One of the things that surprised me when I began my student loan payback journey was how much interest I had to pay when I started making my payments. What was even more surprising to me was how much interest my loans had accrued while I was in school (and making no money). In fact, when I graduated and made my first student loan payment, it didn’t even reduce my student loan balance at all. All of it went directly towards the interest!

Interest is one of those things that we all sort of understand in theory. Most of us basically know that when we borrow money, we agree to pay it back at some point, with a little extra on top. But I don’t think we’re very good at really understanding what interest looks like on a daily basis. Maybe that’s why we sometimes let debt linger in our lives.

I’m sure most personal finance nerds have heard about the Latte Factor. That’s the idea that spending small amounts per day on seemingly insignificant expenses adds up over time. $5 spent at the coffee shop each day adds up to hundreds of thousands of dollars if invested properly, over time. That’s why buying coffee is supposedly the ultimate sin any personal finance nerd can commit.

Well, forget about the latte factor! If you really want a kick in the pants, try calculating how much your debt costs you per day. You might be surprised at how many lattes you’d be able to buy with that money. At a minimum, calculating the daily cost of your debt will motivate you to pay off your debt faster.

How Does Interest Work?

Let’s get to the basics. For almost all debt you take on, interest starts accruing from the moment you sign your name on the dotted line. Generally, each time you make a payment on your debt, you first pay off all of the interest that has accrued on your debt since your last payment. Once that’s been paid off, your payment then gets applied to the principle. As more of your payment hits your principle, your loan balance goes down until it eventually reaches zero.

Now, banks are nice folks (*rolls eyes*). So, in order to make it easier for you, they set up a repayment period where you pay an equal amount each month over a long period of time. Take your standard 10-year repayment plan for student loans as an example. Some guy who’s good at math calculates the amount you need to pay each month so that you’ll pay the entire thing off by the end of the repayment period.

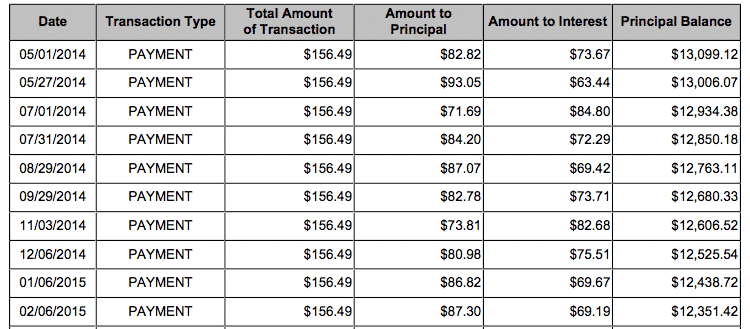

Here’s an example from my own student loan transaction history:

Notice how the minimum amount I paid each month stayed the same. Early on, almost half (sometimes more than half) of my payment went straight to interest. This is how banks are able to make money off your loan. You pay a ton of interest early on because your principal loan balance is higher, and thus, more interest is accruing each month. The bank wants you to take as long as possible to pay off your loan because the longer you pay to it, the more they can make.

Calculate How Much Your Debt Costs You Per Day

To motivate yourself to pay off your debt fast, I recommend calculating how much your debt costs you per day. The formula to calculate this is pretty simple:

Loan Balance x Interest Rate = Cost Of Your Debt Per Year

The amount you calculated is how much interest your debt accrues each year. One problem is that the number you see might be a number that’s too big to really comprehend. So, let’s make one more calculation so that we can really see how much your debt costs:

Cost of Debt Per Year ÷ 365 Days = Cost of Your Debt Per Day

With that simple calculation, you now know how much your debt costs you each day you have it. Are you happy with the number you arrived at? Is that how much you want to spend per day on your debt?

How Much Did My Debt Cost Me Per Day?

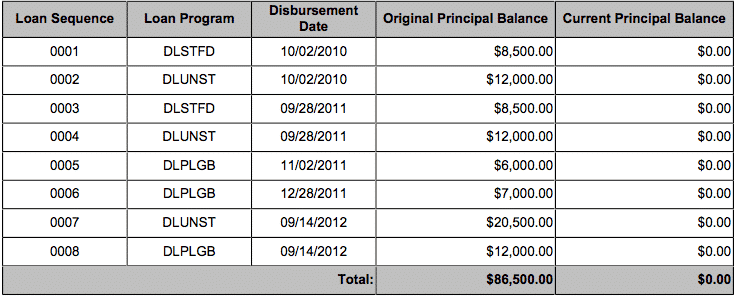

Let’s use my own student loan debt as an example to help clarify things. Below is a screenshot of my student loan balance when I graduated from law school.

$25,000 of that student loan debt was at a 7.9% interest rate. The other $61,500 was at 6.8%. If we do some simple math:

$25,000 x 0.079 = $1,975

$61,500 x 0.068 = $4,182

Altogether, my total law school debt cost me $6,157 per year. Divide that number by 365 days and you can see that my student loan debt cost me $16.86 per day!

Just let that number sink in for a bit. Every single day I kept this debt, I was paying $16.86! I think that’s like a decent dinner every single day!

If you’re wondering what your Latte Factor is, I’ll tell you what it is. It’s your debt! It’s way worse than buying a latte. Those of you coming out with six figures or more of student loans are probably paying closer to $20 per day for your debt! You could buy four fancy lattes per day at that price.

Don’t Forget That Your Debt Costs You Money From Day One

There’s one thing a lot of people forget when it comes to debt – they generally start accruing interest from the day you sign on the dotted line. This has the most impact on those of you paying off student loans. Unless you have a subsidized loan, your student loan debt is costing you money, every single day, throughout the time you’re in school. You don’t notice it because your loans are in deferment during this time.

In my first year of law school, I borrowed $20,500. Fortunately, $8,500 of that loan was subsidized, so it didn’t accrue interest while I was in school. But the remaining $12,000 I borrowed in that first year was accruing interest from the day it was disbursed in 2010 until the day I started repaying my loans back in 2013.

If we do some math, that $12,000 loan cost me $2.23 every single day for the three years I was in law school. That’s a decent cup of coffee, every day, for 3 years. By the time I graduated and started paying back my loans, I had $2,448 of interest sitting around, just waiting to be paid off. I couldn’t even pay off any of the money I had actually borrowed until I paid off all the interest that had accrued on that loan.

And that was just for the first year of my law school loans. I still had two more years where I took out more money!

Make It Your Mission To Reduce The Daily Cost Of Your Debt

I hope that seeing what your loans cost you per day helps motivate you to pay off your debt faster! I know it helped me when I saw this number.

Fortunately, there is a way to reduce the daily cost of your debt. All you have to do is pay it off as fast as you can! Each time you pay down the debt, the daily cost of your loan goes down. Less principle for the bank to work with means less interest can accrue.

Indeed, by paying off $5,000 of my loans that were at a 7.9% interest rate, I cut my daily student loan interest down by more than $1 per day. Not too shabby. Enough money saved for me to go hit up that McDonald’s dollar menu!

Another way to reduce the daily cost of your debt is to lower your interest rate. I waited an entire year before I refinanced my student loans down to a 4.3% interest rate with SoFi. If I had refinanced my loans right away, the daily cost of my student loans would have dropped from $16.86 all the way down to $10.19. Saving more than 6 dollars per day is huge! That’s almost enough to buy a cheap lunch, every single day!

So if you’ve got debt, take a look at how much it costs you per day to keep that debt around. Seeing that number was shocking to me. I knew I didn’t want to pay that much money, every single day, just for the pleasure of having my debt hang around.

I’m going to bet that when you see your number, you won’t be so happy with it either. So let that number motivate you. Make it your mission to reduce the cost of your debt by paying it off fast!

For more information on how to pay off your student loans, check out my Student Loan Refinancing Strategy Guide.

Great post! Very insight that you use your student loan example to illustrate the cost of debt per day. I’ve head many times about the latte factor, but never thought about how much debt cost on a DAILY basis. Definitely an eye opener.

Glad it could open up how you think about debt. Thinking about my student loans like this really is what motivated me to start crushing them. Didn’t think about it like the latte factor, but it’s basically the same thing, just working in reverse.

Good info. Debt is a killer to anyone’s plans for retirement or saving. Most look at the payment amount and miss the broader picture. Debt is known as a silent killer. Thanks for sharing.

-Brian

Thanks Brian! Your debt can really cost you if you aren’t thinking about it.

This is great! I definitely think understanding how much interest you are paying every single day is super motivating to get those suckers paid off– it is for us! And i definitely think refinancing is key. It is scary though to lose some of the protections that you receive with federal loans, but as far as saving money goes (aka minimizing accruing interest) it just makes cents!

Seeing that daily interest cost is super motivating when you’ve got a ton of debt – like what you guys currently have. Refinancing is huge to help reduce that cost and it’s basically a no brainer if you have a good income and are trying to pay your debt off quick. I know for myself, I wasn’t too worried once I refinanced simply because I knew I was paying it off quick. If you’re going to take a while too pay it off, I could see keeping them under federal loans, although if you can get a good interest rate, that might be hard to resist.

It’s fascinating how your interest payments didn’t go down every month that you made a minimum contribution. The overall trend was down but some months, you paid more in interest than the prior month, very interesting stuff!

I’m really against debt. Debt chains the debtor and actually makes the debtor start life behind the start line. Some might even argue debt keeps pushing someone behind over and over again and only after it’s completely paid off, can the debtor start life at the start line. It just sucks!

The different interest payments surprised me as well. I think I know why. Since the payment happens on different days depending on if its a weekend or not, and since every month has a different number of days, sometimes there was more time between payments. Since the minimum payments did so little damage to the principle, my daily interest cost didn’t really change very much each month. So you can see how interest can accrue each day.

Totally agree with you about hating debt. I just hate the inflexibility of it and having it hang over my head.

Debt interest is the devil!!! Haha.

I think the first step is definitely to get it all down on paper to find out what you are actually paying in interest. Most people dont even do that.

The next hard part is proceeding with a refi when necessary. Its like people are scared to refi. Mainly because they dont understand it.

I think that’s the exact reason why most people don’t refinance their debt, especially when doing so is in their favor. Anything that has some friction in getting started inevitably means a lot of people just won’t do it. I know I wasted a year paying unnecessarily high interest just because I didn’t know any better and then dragged my feet for a bit. I’ve got friends who still haven’t refinanced their loans, even though there’s no reason why they won’t do so.

Thanks for stopping by Alexander!

This blog was seriously super interesting and incredibly informative! Loved it!

– Honestly Mag

Thank you! I’m glad you enjoy what you’ve read and hope you come back for more!

Great analysis and perspective! I think a lot of people have heard of the latte factor but not the “daily interest” factor. And I personally have not thought of it that way. Seeing that number could serve as great motivation to pay off debt ASAP, especially for those who are making only minimum payments.

I think latte factor was probably one of the first personal finance things I learned back when I picked up Automatic Millionaire years ago. But that “daily interest” factor adds up way more for most people probably. I know I was spending $16 per day on lattes, but I sure was spending $16 per day on debt.

I love this exercise! I guess, I’m so used to looking at the interest accrued monthly or annually, I didn’t even consider looking at daily cost. But, wow, it sure would be motivating to continue to lower that daily interest cost!

My issue when looking at the big cost is that it just looked so big that it didn’t even feel like a real number to me. But when I broke down the cost of my debt into daily numbers, it felt much more tangible!

Nice work! It’s helpful to look at things from different perspectives. Crazy when you think about saving $6 a day just by taking the time to refinance.

I know! I really wish I had refinanced sooner. I basically wasted a ton of money by not being knowledgeable and being lazy.

Great post! It’s funny that there are so many approaches to personal finance. For some people, hearing the cost per day is what really resonates with them and makes them appreciate the magnitude of what their debt is really costing them. For some other people (like me), the cost per day makes my debt sound SMALLER, and what really motivates me to save is looking at the total interest paid over the life of the loan. Isn’t that weird?

That’s one of the great things about having so many voices out there talking about finances. We can all find the approach that motivates us the most. 🙂

I guess personal finance is really personal. For myself. seeing that big number just made it seem far away, like it wasn’t even real. But when I broke it down and saw it cost me basically a nice lunch every single day, that’s when I really thought of it as a “holy crap this is expensive, I need to get rid of this debt” type thing!

Well there are two ways for making life better. Firstly increase your income and secondly decrease your daily expenses. That’s how you will make life easy.

Thank you so much for Superb calculations.

Oh man I was talking to some colleagues at work today about debt. I wish I had read this article before I talked to them. I will definitely need to share with them figuring out how much debt costs them a day. BRILLIANT. I never say this but I wish tomorrow was Monday. Well maybe not, but I am excited to share 🙂

Haha, I don’t think I ever wish for Monday! But glad that I helped you think about debt a bit! I know it gave me a lot of perspective when I saw how much my debt was costing me per day.

Nice Spin on the debt breakdown FP. I always look at my mortgage debt and remind myself that an extra $250 now means ALOT more to paying it off than $250 in 15 or 20 years will.

What I find insidious is the current cheapness of lending in the modern era. When you can get a car with a .9% interest rate, its worth the minimal debt to me to keep the emergency fund fat and happy.

That’s tough with the car interest rate being so low. I know a lot of people say just invest the difference and play that interest rate arbitrage. My issue is that majority of people won’t invest the difference – they’ll just use that extra money and spend it. I prefer to just keep things more simple in this area. Pay it down fast and then I don’t have to worry about it anymore.

The daily cost of debt is a great reason to get rid of debt, or at least negotiate lower rates. Great article!

Thanks DS. I always think that knowing the daily cost of your debt is an easy way to get yourself motivated. When you calculate how much your debt costs you per year, it’s always some cartoonishly big number, which makes it hard to really measure the impact of your debt on you. But when you break it down to a daily number, it’s much easier to see that your debt is costing you $5, $10, $20, etc dollars per day. A lot us don’t think we spend that much per day on debt.