Hi, I’m Kevin, an attorney, writer, side hustler, and the owner and blogger behind Financial Panther.

I started this blog in 2016 to share my journey getting out of student loan debt, as well as share some of the interesting things I was doing to save and earn more money.

For a bit of background on me, my story is a lot like your typical millennial. I graduated from college in May 2009 – right in the middle of the financial crisis. As you can imagine, it wasn’t a great time to finish school. Finding myself with no job prospects, I ended up moving back home, earning some money with minimum wage jobs at my local golf course and currency exchange at the mall.

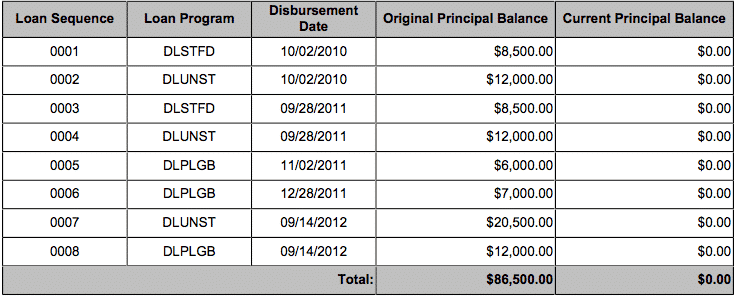

I needed to figure out a career though, so I did what a lot of people do when they have no clue what to do with their life – I headed off to law school. And like most law students, I ended up taking out a bunch of student loans to do it – $87,000 worth to be exact.

On paper, being $87,000 in debt didn’t seem that bad. But once the bills started coming in, it dawned on me that if I didn’t do anything, I’d have this huge debt hanging over my head for the next decade of my life.

Fortunately, I did well enough in law school to land a high-paying job at a big law firm in Minneapolis. This meant I had plenty of money coming in – more than enough for me to live a normal life as a big-shot lawyer. But did I want to live a normal life? A normal life meant spending money on stuff that didn’t really matter and seeing much of my paycheck going out the door to pay student loans and other bills. It meant being stuck in a job that I might not really like all that much. I might have nice things, but I’d be trapped.

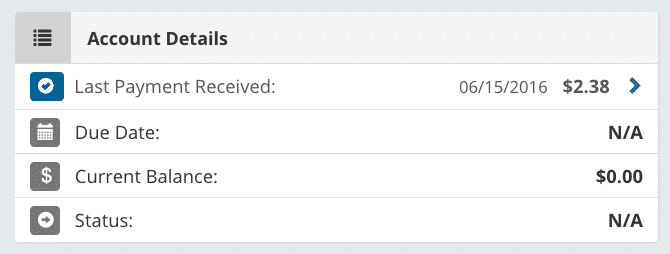

When I graduated from law school, I gave myself one goal – to pay off my student loan debt as fast as I could. I started my first job at the end of 2013 and began seriously repaying my student loans in January 2014. I made my final student loan payment in June of 2016, just two-and-a-half years after I started my debt payoff journey.

Getting rid of my student loans allowed me to take more risks in my career. I ended up taking a $50,000 pay cut to try my hand as a government attorney. When that didn’t work out, I took another pay cut to try out another job as a legal editor.

In 2019, I made the biggest leap of all – quitting my career as a lawyer to go full-time on this blog. I’ve been blogging full-time ever since.

What’s This Blog About?

I started this blog to share what I’ve learned about money and side hustling over the years, as well as to document my journey towards financial independence.

I hope that my experience and knowledge can help you out in some way. As a lawyer and dentist couple, I like to think that this blog can be a particularly helpful resource for future or current lawyers, doctors, dentists, or anyone else with a solid income, too much debt, and not enough knowledge about what to do with it.

The main topics on this blog include the following:

- Personal Finance Stuff

- Financial Independence Stuff

- Side Hustling Using Gig Economy Platforms

- Making Extra Money With Credit Cards and Bank Account Bonuses

- Improving Your Life And Your Finances With Ebikes, Electric Scooters, and Other Forms of Micromobility

What Is A Financial Panther?

The name Financial Panther comes from an episode of the Simpsons, where Homer mishears the words “financial planner” for the words “financial panther.” I’ve always chuckled at this joke. You can see a clip from that episode below:

Whenever I need a definition for a weird word, I look over to the good folks at Urban Dictionary. They define a Financial Panther as:

A large jungle cat that can be trained to maul a person’s creditors and bill-collectors if that person is short on money.

That seems like a pretty good definition to me. I think we could all use a Financial Panther in our lives.

If you’re interested in following along and learning, be sure to sign up for my free email list below. It’s a great way for you to stay up to date with all of my newest posts.

Hi Kevin,

Thank you for sharing you personal story. Well done with paid student loan!

I am just at the beginning of my journey and try to track my finances. I’ve build a tiny tools for my personal needs. If you would be interested in please review and I would much appreciate any feedback or suggestions.

Thanks,

Vitali

G’day mate, nice to discover you online and read your story. Great work on paying off your student debts so quickly – and law school isn’t cheap! I know because it’s almost as expensive as flight school (my ATPL cost me just over AUD $300k). Looking forward to reading through your blog. Cheers, Capt. FI

Hi Kevin,

Thanks for your informative blog. I have CDs expiring and have been looking for a secure place to reinvest the funds. I really enjoyed reading about all your side hustles as a I too quit my RN nursing career after 10 years and paying off my school loans. Enough cannot be said about having a quality of life. Thanks for sharing all your info. Best wishes in your future endeavors.

Thank you Elsa!

Hi Kevin,

I’ll be finishing up my book with Portfolio/Penguin as well, this month, and one chapter I have is on side hustles. Maybe I can feature you and your story? I don’t know what your e-mail address is, hence this comment.

If interested, I would need around a four paragraph blurb about what you did,, roughly how much you made at your day job, what side hustle you started doing while working, how much it’s now making, and how it’s going, whether you are still working a day job. An income range would be good if you don’t feel comfortable with specifics.

No worries if not interested!

Regards,

Sam

Hey Sam,

Definitely am interested. I’ll send you an email to confirm.

Hi Kevin

I’m Johan

I stumbled with your NetSpend Article in search of making my money work for me and also for my son, that’s currently overseas. Yup! he’s a Marine. I would love for him to learn make smart financial decisions and I’m here to guide him. Something that some of our parents never taught us.

We have plans to open a few NetSpend accounts this weekend.

By the way, I love your journey and also the fact that you’re helping others meet their financial goals.

Thanks Johan! Appreciate the kind words.

Hello Kevin

Im Lucchesi

In a quest to findout what or where to put or do with my money to Grow, Work or Generate Profit, I stumbled with your NetSpend Article and it Got my attention immidiatelly and I already started the proccess and found out that they offering 6% APY.

While doing seach for onlines banking I notice Axos Bank kept coming up, highly recommended by other experts, I was wondering if you had any Intake or Opinion on it ??

Not a fan of Axos Bank. I opened accounts with them just for the bonuses. But otherwise, I don’t recommend them.

Love your whole platform! Not a lawyer but my best friend is! I’m a school counselor by day and therapist/clinician by night (I’d say my 2nd job is my side hustle b/c it’s profitable & I get to help a lot children and families)

You’re welcome! I’d say owning my own business. My friend and I started a kickboxing business, and I am working to turn my personal finance website into a full job (I am not quite there yet — there has a lot to be done. I just like to control my time.

I also don’t want to leave the law altogether. I will volunteer my time at this nonprofit organization, giving free legal services to those who cannot afford a lawyer.

Great story! I am myself an attorney who’s trying to get out of the game. Like you did, I also feel trapped. Yes the money is good, but the lifestyle of a typical attorney (nice suits, shoes, drinks after work, etc…) + student loans and other monthly bills, leave you with no money at the end of the month.

I’m glad you were able to get out of it and enjoy like like you should.

Thanks! What are you trying to transition too? I’ve seriously never felt better and have never been happier since getting out of the law game.

Wow, this is written for me! I graduated law school in 2011 with about $35k, which I paid off as soon as I could. I did full time lawyering, freelance/contract lawyering, some teaching on the side, now working full time in a non practicing role for the state government. I’m newish to the Dave Ramsey/FIRE personal finance world, but I am setting BIG financial goals for myself. Definitely interested in exploring side gigs geared towards my skill set. Excited to read more of your work!

I just stumbled across your blog within this past month. It’s very interesting, informative and entertaining. I am a fan!

Thanks Andrew! Glad you enjoy it. Let me know if there’s any topics you think I should cover.

This is great. Love the Simpsons joke. Congrats on paying down that debt!

I totally look up to your blog, I recently started mine a few days ago. It’s funny following bloggers with 203k monthly views on Pinterest and mine says 3 cx

Glad I can come by and leave some feedback hope to read more! Thank you FP

Thanks John! Appreciate the kind words. Keep at it. This whole blogging and online thing is definitely about the long game.

Just found your website, and I love it thank you! Can you please email me who your website company is? I love the layout, colors, etc., and would like to do something similar in my new company (I’m already a real estate broker/owner). LOVE your caricature, also! 🙂 Thanks in advance.

Hey Amy, my business partner does the website for me. Shoot me an email and I can send you along his contact info.

Found your blog this morning while the hubby and i were researching charging limes and birds. We have about 100K in student loans. Thank you for sharing your story and knowledge. I am 46 and want to be debt free by 50. We have no other debt except our home.

Thanks so much for stopping by Marcia! If you have any questions or want me to cover any specific topics, just let me know!

Mr. FP – I have enjoyed your thoughts and writing. I am 61 and sorta retired from a desk job but I can’t stand still. I started out with inspection gigs with OnSource and WeGoLook jobs here and there and bridged into lender inspections for repairs on insurance losses and checks on properties behind on payments. After reading blog, you have inspired me to think differently about what I’m doing and have expanded my side-gigs into the short surveys, receipts, and adding JobSpotter as well as EasyShift/GigWalk/FieldAgent where it makes sense. I was visiting family over the weekend and mentioned I was going to make money on my morning walk, so I did a half mile walk to a Field Agent rental inspection and caught 4 or 5 hiring signs on the way back with about 1-1/2 mile walk in total. I got good exercise and I pocketed $8 or $9 – I think they were at least a bit amazed! I really like your thinking on incorporating these sidegigs into what I would be doing anyway and have begun putting it into practice. I have shared this with my kids and have inspired a few to at least try some of the more passive things. So FP, thank you. Keep up the good work! I wish you well, in all of your endeavors.

Thanks so much and glad to see you around here! That’s the great thing about what you’re doing – since you’re incorporating it into the stuff you’re already doing, it doesn’t have to take up much of your time and it can be fun and give you a benefit beyond just working. $8 or $9 to go for a walk, something you would do anyway, is not a bad deal at all. Stay healthy, live longer, and get paid to boot!

so glad to happen upon your bolgs i have shared your social info to help loved ones, i found you by reading your article on the prism app which i started using this week. I am very interested in your side hustles which i do uber eats on my days off of my regular job working for the state of texas. keep the good info comimg and im glad to have found you so i can do better myself financially.

Thanks Lori! Glad you found your way here and that my stuff is useful to you!

I’m fairly new to your website, but I love it! I know you’re planning on baristaFIRE, but do you have any blog posts about how close you are to achieving that?

Thanks Scott! I haven’t written any specific post about how close I am to that – to be honest, I’m really far away from it still. Makes the blog a little different because I basically am starting from zero (actually from negative now). But I’ll think about how I can incorporate a post about that info, since it’s helpful info to know.

Hi Financial Panther,

I chanced upon your blog recently, and I have to say, you might just be a long lost twin!

My real name is Kevin as well, I used to be in big law (London and Singapore) until recently, and I run a financial blog called Financial Horse ( http://financialhorse.com/ ).

The similarity just blew me away, and thanks for making my day. I’m based in Singapore now, so if you’re ever in the area, don’t hesitate to hit me up!

Great blog btw, absolutely love it. 🙂

Cheers

Hey Financial Horse! Thanks for stopping by and for the kind words. We might very well be twins! What kind of work are you doing now?

Hi Financial Panther. I am working as a corporate counsel now. Not entirely removed from the law, but I am enjoying it. 🙂

Great blog! I love the side hustles and the Simpsons anecdotes!

How many hours are carved into the week for your deliveries and are most of these activities on the weekend? Impressive that you are able to side hustle with your full-time job.

Thanks Smart Money MD! I don’t try to carve any specific time to do these. In the summer, I like to try to get an hour of bike riding in after work, so I’ll often just do an hour or so of deliveries if I feel like it. Same with some weekends. I’ll just wake up and do some deliveries in the AM on my bike, again, for the exercise. The key is, I find it fun and I’m getting exercise. But I don’t really purposely set any hours to do these gigs.

Saw you post on another blog and just KNEW you had to be a Simpsons fan! Loving all your side hustles, got to see which I can start doing 🙂

Thanks Mr. SLM! I’m a big Simpsons fan, at least up until around Season 10 or 11. Glad you enjoy the side hustles and you should totally see which ones work for you.

Thanks for sharing your story. Where are you guys based?

I’ve had a lot of friends who stopped practicing law after 5-10 years to do something else. Have you noticed this trend as well? The law industry seems to really spit people out after chewing them up, just like the banking industry.

Sam

Hi Sam! We live in the Twin Cities, which has a lower cost of living, but still pays pretty good salaries. It’s not rock bottom cost of living here, but combined with the good incomes folks seem to make, you can really carve out a comfortable life.

You are correct in your observation of the legal industry. The attrition rate in “big law” (which is what we call working at the largest firms in the country) is horrendous. The pressure of billable hours wears you down. Plus, dealing with multiple bosses (every partner is basically your boss), competition between associates, and the general unpleasant atmosphere means that the vast majority – anecdotally, I’d guess 80% or more – will move on to a different type of legal environment within the first 3-7 years. I do know some lawyers that have left law altogether, but lawyers are a pretty conservative bunch, and I’d wager that most will just stick around doing some type of law, just in a less high pressure environment. Most likely in-house or government.

The interesting thing about sticking it out in big law is the reward. You’re basically rewarded with even more work and worse hours. Once you hit partner, you don’t just get to sit back and do nothing. So if you’re miserable as an associate, there’s not really a light at the end of the tunnel for sticking it out and trying to make partner (other than making obscene amounts of money and spending it all on housekeepers and nannys to take care of your home, since you’re never home).

So long winded answer, absolutely, the law industry chews people up and spits them right out. It’s basically the nature of the money making machine.

Great story! I can’t wait to read more about how you paid off the debt so quickly, particularly with the side hustles. Did you do this while you were in Biglaw as well?

As a fellow lawyer blogger, welcome to the neighborhood!

Thanks! Love your blog as well. It’s got great info!

As to your question, I didn’t really start these side hustles until mid-2015, but have loved trying these new gigs out.

Thanks for sharing about your journey.