Let’s start with a must:

1) Open a High-Yield Savings Account

If you only do one thing on this list, it should be to open a high-yield savings account. Right now many banks are offering savings accounts with high rates. The only thing required is to open an account at one of these banks, and deposit money into it. It’s that simple and you should get 4-5% back on your money. Here is a great article to read on this:

The Changing Landscape Of High-Yield Savings Accounts

“Whatever you do though, if you have money in a savings account that’s still paying nothing, you absolutely need to move it. With rates where they are now, it’s an insult that some big banks are still paying nothing for their savings accounts.”

Here are some of our recommended savings accounts from established banks:

Ally

- Current rate – 4%

- FDIC-insured savings account

- Simple to open, nice user interface

- No monthly fees

- Online bank only

- Can open as many savings accounts as you want

- Open Account

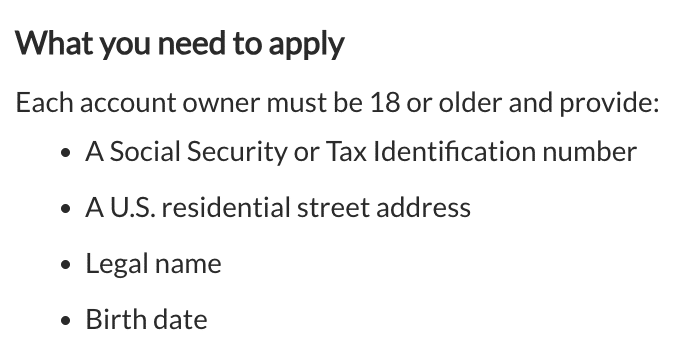

To show how simple it is to open an account, look at the requirements below (taken from Ally website):

Discover

- Current rate – 4.30%

- FDIC-insured savings account

- No monthly fees

- Online bank only

- If you have $15,000-$25,000, you can get a $150-$200 bonus for just opening an account: View Offer

- Open Account

Marcus by Goldman Sachs

- Current rate – 5.15% (For 3 months if you use this link), 4.15% after 3 months

- FDIC-insured savings account

- No monthly fees

- Online bank only

- Open Account

Fintech banking apps

These fintech banking apps offer a higher rate but might require more work to signup/set up (Although I’ve found these take minutes to set up).

Wealthfront (Just opened this one and like it)

- Current rate – 5.30% (For 3 months if you use this link)

- 4.80% after 3 months is over

- FDIC-insured savings account

- No monthly fees

- Open Account

Betterment

- Current rate – 5.25% (For the rest of the year if you deposit money into the account within 14 days of opening it),

- 4.50% rate after the initial promotion is over

- FDIC-insured savings account

- No monthly fees

- Open Account

Western Alliance Bank

- Current rate – 5.20%

- FDIC-insured savings account

- No monthly fees

- Open Account

2) Learn About Your Employer Sponsored Retirement Accounts and Retirement Accounts in General

All about Employer Sponsored Retirement Plans (401(k), 403(b), 457, Pension):

How I Invest In My Employer Sponsored Retirement Plans, Part 1: My Core Investing Philosophy

How I Invest In My Employer Sponsored Retirement Plans, Part 2: Know Your Plans

Aim To Max Out All Of Your Retirement Accounts This Year

Don’t Get Taken Advantage Of When It Comes To Your Retirement Plan For Work

3) Learn What an HSA is and if It is Right for You

If you don’t go to the doctor that often or have low medical costs, consider an HSA:

The HSA: The Perfect Retirement Account For Millennials

Questions To Think About When You’re Setting Up Your HSA

4) Have a Strategy for Your Student Loans

If you have student loans:

Pay Off Your Student Loans Now – It Doesn’t Get Any Easier Later

My Student Loan Refinancing Experience

5) Start an Emergency Fund and Other Funds

Most experts will tell you that you should create an emergency fund that can cover 3-6 months of your living expenses. You can keep this money in a high-interest savings account mentioned above and still make 4-5% back on it.

Think about a stupid mistakes fund.

Create A Stupid Mistakes Fund For Your Stupid Mistakes

The rest of the items on the list are ways to make more money from credit cards, bank accounts, and side hustling. These can be intimidating at first, but if you have time to do them the added income and benefits are definitely worth it.

6) Open a Credit Card for the Welcome Bonus (Travel Hacking)

Recommended: Chase Sapphire Preferred

- 60,000 points (Worth up to $750)

- Annual Fee of $95 (Can downgrade this card after 1 year to avoid paying this fee every year)

- Open card

Recommended: Chase Sapphire Reserved

- 60,000 points (Worth up to $900)

- Annual Fee of $550 (Can downgrade this card after 1 year to avoid paying this fee every year)

- $300 in travel credits each cardmember year

- Priority Pass

- $100 Global Entry Credit

- $60 per year of DoorDash credit

- Lyft Pink membership

- One of the big selling points of this card is that, in year 1, you can actually get the $300 travel credit twice, while only paying the $450 annual fee once. In essence, it’s like Chase is paying you $150 to get this card.

- Open card

The Chase Sapphire Reserve is the best option to go for in my opinion. Even though it comes with a hefty $550 fee upfront, the benefits, for me at least, make it worthwhile and cover the cost of the annual fee. If you’re just absolutely terrified of the high annual fee, then you can go with the Chase Sapphire Preferred as your first card. It is an easy beginner card to start with.

A good article on Kevin opening his first credit card for points, and things he was worried about.

An Amateur Travel Hacker’s First Experience With Travel Hacking

How To Start Travel Hacking – What Should Be Your First Credit Card?

7) Open a Bank Account for the Welcome Bonus

Another great way to earn extra income is via Bank Account Bonuses. The posts below will have all of the information you need to know about bank account bonuses so that you can take advantage of them and start making some real money off your idle cash.

The Ultimate Guide to Bank Account Bonuses

Making Money From Bank and Credit Card Account Sign Up Bonuses

8) Start a Side Hustle

Side Hustling is another great way to make money in your free time. We have a very extensive list below of all the apps/gigs we have come across. Money from these can add up quickly, just look at Kevin’s side hustle reports (He’s made over $150,000 in the last 7 years).

But more importantly, look to try something that you can grow into a long-term project or business. This blog started as a simple project while we both had full-time jobs. Now it supports us both so you never know what can happen.

The Ultimate List Of Over 70+ Side Hustle Apps

Oh and One Last Thing…

9) Get An Ebike

These things are real game-changers. This page has everything you need to know about them.

Change Your Life With an Ebike

Financial Success Appendix

Recap of Employee Retirement Accounts

Employee Retirement Accounts – 401(k), 403(b), 457, Pension, HSA

401(k) or 403(b) Plans

These are the typical retirement plans that most people know about. 401(k)s are typically offered by for-profit companies. When I was working at a law firm, that was the primary tax-deferred plan that I had access to.

403(b)s are basically the same thing as a 401(k) except that they are sponsored by non-profit organizations. Think of things like hospitals, schools, and churches. The smart couple I talked about in the previous section have a 403(b) plan at work.

In 2016 and 2017, the maximum you can contribute to either of these plans is $18,000 per year. This doesn’t include any matching that your employer offers. So, if your employer offers any matching, you can still put in $18,000 of your own money into the plan. In theory, you aren’t able to withdraw your contributions before you’re 59.5 years old without paying a 10% penalty. In practice, though, there are ways around that (which goes beyond the scope of this post).

457 Plans

A 457 plan is basically the state government version of a 401(k). Just like with a 401(k), a 457 plan is funded by payroll contributions. You can then put those contributions into whatever investments are offered by your plan. Most people have heard about a 401(k). But it seems like very few people know about 457 plans.

There are two awesome things about 457 plans that a lot of people don’t know. First, the amount you can contribute to a 457 plan is independent from the amount you can contribute to a 401(k) or a 403(b). That means, if you’re lucky enough to have access to both a 401(k) and a 457 at work, you can contribute the maximum to both accounts! For 2016 and 2017, the maximum annual contribution to a 457 is $18,000. That means someone with access to both accounts can put away $36,000 a year, pre-tax. Pretty sweet!

The second amazing thing about a 457 plan is that it’s not subject to any early withdrawal penalties. In essence, this makes the 457 the ultimate early retirement account. You get all the advantages of tax deferred investing, but you still get the flexibility to take that money out if you decide to go the early retirement route.

There is one caveat though. Unlike a 401(k) or a 403(b), the funds in your 457 plan can be subject to the claims of creditors. That means if your employer goes bankrupt, your life savings might be subject to creditors looking to get their money from your employer. If you’re considering going the 457 route, use caution and consider the financial situation of your employer.

If you’re working for a government entity, then you don’t need to worry about this. A governmental 457 plan is just like any other retirement plan and isn’t subject to creditor claims. So if your government somehow goes bankrupt, you’re still okay.

Pension Plans

Some of you might be in a job that offers a pension plan as well. If you’re fortunate enough to have one, you probably don’t really need to do anything. Your employer will probably just take a certain percentage from your paycheck automatically, and you won’t have a choice in the matter. If you have a defined contribution pension plan, you can probably pick what funds you invest in. Make sure you’re picking the right ones for you.

Health Savings Accounts (HSA)

This is the one that almost no one in the regular world knows about. If you’re pretty healthy, consider signing up for your employer’s high deductible health plan. By doing so, you get access to a Health Savings Account (HSA), which allows you to contribute money pre-tax and take it out without paying taxes, so long as you do so for qualified medical expenses. In addition, if you opt for payroll deductions, an HSA allows you to avoid paying FICA taxes on the funds you contribute to it. It’s basically the only way you can avoid paying those FICA taxes.

The great thing about an HSA is that it can also double up as an extra retirement account. Most HSAs allow you to invest your funds once you’ve built up a decent cash cushion, typically about $1,000 or so. Once you’re 65 years old, your HSA basically becomes like a 401(k), meaning you can withdraw your HSA funds for any purpose, without penalty.

As a bonus, most employers also offer some sort of yearly contribution to your HSA. Around $500 to $1,000 per year isn’t out of the question. Just remember that, unlike a 401(k), the yearly maximum contribution to an HSA includes your employer contributions. So if your employer contributes $500 to your HSA per year, you can only contribute up to the maximum, minus the $500 your employer already contributed. Don’t forget that!