I’m always on the lookout for good high-yield savings accounts and I recently found one that I think is the best high-yield savings account option currently out there. It’s called Raisin and when you open a Raisin account, you gain access to 40 banks and credit unions, most of which are offering high-yield savings accounts with 4.30% interest or more (Current highest rate: 4.35%). Perhaps most important, Raisin is free and all of your funds in Raisin are FDIC-insured or NCUA-insured. This makes Raisin a no-brainer account that – in my view – everyone should open.

Taking advantage of these mega-high-yield savings accounts is one of the first things I recommend people do when setting up their money system. Years ago (back when high-yield savings accounts offered interest rates of about 1%), I wrote about how I maximize my cash savings by using 5% interest savings accounts from Netspend, DCU, and others. These accounts still exist today, but their value is fairly muted at this point. With all of the better options out there, I no longer recommend anyone jump through the hoops of opening multiple 5% interest accounts to maximize their cash savings.

The great thing about Raisin, however, is that, unlike the original 5% interest accounts that I used to recommend, Raisin doesn’t require jumping through any hoops. Opening a Raisin account takes minutes to complete and as I mentioned before, it’s free and all of your funds are FDIC-insured.

With all that said, in this Raisin review, I want to go over what Raisin is, discuss how it works, and explain why I’m now using Raisin to store my emergency fund and any other cash savings I have.

What Is Raisin?

At the outset, when I first discovered Raisin, I was really confused about what it was. It advertised itself as a one-stop savings marketplace for different banks and credit unions, which in itself, doesn’t really tell me anything. Was this a bank account or was it some sort of list that showed you the banks paying the highest interest rates? I wasn’t quite sure.

Once I opened my Raisin account though, it became far more clear to me what Raisin is. The short of it is that Raisin is a platform that allows you to save money in different banks and credit unions from a single website. Here’s what Raisin says on their website:

Raisin is not a bank. It is a digital savings marketplace where you can fund federally insured deposit products with a wide range of maturities and APYs (annual percentage yield) offered by our partner banks and credit unions, allowing you to design a savings strategy customized to your earning and liquidity needs.

Source: https://www.raisin.com/en-us/faq

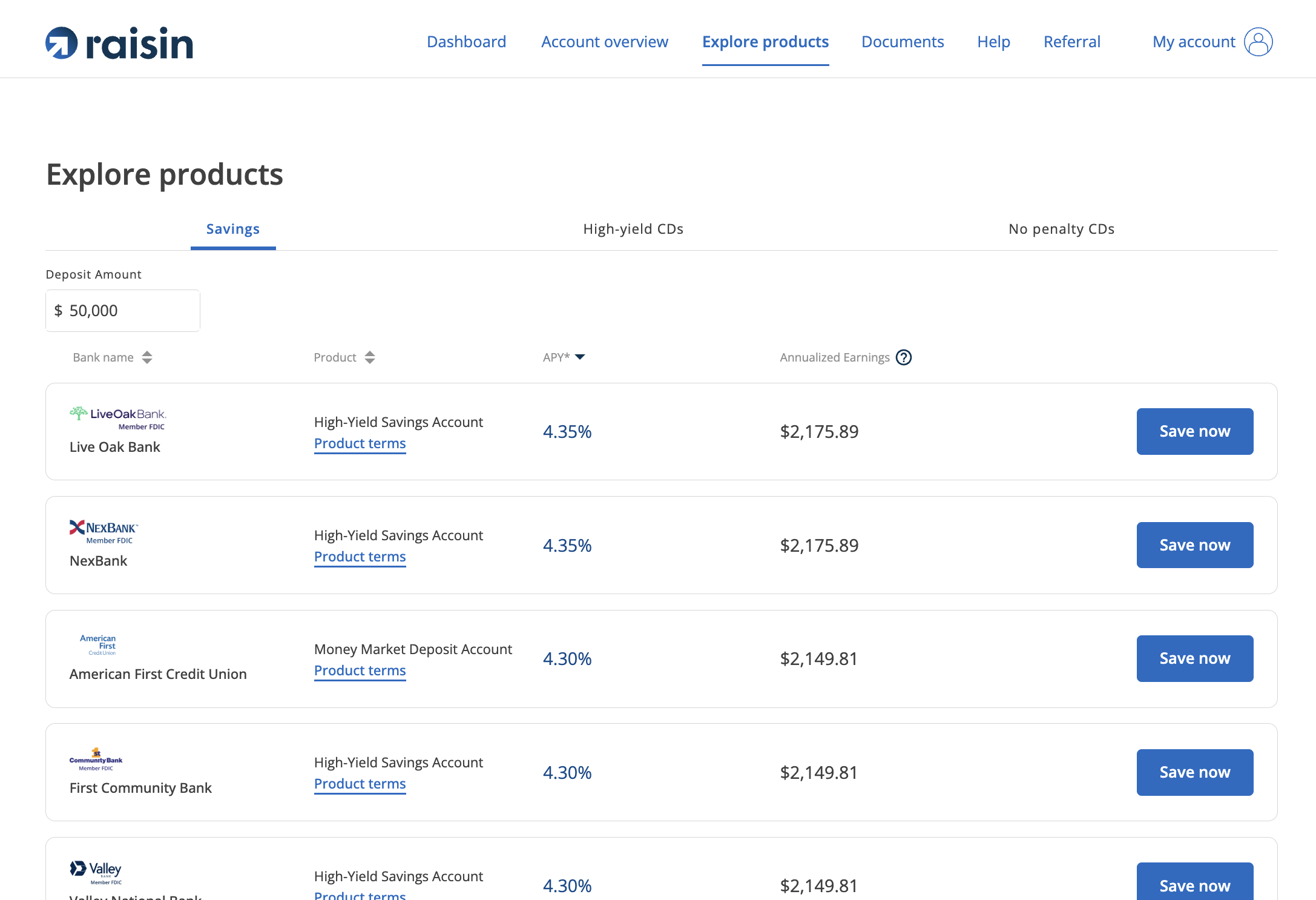

When you sign up for Raisin, you’ll be able to choose from different savings accounts offered by banks and credit unions that are on the Raisin platform. At the time I’m writing this, the majority of banks and credit unions on Raisin are offering high-yield savings accounts with 4.30% interest or higher.

To use Raisin, you first create a free account, then pick one of the partner banks on the Raisin platform. This becomes the bank that you store your funds in. Below is a screenshot from my Raisin account with some of the partner banks.

Once you pick a bank, you deposit your funds directly onto the Raisin platform. These funds are then kept in a custodial account with whatever bank you chose.

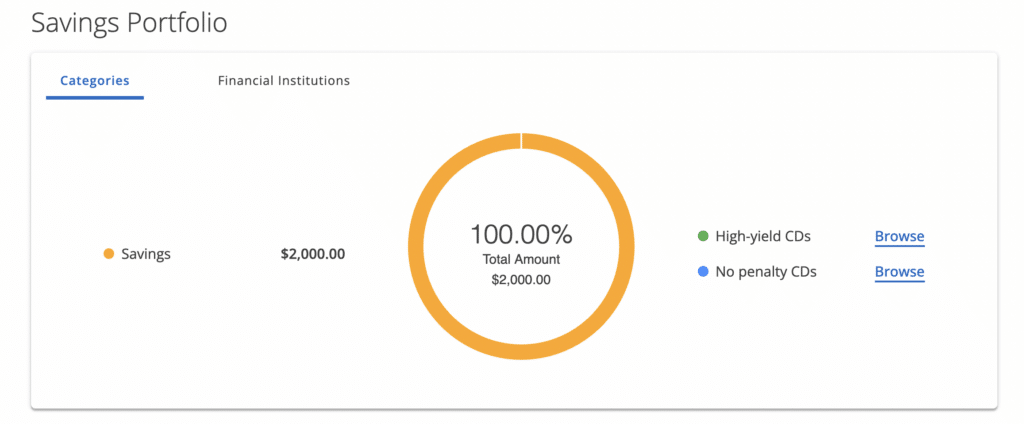

Your Raisin account functions exactly the same as any high-yield savings account and you can see your balance and withdraw your money from Raisin at any time. If you’d like, you can also open savings accounts with multiple banks, but you’ll still be able to see all your money in one central place via your Raisin dashboard.

How Raisin Works

When you deposit funds in Raisin, all of your funds are kept in a custodial account at whichever bank (or banks) you choose on the Raisin platform. All of your funds are FDIC or NCUA-insured, which means your funds are insured up to $250,000 at each bank.

Raisin has a helpful FAQ on its website that makes it clear that even in custodial accounts, funds are insured via pass-through coverage. Specifically, Raisin states the following:

Although Raisin customers’ deposits are pooled in omnibus custodial accounts, there is no impact on the eligible deposit insurance coverage you receive from the financial institution holding your savings. This is because the government entities providing federal deposit insurance — the FDIC for banks and NCUA for credit unions — permit pass-through coverage. So your money has the same coverage in a custodial account as if it were held in an individual account in your name.

Source: https://www.raisin.com/en-us/faq

Importantly, what makes Raisin a winner for me beyond being easy to use is that it charges no fees. So how exactly can Raisin offer their product with no fees?

Raisin explains it clearly on their website. The partner banks and credit unions pay Raisin to market their products to customers. For banks, this is part of their marketing expense. In return, they gain more deposits to their banks when customers find them on Raisin and choose their bank to save their money into.

Which Bank Should You Choose?

To get started with Raisin, you do have to pick a bank to put your money into. And with 40 banks and credit unions, it can be a bit confusing.

When I first opened my account, Western Alliance Bank had the highest interest rate, so I opted to use them. They’re also a large regional bank, so I figured it was probably a good option. That being said, I don’t think it really matters which bank you pick, as for the most part, all of the banks on the Raisin platform offer about the same interest rate.

It looks like Western Alliance Bank stopped taking new customers on Raisin, but there are still dozens of other banks offering 5% or more interest. CloudBank 24/7 is one option currently offering the highest rate (4.35%) on Raisin from what I can see.

But again, my suggestion is to not overthink it. The difference in interest rates between most of the banks on the Raisin platform is 0.05%. That’s an insignificant amount that won’t make any practical difference in how much interest you earn.

One question you might have is what happens if a bank offering a high-interest rate stops taking new customers. Interestingly enough, even if the bank stops offering the rate to new customers, you still keep the same rate. So while Western Alliance Bank stopped taking new customers at the moment, I’m still earning over 4.30% interest from them.

Using Multiple Banks On Raisin

Most people will probably only need to open a Raisin account using one bank – so pick a bank and go with that is what I’d say. That being said, there are three reasons why you might want to use multiple banks on Raisin.

The first is if you have a lot of money you want to set aside. Your funds are insured up to the federal limits (which is $250,000 per bank). To help protect your funds from possible bank failures, Raisin actually sets a $250,000 limit on how much you can deposit into each bank. So, if you have a lot of money to set aside, you’ll have to use multiple banks if you want to get all your money into Raisin.

The second reason you might want to use multiple banks is if you want to set up different sub-savings accounts. Raisin, unfortunately, doesn’t have a feature that lets you set up different sub-savings accounts. Instead, when you put your money into Raisin, it’s all shown to you as one big pool. However, if you want to differentiate your cash savings, you can use multiple banks, and then separate your money into each bank. You’ll be able to see how much money you have in each of the banks you’ve opened, which will make it easy for you to differentiate your savings into different buckets.

Finally, the last reason you might want to use multiple banks is if another bank ends up offering a higher interest rate than whichever bank you initially picked. However, I would only bother with this if the interest rate change was substantial. Most of the time, you won’t have to worry about this.

Raisin Review – Final Thoughts

Right now, with interest rates where they are, I think it makes sense for everyone to maximize their cash savings. I have no idea if this is the new normal and if interest rates will stay where they are, but if they do, you should take advantage of it. Banks should pay you for the money you keep in their accounts, and Raisin is a great way to make sure you’re getting the most out of your cash savings.

For me, Raisin is the perfect spot to put my emergency fund, allowing me to maximize my cash savings while still getting an excellent return on it. I haven’t yet used it to create different sub-savings accounts, but I’ll likely do that as well at some point.

For everyone, I absolutely recommend Raisin and think, at a minimum, this is where you should put your emergency fund. There are no fees, your money is safe and federally insured, and you can access your money at any time. My experience with Raisin has been great and I’m glad I found it.

If you want to sign up for Raisin, you can use this link to get started (my Raisin referral code is kevinh012937).

As always, if you have any questions, feel free to comment below or send me an email. I hope this Raisin review was helpful.

What’s the difference between doing Raisin and just opening a savings account directly with the bank itself?

Great insights on the Raisin platform! The 4.35% interest rate is definitely tempting. I appreciate the clear breakdown of how it works and the potential benefits for savers. Looking forward to seeing how this compares with other options in the coming year!

Have you ever thought of using the corporate debt accounts for savings? GM Right notes, Dominion Energy reliability investment, Ford interest advantage…etc. They all pay 5.13% currently and some can also be used as a HUB and bill pay accounts rather than a 0% checking for bills paired with a high yield savings account. They also have no 6 withdrawal per month or ACH transfer limits and allow check writing at $250 and above as well. Their rates are always among the highest yield without having to constantly switch accounts. These are not FDIC insured but nobody has ever lost a dime in any of them to the best of my knowledge. I have been using these type of accounts for savings since the 90’s.

Something I don’t see mentioned is whether the accounts through Raisin have limits on the 5% like Netspend and DCU do, such as 5% up the first $1,000.

No limits. You can go as much as you want.

I just started using Acorns and they have a 5% savings and 3% checking. I have to do $250 a month in direct deposits a month to waive the fee but so far I’m liking the roundup feature and the APY is nice.

Thanks for the tip about Raisin. This one post made following you pay off for me. I did not see a referral link in your post so I signed up directly.

I use Raisin and have been happy with the various CDs I’ve opened from different banks. It’s easy to set up your account, and easy to connect your funding bank account and then to open various CDs or bank accounts from there. 🙂

I’ve actually made the determination recently with these high interest accounts that I need to find a high interest hub account. I have so many random accounts with various banks but would rather have everything in one central place. I am an envelope saver. This might be a good solution for me. How easy is it to setup recurring transfers from one to other multiple accounts within raisin? Is there a maximum number of accounts you can have in raisin?

Far as I can tell, there’s no way to set up recurring transfers within Raisin unfortunately. Or at least, I don’t see anyway to schedule it in advance. So yeah, that’s a bummer.

Do you still have an Ally account?

It looks like it would be best to move all my funds from Ally to ( through)

Raisin.

I still use Ally as my primary checking account and for short term savings. My emergency fund goes into Raisin though.

Why? I don’t understand why people are using any checking account other than T-Mobile Money. You don’t have to a T-Mobile account to receive 2.25% APY with no fees. There are only two drawbacks that I know of. One is that they hold funds a few days when you initiate transfers on TMM’s platform pulling funds from external sources, but not if you send the money from elsewhere to your TMM account.

The other issue is that we cannot set up recurring transfers for every other month. Other than that, you get 2.5%APY for CHECKING account! Make as many withdrawals as you need, you still get 2.5%APY, and no 6 withdrawal limitations!

These accounts are 5% though. Also, congress got rid of Reg D two years ago, so there’s no 6 withdrawal limitation anymore on savings account – at least not by law anyway. If your bank is still doing a 6 withdrawal limitation, that’s them screwing you over.

Not Ally. I’m referring to the accounts we use to fund these others.

And btw, I just stumbled across something that I immediately thought of you, and I wonder if you’ve heard of it, and or researched it. It’s called Save and currently advertises up to 9.49% APY (variable). Their site says it’s “A New Way to Save. Get market driven yield instead of interest. Deposits insured by Webster Bank, N.A., Member FDIC. Your cash is never put at risk. Investments are made in your selected portfolio. Yield is taxed as a long-term gain, Open Account Market Savings 5-year term 9.49% APY.

I don’t know if I can post a link here, but I’ll try:

https://joinsave.com/marketsavings-lp-v6?utm_source=google&utm_medium=cpc&utm_campaign=CF~SAVE~AU~Brand~KT~Save~MT~Broad~&utm_term=save%20account&utm_content=KD~Account~&gad=1&gclid=Cj0KCQjw06-oBhC6ARIsAGuzdw3OZ0UDfS7v1U9Qdizx6DWwVkbwceQwvPv7pDdj7HbEt93vVo3N1rIaAgrZEALw_wcB#ref-bt-2

I don’t see my replies to you that I left a little while ago. I had tried to leave two since one of them was a url for you to check out. Apparently the one overrode the other, and the latter was removed, because I don’t see either.

I had replied that in my original comment, I was referring to T-Mobile money in place of accounts like Ally, to send money back and forth to NetSpend since TMM is a checking account that gets such great interest (for a checking account) and is not limited to only a few withdrawals each month that savings accounts do. The point is it’s a checking account with 2.25% interest. I know of no other checking account that offers that.

But then, I also mentioned about SAVE, which is a sort of savings account (“banking with market returns”) that gets up to 9.49%APY variable. I posted the url to you, but I’m guessing that’s why the messages were removed. I was hoping you might want to check it out and then provide feedback.

I don’t know how to point you to it other than the url. Maybe joinsave dot com?

Thanks for all the help you’ve given over the years.

Redneck bank has paid like 5.35% on checking for awhile now. Just takes 10 debit card transactions a month, so $2 in gas at the start of every fill up. Been with them for years.

Isn’t that still more work than Raisin though?

Never mind. I found a YouTube review about Save that didn’t look too good. Pretty bad actually. Oh well, it was a thought.

Thanks again!

Yeah and I find that most banks are still screwing us with Reg. D lol

Try Redneck/All America bank Mega Money Market account. Unlimited linking of external accounts for ACH transfers, the interest rate stays fairly competitive it’s 4.4% currently. Internal ACH Transfer limits $5,000 per day or up to $50,000 per day with a phone call. No monthly limit. No ACH limits on external 3rd party ACH transfers. I use this as my high interest HUB along with Dominion Energy Reliability Investment which also has unlimited linking of external accounts for ACH transfers and pays 5.13% APY currently. The latter had no FDIC coverage however.

Thanks, i will look into this.

Did you close out your netspend accounts?

I just kept them open with nothing in them. I have my $1 in and out every quarter automated, so it doesn’t really matter for me to keep them just in case.