Welcome folks to another side hustle report! People seem to love these reports because they give some insight into whether any of these quirky side hustles that I do actually make me any money. It’s not every day that a “big shot” lawyer hops on a bike and becomes a delivery man!

Now for the usual background. For those of you new to this, each month, I document what I earned doing various side hustles outside of my day job. These side hustles are primarily done using sharing economy and gig economy platforms (think of things like Airbnb and Uber). The great thing is that anyone can do these type of side hustles. You don’t need to get a business plan or invest any capital. Instead, just utilize the skills and resources you already have.

I primarily have four sources of side hustle income:

- Renting out a spare guest room on Airbnb

- Dogsitting using DogVacay or Rover

- Making deliveries using Postmates, Doordash, and Uber Eats

- Selling trash finds using Craigslist or OfferUp

Side Hustle Income for December 2016

I calculate side hustle income based on the payout date. Accordingly, if I perform a side hustle in November, but get paid for it in December, I count December as the date the income was earned.

For December, my side hustle income was as follows:

- Airbnb: $339

- DogVacay/Rover: $170

- Postmates/DoorDash/Uber Eats: $19.43

- Selling Trash Finds: $176

Total Side Hustle Income for December 2016 = $704.43

No doubt, my side hustle income was much lower this month as compared to previous months. There are a few reasons for this. On the Airbnb front, we had family staying with us over Christmas, so we needed to block off the last two weeks of December for family. That’s exactly why I find Airbnb so great. You get a ton more flexibility compared to getting a traditional roommate.

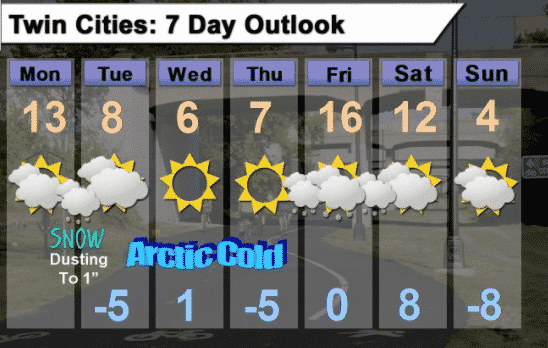

On the delivery man/bike messenger front, well…I live in Minnesota. During one stretch of December, the temperatures looked like this:

I can handle the cold, but even I don’t have that much fun biking around in single digit weather. Couple that with the fact that it’s dark by the time I get home from work, and it’s basically a recipe for me not doing very many bike deliveries.

Here’s a more detailed breakdown of how I earned my side hustle money this month:

Airbnb Income: $339

December is apparently medical school and residency interview month, since every person that stayed with us this month was in town for interviews. These are, without a doubt, our favorite type of guests to have. They’re always super friendly and professional. Plus, I feel like if you got into med school or are trying to get into med school, you’re probably not a crazy person. But really, I just like them the best because they come into town for a specific purpose and stay for such a short period of time that I barely notice them.

Pro tip: if you’re renting out a room in your house, you want guests who come into town for a specific purpose. That way, they’re only in your house to sleep. The majority of the time, they’ll be out and about. You basically get to monetize an extra room in your house while sacrificing very little of your privacy.

The remainder of our December was blocked off for Christmas, which explains the lower earnings for the month. $300 or so just for renting a room out a few times a month isn’t so bad. Some of you probably have an extra room that you barely use. Would it really be that much of a sacrifice to rent it out just a few times per month?

Related: Making Money With Airbnb: Why I Rent Out Our Guest Room

DogVacay and Rover Income: $170

The dog sitting income from DogVacay and Rover remained steady this month. We ended up watching a total of three dogs.

The first dog was an older dog that stayed with us for about 5 days. Unfortunately, the stay didn’t go well. He wasn’t a “bad” dog, but he wasn’t great either. I think he just didn’t fit well with our lifestyle, especially since he barked a lot and had several accidents in our house. That’s always the risk when you take in a new dog. Some dogs just won’t mesh well with you.

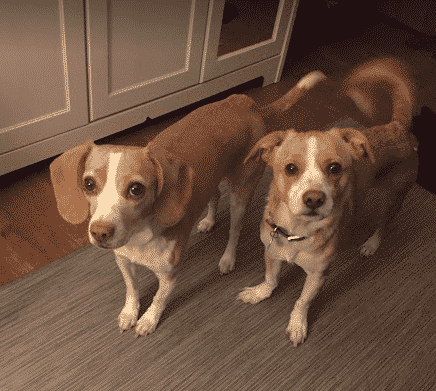

Our other two guest pups were repeat pups that we absolutely love! This little guy below is like a big mop.

And the other pup we watched looks like Financial Pup’s long lost brother.

Related: How I Make Over $2000 Per Year On DogVacay and Rover

Postmates/DoorDash/Uber Eats Income: $19.43

December in Minnesota isn’t the best weather for biking, but I still try to do it when its not too windy or snowy. However, even I’m not hardy enough to go out and bike in really cold temperatures.

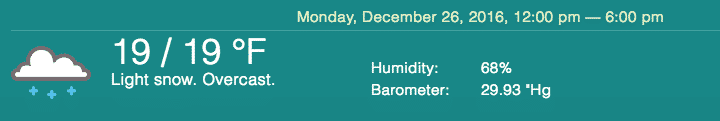

My winter bike messenger work really is just to make sure my accounts stay active. I ended up only doing one delivery for DoorDash and one delivery for Postmates on the day after Christmas.

The temperatures for December 26th looked like this:

I actually started out fine, but pretty much froze during the bike ride and ended up having to catch a bus back home so I could warm up. Still, at least I got some exercise and made a few bucks. Expect to see more of the same for the next two months.

Related: My Postmates Side Hustle: How I Get Paid To Bike Around Town

Trash Income: $176

December was a pretty nice trash income month for us. We’ve had a bunch of stuff we found during the August move-out season sitting in our garage, and I finally got around to listing more of it up for sale.

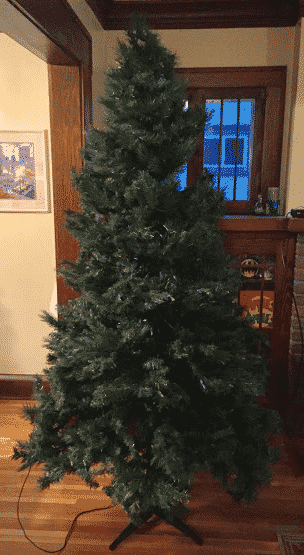

Our big sale was a Christmas tree that Ms. FP and I found on the side of the road back in August. We kept it in our basement and then listed it up for sale this month, snagging a cool $50 in the process. Not so bad for something we found on the side of the road! We also had a second smaller Christmas tree that we sold for $20.

I personally never thought about Christmas trees as a potential trash find item to sell, but when you think about it, it’s actually a great thing to sell. Just stick them in a box, and wait until Christmas rolls around, and you can basically guarantee they sell if you price them right. This is why you need to keep your eyes open and think outside the box!

Other items we sold this month were pretty generic – a few old dressers we found, a bar stool, a TV stand, etc. One decently nice thing we found was this Ikea chair. Brand new, it would cost $60. I sold it for $20, which I thought was a decent price for it. Remember, anything from Ikea is always great to sell.

My next task is to start trying to list up a bunch of desks we still have sitting in our garage from August. I just need to get off my butt and take some pictures of them! We’re still keeping our eye out for trash, and I expect that when the weather warms up, we’ll start seeing some more trash out there.

Related: Making Over $1000 Selling Trash Finds Found In One Dumpster

And that concludes this month’s side hustle report! Even in an off-month, I still managed to bring in an extra $700 without really doing much. Not too bad!

If you’re interested in seeing what I earned in previous months, be sure to check out my side hustle report page, where you can find all of my monthly side hustle reports.

So cool. One man’s trash is another treasure, and you’ve found the best way to take advantage of that. Flipping Christmas trees is AMAZING; I’ve never heard of anyone doing that before!

Haha thanks! I honestly didn’t plan to flip Christmas trees, but now that I see them, it makes a ton of sense. It’s really surprising how many people throw away those trees instead of just hanging onto them and selling them in November/December of the next year. All about that supply + demand. Econ 101 there!

I wish we could do dog sitting but our dog just doesn’t do well with other dogs. He’s found himself in a few dog fights since we moved to California and it’s been terrifying for me to watch. We used to be able to take him to the dog park in Colorado and it was fine. I’m so impressed by your side-hustling and I’m also kicking myself for putting our christmas tree and decorations on craigslist in June! They didn’t sell so I gave them to goodwill. Ugh I should have waited! Great work! I look forward to following your side-hustle series.

Ah, yeah, you gotta keep those Christmas trees! They’re a guaranteed sell when Thanksgiving rolls around, especially if you price them low.

I really miss those days of selling chairs for $20 on Craigslist. I just can’t deal with the crazy Craigslist people – the emails back and forth and the “is it still available” email is one of my only pet peeves! A lot of it comes down to the ROI of your time and clearly there is a nice balance here for you between the somewhat passive (airbnb – washing sheets) and more active (garage cleaning and trash finds). I think we all love these because it’s kinda like a little soap opera in the FI world – STAY TUNED – what did FP find this month? Netflix better watch out!

Haha, the flakes on Craigslist is the biggest problem. I minimize it by telling people to come meet me at a gas station down the street from me (I prefer Craigslist people not knowing where I live). Sure, it takes me a little bit of time emailing with people and walking over to the gas station, but not a ton of time in my opinion. Once you’re pretty used to it, you can list things up on craigslist in just a few minutes too, so I’d still say my hourly rate I earn is pretty good.

Man, I’ve been really thinking about renting out a room in my house for extra income, but every time I get close, I stop b/c I don’t want a random person in my house for money. What if something happens? Most likely it won’t, but what if? Maybe I’m over protective of my family.

Would you do the same with wife and kids? It’s hard to do.

Sam

No doubt, the what if is a risk you take in any venture you do.

I am engaged and we live together, so I’d say I already do this with a “wife.” With kids, I’d probably still do it, but the problem is whether the wife would let me. I’d have no problem with it really because I’m pretty good at vetting people who want to stay with me, and the vast majority of folks who come to stay with me are recent grads or grad students interviewing for a grad program or residency at our large state university. I’m not too worried about these type of guests.

One thing to consider. Why not start small and try renting a room out to 1 person on Airbnb for a night or two. Maybe tell yourself you’ll rent out to 1 person a month for 6 months, just to see if it’s something you like. If you don’t like it, then at least you can say you tried it out and it wasn’t for you.

The great thing with something like Airbnb is that there’s no commitment, which makes it much easier to experiment with then say, getting a full time roommate. We originally started out just testing Airbnb out, but then ended up sticking with it as we found it to be pretty interesting.

I’ve tried to make this case to my wife. She’s the one who shuts me down! Like NO NO ONE IN OUR HOUSE! Happy Wife Happy Life.

Yeah. Not much you can do if the significant other says no. Obviously, can’t hustle on everything we do though, so just gotta pick your battles.

First time i’ve seen trash income listed on well…anything? That’s awesome, keep up the good work!

Thanks Stephen! Haha, true, I don’t think trash income goes into a lot of people’s income reports.

Dude – you kill it with the side hustles. That is all I have to say.

Thanks man!

Love the trash finds. It takes dedication though to be able to search out items. I am not there yet because I have so much going on in my life but I do have items at home that I no longer need and could bring some value. I am going to dip the toe in soon. Thanks for sharing !

-Brian

You probably have a treasure trove of stuff in your house!

The funny thing about my trash finds is that I don’t go around looking for trash very often. The vast majority of my stuff now all comes from what I found in August when the college kids were moving out. I just happened to grab everything I could back then and it’s been enough to sustain me for months now. Otherwise, we’ve just sort of developed our trash eye over the years and just happen to see things pretty regularly. It also helps that we have friends that live in apartment buildings, so we’re often able to just scope out their trash when we happen to be at their apartment.

I had such a good laugh over that Christmas tree. I see so many artificial trees out for trash in January around here, including some by the side of the road. If you lived in Ohio, I’d now be thinking, “Oh, don’t worry, it won’t be there long before FP picks it up!”

When we downsize in a few years to an apartment, I’ll be getting rid of our gigantic artificial tree – I was going to give it away, but now I’m thinking a Craigslist ad will be in order!

Great article!

Haha, if I saw a tree and had room, I’d probably pick it up and just store it in my basement or garage for the year, assuming it looked like it was in good condition. Most people won’t even think of a fake Christmas tree as something you can flip, but that’s basically easy money sitting there.

You should definitely sell the Christmas tree you have. There are a lot of families out there that just want an affordable tree. If you have it listed for a reasonable price and list it up right after Thanksgiving, you’ll have it gone pretty fast I bet. Obviously, price it lower if you for sure want it gone, because otherwise, you’ll end up having to keep it for another year.

I guess living near a university or area with a good amount of tenant turnover can generate an interesting amount of side income.

I always am wary of inadvertently picking up bed bugs (or name your most feared critter) and moving them into the house. Brave soul moving all of the goodies in your car!

The fear of creepy crawlies is something I sometimes worry about as well, but I think it’s a bit more overblown than the reality actually is. The good thing though is that I have a garage, so most stuff never comes into my house.

Also, considering the fact that we’ve got negative temps here, I feel pretty confident that nothing is surviving in my garage!

Good job on hustling! I especially like the “trash finds” idea since it’s also good for the environment! Have you ever thought about selling things on Amazon? Where you find discounted items locally and make money on the spread. I’ve heard good things about it from smartpassiveincome.com.

Well done and Happy New year!

The environmental impact is something we’ve been happy about as well and is what actually first motivated us. It seemed crazy to toss away something into a landfill that still had plenty life in it. Even now, we still grab trash that we don’t even sell – we just donate it to Goodwill.

Amazon is something I’ve done some research in. I’ve heard about the Amazon FBA stuff on Smart Passive Income and Scavenger Life. My only issue is that it takes a bit more work than I want to do and requires a little bit more investment of capital and time. Trash, on the other hand, is just a game of opportunity. I don’t spend any money to do it and don’t really actively go out looking for trash. If I ever reach financial independence, I might consider trying out Amazon FBA on the side with a small amount.

Happy New Year to you too!

Great job on the hustle! I wouldn’t have gone out in that cold either…

Haha, I just gotta bundle up more the next time!

I never stop laughing at your trash finds.

Great job for hustling despite the weather, FP!

So, I was looking at WalkScore.com which also happens to have a BikeScore. Albuquerque, where I’ll be spending 4 weeks in just over 2 months from now is “flat as a pancake”. Might be a great place to be a bike messenger. When it doesn’t snow.

I probably won’t buy a bike though.

Haha, I mean there’s so much trash out there! I can’t even put up all the pictures of stuff I sell just because it’d take up too much space!

You should totally see if you can do one delivery in every city on Postmates, just for fun. You could probably become the first person to do it. Since you’re doing the cross-country road trip, I’ll cut you slack for driving!