Editors Note: Some offers mentioned below are no longer available. View the current offers here.

I’ve always been wary when it comes to credit cards. Even though I’ve never been shy about trying out new fintech apps or opening up new bank accounts, for some reason, credit cards have always scared me. Maybe it’s the fact that a credit card goes on your credit report. Signing up for a new card just seems so … permanent.

My fear of opening up new credit cards probably comes from the fact that my history with credit cards isn’t very robust. I got my first card back in 2006 during my sophomore year of college – a Citi mtvU Visa Card which gave me extra points when I used it at bars and restaurants. The card seemed pretty good and it served as my daily use card throughout my 20s. In 2012, Citi changed the card over to a Citi Forward Card, which was the card that I was using all the way through the beginning of this year. The only other card I’ve gotten during that time is a Target Red Card that I accidentally got when I was actually trying to get the Target Debit Card.

Because of this fear of credit cards, I’ve pretty much missed out on the whole travel hacking craze. If this is a new concept to you, basically, a lot of credit card companies offer lucrative signup bonuses if you open up certain credit cards. People who are knowledgeable about travel hacking can pretty much fly around the world for free just by strategically opening up new cards every year. That’s often thousands of dollars a year that people can make just by opening up new credit cards. Headlines like the one below aren’t that uncommon to see.

For the last 10 years, I’ve adamantly refused to do any travel hacking. Looking back, it seems a bit strange that I was so afraid to get into this world. I make money in a ton of weird ways. Travel hacking seems like it would be a natural fit, so why would I be so against it?

A part of it has to do with a simple lack of knowledge. I just didn’t know that travel hacking was a thing until recently. The other part was fear. Travel hacking seemed confusing to me. For example:

- It wasn’t quite clear to me how new cards affected my credit score. Wouldn’t my credit score drop if I kept opening up new cards?

- There are a ton of cards out there. Which ones was I supposed to open?

- How am I supposed to meet the minimum spend on all of these cards?

- What about those annual fees?

- What do I do with the card once I’m done with it?

- And seriously, won’t opening up all of these new cards wreck my credit score?

Even though a lot of people make travel hacking seem really simple, it’s actually not that straightforward. There’s a lot that you need to know if you want to do it right.

The great thing about the internet is that you can become an expert in pretty much anything if you’re willing to take the time to learn how to do it. Before this year, I knew absolutely nothing about travel hacking. Today, I’d like to think that I’ve graduated to something beyond amateur travel hacker status.

I’m planning to talk a little bit more about what I’ve learned about travel hacking as I continue to get into this world, but for now, here’s the story of my first foray into travel hacking. My goal here is to help you figure out travel hacking, not from the point of view of some super travel hacker expert, but from the point of view of a regular dude just trying to figure out how all of this works.

And take it from this amateur travel hacker – you can become an expert travel hacker too if you’re willing to put in the work.

Missing Out On A Lot Of Points

For the most part, travel hacking is a bit of a niche area, but sometimes, cards get so big that even regular people get into the travel hacking game. In late 2016, Chase offered 100,000 ultimate rewards points for folks that opened up a Chase Sapphire Reserve card. Even my less savvy friends jumped on this offer – most likely because it was advertised all over Facebook by big bloggers. My friends urged me to sign up for it too and I refused. The whole thing seemed too weird to me. I didn’t understand what the whole travel hacking thing was about and didn’t want to risk messing with my credit score.

In retrospect, I should have signed up for the card. Now, I’m kicking myself! But oh well. Live and learn.

My biggest missed opportunity was definitely in the form of my wedding. I’ve learned a lot from planning a wedding, and one thing I know is that weddings are expensive! If you’re going to be paying for all of that stuff, it makes sense to get a little bit of return on your spend. With an average wedding costing in the neighborhood of $30,000, many people could open up 7 or more new credit cards and get thousands of dollars back in the form of hotels and travel.

My wife’s engagement ring was another missed opportunity. I bought it at the beginning of 2016 and threw the whole cost of it on my Citi Forward Card, which I then promptly paid in full. Sure, my card gave me 1% back on my purchase. But had I taken advantage of credit card signup offers, I probably could’ve easily gotten back $1,000 or $2,000 worth of travel.

So if you’re getting married anytime soon, you need to be signing up for multiple credit cards! Don’t let all that spent money go to waste!

My First Experience With Travel Hacking

In February of 2017, I decided to take the plunge and try my hand at travel hacking my first flights. Since I was new to this world, I had a few things I was worried about. First, I wanted something pretty simple and easy to figure out. Second, I didn’t want to pay any annual fees. (I’ve since learned that annual fees shouldn’t be a dealbreaker).

The card that hit all of these points was the Merrill+ Visa Signature Credit Card. At the time, that card offered 50,000 bonus points if you spent $3,000 within the first three months, which translated to about $1,000 worth of plane tickets. And the best part was that the card had no annual fee, making it seem low risk in my eyes. Since I already had to pay for a bunch of wedding expenses, the card seemed like a no-brainer to me.

In terms of redeeming the points, the process was super easy. I spent the $3,000 pretty much immediately by paying a couple of wedding bills with the card. A few days later, the 50,000 bonus points appeared in my account – even before my statement period had ended.

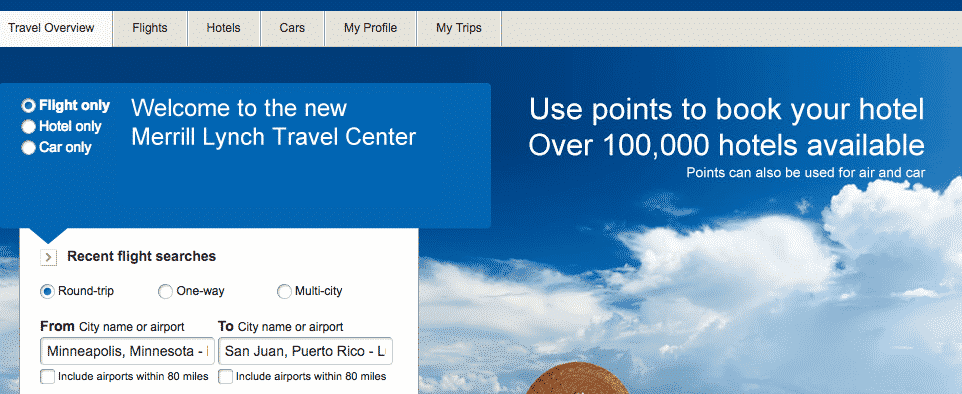

Using the points was a pretty simple process. One thing to note is that the Merrill Lynch travel center has a few quirky rules. Basically, any flight that’s $500 or less costs a flat 25,000 points. My goal was to get as close to a $500 ticket as possib le. Since my wife and I were looking to go to Puerto Rico for our honeymoon, this worked out perfectly for us. Flights to Puerto Rico from Minneapolis clocked in at about $497 roundtrip. We basically were getting the maximum return on our points.

A few clicks of the mouse and that was it. Our honeymoon flights were booked -totally free! It seemed like the perfect beginner card for a new travel hacker like me. And since there was no annual fee, I didn’t have to worry about what I was going to do with the card later.

One thing to note – I didn’t optimize my travel hacking strategy to the fullest. Most people would say that if you’re starting out as a brand new travel hacker, your first five cards should ideally be from Chase. The reason for this has to do with a special rule known as the 5/24 rule. Basically, Chase won’t let you open up new cards if you’ve opened up 5 or more credit cards from any company in the past 24 months. Since Chase is well known for having some of the best signup bonuses, it’s often recommended to go for Chase Cards first before going for other cards. If I could go back in time, I’d probably have done that instead – but that’s a lesson for another day.

Things To Know If You’re Skeptical About Travel Hacking

I think most people who are responsible with their credit cards stand to benefit from travel hacking. Even just a few cards per year would lead to thousands of dollars in free travel.

Here are some things that I’ve learned as I’ve started getting into the world of travel hacking:

1. Meeting Minimum Spends

The key with any new card is meeting the minimum spend requirements. Before you open up a new card, make sure that the minimum spend is something that you can realistically hit.

Of course, you don’t want to be opening up new cards only to spend more than you normally do. That’s why weddings are a great spot to really go all out with travel hacking. Your engagement ring or wedding dress is going to be expensive no matter how you slice it. And paying for everything else that comes with a wedding will be expensive too. You might as well get something in return for spending all of that money.

Most of the time, it’s thousands of dollars you’re getting back in travel and hotels. Don’t miss out on it!

2. Don’t Fear The Annual Fee

Annual fees have always seemed crazy to me. Why would I pay for the benefit of spending money on a credit card?

The key with fees is to remember that you should be getting more back than what the card costs. If you’re getting back $500 or $1,000 in travel and paying $95 for the card, it’s like you’re paying $95 to get $500 or $1,000. That’s a good deal for you.

3. Travel Hacking Won’t Mess Up Your Credit Score

I always figured that travel hacking would screw up my credit score a ton. Turns out that opening up new cards might lead to minor dips, but only in the short term. Even though I’ve opened up 4 new credit cards in the past 5 months, my credit score still hovers at around 800.

Sure, opening up new cards will lower the average age of your credit. But opening up new cards also leads to more available credit, which means a lower credit utilization rate (a lower utilization rate is good for your credit score). It sort of balances out over the long run.

Closing cards was the one thing I was worried about. But I realized one thing:

4. You Don’t Necessarily Have To Cancel Annual Fee Cards

I used to think that if I got a card with an annual fee, my only option was to either keep the card or close it. However, many cards also let you downgrade them to no-annual-fee cards, which means you don’t have to worry about the decision to keep or close the card if you no longer want it.

Travel Hacking Doesn’t Have To Be Scary

Travel hacking can be intimidating if you’re new to it. I know it was for me and it’s the reason why I held off on doing it for so long. But it doesn’t have to be scary. If you know what you’re doing, you’re going to come out ahead – you just need to take a little bit of time to understand how it all works.

I’ve had a ton of fun figuring out this whole travel hacking thing and I’m going to be sharing what I’ve learned with all of you as I figure it out. It’s pretty addictive figuring out ways to optimize your spend in order to get free flights and I can definitely see why people spend so much time thinking about it.

Related: If you like travel hacking, you’ll definitely want to think about optimizing the interest rates on your emergency fund with 5% interest savings accounts. I let fear hold me back from getting into travel hacking and it’s something I regret. Don’t let fear hold you back from maximizing the return on your cash.

Nice article

Thanks!

I put it off for years, too, but jumped into the game just this week. I’m very excited! For me, what held me back was how complicated it seemed. Transferring all of my monthly payments to a new card, tracking to make sure I met the minimum spend, etc. but I’m going for it now! I have plans to get 5 cards in the first year with a potential 340,000+ point return! That’s already up 50,000 from the plan I had just a week ago, hahahaha.

That’s what held me off for so long as well – just how complicated it seemed. I just didn’t understand how it was possible until I actually jumped in.

Wow, what a great and useful post!

I’ve also ignored travel hacking as it sounded too good to be true and I was afraid of damaging my credit score by opening too many cards. I don’t have any debt and I’m obsessed with keeping my credit score over 800.

The other thing that kept me from taking advantage of travel hacking was the annual fees; however, as you point out, we have to look at it differently as a small fee to get bigger rewards.

Reading your post has changed my mind and I might give travel hacking a try. Thanks a bunch!

Thanks! I was also nervous about opening up new cards since I thought it’d mess up my credit score, but over the long term, your score will stay the same or go up. Yes, your average age of credit will drop, but you just keep adding more credit, which is a net gain long term. It’s intimidating getting started, but once you start doing it and understand how it all works, you’ll start wondering how you ever didn’t travel hack! It’s a fun little hobby.

I recently got into travel hacking and while i am confident that the deals can be had so far when i do sample tests on various airlines with points it doesnt seem to be as amazing as people talk about. From my searches, a person could save maybe $200 by using points versus cash.

I wonder how that Jamacia trip was totally free. I would take it myself if i knew how.

So this is definitely something that requires a little bit of learning. It involves transferring points to different airline partners and having flexibility with traveling.

For example, my friend recently booked a ticket to Hawaii for August using his Chase Ultimate Rewards Points. American Airlines (or maybe United – I can’t remember of the top of my head) has flights to anywhere in North America for 25,000 points. He transferred the points, and booked the ticket, which would otherwise cost close to $1,000 if he booked it with cash. And he still has 75,000 Chase Points left over from when he first snagged the bonus.

If you use just the Credit Cards portals, you’ll find that it’s not quite as much value.

For the Jamaica trip (which I haven’t done, but as Mr. Crazy Kicks pretty much explained), it involved this type of transferring. Plus opening up a few hotel cards and snagging the free nights.

I was totally skeptical about it too just a few months ago – the information is out there, but not always all that well organized. Once you understand how it works, there’s ways to get a ton of value from these points.

Happy travel hacking! When we first started I was very anti-fee too, but I’ve since learned the fee is worth it if the rewards are high enough. Another pleasant surprise was how little it affected our credit score.

Looking forward to reading about the trips you’ll be planning with all those points!

Oh I’ve got a bunch of ideas. My only problem is time! I need to save money and retire like you!

I got into Travel Hacking just over a year ago, and my credit score is still over 800 after opening 6 cards. I’m actually planning on opening my 7th card this week!

Highly recommend the TravelMiles101 free course to anyone interested in getting started.

That’s awesome! I’ve now opened up 4 cards this year and have plans to open up at least 3 more over the next few months. Another big benefit with side hustling – you can legitimately open up business cards and snag the bonuses.

Excellent write-up, FP. I have been listening to ChooseFI since you recommended it in a recent post. The guys over at ChooseFI had a podcast episode that explained travel hacking and it was great. I went with the Chase card they recommended to start my travel hacking journey. I’m interested and I will investigate the VISA you discussed.

Cheers!

Yep, I think Chase Sapphire Preferred is probably the first and easiest card to start with since it has no annual fee for the first year and is easy enough to just product change it down to a Chase Freedom or Chase Freedom Unlimited.

I’ve been resisting travel hacking too. Did you take one of those free courses on it or use an aggregator site that describes how many of those cards work? I’m looking forward to reading along as you learn more.

I sort of just dove all into it and have been figuring things out along the way. The subreddit “churning” board has a wealth of information. There are a ton of YouTube channels out there with a lot of good info as well. This Youtube channel/blog Ask Sebby has been really helpful in figuring stuff out too, and totally recommend checking them out if you’ve got the time to watch a few YouTube videos.

Thanks for the tips!

We’ve been travel hacking for about four years with no I’ll effects. In fact we are in Cancun today enjoying some of those points.

Oh man, that’s lucky! I wish I had figured this stuff out sooner.

Right on! Travel hacking has been a lot more lucrative than I expected. We just travel hacked an all inclusive vacation including flights to Jamaica for free – value $6,000. We also flew to Colorado and Costa Rica for free, and we are getting ready to go to Barcelona – all for free.

I have yet to find any downsides. After churning through more than half a dozen cards my credit score is still over 800 🙂

I can totally see why travel hacking is so addictive. I’m basically diving in headfirst into it and trying to understand it all. It’s complicated – there’s definitely a lot to it, no matter how simple anyone makes it seem. But man is it fun.