Every year is a big year when you think about it, but I really did feel like 2016 was one of the bigger years in my life. The only thing is, as you get older, the years all sort of blend together. I have a vague idea of what I did in the past few years, but since I never wrote it down, I don’t exactly remember any specifics.

The great thing about blogging though is that it forces you to buckle down and think about what you did, and then write it all down in a synthesized fashion. When I start telling my crazy stories one day, hopefully, someone can look back on what I wrote and fact check me.

And hopefully, you can learn something from this recap too. I know I learn a ton just reading about what others did over the year. So come learn and be inspired! Or just come and be entertained! It’s all good to me.

Anyway, here’s a recap of some of the big events for me in 2016:

Paid Off All Of My Student Loans!

I graduated law school back in 2013 with about $87,000 worth of student loans. When 2016 came around, I still had about $12,000 remaining on my student loan balance. Not too bad at all considering I had only started paying them for real in 2014. But I still wanted them out of my life. I ended up getting rid of the entire balance by June 2016.

Paying off my student loans was a huge weight off my chest. I’d taken a pretty big risk taking on so much debt, but I did come into it with my eyes open and a plan to pay it off quickly. And luckily for me, my plan paid off. If you’re thinking about taking on debt to go to law school, please talk to me first!

2016 was also the year that I actually looked at how much I had paid towards my student loans. I never really realized how much money I had actually paid until I added up all my payments.

For those of you who are still hustling to pay your loans off, keep on hustling! You’ll be shocked at how fast those loans disappear when you’re really hustling.

And when you do finish paying them off, do like I did and get your payment history. Add it all up and see how much you paid. You’ll be super proud of yourself when you see how much debt you got rid of.

Started A New Job (And Took A $50,00 Pay Cut To Do It!)

I started out my working career at a big law firm and knew pretty much right away that it wasn’t a great fit for me. The work-life balance was terrible and I was getting a lot of anxiety from the job. Still, it paid extremely well and I needed the job if I was going to pay my student loans off fast. I don’t regret starting my career there.

Once I got my loans paid off, I was finally able to make the big job change. In June, I switched jobs and moved from the private sector and into the public sector. The jump meant a much better work-life balance, but also a huge pay cut. A $50,000 pay cut!

The amazing thing though? Because I was living off so much less than I earned, I was able to take the $50,000 pay cut and have no change to my lifestyle at all!

That’s the power of living on less. Not only can you save more, but you can make big career changes without even worrying about it. If I was living like a normal big shot lawyer, taking such a big pay cut probably wouldn’t have been possible. But because I lived on so much less than I earned and threw so much of my income into my student loans, I was able to make the change without worrying about it at all.

Finally Started A Blog

I’d been talking about doing this for a long time, but never actually got around to doing it. I felt like I had something to say and I was doing a ton of weird stuff that a lawyer and dentist couple probably shouldn’t be doing – delivering food, dog sitting, selling trash. I was also constantly annoying my friends with personal finance stuff.

My best friend kept telling me I needed to write about the things I was doing and talking about. He even believed in me so much that he said he’d handle all the web stuff for me (he’s a web developer for his day job and he’s the reason this blog looks the way it does).

In March, I went ahead and bought a domain name, naming myself after a funny Simpsons clip that I like.

A lot of people talk about blogging, but very few people actually go ahead and start doing it. I did the same thing and just sat doing nothing for several months. In July, I finally sat down at a coffeeshop and wrote my first blog post. I started out at writing once a week, and have since aimed to get two posts out every week. I’m still working on refining my writing style – blog writing is just a totally different type of beast – but I like to think I’m getting a little better with each post.

Began Renting A Room Out On Airbnb

I finally jumped on the Airbnb bandwagon this year. In January, Ms. FP and I moved into her four bedroom house and I promptly realized there was a side hustle opportunity here.

Being the tech nerd that I am, I’d been following the rise of Airbnb and totally thought it’d be a fun thing to do. And since we have four bedrooms in our house and only sleep in one of them, I thought it’d make sense to give it a shot. I put up our guest room on Airbnb and figured that if it was too weird, we’d just stop doing it.

I didn’t expect a ton of demand for our house, but ended up being pleasantly surprised. Turns out when you live near a huge college, you get a ton of grad students coming into town for interviews and conferences. These are exactly the type of people we enjoy hosting, and it’s why Airbnb has been a good experience for us so far.

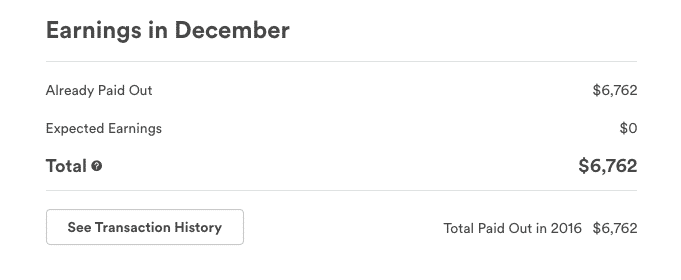

And, bringing in an extra $6,700 renting out a room isn’t so bad either.

Saved Over $30,000 Into My Retirement Accounts

I’m still a little shocked at this one, but I did the math and it looks like I’ve already managed to save over $27,000 into tax-advantaged retirement accounts. And that doesn’t even include at least $5,000 I’ll sock away into my Solo 401(k) once I calculate exactly how much I can contribute.

All together, I should put away well over $30,000 this year into tax-advantaged investments. I’m pretty surprised that I still managed to do the equivalent of maxing out all of my retirement accounts and more, considering the fact that I took a gigantic pay cut in the middle of the year.

The breakdown is pretty interesting. When I left my big law firm job in June, I was on pace to max out my 401(k). I figured the job change meant I probably wouldn’t be able to save as much. To my surprise, I found out that with my employer contribution and no student loans, I was able to save just as much as I was saving before.

I didn’t have any employer contribution at my old job, so I had no idea how much of a difference it makes. But wow! It’s a huge difference when your employer throws some money into retirement for you. If your employer offers a match, do everything you can to get it! It’s amazing what it can do to your savings.

Here’s the breakdown of what I’ve put away as of December 31, 2016:

- 401(k) from my old job = $8,774 (Left this job in June)

- 457 Plan = $5,787

- Defined Contribution Pension = $4,236 (about half of this comes from my employer contribution)

- Roth IRA = $5,500 (managed to max this out just a few days ago!)

- HSA = $3,350 (also managed to max this out a few days ago!)

I Got Engaged!

Last, but not least, and quite obviously the most important thing I did this year – I got engaged!

I haven’t talked about wedding stuff all that much because, to be honest, we’re not doing a great job of being frugal with it. That’s not to say our wedding is going to be some extravagant thing. We have a budget we’re working with. But we’re also lucky enough to have parents who are willing to give us some cash to help us out. We’re still footing some of the bill ourselves, but it’s a huge benefit that our parents are willing to spot much of it.

2017 will be interesting as we figure out how to merge our finances. And also, dealing with the whole being married thing.

And Now For 2017

I’m sure 2017 will be just as big a year as 2016. Ms. FP will become Mrs. FP (assuming she continues to tolerate me), which will be a huge change in itself.

Our income will also be at the lowest it’ll probably ever be for our professional lives. Ms. FP makes nothing in her residency and I’m making a mighty government salary. Once Ms. FP starts getting paid to do dentistry, I don’t imagine our income will ever get lower than it’ll be in 2017.

It’ll be interesting to see if we can still hit our savings goals in 2017.

Thanks to everyone in 2016 for sticking around and helping this blog grow. See you all in the coming year!

Congratulations on such a successful year! I love year end posts like this. You learn so much. For one thing, I never noticed that Ms. FP meant you weren’t married. I thought you were. Looks like we will both be tying the knot next year. We should trade emails on some strategies.

Also, I didn’t realize your buddy helped on the design. That’s why your site is so slick! And here I thought I was just a design slacker. 🙂

Thanks! Yeah, we’ll definitely need to connect about strategies with the merging finances front. I don’t remember if you’ve ever mentioned it, but is your fiance an attorney as well, or is she in a different field?

I owe a lot to my friend who’s basically handled all of the web stuff with this blog. I couldn’t do it without him.

It looks like you had a good 2016! I was just wondering if you had a target financial independence date? I am relatively new to the FI world and haven’t gotten into selling trash to earn extra money yet but maybe someday:)

I actually don’t have any target financial independence date to be honest. I’d love for it to be as soon as possible, but who knows. There’s a lot that can change in the next 10 years or so!

What a great year, FP!

2017 should be equally exciting with a wedding, no more student loans to worry about, and plenty of side hustlin’, I’m sure.

Cheers!

-PoF

Definitely should be a fun 2017! We’ll need to meet up again for sure.

Congrats on paying off your student loans and getting engaged! Looks like you had a great 2016 🙂

So hilarious that you got the name “Financial Panther” from the Simpsons’s episode. I was briefly considering using that as my alias before I decided on FIRECracker. Great minds think alike!

Thanks! Haha, I’m glad I got that name before you did! I would’ve been so bummed!

Congrats on a fantastic year FP! You’ve been an inspiration for my own side hustle journey, thank you for that! I look forward to following along as you progress in the coming year!

Thanks so much! I’m really honored that I’ve been able to be an inspiration to anyone! Really fun to get on that hustle!

Awesome year! Congrats on all of your accomplishments.

Thanks so much! Been a great year and I’m pretty happy with it!

Wow! You had a fantastic year, FP! Paying off the debt and adding so much to the retirement savings, all while taking a paycut!? Congrats! Looking forward to following your journey in 2017! Happy New Year! 🙂

Thanks so much Amanda! Going to be an exciting 2017 for sure. Happy New Year to you too!

Congrats on a successful 2016! Not many can say they took a $50k pay cut and it was a successful year. In your case, though, it sounds like the change was worth it. Congrats on starting your blog. That was one of the biggest and best decisions I made in 2016 as well. Here’s to a prosperous 2017!

Thanks! Starting up the blog was definitely a great thing to do, even just for the ability to keep up my writing skills. Looking forward to seeing what 2017 has in store!

Wow that is quite a year! It’s hard for me to wrap my head around taking a $50k pay cut, but it sounds like it worked out for you! Congrats on all your successes this past year!

Thanks David! I know, it’s crazy when you think about it, but having that ability to take the big pay cut without hurting my lifestyle is exactly why its so important to live on less. It’s good to know that I have a lot of options out there if I want to take them.

Nice work! And congrats on your engagement!

I also got married this past year but didn’t write about spending on the wedding because it just wasn’t that frugal and so many people write posts on how to save on your wedding. It didn’t really change much for us this year, though, because we also were lucky to have parents who chipped in.

Here’s to another great upcoming year!

Thanks Ellie! That’s exactly why I haven’t really written about wedding stuff very much. We’re not having a ridiculous wedding, but it definitely makes it much easier when parents are willing to chip in. I know we’re very fortunate to have that help. Looking forward to the next year!

I cant wait to join you being debt free in Q1 of this year :).

Keep it up FP! Looking forward to more great content in 2017!

It’ll be awesome when you get debt free! Thanks for reading Gary!

Congratulations on your 2016 and wish you all the bests for the future! It is especially great news about your engagement. Don’t feel bad not being frugal about the wedding; make your Mrs happy! 🙂

Happy New Year to you and all the readers!

Thanks Roadrunner! Happy New Year to you to!

Congrats on a big year! I found when I took a pay cut that it took some time to be okay with saving less even though I didn’t need to reduce my lifestyle at all.

Congrats on the engagement! I got married in 2016 and it’s definitely taking some time to figure out how we plan to handle our finances going forward and the whole marriage thing too. It’s worth it though!

Isn’t it actually Dr. FP and not Mrs. FP? Dr. supersedes Mrs. as a title.

Ah good point! Maybe it should be doctor, but then I always remember that she’s only a dentist (I kid, I kid!).

Sounds like a great year. No doubt 2017 will be amazing too! And congratulations on your engagement! I’m eager to read about your new adventures as the groom-to-be 🙂

Thank you so much! 2017 will definitely be an adventure!

Congrats! I just found your blog and I really love it – I can’t believe it took me this long to find.

And great job on paying back your student loans. I’m still buried underneath mine currently but one day they’ll be gone, and I can move onto other things like you too. 🙂

Here’s to an awesomer 2017!

Thanks Lindsay! I’m glad you found the blog! Looking forward to 2017!

Good luck on 2017 FP! I think you are crushing the blog gig.

I don’t have any big goals for 2017 but I am initiating a coffee and alcohol fast for January. My wife asked, “why give up those?” To which I reply, “they are two of my favorite things.”

Now when I miss them I get a reminder to pray and be grateful for what I have. Still excited about February too.

Thanks Jack! And awesome with the coffee and alcohol fast. A few years ago, I dropped soda completely and now I’ve been soda free for 2 years strong. I don’t think I could drop coffee or alcohol forever, but doing a month as a test is definitely not a bad idea. See you in 2017!

Congrats on the great year and the engagement! Hope you have a great 2017!!

— Jim

Thanks so much Jim! Here’s to a great 2017 to you too!

Well done on a solid year, FP!

The food delivery, dogvacay, trash selling and AirBNB are some of the most exciting posts to read!

Mad props to the friend who set you up and makes this place look so professional.

Thanks TJ! Been a fun year doing all this stuff. And my buddy is real good at what he does making this site look good.