Chime is a free online bank that offers a $100 referral bonus if you open a new Chime account using a referral link. To earn the $100 referral bonus, you need to do the following:

- Open a new Chime account using a referral link (here’s my Chime referral link).

- Make a direct deposit of $200 or more within 45 days of opening your account.

- The $100 bonus posts to your Chime account within 2 business days of meeting the requirements, but typically posts instantly once the requirements are met.

When it comes to bank account bonuses, Chime is one of the easier banks out there and because of this, it’s one of the first bank bonuses I recommend for anyone new to the world of bank account bonuses. Here are the main reasons why:

- No Fees. Chime has no minimum balance requirement, as well as no monthly fees or maintenance fees. Since Chime has no fees, this makes it a very easy bank account to manage.

- Bonus Terms Are Easy To Meet. The terms you have to meet to earn the Chime referral bonus are fairly easy to meet, making this one of the easier bank account bonuses out there. The account requires a $200 direct deposit to earn the bonus, which at first glance might seem difficult. However, the direct deposit requirement can be triggered via ACH transfers from most banks (more about this later in the post)

- Bonus Posts Instantly (Or At Most, Within 2 Business Days). Some banks have a long waiting period before your bonus posts. Chime, on the other hand, states that your bonus will post within 2 business days of meeting the direct deposit requirement. In my experience, the bonus usually posts instantly.

- You Can Refer People With Your Referral Link. A big thing about Chime is that once you open a Chime account, you get your own Chime referral link. You’ll earn $100 for every person you refer to Chime and the person you refer will also earn $100 once they open a Chime account with your link and meet the bonus requirements. This makes Chime a very profitable bank account if you have people you can refer with your referral link.

With all that said, in this post, I’ll walk you through exactly what you need to do to earn the $100 Chime referral bonus, as well as provide some additional strategies to make your bonus go even further.

But first, some background about Chime before we get started.

What Is Chime Bank?

Chime is an online bank account that you can access through the Chime app or Chime website. The most important thing about Chime is that it has no fees. This includes no minimum balance requirement, no monthly fees, no maintenance fees, and even no overdraft fees.

Chime is a fintech company, which also means that it has a good mobile app. Among the banking apps, I’d consider Chime one of the nicest and most intuitive ones.

Another interesting feature of Chime is how fast it posts transactions. Direct deposits and transfers into the account post 2 days early, which is nice since it means you get access to your money sooner. Other banks do this now, but Chime was one of the pioneers of early deposits. In the past, I’ve used Chime as a bank account for all my gig economy earnings. All of my earnings went into my Chime bank account and it was nice that my earnings were deposited faster.

Chime Bank $100 Referral Bonus: Step-By-Step Directions

With that background out of the way, let’s look at how to earn your Chime referral bonus. The process should only take you a few minutes to complete, making this bonus well worth your time.

Here are the step-by-step directions to earn your $100 Chime referral bonus.

1. Open Your Chime Account Using A Referral Link. To earn the $100 Chime referral bonus, first, you need to open a Chime account using a referral link. Here’s my referral link to open your Chime account. Opening a Chime account should only take a few minutes.

2. Complete A Direct Deposit Of $200 Or More Within 45 Days Of Account Opening. The next step is to complete a direct deposit of $200 or more within 45 days of opening your Chime account If your employer allows you to change your direct deposit for your paycheck easily, then I recommend doing that. My wife uses Gusto for her payroll, which makes it really easy for us to switch banks for direct deposits (we just log into the Gusto website and add whatever bank we want).

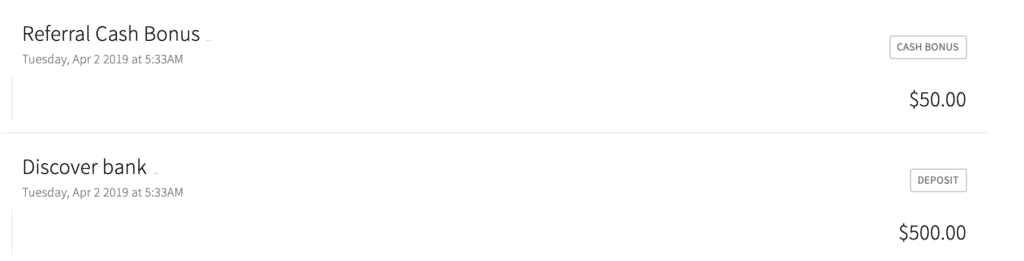

While the terms do say a direct deposit is required, in practice, there are a lot of ways to make Chime think you met this requirement, even if you don’t do a “real” direct deposit. In the past, an ACH transfer from almost any bank account would immediately trigger the bonus, but unfortunately, it seems like Chime has tightened up this requirement a little bit. Back when I did the bonus, I did an ACH transfer from Discover Bank, which instantly triggered the bonus. Some people online have said Discover still works but others have said it doesn’t. If you have a Discover Bank account already, I’d recommend doing an ACH push from Discover to your Chime account to see if it works.

Another data point from Reddit suggests that doing an ACH push from Novo will trigger the direct deposit requirement. This is good because Novo is a business checking account that I personally use and recommend. Even better, Novo has a referral bonus too, so you can open a Novo account, earn the bonus from it, and use it to trigger the direct deposit requirement with Chime. Here’s a post I wrote about Novo and how to earn the referral bonus they offer: Novo Bank $40 Referral Bonus – Step By Step Guide.

Finally, I’ve seen data points that say an ACH push from Wells Fargo works to trigger the bonus. Transfers from brokerage accounts may also work, so if you can do a transfer from Fidelity, Wealthfront, Webull, SoFi Invest, or other similar brokerage accounts, it can be worth a shot.

If the method you use works, the bonus should post very quickly (usually immediately after you complete the transfer). If you don’t see the bonus right away, that means your method likely didn’t work, so try again with something else.

Remember, do not contact Chime to ask them about the bonus if you didn’t do a real direct deposit.

3. Once The Requirements Are Met, The Bonus Should Post Within 2 Business Days. Once you trigger the direct deposit requirement, the bonus should post either instantly or within 2 business days. The majority of the time, it should post immediately. However, since the terms say it can take 2 business days, you might need to wait 2 business days to be sure. If you don’t see the bonus within that time frame, it means the method you used to trigger the direct deposit requirement didn’t work, so try doing a transfer from another bank.

Remember, you need to do an ACH push into your Chime account to trigger the direct deposit requirement. This means logging into your non-Chime bank account, linking Chime to that account, and then pushing the money into Chime from that external account. You don’t do anything from the Chime interface when trying to meet the direct deposit requirement.

Pro-Tip: Refer Your Friends And Earn More Chime Referral Bonuses

When you open your Chime account, you also get your own referral link that you can use to refer other people to Chime. You can currently get $100 for every person that you refer to Chime, up to $1,000 per calendar year.

If you have a spouse or partner, you can refer them and have them follow the same process to earn the referral bonus. They’ll earn $100 for using your referral link and you’ll earn $100 for referring them.

Someone with a two-person household can currently earn $300 with just a few minutes of work. You get $100 for opening your account. Then you get $100 for referring your spouse or partner. And then your spouse or partner gets $100 for using your referral link. This makes Chime a very easy $300 net gain for a two-person household.

Final Thoughts

Chime is an easy bank account bonus that is a good introduction for beginners new to the world of bank account bonuses. Since it’s a completely free account, you don’t have to worry about managing the account or doing anything with it. I would typically recommend keeping your Chime account open forever so that you can use it for referring people.

The entire process to earn this bonus is really fast, so you should be able to earn your $100 Chime referral bonus with just a few minutes of work. You can open your Chime account and earn your bonus using my Chime referral link.

If you have two people, you’ll make $300 with just a few minutes of work. This makes this referral bonus well worth doing.

If you’re interested in diving deeper into the world of bank account bonuses, I highly recommend reading my Ultimate Guide To Bank Account Bonuses, which tells you everything you need to know about bank account bonuses and how they work.

I managed the $100 Chime bonus for myself using Park Community Credit Union; however, trouble was found when working the bonus for my husband. We’d transferred deposits via ACH from Park and Chase without success. As we were about to create another transfer from another financial institution we activated the debit card that had arrived a few days earlier – then Bam! Bonuses for both of us instantly deposited to our Chime accounts. I guess that’s part of the fine print and systems. We missed that. Now you know to activate that debit card as soon as it arrives.

My friend opened an account and forgot to use my referral link. Can we still get the bonus?

I opened an account and forgot to use my daughter’s referral link. Can we still get the bonus?

What happens if the referred stops direct deposit after they receive their bonus? I am bit worried that they will take my bonus back because my kid doesn’t like Chime.

Has this ACH transfer from bank account worked recently?

Update, what triggers the ACH as of March 2023?

Yes will this still work 2023

hello

does the varo bank can Trigger reward?

Hello Also is this still active?

Yes it’s still active.

Hello! I used the link and pushed the $200 from Capital One 360. It didn’t seem to post instantly. Has Capital One worked for anyone else?

Also is this still active? I clicked on the link above in this article to get the $100 bonus

Yes, it’s still active.

I doubt it! I had my sister open an account and she deposited money from her main bank account and they said that didn’t qualify. I haven’t had luck in this area at all!

If it doesn’t work with one bank account, try it with another. Most banks still trigger the direct deposit requirement. You’ll know if it worked because the bonus posts within a few days at most. If it doesn’t, it means it didn’t trigger, so try another bank account. Don’t call the bank if you didn’t do a real DD because of course they’ll say it doesn’t qualify. I recommend you read my post: The Ultimate Guide to Bank Account Bonuses to get a better understanding of how bank bonuses work.

Does Bank of America work?

Try it and see. BoA is not great though because I think they charge you a fee for ACH transfers.

Hello,

I’ve commented a couple of times but haven’t heard anything back yet. Can you please send me the phone number and email address for the account so that I can cash out on the $100. This is the link that I used as referral when signing up for Chime, and even if he is maxed out on bonuses on his end, it won’t take much time to pass this along and I will be able to receive the $100 bonus which would be a huge help for me right now and which I was banking on. I would really appreciate it. Please and Thank You. Let me know if there is anything you need from my end thank you.

Send me an email

Ok so in order for the person who referred me to get his $100 plus for me to get my $100 we just need to deposit $200 or do we have to deposit $200 and set up for my work to transfer my checks to chime too?

My sister and I did this. She used her bank to transfer the money into chime and it did not work at all. I’ve heard so many people say it worked for them but not for us and she did it through her bank the same day. So in order to get the money it has to be from your job or some other type of direct deposit.

Try a different bank. It still works fine. You don’t need a real direct deposit. What bank did you use?

When I go to the Chime website, my Rakuten Chrome extension asks me to activate $50 cash back. I found this odd since you don’t buy anything on Chime. I went into the Rakuten extension and it indicates $50 for Chime Direct Deposit. This indicates can get $150 total when you add this cash back to the referral bonus. I have never seen this before!

Hey– I tried using the Chime promo code and they are asking for email and phone number for the account since the referral link wasn’t used.

Pushed $201 from my Ally and it landed on Jan 5 coded as a P2P, no bonus posted. I guess I’ll have to try another bank? I just started this last month and have about 7 accounts open so far and have used Ally for all of them. It will be really annoying if none of them work for the bonus 😖

Yeah, you’ll need to try another. Thanks for the data point. Let us know which one works for you.

So Ally did not work, but Wells Fargo did. Got the bonus as soon as it posted. You must be stacking cash with all these referrals 😉 I’m still waiting for the bonuses on all my other accounts now….

Glad it worked. So it seems like Ally doesn’t work anymore, but glad to see other banks are still working fine.

Hey panther sir. Chime just sent me a push telling me it’s now 100 and 175…so if referring my spouse that would be 275!!!( Any idea if this still works 2023 April. It also says the payment can come from a gig payer…..does that mean i can hire myself in fiverr and transfer the momey from there ty in advance.

Same experience for me with Ally and not getting deposit bonus. I did get the $100 referral bonus.

So I tried doing it by transferring my money from capital one checking to my chime account and they are giving me a hard ways to go. Is there anything special I have to do to earn the deposit?

Try a different bank

I just wanted to say for anyone who tries that Navy Federal CU is classified as a p2p transaction and not an ACH direct deposit with Chime. Chime also states the following after reading more on the transfer: “Bank ACH transfers, Pay Friends transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, and cash loads or deposits are not qualifying direct deposits.” Note sure if Plaid is the processor for the transactions somehow as well as the verification process to log in and link banks, and somehow flags bank-to-bank transfers now more easier? Anyways, I will try the Capital One 360 account since you have it listed also.

I did a chase online ach transfer and my money deposited but I still haven’t received the bonus and it’s been 8 hours. Should I be worried?

Did you initiate from the chase website or from the chime website.

Chase

If you don’t see anything within a day or two, then try again with a different bank

The Chase website but it lead me to a chime login from there

I opened a chime account, but there is both a spending account and a savings account. My Ally account sent to microdeposits to the spending account which I confirmed and my account was linked. However, Ally can’t pull them back and I got a notice from Chime that there weren’t enough funds. I tried to move them from the spending account to the savings account, but the minimum transfer is $1.

I am in the process of sending $200 to the Chime account to get the bonus and wondering where the money will wind up.

Did I open the account incorrectly?

I think you’re fine.

I can confirm that everything worked fine. I instantly received the $100 bonus upon my $200 Ally transfer hitting my Chime account. I have also sent my referral link for my wife to open an account and Chime instantly sent an email saying an account was open and the additional $100 bonus in my account was pending a deposit in my wife’s account.

Thank you again for all you do to make us aware of these bonuses, Kevin. I have also been able to build (and still adding to) emergency savings for the first time in my life utilizing Netspend. Everything has worked perfectly.

You provide valuable resources!

Hi, does anyone know if Navy Federal will work? Thank you.

Yeah it should work. If it doesn’t, try another bank. But I can’t see why it wouldn’t work.

Navy Fed does not work.

I tried to connect my Chime account (accounting/routing number) to my Discover account to initiate the transfer, but as soon as I added my Discover account was locked. Discover rep on the phone said that Chime is under Bancorp Bank, and they’ve blocked all transfers to Bancorp Banks from Discover. Is this true if so, how recently was this rule made? I might be out of luck in this case.

No clue if this is true – or for that matter why Discover would block all transfers to Bancorp Banks.

If true, just use another bank though. It’s not a big deal.

Do you know if this offer can be repeated again after the account was closed? And if so, after how long?

I don’t think you can churn this account.

Hey Kevin,

Thanks for this story! I have a question. How do I make sure that a deposit to chime using cash app will go through correctly? Thanks😊

If your bonus posts, then it worked correctly. If not, try again with a different method.

I recently tried this, transfer the money from Cash App on 9/8/2021 to Chime, the slow transfer method & didn’t receive my bonus. I am not trying to do a Chase push to see if that will trigger it.

I can confirm the Chase push worked. My deposited came and a minute after got the $100 bonus.

Hopefully others will find this useful.

I can confirm a Wells Fargo transfer did the trick. The only thing is now I have $300 in acct. I can just take out or leave for X amount days?

You can take it all out

Cash app not working as of mid September. Wondering if I should try my actual bank account or zelle. Anyone have any thoughts?

I would recommend bank account

Just use a bank account. Any bank account will do.

As of August 28, 2021, do you still think that a $200.00 Chase ACH Push would allow for the $100.00 bonus?

Yes it still works.

Thank you

I will sign up next week. Do you still have room for referrals or did you max out?

Referral link still works. I switch them between friends and family whenever it gets maxed out.

Thank you. Got my $100 bonus today!!

What ACH did you use?

Thanks for the post. I think I will sign up next week using your link. Does your referral link still work? Did you reach your max? Thanks

I signed up with Chime and received my bonus- thank you! Question- I had my husband sign up under my referral, but neither of us have received the bonus. I used the same account to transfer the funds to chime which is a joint account with a credit union that we share. Why would that have worked for me but not my husband? I did recently open an Ally account for me and was going to try transferring the money from that account to his Chime account. Do you think that will work?

Not sure about anyone here, but there are MANY here: https://www.doctorofcredit.com/chime-closing-some-accounts-no-reason-provided/

Has anyone else had difficulty with Chime or heard of these stories? I was about to sign up until I read Kyle’s comment above.

If you’re only signing up for the bonus, then really it doesn’t matter about these shutdown stories. Just get your bonus. Pull the money out and move on to the next bonus!

Hi Kevin, I’m living in Vietnam. I want open a new Chime account with your referral. But i don’t know Viet Nam accept or not?.

Please help, thank you so much!

Hi Kien, unfortunately, Chime I think is for US customers only. Not sure if you can do it if you’re a US citizen but live overseas.

Thank you for repply the comment. I can try. 🤝

Hi Kevin,

I opened my Chime account using your referral. I used my Capital one account to use as the transfer bank. Capital one has the information but has not sent Chime the required cents transactions to verify my account. It’s been three days. I also used the Capital one account to open a Chase checking for the bonus and that went well. I was wondering if I should give Capital one more time, but it seems odd that Chime doesn’t show the small transactions to verify account? I was thinking that I don’t want to get in a 20 minute plus conversation with Capital One. Thoughts? Also, is ACH credit the same as a direct deposit? That’s what’s showing up on my Chase bank account.

Hi Lisa,

Not sure if you figured this out yet. If it hasn’t gone through yet, my guess is there’s a glitch on someone’s end. Usually test transactions take a day at most (sometimes same day with Chime even).

ACH credit is not normally the same thing as direct deposit. However, Chime’s system right now doesn’t seem to be able to differentiate between the two so that’s why ACH works right now.

Hi Kevin! Just received my $75 bonus, so $75 should be coming your way soon too! Thank you so much for the detailed steps above. I have a question for you that’s both specific to Chime and more general to all bank account bonuses…

Do you keep the direct deposit in the bank where you received the bonus for a certain amount of time? Now that I have received my Chime bonus, I would like to move that $200 elsewhere to earn another bonus, but I’m wondering if I should leave it there for a certain amount of time.

Thanks!

Allison

Hey Allison, glad it worked!

You’ll always want to read the terms of the specific bank bonus to see if you have to leave the money in there. Typically, the terms will have something like a required minimum balance for X number of days.

That said, Chime is the easiest one because the direct deposit requirement is easy to meet, the bonus posts immediately, and you don’t need to leave any money in the account. You can transfer all of the money in the account out immediately.

My advice would be to leave 1 cent in the account. You don’t have to do this, but that’s what I typically do with accounts that I want to keep open forever. In this case, I recommend keeping your Chime account open forever because you never know when you might be able to refer someone using your own referral link.

I’d recommend pulling the money out via ACH transfer from your regular bank also. That is, go to your regular bank website and pull the money out of Chime from there. So if you have $275 in your account. maybe pull out $274.99 and leave 1 cent in your Chime account.

Just a word of caution. There is a really long thread on DOC with countless complaints from people who have had their accounts either locked or closed and people are literally fighting to get their money back (sometimes thousands of dollars). My wife was one of them. Luckily it was only about $65, but took months of emails, a BBB complaint, and a complaint to the Consumer Financial Protection Bureau to finally get access back. If you do this, I’d recommend only very small balances and closing the account as soon as the bonus posts. A quick Google search will show you how wide spread this is.

Hey Kyle,

Story time. I was actually a victim myself of getting my Chime account shut down. I’ve been a Chime user since early 2019 (so nearly 2 years at this point). It’s been my primary bank account for all of my gig economy apps.

In December, a friend of mine sent me some money via Chime’s P2P transfer option and in the notes field, she wrote “Kevin’s Racket.” The word Racket must’ve triggered some automatic thing in Chime because a day later, I got an email saying my account was on hold and to provide information about my recent transactions and provide identifying documents. I did all of that, then received an email not too long later saying my account was shut down. At the time, I had over $7,000 in my account and it was still the primary account I used.

I tried to appeal it because this is an account I actually like, but they said no dice, my account is closed forever and they won’t reopen. I asked for copies of all my bank statements, which they emailed to me immediately. They told me that my funds would be sent to me by check after 14 days, so I’m still waiting on it. I’ve been told that my funds will arrive January 11th or 12th, so we’ll see.

Frustrating to get my account closed, but seems like they are super cautious about anything that seems fraudulent.

That said, I would not recommend closing your account. You should always keep your Chime account open because of the referral program. Open the account, get your bonus, take your money out. Then keep the account open with a penny in it or something and use it just to refer people. Don’t use Chime for anything else – I agree with you there.

Curious, why was your wife’s account closed? There had to be something that triggered it.

Her account was locked, and Chime repeatedly refused to tell us why. We asked several times via email and phone for additional details. They would only repeat a generic “account is not in compliance with internal policies” response. Her account was opened early last year simply to get her the bonus and me the referral, and she did the bare minimum to meet those requirements and hadn’t touched the account since. That was back in April. In August she attempted to log in to find the account locked/suspended. She was never informed by Chime that they had taken any action on the account.

They then asked to submit pics of ID. The first could be her driver’s license and the second could be something as simple as a bill with her name/address, so that’s what she did. THEN they asked for a clearer picture of the license. She submitted that. THEN they asked for a picture of the back of the license, so she submitted that. THEN they decided the bill wasn’t enough, so they asked for a picture of her passport. She submitted that. THEN they asked for a picture of her holding her passport. That’s where we drew the line. One… this behavior raised some red flags with us. We’ve never heard of a bank asking for such a thing. Two… had we submitted the picture of her, were they just going to ask for something additional? We didn’t know when it was going to stop.

As if this craziness wasn’t enough, their responses to the BBB and CFPB contained several untruths about how helpful they were trying to be and how forthcoming they were with information, which told us all we needed to know about this company. The CFPB complaint finally got them to reinstate her access (now after almost 4 months later). So she pulled her funds and closed it down. I closed my account almost immediately after they asked for a picture of her holding her passport (and a quick Google search revealing how widespread these suspensions/closings were).

All I can tell is that Chime is very conservative when it comes to risk, which is why they close accounts that get flagged by some automated system. My guess is because it’s a fintech company that’s likely going to go public eventually, so they’re probably just extra conservative to avoid issues (you might be surprised to hear this, but Chime is currently the highest valued fintech startup in the US).

I know why my account got the automatic flag – it had to have been because of my friend sending me money and writing “racket” which I assume is a keyword they flag.

Personally, I wouldn’t have closed any of your accounts. Any account with a referral, you should always leave it open purely for referral purposes. But if it’s about principles, then sure, I get it.

As a little update, Chime did send me my statement balance check within the time period they provided. I’m not happy my account got shut down because it means I lose out on a lot of potential future referrals, but it happens.

Yeah, I get it. But my closing wasn’t even about principles. Asking for pictures of my wife, refusing to provide anything other than a vague “policies” explanation, not telling us they took said action on the account, and then lying in their responses to BBB and CFPB… I lost every bit of trust in them. I didn’t want our money/personal information wrapped up with them in any capacity. Although the boat has certainly sailed on the personal info piece… not like they completely wiped it from their system. 🙂

I thought you said you can only make ten referrals a year that will be paid?

Nerdwallet also says Chime should not be used for small business purposes, so they could have closed your account due to that. I imagine lots of folks had their gig economy jobs DD posted there.

https://www.nerdwallet.com/article/banking/neobank-chime-account-closures

“Don’t use your account for commercial use if it’s not allowed. Neobanks such as Chime, Varo and N26 mention in their account agreements that accounts may be closed due to suspected business activity. If you freelance or run a small business, set up an account at a neobank such as Oxygen, Lili or Lance that focus on business banking.”

Hello so I was reading the terms. Can I ask if you sent your code to someone and when they link their account to do the transfer the error message from chime and the funds are there. Can I just add the 200$ through my pay friends option on the app? What other ways qualify?

You need to do an ACH push from a bank to trigger the DD.