Sometime not too long ago, my sister-in-law was over at my house and noticed a huge stack of credit and debit cards on my dining room table – probably 75 of them at least. It’s an admittedly laughable amount of cards for anyone to have.

“You have a problem,” she opined.

That’s a fair assessment – I definitely do have a problem. But in my defense, not all of those cards were active. Most of them were debit cards that I acquired over the years from opening different bank accounts.

That’s because, over the past 4 years or so, I’ve been regularly opening (and closing) different bank accounts to earn lucrative sign-up bonuses – typically between $100 to $500 per bank account. It’s a world that a lot of people don’t know about, but just like with credit card signup bonuses, many bank accounts do the same thing, offering signup bonuses if you open new accounts and meet certain requirements.

And opening up all of these bank accounts has been lucrative. In 2019, I made over $4,000 from bank account bonuses. My wife earned almost as much as I did, bringing in over $3,000 from bank account bonuses on her end. I did the math and since I started taking advantage of bank account bonuses back in 2016, my wife and I have made over $14,000 – all just from strategically opening up new bank accounts!

That’s pretty astounding. When you think about it, doing this has turned into a fairly lucrative side hustle of sorts for me. And it’s something that a lot of people could do too.

In today’s post, I want to go over my past year of bank account bonuses, provide some detail about the strategies I used to do this, and explain how you can incorporate bank account bonuses into your own life. You can then use this extra income to pay off debt, invest with, or use it for other purposes.

Note that bank account bonuses are a big topic – far too long for me to fully explain in this single, relatively short post. I wrote a massive, in-depth guide to bank account bonuses that you should read if this is something you are interested in doing and that you don’t know much about.

My Bank Account Bonuses For 2019

I hit the bank account bonus game hard last year. In 2019, I opened a total of 24 bank accounts for myself. My wife opened 19 bank accounts for herself. Altogether, we made $7,577 in bank account bonuses – enough to fund a really fancy trip if we wanted to use it that way.

I keep track of all of my bank account bonuses in a spreadsheet, a copy of which you can download here. It’s a simple spreadsheet that lists the name of the bank, when I opened the account, when I closed it, how much I made from each account, and when I earned the bonus. I also color-code the spreadsheet so I can easily remember things (yellow means I haven’t received the bonus, green is to remind me when to close accounts). Feel free to take this spreadsheet and modify it for your own purposes.

For those that do not feel like downloading the spreadsheet, below is a table I’ve created that lists all of the bank account bonuses I earned in 2019. Note that there are several bank accounts that I opened in the last few months of the year where the bonus will post in 2020. I’ve left those off this table since I count the bonuses in the year that I earn them.

| Bank | Bonus Amount |

|---|---|

| Wells Fargo | $200 |

| TIAA | $150 |

| BMO Harris | $200 |

| Bank of America | $100 |

| Varo | $100 |

| PNC | $300 |

| Ally | $123 |

| Swell Investing | $50 |

| Royal Credit Union | $200 |

| Marcus by Goldman Sachs | $100 |

| HSBC Checking | $200 |

| Chime | $300 |

| HSBC Savings | $125 |

| Aspiration | $100 |

| Ellevest | $100 |

| Coin | $50 |

| Matador | $40 |

| SoFi Money | $75 |

| Lili | $15 |

| Citi Bank | $500 |

| Minnesota Bank and Trust | $350 |

| Bell Bank | $205 |

| Simple | $250 |

| Flagship Bank | $100 |

| Lana | $25 |

| Associated Bank | $175 |

| US Bank | $300 |

How Was I Able To Earn So Many Bank Account Bonuses?

At the outset, if you’re going to get into the bank account bonus game, you absolutely need to be organized. This is not something you can just muck your way through – if you do that, I guarantee you’re going to mess up along the way. Using a spreadsheet like the one I created is a good way to stay organized. I also recommend creating checklists in an app like Evernote or Taskade so you can mark when you’ve met each requirement (I use Taskade to keep track of my bank account bonus tasks).

Beyond being organized, there are also a few things I have going for me that make it easier for me to earn bank account bonuses. These include the following:

1. I Can Easily Meet Direct Deposit Requirements

Most bank account bonuses will require you to meet some sort of direct deposit requirement. Generally, to meet this requirement, you have to have a certain amount of money come to your account from an outside source, usually through an employer direct deposit to your account.

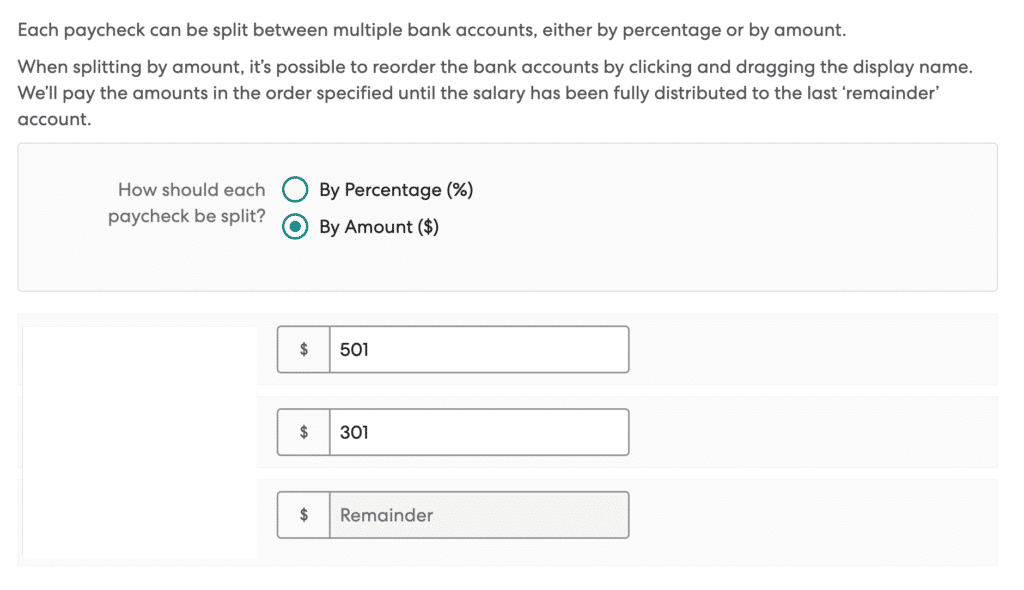

For the past year, I’ve had it really easy because my wife uses a payroll system for her business called Gusto. This payroll system allows us to change her direct deposit anytime we want. We can also divide up her paycheck into different bank accounts, which makes it easy for us to meet the requirements for multiple bank account bonuses at the same time. If you have a payroll system that lets you easily change your direct deposit, then you should absolutely take advantage of bank account bonuses.

If you don’t have a payroll system that allows you to easily switch your direct deposit, you’re not out of luck. Banks have automatic systems that code transfers into bank accounts as direct deposits, which means it’s possible to “fake” a direct deposit by transferring money from one account to another. This is what I did for years before my wife got set up with Gusto and back then, I was still able to make thousands opening up bank accounts. I have suggestions on how you can fake direct deposits in my Ultimate Guide to Bank Account Bonuses.

2. I Have A Good Amount Of Cash Set Aside For Bank Account Bonuses

The second thing that I do to make it easier for me to earn bank account bonuses is that I have a decent chunk of spare cash that I can dedicate towards getting bank account bonuses.

A good strategy is to utilize some of your emergency funds for bank account bonuses. By doing this, you can get a higher rate of return on your emergency fund without any risk of loss. (Related: A Better Emergency Fund Strategy)

It’s possible to play the bank account bonus game without a lot of extra cash, but you’ll find you have more options if you have extra cash that you can use. I usually recommend having at least $5,000 that you can utilize towards bank account bonuses.

You Can Take it Slow

One thing to remember is that you don’t have to be as extreme as I am when it comes to this stuff. Obviously, opening up 20+ accounts in a year can be intimidating, especially if you’ve never done the bank account bonus strategy before.

When I first started, I only opened a few bank accounts per year, carefully making sure that I could meet any requirements. As I got more comfortable, I ramped it up to the amount you see now. If I find myself getting busier in the future, I’ll likely scale back my bank account bonus churning.

The key is to go at a pace that you are comfortable with and only jump in as much as you can handle. I’ve admittedly always been one to get pretty deep into these optimization strategies and money hacks, but that’s not what you have to do.

For most people just starting, I think doing a handful of bank account bonuses in a year is simple without getting too stressed out. Assuming you go for bank account bonuses that pay in the $200 to $300 range, you should be able to make $500 to $1,000 in a year without getting too overwhelmed.

Is It Worth It?

The short answer is, yes, I think almost anyone can earn $1,000 or so worth of bank account bonuses each year with very little trouble. Even if you think it’s not worth the hassle, the truth is, most bank account bonuses pay enough that the hourly rate you’re making is going to be $100 or more per hour.

As an example, imagine you find a bank account that is offering a $200 bonus. Even if you took two hours to do everything (which would be an unrealistically high amount of time, in my opinion), you’d still average $100 per hour. For most people, the hourly rate you’ll make is going to be much higher than that.

Indeed, bank account bonuses have gotten so good that I’ve even opened up bank accounts in other cities. Towards the end of last year, I opened up three bank accounts in-branch in cities that I was visiting but don’t live in. These bank accounts took me about 20 minutes to open and when you consider that all of them pay $200 or more, I’m looking at an absurdly high hourly rate just by stopping in and opening up some bank accounts in cities that I happened to be in.

For those of you who are searching for bank account bonuses, the absolute best resource for finding bank account bonuses is Doctor of Credit, who keeps a list of the best bank account bonuses that he updates each month. Doctor of Credit also maintains a list of methods that satisfy direct deposit requirements for various banks. This list isn’t always accurate or up-to-date, however, so you’ll want to review the comments and do your own research.

If you’re looking for a few easy bank bonuses that you can start with to get a taste of how this works, try the ones I list below. They have easy requirements and the accounts have no fees to worry about, so they’re good beginner accounts you can use to see if the bank account bonus game makes sense for you.

- Chime. You’ll get $50 when you open an account using my link and do a direct deposit of $200 or more. This one is really easy for beginners since the account has no fees to worry about and an ACH transfer from pretty much any bank will trigger the direct deposit requirement. The bonus also posts within a day or two of meeting the direct deposit requirement.

- SoFi Money. SoFi Money is offering $50 if you use my referral link and fund the account with $500 or more. This bank account also has zero fees, so it’s an easy beginner account to work with. This is actually one of my favorite bank accounts currently, so I’d recommend it as a primary bank account if you’re looking for a new checking account.

- Aspiration. Aspiration gives you $25 if you open a checking and savings account and fund the savings account with $50. Make sure to read the terms at the bottom because I think they change sometimes. The only issue is that Aspiration takes up to 8 weeks to post your bonus, so it’s not as fast as the others. It’s a 100% free account though, so you don’t have to worry about any fees.

- SoFi Invest. This is not a bank bonus, but rather it’s a brokerage account bonus that works the same way as a bank bonus. For this one, you need to fund your SoFi Invest account with $5,000. You’ll then get $50 in free stock, which you can then immediately sell and turn into regular cash. You don’t need to invest the money you deposit into the account, so you can just put it in and then take it out later. This one is an easy $50 for a few minutes of work if you have the cash to spare. It’s also 100% free, so there are no fees to worry about.

You have taken bank bonus’s to a whole new level. We typically sign up for a credit card bonus once a year to take advantage of a ton of bonus miles or points or whatever. And this past year a local credit union was offering a 250 dollar sign up bonus as well as 5% on $5000 is checking plus 3% on $10000 in savings. I thought we were hitting the ball out of the park! You’ve put us all to shame with your sign up bonus. Wow and congrats are the only words that come to mind! Haha

-Isaac

I’m obsessive with this stuff – but also I do it because I think it’s fun!

I have been doing the bank account bonuses for about 5 years now. It’s an obsession and I’m glad someone shares in it with me! I currently have three going on at one time. Frontiers, Affinity, and Wells Fargo. Just finished with Wings Financial, US bank and Varo! I don’t ever plan on stopping! Appreciate your work here.

Thanks for all the information! How did you find out when you can close your accounts? I’m looking at TD bank because they have a great bonus. Unfortunately its not on your spreadsheet so I can’t see how long you had your account open. Trying to do some online research but the website gives no mention of how long the account needs to stay open.

Generally, the things you need to think about when closing an account is (1) whether there is a requirement to keep it open for a certain length of time, and (2) whether there is an early termination fee.

If terms don’t say anything about keeping it open or forfeiting bonus if you don’t keep it open for a certain length of time, then it’s safe to assume you can close immediately.

Early termination fee you’ll need to find by looking at the fee schedule. If you search for the bank you’re doing on Doctor of Credit, it’ll also usually tell you if there’s an early termination fee. If fee schedule says nothing, then there’s no early termination fee.

Generally, if the account is a free account or doesn’t take much work to keep it free, I recommend leaving it open for a few months after you earn the bonus. Main reason is to not get the bank too angry and it makes it look less like you just opened the account for the bonus. My general rule is if the account requires no work to keep fee-free and it’s not an account I’m churning, I’ll just leave it open for 6 months and then close after 6 months. If there’s fees, I close the instant I can.

Did SoFi change their referral program? When I signed up through your link, I only had to fund it with $100 for us to get our bonuses. Now when I try to refer someone it says the bonuses will pay once they make two direct deposits of $500+.

Looks like they must’ve changed this just a day ago or something. Used to be fund with $100 to get bonus. Now it’s two direct deposits of $500 to get the bonus. I’m not sure yet what codes as a direct deposit, so willl need some time to figure that out.

The plus is that this bonus for new users is at $75, which is better than it was before. The negative is it now requires direct deposits to trigger the bonus.

Do most of them have limits on referral by address? My head immediately goes to… refer my wife, then she gets the bonus and I get referral bonus.

For the bank accounts that have referrals, always refer your spouse. Example – Chime, you use my link (if you want) and get $50. Then you refer your spouse and get $50 for referring your spouse and they get $50 for getting referred by you. Boom, that $150 for a few minutes of work.

I gotta look into this! I haven’t really done anything differently with my finances other than open new credit cards for like a year now lol. Need a new project to work on. Also thinking about trying your 5% savings trick. Thanks for the cool tips you share!

If you’re into travel hacking, bank account bonuses and these 5% interest accounts are a natural next thing to work on. People like us are natural optimizers.

Curious… You have quite a few “keep open forever.” I get that they are fee-free, but why keep them open?

Good post Kevin. When you say you open up accounts in cities/states that you visit, how do you do that? Don’t they need an address from that state to verify residence?

So, the accounts I open out-of-state is because some banks won’t let you open an account online if they don’t have a presence in your state or city. The only way around this is to open an account in branch. The vast majority of banks will let you open an account in branch even with an out-of-state address and license. All I do is let them know I don’t live in the state and that my address is in a different state and I give them my ID. Sometimes they might ask why you’re opening an account and I just say I have family in the area that I visit and want a local account to make things easier. Or I say I’m going to move there for school in the future.

Good question. There are certain accounts that I think are good enough that I just leave them open in case – and some accounts I’ve actually just started using because the accounts were so good. If I put it as keep open forever, it’s because I thought it was actually a good bank account worth having.

I have appreciated your insight and information you willingly share. I was early in my bank bonus career when I found your blog and read your Ultimate Guide to Bank Bonus’ and that really propelled me. I was able to earn over 3k last year and didn’t start until August. I have plenty of time to work at it as I am retired. But reading your side hustle info as well has been enlightening. Thanks!

That’s awesome! Glad my post was helpful to you!

Don’t you worry about Banks having your information? They can get hacked all the time. And Wells Fargo was opening accounts without permission

This is so intriguing . Yea, I was having the same thought. My info flying around thru a seemingly porous cybersphere – not that it already isn’t – gives me pause.

Also, all three of my credit bureaus are locked down (thanks to the clowns at Experian). I assume I would need to unlock them them to open new accounts?

No you don’t need to unlock your credit reports to open new accounts. Bank accounts are unrelated to credit scores. Credit scores are for credit related things. Bank accounts aren’t credit – it’s like the opposite of credit.

No, I don’t worry about that. I will say if you’re worried about hacking and your account getting leaked, the things I do on this blog are definitely not made for you.

Love the article! My goal is to earn $3,000+ in bonuses in 2020 and you’ve help to inspire me to keep at it.

Keep at it!

Wow! Interesting! Does this affect credit scores? Don’t these result in credit inquiries?

Majority (think 95% or more) of bank accounts do not result in a credit inquiry and I don’t open any bank accounts that do what’s called a “hard pull” which is what actually is a credit inquiry. Instead, banks use a system called ChexSystems, which is a thing that some banks use when you open a bank account. It has nothing to do with your credit score, which is run by a private company called FICO.

In short, no, opening bank accounts has no impact on your credit score and doesn’t result in credit inquiries.

Kevin, this is a really good article. I agree 100% with you in terms of this being a somewhat easy strategy to make some money. In 2019, I opened a few accounts and made ~$1500. The challenge as discussed in the post is that some accounts may require large deposits to give you access to the bonus and also require the money sitting for ~6mo before you can close the account without having to give the bonus back. In 2020, I plan to do the same thing I did last year and open ones that offered the highest bonuses provided they are around. I’ll think about other ones you mentioned but not sure I want to have that many, we’ll see. Anyways, thanks for this post and keep it up!

Thanks! Opening up a few accounts and making $1,500 is great! That’s something a lot of people can do.

Hello Kevin,

What an interesting post! I have never opened a bank account to get a bonus before. Are the bonuses taxable?

On an unrelated note, I hope to see you again at FinCon this year!

Best,

Jerry

Hey Jerry, yep the bonuses are taxable as interest income. So it’s the same as if you earned interest in a bank account.