One of the best things I did coming out of law school was to pay off my student loans as fast as I could. Doing this gave me a ton of flexibility in the type of money I had to earn.

With my student loans gone, I didn’t need to work in a job earning a certain amount of money, all so that a portion of it could go out the door to some student loan company. And I could rest easy at night knowing that I didn’t have to keep paying for a piece of paper that I had earned years ago!

Interestingly, even though I knew how much in student loans I had paid off, I had never actually looked at what I had paid over those 2.5 years.

I thought it might be an interesting trip down memory lane to see this information, so a few weeks ago, I requested my payment history from my student loan servicing companies and took a look.

Background On My Student Loans

Before diving in, it’s best to look at how I ended up with these student loans in the first place. I went to a law school that gave me a 50% scholarship – a fairly smart move in my book since my other options were much more expensive and would have put me into far more debt. My goal when I entered law school was to keep my costs at a level that I thought would be manageable.

While the scholarship did help to lower my school costs, it still cost a lot in both tuition and living expenses for me to make it through those three years.

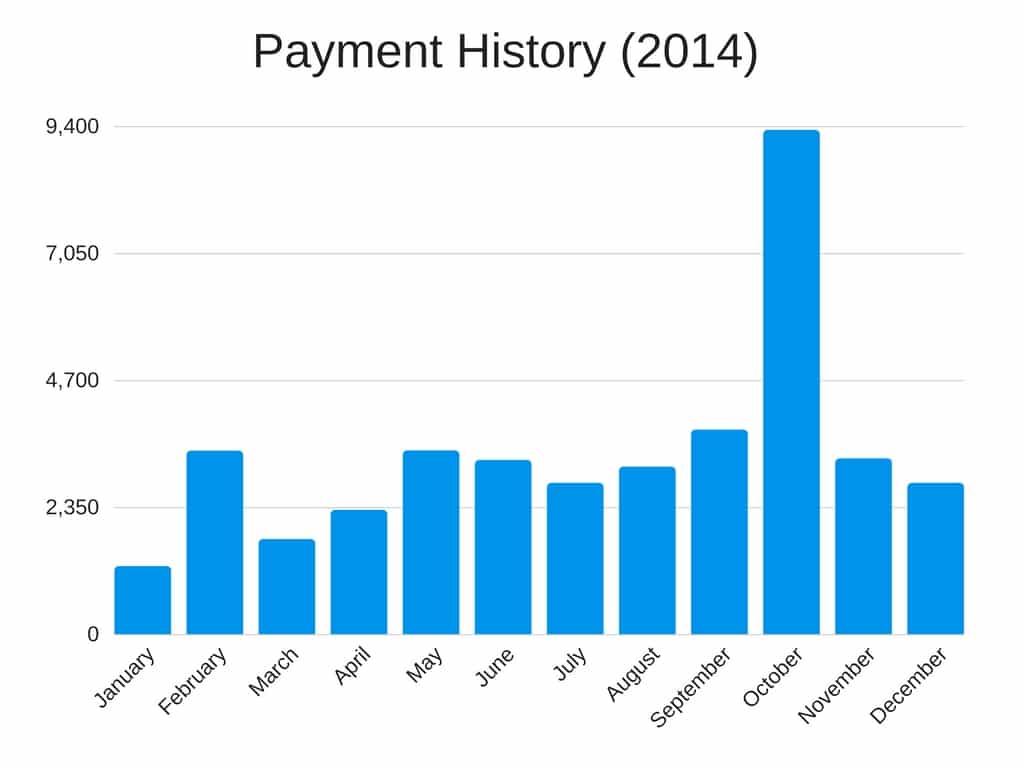

Here’s what my student loan balance looked like when I graduated from law school in May 2013:

As you can see, I had 8 different loans in varying amounts. $25,000 of those loans had an interest rate of 7.9%. The remainder were at a 6.8% interest rate. Altogether, my total law school debt equaled $86,500.

I also had $552 in student loans remaining from my undergraduate days that I had failed to pay off. As a result, my total student loans when I graduated from law school equaled $87,052.

That’s a pretty decent amount of student loans for a 26-year old kid starting his first real job. Let’s get started paying them off!

2013 – Trying to Figure Out What The Heck To Do With My Loans

I graduated from law school in May 2013 and started my first job in September 2013 at a large law firm in the Midwest. Since I’d just graduated, I received a 6 month grace period and wasn’t required to make my first student loan payment until December 2013.

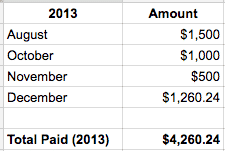

I don’t really remember why I did it, but I happened to make a few extra payments before my loans officially came due. This is what my 2013 student loan payments looked like:

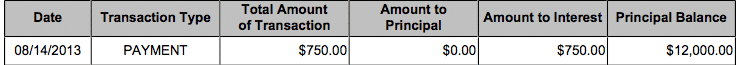

The thing that most people forget about student loans is that they continue to accrue interest while you’re in school. So when I made that first student loan payment in August 2013, here’s what it looked like:

Ouch! The $750 payment didn’t even touch any of the loan principal. I was basically throwing money away here.

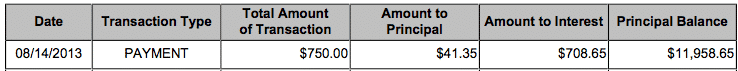

My second payment of $750 on a different student loan did only slightly better.

Nice! A full $41 of my $750 payment hit the principal on that loan!

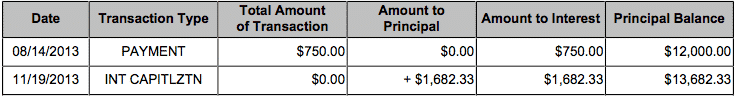

Stupidly, though, I didn’t understand the concept of capitalization. For those of you who don’t know what that is, basically, once your student loans go into repayment, all of the unpaid interest that accrued during the years you were in school gets added into your principal and becomes your new loan amount unless you pay the interest off before it capitalizes. Remember that $750 payment I made on the one loan? Here’s what that loan looked like once it capitalized:

Do you see what just happened? My $12,000 student loan suddenly became a $13,682 student loan! Interest had been accruing on it during the three years I had been in law school and once the loan entered repayment, the unpaid interest got tacked right onto the principal! This was awful because I now had to pay back the capitalized interest AND all of the new interest that was accruing from that. And it wasn’t the only loan that capitalized either. I had three other loans that capitalized, adding thousands to my principal.

2014 – My First (Real) Year of Repayment

I consider 2014 to be the first year I really started trying to pay off my student loans. As a first-year associate, I was making a yearly salary of $110,000, so I had the income to make a big dent on my loans. All I had to do was avoid that lawyer lifestyle trap that a lot of my colleagues fell into.

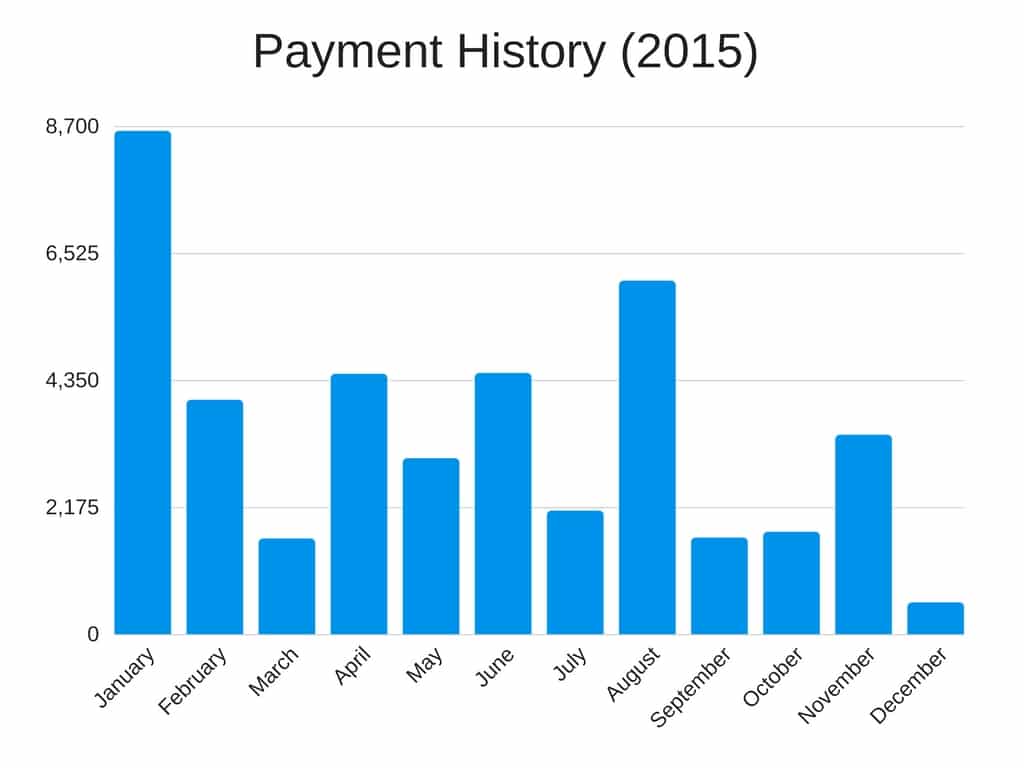

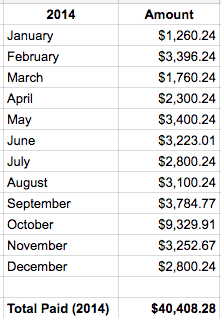

Here are the amounts I paid towards my student loans in 2014:

Wow! I knew I had paid a lot towards my loans, but I never really realized how much it was until I actually wrote it all down. Here’s a nifty chart showing my student loan payments in 2014:

You’re also probably wondering why my payments jump around and seem to differ a lot each month. A lot of this had to do with me randomly throwing down extra payments whenever I saw my bank account getting too big. I wanted to avoid what I call Paycheck Complacency, so that’s why you see the random spikes and dips throughout the year.

2015 – My Second Year of Repayment

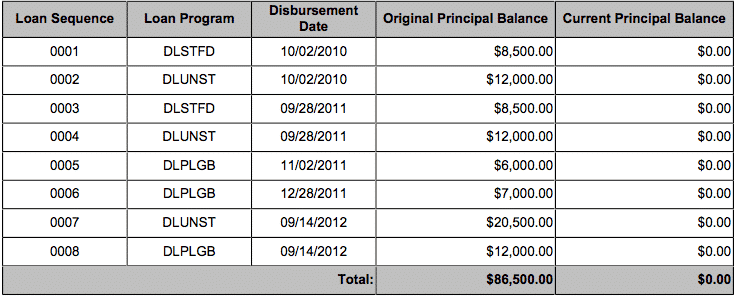

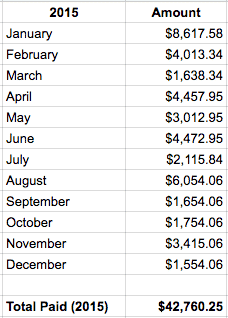

I got a raise in 2015 and my yearly salary went up to $115,000. Again, I had a good amount of income to work with here. Here’s what my 2015 payments looked like:

It looks like 2015 started off great. I pulled a bit more money from my emergency fund to start out of the year, which is why you see that really big spike early on. I’m not exactly sure why I did that, but my best guess is that I’d been listening to a bunch of Dave Ramsey and got really motivated to get that loan balance down some more. In any event, the money in my emergency fund wasn’t earning a ton, whereas paying down my debt was a guaranteed 6.8% return.

Another big thing I did was to use my three-paycheck months to really toss a ton of money at my loans. I was paid bi-weekly (as many people are), so twice a year, I’d see a month with three paychecks. Since I was living fine on just two paychecks per month, each time a three paycheck month came around, I threw the entire third paycheck towards the student loans.

Refinancing My Student Loans

One mistake that I made when I was paying off my student loans was not refinancing them in the first year that I was paying them off. If you’re like me and are planning to pay off your student loans fast, then there’s really no reason not to wait on refinancing your student loans. Refinancing means you’ll lower your interest rate, which then means that you’ll pay less interest overall and get more of your money working for you.

I ended up refinancing my student loans three times while I was paying them off (most people don’t realize that you can refinance your student loans as many times as you want). Below are the three companies that I refinanced my student loans with:

- SoFi – The first company that I refinanced my student loans with was SoFi. They offered me a 4.3% interest rate in March 2015 – far better than the 6.8% I was originally paying on my loans. SoFi is probably one of the best student loan refinancing companies out there simply because of all the sweet perks you can get when you refinance your loans with them. I’ve easily received thousands of dollars in free food, drinks, and event tickets from attending SoFi member events. (check out my experience at SoFi’s New York debt payoff party or when I went to the Big Ten Championship for free). Even better, you can still attend these events after you’ve paid off your loans! Refinance your student loans with SoFi and you’ll receive a $100 signup bonus and gain access to the SoFi member events. You can also sign up for a SoFi Money account and get a small signup bonus just for downloading the SoFi app.

- CommonBond – I refinanced my student loans again in May 2015, this time with CommonBond. Instead of going for a fixed rate, I instead opted for a variable rate, which allowed me to get an interest rate starting at just 1.93% (for whatever reason, I couldn’t get a variable rate with SoFi). Because I knew that I was going to pay back my loans fast, it made sense to refinance to a variable rate since I could pay off my debt before interest rates rose. Refinance with CommonBond if you’re looking for a good variable rate option.

- Earnest – I’m also a total weirdo and like experimenting with new fintech companies, so in August 2015, I went ahead and refinanced another $5,000 of my student loans with Earnest. Of all the student loan refinancing companies, I’d say Earnest has the best-looking and cleanest interface. If you refinance your student loans with Earnest, you’ll receive a $200 signup bonus.

If you’re not sure about which company to refinance your loans with, a good option is to use a company that can search multiple student loan refinancing companies for you at the same time. These companies are basically like the Kayak or Priceline of student loan refinancing. You can run a search and all of the potential rates that you can get will show up for you in one spot.

The company that I recommend for this is Credible:

- Credible – Credible is a great company that can help you compare interest rates from many of the top student loan refinancing companies, including Earnest and Citizens Bank. It’s free to use and if you refinance your student loans using Credible, they’ll pay you $200. Refinance your student loans using Credible and earn yourself a $200 signup bonus!

My advice is to refinance your student loans with SoFi first – that way you’ll gain access to all of the free SoFi member events (remember, you can still go to these events even after you’ve paid off your SoFi loan).

After that, refinance your student loans again using Credible and pick the company that offers you the lowest interest rate. If you do this, you’ll get all of the benefits of having refinanced with SoFi once (i.e. going to all of the SoFi events), and you’ll then have the lowest interest rate on your student loans (plus an extra $200 for using Credible to refinance your student loans).

Or if you’re like me, you could be crazy and refinance your loans with basically every company. That’s pretty much what I did, and while it wasn’t necessary, it did give me access to a lot of signup bonuses.

If you’re confused about refinancing, make sure to check out my post about my student loan refinancing experience, where I walk through exactly what I did when I refinanced my student loans. You can read that post here: My Student Loan Refinancing Experience.

2016 – My Final (Half) Year Of Repayment

I started off 2016 with another raise, this time to $125,000 per year. Again, I had a great income to pay off these loans fast, assuming I didn’t fall into the lawyer trap.

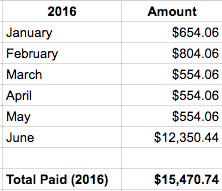

So what the heck happened here? Why was I paying so little for those first 5 months and then suddenly dropping this huge bomb at the end?

I like to think of 2016 as a year of transition. I was so close to the finish line and knew I was going to try to get out of that big law firm job as soon as possible. The interest rate on my remaining student loans was also still very low. Even with interest rate hikes, my variable rate was still in the 2% range and never got higher than 2.17%. Since my rates were so low, I decided that just to be safe, instead of paying extra to my loans, I’d pay the extra to myself, just in case I needed the money if I quit my job.

Note the emphasis on “just in case.” The key was that this money was earmarked for student loan payments or in case something drastic happened that resulted in me needing the money. I didn’t spend that money on something else!

In June, I got myself a new gig in state government and decided to go ahead and take all of the cash I had on hand and wipe all the debt out. That’s why you see that big $12,000+ payment in June.

How Much Did My Student Loans Cost?

Adding it all up, I paid a grand total of $102,899.51 towards my student loans between 2013 and 2016. My $87,052 in student loans ended up costing me an extra $15,847.51. That’s 15% of the total amount I had borrowed! No wonder companies like loaning money!

Here’s what I find interesting. By the end of 2015, I had paid $87,428.77 towards my student loans. For those of you keeping score at home, I had paid back everything I had borrowed by that point. And I still had to pay another $15,000!

Could I have made more money by investing this money instead of paying down my student loans? Perhaps. But, remember, personal finance is personal. I valued the flexibility in knowing that a certain portion of my paycheck didn’t have to go out the door for money I borrowed a long time ago. And it’s amazing to not have to think about one more bill each month.

One caveat. I know that the amounts I paid aren’t something that a lot of people can do. There’s no secret to paying off student loans beyond spending less than you earn, and using the rest to pay off your loans. This post shows you exactly what you need to pay if you want to do what I did.

If you’re struggling with a ton of debt and not enough income, then you need to figure out a way to raise your income. Pick up a side hustle if you need it. Just don’t give up and think that you have no options. There’s a huge world out there and you have more options than you think.

It was really interesting to see how much I had to pay in order to wipe out my student loans. If you’ve never done this exercise before, I say give it a shot. See how much you’ve paid on your loans. I bet you’ll be surprised (and shocked) at the number you see.

Hi Hayden,

I have two school loans and one is parent plus. Is there anyway I can combine the two and payoff with one rate? I read your story but I’m not too keen on refinance.

You can consolidate, but honestly, I don’t recommend doing that. It’s better to keep them all as different loans of varying amounts. You’ll feel more accomplished as you pay off each loan. Google debt snowball and consider doing that.

Wish I discovers ur blog back in 2017 before I consolidated my loans! 🤦🏾♀️ I just over 125K with daily interest equates to a total of $566 per month..,I am currently in IBR my biggest fear is now that I am homeowner just b/c u make more money student loans don’t account for larger bills leaving less room as ur monthly student payment goes up. I am devastated at the amount of interest accrued monthly so it seems almost impossible to make a headway on my loans. My plan is to build up my 5K emergency fund as crating sinking funds to cover a majority of my large bills over the summers months since I am a 10 month employee get sum hrs which equates to few thousand dollars plus my side hustle slows down in the summer. But the plan is just before the interest free Pd is over due to COVID19 I’ll make a large sum payment to my students loans…thinking it may be good time to refinance after that seeing as I am hearing about the companies u mentioned and the bonuses but my fear is losing the benefits of not having federal loan i.e if I had a SoFi loan it isn’t a federal loan right so I would have been able to take advantage of the no interest free period! I need a plan to aggressively pay off my student loans! I know I can do it bc I have been aggressively applying the snowball method to my CC debt & paid over 12K towards my cards in two months & from Nov 1st-March 13th I’ve paid off about 23K & would’ve finished my CC debt pay off this month if I did not put the pause button to have a heftier savings acct in these uncertain times!!! I love all your content & im thrilled to receive info on getting rid of these student loans once and for all. Side note in 2018 my AGI was 62K & in 2019 I am sure my AGI grew at least 15K as my side hustle hrly rate double once I went from a LAC to an LPC I just haven’t filed taxes yet so I can earn the full $1200 stimulus check to throw into my emergency fund then I’ll finally file 2019 to see what I am really working with! I have so many questions btw so I may definitely email you!

Right now, don’t refinance any federal loans since the fed loans are no-interest right now. Stockpile that cash and set it aside. If you need it to live, you’ll have it. During these pandemic times, you want as much cash as possible just in case. Once things settle, you can reassess and see what your timeline looks like.

Awesome what you’re doing here! My original inspiration was Dave Ramsey (class i took in high school), but i find your content to be much more comprehensive and millennial friendly… I graduated Aug. 2018 with a BS in Accounting and paid off my $20k student loan balance in ~11 months! I have now been debt free for about a month, building up my emergency fund. I have no retirement/investment accounts (yet).

What would be your suggestion to a 23 year old, debt free, recent college grad who is soon to have a fully funded emergency fund? Is now the time to start investing?

PS – your side hustle reports are fantastic! I aspire to quit my day job and move from Iowa to a major city so I can take full advantage of the gig economy someday. I just find that my fixed income suits me for now while I gather my bearings.

Hi Hayden,

That’s awesome that you paid off your student loans! Great job!

Yep, definitely start investing once you feel that you are ready. Don’t do the Dave Ramsey method of investing though – he’s great for how to get out of debt, not so great for investing advice.

Simple, low-cost index funds with Vanguard or Fidelity is the way to go. If you want to make things really easy, robo-advisors like M1 Finance and or Axos Invest (formerly wisebanyan) are 100% free and make things really easy. Basically put money into them and they’ll automatically invest it for you in a low-cost, properly diversified account. You can’t mess up that way.

Feel free to hit me up if any questions. Maybe I can use this as a post topic now that I think about it.

We should have a blog of people not spending money which is not theirs, and therefore living worry free. No debt, no payment.

My friend has a doctoral degree and 2 masters, never had a loan. He does not even waste laughing about other people, he is beyond.

Thus I do not have the same level of education, I also never had a loan, I live a worry free live that most never will experience. Only because they chose to though!

So are student interest rates in the US always this high ? Provincial student loans are at about 3 percent here in Canada.

Yes, they’ve been crazy high in the states since at least 2009.

Hi. Thanks for the great article.

I’m going to start law school this year and was wondering if your $87,000 debt was just the tuition, or if it also accounts for other costs of living. I’m also getting 50%+ scholarships at several schools and it seems like tuition alone (after scholarships) would bring me above $80,000 debt, with cost of living probably adding somewhere near $20,000-$30,000 per year on top of that.

I owe 87,000.00 age 62, half is Parent Plus, can a refinancing company help me? I have put my payments in deferrment 4 times this past year just have enough to pay bills. Paying by Income Driven only causes me to pay 3 times what I can afford. My payments now are at 510. with increments of 2 years increase. How can I pay more or is it better to refinance?

Thank you for any assistance or advice.

So, refinancing is really more something that you can do when you’re earning a good income already. You need to get your income up first, because if you’re putting loans on deferment so that you can have enough to pay your other bills, you won’t get approved for a refinance. These refinancing companies are basically looking to get people with a good income so that they can reduce their chance of default.

I don’t think that AES is considered a crappy company (and no, I have no affiliation other than consolidating my student loans with them) and they will put the extra towards the prinicipal IF YOU OFFICIALLY ASK THEM TO, but respectfully think you missed my point… anyone giving advice regarding whether to pay extra on a loan should be suggesting that the debtor make sure to ask what the loan company does with the extra payment. It’s not just “crappy” companies that do that and I believe most debtors aren’t aware…

Uh…AES is horrible – on the same level as fed loan servicing. As to giving student loan advice, I already said my student loan advice was to refinance with a good company like one of the ones I refinanced with. Any company where you have to OFFICIALLY ASK THEM to put your payment towards principal and not just hold it for a million payments is terrible. No good student loan refinancing company does that.

I know that for some loan companies (i.e. aes and others) you have to officially request that any additional funds paid in a month go to principal, otherwise they put it towards furure payments and you are paid ahead but it won’t gobto principle. So if for instance you pay $400 in a month and your payment is only supposed to be $200 they will consider you paid for the next month and can skip payment that next month if you want but they won’t put the $200 towards the principal. That makes a huge difference that everyone should be aware of.

Yeah, that’s why those companies suck. If you’re paying off your student loans fast, refinance with a good company and don’t deal with those crappy companies.

which companies let you make extra payments toward the principal?

Every company. To pay towards principal, all you do is pay more than the minimum payment. So, if you pay 100 dollars minimum payment and 80 dollars goes to principal and 20 dollars goes to interest, if you pay 101 dollars, you now have paid 1 dollar to principal. Does that make sense?

I called around and some apply the extra payment towards the interest first.

That’s the way every loan works. Any fixed loan (i.e., you borrow X amount and you agree to pay that back – think mortgage, student loan) has something called an amortization schedule. The bank divides up your payments over the number of months of your loan, and then each payment pays back a certain amount of the principle plus the interest that accrued over that month.

When you pay extra, then that goes towards principle because you paid back the interest already that accrued for that month. You can’t just pay only principle and not pay back interest. Every payment you make, you always pay interest first, then the rest pays down your loan principle.

Hit me up if you need more info and I can try to go through some examples with you. It might be confusing if you don’t have the basic background of how an amortized loan works.

Thanks for that was a bit helpful. My next question would be does it matter what company I refinance with? I am currently with the Income Based Plan with FedLoan Servicing with a rate of 6.8% but I really want to get rid of the 125K balance that I owe. I calculated that if I put my income towards the debts we can be debt free in 3 years or less. I need a side hustle and a different job making more money.

What a great article! Thanks for the reminder that paying off student loans is a huge accomplishment, no matter your salary. I just paid off my law school and grad school debt this past April – was about 130K that had been hanging around my neck since May, 2008. Got serious about tackling the debt 5 years ago when I had received yet another promotion and was still living paycheck to paycheck and paying only the minimum each month on my loans. I created a budget, seriously downsized my lifestyle and started putting anything extra towards the loans. My goal became I wanted this debt gone before my 10 year reunion this past June and I did it! I am still in shock each morning that I no longer “have” to work in corporate America, I am now CHOOSING to because I no longer owe anyone money! And now that great salary I’m making is all mine, no longer do I have to pay a portion to old debt. An amazing feeling, wish everyone could know what this feels like, to be completely free 🙂

First, that is awesome that you paid off your student loans! 10 years is a long time to have that student loan anchor weighing you down, but its better than 30 years!

Thanks for sharing!

You gave those loans a smackdown! Great job, and great job on breaking it down.

I know the extra $15K hurt. But what if you kept the loans another 5 years only making minimum payments and then decided to pay off the total in one shot. Any idea what that would look like?

Really liked smacking down those student loans! It felt awesome, and I was surprised to see how much I had been putting into them each month. If you had asked me, I thought I was paying much less each month.

That’s an interesting question you ask and I really am not sure how to do the math on it. So my minimum payments at the beginning of 2016 wouldn’t have allowed me to keep the loans another 5 years. When I refinanced my loans, my minimum payment dropped down to around $554 per month. I had already paid so much of it off that, even paying just minimum payments, the loans would’ve been gone in a year and a half.

If I had instead taken the remaining balance and refinanced it to a smaller amount, let’s see what it’d look like for a 5 year period. Assuming around the same interest rate of 2.17% (note that this was variable, so it would go up eventually), I’d only pay a minimum payment of $264 per month. A tiny amount really in the long run. My total interest I’d pay would only be around $850 or so. Again, a really small amount. So I guess my answer is, I have no idea.

In retrospect, I probably could have refinanced my loans again and then just started throwing some extra into investments, leaving the student loans around to linger. The only thing putting a snag in this plan was my desire to get a different job – one that would force me to take a paycut. There’s a lot of ways to play around with debt, but just for my own personal reasons, I wanted to get rid of it. Makes me feel like I got what I needed from my JD.

WOW refinancing three times! I actually like to try out companies too just because I’m a fintech nerd. I paid off my debt prior to refinancing but I’m thinking about taking some of my parent’s debt into my name through Sofi. Congrats on crushing your debt! You’re killing it!

Thanks Julie! I’m a totally fintech nerd too and I am also one of these schemer type people who’s always trying to snag free stuff. All of these companies offered money for refinancing with them, so I couldn’t resist. And as a benefit, I have first hand experience with each of these companies now. A downside is that you get a hard credit inquiry. It didn’t really hurt my credit score, but credit junkies will tell you it’s not good to let that happen. I wasn’t smart enough to think about that when I refinanced three times.

And you should totally figure out some way to get a refinance through SoFi! They hold quarterly dinners at fancy restaurants, so I’ve been able to snag free dinners with Ms. FP four times a year. It’s awesome! We’ve got one scheduled for next month.

Wow that’s a great achievement, congratulations! One thing that I do wonder is how you were able to score raises, if you don’t mind me asking 🙂 I’m a newly graduate and entering the workforce for the first time and always wondered how people have scored raises.

Thanks Finance Solver! So in the law firm world, raises are actually automatic for the first few years. We’re in what’s called “lockstep” compensation. Basically, everyone starts out making the same amount of money the first year, and moves up the exact same amount each year. So I didn’t really have to do anything to get my raises other than to not get fired.

This post is awesome! That $15k interest is crazy.

I’m on the last leg of paying my $55k in Student Loans off. I currently have paid off $45k in 2.5 years making less than $50k gross annually. I will probably do what you did and reach out to the student loan companies for a transcript of all payments. I track my total payments in Mint but it would be interesting to see how much paid in interest vs principal.

Just curious, How much did you keep your emergency fund during your loan repayment period? Also, did you invest in a 401k or similar retirement plan during this time?

Currently, I’m investing in my companies match (6%) and have about two months expenses saved up because my focus has been debt payoff. If I continue at this rate, I will have about 4.5 months left until I’m done. However, as you were in 2015, I am thinking about changing jobs, and part of me feels like I need to beef up my emergency fund to 3-4 months at least but the other part of me just wants to pay off everything ASAP.

That’s awesome Gary. This was a great exercise. I totally underestimated what I had paid in my student loans. Turned out I had paid way more than I thought.

I typically kept around $5,000 or so in emergency fund money. When I started out, I was trying to get my emergency fund up to around $18k, then realized I likely didn’t need that much cash and started pulling money out of there and towards my debt. In 2013, I didn’t invest anything in my 401(k). I wasn’t eligible to contribute. In 2014, I contributed the default contribution rate of 5% that my employer set. I didn’t know anything about how a 401(k) worked, and didn’t really understand where that money was going. In 2015, I upped my contribution rate to 10%. Then in 2016, I set it to 15% or so to put me on pace to max it out for the year. My employer offered no match.

I took a bit of a calculated risk as well by keeping my emergency fund low while I was in the midst of a job change. One potential solution is to do a “just in case” type fund. If you have a decent interest rate on your loans, then instead of paying off your loans, you could just pay the extra to yourself and save it in a high yield savings account. At some point, you’ll have enough in your savings to just wipe off the debt in one fell swoop, if you want. And if something comes up, you’ll still have that money, “just in case” you need it.

I loved following your journey. I was incredibly fortunate not to have any student loans but know many people struggle in this area. I think you hit the nail on head when you said you have to figure out various ways to pay off your debt if you aren’t making income. I know it’s not easy but living in debt isn’t easy either.

Thanks MSM. Glad you enjoyed the post. I think it was most helpful to see how much I actually had to pay in order to pay off my student loans that fast. When I thought about it, I thought I was paying way less than I actually did.

Wow I love the detail! Obviously your focus and commitment came into play here. I also appreciate you pointing out that how much you earn absolutely comes into play. It drives me insane when people don’t mention that!

Glad you enjoyed it David! Exactly right, your income matters a ton! If you have six figures of student loan debt and are making 30k a year, you’ll never get anywhere, no matter what you do. The math just simply cannot work out. You need to figure out a way to get that income up.

Generally, if you’re taking on a ton of student loan debt, you’re hopefully in a job that will earn the requisite income necessary to pay it off. If you took out a ton of debt for a job with no prospects, that’s another story for another day. But in the end, if you want to pay off student loans fast, you need the income to be able to make A LOT of payments. And then you need the discipline not to spend all of the income you’re bringing in. A lot of doctors, lawyers, dentists, etc – they don’t understand this and all of their income flies out the door.

That is awesome! It is nice to see that you were laser focused in paying your student debt off. I hear that SoFi helps with loan consolidation as well and have pretty good rates.

Another great thing with SoFi are the free dinners you get. In most cities, they do quarterly meet ups at fancy restaurants. I’ve been able to eat at some nice places because of that.

Great job, FP. Feels great not having to make that payment every month, eh? I personally can’t wait for that day to come. I’m about halfway through paying off my monstrous student loan debt.

I also like that “just in case” move you pulled. It showed that you had not only the foresight to slightly alter your financial plan, but also the discipline to not spend that extra money on “nice things”.

It’s a terrific feeling. Really love knowing that my JD is all paid for. You’ve got crazy debt, but I’ll bet you’ll be through with it faster than you think. Keep track of your payments if you can. I’d really love to know how much you ended up paying for the MDs!

And yeah, the “just in case” move was an interesting one. If the interest rate on your loans is low enough, I see some value in doing the “just in case” fund. Once you pay student loans, that money is gone forever, so you lose a bit of flexibility in that sense. If you keep a “just in case” fund, you can handle issues if something catastrophic comes up.

Wow, I did not know about the interest beginning to compound in the repayment period and otherwise accruing essentially straight-line during the deferral period. That’s good to know. So if you start paying your student loans early, pick one loan and stick with that one. Especially if you can pick one with a fairly small balance that also has one of the higher interest rates.

Nice work on the 50% scholarship! I chose my law school based on a 50% scholarship, too. My school had a merit-based system that allowed me to increase my scholarship based on class ranking in subsequent years. I busted my butt and ended up with a 60% scholarship in year 2 and 70% in year 3. That was freaking sweet.

Yep. The interest starts accruing right away for most student loans. When I was in school, they had federally subsidized loans where the feds paid off the interest for you, but they got rid of federally subsidized loans during my second year of law school. Since you have a ton of loans, you have thousands of dollars of accrued interest by the end of the 3 years. And then when you don’t pay them off before the loan is due for repayment, they just capitalize it and throw it right into the principal.

And the scholarship was pretty important. Most lawyers today are graduating with six figures of student loan debt, so I came out relatively unscathed when you think about it.

Did you manage to get out of law school with no debt?

An awesome achievement. I have a lot of friends who still complain about their student debt. But as you showed, if you want to get rid of it you just have to work towards that goal.

I went the other route of paying them slowly and investing extra cash. But as you said personal finance is personal, and you are way ahead of the game any way you dice it.

It’s definitely another route I could have taken, and would have been nice to have an extra $100k invested. The main thing that makes me happy about paying off these loans is the freedom. I needed to work the miserable job and get the big paycheck in order to keep paying the loans. Without the loans, I’ve got a lot more flexibility. Not financially independent by any means, but sorta a different quasi type of independence, I suppose!

Great job killing those loans in short order! It’s great to have it paid off early on and get a more financially stable start!

My husband and I had about $40,000 in student loans (a long time ago – we’re old). We had purchased a house, bought cars, and started a family before we even started to work on them. Hindsight is always better, I guess, but I wish we would have put the student loans as a priority sooner. At least they’re gone now!

Hey, at least you don’t have those loans anymore! Was really freeing to get rid of the student loans. I know a lot of people who are still stuck doing jobs they hate because they need the paycheck.