Update. Beginning July 1, 2018, Insight will be closing all of its 5% interest savings accounts. For current Insight users, wait until your interest posts on June 30th or July 1st, then move your money over to your Insight card and do an ACH withdrawal from your normal bank (for example, I will be moving all of my funds to my Insight card after my interest posts, then doing an ACH withdrawal from my Ally account). After that, send a secure message to Insight and ask to close each individual card. Save the confirmation that your account has been closed so that you have evidence that your account was closed, just in case something happens (the best way to do this is to screenshot the message, then save it Google Drive or something similar).

Remember that there are still 5% interest savings account options! With Insight no longer available, Netspend is now the best way to earn 5% interest on up to $5,000 per person with pretty minimal work (plus, you also get a $20 signup bonus when you open your first Netspend account). If you have a two-person household, you’ll be able to put away $10,000 earning 5% interest, which is not a bad emergency fund. Be sure to read my post on how to get 5% interest with Netspend (plus a $20 signup bonus) for a step-by-step guide on how to set up your Netspend account. I’ve also written a post with ideas on where to put your money now that Insight is gone – check it out here.

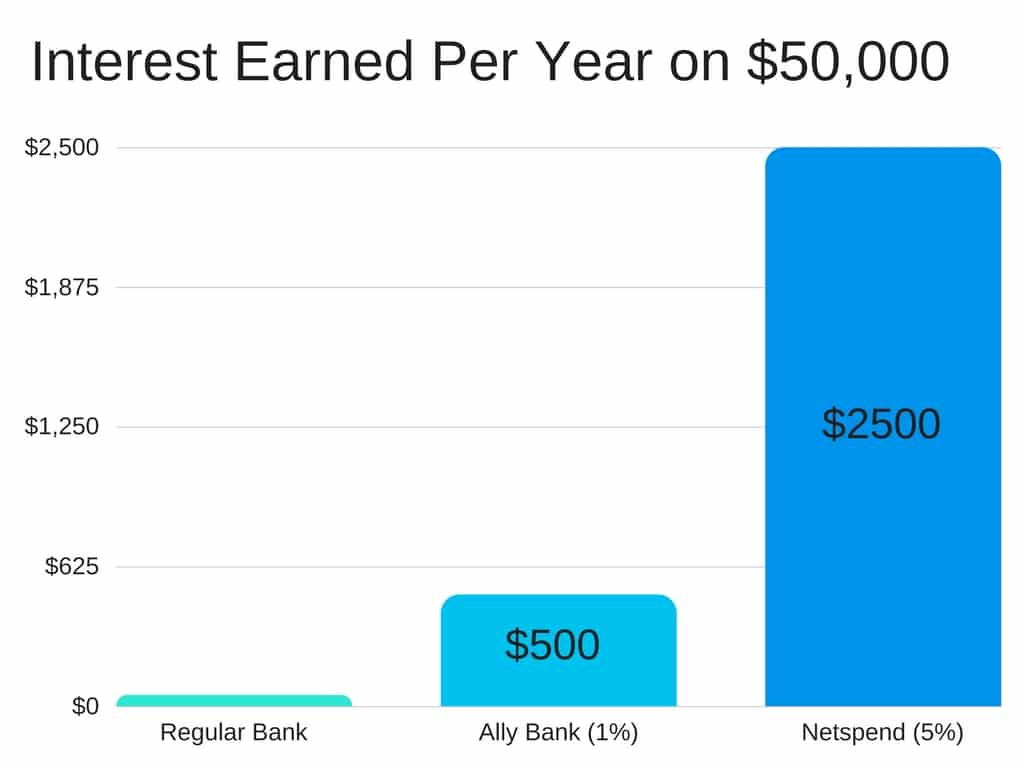

One of the things I like doing is figuring out ways to get the maximum yield on my cash. Most people just accept whatever their bank offers them. The problem is that even your highest-yielding savings account pays you just 1% or less interest these days.

What a lot of people don’t know is that there’s an entire world of super high yield savings accounts out there. These are savings accounts that pay way more than even your highest paying online savings accounts. The thing about these accounts is that you won’t find them at any normal bank. They’re sort of secret, and you can only find them “hidden” in prepaid debit card products.

I previously thought that it was only possible to get 5% interest on up to $10,000 by using all of the cards available from Netspend. However, a reader of this blog – Mr. PTM – reminded me that there are a few more super high yield options out there that allow you to put even more money away earning 5% guaranteed interest.

As a result, I finally pulled the trigger and snagged myself a couple of Insight Cards.

If you sign up for these in combination with the Netspend cards that I’ve talked about in a previous post, then you could put away a minimum of $20,000 and potentially as much as $50,000 earning 5% guaranteed interest per year.

For the vast majority of households, $20,000 to $50,000 is more than enough to serve as a massive emergency fund. And since you’re getting 5% interest each year, you won’t have to worry about the low returns that normally come with keeping a big pile of cash.

As a point of comparison, you would need to save $250,000 in your standard online bank account in order to get the same returns as you would get on $50,000 earning 5% interest. That’s a huge difference!

What turns most people away from these accounts is that they take a little bit of upfront work to set up. In reality, it’s not really as much work as you’d think. A lot of people spend way more time figuring out how to travel hack or clip coupons. This is just another way to optimize your finances.

Plus, once you understand how these savings accounts work, it’s possible to set them up and have everything fully automated in just a few minutes. Today, I only look at my accounts four times per year, but I could look at them 1 or 0 times per year if I wanted to.

*This post is the second part of a two-part series. Be sure to also read part one, Netspend Account: 5% Interest Savings and $20 Signup Bonus, if you want to learn how to fully maximize your 5% interest savings and snag a $20 signup bonus in the process.

What Is An Insight Card?

Briefly, an Insight Card is a prepaid debit card. These products generally come riddled with high fees and are designed primarily to prey on the poor and unbanked.

We’re not interested in the prepaid debit card. What we want is to gain access to the 5% interest FDIC-insured savings account that comes with each Insight Card. The good thing is that if you follow the steps in this post, you’ll earn 5% guaranteed interest and never pay any fees. I like to think that we’re fighting back in a way.

So how does an Insight Card work? It’s easiest to think of your Insight Card as having two parts.

- The first part is a prepaid debit card.

- The second part is a 5% interest savings account which allows you to earn 5% interest on up to $5,000 per card (you can generally get between 2 and 4 Insight cards per person).

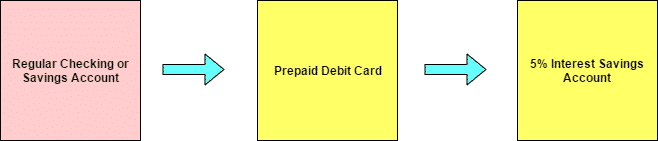

The important thing to know is that you can’t get access to the savings account without first getting the prepaid debit card. Think of it as looking a bit like the below diagram:

In order to get money into your 5% interest savings account, you need to first send it over to the prepaid debit card. From there, the money then goes into the 5% interest account. The prepaid debit card acts sort of like a funnel, getting money from your bank into the 5% interest savings account.

How To Set Up Your Insight Card

First, if you haven’t already, you should start here. In that post, I explain exactly how I’m able to use my Netspend accounts in order to put away $5,000 earning a guaranteed 5% interest per year ($10,000 if you’re a two-person household).

If you want to maximize your 5% interest savings, you’re going to want to read both this post and the previous post on this topic. You’ll especially want to read the previous post in order to understand how to withdraw money from your prepaid debit card accounts (although I’ll touch upon it briefly below as well).

The process for setting up an Insight Card is largely the same as with Netspend.

1. Set Up A Bank Account With A Normal, Online Bank.

First, you need to have a bank account with a normal, online bank. I highly recommend using Ally Bank. It’s the only bank I’ve used with these accounts and the only one that I know will work perfectly with your Insight Cards.

The good thing is that Ally allows you to connect up to 20 external bank accounts. We’ll need to potentially link as many as nine external accounts if we want to max out our 5% savings. If you don’t have an Ally account, I highly recommend getting one. It only takes a few minutes and you can sign up for it all online.

2. Sign Up For Your Insight Card.

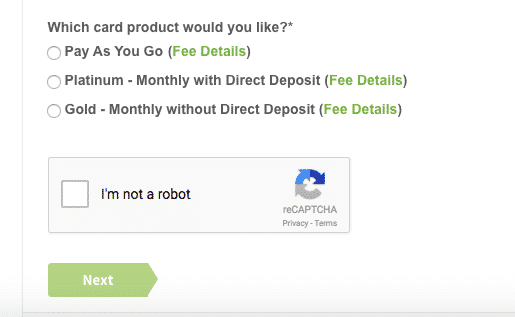

Next, sign up for your Insight Card. On the main page, click the “Get A Card” button. It should then bring you to a page that looks like this:

Click the button that says “Click Here To Get Started” and then enter in all of the information requested. You’ll notice a section in the sign-up process that asks you what type of plan you want to sign up for. Make sure you select the “Pay As You Go” Plan. That way, you won’t pay any monthly fees.

3. Wait For Your Insight Card To Arrive, Then Activate It.

Once you sign up for your Insight Card, you’ll get a confirmation telling you to wait 7-10 days for your card. All of my cards have typically arrived within a week.

When the card arrives, call the number on the front of the card and follow the automated directions to activate your account. It shouldn’t take more than a few minutes.

Remember to also set up your online account with Insight. Just go to the Insight Card login screen and register as a first time user in order to set up your online account.

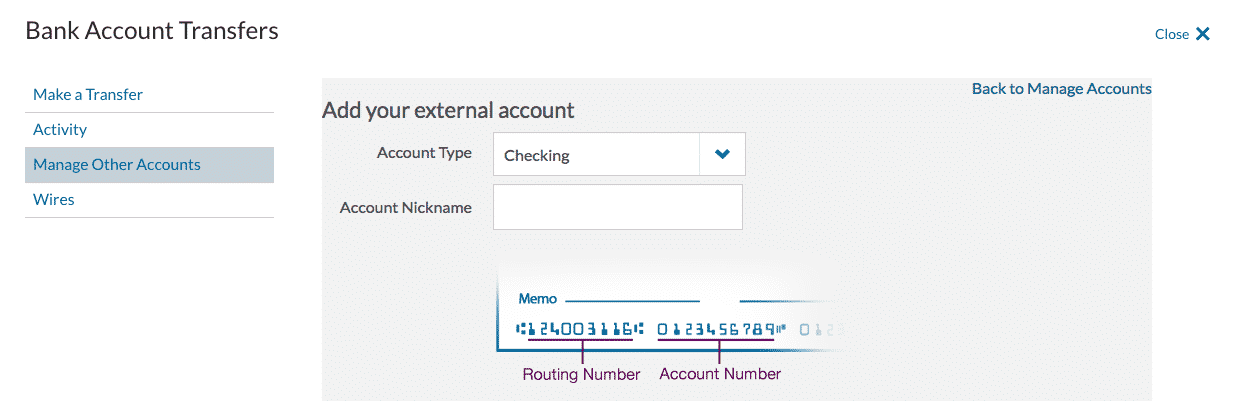

4. Link Your Insight Card With Your Normal Bank Account.

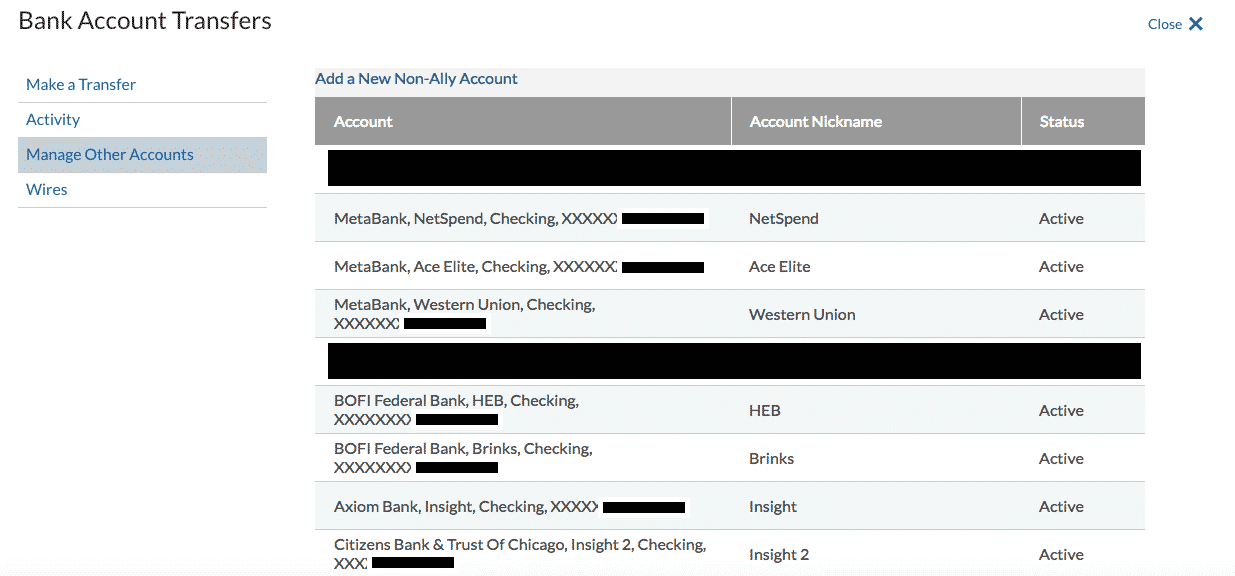

In the packet of stuff you received, there should be a voided check. This has your routing number and account number. Keep this information in a safe place. You’ll use that information to link your Insight Card as an external account with your normal bank, as shown below:

For me, I logged into my Ally account and entered in the routing and account number for my Insight Card. Ally then sent two test deposits that I needed to confirm in order to complete the link with my bank.

Once you’ve linked all of your 5% interest accounts, your external bank account screen should look something like this:

5. Move Money From Your Bank Account Onto Your Insight Card.

From your normal bank account, set up a transfer to your Insight Card. Since Insight allows us to have $5,000 earning 5% interest, I’d recommend transferring the full $5,000 onto your Insight Card.

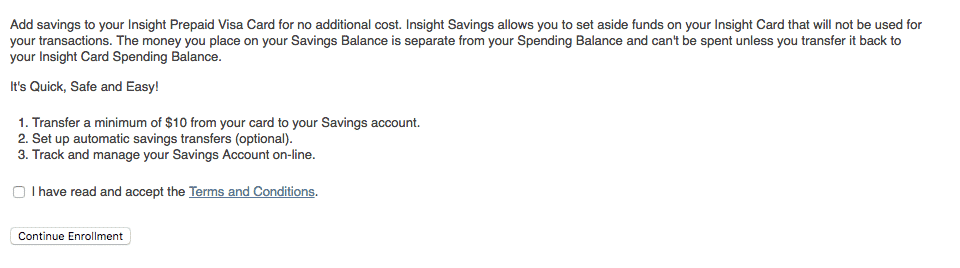

6. Activate Your 5% Interest Savings Account and Transfer Money Into It From Your Prepaid Debit Card.

Once you’ve transferred at least $10 onto your Insight Card, you’ll get the option of activating your 5% interest savings account. The screen to do that should be in the savings tab of your Insight account and should look like this:

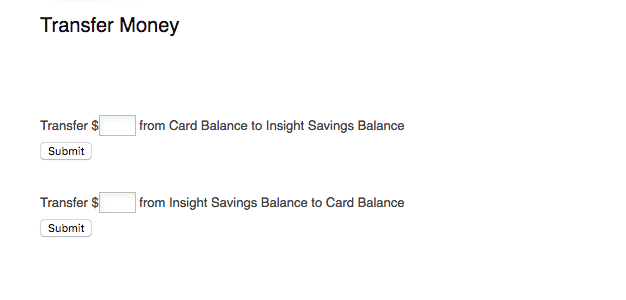

Once activated, transfer your money from your Insight Card into your 5% interest savings account. That screen should look like this:

7. Set Up An Automatic Transfer of $1 Every 2 Months Onto Your Insight Card In Order To Avoid Any Inactivity Fees.

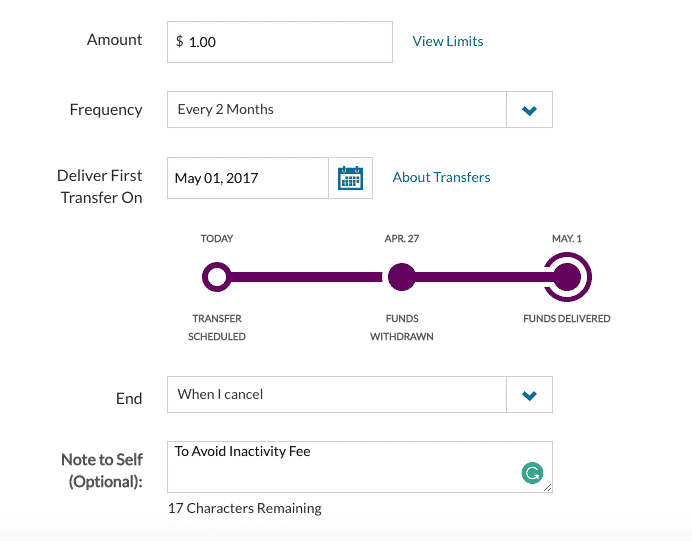

The last step is to automate a $1 transfer onto your Insight Card, set for every two months. This is very easy to do in Ally. The screen to set up your automated transfers should look like this:

Once you’ve set up your automated transfers, you’ll avoid any inactivity fees and you’ll never even have to think about the account other than if you want to pull out any interest you’ve accumulated.

One thing to note is that if you’re automating transfers from your savings account, you’ll have to deal with the six transactions per statement limit that apply to savings accounts. Your choices are to either stagger your $1 transfers (i.e. do 5 transfers 1 month and 4 transfers in the next month), or a simpler solution is to create an Ally checking account and automate all of your $1 transfers from that account.

I used to stagger my transfers but after dealing with that, I decided to just open up an Ally checking account and set up all of my $1 transfers at once from that account. Every two months, all of my $1 transfers go out at the exact same time. I think it’s easier that way.

8. Open Up A Second, Third, and Fourth Insight Card For Yourself And Repeat The Same Steps With Your Spouse.

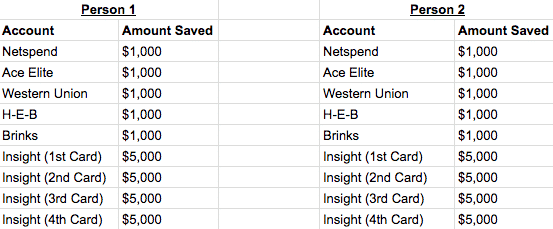

A little-known fact is that Insight allows you to open up at least two and possibly as many as four accounts per person (I currently have three active cards for myself and three for my wife). If you can open up four Insight cards per person, that’s $20,000 you can put away for yourself and $40,000 your household can put away into just these accounts. Combine that with the 5 accounts that you can open with Netspend and you’re looking at putting away as much as $25,000 per person or $50,000 per household.

In terms of how we did it, I first signed up for my Insight Card, funded it, and activated the savings account. I then signed up my wife, funded her card and activated her savings account. After that, I repeated the sign-up process for myself.

Oddly, when I tried to repeat the process for my wife, we received an error message saying that she couldn’t sign up for another Insight Card online and that it had to be done at a store. About a week later, the card randomly arrived. We’re not sure why that happened, but if you’re having issues with getting your second card, you could consider waiting a week or two just to see if your second card arrives.

I had no issues ordering my third or fourth card and neither did my wife.

Any Potential Cons With The Insight Card?

One potential con included reports that Insight only allowed folks to withdraw $1,500 per 24-hour period.

I can confirm that this is not the case, as both my wife and I have been able to withdraw well over $1,500 at once without any issues.

In What Order Should You Open These Accounts?

There are two ways you can go about opening up these accounts. Which route you take will really depend on what your goals are:

- If you want to get either $20 or $60 worth of signup bonuses (depending on whether you have a partner or spouse), then start with the Netspend cards first, then move onto the Insight cards until you have every card possible opened up.

- If you don’t care about the signup bonuses or only have a few thousand bucks that you’re trying to store away, then just go with the Insight cards.

When I signed up for these cards, I started with the Netspend cards first since my goal was to open every single 5% account that I could and because I thought it made sense to snag myself the Netspend signup bonuses too. Insight, unfortunately, doesn’t offer any signup bonus, so the way I see it, if you’re going to maximize your 5% interest savings, you might as well start yourself off with a free $20 first (you’ll actually end up with $60 in bonuses if you are working on this with your spouse).

If you want to start off with a $20 signup bonus, you’ll want to follow this order of opening up these cards:

- First, sign up for a regular Netspend card, fund it, and snag a $20 bonus. If you use my sign up link, you’ll get a $20 bonus once you deposit $40 or more (note, I’ll also receive $20 as a referral bonus). Make sure that the code 1450481187 is in the Referral Code section of the sign-up form in order to qualify for the $20 bonus. The process of opening up a Netspend card is almost exactly the same as with Insight and you can read more about how to set up your Netspend cards here. After you’ve completed this step, you’ll be able to put away $1,000 earning 5% interest.

- Second, use your Netspend referral code and refer your spouse or partner to Netspend. If you do that, you’ll get a $20 referral bonus for referring your spouse and your spouse will get a $20 signup bonus. Altogether, that’s a cool $60 for opening up two Netspend accounts ($40 for you and $20 for your spouse). You’ll now have a total of $2,000 earning 5% interest.

- Third, open up all of the Insight Cards you can. You should be able to open up a minimum of two Insight cards per person and possibly as many as four per person. Make sure to take it one at a time (i.e. open up one card first before opening up the next card). You shouldn’t have any trouble opening up your first Insight card, but check the troubleshooting section of this post if you find yourself having trouble getting your second or third card. If you’ve managed to open up all of the Insight cards you can, you should now be able to save a total of $42,000 earning 5% interest.

- Fourth, open up an Ace Elite prepaid debit card. You should now have $43,000 earning 5% interest.

- Fifth, open up the Western Union prepaid debit card. You now have $44,000 earning 5% interest.

- Sixth, open up the H-E-B prepaid debit card. The one thing to note about the H-E-B card is that it comes with a $2.95 activation fee. They deduct this right out of your account, so the account starts off in the negative once you sign up. The $2.95 activation fee is worth it, though, because we’re going to get much more back in interest. You should now have $45,000 earning 5% interest.

- Seventh, open up the Brinks prepaid Mastercard. There are reports that this card requires a real direct deposit to set up the savings account, but I found that when I transferred money from Ally, it activated the savings account with no problems. You’ll now have $46,000 earning 5% interest.

- Finally, repeat the Ace Elite, Western Union, H-E-B, and Brinks cards with your spouse. You now have $50,000 earning 5% interest.

If you don’t have a spouse, then just ignore the steps involving a spouse and do the steps that apply only to you.

If the $20-$60 signup bonus doesn’t matter to you, then you should start by opening up all of the Insight Cards that you can first, then move on to the Netspend cards in the order I’ve outlined above.

Remember, take it slowly. Don’t open up the next card until you have the previous card fully set up. If you have every account set up and maxed out, it should look like this:

Important Things To Remember About Your Insight Card

- Interest Is Paid Quarterly. Expect to see interest posted on January 1st, April 1st, July 1st, and October 1st of each year. If you ever plan to close these accounts (why would you though?), make sure that the interest posts first. Otherwise, you’ll lose the interest.

- Each Insight Savings Account Is Limited to $5,000. You can’t put more than $5,000 into each savings account. Notably, however, it appears that any interest you accumulate above $5,000 in each account still earns 5% interest. In other words, you can just leave the accumulated interest in each savings account if you want, even if it takes the savings accounts above a $5,000 balance.

- You Can Open At Least 2 And Potentially As Many As 4 Cards Per Person. It isn’t advertised, but every person in your household can have at least 2 and possibly as many as 4 different Insight cards. This effectively allows each person to save as much as $20,000 by saving $5,000 into each Insight account. Due to recent changes, it seems that Insight might limit you to 2 or 3 cards. From my experience and reader experiences, it seems that, at a minimum, everyone should be able to get 2 Insight Cards per person, and many people should be able to get at least 3 cards. Your mileage may vary, but read the comments at the bottom of this post for other reader experiences.

- There’s No Hard Credit Check. Opening an Insight Card does not result in a hard credit pull. As far as I know, there isn’t even a soft credit pull. There’s also no Chex Report inquiry.

- No Minimum Balance Requirement. You don’t need to keep any minimum balance in the savings account. The only fee you’d ever need to worry about is the inactivity fee. However, if you’ve automated the periodic $1 transfer onto the Insight Card (as described above), then you shouldn’t have to worry about the inactivity fee either. Any usage fees don’t matter because we’ll never use the card for anything.

- Make Sure You Understand How To Withdraw Money From Your Insight Card. Just remember that if you’re withdrawing money, you need to have the money on the Insight Card first. Then, when you want to withdraw the money, you initiate the ACH pull from your normal bank account. Be sure to check out Part 1 of this series to get a full explanation on how to withdraw your money.

- Your Money Is Liquid. Any money in your 5% accounts can be withdrawn within 1 or 2 business days. It’s just a matter of moving your money from your savings account to the debit card (this is instant), then doing an ACH transfer from your debit card to your regular bank account. In other words, if you need the money, you’ll get it in however long it normally takes you to ACH money from one bank to another (1 or 2 days typically).

- Don’t Use The Card And Don’t Call Insight Customer Service Unless Absolutely Necessary. Remember, this is a product meant to prey on the poor and unbanked. We’re not using it for that – we’re using it just for the 5% interest account, essentially striking back by not using the card at all and collecting our interest from them. If you do call Insight, you’ll get hit with a $1 fee for calling them. It’s not the end of the world, but it’s a reason why you shouldn’t call them for anything unless absolutely necessary.

Quick Recap

To quickly recap the process of setting up your Insight 5% interest savings accounts:

- Set up an online bank account with a bank like Ally.

- Sign up for your first Insight Card.

- Get your Insight Card in the mail and activate your account.

- Link your bank account with your Insight Card.

- Transfer money from your bank account onto your Insight Card.

- Activate the 5% interest savings account.

- Transfer money from your Insight Card to your 5% interest savings account.

- Automate a $1 transfer to the Insight Card for every 2 months.

- Sign up for a second, third, and fourth Insight Card and repeat the same steps.

- If you have a spouse, follow the same steps with your spouse.

Answers To Common Troubleshooting Questions With Your Insight Account

I didn’t have any issues when I signed up for my Insight Cards, but we did have some issues with setting up the second card for my spouse. Here are the most common issues that you might encounter when setting up your Insight Card and how to resolve them.

1. Issues Linking Your Insight Card With Your Ally Bank Account.

Some people have reported issues with linking their bank account with Insight. We actually had this same issue when we attempted to set up my spouse’s second Insight Card.

The reason for this has to do with Ally sometimes being unable to pull back the trial deposits from Insight. This can happen because Ally sometimes attempts to pull back the trial deposits before they’ve actually made it onto the Insight card, which leads to the link being rejected. I’ve found there are two solutions to this problem:

-

- Wait a week, unlink your Ally account from Insight, and then relink your Ally account again. You should be able to confirm your account the second time around; or

- Fund your Insight card with a bank that doesn’t require trial deposits or that doesn’t withdraw the trial deposits. Discover Bank is a good one to use for this – you can link your Discover Bank account to Insight, put a few bucks on your Insight card, then link your Ally account to Insight. That way, you’ll avoid any issues with Ally not being able to pull back the trial deposits. Discover Bank has no fees and usually has signup bonuses when you open an account, so it makes it a worthwhile bank account to have anyway.

The other option is to go somewhere and load the card in person. It’ll cost a small fee to load the card in person, but you’ll make it all back with the interest you’ll earn. I’d personally recommend going with one of the first two options I mention above.

2. Getting An Error Message When Attempting To Order Your Second Card.

This probably won’t happen when you’re ordering your first Insight card, but it can happen with your second card. When you attempt to order your second Insight Card, you might receive the following error message:

I didn’t get this error myself when I ordered my second Insight Card, but my wife did. There are three solutions here from what I can tell.

- Wait to see if a card comes anyway. The first is to just wait and see if the card comes anyway. When we got this message for my wife’s second card, I went ahead and kept trying to resubmit the information each day. Every day, I received the same error message. For some reason, the card randomly came about a week later. I’m not sure why it arrived since I kept getting the same error message, but it seems possible that, even with the error message, your second Insight Card will eventually arrive in a week or two.

- Go to a check cashing place to get a card in person. The second solution is to go to a store that carries the Insight Card and get it in person. I haven’t tried to get the card in person, so if anyone is ever successful in doing that, let me know. From what folks have told me, it seems like the best places to find these cards in person are at payday loan and check cashing places.

- Order a card over the phone. The third is to call Insight directly and order a card over the phone. There is a phone number in the comments that folks have used with success. The important thing to do here is, if you call them, make sure you confirm that they put you in the “Pay As You Go” Plan. Seriously, hassle them over and over to make sure that they put you in that plan. Otherwise, you’ll end up getting put in some monthly fee plan and then you’ll have to call them to get them to switch it.

Maximize The Yield On Your Cash

If you follow my steps, you’ll be able to get yourself $5,000 earning 5% interest in an FDIC insured savings account.

If there are two people in your household, you’ll be able to put away another $5,000 more, for a total of $10,000 earning 5% guaranteed interest.

Continue to open up as many Insight Cards as you can for each person, plus open up every Netspend card you can, and a household can put away as much as $50,000 earning 5% guaranteed interest.

That’s good for as much as $2,500 of interest per year. You’d have to save $250,000 if you wanted to get that same interest from a normal high-yield savings account! That’s a significant difference that makes doing this all well worth it. And the good thing is that once these accounts are set up, they require no time on your end. Everything is fully automated and you won’t even have to think about these accounts other than if you want to withdraw money.

Your cash doesn’t have to earn just 1% interest. Follow these steps and you can increase the yield on your cash savings to a point where you won’t be worried about holding your money in cash.

So many people spend time travel hacking and figuring out how to save money in other areas. Why not spend a little bit of time figuring out how to maximize the interest on your cash too? I think you can agree that 5% interest in an FDIC-insured savings account is nothing to sneeze at.

Make sure that you don’t read this post just by itself. Go back to Part 1 of this series – Netspend Account: 5% Interest Savings and $20 Signup Bonus, in order to maximize your 5% interest savings and snag a $20 signup bonus in the process.

**UPDATE (9/6/17): It looks like Insight might be limiting folks to three cards per person. Assuming the limit is now three Insight cards per person, that’s still a total of $30,000 that a household can put away in just these cards. Add another $10,000 in 5% interest savings if you open up all of the Netspend cards as well and things are still looking good for folks like us who want to earn good rates of return on our cash.

Let me know if you’re taking advantage of these 5% interest savings accounts. It’s always helpful to hear from as many people as possible.

Hey Katie, no problems, I doubt the 5$ membership earns any cashback but I always keep 1005$ cuz I don’t count the membership money on it.

Hi Emil,

When filling in the application, I chose the first option for eligibility. I didn’t see the $10 donation option. Now the status of my application is “submitted for review”. I don’t know whether I will get approved. I hope I will. I hope they will not ask me to submit additional government issued documents. Do you know usually how long it takes to process the application? Thank you very much!

Hey Katie, last time I applied I’m almost certain it ask me something like “you got any relative banking with us or do you live in MA? Or donate to become a member” something like that, I don’t recall having to go through a review process but I don’t think it should take longer than 2 bs days, if they didn’t ask you any of it maybe they removed that req? Hopefully

Hi Emil,

Is there a $5 fee to open the DCU account? I deposited $1000, but only $995 is available. The customer service said there is a $5 fee to open the account. But when I applied for this account, I didn’t see any information for the fee of opening this account. Thank you very much!

Hi Katie, this was most likely the donation required to apply, the only 5$ I’m aware of is the 5$ membership required which is not a fee because you can see your balance at accounts, available balance is always 5$ less than current balance because in order to keep the account open you need to leave 5$ at all times, once you close the account they give you the current balance back which includes the 5$ membership which again is not a fee its just to be a member and not leave the account on 0$ like any other regular bank account, if you deposited 1,000 and available balance says 990 and current balance 995$ then yea you were charged a fee most likely the donation I told you about, but if it says 995$ available and 1,000$ current balance then no fee was charged.

Hi Emil,

Thank you for your explaination. I think my $5 difference is the membership. Does this membership $5 also have interest? Thank you very much!

Hi Katie, no need to live in MA, you can join by paying 10$ in reach out for school(part of the application process and is a one time donation) for me 10$ is totally worth it, I use that checking account as main source to autopay for stuff like gym, linked my target 5% cashback red card, while maintaining 1k or less I always earn 6% cashback which is perfect for me.

Did happened to me but I was able to recover the pass with my emaiI, closed all my accounts a while ago since I gave up on hope that they will ever bring the 5% back, I don’t recommend calling cuz they will charge you 1$, try incognito or perhaps you’re using the old website or the wrong email? Also if you tried to recover or login by midnight then their website sometimes don’t even work at that time so try morning or afternoon, They have a new website to log in to their accounts now.. we’ll not like new new but like at least a year old new, insightvisa.com,

Hi Emil, thank you for your reply. With “forgot your password”, I entered my user name, date of birth, card expiration date and security code. But it only shows “Could not find account with information provided”. The website I went to is insightvisa.com. I have emailed the customer service. I hope they can solve this problem for me.

Hi Emil, the email I got from the customer service said I need to call them. After calling them, I was told my account was closed for the second time and there was no way to open it anymore. In June, I got an email saying that they closed my account, moved my money from the savings account to the prepaid account and I was going to get a check for my money. A few days later, I called the customer service, she reopened my account for me. And I took out the interest. Then I thought my account was fine. Two days ago, I found I could not log into my accout again. And this time, my money was not moved from the savings account to the prepaid account. They just closed my account without any notice and without giving my money back. The customer service said she will submit a request to review my account and see what they are going to do with my money. And there is no time frame for this process. If I want to know whether I can get my money back, I need to keep calling them and keep paying for the $1 every time I call. I hope I can get my money back as soon as possible.

Wow… their costumer service really stinks to be honest, but the 5% was worth the hassle, why did you keep any money at all if they’re not paying 5% anymore? Definitely keep track of your money, as far as I know if they close an account on their end they should snail mail you a check in about 10 days or so.

Hi Emil, I totally agree with you. I opened two insight cards several years ago. Later they closed the savings accout, so I took my money out. Then I heard that the savings accout was back, but only available to cards opened at a store. So the savings account in my old two cards didn’t come back. I went to a store to open an account. But the clerk opened the wrong plan. I thought I could close this one and apply for another one, so I closed it. Then I was told, one person can only apply for four accounts at most. Even though you closed your old accounts, there is no way to apply for a new account if you already applied for four times before. So finally I only have this one last account from March last year. And at that time, the interest rate was 5%. But soon it became 1%. I know it is not that good. But I didn’t know any cards with a better rate that 1%. So I just kept this last insight card. Now, I got kicked out without any notice. They are not even sending me a check for my money. Last time in June, when they told me in the email that they closed my account, they said they were going to send me a check. This time, there is nothing. I had to call them to know what happend and got charged the $1 for calling them. The customer service said she would waive the fee for me but she didn’t. I called again for the refund, just got refused and got charged another $1. I dare not call again. I emailed customer service to get the $2 refund. I hope they will help me.

Hey Katie, yea.. their costumer service just keeps worsening, 1% is quite low, you might want to consider netspend, Western union, h e b, Ace elite and brinks, they’re all link to netspend and each has the ability to open a savings account with 5% any up to 1 000$, there’s another one called h e b debit which is not the same as the one I mentioned earlier since it offers 6% on balances up to 2,000$ !and yes! you can have both heb and heb debit opened, just one thing to keep in mind about those 6 accounts, to keep them fee free you have to make at least a 1$ deposit every 90 days or less or you’ll get like a 3$ dormant fee, you can also get dcu which offers 6% on balances up to 1 000$, you can also get porte which offers 3% any on balances up to 15,000 if you have 1,000$ or more direct deposit each month easy req, they’re having a referral BTW 100$ for you if you apply thr this link https://portebanking.app.link/8xLEMqcdmhb, those are all the accounts I currently own which offer great apy up until today, hope that helps since you seem like very interested in getting the most out of your cash, keep it that way, very few ppl like us and Financial Panther who always strive for the very best.

Hi Emil, thank you very much for the information of those accounts with good apy. I will definitely look into them. Now I am more worried about whether I will get my money in the savings account back. The customer service said there is no time frame to review my account. I don’t know if they will really review my account and how long it will take to process the refund check. I really don’t want to lose my money.

Hey Katie, no problems, next time you get in contact with em threaten with filing a cfpb complain or actually file it, banks are scared of that.

Hi Emil,

I tried to apply for the DCU membership. But I don’t live in MA. So it seems that I cannot apply for it.

I cannot log in my insight prepaid card online account. It always shows “Invalid Credentials” though my username and password are both correct. I tried “forgot your password”. But it shows “Could not find account with information provided”. Has this happened to anyone? Thank you very much!

Hi Financial Panther,

Do you have any articles about treasury bonds/notes/bills?

Thanks a lot.

Sorry, don’t really know much about treasury bonds. At my age, it’s unlikely I would use them.

Hi everyone, has this happened to anyone? I got texts saying that I got 5 retail load deposits, $20 for each, at two different times. And there was really $100 deposit in my account. But I didn’t make any retail load deposit. Is it an error from Insight? Or does it mean that someone has a card with the same number? Thank you very much!

I’m not seeing an option to transfer money in my insight account (I still see both prepaid and savings accounts). Is anyone having the same issue or am I just blind?

Nope, you’re not blind. Log into your insight accounts, then put this link into the address bar: https://www.insightvisa.com/savings/transfer

You’ll be able to transfer from there.

Thanks, FP! Am keeping my account open per your suggestion. Hope this come back!

For the ones that still had insight savings earning at 5%. Did the rate just change ? Account terms show as of 7/1/2020 APY is 1% for me now.

Yeah, we got word the rate changed last month. So unfortunately, Insight is done now. I still recommend just keeping them open, especially if you’ve got everything automated already anyway. My reasoning is that we never know what might happen, but always possible this comes back one day. Remember, they got rid of the 5% for everyone before, then randomly brought it back, so it could happen again.

Looking at this decision from a purely business model perspective it seems they will be alienating their own customer base with this move to drop interest rates on savings. With the NetSpend and clones all still paying 5% on $1,000 I can’t see why any of Insight’s main customers “the unbanked” would choose Insight over NetSpend now. As a new debit card using customer I would choose NetSpend over Insight particularly if I didn’t have $5,000 to save in the first place. You would make the same amount in interest by only saving $1,000. If they were smart they would have done 5% on $1,000 and 1% above $1,000 still making them the better choice and without upsetting or losing their existing customers. Now they will probably see a mass exodus.

Thanks FP that’s what I figure as well. I posted about this HMBradley account a while ago over at DepositAccounts and a few people told me they had this MHBradley account and it didn’t actually pay the 3% because they use some type of average monthly balance which cuts the interest rate in half. Please post back with your experience. After reading their FAQ section it left me with more questions than answers.

Just got the July statement and it’s 1% as expected. Well we had a good run boys! I think I’m going to pull the cash out and put it in my add-on CD’s now. What I’m trying to figure out is if I keep the account open with say $10 will I still get the interest from July/Aug on October 1st? I’m thinking yes but the terms are a bit confusing on this. This will be the first time I have withdrawn any money from these accounts prior to the end of the quarter when some of our savings accounts were closed.

As long as your accounts are still open, you should get the interest, even if there’s nothing in it in theory. You’d just only get interest for the days you actually had money in it I would think.

I pulled my funds out, but I’m leaving my Insight accounts open with the automated $1 in, $1 out every 90 days. Last time this happened, a lot of people rushed to close their accounts, then they missed out when the 5% interest accounts came back for those of us that kept them opened. The way I see it, if you’ve already automated your accounts to avoid the inactivity fee, it basically costs you nothing to keep them open in case something ever changes.

As a suggestion for anyone (and I’ll update this post and other related posts), my current plan is max out my Netspend accounts, max out DCU, max out Service Credit Union, and then put the rest into HMBradley for the 3% interest. Everything else continues to be used for bank bonuses, so that gives me a nice emergency fund getting a good rate of return with little work.

Hey guys just a tip whatever you do don’t close your account or pull money out until October 1st! If you do you will forfeit all your interest for the quarter. See terms and conditions here:

https://www.insightcards.com/legal/insightrb_cha_insgpr0620.pdf

Page 12 TRUTH-IN-SAVINGS DISCLOSURES

Effect of Closing Your Savings Account: If you or we close your Insight Savings, we will return all available funds, less any

amount owed to us, to you by transferring the funds to your Card. If you close your Card account, your Insight Savings will also be closed by transferring all available funds to the Card prior to the Card closure. Accrued interest will not be posted to your savings account prior to the closing transfer. Any accrued interest will be forfeited.

Statement still says 5%. Calculation says ~1% for quarter.

It sounds like all insight accounts are now at 1%.

Yeah, my advice is wait to see what posts next quarter. Every bank is at 1% these days anyway, so not really a loss to wait and see if they actually enforce this change. Don’t forget, they got rid of the 5% accounts before for those of us grandfathered in, then brought them back for no reason.

Good advice FP. And like you said 1% might end up looking good for liquid cash in a FDIC insured account with rates dropping to the floor. The July statement should tell us the rate for sure. Don’t they need to send us a email or letter before these changes take effect anyway?

You’d think they’d have to tell us something…but this is Insight, so who knows!

There are checking accounts accounts out there giving WAY more than 1%, so there is a loss to those of us that have access to those. Instead of wasting a whole quarter, the smarter thing would be to check your monthly statement at the end of this month. Allegedly, the drop to 1% took effect July 1, check on Aug 1 if you earned 1% or 5% and then decide what to do.

Yeah, the thing is, the super-high yield checking accounts are a bit of a different beast since they require you to do some actual work each month that isn’t likely to be able to be automated (i.e. 15 debit card transactions). I’ve always compared these Insight/Netspend accounts to normal high-yield savings accounts vs. the high-yield checking accounts that require you to meet certain requirements. Just my opinion though.

Yeah rewards checking accounts have hoops and their rates are dropping as well or they are lowering the cap that earns the higher rate. I’ll be putting this in a 3.5% add-on CD while leaving $10 in the accounts to keep them open in case things change like they have before.

Can I ask where your 3.5% CD is from? Would you happen to know if this is the highest rate available now? Thanks.

I have 6 different add-on CD’s from various institutions. None of them are available currently.

1. NFCU(Navy Federal Credit Union) 3.75% IRA add- on CD $150,000 cap

2. MACU(Mountain America Credit Union) 3.75% youth add-on CD $50,000 cap

3. MACU(Mountain America Credit Union) 3.50% add-on CD x2 $100.000 cap

4. GTE Financial 3.04% add-on CD x2 No cap

I decided to plan ahead after the Obama 0% years as to not get caught off guard with ultra low rates again.

Is there any updated information for someone picking these up for the first time? The last good info I see on here is from April. The only place I can find that physically provides the cards is providing only the green mobile banking card – they said they thought that the reloadable prepaid card was being discontinued. This is funny considering both are still being advertised online…on the other hand, the mobile card is the only one of the two of them to mention anything about the savings account, which it states is at an APY of 1%. Just looking for any updated success stories. I’d have to drive 45 min-1 hr to another town to go in-store if I need to do that. If it’s working, it’s worth the drive; if it’s not working…I mean, I’m really trying not to go anywhere I don’t have to right now, so…

Good ??? One of my cards does expire this month, but hasn’t been replaced yet. Curious if your new card is due to expire, or did they send you mines by mistake.😶

I’ll take a fifth one and dare them to say, Oops. 🏋️

Actually I have 2 cards due to expire this month. Neither of them match this card number. These are my first Insight cards to ever expire. I wasn’t sure if they were going to send out replacements or not. I did have one last phone application hanging out there that was supposed to have been declined since I had the max of 4 but I never heard back from Insight on that one about a year ago.

I have extensive experience with credit cards and they never change your card number unless they need to issue you a new card due to fraud or they change banks. Debit cards however seem to have different rules. I have 2 Netspend cards and they sent me 2 new cards with totally different account numbers so maybe that’s just how debit cards roll.

Question for FP or anyone who may know.

I just got another Insight card in the mailbox yesterday out of the blue. I have not applied for any more cards since hitting the max(4) years ago. I figured that it was just a replacement card except for the fact that it doesn’t match any of my card numbers or even my wife’s card numbers!?! I have never requested any additional cards for any of my accounts but I did get 2 replacement cards that I never ordered years ago and they had the exact same account numbers with a different expiration date.

So my question is that if anyone has received a replacement Insight card has that replacement card been a totally different account number or was it the same account number as the card it replaced with a new expiration date only?

Only 2 scenarios are possible here:

1. This is a totally new and different account(This is what I’m thinking) or

2. They change your account number when issuing new Insight cards to replace expired cards(strange but possible)

Thanks in advance for any help figuring this out.

My cards also just expired I assume and they sent me new ones. I didn’t look at the numbers, because honestly, I just toss them in a drawer and don’t activate them. I think they are the same account – just with different numbers. On a practical level, doesn’t really matter that they change the card numbers since none of us are using the cards anyway.

Thanks for the quick response FP! Well I was just wondering because if this is somehow a “NEW” card and not just a replacement I could create a new username and password and see if the “savings” link is there. Nothing like another 5% account with rates in the banks going to 0%. As far as I can tell the actual card number does not show up anywhere online only the savings/checking account number. So there is no way to tell which “savings” account this card may or may not be attached to. I didn’t want to try and set up a new user name and password until I know for sure. I don’t want to get locked out of one of my existing accounts by accident. I also have never activates any of my Insight cards since I didn’t plan on using them. Now I’m not sure if that was the best move or not.

You can. All of your cards show their routing & account #s on the Insight website. Your new card is attached to a brand new sheet of info that shows the account # at the bottom. Match that account # to one of your website account #s. I just got my new one in the mail and it is a new card # that is replacing the card attached to my very 1st Insight Card.

Cheers,

SW

Thanks SW! Yeah I’m a moron I just found the account number the card is associated with on the bottom of the voided check for payroll deduction. It’s a replacement card for my 2nd Insight card. So apparently they issue totally new debit card numbers when they replace expired cards. Mystery solved I don’t have to call Shaggy and Scooby now. Do you guys recommend activating the cards or not? I’m not using the card either way but I just want to make sure they don’t close any accounts for some type of inactivity.

Well, I suspect….yes? Maybe you should activate it? Because the money goes to Card Balance first, then to Savings balance: “Transfer an amount from Card Balance to Insight Savings Balance.”

Then the “Card History ” dropdown menu shows “Transaction History” & “Spending Summary.” It says “Card” history.

Look, don’t get me to lying. I’m just not sure.

Cheers,

SW

SW: I just got my second replacement card for my first Insight account today and the numbers on the card match exactly. My second account was the one that I opened online where the savings was closed and then reopened so that may be the reason for the different card numbers.

So now I have it figured out. The card numbers should remain the same unless your savings account was closed and reopened in that case you get a card with a different account number. Now I don’t feel so dumb that was a bit tricky to figure out since I had done a fifth application about a year ago I wasn’t sure what was going on.

It appears Insight blocks temporary transfers from other banks. For example, if another bank deposits $0.35 to verify the account, it cannot pull the money back.

This has happened to me twice and includes Ally bank.

I think the problem is that sometimes your bank tries to pull the money back before Insight has it on the card, which is why it gets blocked. The solution to this is to find a bank that doesn’t pull the money back or get some money on the card in advance. I had one of my Insight cards have this problem, where it didn’t work with Ally and then got blocked. I ended up using Simple bank, linking that to Insight, and that worked. Then I just automated $1 in and $1 back out from that Simple bank account into perpetuity. You could try opening an account with Simple and seeing if that links successfully (it’s a free bank).

Thank you DK for asking the transfer question. Thank you Kevin for the solution. I encountered the same problems as DK and glad you got a solution!

Glad it worked! Make sure you bookmark that link!

Hi Financial Panther, for insight cards, anyone can only have at most four applications, right? If you get one card and later you close it, you lose one application opportunity. If you already applied four times, even though you close some of your accounts, you cannot open new accounts any more. Is that correct? Thank you very much!

I think the amount of cards you can have varies and is sort of random. I was never able to get more than 3 cards per person myself. I don’t know what happens if you close an account and if that opens it up for you to get more cards.

Hi Financial Panther, I closed my old cards and tried to open a new card, but I got rejected. The customer service said one person can only apply at most four times. If you applied four times before, even though you close those cards, you cannot be an insight customer any more.

Thanks for the data point! Good for people to know.

Call me crazy, but I can’t figure out how to transfer my savings interest to my prepaid card. I’ve done it easily before, but the option seems to be missing or I’m just blind.

A couple of quarters ago, Insight took away the transfer option. To get to that transfer page, log into your insight account, then go to this link. https://www.insightvisa.com/savings/transfer

It’ll bring you to the transfer page where you can move money back and forth between the card and the savings account. Make sure to bookmark that link so you have it again for next quarter.

I opened an account at a location. But I cannot use the online account. After registering the card with an online account, it said I need to confirm my email. But what it said on the webpage is that “We sent a confirmation email to” then blank. How can I receive an email? There was not my email address there. I went to the location. They said they entered my email when they opened my account for me. They asked me to call the number on the back of the card, which I did. But there are no options to talk to a real person.

I contacted the customer service through the message center asking whether I can enroll in the savings account. They replied that my account is not available for the savings option. I may open a Mobile banking account and create a savings account this way.

I took my money out and left the account open after it said the savings option was closed in 2018. Recently I found people say that it is back, so I checked my account but the savings option is not in my account.

Did you put $10 or more back into your card to see if it turns on the savings option. I have mine back, but I reactivated it about a year ago when people discovered it was back for current users.

I put $20 into my card but it didn’t turn on the savings option. I asked the customer service how I can open a 5% interest savings account I used to have. They said that Mobile Banking is the only card that has the option for savings. Some comment said it only has 1% interest. The customer service didn’t mention opening an account at a retail location at all though the cardholder agreement said that cards opened at a retail location can open a savings account. And they also told me to go to the http://www.insightvisa.com website to sign up for a mobile banking account. But it is only a log in webpage. There is nowhere to sign up for anything.

Hmm they might have closed the grandfathered loophole. I luckily still have all my 5% interest accounts going strong.

Anyone started pulling out money(5k, 1k) from savings accounts(5k and 1k) due to alarming rate of market falling/virus-spread and this prepaid banks may get into possible bankruptcy situation?

Successfully opened a brand new insight account at a check cashing place and activated the 5% interest account today. Have to be attentive though as the first place I went only would let me open the “mobile banking” card (green card) which only comes with a 1% interest rate. Make sure you get the prepaid card (black card). I should have another one coming in the mail too, so I will take the leap to see if it works for the 5% too by chance.

Thanks for the data point. It seems mixed whether opening Insight online works for 5%, so I’m still a little confused about it. My friend opened online late last year and the 5% was working for her no problem.

Can someone verify if this is working (getting the black card for the 5% interest).

I can verify that the Insight black card I ordered online DID NOT get the savings option. I can also verify that the CS agent I spoke to at Insight told me that only the cards obtained through an “Insight partner location” are eligible for savings accounts. The T&C also state this. However, there are a few recent reports of the online cards getting access to savings, so… YMMV. It doesn’t cost anything but time to try and see.

Hello Deklin, may I ask which check cashing place did you open your new insight account? Thank you! I went to Western Union. But they told me that the insight system is down. They only have Green Dot.

I went to Lend Nation first and they had both but would only give me the mobile banking card. Then I went to a Western Union one after calling insight and asking where I could get one in person and they directed me there as well as the Lend Nation I went to.

Were you charged to call the customer service? May I ask which city you are at? Thank you very much!

I was not charged as I did not have a card yet. I was travelling through Chicago and picked one up while there.

Hello Deklin, how did you transfer money onto your account? I tried to use an Ally transfer, but it wouldn’t let them take the money back so that option was blocked. Did you use a different bank for transfer?

I successfully used Ally but looking at my statement they may have taken the debit off of the account before it credited the two credit amounts so if the card is empty you may not be able to execute the trial debit. My card had $10 on it as I loaded it at a reload location. Other than that I am unsure as I was successful with Ally on 2/28. Hope that helps!

The recent comments in the Netspend post indicating that Insight savings is available again have piqued my (and others I’m sure) interest. Although the (prepaid) Insight website doesn’t mention savings, It is still in the T & C fine print at 5%. Since it doesn’t cost anything I set up an Insight account, and funded it, but there is no savings option anywhere on mine. I’d be interested to see more detail from the others who said its live, but I have to assume its dead.

Yep, I’m going to update some posts and write a new post. My friend opened an Insight account a few months ago and confirmed for me that the 5% is working for new accounts as well. Get in on it while the going is good!

If the savings transfer option doesn’t show up, which is the case lately, use this link while you’re logged into your account. http://www.insightvisa.com/savings/transfer

That will bring up the transfer page that lets you move money between the card and the savings accounts – and vice versa.

I tried to manually navigate to http://www.insightvisa.com/savings/transfer while logged in and I got an error something like: “the savings feature is not enabled on this account”, But you’re saying that the savings IS live again? What gives? Why can some access it and not others?

Not sure. Is your savings account not activated at all yet? Possible that it’s not working – Insight is hit or miss at this point, which is why I’ve been assuming it’s dead for new accounts. Old accounts still grandfathered into the 5% interest.

I found this in the cardmember agreement:

“Opening Your Savings Account. If your Card is active and was opened through a Retail Location, you may open an interest-bearing Savings Account through Online Banking…”

Did your friend open the account at a retail location? Mine was online.

Possibly dumb question, What kind of retail location opens these cards?

My friend that recently opened the account definitely did not open their account at a retail location. But again, I’m not exactly sure what the current status of these insight accounts is.

I have another friend that has opened them at retail locations, but he did it years ago – you have to open them at sketchy check-cashing places. He didn’t have a problem doing this. It’s like opening a bank account, just at a weird check-cashing place. He was able to do it because it was next to his apartment.

I’ve checked every check cashing/payday loan place around, as well as in-store money centers, even drug stores but there aren’t any Insight cards to be found.

I tried a secure message to Insight about the savings, but they responded with “you need to call customer service for this kind of inquiry” so I ate the $2 (because the first call was cut off before I got so speak with anyone) only to have the rep tell me that the account must be opened at a retail location to have access to savings. I then asked where I could find one and after she searched using my zip code she returned with “there are no Insight partners near you”. So I guess this is dead, for me at least.

Bummer. Yeah, Insight is one of those things where the status of it is a very much “your mileage may vary” situation. I’m fortunate enough to still have it working fine for me, but it looks like it’s a bit hit or miss whether it’s still active.

I logged into my Insight card yesterday to transfer out the interest only to find the “Transfer” option dissapeared. I sent a secure message informing them of this, assuming it was a glitch, only to be responded with “You need to call us to resolve this.”

Anyone else deal with this?

I posted this in another comment thread.

FYI to everyone. For people that had Insight accounts, it looks like either due to a glitch or on purpose, they removed the option to transfer between the card and the savings account. However, if you type in http://www.insightvisa.com/savings/transfer when you’re logged in, it brings you to the page that lets you move between savings and the card. Will keep an eye to see if this is a permanent thing or if this was just a glitch for some reason.

The tab of transfer shows up today. Very interesting!

Interesting. Maybe was just a temporary glitch that they fixed.

I have a 2nd account I can’t find the link to add savings now. Anyone know the url?

Right FP I have not jumped in on this one yet either. The big plus with this is that it’s 3% for online purchases as well as for the savings account. I already have the Bank of America cash rewards card set to 3% for online shopping plus a 10% bonus for having a checking account with them so 3.3%. For some folks who spend a lot online each month and are not already getting 3% this deal may make sense.

The crazy thing is that I think both of these cards may now be owned by green Dot.

Hi FP maybe you could do a separate post on this.

There is a new card on the market that has a 3% savings account on up to $10,000. The Green Dot unlimited cash back prepaid debit card. First the good news:

1. Earn 3% APY on up to $10,000 in a FDIC insured savings account. Anything over $10,000 earns 0%.

2. Earn 3% cash back for all in app and online purchases UNLIMITED.

3. Deposit cash using the Green Dot app for free

4. There is a $50 sign up bonus

https://www.greendot.com/

Ok now that sounds pretty good but here is the bad news:

1. There is a $7.95 monthly fee which is only avoidable if you spend $1,000/mo.

2. Your interest and cash back rewards including the $50 account opening bonus is only available on your anniversary date so you have to wait one year.

https://www.greendot.com/for-people/our-products/3-percent-unlimited#howitworks

FAQ’s https://www.greendot.com/product-faqs-overview/green-dot-unlimited-cash-back-savings-account-help

Terms and conditions:

https://www.greendot.com/content/dam/greendot/legal/about/docs/gdunlimited3daa.pdf

I have not had time to read through all the fine print yet but it would seem that if we could come up with some monthly MS(manufactured spend) ideas this may be profitable. My first thought would be purchasing a $1,000 CD online at GTE federal credit union(they accept credit card funding of CD’s) while earning 3% and satisfying the $1,000 monthly spending requirement to avoid the monthly fee. It may or may not work but GTE definitely codes as a purchase on my Citibank double cash card.

I’ll have to look into this. Gut reaction is that this is too much work, especially since I’m always working on minimum spend requirements on credit cards, so not sure why I’d ever use this.

Hi guys just a update. It looks like the savings account statements are now available again so we can check our accounts monthly. Last interest posted correctly for all of my accounts(8) on 7/01/19.

I also see the statement for May 2019. Shows 5% interest, so this is good to go for everyone who kept their accounts open. Big news for me and my wife because we each have three and then with Netspend, we’re each able to put away $20k at 5% interest, $40k total for our household. I’m very comfortable with that as my emergency fund.

You go into insight website and click onto the new card they’re offering I believe iS called online banking card, click details and it will show the 1% savings at the bottom

Where did you see the 1% savings? I don’t see anywhere that you can sign up for a card or any info on the savings.

SO I was trying to open the second card. I went to the website: https://www.insightcards.com/get-a-card/. But when I clicked “click here to get started”, it turned into a page where it said: “The requested URL was rejected. If you are receiving this message, your support ID is: 13112641709247422652”. Can anyone confirm whether they can open a second insight card?

Insight 5% interest accounts no longer exist. See my note at the beginning of this post.

WRONG!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3/27/2019

Just logged into my ISC #1 account ( the 1 of 4 that I opened only online, the last 3 I was forced to call in and open) which I never cancelled just in case things changed…and they have!!!! They just offered an “open up saving account” option again!!!!!!!

As you may remember, the call-in accounts kept their savings accounts. The online portal accounts dropped theirs. Now they’re back.

LOOK…

SECTION 3: ANNUAL PERCENTAGE YIELD AND INTEREST RATE. The interest rate for your Insight Savings is 4.88%

with an Annual Percentage Yield of 5.00%. Interest will begin to accrue on the date of deposit. The APY and interest rate

on your account may change. We may change the APY and interest rate on your account at any time in our sole discretion.

It’s back with a $10 min deposit. I just have $4 in there now, but it’s time to get my %5 back!!!!

Cheers,

SW

Wow this is big news for the insight community, I actually find it retarded that insight kept this for so long when interest were below 1% and eradicated it after it went above 2%, a lot of banks are now offering 4 and 5% accounts(with states restrictions of course) so it was only a matter of time before they came back, I wonder if I call in I would be able to open a 4th card XD currently own 3 but will wait for a dp on this cuz now I’m not in a rush cuz I opened a 4% account on 30k and I barely have 5k on it still filling it with salary.

Hm maybe this is for ppl who own a grandfathered account cuz they just updated their website today and indeed they allowed the savings account but with 1% apy on online banking account, most likely will increase with time cu, 1% is ridiculous.

SW,

Did you re-open your savings account? Have you been getting the 5% interest? I didn’t find anything in the terms & conditions about a $5000 maximum like before. Does it mean that there’s no cap to the amount that can earn the 5%?

No, I never closed the card. I had auto refill coming from Ally. $3or5 sitting on the card. I always check the statements to see if they try to charge me for something and low & behold a savings account link reappeared again. I clicked on the link and found the same 5% @ 5k stipulation as before. Loaded it up a few days before ending quarter & got about $2-3 interest.

Thanks for the post SW! I was able to re-open my 2 savings accounts on the cards I kept open. I only funded them with $5,000 in April so I won’t know for sure if the interest is correct until Jul. 1st. The terms look the same to me and I think this only will work for us “grandfathered” folks who never closed their cards. If you closed your cards out last year you are out of luck. New cards only get 1% APY and the same $5,000 cap.

Thanks for the info, guys! Yes, I kept my card open as well, and I do see the 5% in terms and conditions. I’m going to fund it again with $5000! Thanks!

Sounds about right. I kept mine open because I was too lazy to close it when everyone was doom & glooming the cards.

@Carly: Still a $5,000 cap but you bring up a good point. We should keep a eye on the cap for the 1% savings accounts just in case they end up increasing it in the future to say $10,000 for example. Hey you never know, how many people closed out their old cards thinking they were useless last year only to regret that decision now?

Okay, so I’ve been way behind on keeping up with the comments, but I thankfully kept open all of my accounts and am going to move money back into them and see if the 5% interest sticks. If so, this is big. I still have 3 accounts and my wife has still 3 accounts too.

I kept two open and deposited the $5k in each. I can confirm I got a few bucks of interest in the account where I was able to put money in before the end of March.

Wish I could sign up for more accounts of course but so glad I didn’t close these two.

Yes my 1099 came from Republic Bank of Chicago

I read somewhere actually that it’s Republic Bank of Chicago. I did get two from Axiom and three from Metabank which I think are all the Netspend cards. Did you get yours from Insight?

What company name do the 1099s from Insight come under?

I think it’s Axiom Bank.

Hmm… so I received my first ever 1099 from Republic Bank of Chicago despite having had Insight cards for several years.

In any case, I have 3 cards and the interest they reported is $189.75 HIGHER than what I received in 2018 (almost like they have a record of me having a 4th card which I definitely do NOT have, especially with Republic Bank of Chicago).

I plan to call them at (630) 570-7700 on Monday morning. Any other thoughts? Has this happened to anyone else?

I wouldn’t recommend calling to complain, remember that they already killed this deal for most costumers and the one’s left aren’t supposed to be winning, but if you want to take the risk well.. do the math again with all your accounts cuz I don’t think they made any mistake, remember that 5% out of 5k a year is 250$ for each account.

I just did the math on mine and not a single cent they reported higher or less, I got 235.06 for 2018 for all my 3 cards, so go to savings statements and click jan 01 2018 until dec 31 2018 and do the math on all interest posting transaction and you will get your 189.75, do not call them as they might close your account being a grandfathered one, no1 complains on grandfathered accounts unless they want 8t closed.

Their 1099 include interest from 2017q4 to 2018q3.

Thank you all. Just to be clear, my accounts were all closed in July and are no longer active. So I should have only 3 quarters of interest including the interest from 2017q4 that posted on January 1st. But it seems that they reported as if I receive 4 quarters of interest (or, alternately, as if I received 3 quarters of interest on 4 accounts, despite only having 3 accounts). No one in a similar situation then?

I guess, to be clearer, as my accounts were all closed on July 1st, I didn’t receive any interest for 2018q3. Yet, the reported interest on my 1099 seems to include 2018q3 interest for all 3 accounts, despite all 3 having been closed at that point in time and not having received any interest (FWIW, I still have online access to all 3 accounts so I can easily verify that this is the case).

You and all of those that got their account closed after july 1st got their interest posted, unless you closed it before it posted which was a very ugly move on your side(if this was the case)

Yes, but Q3 interest is the interest accrued July 1-September 31st which would have posted on October 1st. At this point, my account was closed and I received no further interest.

In other words, I received 3 interest payments: on 1/1, 4/1, and 7/1. However, my 1099-INT is for $250×3 whereas I only received $180×3.

So it is off by $180, which is not an insignificant amount.

To follow up, I called 630-570-7700 who ended up transferring me to Insight. I spent several minutes on hold and was told that Insight was updating their system, and that I would be sent a 2nd, corrected 1099-INT after the end of January. We’ll see what happens.

Strange their 1099 INT has always been correct for me. Maybe they are adding in interest from the 1099 they forgot to give you from the previous year? Even if they don’t mail you one you are still obligated to report any interest earned though unless it is under $10(anything under $10 doesn’t get reported to the IRS and no 1099 INT’s are generated). Yeah I know you are supposed to report that too but I figure what the IRS don’t know wont hurt me! lol

Thanks sly, as always on the spot, this is the answer I was looking for and couldn’t find, I opened a salemfive account and earned about 2$ or less, closed the acc and never got a statement or 1099, now I know what to do.

You’re right in that I did not get a 1099-INT from RBoC last year, although I still reported it on my 1040.

Additionally, my interest for 2017 would have been $158.63, whereas my 2018 1099-INT exceeds my actual interest by $189.75, so I don’t think that explains it.

Thanks for your suggestion, though.

Also, FWIW, I just pulled my “Wage & Income Transcript” for 2017 from the IRS and it looks like Republic Bank of Chicago DID send the IRS a 1099-INT for me for $158.00, they just somehow didn’t send it to me. So I don’t think they’d include the 2017 interest again in 2018.

After some certified letters with return receipt, faxes, and emails, received my corrected 1099-INT with right amount today.

I just tried to open another one over the phone. I called twice, spoke to two different reps, they said they no longer open them over the phone.

Has anybody else had luck opening them over the phone?

I don’t think they will allow phone applications anymore(or at least they won’t have the 5% savings account attached). The only way to get a new card with the possibility of the 5% savings account would be to go to a “partner location” which would be a check cashing place or payday loan store etc. The only thing I was able to find on where the partner locations might be is here:

https://www.nclc.org/images/pdf/high_cost_small_loans/payday_loans/Report_PaydayLendersPrepaid71515.pdf

you have to scroll down to page 6.

these are the places it mentions as selling Insight cards as of 2015:

– QC Holdings (Quik Cash, The Loan Store, LendNation)

– Approved Cash Advance

– Community Choice Financial (CheckSmart, Cash & Go)

This is not a complete list by far and maybe calling Insight and asking them where they sell them in your state would work.

Thanks Lisa too bad it didn’t work. I figured it was worth a shot. Now if only someone could open a new card at a partner location and see if it still comes with the savings account after loading $10 we would all know for sure if this deal is truly dead for new applicants. Someone over at Doctor of Credit did this but they had 4 cards open, closed 2 and then opened the new one the same day the other 2 were closed. They reported that the savings link didn’t appear but I surmised that it probably takes a while for the computer system to register the accounts as closed. Since 4 cards were the max limit allowed this may have kicked out a computer error not allowing the savings link. So this is still not a definitive data point. I am guessing that a new card would still have the savings account attached in order to compete with the Netspend line of cards that do. You have to remember that the main focus of these cards are the “unbanked” who may not have access to a traditional savings account at a bank. Here is the thread:

https://www.doctorofcredit.com/insight-is-only-closing-5-apy-accounts-opened-online/

I loaded 10$ to an account which previous had the savings acct closed by insight. There is no option to transfer money to savings. When clicking on transfer money under savings tab it simply says you are not enrolled in savings.

I feel bad for FP after writing all this up and helping all of us out he has all 8 of his 5% accounts shut down! I hope everyone at least used his Netspend referral link to give him $20 for his efforts. I would like to personally thank FP once again for his great write up as I would not be earning 5% without it.

Haha, don’t feel bad for me! Just happy that people opening it up in-person are still getting the 5%. I kept all of my insight accounts open just in case it ever comes back, since I have everything automated anyway.

What’s funny is that this Insight post used to be my #1 highest visited post, then after Insight was killed, it dropped to nothing. Oh well.

Hi FP! Just a update for anyone else who still has a Insight savings account. It looks like they have updated their website and the estatements are no longer available(maybe just temporary?) just the transaction history. So no way to tell if we are still getting 5% other than the updated savings agreement at the bottom dated Revised 01/29/2018 which states the account is still earning 5% APY. and that a statement should be available on the website. My November statement showed I was still earning the correct interest. Hopefully we will get a new Dec. statement in order to verify.

That’s a very good observation as always sly you’re one step ahead of most of us, indeed the old web is down and this new one is more complicated as it doesn’t show the monthly interest no more, not even on statement, Jan 1st we’ll get a taste of what they did and hopefully the interest does post, otherwise will have to scavenge on around 3% savings which on my opinion makes no sense that this account’s been open with 5% since regular savings gave less than nothing and now that interest is rising they want to make it harder, shouldn’t the opposite be on track? Just my thought

I totally agree. You can now get 2.5% APY on liquid cash at EBSB direct(FDIC insured) and 2.788% APY over at GM right notes(non FDIC insured) with basically no cap. Short term CD’s at Andrews FCU 8 month 2.86% APY and Inova FCU 3% APY for a 1 year CD. It should be easy to get 5% on a $5,000 capped account by now without the debit card hoops and direct deposit requirements of so called rewards checking accounts. Soon we may be able to get 5% on 5 year CD’s again. There were some 4-5% CD’s out earlier in the year already. It’s funny that for around 30 years 5% was like the typical joke interest rate that all banks paid on savings and if you looked around you could find 6-7% MMA’s/CD’s. Now 5% is like the holy grail of interest.

I just received my 5% apy, check out yours pals, insight is still popping.

Happy New Year! Good to see the interest post today. Still no monthly statements though maybe Jan. will have one. Ohhhhh my aching head! lol

That’s so awesome that Insight is still popping. To confirm, this is just for people that opened up insight accounts in person, right? Like my insight savings accounts all got closed because I opened them all online.

In person at a partner location and also by phone. Apparently I had opened only 2 accounts online and the other 6 by phone. I still have about $32,000(with interest) earning 5% at Insight plus some Netspend cards. There has still been no definitive data points on whether or not a new Insight card from a partner location still has the savings account so that may be worth a shot if someone feels adventurous. These are dead by phone for sure though. I still have 2 Insight cards with no savings accounts and I will load $10 on them to see if the savings link comes back as they have just updated their website and who knows maybe I’ll get lucky. Another great option is DCU credit union 6.17% on up to $1,000 I’ll be opening up this one next.

https://www.dcu.org/personal-banking/savings-reg-shar.html

Yeah, let me know about whether the $10 load works. I kept all of my insight accounts open just in case, and I see that there is the savings option again.

I don’t remember why I haven’t done DCU yet because that one seems like a no-brainer also, but I haven’t done it yet for some reason. There’s no hard pull for it right?