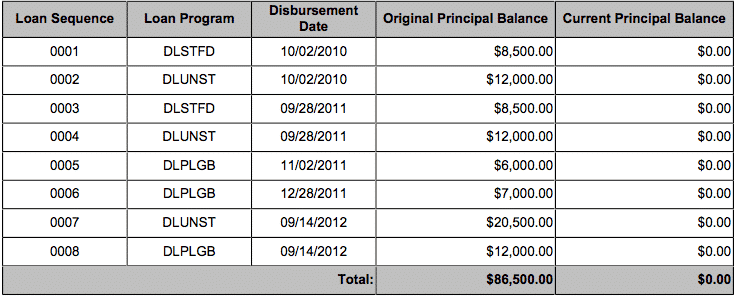

These days, student loans are pretty much a given for most young professionals. When I graduated law school back in 2013, I had a hugely negative net worth thanks to $87,000 worth of student loans that I had taken out. That doesn’t seem like all that much when you consider that the average law student today graduates with almost double that amount of debt. I think it’s a testament to just how normalized student loans have become when $87,000 can seem like nothing.

The thing that really stinks about student loans isn’t just the monthly payment. It’s the huge amount that you’re paying out each year towards interest. If you look at my own student loan history, you can see that I paid over $15,000 in interest over the life of the loan.

And that’s with me paying off the loan in just two years!

One of the reasons we’re paying so much in interest is because of the high-interest rates we’re given. Since anyone can get a student loan, the interest rates are higher than they should be for folks who are going into fields where they should hopefully make a decent income. Regular grad school loans clock in at a 6.8% interest rate these days. Grad plus loans come in at a whopping 7.9% interest rate.

Those kind of interest rates are no joke. Refinancing your loans takes into account your earning ability and gets you an interest rate that is more in line with your ability to repay your debt. In theory, most big law attorneys should be able to get their interest rate down to 5% or less.

My friend, the Big Law Investor, recently released a terrific student loan refinancing guide that I think anyone with student loans should check out. You can check out his student loan refinancing guide here. In that guide, he shares a ton of helpful information that’ll help anyone who’s trying to figure out how to refinance their student loans.

I thought I’d build upon what he wrote by talking a little bit about my own student loan refinancing experience. The great thing about the internet is that you can learn from people who’ve gone through this stuff before. And back in 2015, I went through a ton of student loan refinancing.

A Timeline Of My Student Loan Refinancing Experience

I’m a little bit weird. Instead of refinancing just once, I actually went ahead and refinanced my student loans three times with each of the big three student loan refinancing companies. In my mind, the big three are SoFi, CommonBond, and Earnest. There are definitely more out there, but I consider these three companies to be the big players in the student loan refinancing field.

I went through all of 2014 hustling to pay off my debt but doing so at 6.8% and 7.9% interest rates. At the time, I didn’t know that student loan refinancing was a thing. In retrospect, I basically wasted at least a few thousand dollars by not refinancing. By the end of 2014, I had paid off all of my 7.9% interest loans, leaving me with just the 6.8% interest ones remaining.

2015 was the first year I discovered that student loan refinancing was a thing. I waffled for a bit about what to do. Lawyers are naturally a conservative bunch, so it’s easy for us to get scared away from refinancing. Plus, the idea of refinancing sounds scary, these companies were new (at the time), and people on random forums kept mentioning that I would lose “federal protections” if I refinanced my student loans.

When you think about it, student loan refinancing is pretty simple in its most basic form. What you’re doing is taking out a loan with a new company and using that money to pay off your old loan. Once you do that, you have a new loan, except at a lower, more favorable interest rate.

Here’s a timeline detailing my student loan refinancing experience:

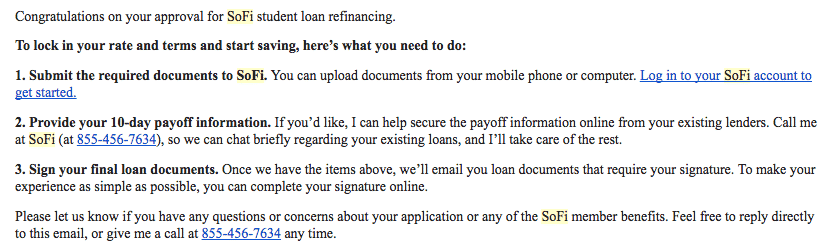

- February 2015: Applied for student loan refinancing with SoFi

- March 2015: SoFi student loan refinancing completed

- May 2015: Applied for student loan refinancing with CommonBond

- June 2015: CommonBond student loan refinancing completed; Paid all of SoFi student loan using CommonBond funds

- August 2015: Refinanced a portion of my student loans with Earnest. Paid off all of it in the same month.

- June 2016: Paid off CommonBond student loan.

Refinancing With SoFi

I first refinanced with SoFi, lowering my interest rate from 6.8% down to 4.3%. When I refinanced, I opted for a five-year, fixed rate term. I’m a risk adverse lawyer, so I never even thought about going for the variable rate term.

The process of getting approved was done entirely online. You basically enter in all the information about your job and what type of income you make. After I was pre-approved, I received the following email:

I then had to submit two paystubs in order to lock in the rate. I can’t really recall if I had to submit anything else. The main thing that companies like SoFi care about are that you have good credit and actually make enough money where you’ll be able to repay the loan.

Refinancing With CommonBond

Next on my refinancing journey was CommonBond. I’d been seeing their ads all over the place and figured I’d see what kind of rate I could get. The unique thing about CommonBond is their social mission. Much like Warby Parker or Toms shoes, CommonBond funds the education of a person in need for every loan that gets taken out with them. If you’re into companies with this kind of social mission, CommonBond is the way to go.

After noticing that they could offer me a variable rate of just 1.93%, I decided I’d be foolish not to take it. I opted to go with a five-year variable rate term. My rationale was that, by the time student loan interest rates rose, I’d be long done with my student loan. I ended up being right about that.

The process of setting up my refinance with CommonBond was largely the same as with SoFi. It took just a few weeks between my application and refinancing.

As a bonus, I also received a little bit of swag from CommonBond. And I used a referral link online, so I was able to get a little bit of cashback as well.

Refinancing With Earnest

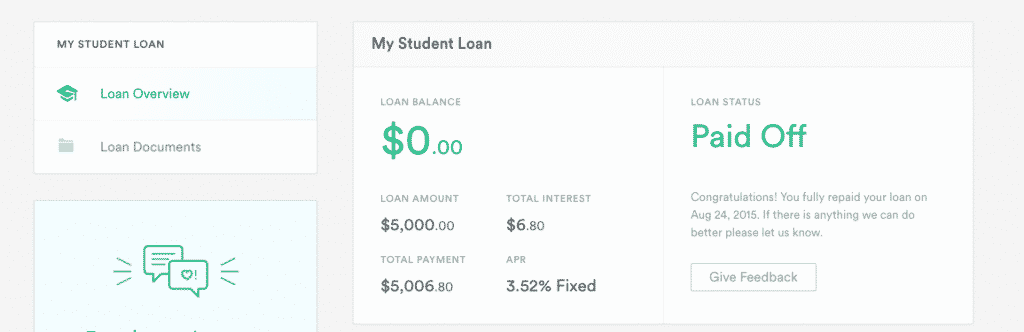

Last on my refinancing stop was Earnest. I’d received an email offering me $100 if I refinanced my loan with them. I already had a super low-interest rate, but I sort of wanted that $100. And I wanted to see what the Earnest platform looked like.

Since I had a huge chunk of cash to use that month, I decided to refinance the minimum amount with Earnest – $5,000. It was probably a waste of time, but since I’m an experimenter, it let me see what the Earnest platform looks like.

Of all the big three companies, Earnest definitely has the best-looking payment platform. The other two companies outsource their payments to a third party servicing company, which generally means a crappier looking website.

Ultimately, I think refinancing with any of these companies is fine. I also don’t think there’s any problem with refinancing with multiple companies and snagging referral bonuses along the way.

But…if you can only choose one, SoFi might be the company you want to go with because of all the free stuff you can get (explained in more detail below).

Getting Free Food With SoFi

One thing that I haven’t seen a lot of people talk about is all the free stuff you can get when you refinance with these companies. There’s one particular company that really shines above all the others in the free stuff department – SoFi.

About four to six times per year, SoFi sponsors member events that are free to all SoFi members. You can check out a page of all their events here. They have a clever system to avoid people from signing up and then flaking out, though. When you sign up to attend an event, they charge you a fee, but they refund that fee when you actually go to the event.

In 2016, I attended four SoFi events, all of which were held at fancy restaurants that I’d probably never go to on my own. Some of the events are just regular happy hours, but with enough food that you can basically get a meal for yourself. And they’re always open bar. I go for the expensive cocktails so that I can get my money’s worth. Any drink with an egg in it is always good for me.

SoFi has also held three fancy dinners in my city that would easily cost $100 per person if you include the drinks and tip you’d have to leave.

The good thing is that SoFi allows you to bring a guest with you, so you don’t have to go by yourself. My wife and I basically turn it into a date night. And the other amazing thing is that you can still go to these events even AFTER you’ve paid off your student loans.

I haven’t had a SoFi loan since 2015 and I’m still attending every single SoFi event that comes up. Since 2015, I’d estimate that my wife and I have probably snagged $1,000 worth of food and drink between the two of us.

That number is now probably closer to $3,000 worth of free food and drink since I also won a SoFi contest that allowed me to fly to New York for free (check out my recap of my SoFi trip here).

Just a tip though – these SoFi events fill up fast, so you’ve got to be ready and sign up for them as soon as you see them.

Things To Remember If You’re Going To Refinance

- It’s A Hard Credit Pull. If you’re just checking for a potential interest rate, that’ll be a soft pull that has no effect on your credit. The hard pull comes into play once you actually pull the trigger and submit an application to refinance your loans. For most people, this won’t matter too much. A couple of hard credit pulls won’t really mess with your credit very much and they only affect your credit score for a year. Still, worth thinking about if that matters to you.

- Remember To Pay Off Your Old Loan. Student loans accrue interest daily. As a result, it’s sort of hard to figure out exactly how much you need to borrow for your refinance. Remember that when you refinance your loan, you’re basically taking out a new loan and paying off your old loan with that new money. Every time I refinanced my student loans, I was always left with a few bucks outstanding on my own loan. Just make sure to pay that off so that your old account is actually down to zero.

- Don’t Keep Extending Out The Life Of Your Loan. A lot of people only look at the monthly payment. You could definitely keep refinancing your loans and make your monthly payment smaller and smaller. But that’s sort of missing the point. Student loans suck. Instead of extending out the life of your loan, just use the lower rate to make more of a dent on that principle.

- Be Careful If You’re Going For Any Sort Of Loan Forgiveness. If you’re going for some sort of loan forgiveness program, the answer is pretty simple. Don’t refinance your debt. If you’re a doctor with a ton of debt and doing a long residency, you may want to keep your federal student loans and go for public service loan forgiveness. For most other professions, public service loan forgiveness probably isn’t worth it. Admittedly, I haven’t done the math, but it seems like most lawyers would come out ahead by just sucking it up in big law for a few years and crushing the debt.

- Federal Protections Are Probably Overrated. One of the most common arguments I hear to not refinance your student loans is that you want to keep those “federal protections.” I suppose it’s true that, if something happens to you, federal loans will allow you to go into forbearance or deferment for a while. The thing is, since I think most people should pay off their debt quickly, you’re basically paying extra for something you might not really need. In addition, these student loan refinancing companies also offer benefits if something like a job loss were to happen. SoFi, for example, will suspend your payments for 3 months and help you find a new job if you lose your job through no fault of your own. For most people, that’s probably plenty of cushion.

- It Costs Nothing To Refinance. I think this is something that really confuses a lot of people. Refinancing a home mortgage costs money, so most people assume that it must cost money to refinance a student loan. This is what’s great about refinancing. It’s totally, 100% free to refinance your student loans. You don’t pay a cent to refinance your student loan to a lower rate.

What Should You Do If You’re Looking To Refinance Your Student Loans?

The way I see it, you have two options when it comes to refinancing your student loans.

Your first option is to do like I did and pick and choose your way through each individual student loan company. Each one has its benefits:

- Refinance with SoFi and you’ll receive a $100 signup bonus and get access to all of SoFi’s awesome member events (free food and drinks galore).

- Refinance with CommonBond if you’re looking for a student loan refinancing company with a noble social mission.

- Refinance with Earnest and you’ll receive a $200 signup bonus and have an amazing student loan repayment interface.

I think any of these companies will do the trick, although I’m partial to SoFi simply because of all the side benefits I’ve received from refinancing with them.

Your second option is to use a company that’s basically a search engine for student loan refinancing companies. The way these companies work is pretty simple. They’re basically like the Kayak or Priceline of student loan refinancing companies – you give them your info and then they show you all the rates from every student loan refinancing company. It’s like when you book your flight using Kayak, instead of booking directly through United, Delta, or whatever airline you’re actually flying with.

In this area, I recommend using Credible. If you use Credible, you’ll be able to see your interest rates for almost every student loan company out there. Even better, Credible will give you $200 if you refinance your student loans using the below link.

- Search for and refinance your student loans using Credible and you’ll receive a $200 signup bonus.

For sure, if you’ve got a good income and aren’t planning to go for any sort of student loan forgiveness program, then you NEED to refinance your student loans – it’s a no-brainer. Hopefully, my experience with refinancing my student loans can help you out along the way.

How much of a difference between a fixed and variable rate do you think makes a variable rate worth it? I’ve been getting quotes and the difference currently is .31%, however at least for the time being it sounds like the Feds are likely to drop rates or stay flat for the next 2 years so I’m leaning towards variable as well.

I’m lucky that I consolidated most of my federal loans at a time when the interest rate was ultra low. Refinancing is a great tool for those with a lot of student loan debt with higher rates. Is there anything to stop someone from refinancing just to get the bonuses? Kinda like how you can open and close bank accounts to get their bonuses?!

There’s nothing stopping you other than not wanting to get hard credit inquiries. I refinanced a bunch of times and snagged a bonus every single time! With Earnest, they actually lost money on me because I paid off the loan in one month just to snag that bonus.

Very nice write up, FP! I never heard of Common Bond, which is a bummer with that slamming low rate you received!! I could have saved myself quite a bit with that interest rate – water under the bridge now…

Yeah, that rate was crazy low!

Wow! I didn’t realize that SoFi had events to attend, and that you’d still be invited after repaying all of your loans!

I, unfortunately, wasn’t too savvy at the time of debt either, so I just repaid like there was no tomorrow. I did eventually pay it off. I’m not sure how much extra interest I paid in the process.

Yeah, these events are where it’s at. Another side benefit that a lot of people either don’t know about or don’t talk about very much.

You should totally pull all your student loan info and find out how much you ended up paying all together. It’s interesting to see.