Hi, I’m Kevin and I’m an attorney, writer, gig economy expert, side hustler, and the blogger behind Financial Panther. I paid off $87,000 worth of student loans in just 2.5 years by choosing not to live like a big shot lawyer. I started this blog to share all I know about personal finance, travel hacking, and making more money by side hustling. Click here to learn more about me.

Get Started With

Recent Posts

Every once in a while, I run across a bank bonus that I think everyone should get in on if they can, especially because the requirements to earn the bonus are so easy. In this case, I stumbled on a bank bonus from U.S. Bank for their “Smartly” Checking Account. If you’re eligible and able to meet the requirements for this bonus, I highly recommend going for it. The requirements for the U.S. Bank Smartly Checking account … Read post

I recently discovered something about my high-deductible health plan that I never realized. Despite only having a high-deductible health plan for myself, it turns out that all of the qualified medical expenses that my family incurs are eligible for reimbursement from my health savings account, even though none of my family members are on my health plan. This is a fairly big deal for me, as it adds up to much … Read post

In today’s post, we’ll be taking a look at what I earned from side hustling and the gig economy in March 2025. March was another bad side hustle month for me, although an improvement from what I did in February. One oddity is that I didn’t get any bookings on Rover in March. Meanwhile, my food delivery earnings leveled back out thanks to improved weather that’s been making it easier for me to bike around … Read post

I have a lot of different premium credit cards, many of which come with different credits that I need to use. Most cards don’t make using these credits all that easy, however. They do this typically by limiting how often you can use the credits, or by dividing the credits up into smaller amounts. Using these credits is important, though, as you need to use them to maximize the value of your cards, especially if … Read post

I write about fintech and fintech banking apps a lot, so I sometimes get asked what I think about these companies and how safe they are, especially given some of the negative news that’s happened with some of them in the past year. As a bit of background, most of the fintech banks you see out there (sometimes called “neobanks) aren’t actually banks. Rather, they’re technology apps that partner with licensed banks to hold your funds … Read post

When you’ve been in the credit card game long enough, you start to notice that certain cards always seem to come back into your wallet. I’m not someone who focuses on spending categories too much – most of the time, I find my time is better served opening new cards to get signup bonuses. Since I’m focusing on signup bonuses, it means I’m opening a lot of new cards each year. And while the cards do change as different … Read post

Popular Posts

This post lists every single gig economy and side hustle app I’ve used or know about. Most are apps that I’ve personally used myself and continue to use today. Note that this will be an evolving list since new apps come and go all the time. I’ll do my best to keep this post updated on a regular basis with all of the best gig economy apps that I hear about … Read post

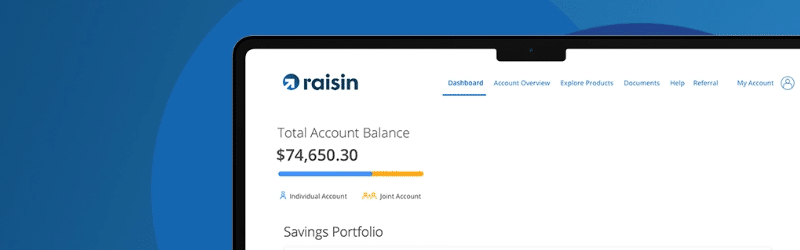

I’m always on the lookout for good high-yield savings accounts and I recently found one that I think is the best option currently out there. It’s called Raisin. Opening a Raisin account takes minutes to complete, it’s free, and all of your funds are FDIC-insured. I explain how it works, why I’m now using it to store my emergency fund and any other cash savings I have, and why I recommend everyone check it out in this review.

The Reverse Latte Factor is an important thought experiment about how impactful small amounts of extra money added up consistently over time can be to your finances. And the beauty of the Reverse Latte Factor is that it doesn’t require you to give up all of the little pleasures in your life … Read post

Bank account bonuses are a great way to earn extra income. I’ve been using this strategy for years, regularly earning between $5,000 and $10,000 per year in bank account bonuses. This post contains what I think are easy bank account bonuses and is an excellent starting point for beginners … Read post

I’m a biking advocate. I’ve been using a bike as my primary mode of transportation for a decade. But even more than being a biking advocate, I’m an ebike advocate. And pound for pound, I think the best investment I’ve ever made is my ebike. For many of you reading this, I’m convinced that an ebike can be the best investment you ever make too … Read post

Over the past two years or so, I’ve earned a little over $30,000 doing a bunch of interesting side hustles. The question I often get is how I find the time to do all of these things. For most people, the ability to earn extra money comes down to time – most people work all … Read post

My Reviews

Bank Signup Bonuses (Step-by-Step)

Upgrade $200 Referral Bonus

Ally Bank Bonus ($100)

Fairwinds Credit Union Referral Bonus ($175)

Chime Bank $100 Referral Bonus

US Bank Business Checking $900/500 Signup Bonus

GO2Bank $50 Referral Bonus

Current Bank $50 Referral Bonus

Other Signup Bonuses

M1 Finance $100 Referral Bonus

SoFi Invest $25 Referral Bonus

Webull Referral Bonus (20 stock shares)

Moomoo Referral Bonus (15 stock shares)

Side Hustle Reviews

DoorDash Dasher: What It’s Like Delivering For DoorDash in 2023

Uber Eats Driver: Delivering For Uber Eats In 2023

Grubhub Delivery Driver – What It’s Like Delivering For Grubhub In 2023

Rover Pet Sitting – How To Make Money Dog Sitting With Rover

Wag App Review – My Experience As An On-Demand Dog Walker

Shipt Shopper App: My Grocery Delivery Side Hustle

Making Money With Airbnb In 2023: Why I Rent Out Our Guest Room

Observa App Review – Can You Use Observa To Make Extra Money?

IVueIt Review 2023 – Make Money Taking Photos For Businesses