When I first started figuring out my side hustle strategy years ago, I found that the gig economy and sharing economy worked best for me. What made it work so well was the flexibility that came with these gigs. I was working a full-time, demanding job at the time, so my ability to side hustle was fairly limited. The gig economy worked well because I could turn on the apps whenever I wanted and pick up a random gig whenever it made sense for me. In the history of work up to that point, there really wasn’t a way to work like this, so I took advantage of it.

The criticism that gig economy work often gets is that it’s low-value work that can’t really scale. I can’t say that this statement is entirely wrong because it’s true, the nature of gig economy work means that you have a natural cap as to what you can earn. You only have so many hours in a day and doing any of these gigs takes time. As many would point out, when you do gig work, you’re trading time for money.

And yet, this isn’t exactly true either. When you think about it, doing gig work isn’t exactly trading time for money. Rather, you’re trading tasks for money, getting paid for each task that you complete.

It’s a small distinction that might not look like a big deal at first. But I think it’s a distinction that matters and is worth thinking about.

Time For Money Vs. Tasks For Money – What’s The Difference?

At first glance, trading time for money and trading a task for money seem pretty similar. In both situations, you’re still actively trading some of your limited time on this earth for some amount of money.

But I think there is a difference that makes the distinction between the two matter. Here’s why:

1. Trading Tasks For Money Means You Can Vary What You Make

The big factor with trading time for money vs. trading a task for money is that, with the former, the amount you can make is capped at a set amount whereas, with the latter, you can vary what you make through means that you can potentially control.

Here’s what I mean. A job that pays you $20 per hour means that you have no choice as to what you make other than trading more hours of your life for more money. If you want to increase what you make for your time, you have to get the person paying you to pay you more. Obviously, if you’re getting paid on a straight hourly basis, figuring out ways to get paid more for your time is a smart thing to do. But it’s ultimately not in your control. It’s in the control of the person who’s paying you.

Contrast that with the way the gig economy works, where you’re typically trading tasks in exchange for money. The amount you can make when trading tasks for money generally isn’t tied to the time you work – it’s tied to completing the task.

Are you still trading time for money? Sure, in a way you are. But it’s not exactly the same because of two very important characteristics that come with trading tasks for money: (1) you can accept only higher-paying tasks (i.e. by setting your own price for work you’ll accept); or (2) by being more efficient and either completing tasks faster or completing more tasks in a shorter amount of time. What this means is that in the world of trading tasks for money, two people doing the same thing likely won’t make the same amount. At least some portion of what you make is tied to your skills.

This is the thing about a lot of gig economy apps that I think most people don’t understand – they do take skill to complete. I don’t mean they require hard-skills, but rather soft skills in understanding which type of gigs to accept and how to complete gigs more efficiently.

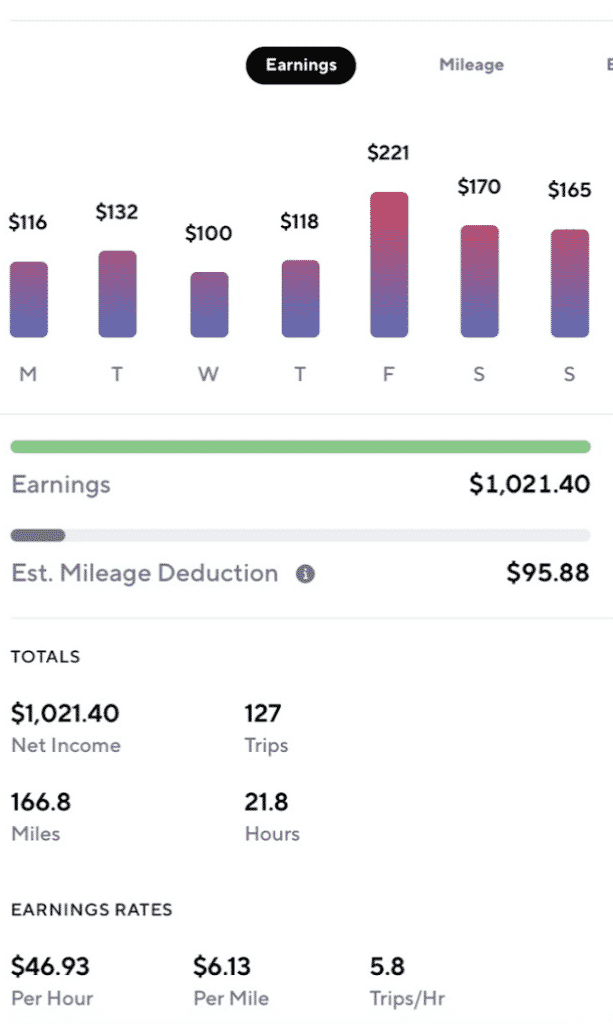

Over the past several years, I’ve put this principle into practice. Regular readers of this blog know that I love doing food deliveries on my bike. I’ve now been doing food deliveries as a side hustle for over 5 years. Over those years, I’ve gotten better at picking and choosing which orders I accept, thinking of myself much more like a business trading tasks for money, rather than trading my time for money. It’s gotten to the point that I’ve regularly able to earn the equivalent of $40 or more per hour doing deliveries, simply because I’m able to strategize and complete more deliveries in a shorter amount of time compared to most people.

2. Not All Tasks Are Created Equal

In the gig economy world, you often see two types of tasks: timebound tasks and non-timebound tasks. This raises an important issue when it comes to trading tasks for money. Not all tasks are created equal.

So what’s the difference between these types of tasks? Timebound tasks are those tasks where you have to complete the task over a set period of time. An example of a timebound task would be walking dogs using apps like Wag or Rover. In these tasks, you’re contracted to walk a dog for a set period of time (typically 20, 30, or 60 minutes).

When you think about it, a timebound task is pretty similar to a job where you’re paid hourly, with the primary difference that you can work in shorter increments and you have more flexibility with when you work. The big problem that comes with timebound tasks is that there aren’t many ways to increase your earnings for the time you spend working. The only real way you can do this would be to either charge more for your time or increase your earnings by adding more tasks into the same time period – for example, by walking multiple dogs at once.

In contrast to timebound tasks, non-timebound tasks are tasks where you’re paid a set amount to complete a task, regardless of how much time it takes you to complete. That’s how the food delivery game works – you’re offered a task and a payment amount, and you’re paid for that task regardless of how long it takes you. This matters a lot because it means what you make is largely a product of what you can do. The faster you can complete your tasks and the more tasks you can complete, the more you’ll make.

This doesn’t just apply to regular gig economy stuff either. Freelancing typically works in a similar way. For example, a freelance writer might charge a fixed amount for 1,000 words. The faster they can complete these tasks and the more of them they can complete, the more they can make.

It’s this distinction that has led me to shy away from timebound tasks like dog-walking and instead focus more on non-timebound tasks like food delivery. By working during peak periods, being strategic with which orders I accept, and doing multiple orders at the same time, I’m able to earn a lot more for the time I spend working.

3. Trading Tasks For Money Means You Can Use Reverse Latte Factor Principles

One concept that I’ve talked about on this blog is something that I call the Reverse Latte Factor. It’s a spin on the traditional Latte Factor concept, which basically says that most of us spend small amounts on frivolous things each day. If we cut out those frivolous expenses and save that money, it can add up to large sums when invested over the long-term.

The Reverse Latte Factor is essentially the opposite of that. Rather than cutting expenses, consider all of the ways you can generate extra income. Because if cutting small expenses and saving that money each day adds up over time, what happens if we take actions to earn small amounts of extra income on a daily basis?

It turns out it can add up to a lot. Below is a chart demonstrating what consistent, small amounts of extra income can add up to when invested over the long-term (the chart assumes a 7% annual rate of return).

| Amount Earned Per Day | Total in 30 Years |

|---|---|

| $5 | $184,458.30 |

| $10 | $368,916.60 |

| $15 | $553,374.90 |

| $20 | $737,833.20 |

| $25 | $922,291.50 |

| $30 | $1,106,749.80 |

What trading tasks for money does is allow you to earn extra income in small, piecemeal chunks like this. Earning an extra $5 per day can add up to over $180,000 when invested over the long-term. Double that to $10 per day and you’re looking at over $360,000. Figure out how to make an extra $30 per day and you can literally become a millionaire.

What does it take to make an extra $5, $10, or $30 per day? You might not be able to do this if you’re trading time for money because there aren’t that many side hustles or side gigs you can do that will just let you work for a few minutes per day whenever you want. But if you’re trading tasks for money, those numbers might be more in reach than you think.

Takeaways

Gig economy apps obviously have their limitations. They aren’t passive income and they do require you to use up your time if you want to bring in money. But in my opinion, there really aren’t many things that are truly passive income.

Everyone has to work for money, whether they put in the work upfront or they put in the work as an ongoing thing. Even though this website generates income for me in ways that some people would call passive, the fact is, I have to put in a massive amount of work on it every week in order to keep that income flowing in.

Ultimately, there’s a difference I think between trading time for money and trading tasks for money. Most people look at these gig economy apps and think about what they pay on a per hour basis. I’m guilty of doing that as well. But that’s not what these gig apps are about. You’re not exactly trading time for money. You’re trading the task you’re doing in exchange for money. The time that comes into play is incidental and something that you can potentially control.

I am so happy for your blog and the emphasis on side-hustles- which also means emphasis on being self-employed, I’ve been self-employed at least in part my entire post-college work life. I’ve scaled back in recent weeks once I finally started getting PUA, but will start a new (1099!) job next week, that will make me ineligible combined with my other dinky job, will be time to start hitting the app gigs again in earnest.

I used quite a few of your thoughts and analysis in getting my boyfriend to consider and finally join the gig economy, with deliveries, since he left his job end of Feb and didn’t qualify for unemployment. He’s finding it difficult to want to do the available jobs now: half or less pay, with less flexibility of hours.

That’s one of the things about these gig apps – they’re a nice easy introduction into the world of entrepreneurship. You might not feel like it, but when you do these gigs, trading tasks for money like this, you are a business, so this stuff is a nice way to work your way into entrepreneurship.

As a higher ed Math teacher, your article resonates with me. I am middle-aged now, and my career has changed a lot over the years. When I first started working after college, the internet wasn’t a thing. I had a traditional job. I lucked out to be able to work from home in the 90s after my son was born. I would have been all over the gig economy had it been available more then, but I kind of designed my own.

Keep up the informative articles, and I’m rooting for your continued success. I would also like to add that having a complementary (and complimentary!) partner is so important. My spouse has a more traditional job that has enabled me to do my gig thing and work from home. Likewise, all the old stresses of coordinating travel and the demands of 9 to 5 are mostly gone, but his job provides the health insurance.

Thank you Jean.

Absolutely, I agree with the spouse situation. There’s no doubt about it that I’m able to take the risks I’m taking because I have a spouse with a good, stable career path. Only issue for us is that she owns her own practice, which means we’re both paying for our own health insurance with our own money. If I was still working a 9-5, my wife would probably be on my health insurance.

I would love to see an article by you on health insurance for those in the gig economy!

That’s a great idea. I’ll put that down for a potential future post.

I look forward to seeing it.