One of the best ways to get into real estate is to start house hacking – that is, using the house you already live in to generate income. Since housing is likely going to be your biggest monthly expense, if you can figure out ways to reduce those costs, you can dramatically increase your ability to save and speed up your path towards financial independence.

House hacking can come in many forms, but the traditional view of house hacking says that you should get a multi-unit property (a duplex, triplex, or something similar), live in one unit, then rent out the other units. If you do this right, the income you generate from your other units should be enough to cover some or all of your monthly housing expenses.

However, there are a lot of ways to get into house hacking besides getting a duplex, and perhaps the easiest way to get started is to just take advantage of the extra space you already have in your house. For the past three years, my wife and I have done exactly that by renting out a spare room in our house on Airbnb. It’s worked out well and has substantially reduced our monthly housing expenses. (Read more about why we rent out our guest room on Airbnb here).

In today’s post, I want to go over some of the numbers from this latest year of Airbnb hosting to help you understand just how valuable Airbnb hosting can be for you.

Our Airbnb House Hacking Setup

Before jumping into the numbers, I think it might be helpful to go over our particular Airbnb set up so you can get a sense of how things work on our end.

My wife and I live in a four-bedroom house near a large, flagship state university. As an income producing property, this comes with a lot of advantages, namely that a large university creates a ton of demand for housing.

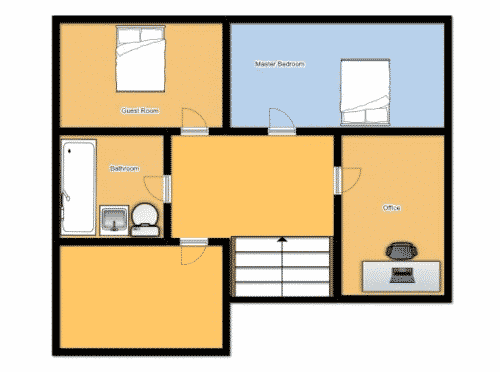

Since it’s just my wife and me living in our house (along with our dog), we have a lot of space that would otherwise go unused. Below is a general floorplan of our second floor so you can get an idea of our current living situation:

The blue room in the above floorplan is our master bedroom. The room directly to the left of our room is the guest room that we have listed up on Airbnb. The other two rooms are a kid’s room for when our niece visits us and an office, neither of which are listed on Airbnb.

We have our home listed up on Airbnb in two ways:

- A private room listing where the guest rents out the guest room and stays in the house with us.

- A whole house listing where the guest rents our entire house and we move out while they are there.

Our primary listing – and the one that we’ve been doing since 2016 – is the Airbnb guest room. This room has a queen bed and can fit two people. Since we’re near the University, our guests are primarily students coming into town for interviews or conferences. You’ll note that we only have 1 bathroom on this floor, which means that we technically share the bathroom with our Airbnb guests. This actually isn’t too problematic for us since we also have a full bathroom in our basement that we can use when guests are around.

Our second listing is the whole house listing that we listed up at the beginning of 2018. We’ve set this up to be a two-night minimum stay and it’s only available on weekends. The way we make this work is that if someone books our house, we just clean up our house, put our valuables into a storage room in our basement, and then either stay with family or go on a trip somewhere.

After years of doing this, our Airbnb runs pretty smoothly now. We have a house manual that I set up using Hostfully, which contains all of the important info for guests to know. Messages are automated with Aviva IQ. And I’ve got dynamic, automated pricing set up with Beyond Pricing. My friend also recently got a Roomba and has been raving about it, and I think I’m going to get one of those soon since I feel like they could really reduce my vacuuming time.

The Numbers

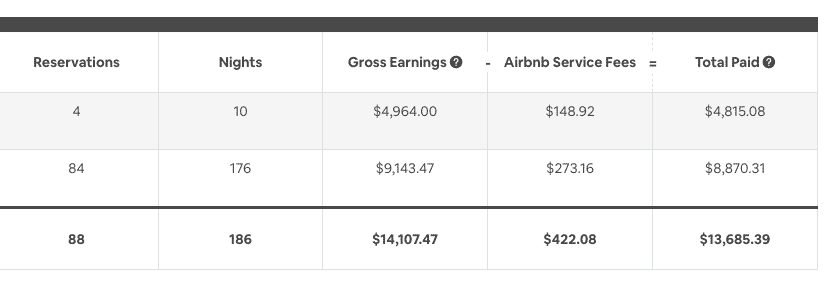

With that background out of the way, let’s get into the numbers. Below is a screenshot of my 2018 Airbnb earnings (courtesy of my Airbnb dashboard).

- Total earnings for the whole house listing came out to $4,815.08 with 10 total nights booked. This comes out to an average nightly rate of $481.50. However, there is a big caveat here, as two of those nights were booked during the 2018 Super Bowl. We ended up making $2,500 for that two-night Super Bowl stay, which is obviously a unique situation that isn’t regularly repeatable. Although, it might be more repeatable than you think since almost every major city has big events each year that you can take advantage of. Still, if you take out the $2,500 Super Bowl weekend booking, we’re looking at an average whole house rental rate of closer to $289 per night. Still very good, and just two nights is enough to cover a significant chunk of our mortgage.

- Our guest room is our primary Airbnb listing, and we ended up with 176 nights booked in 2018. The room itself brought in $8,870.31 over those 176 nights or an average nightly rate of $50.39. Again, this is pretty significant income, especially when you consider that our guest room would otherwise sit unused.

As a note, you’ll notice that Airbnb charges a service fee. This is a 3% fee that Airbnb charges to the host that essentially covers the credit card transaction costs. It’s a fee that’s pretty much unavoidable, even if you were to run your own short-term rental business outside of Airbnb.

Cost Benefits of House Hacking With Airbnb

What’s big about Airbnb isn’t just the income we generate – it’s about what that income means when it comes to our housing expenses.

Our mortgage payment, which includes principal, interest, taxes, and insurance, comes out to approximately $1,300 per month, or about $15,600 per year. This payment can vary slightly based on changes to our property taxes and insurance costs, but generally, our mortgage payment fits in around those numbers.

Breaking it down a little bit more:

- 2018 Housing Expenses: $15,600

- 2018 Airbnb Income: $13,685.39

What this means is that house hacking with Airbnb covered about 87% of our 2018 housing expenses. Obviously, we have to take money out of our Airbnb income for taxes, but the point is still there that Airbnb is a fairly accessible way to reduce or subsidize your housing costs. Indeed, our spare room alone, which takes us very little work to maintain, and importantly, would sit unused otherwise, brought in enough to cover 56% of our yearly housing expenses.

Things get really interesting when you break down the nightly rate compared to what a traditional roommate would bring in. The market rent for a full-time roommate in our house would be about $600 per month or an average nightly rate of $19.72. Our average nightly rate on Airbnb hovers around $50, so, by renting out the room on Airbnb, we’re increasing daily revenue by about 2.5 times. I’ve found that it usually only takes me between 10 and 14 days to earn the same amount as I would from a full-time roommate. And we get the added benefit of less wear and tear on our house since an Airbnb guest is in our house for much shorter periods of time compared to a traditional roommate.

In terms of expenses, the beauty of house hacking with Airbnb is that a lot of your expenses are pretty minimal. We already spend money on heating our house. I suppose more water and electricity gets used, although I don’t think it’s significant enough to really make a difference.

Takeaways from My Airbnb Experience

A Low-Risk Introduction To Real Estate. Unlike getting a duplex or other multi-unit property, renting out a guest room or your entire house on Airbnb doesn’t really require you to do anything special. You might already own a house already, and this is just an easy way to take advantage of the things you already own. The worst-case scenario is you find out that Airbnb isn’t for you, and then you’re just living in your house like you were before.

Better Than A Roommate. A lot of people think renting out a room on Airbnb is the same thing as having a roommate, but the truth is, it’s completely different. An Airbnb guest comes into your house as a guest, which is a totally different mindset then coming into a house as a roommate. I barely notice most of my Airbnb guests – they’re just there to sleep and shower, and the rest of the time, they’re out and about. And if you get someone you don’t really like, they’re gone in a day or two, unlike a roommate who’s probably going to be stuck with you for a year. My friend The Mastermind Within is a house hacker himself that goes with the traditional roommate route, but I keep trying to convince him to go with Airbnb. He’s got the perfect setup for a great Airbnb listing.

The Ability To Turn Your Primary Residence Into An Income Producing Property. For most people, your primary residence is really more like a consumption item, rather than an investment. After all, the house that you live in doesn’t generate any income (and indeed, costs you money to live there). But by using the extra space in your house, it’s possible to monetize your home and make it act more like an income producing asset.

A Big Impact On Your Financial Independence Journey. Even small amounts can mean a lot on your journey to financial independence. Under the frequently mentioned 4% rule, you can typically pull 4% of your portfolio indefinitely to fund without running out of money. So, if you wanted to generate $5,000 of income each year, you’d need to have $125,000 in your portfolio. But this rule also works in reverse – if you can make $5,000 per year from Airbnb, you’d need $125,000 less in your portfolio. Generating $5,000 from Airbnb in a year is something that I think a lot of people could do.

I hope this post was helpful to you. Take what works with my situation and consider using it for your situation. If you feel like supporting this blog, you can sign up to be an Airbnb host with this link. Feel free to hit me up if you have any questions.

Thank you, Kevin. I love reading tips and hacks like this.

My biggest question is regarding income tax on earned AirBNB income. Are you not paying it? haha Do you not nee to pay it? Where I live, Canada, we need to pay income tax on our STR income. For anyone with a job, that means the AirBnb income is taxed at our marginal rate. For me, that’s 48%. After I pay income tax, after my guest is charged 13% gov Sales tax and after my guest and I both pay airbnb fees, I’m only earning about 30-35% of what the guest pays.

How are you avoiding this?

Thanks for writing this post. We just traveled down to Australia where we stayed in Airbnbs where other people were living there. Two of the places we were sharing with the owner (which were both decent experiences) and one place was with other Airbnb renters (not as good because the other people were messy!). However, the shared concept got us thinking about using our own house as an Airbnb. We have 2 bedrooms, 1 bathroom upstairs, and 2 bedrooms, 1.5 bathrooms downstairs, so it is actually a pretty good split. I am not sure if our neighborhood would be the best location wise, but we are definitely intrigued by the idea!

You know, when I started this whole Airbnb thing, I had no idea what type of guests I’d get. Once you start trying it out, you’ll get a feel for who comes to your neighborhood. The great thing is, if it works out, then great. And if it doesn’t, you don’t really lose anything other than some time. With bedrooms on different floors, it might be worth listing up one and seeing how it works out.

This is very helpful. It’s something we are considering now that we’re almost empty-nesters (I wouldn’t consider it with kids in the same home). That said, I wonder about sharing the living room and kitchen. Do you keep these off-limits or let your guests use?

Living room and Kitchen are open to guests. Most of my guests just hang out in their rooms though, except for some people that want to be my friend, which I’m cool with. I also tell people they can use my kitchen, but in all of my time doing Airbnb, I think maybe 2 or 3 people ever have cooked something in my house. Basically, no one ever cooks.

What house hacks or other income producing hacks do you recommend for people renting in expensive cities like San Fransisco? Most of us here in San Fransisco rent because the house prices are outrageous.

Yeah, in those kind of cities, I’m not sure. My brother bought a really expensive house in DC and is currently living there with roommates and renting out his basement on Airbnb. GuyOnFire also house hacks while living in a major, super expensive city.

Another option is renting a place with an extra room and doing Airbnb. Obviously will depend on city regulations and whether your landlord will let you do that, but just an option. I think even renting out a couch is possible in big cities like San Francisco, especially if there are big events in town.

What a wonderful side hustle! You have a 50% occupancy rate for your guest room so the location must be really nice. Did you think of this at all when you purchased the house? Any advice for prospective home owners who’re contemplating using AirBnBs to help cover mortgage payments?

The house is located next to one of the largest Universities in the United States (and maybe the world), so that basically brings with it infinite demand. I could pretty much be at 100% occupancy if I wanted to (I just choose not to just because my wife and I like to have our house to ourselves sometimes).

My wife actually bought this house before I met her, and she house hacked by living in one room and renting out the other 3 rooms to grad students. It helped her to essentially live for free, since her rent payments were more than her mortgage payments.

If you’re thinking of buying a house, my big advice is buy it knowing that you can afford it without the Airbnb. That way, the Airbnb is just icing on the cake, and it doesn’t put you in a position where you’re stuck if you don’t do Airbnb. If you have a house with a bathroom that you don’t even have to share with your guests, that makes things much easier.

Location matters, but don’t just think in terms of vacation locations, but also think about what business sort of events could bring people to the neighborhood. I’ve had a lot of luck with my Airbnb because I’m near a large college campus, so instead of vacationers, almost all of my guests are students coming into town for interviews or conferences. These are the best guests because they’re much less demanding and they’re never around your house.

Man this is a great side hustle and a perfect way to lower that big line item of housing on the budget. If only I had a house to do this in!!

This is absolutely something I’ll be looking into one day, but until then I guess I’ll just have to follow along 🙂

Yeah, you need your own place if you’re going to do this. Admittedly, I am pretty privileged to have the extra space to do this right now.

A small nit-pick. I wouldn’t say you were privileged to have an extra room to rent. I would say that you and Mrs. FP have worked very hard, each in their own ways, to have the ability to purchase an in-city home in a major city. There is no privilege involved and this is the beauty of being a free American to pursue your life as you wish w/o harm to others.

You nailed with your comment on kids. We have a 5 year old and a 15 month old so there’s no way the wife would go with the idea of renting a room. I like the idea of renting our house but not sure If I could get in trouble with the HoA. Based on your experience it seems your HoA (if you have one) does not impose any limitations. True statement or is just that you haven’t even asked?

We don’t have an HOA since we live in a house in the city, so not something that I have to think about. Obviously, people in condos and subdivisions have to think about that, because you’re right, a lot of those places won’t let you do Airbnb.

In my city, we do have to get a license though from the city if we rent out our house when we’re not there. It’s like 50 bucks a year. We don’t need any license if we rent out a room in the house that we live in though.

Awesome that you covered 87% of your housing expenses last year. I’m going to check out some of the Airbnb resources you mentioned.

So far I’ve had 2 guests in my house from Airbnb and it was pretty easy. Only $54 in earnings though. This month I have 2 full time roommates for $1000 ($500 per room), but it will end in March. So I’ll prob go back to Airbnb and leave open most of the dates and see how I do. I know it will be limited results untill I get over 10 5* reviews.

Yeah, like anything, it takes time to get into the groove with Airbnb – and of course, location matters a ton. It’s possible your location won’t work out all that well. Or maybe you’ll discover something in your area that draws more people than you thought. I know when I started my Airbnb, it never occurred to me that there would be so many students coming into town for interviews and conferences.

Also, make sure to check out some of the people around you and see what they’re doing and what you can do better than them. It sounds like your first two stays went well though, which is good.

Hi. Kinda off topic to this post, but I wanted to thank you for your blog. It inspired me to sell the crap I have in my garage and so far made 100 bucks this month. I also downloaded the apps you used and am starting tomoney using those as well(google rewards).

Awesome! Thank you Maria for the kind words. I’m in the same process of selling stuff from my house too – I have so many old clothes that I’ve never worn. Honestly, I bet most of us have $1,000 or more bucks just sitting in our house that we could sell off.

What about the risk of having bad tenants who cause damage ?

Like anything we do in life, there’s always a risk – even just stepping outside I risk getting hit by a car or tripping and hurting myself.

I can say that after hosting over 200 guests in 3 years, I’ve had only minor things happen – a broken glass, a stain on a sheet, etc. The beauty is that when you rent out just a room in your house, the risk of damage is pretty low. It’s not like you can throw a party or something when I live there.

It also helps that Airbnb has insurance, so if something happens, you can get paid.

Man, the numbers speak for themselves! After this year, we will see what I do with my house. The passive income is great, but it’s possible to get higher returns with AirBnB 🙂

Man, the thing is, once you have things rolling, it’s pretty passive. You already have to keep your house clean anyway, so any cleaning you do is pretty much a byproduct of what you have to do anyway. Keys are taken care of by a lockbox. All you really have to do is just change the sheets between guests and clean the bathroom. If you get a Roomba or something, that makes it even easier – just drop it into your airbnb room in between guests and let it do its thing. You have a real sweet set up because you don’t even need to share a bathroom with anyone. I bet you could get guests who are in town for conventions and that kind of thing.

I would be totally lying if I didn’t tell you that my hands were sweating reading this entire post. I keep trying to imagine sharing a wall (or actually our baby sharing a wall) with strangers. I’m tempted to make a listing to see if we even get any takers, but that seems like a lot of work just to fill my curiosity. Good thing I can just stalk your blog and live through you!

Haha, yeah I do have the benefit of not having kids – just a dog that I’m not too worried about. Kids are going to be in the horizon for me one day, and I am fairly certain that when we have kids, we’ll take a break on Airbnb. I’m still debating about whether we could keep doing Airbnb just for students coming to campus for interviews. I really enjoy hosting those type of guests because I find them really respectful and cool, and honestly, I feel like I’m helping by giving someone a clean, good space to sleep in before a big interview.