M1 Finance is a free investing app that I highly recommend. It’s my favorite fintech/robo-advisor investing app and one that is great for anyone looking to start investing and that wants to make sure they’re doing it correctly. M1 Finance is also currently offering a $75 referral bonus if you sign up using a referral link. To earn your M1 Finance referral bonus, you have to do the following:

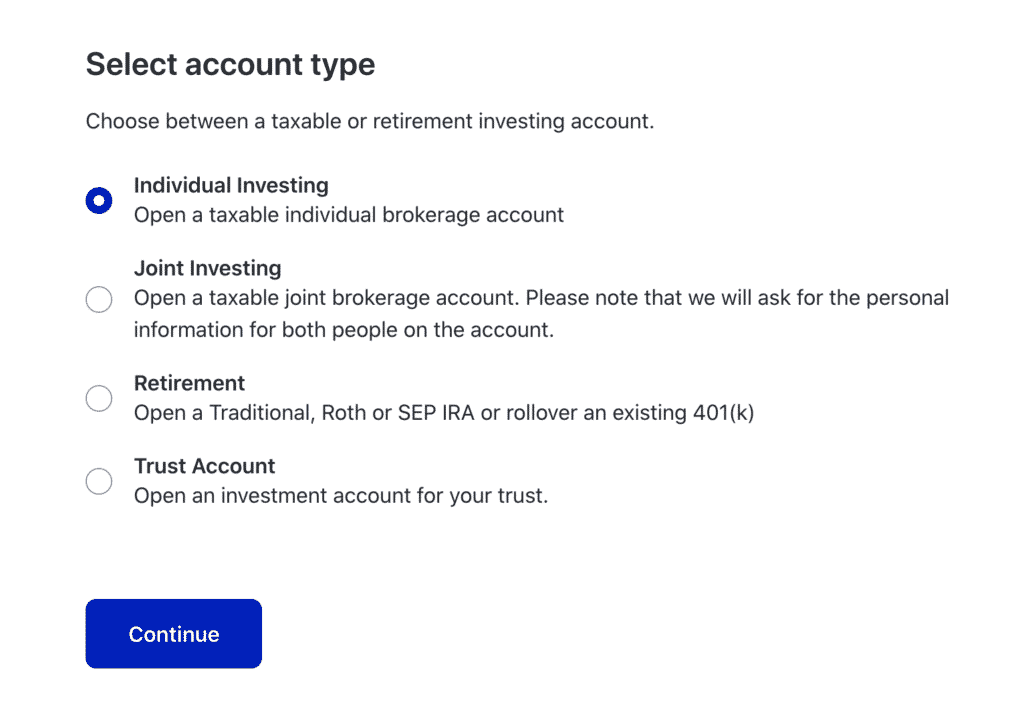

- Open an M1 Finance account using a referral link (here is my referral link). You can open either a taxable brokerage account or a retirement account such as an IRA or Roth IRA. I recommend opening a taxable M1 Finance brokerage account, as it will make earning the bonus easier. Annoyingly, the referral link doesn’t show the bonus terms, but you can see the current referral terms here: https://m1.com/100-referral/. That’s where I got my referral link that is in this post.

- Fund your account with at least $10,000.

- Leave the $10,000 in your account for at least 30 days.

- You’ll receive your $75 bonus 14 business days after meeting these requirements. Note that you’ll need to have a taxable M1 Finance brokerage account to get the bonus (M1 Finance can’t put money into a tax-advantaged account like an IRA or Roth IRA).

In this post, I’ll walk you through exactly what you need to do to earn your M1 Finance referral bonus and give you my thoughts as to why I think M1 Finance is an investing platform that’s worth using.

One important thing to know is that you do not have to invest the funds that you deposit into your M1 Finance account to be eligible for the referral bonus. So, if you only want to get the bonus and don’t actually want to invest using M1 Finance, your best bet is to open a taxable account, fund it with $10,000, and then leave it in your account in cash for 30 days. We’ll talk about this tactic more later in this post.

What Is M1 Finance?

M1 Finance is an investing app that offers taxable investment accounts, as well as tax-advantaged retirement accounts in the form of IRAs, Roth IRAs, and SEP IRAs. The app is what you could call a roboadvisor. Rather than manually choosing each investment, M1 Finance instead uses a pie-based interface. When you invest, you select your pie and M1 Finance will automatically distribute your contributions in the percentages you’ve set up in your pies.

There are two ways to create a pie. You can either create your own custom pie or you can use M1 Finance’s expert pies. I generally recommend using M1 Finance’s expert pies if you aren’t exactly sure what you’re doing or if you aren’t comfortable creating your own pie. Even if you create your own pie, remember that when it comes to investing, simpler is often better.

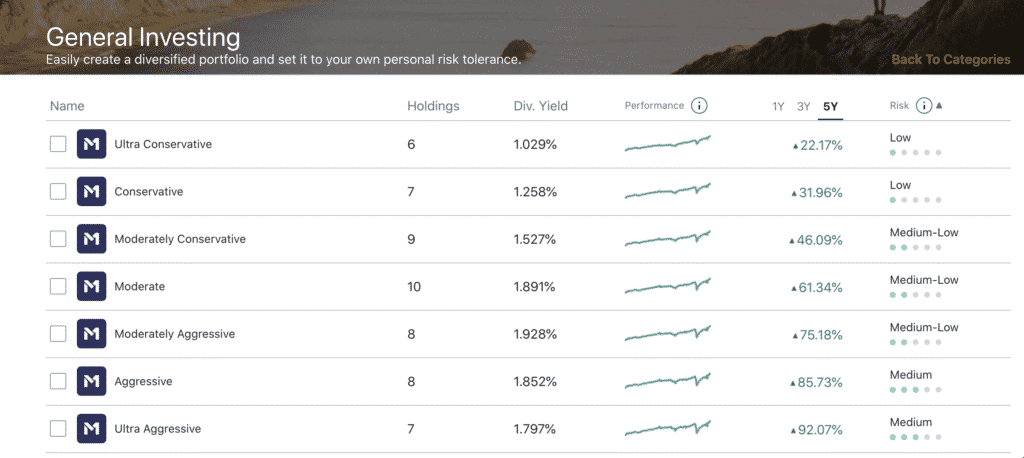

M1 Finance has a lot of expert pies. For example, under general investing, you can pick your investment pie based on how aggressive or conservative you want to be. Each pie consists of low-cost Vanguard index fund ETFs, which are empirically one of the best ways to invest.

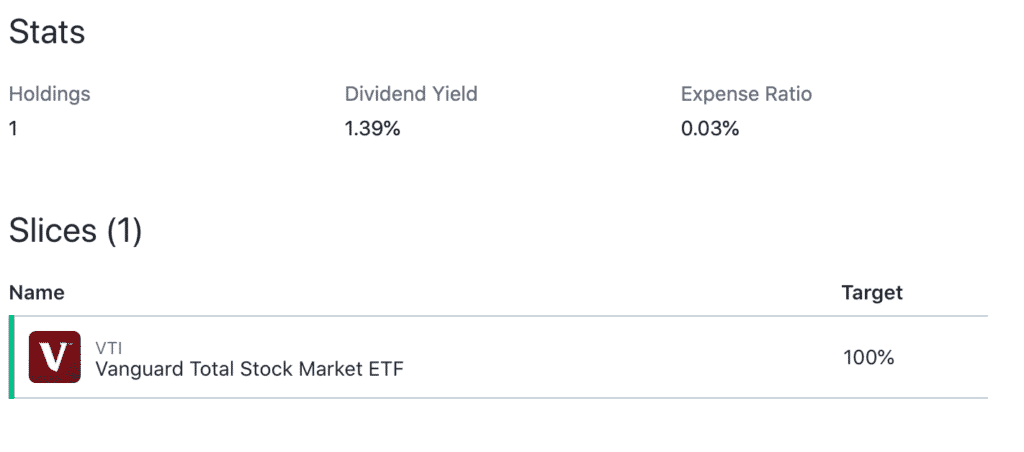

I like to keep things simple when I invest, so my pie consists of a single investment, the Vanguard Total Stock Market ETF (VTI). This is a highly diversified index ETF that invests in every publicly traded company in the United States. Since I’m young and still have a long investing horizon, it’s fine for me to invest in this single ETF.

M1 Finance Referral Bonus Step-By-Step Directions

M1 Finance is an excellent option if you’re looking to invest in either a taxable account or a tax-advantaged retirement account. I invest directly with Vanguard for my Roth IRA, but I use M1 Finance as a taxable account that I contribute to every month.

Even if you have no interest in investing using M1 Finance, it can still be worth opening an M1 Finance account simply to collect the referral bonus. Importantly, M1 Finance has no fees, so you can easily open an account, earn your bonus, and then take your money out. In addition, earning the M1 Finance referral bonus doesn’t require you to actually invest your money once you contribute to your account. If you want, you can simply opt not to create an investment pie and leave your money as cash.

That said, here are the step-by-step directions you can follow to earn your M1 Finance referral bonus:

1. Open An M1 Finance Account Using A Referral Link. To earn your $75 M1 Finance Referral bonus, first open an M1 Finance account using a referral link. Here is my M1 Finance referral link. The referral link stupidly doesn’t show the terms or even provide any indication that it is a referral link, but you can see the referral bonus terms at this link: https://m1.com/100-referral/. That link is where I generated my referral link.

I recommend opening an Individual Investing account, as shown below.

2. Fund Your Account With $10,000 Or More. Next, deposit $10,000 or more into your new M1 Finance account. Remember that you do not have to actually invest the money you put into the account. You can simply opt not to create a pie. Your money will then sit as cash in your account, which you can then withdraw later without any risk of loss.

3. Leave $10,000 In Your M1 Finance Account For 30 Days. The referral bonus terms require you to leave at least $10,000 in your M1 Finance account for 30 days. I recommend setting a calendar reminder 30 days into the future so you remember to check your account.

4. Your Bonus Will Post 14 Business Days After Meeting The Above Requirements. If you left $10,000 or more in your M1 Finance account, your bonus will post within 14 business days after the 30 days have passed. In my experience, the bonus usually posts sooner than that, but the terms do state it will take 14 business days.

Refer Your Friends For Additional Bonuses

M1 Finance also allows you to refer your friends and family members, which means you can earn more money by referring people that you know. You can find your referral link in the settings section of the app.

The referral bonus is normally $10, but occasionally, M1 Finance increases the referral bonus to higher amounts. There’s no way to predict when the referral bonus will increase or decrease, unfortunately. If you’re reading this and the referral bonus is more than $10, I’d recommend jumping on it right away. Whether or not it’s worth waiting for a potentially larger bonus is up to you – just be aware you might be waiting a while if you do wait for a higher bonus.

If you want to earn additional referral bonuses, consider sending your friends and family your M1 Finance link and walking them through the process. You can even copy and paste the directions in this post if you’d like.

Final Thoughts

M1 Finance is an excellent investing app that I personally use. It’s especially good for beginning investors who want to make sure their investments are properly diversified and that they have an appropriate asset allocation.

What makes M1 Finance particularly good is its fees. They charge no management fees and all their investment options are low-cost, index ETFs from Vanguard. There’s really no downside to M1 Finance, in my opinion.

The fact that you can earn a referral bonus for opening an M1 Finance account is the cherry on top that makes M1 Finance, in my opinion, the best roboadvisor and best investing app out there.

If you use a referral link, like the one you posted, you do not get the bonus. Grrr. Wish I had known that before I transferred money to M1.

What happened? Why do you say you don’t get a referral with my link? I’m looking in the app and it literally is a referral link. Give us some more info please.

I clicked on the link, but the site says “There’s $10 waiting for you! Just sign up and fund your free M1 account.” Has the bonus been reduced?

Never got my $50. 🙁

I”m in. Opened account today and did the $100 deposit….I think this is about my third referral for you. 🙂

Can I make a plea for the community? I’m underemployed so I’m trying to get Likes and Subscribes on my channel that has mostly tech stuff on it:

https://www.youtube.com/c/RobertBullock/videos

Hope to monetize it soon.

Electric cars, computers, solar, etc. are current subjects.

Thanks,

rob