One of the books that I think everyone should read is The Life-Changing Magic of Tidying Up by Marie Kondo. It’s a book that’s about much more than it seems – far more, anyway, than just a book about how to tidy and clean your house.

Those of us who consume content about financial independence and early retirement are, I think, on a mission to change how we move through the world. I know that I first stumbled onto the financial independence community because I felt that something I was doing just didn’t feel right. For me, life felt like it was on auto-pilot. I was doing all of the things I thought I was supposed to be doing without really thinking about whether the path I was on was right for me.

Too many of us do things without thinking about why we do it. There’s a lot of value, I think, in challenging your default settings and assumptions. Marie Kondo’s book, in my opinion, does exactly that. It takes something that seems pretty simple – cleaning and organizing your house – and challenges you to think differently, flipping everything that you think about cleaning and organizing on its head.

I’ve been in quarantine over the past few weeks, and with all the time I’ve spent at home lately, I thought it fitting to pull this book off the shelf and give it another read. In today’s post, I want to go over the big lesson in this book that has greatly impacted me and discuss how you can take advantage of tidying up to improve your own financial life in the tough times that we’re currently in.

The Big Lesson From The Life-Changing Magic of Tidying Up

We should be choosing what we want to keep, not what we want to get rid of.

A few weeks ago, I made a decision that I was going to start getting things in my house back in order. My wife and I recently had a baby, and right now seems like an important time to declutter and make sure our house is in a condition that makes us comfortable.

The thing is that when you spend your entire life accumulating, it can be hard to figure out what you’re supposed to do with all of that stuff. It really hit me when I was organizing my closet and realized I had over 40 dress shirts. And since I quit my job last year, I’ve literally worn dress shirts just a handful of times. There’s really no reason for me to have so many of these shirts clogging up my closet.

Figuring out what to get rid of and what to keep can be difficult though. I’d always been taught that when I want to get rid of stuff and declutter, the first thing to do is to figure out what I want to get rid of. That’s the default way most of us think.

The big takeaway – and the one critical lesson that Marie Kondo teaches us – is this: challenge your defaults. Marie Kondo’s “KonMari” method essentially teaches you to switch your defaults. Assume you’re going to get rid of everything and only keep the things that you can convince yourself to keep. She refers to it as keeping the things that spark joy.

However you choose to think of it, that’s the important thing – if you want to make big changes, you need to change the default way you view the world. I took this to heart. Everything in my closet was destined to leave my house by default. It would only stay if I could convince myself otherwise.

Taking Advantage Of Tidying Up During The Quarantine

I went through my latest tidying up adventure by going through the categories of stuff in the order that Marie Kondo teaches. She tells people to first go through all of their clothes, then look at books, then papers, then miscellaneous stuff, and then mementos. I think there are pros and cons to decluttering by category, rather than by room (I personally prefer going room by room), but the point makes sense – when it comes to big projects like this, you need to break things down into smaller chunks.

From a monetary standpoint, tidying up can actually bring in extra income that can be especially important in times of crisis like the one we’re in now. Most of us forget that the things in our house have actual value. The truth is, if you’re willing to put in a little bit of work, almost everything in your house can be turned into cash.

As an example, I had a ton of dress shirts that I bought over the years. I ended up bundling a bunch of similar branded dress shirts together and sold them together as a lot. This made it easier to sell and came with the added benefit of getting all of my dress shirts out of my house in one go while putting some extra money in my pocket as well. It’s not a ton of money, but it’s at least some money in my pocket – a small revenue stream that consistently fills my PayPal account.

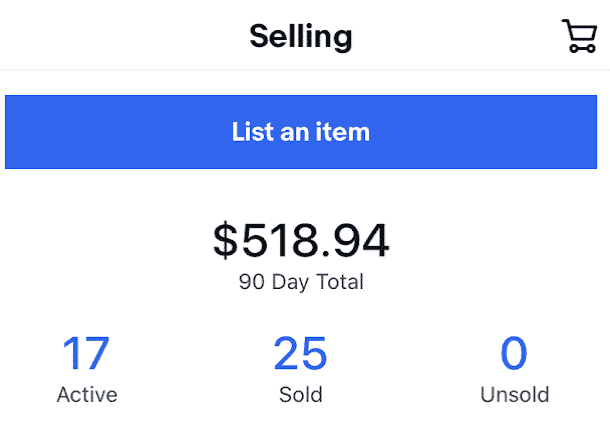

If you pull up my Ebay account, you can see that my running total of stuff sold over the past 90 days is in the $500 range. Some of that is from stuff I bought and flipped, but a good chunk of that money was made simply by reselling things that were doing nothing in my house. And importantly, selling stuff that I wasn’t using and didn’t need gives these items a second life with someone else, hopefully in a more useful setting.

An interesting thing can come about when you start thinking about the stuff you have in your house as essentially something you’re renting until you can resell. The Money Wizard broke it down very well in a recent post he wrote, explaining how you can buy something used and resell it later when you’re done with it. The difference between whatever you paid for the item and the amount you sold the item for is essentially the amount you paid to rent the item for however long you had it.

I’ve done this same strategy over the years, buying used furniture, using it for a few years, then reselling it for almost what I paid for it. Certain brands hold their value extremely well – things from Ikea come to mind. Most of the time, you can buy any piece of furniture from Ikea used and resell it for almost exactly what you paid for it. In some circumstances, you can even make a profit. I remember a few years back when I bought a set of barstools for $85, used them for a year, then sold them when I moved for $90.

In short, if you take the time to implement some tidying in your life, you might find that you have some real money sitting in your house, tied up, doing nothing in the form of stuff in your closet and drawers. Get rid of that stuff, clear more space in your house, and maybe put away a little bit of extra money for yourself too.

Reset Our Defaults

I think most of us live our lives on a sort of auto-pilot, doing things simply because that’s the way things have always been. We do this with our lives and careers. And we do it with our stuff. Rereading Marie Kondo’s The Life-Changing Magic of Tidying Up reminded me about this – how we default to things without thinking too much about why.

When it comes to stuff, most of us default to keeping things around us without thinking too much about why it’s there. I never needed to have 40 dress shirts or 100 t-shirts in my closet or dresser. When I was working a regular office job, maybe I needed some of those shirts. But really, I probably didn’t need all of them.

The lessons to consider from Marie Kondo’s book are this. Reset your defaults. The things we surround ourselves with should matter. We let stuff build up around us without thinking about why it’s there.

These past few weeks in quarantine have really challenged all of our default settings. On the home front, it’s made me much more aware of how much stuff I’ve let build up around me. My goal has been to do something about it. It’s still a work in progress.

I recently started reading The Minimalist Home by Joshua Becker, which seems to have another take on how to approach decluttering a home. So far, the book has intrigued me. It might be worth reading both of these books if you have the time and inclination.

Hey Kevin,

Effectively challenging those defaults we allow ourselves to take on is certainly the path to growth.

The concept of deciding what we want to keep it a great way to flip our usual methodology in life on its head. Rather than thinking about the things we want to get rid of, the friendships we no longer need, better to think of what and who is continuing to support our journey and urge us along life’s journey.

I’ll have to give this a read.

Take care,

Ryan