When it comes to investing, it seems like most long-term success comes down to a few things.

First, you have to pick a reasonable asset allocation, which generally means investing in a broadly diversified portfolio (I recommend Total Stock Market Index Funds like VTSAX, FSKAX, or the like).

Second, once you’ve picked a reasonable asset allocation, you then have to either forget about your investments completely, or you have to have the willpower to not freak out when things get rough.

The willpower thing isn’t easy. I was a broke college kid back in 2008, so I never did get to see how I would react if all the money I invested dropped in value each day. I like to think that I would have had the willpower to hold tight, but I can’t really be sure. Sure, there have been dips and bumps along the way over the past decade, but nothing that has really tested my strength that much, so I can’t really be sure how I’ll act if there’s an extended stock market decline.

The solution to this willpower problem, I’ve always been told, is to allocate some percentage of your portfolio to bonds. The idea here is that bonds help smooth out the volatility that comes with stocks. When the market has a bad stretch, the portfolio that has some bonds in it won’t do as badly, and hence, the investor with the bond allocation will be less likely to freak out and sell everything.

This is not what I’ve done and indeed, since I started investing, I’ve gone with a 100% equity portfolio. My rationale is that I’m young and still deep in the wealth accumulation phase of my life. My goal is to get the highest returns possible over the long run. At this point, the only real reason for someone like me to have bonds is to reduce my chances of freaking out when the market takes a dip.

This leads to another question - does a bond allocation really help avoid freakouts?

Reasons For Bond Allocations

The typical recommendation from most experts is for the young investor to have at least a small percentage of their portfolio in bonds. Vanguard’s most aggressive Target-Date Funds have a 10% bond allocation. Robo-advisors like M1 Finance, Betterment, and Wealthfront also have a small bond allocation of 5-10% for young investors.

If you go to investing forums like the Bogleheads, you’ll find a lot of people explaining why you need bonds in your portfolio. People will say things like this:

- “[S]peaking personally and subjectively, it’s easy for me to overestimate my ability and willingness to take risk, so that without the stabilizing effect of having some bonds in the portfolio I would lose confidence and abandon an all-stock strategy during a severe stock market decline.”

- “[M]ost folks here recommend every investor–particularly novices–have at least some [bonds].”

This rationale has never made much sense to me. Most people wouldn’t advocate a young investor to have a large bond allocation in their portfolio. Instead, the suggestion is to have “some” bond allocation, which typically means something like 5% to 20% in bonds.

The problem is that such a small allocation really doesn’t do much. If the market tanks and your portfolio drops 50% which then causes you to freak out and sell everything, would you really not freak out because you had some bonds in your portfolio and your portfolio only dropped 35% or 40%?

That isn’t to say bonds are pointless. There are a few actual reasons for having at least some bond allocation that doesn’t have to do with reducing freakouts. The first is that having bonds does help with rebalancing. That is, if your stocks drop in value during a downturn, you can sell some of your bonds and rebalance your portfolio, allowing you to buy more stocks at a discount. The thing that doesn’t seem to make much sense about this is that historically, stocks go up more often than they go down. So if the point of bonds is just to be able to rebalance, it doesn’t seem to make much sense to me to keep a lower-earning asset class simply for the opportunity to buy stocks at a discount. Most of the time, you’ll just be waiting.

The second reason for bonds has to do with taking on risk and the level of return you get. There’s a concept in investing called the efficient frontier, which essentially means getting the highest rate of return at the lowest level of risk (I’m not an investing expert by any means, so forgive me if I butchered the explanation). The general idea is you want whatever return you get to be appropriate for the level of risk you’re taking. Putting everything you own into Bitcoin could make you really rich. But the risk you take by putting everything into it isn’t worth the return you’ll get.

There’s an argument that can be made that a 100% equity portfolio takes on too much risk for the return you get, which might justify having a small bond allocation during the accumulation phase. I admittedly can’t argue with that.

What Do Bonds Really Do For Your Portfolio During Market Crashes?

All that said, for most people, the main explanation for having bonds is to smooth out volatility. And the point of smoothing out volatility is to avoid the freakout moment where you sell everything because things are going bad.

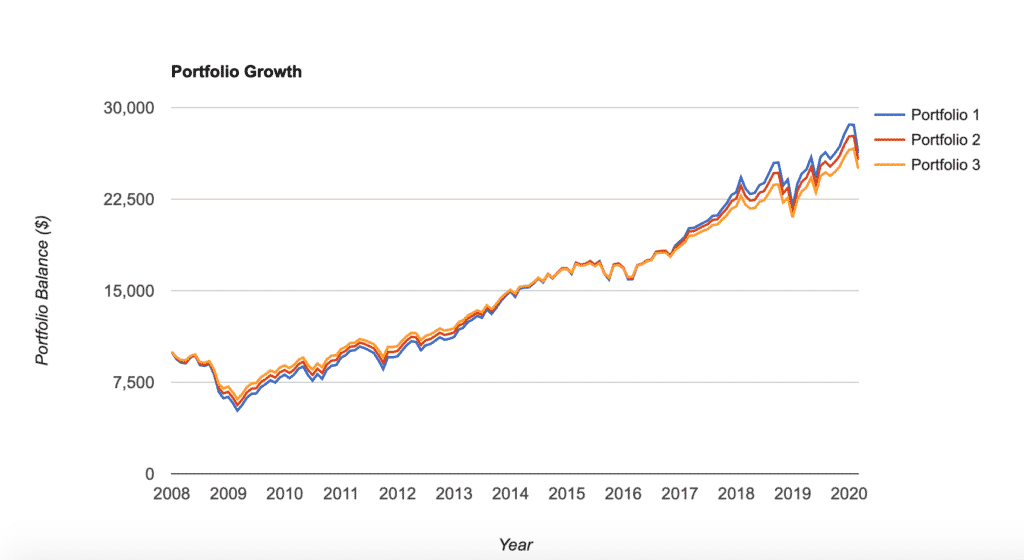

But let’s see if this would really help you not freak out. Below is a chart showing the returns since 2008 for a 100% equity portfolio, a 90% equities/10% bonds portfolio, and an 80% equities/20% bonds portfolio.

What we can see here is that the difference between all of these portfolios was so negligible that it basically meant nothing for “avoiding freakout” purposes. Starting with a $10,000 portfolio, the 100% equity portfolio fell to $5,177 at its lowest point. The 80/20 portfolio fell to $6,108. I can’t see why someone would freak out seeing their portfolio drop 50%, but not freak out seeing their portfolio drop 40%.

When you look at the numbers, even a 50/50 portfolio would have dropped to $7,611 at the bottom of the financial crisis. Only a portfolio with 90% bonds avoided any major dip. And we can all agree that’s probably not a reasonable allocation for anyone building wealth.

What all this tells me is that a small bond allocation is not going to stop someone from freaking out. Whether a person freaks out or not is going to come down to them alone. It all going to come down to willpower.

Takeaways

The takeaway from all this is that how you handle market downturns and crashes is on you. It’s a mind game. Bonds aren’t going to save you.

For myself, I’ve opted for a 100% stock allocation. My rationale is that I believe that the market will go up over time and that companies will continue to grow and innovate. I have no choice but to believe that if I believe in capitalism.

But I also know it’s not going to be a smooth ride. Stuff will happen. Markets will go up and down.

The goal is to avoid freaking out when things get tough. If having some percentage of bonds does that for you, then that’s fine. Do what you have to do to not freak out. Just don’t freak out when the going gets tough.

Great summary,

As you mentioned, personally I just think that re-balancing is probably the key and hence Treasury Bond ETFs and Aggregate Funds are probably most suited for the average investor (although arguably TIPS can be good in this market, too)

For your readers it might be helpful to go through the Bond Guide that I’ve written:

https://bankeronwheels.com/best-bond-etfs/

All the best,

Raph

Thanks for sharing!

I was like you, 100% equities during accumulation phase. However a few years before retiring slightly early I started moving more into bonds. Now I’m only half stocks and the other half is bonds, cash, REITs, gold, commodities, etc. but mostly bonds. I can’t see that 10% bonds does much useful. But at my level I saw a much smaller drop than the market as a whole, of course I gain less too but once you’ve “won” the proverbial game there is not much reason to keep your franchise player on the field.

Yep, once you’ve won the game, you’re good. 50% bonds actually makes a difference when things drop a lot.

100% stocks and no cash?

Good point. No, I have a $42,000 emergency fund that earns 5% interest, so it’s essentially a bond allocation.

I don’t keep that cash for the bond allocation aspect of it though. I keep it since my risk-free rate of return is so high on it and I like having an emergency fund.

Where are you getting 5%? In a high yield savings account or CD?

I have a little hack that lets me do this. See this post here for more info: Netspend 5% Interest Accounts

Okay, so I am not the only one skeptical of the importance of bonds. I guess we both are willing to take the risk. However, I noticed that your graph does not show numbers which predate the recession.

Yeah, my point was just to show how the big drop happens even if you have a small percentage in bonds. So what’s the point of 10% in bonds? If you’re going to freak out, you’re going to freak out. It comes down to willpower to not freak out.

I recall reading that 100% stock allocation was not the best return over the past 30 years. I can’t recall the exact allocation but I seem to have something like 85% stocks/15% bonds in my mind.

The reason I have about 35% bonds in my portfolio is because I am considering retirement soon.

I think the DJIA was down 12% last week. During the same period, my portfolio was only down 5%

Dan

Yeah, I feel like I’ve read that as well that some percentage of bonds had the highest return. But we know that as a rule, equities return more over time.

My main thing I never understand with bonds (and my thinking with this post) was how it stops someone from freaking out and selling everything. The market dropped 12% and some people freaked out and sold everything. If you had 10% bonds, your portfolio still dropped close to 12%. So ultimately, the small bond allocation really doesn’t do much in the avoiding selling at the bottom problem. That’s all about willpower in the end.