I usually get praise for the fact that I was able to pay off $87,000 in student loans in 2.5 years. It’s definitely one of my proudest money moves and, importantly, it opened up a lot of doors for me. Not being forced to stay in any particular job because I “needed” the income greatly improved my quality of life.

But sometimes when I share my story, rather than praise, I’m met with scoffs.

Of course you were able to pay off your student loans quickly! You’re a big shot lawyer making six figures a year!

True enough, I did make a six figure salary (I don’t make a six figure salary anymore). And yes, without that salary, I likely would not have been able to pay my student loans off as fast as I did. It’s pretty basic math. Take your income, subtract your expenses, and everything that’s left over is what you can use to pay your student loans.

But these scoffs got me thinking. The assumption appeared to be that anyone in my position could do what I did.

So, if I was able to pay off my student loans off as fast as I did, why weren’t others in my position doing the same?

How Your Typical Young Lawyer Spends His Six Figure Salary

I thought it’d be helpful to do a thought experiment on your typical young lawyer to see why someone earning $110,000 per year couldn’t crush those student loans fast.

I’m basing these numbers off my own numbers here in Minnesota. But you could potentially translate these numbers into any location. If anything, you can at least get an idea of why a high salary by itself isn’t enough to pay off student loans fast. If you want to succeed in paying off student loans fast, you have to actively be trying to do so.

For our calculations, we assume that this young lawyer is earning $110,000 per year, which was my starting salary when I began my first big law job. We also assume this young lawyer contributes 5% of his income to a 401(k). I chose that number because that was the default contribution rate that my firm set for me when I became eligible to contribute to my 401(k). Finally, just to make these numbers easier, I assume that this young lawyer is single and without any family.

Here’s what we’re looking at for income and expenses per year:

- Pretax Salary = $110,000

- Salary after 401(k) contributions = $104,500

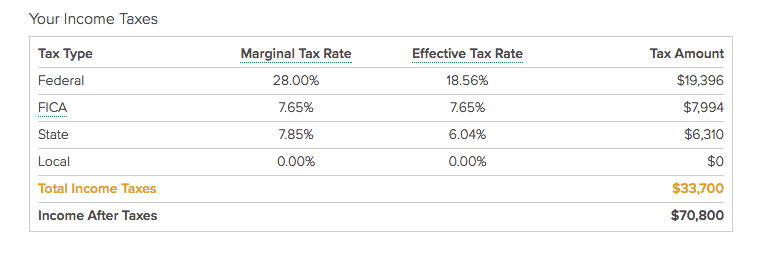

- Taxes = $33,700

- Take Home Pay = $70,800

Expenses

- Rent = $19,200

- Parking = $1,200

- Student Loans = $12,000

- Car Payment = $6,000

- Food = $12,000

- Pet Care = $7,000

- Gym = $600

- Cable = $1,440

- Car Insurance = $1,800

- Clothes = $2,400

- Vacations = $4,000

Total Expenses = $67,640

Amount Remaining = $3,160

So as we can see, your average young lawyer in this situation takes home $70,800 per year. Despite that, at the end of the year, he’s left with only $3,160.

Let’s take closer look at these numbers:

Taxes

I used a calculator from SmartAsset to determine the likely tax burden for someone making $110,000 per year. Since your average young lawyer doesn’t understand taxes or tax deferred savings, he does nothing with his 401(k) and just lets his firm take out the 5% from his gross pay each pay period.

With a taxable income now of $104,500, your average young lawyer pays $33,700 in state and federal income tax. He pays an effective federal tax rate of around 18.5%. He then pays a state tax rate of around 6%.

Don’t forget the FICA taxes. Your young lawyer pays 7.65% on that front After taxes, your young lawyer now has $70,800 to spend per year, or $5,900 per month.

Rent

Your average young lawyer doesn’t opt to live in a “normal” apartment building like a regular person. He opts instead to live in a 1 bedroom, luxury apartment building in a cool part of town. As many of you have probably noticed, luxury apartment buildings are popping up all over the place. The demand for these buildings are obviously there or else, why would they get built?

There are a bunch of reasons why your average young lawyer wants to live in a luxury apartment building. Everyone else he knows lives in those buildings, so that’s the only type of living he knows. These buildings are close to downtown, so he can get to work quickly. They’re also in a very hip part of town, right next to all the cool restaurants and bars. And your young lawyer wants a nice place to come home to after a long day of work. These are all fair points. But it means that this lawyer will have to pay for those privileges.

Just perusing Craigslist, I see luxury apartments ranging from $1,500 to $2,000 per month, so I think $1,600 per month as your average rent is a fair number. Over the course of a year, that’s $19,200 per year spent on rent.

Parking

Of course, paying rent isn’t the only cost of living in a luxury apartment. Your average young lawyer doesn’t take the bus or bike around town. They drive a car (even though the car sits idle for a majority of their day). Since this young lawyer lives in a luxury apartment, he likely cannot park in the street, since his neighborhood is too cool to have any available street parking. And besides, he likes the benefit of the heated, underground parking in his luxury apartment. $100 per month to park your car is a fairly reasonable amount. By the end of the year, this young lawyer has spent $1,200 just to have a small, rectangular piece of concrete to place his car.

Car Payment

Your average lawyer is going to have a car (which he has to pay to park as discussed above). Since he’s starting a new job, he’ll want to buy a new car. But of course, he’s been a student for the past three years, so he has no money. So how does he buy the car?

According to a recent article, the average car payment in the US is around $500 per month on a $30,000 car loan. We lawyers are a pretty average bunch when it comes to our money, except for the fact that some of us just happen to make a little more of it. A $500 per month car payment doesn’t seem like all that much when you’re making six figures a year. By the end of the year, your average lawyer has paid $6,000 for his car.

Student Loans

I graduated with $87,000 in student loans, which was actually on the low side for a newly graduated lawyer. Your average law student is graduating with around $140,000 in student loans. Holy crap!

For purposes of this exercise, I’m going to be generous and assume this average young lawyer left law school with a paltry $87,000 in student loans.

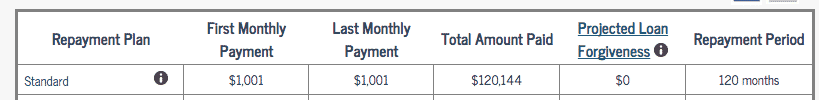

At a 6.8% interest rate, your average lawyer’s monthly payment for a 10-year loan is about $1,000 per month. By the end of the year, he’s paid $12,000 towards student loans. And he still has 9 more years to go!

If he’s smart, he can reduce his interest rate by refinancing his student loans with one of the many student loans refinancing companies out there. Since I enjoy experimenting, I actually refinanced my loans with all three of the big names in the student loan refinancing space, just so I could know what the experience was like with each of them. Try SoFi, CommonBond, or Earnest, and go with the one that gives you the best rate.

Food and Drinks

Okay, you’re probably wondering how a single person can spend $12,000 per year on food and drinks. I’ll tell you how. He goes out to eat and drink…a lot. And he does it at all the coolest places in town.

$12,000 per year on food comes out to about $33 per day. Since your average lawyer never packs his own lunch, that means he’ll spend about $10 every weekday on lunch. He’ll then grab a few lattes every day as well, so throw in another $10 per day on coffees. Add in a few happy hours, a few cocktail hours, and a few fancy nights out every week, and you’re pretty soon hitting a $33 per day food and drink budget.

Don’t forget, your average young lawyer chose to live in a luxury apartment because he wanted to be near all the coolest restaurants and bars in town. It’d be a waste if he didn’t take advantage of what the neighborhood had to offer.

Pet Care Costs

This one doesn’t apply to everyone, but in my experience, almost every young lawyer seems to get a dog. I have my own dog too, so I’m not going to judge anyone for that fact. But the costs of dog ownership can add up!

Your average young lawyer doesn’t want their dog to be cooped up in their luxury apartment all day, so they’ll pay to have their pup go to doggy day care. At $31 per day, that comes out to $155 per week, or around $620 per month! Don’t forget those times when your young lawyer goes out of town and needs to pay for dog boarding.

To be generous, I’m rounding this amount to an even $7,000 per year for pet care costs (although I believe this number is likely higher for many people).

Other Costs

I won’t go into full detail on some of these other costs, but I think these are also reasonable.

Spending $2,400 per year on clothes might even be on the low end. Your average male lawyer is spending $500 or $600 on suits from J. Crew and Brooks Brothers. Buy a few suits, a few shirts, and whatever else you buy during the year and you’re suddenly at $2,400 per year on clothing costs.

Vacations are another thing that I’m estimating fairly randomly. Your average lawyer isn’t going camping in the woods, that’s for sure. Add up the cost of a few plane tickets, hotel stays, and weddings per year, and you probably come out to around $4,000 by the end of the year.

Cable, gym, insurance. That stuff is all pretty self explanatory.

The High Cost of Living Normally

Once you’ve added up all these costs, your average lawyer is left with only $3,160 remaining to put into his student loans.

This is why your average lawyer, despite making six figures, isn’t making a dent on his student loans. The money is going out the door on other things.

By living just like everyone else, this lawyer, despite bringing home $5,900 per month, still can’t get ahead. He spends $5,600 a month, and only has $300 left over at the end of the month! I haven’t even included random costs that probably come up. In all likelihood, this lawyer probably just breaks even each month. And he’ll have to keep earning six figures in order to keep up his lifestyle.

He’s trapped.

This lawyer will live comfortably. He’ll go on his vacations. Drive a nice car. Live in a nice apartment building. But as you can see, he won’t pay off his student loans. And he’ll never be able to leave that big law firm job.

Obviously your “New” lawyer is living way beyond his means! He doesn’t need a $500 monthly car loan right out of school! I got a brand new car for $138/mo after I graduated med school. And $33 per day for food is laughable. Even including a bar bill, it might be $33 1 or 2 days a week max, not every day! Are you seriously trying to blame him not getting ahead while paying for a gym membership, doggy day care, a $500/month car loan and an exorbitant food/bar tab? Too funny! So he easily has more than $900/mo to add to his $1000 /mo payment towards his loans OR to put in savings (depending on his interest rate on his loans). He is not “getting ahead” because he is foolish with his money, not because of loan debt (which you acknowledge he is paying on monthly).

Clothes, vacations, cable, and pet care could easily be cut in half, leaving an extra $7500. Losing the car would save you an additional $9,000 (minus $1,500 for the subsequent public transportation). Add that to your original surplus of $3,000 for a total of $18,000 per year. New law school grads should not expect themselves (or their pets) to live in luxury.

My salary right out of law school was $70,000. Take-home pay was around $40,000. I was single, lived with my dog and a roommate in a cheap apartment in Chicago, and only spent $24,000 per year on expenses. I kept myself to a strict $2,000 /mo budget, which is actually pretty comfortable for a single 20-something. The rest ($16,000 /yr) went to student loans, which I paid off in just under 5 years.

In your real-world scenario, paying off $87k in debt in 2.5 years with a salary of $110k is impressive. But your hypothetical lawyer is an extravagant over-spender. Think about it this way: if her take-home pay is $70,000, and she puts $30,000 towards paying off loans (which would have them paid off in about 3 years) then she still has $40,000 for everything else. The average household income in the U.S. is $60,000, with an after-tax income of about $48,000. But that’s for a family of 2.5 people with 2.3 vehicles. If the average family can survive on $48k, then a young, single, lawyer should thrive on $40k.

Great article! Any advice for someone with $325,000 on federal loans for law debt but only $40,000 pre-tax on salary without any luxury expenses like vacations (what are those?)

I think for folks like me, even after minimizing expenses (living with in-laws, carpooling, leave the dog at home rather than hiring pet care) we get stuck in the “eventually make IBR payments for 25 years for the taxed forgiveness, then make a payment arrangement with the IRS and continue paying monthly payments until you die” strategy.

If you’re in that situation, you need to either figure out how to make more money or go for a government job and do PSLF. It’s just a math problem here. Honestly, $40k a year is $20 an hour if you’re working 40 hours a week. If you work more than that, you’re literally making less than $20 an hour. You can literally make that much doing almost anything in my opinion – I was offered a job as an administrative assistant in 2009 for $15 per hour, which means, honestly, a lot of admin assistants are making more than $40k a year today. Unless there’s a reason you are working that job (like it is a PSLF eligible job or it has the potential of earning a lot more pretty soon, such as you can become a partner like in a few years), then you’d need to drop that job and literally go make more money doing something else.

Except for those of us 9.5 years into PSLF who are watching our coworkers apply and get denied for the loan forgiveness. Meanwhile my debt has doubled while I was making those IDE payments and living like a complete pauper, now terrified I’m going to have to attempt to find a higher paying job.

Yeah sorry man. That sucks.You guys might want to check with Travis at Student Loan Planner. He’s sort of the foremost expert on helping people like you guys.

So I don’t see anything in here about how you paid off the loans so fast! Any tips? I’m a law school student and your article really worried me.

Check out this post where I break down exactly what I paid each month while I was paying off my loans.

My cousin went to law school with the help of his family and my parents gave what they could to help, but he couldn’t find a job after law school. Now works as an office clerk, but after graduation he had to work in construction it was the only thing he could find, but recently he found the office clerk job.

At least he doesn’t have student loans! Remains to be seen whether he will work in law or not. BTW, this is my cousin that lives overseas in Russia, but I found it interesting how the economy over there is similar to the one over here at least when it comes to law graduates.

There’s no doubt, it’s definitely a bad market for lawyers right now. If you’re considering taking out loans for law school, you really need to carefully consider whether you will earn the income necessary to pay off your loans. I was fortunate that I got a good job right out of school and hustled away my debt. I have a lot of classmates who also took on tons of debt who didn’t get these type of jobs, and are struggling to make a big dent in their loans.

DOG BOARDING COSTS UGH!! That is the one line item that absolutely kicks me out of the elite personal finance club. We’re paying $70/day now for someone to stay in our apartment with our dog because he can’t stay in group kennels (doesn’t play well with other dogs). I love this article because it shows how the money can just slip away with lifestyle creep. Great post!

Thanks Julie! Wow, $70 per day seems pretty high. Is that for 5 days per week? Have you checked out DogVacay or Rover to see if there are any potentially cheaper sitters that could help you out?

Also, the average lawyer doesn’t necessarily make a lot of money like most people think. They assume all attorneys are making 6 figures. I remember seeing many entry level attorney jobs paying $40k…and I live in NYC. They also work long hours and have a bunch of student loan debt.

Definitely true. Lawyer salaries for recent graduates is extremely bimodal. This means that about half of recent grads will make very little, and the other half will make huge, six figure sums. It’s a pretty big risk when taking on law school debt, so anyone who does so needs to carefully think about whether they’ll make the income necessary to pay it off.

Half!? More like 3/4 making closer to 40k and 1/4 (which is overestimating) make 180k. Mean vs median

I don’t have the research right in front of me (though it’s one of the studies I have printed out and reference a lot), but there is a relatively high percentage of people making over $75,000 a year who are concerned about their ability to pay off their student loans. I noticed you put $12k here, but for some their undergrad alone may not be much less than that. Pile on law school debt and I’m not surprised that those making six figures struggle to pay down debt.

Definitely true. There are quite a number of people with tons more debt. My hope with this hypothetical was just to show that it can be difficult for anyone to pay down their student loan debt, no matter what income you are at. This is especially true if the individual isn’t conscious about where there money is going, which is what happens to a lot of high income earners.

Great break down on lifestyle inflation. I see the same thing happening with young high-tech engineers as well. Entry level engineering positions are paying around 100K, so a kid out of college finds himself/herself with all this money and wants to live big. Paying his/her college debt is a much lower priority.

It’s so easy for this to happen to anyone. If you aren’t aware of where your money is going, its easy to just spend it all without thinking about it. I think spending can be a lot like water – it just fills whatever vessel you have. That recent grad spent nothing while he was in school because he had no money. A year later, he has a big paycheck and spends a ton without even noticing it.

Loved the article FP. I have many close friends who are lawyers and have to say your hypothetical is reality for most.

Being a cop you can mitigate a lot of the expected expenses and avoid the student loans, which has been nice!

Your conclusion is accurate and reminds me of Grisham’s classic “The Firm.” You WILL be a great employee. Because you are as trapped as an indentured servant. Congrats again on your escape from the gravitational pull of debt.

Thanks Jack! Appreciate the kind words! Very good point about being trapped. That’s exactly right! Once you get into the lifestyle, you basically are stuck in the job.

Sounds like you made a great decision going to law enforcement route and avoiding the huge student loan burdens that come with law school.

Thanks for sharing this example FP. When you break it down by the numbers, there really isn’t much leftover. It also goes to show how quickly you can burn money chasing a lifestyle. It’s actually crazy.

I too have some young successful lawyer friends who have all the “trappings” of a great lifestyle. But as you said, I don’t think all of them will be able to escape, unfortunately. Cheers to being conscious to where your money goes.

Thanks Jay! It’s definitely easy to see your money just fly out the door if you aren’t conscious about it. Who knows whether your lawyer friends are just killing it on the money front or barely skating by.

I think too often people aren’t willing to make the changes in their own life so it’s easier to scoff at others. It’s unfortunate as a society that we like to make excuses and tear down others instead of look in the mirror and cheer those around us.

Definitely true. One thing I do understand is that it can be frustrating for folks who have a ton of student loan debt and not a particularly high income. My hope with this post was just to show that a high income alone isn’t enough. It’s really easy for a guy with a high income to spend a ton of money on things other than student loans. That’s why I celebrate when anyone is able to pay off their student loans, regardless of income.

It’s kind of sad how easy it is to explain life style inflation away. How quickly the human psyche goes from I ate ramman noodles in college too I can just make due on 120k a year. In a country where the average household income is 50k a year it really stands out.

It’s pretty easy to just fall into this trap. This is why it’s so important to keep trying to live like a student for a few years out. You can really set yourself up in a great position. And very good point about that average household income. I also try to make sure that I recognize that fact as well. If people are making it on 50k a year salary, there’s absolutely no reason why a young, recent grad needs to spend so much.

Wow that’s incredible you paid it off so fast. I just started my own student loan consulting business so if you know any lawyers out there with $140k in debt send em my way, I think I could help!

Will do Travis! I’ll keep an eye out for folks that might need the help!

You’re dead-on right about all those things. AND the lawyer is probably thinking that he/she is living modestly, because so many lawyers around are driving $800/month cars and living in homes that cost way more than $1,600/month!

I do think your debt payoff is impressive, because it can be difficult to push back against the peer pressure to expand your lifestyle upon graduation. You’ve done a great job at holding your own and paying things off as fast as possible, which has earned you your freedom. Woo hoo!

That said, I also understand the frustration from people who are earning a lot less. It’s probably really frustrating to read headlines like “How I paid off $x of student loans in y months!” over and over again. Because the #1 component of that is earning a ton of money, although a close second is cutting back spending. So for the reader who is maxed out at a job earning $40k per year, it’s literally impossible to pay off some of those debt numbers in that period of time.

But your experience and approach is different than most, which is why I really dig your blog. You are one of the very few out there who supplements his gig with dogsitting, Airbnb, and dumpster diving (ok, not really that), and I think that’s really cool. Hopefully people who feel like they’re stuck in their current incomes will really focus on all the bonus income-earning stuff you’re doing and see things that they can do to get out of their rut.

Thanks Yetisaurus! Really appreciate you checking out the blog. It can definitely be frustrating for folks with a ton of debt and not enough income. Just like you said, you really have to have a high income in order to pay of debt really fast, or else otherwise have some help along the way.

My hope with this post was to show that high income might he necessary, but isn’t necessarily sufficient (like the LSAT knowledge at work here?).

Your average lawyer (or any high income earner) is living just like this. Normally. The problem is, debt is normal too. You can’t live normal if your goal is to pay off debt.

And I seriously will never stop dumpster diving if I can!

Haha! Necessary, but not sufficient. That takes me back. 🙂 And I’m not only checking out your blog, I’m a subscriber. You write good stuff! See ya in the nearest dumpster, Oscar the Grouch. 😛