right away and hit the $5K spending tonight, but I held off until I could get green light from Chase which apparently is reluctant. I know they tried to help me but I need just a little bit more.

Is there any game plan I could devise to salvage the 80K on my second Ink Biz? Should my spouse call Chase and make the application conditional upon me getting my points (Spouse has a direct deposit checking and wanted to open Biz Checking with them)? Should I return some of my purchases on Ink Pref and open another card (AMEX etc) and charge to those cards, cancel Ink Pref and open it in future since I never got those bonus points the first time? In terms of 5/24, I dont think I qualify now as I have opened those others card plus a Citi travel card too. However, my spouse most probably meets that on the personal side.

Any help would be greatly appreciated, although I dont have more than 1 day or 2 to act on this, assuming there is a way.

Cheers,

MN

Hey. If you miss the spend on a card, unfortunately, you’re going to be out of luck. I don’t think any cards will budge on that, so just chalk that up as a learning experience.

Note, it’s actually possible to open a 3rd CIP by opening one up using your middle name on the card and your ssn. I think I’m going to write a post on this because it basically means everyone can get 280k UR points from 3 business cards.

Thank you for such an informative post. I am brand new to travel hacking and trying to learn how this all works. I would like to take your advice and get a business credit card. Would owning a rental property and managing it qualify as owning my own business?

Absolutely. It’s small business like yours that is the backbone of this country.

Great advice on using credit cards to make travelling more affordable. Also many thanks for recommending using business cards instead of personal cards – I wish I’d known about this sooner. I recently tried this with a personal credit card, which i intend on cancelling at a later date and hadn’t considered the impacts of cancelling it.

Don’t worry too much about closing personal cards either. Remember that for FICO purposes, when you close a personal card, it still continues to age with your credit profile for 10 years before dropping off. In other words, a closed account continues to help your average age of account for 10 years. By the time a decade has passed, you’ll have a bunch of other cards that are still bringing up your credit score.

Hey Kevin, man I just had to come here to thank you for writing this post! Actually all your posts are super helpful and spot on accurate. I just got my 2nd ink business preferred in the mail doing exactly what you said and it works like cake! Here come another 100k UR! My wife was so reluctant at first but I think she’ll be pretty ecstatic when I get us first class flights to Tokyo in 2020! After this our balance should be 580k URs, and that’s just since May 2017. Having a high income and high expenses certainly helps you play the game but we consider ourselves very lucky to have people online guiding us to the best strategies. Anyways, you rock dude. If you’re ever in the Houston area, give me a ring. I’d be honored to take you guys out for dinner and nerd out over this stuff 🙂

Dude, thank you so much! I’m glad it helped. You seriously made my day!

Should I apply for a business credit card if I have poor credit? I do have a business and have had for years.

You can, but the question really becomes whether you’ll be able to get approved for it. All of the good business cards require good credit, so you might not be able to get them.

Ok. Thank you.

Thanks! I noticed they use the ‘add employee card’ language instead of authorized user on the consumer cards. Is there an additional card user bonus on the CIP?

Kevin: noticed the new application has a place for EIN and section for the user requesting SSN. Is this new, or as long as you swap the EIN/SSN in the top section you can qualify 2x?

You should still be able to get the CIP twice. Just make sure to use your EIN for the second application. They always will need your SSN because they still need to pull your credit score and you’re personally liable if you don’t pay your business credit card.

Great post FP!!! We recently got the Southwest CP so gotta live the travel hacking game (done with disciplined on fixed expenses). I’ve been thinking about the CIP and now that we are done with the companion pass might pull the trigger on it. Again great post my friend.

Thanks! Definitely go for the CIP. If I was ranking cards, I would say its the absolute best deal out there right now.

Great write up on business cards! Like you, I have leveraged business card sign up bonuses to earn hundreds of thousands of points for travel hacking. Currently, I think this is the best way to earn points since the glory days of mileage running, mattress running, buying a million $1 coins with a credit card then depositing the money back into the bank, and other forms of churning and manufactured spending are unfortunately long gone.

My personal favorite is the Chase Ink Plus card (which is not available anymore). Earning 5x UR points on office supply stores that sell any kind of gift card is HUGE and a great way to rack up the points.

I would also suggest you sign up for the Amex Blue Business Plus card, especially if you can get a sign up bonus. The card earns 2x MR points ANYWHERE up to $50,000. I’ve been using this card for every day spend for purchases that do not fall into a specific bonus category.

Yeah, it’s getting harder to manufactured spend, but surprisingly, I still figure out ways here and there (funding bank accounts generally). I’ll definitely add the Amex BBP card to my list in the future (thanks for sharing)!. Personally, I don’t care too much about spend categories, but mainly because my goal is to always be working on minimum spend on a card.

Fantastic summary of business travel rewards cards!

My wife and I both have finished up our minimum spend on Chase Ink cards. I used mine to pay for our property taxes at the end of 2017. We did have to pay a 2% fee to pay by credit card but the rewards were way more in value. Then I referred my wife for her card who used it to pay for our son to get braces.

I hadn’t realized that I can now turn around and use my EIN to get the card again … which I now plan to do later this spring.

I am currently finishing up spending on 2 other business cards – Chase Marriott Rewards and CaptialOne Spark Business. Once those are done, we will definitely look at the Chase Ink again.

Overall, I love business cards compared to personal cards. Since last August (about 7 months now), my wife and I have opened up a total of 7 rewards cards – 3 personal and 4 business.

Thanks so much for the info!

That’s awesome John. I really like AmEx biz cards especially – it seems like they don’t do hard pulls after you get your first AmEx card.

Yeah, definitely double up on those CIPs if you can – I’ve got 2 myself and will go for a 2nd with my wife later. Make sure to use your own referrals when you apply for your second CIPs (i.e. use your wife’s referral link when you apply for the 2nd CIP and have your wife use your referral link when she applies for her 2nd CIP). That way you’ll get 100k points for each of those cards.

Awesome post FP!

I’m actually in the process of getting the Chase Ink Preferred card but I started the process by mailing in the forms – can I walk into my nearest chase bank and try to get the 100k points still?

I’d also love to see more posts on new cards you’ve applied for, it would be a great example for the rest of us travel hacking novices.

I’m not actually sure, to be honest, but if you have the time, it probably doesn’t hurt to try. What do you have to lose?

Thanks for the suggestion on post ideas. I’ll definitely see if I can put something together – I know that that figuring out all this credit card stuff can be confusing, so it’s helpful to see how others are doing it. You’ve given me inspiration for a post idea now that I’m thinking about it.

LOVE the Chase Ink. However, I don’t recommend ever taking the bait on their periodic zero interest transfer offers. They will charge you interest on the balance for your regular credit use – and it comes with a fee. It’s quite the bait-and-switch on Chase’s part. And they refuse to reverse interest charges. They are the DEVIL.

The only caveat to using business credit cards is to be sure that if your business is an LLC, that charges you make on the card are specific to the business. It’s way easier than you might think to “break the corporate veil” and wind up nullifying the protection your LLC offers. Just food for thought.

(and yeah, I’m totally bummed that I’ve exceeded the 5/24 with Chase – no more personal or business CCs from them for a while, I’m afraid!)

Ooh, don’t know anything about that zero interest transfer thing – I just want the points! But I’ll take your word and never use that transfer offer.

And look at you bringing in that lawyer talk here with the piercing the corporate veil. It’s a good point – if you have a business entity (which means you filed paperwork with the state), then yes, you’ll definitely not want to mix personal and business expenses. My wife is planning to buy a practice, and her business cards that we’ll get her will definitely not include any personal spend on them.

Most people doing little side hustles like tutoring, uber, postmates, etc won’t have any form of limited liability, so mixing business and personal won’t matter. I’m guessing that 95% of people earning money on the side will be doing so as sole props.

For new cards for you, can you get some more AmEx cards? There are some good AmEx offers out there if you need a card to put some spend on. Nice thing with AmEx is that, once you have one hard inquiry from them, they don’t seem to do any more hard inquiries for subsequent cards, so that’s literally getting a new card with literally zero impact on your credit score.

Hey Kevin!

I just wrote a post for you, on LLCs. Come on over if you’re looking for a quick nap. Haha!

You’re spot on that most side gigs are pretty free and clear from the necessity of an LLC. But if you walk dogs, keep those pitbulls on a strong leash!

Interesting on the Amex front. I did in fact just get a new Starwood Preferred card – easy as pie. Seems like a good two year lag between closing the original card and opening the new works pretty good.

I’ll have to check the LLC post out! Hmm…might not be a bad idea to do an LLC for my dog walking biz though.

Thanks for writing this post. My wife does some tutoring and I really want to dive into the business credit cards for all the extra points we could earn. However, she only earns about $500 a year right now. Did you apply for any business cards when you were just starting out your side hustles (when your income might have been lower)? Also, with a low business income is there a risk that the credit limit would be too low to meet the minimum spend for rewards (say credit limit of only $1000)?

In my experience, its really easy to get approved for that first card – $500 to $1,000 of income should be enough – remember, you can estimate your revenue, so it’s not out of the question to have a goal of earning $1,000.

I’ve found that credit limits on business cards are really random and not necessarily tied to the business income you put. The Chase Ink Preferred has a minimum credit limit of $5,000, so no matter what, you’ll have that as your credit limit. My advice is put in the income that you realistically think you could get as a goal. $1,000 from tutoring and everything else she might do on the side is more than realistic.

Don’t be afraid of the business card! Believe in yourself and remember this – small business like yours is the backbone of this economy! That’s what I always remind myself.

Thanks for your quick reply. I appreciate the encouragement! I’m definitely eyeing the Chase Ink Preferred Card; great to know the credit limit is high enough to meet the minimum spend.

No problem. Let me know how it goes. Obviously applying in branch to try to get the 100,000 point offer is ideal, but that depends on your level of comfort, since when you apply in branch, you’ll have to talk to someone in person. I’m fairly certain that you won’t have a problem getting that first Chase Ink Preferred, especially if you have a good credit score. Good luck!