It’s pretty easy to become complacent when it comes to our paychecks. We collect them every two weeks and just assume that whatever amount is on that check is the amount we need to survive. It’s funny how your expenses always seem to match up to whatever amount is on your paycheck.

I think of this as what I would call “paycheck complacency.” First, we arbitrarily begin with some number on our paycheck that we often (perhaps unwittingly) choose. Second, we get used to that amount. Third, we assume that’s the amount we need in order to live.

Here’s the thing – you might think you need it all, but the reality is, you probably don’t. I say to you, mess around with your savings rate! Experiment with it. Tinker with the amounts you see on your paychecks. See if the size of your paycheck really matters or if you only think it matters.

Arbitrarily Picking A Paycheck Size

Let me explain what I mean about arbitrarily picking the size of your paycheck with an example from my own life.

I previously wrote about how I took a $50,000 pay cut earlier this year, yet still found myself saving pretty much the same amount of money as I was saving in my old job. This was rather surprising to me. I had assumed that a $50,000 pay cut would mean a corresponding decrease in the amount that I was able to save. What happened exactly?

When I started my new job, I did as most people do. I met with the HR person and filled out my employment forms, including my retirement plan forms. My employer requires us to contribute 11.5% of our salary to a defined contribution pension plan (5.5% from the employee, 6% from the employer). So no choice for me there. Part of my paycheck was already decided for me with that decision.

But, my employer also allows us to contribute to a 457(b). Since I am horrible at doing math in my head and since I wanted time to make sure I could adjust to the size of my new paychecks, I just picked a random number to save. 10% sounded good to me – a nice, round number. As luck would have it, the amount I had randomly decided to save also meant I was saving about the same amount as in my old job.

But most importantly, with the somewhat arbitrary decision to save 10% into my 457(b), I had decided how big my paycheck would be. This amount was my new baseline. My random decision to save 10% into a 457(b) meant that my brain now thought that the number on my paycheck was what I needed to live.

Does any of this sound familiar to you?

My Recent Bout Of Paycheck Complacency

I found that the amount I was seeing in my paycheck was plenty for me. I still had enough money to both pay my bills and keep a good cushion in my checking account.

And then like most people, I just stopped doing anything. My paychecks came in, the money went where it needed to go, and I was living totally fine. While I didn’t explicitly say it, in my mind, the numbers that were on my paychecks were what I thought I probably needed to live.

After I realized that the amount I was saving was almost the same as in my previous job, I went ahead and calculated how much more I would need to save in order to equal what I was on pace to save in my last job. It turns out I only needed to increase my 457(b) contributions by 2.5%.

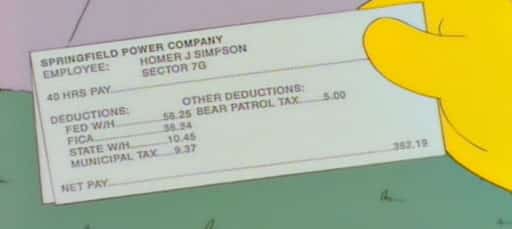

When I increased my savings rate by 2.5%, I wasn’t quite sure what my next paycheck would look like. It turns out that upping my savings rate increased my 457(b) contributions by $71.80 per paycheck while reducing my actual paycheck by only $27.41.

Of course, this is because my savings are going in pre-tax. I understood this in an abstract sense, but I really didn’t realize how little my paycheck would change with that increase in savings. That extra $71.80 per paycheck comes out to an extra $1,866.80 saved over the course of a year. That’s a pretty decent chunk of change saved pre-tax. Meanwhile, did I really need that extra $27.41 in my paycheck? My paychecks still looked basically the same to me. I barely noticed a difference.

Pushing Myself In Order To Avoid Paycheck Complacency

After looking at my most recent paycheck, I realized that I still needed to do a little tinkering with my savings rate. The new amount in my paycheck wasn’t at a point where I really needed all of it. It certainly didn’t feel particularly painful to see my paycheck with $27 less in it. If saving an extra 2.5% was no issue for me, I figured I’d just up my savings rate a little bit more

I’m now putting away 16% of my income into a 457(b). Couple that with what’s going into my pension plan and that means 27.5% of my pretax income is going into tax-deferred retirement savings. I’m not maxing out my 457(b) quite yet, but I am on pace to put away more than $18,000 per year into tax-deferred, work retirement plans.

If that percentage was just picked randomly as a savings percentage, many people might think that’s too much to handle. But just by avoiding paycheck complacency, I was able to slowly ratchet up my pretax retirement savings. I’m still tinkering with my paychecks, testing myself, seeing whether I really need the number that’s on the paycheck. Your brain will tell you that you need all of it. I think you should see if that’s really true.

Suggestions To Avoid Paycheck Complacency

Increase Your Retirement Contributions By Just A Little. Do it! Even just a percent or two. Test yourself. See if the smaller paycheck really makes a difference. Increasing your employee contributions by a few percentage points will only reduce your actual paycheck by a fairly small amount. Most people won’t even notice it. But the difference in your investing life can be huge.

Always Push Yourself. Saving should probably hurt at least a little. You want to feel a bit of a pinch. Remember, your income isn’t guaranteed. Live on less and you’ll be prepared to ride out any storms that come your way.

If You’re Maxing Out Your Employee Contributions Already, Try Saving Some Of Your Money Elsewhere. Your employer probably lets you split up your paycheck to different bank accounts. If you’re already maxing out your employee retirement contributions, why not see if you can take a little bit out of your paycheck and put it somewhere else. Save it for a rainy day, use it to invest, or do something else with it. Just test yourself and see if you really need all of that number on your paycheck. You’ll probably find out that you don’t.

I love this term! Pay check complacency. I’ve always been aware of lifestyle creep or inflation with pay increases but never thought of it from this angle.

Wonder if it would have the same effect from a contractors point of view. ‘Pre-tax’ effect you’re talking about doesn’t really apply the same way. Still curious enough to experiment!

Another great post! I think you described a lot of people in this post. Most people think that they need their entire paycheck to survive. However, they never really sit down and do the calculations. Kudos for showing how pre-tax savings really does not make a huge difference, in regards to the individual paychecks, but makes a huge difference in a retirement fund. Love it!

Thanks Piggbanknomics! I really do think people overestimate how much their paycheck changes from small changes in pre-tax savings. And really do think that most people won’t even notice the difference in their paycheck if they mess around with the numbers they do see.

Great post! I like the term paycheck complacency. One thing we do is to pretend like I don’t get raises. Whenever one comes, we funnel the increase into prepaying our mortgage. Over a few years, the additions mean we will pay it off pretty quickly and once we are done well have a ton extra that we can then put into investments.

We typically get raises in April and I don’t see a good reason that my expenses in April should be any higher than in March 🙂

Exactly right! Funneling your raises towards something else is a great way to keep your paycheck “in check”, so to speak. It’s surprising how easy it is to get used to what’s on your paycheck. If you see it there, you’re bound to find some way to spend it.

Awesome article! I love that quote from FS, and glad to see you’ve upped your contributions.

Thanks Matt! I must just be a cheap guy to entertain or something, because I see my paychecks, and even though they’re smaller than they used to be, they’re still enough for me.

Nice topic! I’ve definitely done the 1%, 2% bumps to pre-tax savings, often at raise time. I also tinker with my paycheck with W4 exemptions but also at annual enrollment (insurance levels, HSA contributions) … I stick with the max 401k that my employer will match and the rest goes towards rental house investments.

Great to hear it Abandoned Cubicle! I haven’t gotten into the rental house market yet, but it’s definitely something that we’ll be looking at one day.

I’m a big fan of pre-tax contributions…the impact to your paycheck is not as big as you might think because of all the taxes. And I live in NYC so the tax savings are awesome. I got a co-worker who contributed 0% to start saving and he too was surprised that there wasn’t much of an impact. I also like automating savings since it’s out of sight and out of mind. I’ve also tried to increase my contributions with every pay increase…and now I’ve maxed it out. Will have my wife do the same with hers.

Awesome! I still haven’t maxed out my own 457(b) yet, simply because I’m not quite sure if I can handle the smaller paycheck just yet. But once we become a 2 income household, I’ll definitely be maxing out that 457(b). I’m lucky in that I get a defined contribution pension at my job (it’s basically the same as a 401(k), which doesn’t count as part of my 457(b) limit. So when I combine my savings, I do technically save more than the max that could be saved in just a 401(k). Once I can max out that 457(b), I’ll really be saving a ton of money.

Nice work Panther! I am a big fan of leveraging the pre-tax savings. You take a small hit in your paycheck in return for much bigger rewards in your savings.

Exactly! It’s hard to conceptualize it until you actually see how much bigger your savings become versus how slight the paycheck hit actually is. I know I’m not enough of a math genius to be able to see how little my paycheck changes from a small change in the percentage I save pre-tax.

Nice post, FP! I agree with the idea of slowly increasing the savings rate by 1% to 2% at a time. You won’t notice it and will get used to it.

This strategy has worked for me.

Thanks for the kind words Michael! Your paycheck is a lot like portion sizes on a plate. If it’s there, you’ll probably eat it all. But if you make it just a little bit smaller, you probably won’t notice.

Great article! Paycheck complacency is another example of the capacity for humans to get used to the status quo. We’re adaptable creatures. That’s a good thing, but it can cause us to be complacent. Like the other commenters, I love how you encourage us to push for more savings. And it’s got to be ongoing, because the lifestyle creep is relentless. Great stuff

I think our brains are just hardwired to accept what we have in front of us. If I gave you only X amount to live off of, I’m sure most of us could figure out a way to make it work. And if you up that amount a little more, I’m sure you can figure out a way to make that work. Just gotta keep messing with those numbers so you don’t get too comfortable.

Great post!!! So much truth here! We had the same experience. When we moved a couple of years ago, we knocked the 401k contributions down to enable us to handle the moving expenses better. A year later, we still hadn’t bumped the contributions back up and were spending the entire paycheck. We decided it needed to change so, one month, we increased the contributions by 16%. It was painful for a few months, but it forced us to figure out how to live with the new paycheck. A year and a half later the changes stuck and we’re maxing all tax advantaged accounts.

That’s awesome that you are maxing our your tax advantaged accounts. And your situation is a great example of the paycheck complacency I was talking about. Right on that you increase it by so much at once!

In addition to his and 401k reductions we’ve also setup a reoccurring withdrawal to a savings account. In budgeting I treat it as a reoccurring bill. So far despite a highly variable pay over the last decade I’ve never touched that bill.

That’s awesome! Way to set up those savings.

What a neat concept. I never thought of it this way, but pay check complacency definitely makes sense. I also think you are to be commended for being proactive and pushing for more. I love how the brain tends to find creative solutions when you put a little pressure on yourself. Thanks again for the cool idea!

Thanks Jay. I just sorta thought of the concept as I was looking at my latest pay stub. We have a lot of control in how much money is in that paycheck and I didn’t really realize I wasn’t thinking about that until I started writing this post. Really hope the concept helps you!

Great advice. I think always pushing yourself to save more and stretch your money farther is a really great thing to do. My wife and I are always trying to see where we can push ourselves, and even if it is painful we always feel good once we make the change and integrate it into our lives.

Thanks David. Exactly right. Once you see your paycheck get smaller, you’ll most likely just get used to it. It’s like working out. Just keep pushing yourself on how far you can go.

Awesome post Financial Panther. I found myself nodding along with this post agreeing with each paragraph.

I currently am maxing out my 401k and IRAs (both me and my wife). After I was able to do this I found myself becoming complacent and not nearly as motivated to save anymore.

Having been inspired by the PF community I recently set new goals in order to keep myself motivated to work towards something.

Awesome! Sounds like you’re doing a great job maxing out maxing out all of your accounts. I’m working my way towards that as well. Maxing out my Roth and my HSA, but not maxing out my 457 yet, although I am still saving more than 18k in total in my workplace plans, so in a regular job, it would be maxed out.

Keep tinkering with that paycheck and see what else you can save. I bet you’ll be surprised.

Good post, Panther. It runs true.

By switching from a large city police department to a small city dramatically closer to me I was able to raise my salary (through travel cost reduction and salary increases) approximately 20% in the last two years. I haven’t seen any of that in my checking account.

My take home pay is still the exact same, but now my 457, and my family’s IRAs are at max deposits. But as stated it is just a number. I can think of three different things I could ax right now to increase savings, it’s just a quality of life argument.

That’s awesome and it’s great that you’ve basically trained yourself to the amount on your paycheck. Like when you think about it, your brain just assumes that’s the amount you need, right? But imagine if you kept letting that paycheck creep up. I imagine that suddenly, that needs amount is what your brain would tell you that you need. Just my thought anyway.

It’s a good thought. The “lunchbox effect.” The more you pack the more you think you need! Surely your stomach will expand to cover whatever is in there, whether it’s needed or not!

Great post. I think pre-tax contributions are a great way to save because it’s money taken out of your paycheck before you even see it. So like you say, small incremental increases (like 1-2% every month or so) may not even be all that noticeable when it comes to your actual paycheck. I think another good way to increase your savings rate is automatic transfers from your checking account to your savings. It’s kind of like paying a monthly bill to yourself.

Thanks! I also have a lot of money that flows to different accounts automatically and I treat it exactly like a bill as well.