Digital Federal Credit Union (DCU) is a free, nationwide credit union that I recommend to readers for two reasons. First, DCU has a $20 referral bonus if you open a free DCU checking account with a referral link. Second, DCU has a savings account that gives you 6.17% interest on your first $1,000. This makes DCU an excellent bank account that you should use as part of a super-high-yield savings strategy. The fact that you can get a signup bonus for opening an account is just icing on the cake.

Earning your $20 referral bonus is simple. There are a few ways you can earn your DCU referral bonus, but below is what I think is the easiest option:

- Open a free DCU checking account using a referral link (here is my DCU referral link).

- Within 90 days of opening your account, complete at least 5 qualifying transactions in the same calendar month (this includes debit/credit card transactions, ACH transfers, Point of Sale (POS) transactions, bill pay payments, balance transfers to your DCU Visa Credit Card, and Pay a Person transactions).

You can also earn your bonus by completing a direct deposit or by taking out a vehicle loan. I’ll briefly mention those options later in this post, but in general, completing the 5 qualifying transactions is the simplest and fastest way to earn your DCU referral bonus.

In the remainder of this post, we’ll take a deeper look at what you need to do to earn your DCU referral bonus. We’ll also go over how the 6.17% interest savings account works and why it’s worth doing. Before we get started though, let’s quickly go over what DCU is.

What Is DCU?

DCU is a not-for-profit, federally chartered credit union that serves over 900,000 members in all 50 states. As you can probably guess by its name, DCU (Digital Federal Credit Union) is primarily an online-based credit union, with most transactions completed via its website or mobile app. They offer the same products as any full-service bank (i.e. checking and savings accounts, loan products, etc), making DCU a solid and reliable choice for anyone looking for a bank.

There are two banking products DCU offers that are relevant to our purposes. The first is a free checking account. This account has no monthly fees or minimum balance requirements, which makes it an easy bank account to maintain. They also (at least temporarily) reimburse all ATM fees. Importantly, DCU also offers a $20 referral bonus if you open a free checking account and meet some fairly easy requirements. We’ll talk about that more in the bulk of this post.

The second banking product that DCU offers is a free savings account that offers an astounding 6.17% interest on the first $1,000 in the account. Everything above $1,000 earns 0.15%. This makes DCU an excellent savings account to park $1,000 of your emergency fund. We’ll go into more detail about this savings account later in this post as well.

DCU Referral Bonus: Step-By-Step Directions

Opening a DCU checking account isn’t difficult, but there are a few nuances that you need to know about. Here are the steps you need to follow to open your DCU checking account and earn your $100 referral bonus.

1. Open A DCU Checking Account With A Referral. The first thing you’ll need to do is open a DCU checking account using a referral link (again, here is my DCU referral link).

The referral link doesn’t mention the bonus terms, but you’ll know it’s a referral link because the URL will have my unique referral link. The terms for the referral bonus can be found here on the DCU website. So long as those terms are still there, you’ll know the referral bonus is still active. As a precaution, I recommend saving a PDF of that page just in case there are any issues and you need to show the terms to customer service.

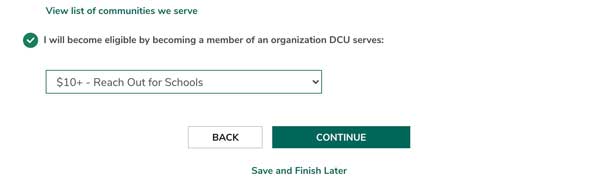

2. Donate $10 To Reach Out For Schools To Qualify For Membership. DCU is a credit union, which means membership is limited. For our purposes, everyone can qualify for membership with DCU so long as they are a member of one of their partner organizations.

In this case, the cheapest organization you can join is Reach Out For Schools, a non-profit that raises money for schools. It costs $10 to join this organization and it’s a one-time fee. During the application process, you’ll see an option to make your donation. Once you’re a member of DCU, your family members will be eligible for DCU membership based on their relationship with you.

If you’re opening a checking account, you’ll earn your money back via the signup bonus. More importantly, though, the main reason we’re opening up the DCU checking account is to gain access to the 6.17% interest savings account.

In any event, there are worse ways to spend $10 than giving it to an organization that helps schools.

3. (Optional) Fund Your Checking Account With $250 Using A Credit Card. One advantage of opening a DCU checking account is that DCU allows you to fund up to $250 using a Visa or Mastercard. If you’re earning credit card rewards, this is an easy way to get some extra spending on your card without having to actually spend any money. Simply fund the account with a credit card, then pay the card with the money you funded into your account. You don’t have to do this, but I do recommend doing this if you can. Be sure to make sure that your credit card won’t charge the funding as a cash advance (Chase credit cards have the biggest risk of doing this).

4. Complete 5 Debit Card Transactions In One Calendar Month. The terms require you to complete 5 debit card transactions in one calendar month to earn your bonus. An easy way to do this is to reload your Amazon gift card balance using your DCU debit card. Amazon lets you reload as little as 50 cents at a time, so doing five 50 cent transactions is all you need to do to meet this requirement.

Alternatively, you can also earn your bonus by completing a recurring direct deposit of $500 per month or taking out a vehicle, RV, boat, or mobility loan. Both of those options are more difficult so I don’t recommend meeting the bonus requirements that way (but if you were going to take out a loan already, then you might as well get your bonus that way).

5. The Bonus Will Post After You Meet The Requirements. Your $20 bonus will post within 30 days of the five qualifying transactions successfully posting to your checking account.

If you’re meeting the requirements via the direct deposit or loan option, your bonus will post within 30 days of completing the direct deposit or funding your loan.

DCU Savings Account Strategy

Opening this account for the referral bonus is great, but what really makes DCU worth it is the super-high-yield savings account that they offer. You’ll get 6.17% interest on your first $1,000 in your savings account. Everything over $1,000 will earn 0.15% interest (so ideally, you only want to keep $1,000 in your savings account). Interest is paid monthly, so you’ll see the interest at the beginning of each month.

Doing the math, you’ll earn about $61 of interest per year on your $1,000. As a comparison, in a typical savings account earning about 0.5% interest, you’d need to have a little over $12,000 to earn the same amount of interest. That’s a huge difference that I think puts things into perspective and emphasizes why it’s worthwhile to take advantage of a savings account like this.

The best thing you can do is take $1,000 and park it in there. Since interest is paid monthly, if you don’t want to leave more than $1,000 in there, just pull the interest out each month into a different savings account that earns more interest.

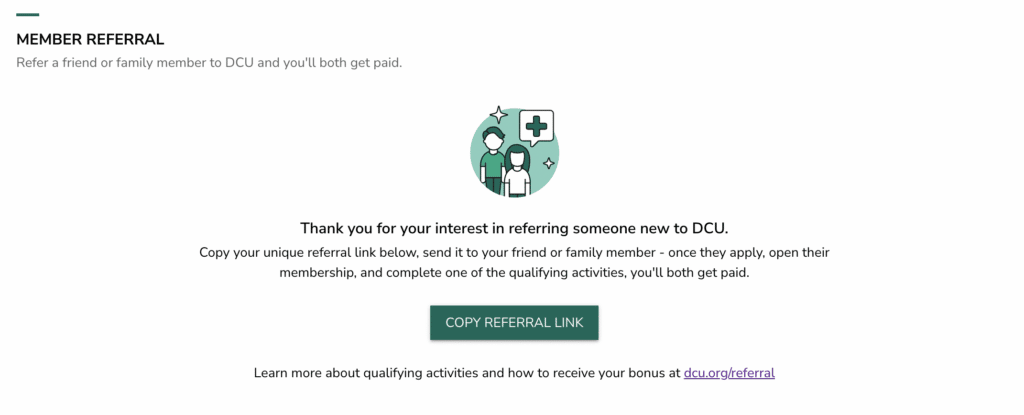

Refer Your Friends And Family

DCU is a credit union that I support. And after you’ve opened your accounts, you’ll probably feel the same way. An easy way to earn a little bit of extra money is to refer your friends and family members using your referral. At the moment, you’ll earn $10 for each referral and the person you refer will earn $20.

You can find your referral link in the “Membership” section of the DCU website. When you’re logged into your account, click “Membership” in the top row, then on the next page, look for the section that says “Member Referral.”

From there, you’ll be able to get your referral link that you can use to refer other people. The nice thing is that, in contrast to how it used to be, DCU will now generate a single referral link that you can use as many times as you want. Previously, DCU required you to generate a new link each time you wanted to refer someone, which made it much more of a hassle.

Final Thoughts

DCU is a good credit union that I recommend because of the 6.17% interest savings account. It’s the highest-paying savings account currently available – nothing else even comes close. If you combine it with my strategy for other 5% interest options, you can have a decent chunk of cash earning a good rate of return in FDIC-insured savings accounts. The fact that you can earn a referral bonus as well makes this account one that I think everyone should open.

Right now, with interest rates where they are, I recommend using Raisin, which is a free high-yield savings option that you can set up in minutes. Check out my post on Raisin here.

If you’re interested in learning more about bank account bonuses, be sure to check out my post, The Ultimate Guide to Bank Account Bonuses.

For other mega-high-yield savings options, check out these posts:

- Where To Get 5% Interest Savings Accounts

- Netspend Account: The Ultimate Guide to a 5% Interest Savings Account

- The H-E-B Debit Card 6% Interest Savings Account

- Current Bank App – A 4% Interest Savings Account On Up To $6,000

- Service Credit Union – A Mega-High-Yield Savings Account For Up To $3,500

- Workers Credit Union Savings Account – Earn 3.56% Interest On Up To $1,000

And if you’re interested in earning your DCU referral bonus, please consider signing up for DCU using my referral link. I hope this post was helpful!

Looks like the rereferral amounts are now only $10 & $20.

They have been giving me a hard time for weeks now after completing all of the requirements. They keep adding extra hoops such as, wait another week, and then after I do, they ask for the referral link. Then after I sent them the link, they now want a referral code from Kevin.

I have no idea why they keep adding more excuses and misleading me.

Hey there! I left a comment before but not sure if you got it. I used your link and I made 5 purchases on the Amazon Load like you mentioned. I used the card after it came. Is that all I needed to do? Just want to make sure I did it right. I’m trying to get money before Christmas for my kids gifts but says it can take 30 days. About how long does it take you to get it after someone let’s you know they did it? Anyway let me know and talk to you soon. Have a HAPPY Holiday!!!

Hi Financial Panther,

Would you know any other bank or investment platform allows you to fund the account via credit card without fees?

The only other one I know so far is fundrise.

Can you get the referral if you already have a DCU savings account or do you have to be an entirely new customer?

I believe you can. But shoot me an email and I’ll see if I can refer you. If I can’t, it’ll say you’ve already been referred and won’t let me refer you.

hi—i tried to set up an account with dcu but i got this message. i tried 5 different credit and debit cards and a bank account but nothing worked. anyone have any idea’s ?

The card funding transaction was declined. Please provide a different card or choose another funding option.

I recommend you just call them. It will be a pain in the ass to get a hold of someone but it’s worth it to get your acct. Set up

Hi Kevin and thanks for this thorough guide!

I sent you a message through your contact form so as to get a DCU checking and savings referral from you.

Did you get it?

Thanks in advance!

In case you have not recd referral code from Kevin. Msg me (Kevin not in any way am I trying to take from you, I just want M1 to benefit from DCU the way I have), I am being honest when I say this Credit union literally has changed my life. Lol, sounds so dramatic I know. But , read my above comments regarding my experience with them. This credit union saved me about $6,700 on a car I bought in Feb. I am and will forever be a loyal DCU and Financial Panther follower!!

Hi Ariri, I have also sent a message and have not heard back. Would you be willing to share your referral?

the link is in the post, you don’t need a referral code. I just signed up and didn’t need one and I’m getting the $100 because it said I was signing up under him just by clicking the link he posted in the blog post. 😀

Thanks for the guide! I am not working on the 5 transactions… any idea if I can do them all at once or if they would get flagged as fraud if they aren’t spaced out?

You can do them all at once. Shouldn’t be a problem.

Hey there! I just wanted to say thank you! I signed up under you about a week ago. I’m still waiting for my card so wanted to ask if adding the bank account info to Amazon, and loading my gift card or buying 5 inexpensive items. Would that work? I wasn’t sure about the ach transfers either. Is that like sending money to Cash App?

Hi Kevin!

Thank you so much for such helpful information! Like the Netspend accounts, I’m only interested in the savings. Is there an inactivity fee or monthly minimums for the checking account? Wasn’t sure if the same setup would apply where I need to setup a reoccurring deposit every 60-90 days.

Thank you in advance as always!

I opened a savings just for the interest. But soon realized how awesome this credit union is! My credit not great so I also opened a Credit Builder Loan . My credit score went up after only 3 payments. I then purchased a car and financed thru dealer 8.64% interest. I then received an offer from DCU to refinance an auto loan and get 1.9% and $150 bonus. I had not even made 1 payment on my car. I thought for sure I would not be approved. I placed a phone call and did the whole application over the phone, and was approved! Not just that I rec’d a much better deal on the following…

Dealer GAP $895. DCU GAP $295. SAVED $600

Dealer service contact $3,700. DCU service contract $1,395.00. SAVED approx $2,700

Dealer interest $8,000 DCU $1, 300 SAVED $6,700

Then because I now have a “RELATIONSHIP” with DCU (checking, savings, refinance loan, credit building loan) the loan agent working with me on the auto loan said I qualified for the DCU credit card. Which I was approved $10,000 interest 8%. Which was amazing to me since my other credit cards are at 22-23%. No annual fee, or balance transfer fees it’s a great card!

Another perk about the ATM fee is that you can withdrawal anywhere and they will pay you back. $7.00 was reimbursed back it to me from a casino ATM. They have many different types of loans that can really help people out such as a loan to modify your home due to a disability, or to install heating. This credit union is amazing.

Update on how amazing this credit union is… Since I have had my checking open for 6 months I now qualified to earn interest on my checking balance 0.50% which I will take. Sure why not! I’ve banked my whole adult life with WellsFargo and never have rec’d the interest Ive collected with less than a year of being a member. Also, I qualified to opt in for overdraft coverage which is another bonus. Oh annnd I just opened a Holiday Savings Acct. With them.

What?! A 6.17% interest savings account? You’d be lucky to get a 7% annual return on your money investing in equities, that sounds like a phenomenal deal.

Hello Panther

You are Great with this Insights, Im also doing the five 5% Nestpend cards, I used the All Access one I think by mistake, and I Stumbled into that they do 6% on the saving account upto the first $2000.

I have literally $60k cash in a shoe box in my closet that I’ve put away in the last 3 years and I want to put that cash to work, my Girl and I are doing the 10 NetSpend accounts but thats only 10k, I also bought into Permanent/ Whole Life Insurance that Accrues a nice Cash Lump Sum, But I want a bank thats compounds daily, What can you suggest ??

They charge $5/month for the savings account and the fee cannot be waived FYI.

Wow, 6.17%?!?!?!? This is even better than the Netspend accounts! I opened all of the Netspend accounts that I could. so this is fantastic news. Thanks for sharing!

Be sure to check out this post for more ideas. If you’re someone who’s done the Netspend accounts, there’s many more you’ll want to take advantage of too.

Where To Get 5% Interest Savings Accounts Now That Insight Is Gone