Welcome to Part 2 of an ongoing series detailing the process I went through in picking investments for my new employer sponsored retirement plans. Back in June, I switched jobs, moving from the private sector into the public sector. In addition to a huge change in salary, the job change also meant a whole new set of retirement plans and employee benefits that I had never heard about.

My hope is that this series can help those of you who are just starting a new job or have just switched jobs to learn more about the benefits that your employer probably offers . If you haven’t already, I recommend first reading Part 1: My Core Investing Philosophy, which details the key principles I follow when investing.

Part 2 of this series is pretty straightforward, but is something that is often overlooked (even by people who are good at saving). You need to ask yourself the basic question – what type of retirement plans does my employer offer?

What Type Of Retirement Plans Do You Have?

I know, it seems kind of obvious, but you’d be surprised at how many people don’t know this pretty important question.

Take the example of a very smart couple that I know. The two of them both work at a local hospital and diligently max out their 403(b)s. Combined, they put away $36,000 a year into tax-deferred retirement plans offered by their employer. They’re really crushing it! And while they aren’t thinking about financial independence, I have no doubt that they could become financially independent in the next decade without even realizing it.

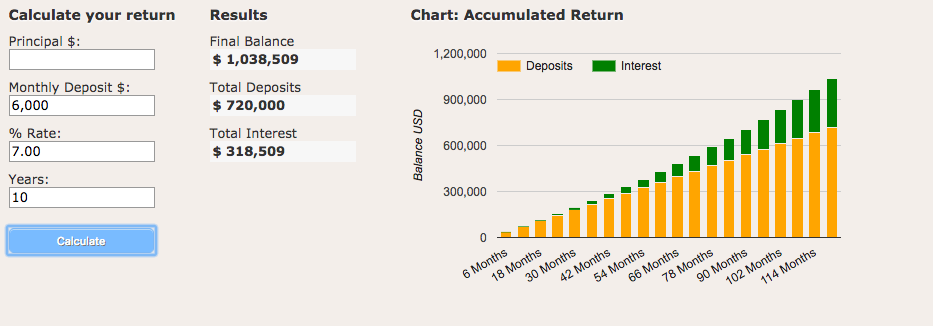

With the new year coming up, we got to talking and I mentioned to them that since they both work at a hospital, it wouldn’t surprise me if they also had access to a 457(b). They’d never heard about this type of retirement plan, but out of curiosity, they decided to check with their benefits department to see if it existed. Sure enough, it did. If they wanted to, they could put away another $18,000 each, or a total of $72,000 per year for the two of them, into tax-deferred investments. That could easily come out to a million dollars over the next ten years.

What’s important here is that this retirement plan wasn’t advertised by their employer. It took a bit of digging in order to find it. This is why it’s a good idea to carefully read through your benefits package. If you’re not sure, call your benefits department and find out what sort of retirement benefits your employer offers. You want to be able to take advantage of everything your employer offers.

Know Your Employer Sponsored Retirement Plans

Most employees will have access to one or more of the following types of employer sponsored retirement plans. In general, these plans allow you to deduct a certain percentage of your paycheck on a pre-tax basis and invest it into whatever funds your employer plan offers. It is possible for some of these plans to have a Roth version as well, which allows you to invest money from your paycheck on a post-tax basis. You can then withdraw this money in the future, tax-free.

Here’s a quick overview of the most common employer sponsored retirement plans:

401(k) or 403(b) Plans

These are the typical retirement plans that most people know about. 401(k)s are typically offered by for-profit companies. When I was working at a law firm, that was the primary tax-deferred plan that I had access to.

403(b)s are basically the same thing as a 401(k) except that they are sponsored by non-profit organizations. Think of things like hospitals, schools, and churches. The smart couple I talked about in the previous section have a 403(b) plan at work.

In 2016 and 2017, the maximum you can contribute to either of these plans is $18,000 per year. This doesn’t include any matching that your employer offers. So, if your employer offers any matching, you can still put in $18,000 of your own money into the plan. In theory, you aren’t able to withdraw your contributions before you’re 59.5 years old without paying a 10% penalty. In practice, though, there are ways around that (which goes beyond the scope of this post).

457 Plans

A 457 plan is basically the state government version of a 401(k). Just like with a 401(k), a 457 plan is funded by payroll contributions. You can then put those contributions into whatever investments are offered by your plan. Most people have heard about a 401(k). But it seems like very few people know about 457 plans.

There are two awesome things about 457 plans that a lot of people don’t know. First, the amount you can contribute to a 457 plan is independent from the amount you can contribute to a 401(k) or a 403(b). That means, if you’re lucky enough to have access to both a 401(k) and a 457 at work, you can contribute the maximum to both accounts! For 2016 and 2017, the maximum annual contribution to a 457 is $18,000. That means someone with access to both accounts can put away $36,000 a year, pre-tax. Pretty sweet!

The second amazing thing about a 457 plan is that it’s not subject to any early withdrawal penalties. In essence, this makes the 457 the ultimate early retirement account. You get all the advantages of tax deferred investing, but you still get the flexibility to take that money out if you decide to go the early retirement route.

There is one caveat though. Unlike a 401(k) or a 403(b), the funds in your 457 plan can be subject to the claims of creditors. That means if your employer goes bankrupt, your life savings might be subject to creditors looking to get their money from your employer. If you’re considering going the 457 route, use caution and consider the financial situation of your employer.

If you’re working for a government entity, then you don’t need to worry about this. A governmental 457 plan is just like any other retirement plan and isn’t subject to creditor claims. So if your government somehow goes bankrupt, you’re still okay.

Pension Plans

Some of you might be in a job that offers a pension plan as well. If you’re fortunate enough to have one, you probably don’t really need to do anything. Your employer will probably just take a certain percentage from your paycheck automatically, and you won’t have a choice in the matter. If you have a defined contribution pension plan, you can probably pick what funds you invest in. Make sure you’re picking the right ones for you.

Health Savings Accounts

This is the one that almost no one in the regular world knows about. If you’re pretty healthy, consider signing up for your employer’s high deductible health plan. By doing so, you get access to a Health Savings Account (HSA), which allows you to contribute money pre-tax and take it out without paying taxes, so long as you do so for qualified medical expenses. In addition, if you opt for payroll deductions, an HSA allows you to avoid paying FICA taxes on the funds you contribute to it. It’s basically the only way you can avoid paying those FICA taxes.

The great thing about an HSA is that it can also double up as an extra retirement account. Most HSAs allow you to invest your funds once you’ve built up a decent cash cushion, typically about $1,000 or so. Once you’re 65 years old, your HSA basically becomes like a 401(k), meaning you can withdraw your HSA funds for any purpose, without penalty.

As a bonus, most employers also offer some sort of yearly contribution to your HSA. Around $500 to $1,000 per year isn’t out of the question. Just remember that, unlike a 401(k), the yearly maximum contribution to an HSA includes your employer contributions. So if your employer contributes $500 to your HSA per year, you can only contribute up to the maximum, minus the $500 your employer already contributed. Don’t forget that!

My Retirement Accounts

I found out that my employer gives us access to three types of retirement accounts:

- A defined contribution pension plan

- A 457 plan

- An HSA

The pension plan is basically the same as a 401(k) except that the amount we can contribute to it is set by state law. I can’t change what I or my employer contributes to it, although I can choose what my pension is invested in. It’s nice because I essentially get an extra retirement account, which allows me to put away more than what I otherwise could.

My employer also offers a 457(b) plan. For a state employee like myself, this is an awesome plan. I can pull that money out if I decide to retire early and, since I work for the state, I don’t have to worry about it being subject to creditor claims if my state somehow went bankrupt.

Finally, I have an HSA. The great thing is that my employer contributes $500 per year to it. Since I basically never go to the doctor, this is a terrific benefit for me. This is just a good example of how you need to do research into your employer benefits. My employer doesn’t advertise high deductible health plans at all. My guess is that most people don’t even know what that is.

Here’s what’s even more interesting. My employer gives us an extra $300 per year (or $800 per year total to our HSA) if we take a little, at-home blood test. All I had to do was prick my finger with a device that was mailed to me, squeeze a few drops onto a little card, and then mail it back to the lab. This benefit was really hard to find and I had to call my benefits department to ask about this.

300 extra bucks just for a few drops of my blood? I’ll take that!*

*Okay, I admit, I almost fainted at the sight of my own blood. I don’t think I could make it in the medical world.

So that’s a basic overview of the types of benefits your employer might offer. Stay tuned for Part 3, when we go over the investments in my employer sponsored plans.

I work in HR, and I’ve talked to so many people who really don’t understand their benefits. It’s crucial to thoroughly read any benefits information the company gives you and to ask HR questions if there’s anything you don’t understand.

Totally agree. A lot of employers don’t make this information all that clear. Not to mention that a lot of people just don’t know about these retirement plan options. Combine the two, and you can see why people just don’t know what types of plans they might have access to at work.

I miss my HSA account. At my old employer, we only had access to high deductible plans (which I prefer since I don’t visit the doctor often). Along with the high deductible plan, we had an HSA account which contributions were matched dollar for dollar up to $1,200 for single and $2,400 for family. I racked up a nice balance in my HSA and was able to invest it as well. Unfortunately, my new employer offers only a mediocre plan that isn’t a high deductible so I can’t contribute to an HsA anymore. Can’t complain though because outside of that, everything else beats my old job!

That’s a sweet employer contribution to your HSA! That’s funding around a third of your limit for the year, which is just some great free money!

Nice summary. I have a pension plan where my employer currently puts 12% of my salary into it. High percentage is based on my extensive years of service. Also have HSA and dependent care spending account and a 401k.

Also have a deferred compensation plan which is a bit like the 457- I can sock away a large amount of pretax salary if I choose and can withdraw it when I dictate e.g each year I elect to defer salary, I set when the withdrawal date is. Generally before age 59.5!!

You have a ton of ways to use those employer accounts. The pension plan is awesome. My employer only puts in 6%. Is it a defined contribution plan or a defined benefit plan? I sort of prefer the defined contribution plan myself just because then I don’t need to worry about the pension plan failing (at least I think it can’t fail…).

im definitely jealous of the 457b. I do however have 2 employer options not on your list. Albeit they only have tax shielding for a limited time. The first is a dependent care fsa. Basically routing my expenses for daycare through the plan makes 5k of salary tax free. Then simply inset the amount at the end of the year in a Roth and you have 5k tax free earning interest. Unfortunately with my wife’s transitioning to stay at home mom I lose this next year. The second is employee stock purchase plan. Essentially the employer sells me stock at a 15 percent discount. This one is not tax exempt if you do what you should do and sell immediately to avoid concentrated holdings in your employer.

Great points. There are definitely more options I’m sure. I was just thinking about some of the more common ones that I know about. The FSA point is smart. Something I’ll have to think about one day, I’m sure.

The stock purchase plan is interesting to me, as I’ve never had one before. So it’s not tax advantaged, so does that mean if you sell it right away, you pay taxes on the 15% difference between what you bought it at and what you sold it at?

You pay taxes on the contribution up front. The earnings including the 15 percent have a holding rule where if you have for a year it reverts to cap gains rates. The issue is that requires you to hold your company stock, which is something I’d advise against due to concentrated risk. Selling immediately reverts to ordinary income.

I’m not sure about that point you made regarding 457 plans. My 457 contributions are 100% from my paycheck, so there should be no third party claim to that money.

So a non-governmental 457 plan is actually a bit different from a 401(k) or 403(b) because it’s a non-qualified deferred compensation plan. In a 401(k) or 403(b), the money is put away for you in a trust. Basically, this means it belongs to you and you alone. No one can take it. You defer the compensation to a later date, but it’s held in trust for your benefit.

In contrast, with a non-governmental 457 plan, even though the deductions are coming from your paycheck, it’s a non-qualified plan. As a result, when you defer the compensation, it is actually still being held by your employer and technically belongs to your employer, which is why it can be subject to the claims of your employer’s creditors.

I probably haven’t explained it very well, because to be honest, I haven’t gone into the tax code, but this Q&A series from White Coat Investor should help explain it better than I can: http://whitecoatinvestor.com/non-governmental-457-plans-friday-qa-series/

Do you know if your 457 is a governmental 457 or a non-governmental 457?

Yeah, that blood testing idea is great. $300 in an HSA is triple-tax free, so that’s REAL money in your pocket.

I’ve always wondered more why healthcare companies don’t pay us to be healthy. When I lived in the UK, I found it amazing that a friend could actually earn cash from their company for going to the gym. I’m not sure why this was the case given the governmental healthcare, but every time she swiped in to the gym she earned a credit and if she hit however many she needed a month she got £100.

It seems like insurance companies would have a similar policy. Pay us to be healthy which means lower healthcare costs in the future. I assume the flaw in this plan is that insurance companies don’t want to pay you to be healthy today since they may not be the ones insuring you later when you’re older.

I feel like I heard a Planet Money podcast episode where the hosts talked about an insurance company that did those sort of incentives. It makes sense. You’d think that as an insurance company, it’d be cheaper to pay people to be healthier rather than paying out health insurance claims. I’m sure there’s some reason why they don’t do that.

I’ve done extra testing for cash back on my health plan, but never collected my own blood!

Since Mrs CKs retirement gig is with a community college she has access to both the 403b and 457. It blew my mind when we first found out she could contribute to both. Your friends can really crush it if they max out all those pre-tax contributions!

I seriously almost fainted by looking at myself as I squeezed out some drops of blood. I don’t do well at the sight of blood I guess.

The 401k/403b and 457 combo is seriously underutilized. 99% of people have no idea that you can contribute to both. I only have the 457 at work, but I discovered that I can sort of create my own 401k/457 combo by starting up a solo 401k and throwing my side hustle money into it.

Does your employer offer relatively good investment options in your 401k? My employer used to use ADP as the custodian for investments (yes, they not only do payroll), and the loads were pretty high. Fortunately, they switched to Wells Fargo, which is marginally better.

This will be coming in a future post for sure, but yes, my employer has really good options! The benefit of working for the state is that it has some sway in making sure that it’s employees aren’t being duped by high fees. Lots of Vanguard options in there.

Thanks for the overview, FP! I think it’s awesome that your job contributes $500 a year to your HSA with an additional $300 for a few drops of blood. $800 of free money a year is amazing! On a side note, what are they doing with your blood? Are they cloning an army of Financial Panthers?

You tell me! You’re the doctor here. They did send me my test results, so maybe they just want us to see how our health looks and take some action. In theory, the more I take care of myself, the cheaper it is for my insurance company, right?