Hey folks! You all know that I love podcasts and without a doubt, one of my favorite new podcasts is Fire Drill Podcast with Gwen from Fiery Millennials and J from Millennial Boss.

Beyond just being really entertaining and a wealth of information, what I really like about their podcast is that they really take the time to dive into the personal finance stories of people beyond the usual suspects in the personal finance world. It’s nice to get different stories from people that you might not have otherwise heard about before.

This past week, I was lucky enough to be a guest on their show and we got to talking about a lot of interesting stuff that I think will help anyone on their financial journey, including:

- My weird legal career trajectory (going from biglaw to government to non-profit – and taking pay cuts in the process);

- Paying off $87k worth of student loans (and buying myself some flexibility in the process);

- Solo 401k plans (sounds boring, I know, but they’re not);

- The idea of “Soft” FIRE or “Barista” FIRE;

- And of course, I get into detail about a lot of the weird side hustles I do (like Airbnb and Rover) and why I think they’re something you should do too.

You can listen to the full episode by heading over to Fire Drill Podcast. Hope you like it!

****

And before I peace out, just wanted to drop a line on a few other schemes I’ve got going on that’ll take you just a few minutes to do and that I think are at least worth looking into:

- Get $60 worth of stuff from Giftagram for $10 (and potentially $140 worth of stuff for $20).

- Get $75 worth of Amazon gift cards by opening up a Wealthsimple account and depositing $500 for 45 days.

- Get a free share of stock by opening up an account with Robinhood.

- Get a free $5 worth of any stock with Stockpile.

- Get a $20 Amazon Gift Card for downloading and linking a brokerage account with Personal Capital.

Here are the details below:

1. Get $60 worth of stuff from Giftagram for $10 (and potentially $140 worth of stuff for $20).

Giftagram has an interesting deal going on where you can get at least $60 worth of stuff for the effective price of $10.

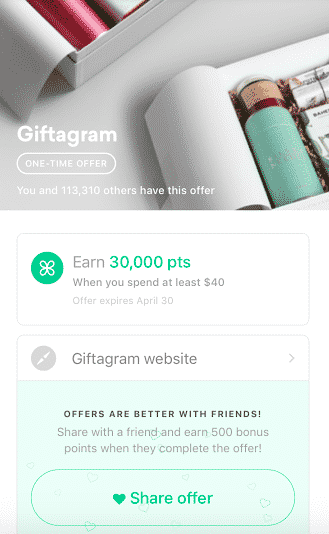

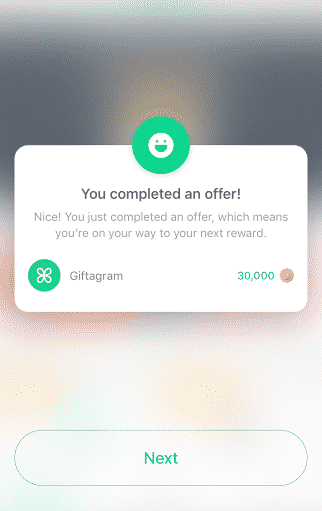

To this deal, first, check your Drop account to see if you have a targeted offer for 30,000 Drop points after making an eligible purchase from Giftagram.

To learn more about Drop, check out my recent post on the 7 Best Cashback Apps. The quick overview is that you link your credit cards to Drop, it tracks your credit card spending, and if you make eligible purchases using those cards, you get Drop points which you can then use for things like Amazon gift cards. It’s a nice way to get some passive cashback on your everyday spend.

My wife and I both had this 30,000 point Giftagram offer in our Drop account and you should have it too (as far as I can tell, everyone will get this offer at some point – it just might take a day or two to see it if you’ve just signed up for Drop). The offer will look like this:

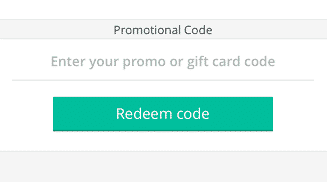

To get $60 worth of items for $10, first, download Giftagram and use someone’s referral code, which will then give you $20 worth of Giftagram credit. You can enter a referral code in the section titled “My Credits/Promo Code.”

After that, make sure that you make a purchase of at least $60 using a credit card that you’ve linked to Drop. If you do this, whatever you buy will have a price of $40, which will also activate the 30,000 Drop points offer (good for $30 in Amazon gift cards).

Thus, a $60 item, minus $20 in Giftagram credit, minus $30 in Amazon gift cards equals an effective price of $10 for something that costs $60 on Giftagram.

The way to maximize this offer is if you can do it with a partner or spouse. If you follow these steps, you can get $140 worth of items for an effective price of $20. Here’s how it works:

- It turns out that each person can refer the other person, so what I did was have my wife open up a Giftagram account first. I then used her referral code on my own account and bought a $60 item for the effective price of $10 by following the steps I laid out above.

- Since I used my wife’s referral code, she received $20 of Giftagram credit as a referral bonus (the person who gives the referral code gets $20 of Giftagram credit when someone they refer makes their first purchase).

- My wife then used my referral code (which Giftagram allows), which then gave her another $20 of credit. At this point, she was now sitting on $40 of Giftagram credit ($20 for referring me and $20 for me referring her).

- We then found something on her Giftagram account for $80, which ended up costing $40 once the Giftagram credit was applied. A $40 purchase was enough to activate the 30,000 point drop offer, so something that cost $80 had an effective price of $10.

Altogether, we bought $140 worth of stuff for an effective price of $20 ($60 worth of Giftagram credit from referring each other plus $60 worth of Amazon gift cards from Drop).

Even better, once you do that, the first person will end up with another $20 of Drop credit, so in theory, you can go ahead and buy something else. The only issue is that if the item costs less than $40, you have to pay for shipping and handling.

- If you don’t have anyone to do this deal with, consider using my Giftagram referral code and at least snag yourself a $60 item for an effective price of $10: KH263791

- If you haven’t downloaded Drop yet, use my referral code and get some free Drop points to start off your account: j6d3y

*Update: As of 11/27, it appears that the referral credit has been dropped to $15 per person. You’ll need to adjust the numbers above accordingly.

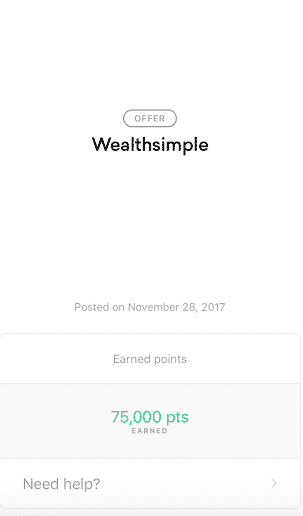

2. Get $75 worth of Amazon gift cards by opening up a Wealthsimple account and depositing $500 for 45 days.

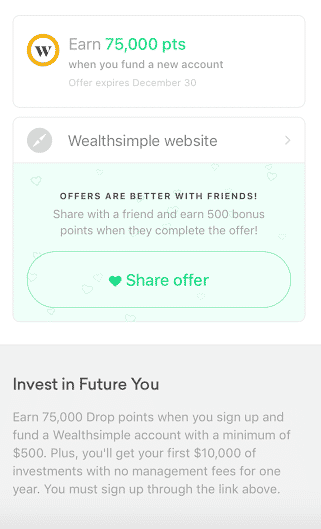

This seems like a pretty easy deal as well. I found this offer in my Drop account offering me 75,000 Drop points if I opened up a Wealthsimple account and funded it with $500:

Wealthsimple, for those of you that don’t know, is a roboadvisor similar to Betterment or Wealthfront. They’ve been primarily for the Canadian market but just broke their way into the US market recently.

The offer terms are pretty straightforward – all you need to do is open a Wealthsimple account through the Drop app and fund $500 into your Wealthsimple account. You’ll then receive a 75,000 point Drop bonus within 45 days.

75,000 Drop points are worth $75 worth of Amazon gift cards, which is good for a 15% return on your $500 in just 45 days.

I set up my account, funded $500 to it, and picked the most conservative portfolio allocation Wealthsimple offers (35% stocks/65% bonds). My plan is to withdraw the money from my account once I get my 75,000 Drop points.

If you have the liquidity to tie up $500 for 45 days, I think this is definitely worth doing. It only took me 5 or 10 minutes to get signed up. Plus, as a side benefit, I’ll get to test out Wealthsimple.

*Update: I ended up earning my 75,000 Drop points just a day or two after I funded my Wealthsimple account. This one is a no-brainer – don’t miss out on it!

3. Get a free share of stock by opening up an account with Robinhood.

I’ve debated sharing this but decided it’s worth just because it takes so little time to set up. The app in question here is called Robinhood.

Robinhood is a free brokerage account that lets you buy and sell stocks for free. You can buy ETFs using the app too, so you could use Robinhood as part of a passive index investing strategy. Back before I started this blog, I actually used Robinhood to buy a share of Twitter stock at $28. Today, my Twitter stock…well, it’s not at $28. I’m still holding onto that Twitter stock though just in case it ever goes back up.

Robinhood does have an interesting referral program going on right now where, if you refer someone, each person gets a free share of a random stock. I referred my wife over the weekend and we both ended up getting a share of Groupon stock. Robinhood says that you have a 1% or 2% chance of ending up with a share of Facebook, Apple, or Microsoft stock, so I think it’s worth signing up just to see what stock you end up with.

Obviously, one share of stock isn’t going to make you rich, but it takes less than 5 minutes to sign up and costs absolutely nothing, so you really have nothing to lose other than a few minutes of your time.

Use my referral link here and see what free stock you end up with (note that I’ll also get a free share of stock if you use my link).

4. Get a free $5 worth of any stock with Stockpile.

I learned about this app while I was at FinCon and while it’s not an app I would use in my normal day-to-day investing strategy, it’s at least worth signing up for just to get yourself a free 5 bucks worth of stock.

Stockpile is basically similar to Robinhood, only the app allows you to buy fractional shares of stock. The main downside (and why I haven’t really tested it out) is that it costs 99 cents per trade.

Still, if you use any referral link, you’ll get 5 bucks worth of any stock you want. And you don’t have to pay anything or fund the account with anything in order to get the 5 bucks worth of stock.

From what I can tell, I also get nothing if you use my referral link, so really, I’m just telling you about this deal solely because I think it’s worth doing for the quick 5 bucks.

Use this link and get yourself a free $5 worth of stock from Stockpile (I don’t get anything for this, I don’t think).

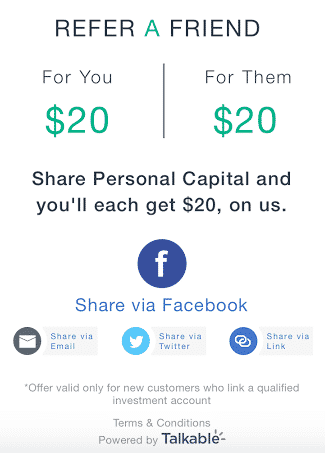

5. Get a $20 Amazon Gift Card for downloading and linking a brokerage account with Personal Capital.

That last quick thing is an offer that I received over the weekend for $20 if you download and link a brokerage account to Personal Capital.

Personal Capital is an app that’s similar to Mint – you can use it to track your transactions and see how your budget and investments are doing. Along with Mint, Personal Capital is an app that I use every single day. And like Mint, it’s totally, 100% free.

It looks like, under this current deal, you can get a free $20 just for downloading and linking a brokerage account to Personal Capital. Seems easy enough to do, so thought I’d share it out to folks who might be interested. Obviously, this offer only applies to people who’ve never used Personal Capital before (or at least I assume so).

Plus, you might find out that, similar to me, Personal Capital becomes something that you use every single day.

Hope this stuff helps! Enjoy the rest of the weekend!

Holy crap, FP! I can’t believe I missed your interview with Gwen and J. Thanks for alerting me, my friend. Listening to it today. Cheers.

It was awesome, Kevin. I really think you’ve solved the mystery of life — at least for you. I admire you for not following the traditional lawyering path and paving your own way.

Thanks Mrs. Groovy!

Thanks Mr. Groovy! Hope you enjoy(ed) it!

Thanks for the heads up on this podcast

Not heard it before so I will give it a go =D

Awesome! Hope you enjoy it!

How long did it take for your funds to be transferred into your Wealth Simple account?

Have you heard of SaverLife.org? It is a non-profit program that last six months. For every month you deposit $20 in your savings account, they set aside $10 for you to redeem when the program ends. This morning I got an update from the program director saying that the income qualifications for the program had been removed.

Hi Jerry!

Happy Holidays! We came across your blog post about SaverLife last week – thank you for mentioning us! As a nonprofit, we have a very small marketing budget, so we appreciate the help in getting the word out about our program!

I wanted to let you know that we have removed the income qualification to participate in SaverLife. We wanted to make the program accessible for anyone who has a need to start saving.

Also, I have one more question for you – would you be interested in being interviewed by my colleague about your saving experience with SaverLife? We are always looking to add happy graduate testimonials to our Saver Success story page.

Let me know and I will introduce you to my colleague Grace.

Thanks again for the review on your blog!

Shana

It took my a few days for my funds to get transfered into wealthsimple. Then just a few days to pull the funds back out.

Never heard of Saverlife, but maybe I’ll take a look.

Great interview! Fire Drill is becoming one of my favorite podcasts. Its entertaining, good info and I like the variety of guests.

I also signed up for wealthsimple and did the Drop promo! – Do you sell the amazon gift cards for cash or keep them for personal use?

Thanks Gary. I just keep them for personal use. To me, Amazon gift cards are basically as good as cash.

Awesome, it’s a fun podcast to listen to…like a couple of old friends chatting. Anyways, thanks for the heads up on the schemes…I’m always down to make a few bucks!

Thanks man! For sure check out that Wealthsimple scheme. I just completed that one and got my $75 almost immediately.

Wow, I just created a drop account and used your referral code. I am contemplating signing up for Wealthsimple to get that $75 reward

Have you taken your money out of the account since you have been rewarded or do you still have to wait 45 days?

I haven’t taken it out yet, but I plan to soon. There’s nothing in the terms and conditions that says you have to keep the money in the account for 45 days. The terms just say that it could take up to 45 days to earn your Drop points.

Thanks for sharing! I am about to open an account!

I just opened up a Roth IRA account. What would be the tax implications of opening and closing an investment account so rapidly? I am assuming there wouldn’t be any since a Roth is an after-tax account.

I don’t think any. I just opened a taxable account (they call it a “personal” account) and that’s what I would recommend just to avoid any potential issues.

Thanks a lot! And I see that I can redeem those points for a Best Buy Card!

I personally recommend redeeming for Amazon just because that’s basically as good as cash for most people, but obviously if you have something to get at Best Buy, then do that.

I am going to upgrade my girlfriend’s TV for Christmas. Just looking for something under $250. I’ll check Amazon and Best Buy for the best deals.

Dope, I can’t wait to listen to the podcast!

Thanks Jerry!