A great lesson for anyone thinking about how money works is to think about the concept of real hourly wage.

If you’re paid an hourly wage, you know what you make for each hour that you work. And if you’re paid a salary, you can figure out approximately what you make per hour. For example, if you make $50,000 per year, your hourly wage is $25 per hour, assuming you work a standard 2,000 hours per year.

Here’s the thing though – very few of us actually make what we think our hourly wage is. That’s because there’s often much more that goes into work than just working. We have to commute. We have to get dressed and ready for work in the morning. Many of us have to do some work at home. Even when we have no work to do, we usually have to sit in our office for set hours of the day. And we spend many other countless minutes and hours of our day doing things that aren’t really for us.

A more accurate way to think about what we earn is to look at our real hourly wage. This is a concept that I first learned about in Your Money or Your Life, one of the most important books in the financial independence space. In the book, the authors discuss the concept of real hourly wage, which is the amount that we actually earn after we take into account all of the things we have to do for our jobs.

To figure out your real hourly wage, simply take what you earn, then add up all the time you spend working, as well as the time you spend commuting, getting ready for work in the morning, and everything else you have to do for your job. Your real hourly wage will show you how much you’re really making per hour.

I always knew that my salary was less than what it looked like on paper. When I worked at a big law firm, I spent so many hours of my day, not just working, but also being at work, thinking about work, and doing things that weren’t really for me. I had to do all of these things for my job. But I never really accounted for it when I thought about what I was really earning.

Delivering food on my bike with on-demand food delivery apps is an exercise in what real hourly wage is all about. Here are some lessons delivering food has taught me about real hourly wage.

Your Commute Time Can Destroy Your Real Hourly Wage

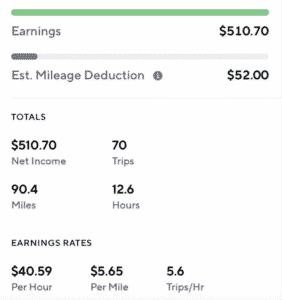

I regularly earn $30 to $40 per hour delivering food on my bike with apps like Postmates, DoorDash, Uber Eats, and Grubhub. When I calculate what I earn per hour with these apps, I always calculate it from the second I walk out my front door to the second I walk back into my house. I suspect that if I didn’t do this, people would challenge me on my hourly earnings, telling me that I need to calculate my travel time if I want to get an accurate picture of what my delivery income really is.

I’m fortunate that I live in a dense area where I can literally sit on my couch, turn on my delivery apps, and wait for an order to come before I walk out the door. Quite tellingly, if I had to do any sort of commute to busy delivery areas, it’d crush my hourly earnings. I can earn $40 in an hour most days with these apps (and that’s door-to-door from when I walk out of my house to when I get back). If I had to add 15 minutes of travel time each way, however, it’d cut my hourly earnings to $26.66 per hour. That’s still pretty good for just delivering food on my bike, but it’s not the $40 per hour that I see now.

It seems clear that I have to incorporate any commute time to get an accurate picture of what I’m really making with these delivery apps. But interestingly enough, it seems like many of us discount our commute time when we think about what we earn with our 9-5 jobs. Anecdotally, I can’t think of a single person that calculates their commute time when they think about how many hours they work in a week.

And all that time does add up. 30 minutes to get to work in the morning. Another 30 minutes to get home from work. That’s an additional 5 hours per week that we spend doing work-related activities. Add in another 30 minutes per day to get dressed and ready for work and it turns out many of us are spending an additional 7 hours or more per week doing unpaid work related to our jobs. Perhaps all of this isn’t as relevant today given that many office workers can work from home, but you have to assume that at some point, offices will reopen and people will be commuting again.

There are ways to take back some of your commute time (or at least repurpose it to something that benefits you). Biking to work comes with the added benefit of adding exercise time into your workday, which is a way to double-dip your time in a way – commuting and exercising at the same time. Many of us probably read or do other things when we’re taking the bus or train. I’m not sure if you can count all of it back as your time, but it’s at least something that gives you back some of those lost hours.

Trading Time For Money Makes It Difficult To Increase Your Real Hourly Wage

There’s a common misconception that doing something like food delivery is trading time for money. And undoubtedly that is what you’re doing. But it’s also not exactly that.

In truth, most of these gig economy apps aren’t about trading time for money. Instead, it’s about trading tasks for money. You don’t make an income for the hours you spend working. You make an income for the tasks that you complete. It’s a subtle distinction, but it does make a difference.

Every real job I’ve ever had paid me a salary. When I think about it, this salary wasn’t really in exchange for completing assignments. My employer paid me for my time. If I finished all my work, I needed to either find something else to do or wait for something else to come to me (or at least sit in my office and pretend I was working on something).

When you get paid for your time, it becomes really difficult to change what your real hourly wage is. The only thing you can really do is to reduce the amount of time you spend on work activities outside of work. That means creating a shorter commute or spending less time at work.

I had a friend of mine who increased his real hourly wage significantly when he went to remote work. He worked at a government agency that let everyone work remotely after 2 years of service. When he went remote, he removed hours per week of commuting time, while still earning the same salary. Thus, his real hourly wage increase.

When you trade tasks for money, you can vary what you earn. You can do this by being more efficient with the tasks you are getting paid to complete. And you can also opt to only take on only higher-paying tasks.

What are the action steps you can take here? If you’re trading your time for money, figure out what you can do to reduce the amount of time you spend doing work-related activities outside of work. Figuring out how you can shorten your commute can dramatically increase your real hourly wage. If you can finish your work sooner and leave work early without angering your employer, try to do that (easier said than done, I know).

Working Set Hours Makes It Difficult To Increase Your Real Hourly Wage Too

In the Four Hour Workweek, Tim Ferris points out an interesting fact – how is it that everyone in the world needs about 8 hours per day to do their job?

That’s the nature of how jobs work in the modern world. We have set business hours and regardless of whether we have any work to do, we’re still expected to be at work during those times. I had three different jobs when I was working as an attorney. And in all three jobs, I was told to be at work by a specific time (indeed, in two of those jobs, I got a light talking to when I didn’t get into the office by the time they wanted me to be there).

Entrepreneurial work like the type I’m doing now changes this up a bit. I work a lot of hours still. But these days, I don’t have to pretend to work or find work to do to fill up my day. Instead, I only do work that I need to do. I’m still admittedly not very efficient – I waste a lot of time when I’m working – but I’m no longer pretending to work or seeking out work that I maybe need to do but don’t really need to do.

Unfortunately, if you’re in a job that has set working hours, there’s not much you can do here to increase your real hourly wage other than what I mentioned previously – reducing the amount of time you spend on work outside of work.

Final Thoughts

Your real hourly wage tells you a lot about what you’re trading your time for. A more complete picture of how much we’re really getting for our time is always helpful. In some cases, maybe the amount you’re getting paid for your time isn’t enough.

I quit my regular 9-5 job two years ago to pursue writing and side hustling. My job was fine but it wasn’t a particularly good fit for me. I didn’t make that much at my last job, but my big fear was that I wouldn’t make enough money to support my lifestyle. When I think about how much time I really spent at work, the amount I actually made was even less than I thought.

That’s the advantage of what I’m doing now. There are ups and downs of course. Things aren’t always certain. But I have a lot more ways to take control of my real hourly wage.

Seems like when you compute your real hourly wage, it should not only account for time spent to “access” the job, but money spent too. That is, you should subtract the *costs* of working from what you earn, i.e., compute your *net* earnings. Things like business attire you have to wear to your job, commuting costs (gas, maintenance, etc.), costs for eating meals (assuming you don’t brown bag breakfast and lunch), etc. Costs of working vary by the job you do and where it’s located so it affects your REAL hourly wage.

I don’t disagree with that and I do track my expenses and deduct those costs when doing my taxes each year. I use an electric bike, so my costs are very low. Just the cost to charge the battery (which is minimal – on the order of cents per day) and maintenance costs, which is a few hundred bucks every few months.

I would point out that there is a level of absurdity once we start going deep down that Money or Your Life rabbit hole of what’s part of your real hourly wage.

For example, if we’re counting our going out to eat lunch as a cost of working, then do we start counting our dinner costs when we buy food since we’re getting home late from work? Do we count the housing expenses for the city we’re living in now since we could live in a cheaper city? Do we count the fact we’re living in this country instead of living in a cheaper country? There’s not really a logical endpoint once we get too deep down that path.

Commuting is just unpaid work.

Yeah you are spot on here. Communite time should be taken into account. Sure you can make your commute time useful (and you should) by listening to podcasts, audiobooks, or reading (train commute). But there is an overarching problem in our society that is focussed around the amount of time at your desk versus your actual productivity.

This is why I always tried to utilize Four Hour Work Week philosophies to work smarter versus harder, even as a CEO. Now I “work” a few hours a day, but try to make those hours count as much as possible. I bet that even though I work a fraction of the time, my output is likely near many 40 hour week employees.

I wonder if the move towards remote work over the past year might change this office time thing. My guess is probably not – I have a feeling that as soon as employers can get people back in the office, they’ll do so.

I think we’ll see some employers decide that expensive office space is not worth it anymore (my former employer I know has already canceled leases left and right), but I’d guess that the bulk will return to the norm as soon as they can.

I wonder how much the productivity of workers will increase if companies incentivized actual work. If they said “if you finish all your work by 3pm, you can go home”. I bet a lot of people will kick it into overdrive and instead of going on twitter, they’ll finish that dreaded report.

That’s why working a set amount of hours isn’t a good model. Why work to produce as much as I can in a condensed timeframe when it’s not going to matter at the end of the day?

Agree on being happy controlling your own destiny. I used to not take the side hustle culture seriously until I started my blog. Turns out, I love it so much more than working a regular day job even though I make $0.

It’s all Parkinson’s Law – work expands to fill the time you give it. It’s why when I got 6 weeks to write a paper for school, I always took the full 6 weeks and ended up actually getting it done in the last day. Give me one day to do it and I’d get it done in one day.