I think most of us could use a little more money in our lives. The only problem is that earning more money isn’t always that easy or immediate. Raises are typically an annual thing and definitely not guaranteed. Bonuses are the same way. You could switch jobs to make more money, but that’s not always an option for everyone.

One surefire way to make some extra money is to get some overtime hours. But, if you’re a white-collar worker like many of us are, you’re probably getting paid a salary. Even those of you who might be eligible for overtime probably can’t do so regularly.

This got me thinking though…

Why can’t we just create our own overtime?

I know, I know. We’re all super busy and work plenty of hours. At least that’s what we tell ourselves. Yet, despite being so busy, we all still seem to find time to catch up on our Facebook posts, post our tweets, watch the latest episodes of our favorite TV shows, and all the other stuff we do to fill our day.

Maybe we all have a little more time than we think?

Do You Work As Much As This Guy?

A few days ago, my local newspaper had an article about a security counselor at a Minnesota hospital who made an extra $294,000 in overtime pay over the past three years. Take a look at what his yearly overtime earnings were:

* Note: Fiscal year in the above chart is calculated from July 1st to June 30th (i.e. fiscal year 2014 = July 1, 2013 to June 30, 2014).

Delving deeper, I found out that a security counselor is essentially a security guard. There’s no doubt, it’s an incredibly tough job and not one that a lot of us could do.

It’s also not a particularly high-paying job or one that requires a lot of education. You only need a high school diploma to qualify. The wage for a security counselor ranges from $18.31 per hour to $25.32 per hour. This equates to around $38,000 to $52,000 per year – a pretty average salary, in my opinion.

So how does a guy who might make as much as $52,000 per year, wind up making more than double that in overtime alone? Here’s what the Star Tribune said:

One employee, a security counselor at the Minnesota Security Hospital in St. Peter, has worked 8,129 hours of overtime since 2013, collecting $294,493 in extra pay.

Doing the math, this guy worked an average of 2,709 overtime hours per year in the past three years. That’s an average of 52 overtime hours per week! This guy was literally working the equivalent of a second full-time job (and then some). As a benefit, he likely tripled his yearly income. That’s pretty astounding.

No, you don’t have to work 90 hours a week as this guy did. What I am saying, though, is to really look at your schedule. We all get 168 hours in a week. If this guy could spend more than half of his week working, can you find some time to work a little bit more?

My guess is that if you’re working around 40 hours per week, you probably have some wiggle room to work with.

Create Your Own Overtime

This is where we come to the concept of creating your own overtime. I’ve said before that we live in the best time ever in history to start up a side hustle. If you’ve got more time on your hands than you think, why not try and see if you can put it to use?

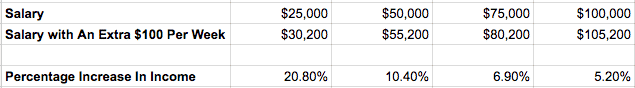

I think it’s perfectly reasonable to try to make yourself $20 per hour on the side. If you carve out just 5 hours per week, for 52 weeks per year, you’ll make an extra $100 per week or an extra $5,200 per year. That’s enough to almost max out a Roth IRA.

Five hours of extra work per week isn’t very hard to do unless you’re working well over 40 hours per week already. You’ve got 48 hours to use each weekend! And with the nature of the gig economy, you don’t necessarily have to carve out specific time to work like you would have to do with a job. Instead, you can find something you’re already doing and incorporate it into your routine.

For example, I already enjoy biking and exercising. It doesn’t really add much work for me to bike around town, get some exercise, and make a little extra cash. I have a spare room in my house. It’s not a ton of work for me to occasionally rent it out on Airbnb. And I already have a dog, so it’s not much work for me to occasionally dog sit a second dog.

Don’t Underestimate Your Side Hustle

The interesting thing is how much of an impact your side hustle can have on your income. Working an extra 5 hours per week to make an extra $5,200 per year doesn’t seem like all that much by itself.

But consider a new graduate making $50,000 or so per year. If you consider the impact of that extra $5,200 per year, that’s a 10% wage increase just from an extra 5 hours of work per week. There aren’t a ton of ways to increase your income by that much in a single year.

Even a person making a stout $100,000 per year could benefit by increasing their wage by another $5,200 per year. That’s good for a 5% salary increase, better than the 3% raise a lot of people get each year. And if that same person could figure out how to bring in an extra $10,000 per year on the side, that’s good for a 10% raise in just one year.

Get Creative With Creating Your Own Overtime

There are a lot of ways to pull in some extra income that can lead to an extra $100 per week or so. And you don’t have to use up a ton of your time either.

For example:

- Rent out a room on Airbnb for just 4 nights per month at $50 per night for an extra $200 per month.

- Make an extra $200 per month doing DoorDash, Uber Eats, and Grubhub on the side by working an extra 10 hours per month (or 2.5 hours per week).

- Do an hour of DoorDash, Uber Eats, and Grubhub on your way home from work. Do nothing on the weekends.

- Wake up at 8 am on Saturdays and Sundays and do some side hustling until 11 am. Do nothing the rest of the day.

If you’re working a ton of hours already or already have a large income, of course, don’t add more work to your plate unless you think it’s fun. Even if I made hundreds of thousands per year, I’d probably still be an occasional bike messenger because I think it’s fun.

But if you’re like most people, you’re probably working a lot less than you think. That means you have a lot more free time than you think.

Why not give yourself a raise then? If that security counselor can work an extra 52 hours per week, then I’m sure most of us can find a way to work an extra 5 or so hours per week.

Wow this is such an interesting concept! I’ve always thought of it as a side hustle or a side business. I started my new blog about 2 months ago and have been working on it almost 30 hours a week without an income. But I really like it, so I don’t mind =)

Blogging is definitely something that takes a lot of time – but it’s so much fun! If you need money right away, blogging definitely is NOT the way to go. It’s definitely a long-term play.

This is awesome! I wish my employer didn’t limit my overtime to 10h/week !!!

We started airbnb last month and it has been really good so far, it is fun to meet new guest and we made $350 last month. It’s not exactly doubling my salary like that security guard but it’s still good! 🙂

Hey, $350 a month adds up to $4200 per year! That’s not too shabby in my opinion. And probably doesn’t take up too much work either!

Totally agree with this approach! It’s easier than ever to pick up work here and there. And as you mentioned, if you can stick with it the results can be equivalent to a raise. Additionally, as you put that money to work for you the rewards from compounding and dividends make the bottom-line impact even better.

I didn’t even mention what a big impact on your savings rate working a little extra can have. Imagine making an extra $5200 a year and banking all of it! You can really up your savings rate a ton.

Okay, that security counselor overtime is seriously impressive. You make a great point! We always think “I don’t have time to…” fill in the blank. It’s really all about creating the time – it’s there, we just have to choose how we use it.

Yeah, that is a crazy and unsustainable level of work. No one should do that. But it really shows that you’ve got the time if you really think about it. If one guy can work 90 hours a week, working 40 hours a week in one job and 10 hours a week doing something else should seem like a cakewalk!

Working a bit more now, to ensure you have a lot more in the future. Definitely worth it to me! Create side hustles that you enjoy and it won’t even seem like work!

Very important about doing side hustles you enjoy. I never really feel like I’m “working” when I’m doing bike messenger deliveries. I find it fun to me, and I’m doing it because I want to, not because I have to.

I’m always surprised at how much time I can fritter away doing basically nothing. Since I started my blog it’s surprisingly easy to find a few hours to write a post without affecting my usual activities! That’s my (unpaid) overtime!

Unpaid overtime is alright too! I do the same thing here. It’s good that you’re using the time, instead of doing like a lot of people who fritter there time away, then say they don’t have time to hustle.

I love these stories. They’re so inspirational! With a little creativity it can be pretty easy to supplement your income, at least a little bit. Also, don’t ignore savings. I spend about 1-2 hours a week on organizing our shopping list using coupons. I calculated this freed up about $5k the first year from our old spend pattern – my hubby jokes that it’s my part time job. Lol. Soon as I noticed the amount we opened Roth accounts (in addition to our 401ks) – putting the savings to work by helping grow our net worth. It’s good to have a plan in mind for the new income.

That’s great on the savings! I totally don’t do a great job at calculating the value of savings like tha. And what’s really important there is that you’re actually saving that money, rather than using it somewhere else! A lot of people are great at saving, but then all it really does is just shuffle money around to other spending things.

Overtime is endemic to my line of work. The important thing for me is to live as if I won’t have overtime and make every effort to properly balance the time I get with time spent with my family. Unfortunately a lot of law enforcement become too absorbed by the job and lose touch with their family.

If I lose them because of work then I have lost what I care about most for something that does not love you at all. Hmmm, too sappy for my normal tone. I’ll end with, “Yes! Overtime is sweet!” But like all dessert, you want to pick up he right amount.

Like your bike messenger dates: still picking up that OT (so to speak) but still affirming your family bond. Respect.

You make a good point there Jack. It’s definitely true that you don’t want to get caught up in the hustle so much that you lose sight of what’s really important. Money’s just a tool, after all. Doesn’t really mean anything if you’re sacrificing too much in order to get it.

I’m always fascinated by these guys/gals that really hustle. I think they deserve every penny. I looked deeper into the story from your local paper and it looks like the security counselor has been working there for 33 years and is originally from Sierra Leone. I had hoped to find some information about his life and boy did I!

Apparently, he has seven children and also used his earnings to support 27 nieces and nephews in Sierra Leone whose fathers were killed in recent wars. Assuming that’s true, it’s not a bad use of your overtime wages!

He’s also suing the state for incorrectly calculating the overtime wage:

http://www.southernminn.com/st_peter_herald/news/article_a2382826-a775-5320-ac4e-bdfd0c78dbb8.html

I saw that story too and found it really interesting. Really goes to show how anyone can hustle if you’re really working towards something. Wonder what’s happened with that wage suit.

There’s been several similar stories in the news lately. I love hearing about people taking advantage of opportunities available to them to earn more money. As you mention in your article, you don’t have to take it to that extreme. I’ve worked plenty of 90 hour high preasure weeks under tight deadlines, and I couldn’t keep it up for an entire year. But throwing in an extra 10 hours a week….everyone can do that. With the side hustle opportunities available now, there are no excuses. Everyone has time, but not everyone is willing to sacrifice the things that currently fill their free time. From binge watching Netflix to spending hours at a time on social media, time sucks are everywhere in today’s world making us think we’re way more busy than we really are.

Exactly. Just looking on google, it looks like the average person watches 5 hours of TV per day. I can see that. You work 9-5, then come home and watch TV from 6pm to 11pm. I know I’ve done that (and still do that sometimes). Just take away 1 hour of that and throw it into working a little bit, and you suddenly have 5 extra hours of work in a week. And like you pointed out, there are so many ways to make some extra dough today.

That’s a lot of overtime. But you know what, if you want to make more money sometimes you have to put in a little sweat equity and work more, whether that’s clocking some overtime or working a side hustle.

It’s a ludicrous amount of overtime that I don’t think anyone should aim to do on a regular basis! But, what it does show is that, if someone can do 50+ hours of overtime per week, most of us can probably find a way to do at least 5 hours of extra work per week. If you’re only working a regular 9-5, it really isn’t much work to add another hour or 2 into that, or find a way to add a few hours on the weekend.

Wow, I’m surprised they allowed the security guard to work that many overtime hours! You’d think it’d be cheaper to hire an extra employee vs. paying overtime, but I guess not.

I really need work/life balance but it does sound pretty tempting to push yourself ridiculously hard like that guy did for a few years and then scale back after that.

To be fair, state government isn’t exactly the model of efficiency. Not exactly sure how someone can accumulate so much overtime. My guess is a combination of government bureaucracy stuff, coupled with fairly low pay and a tough job. All these make it so that people probably don’t wan to work the job, which leads to a lot of available overtime hours.

I had a friend who did a similar thing as a train conductor. He basically took as much overtime as he wanted and made well over six figures a year driving a subway train.

Most comapnies are working people in the ground today with excess overtime.