The Chase Ink line of business credit cards is one of the most valuable business credit cards you can get, primarily because they earn Chase Ultimate Rewards Points (which is my favorite type of transferable rewards currency). In addition, because the Chase Ink credit cards are business credit cards, they don’t appear on your personal credit report, so they don’t impact your 5/24 status. Getting cards that don’t impact my 5/24 status is particularly important for people like me who want to keep getting a lot of new cards, but also leave open the ability to get new Chase credit cards.

For years, it’s been well known in the travel rewards community that you could open multiple Ink cards and earn the bonus each time you opened the card. Using this strategy, I would regularly open a new Chase Ink card every 3-4 months, helping me to accumulate a large stash of Chase Ultimate Rewards points every year just from the sign-up bonuses on these cards.

In recent months, however, it seems Chase has tightened up their business credit card applications, making it far more difficult to get multiple Ink cards or multiple Chase business cards, in general. That being said, my wife was due for another Chase Ink business credit card, and with my stash of Chase Ultimate Rewards Points starting to dwindle a bit, we decided now was a good time to throw in an application for her.

This is what my experience was like opening a Chase Ink Unlimited card under the more restrictive application rules that seem to be in effect these days.

Chase Ink Business Card Application Restrictions

As a bit of background, the Chase Ink line of business credit cards comes in three different types. These include the following:

- Chase Ink Unlimited ($0 Annual Fee)

- Chase Ink Cash ($0 Annual Fee)

- Chase Ink Preferred ($95 Annual Fee)

There’s also a fourth Ink card called the Chase Ink Premier, but this card doesn’t earn Ultimate Rewards points and is not a card I would recommend to most people.

The main requirement to get a Chase Ink card is having a business. This shouldn’t be an issue for the vast majority of people – remember that almost anything you can do to earn money outside of a regular W-2 job can qualify as a business. This includes simple activities like selling things on eBay or working in the gig economy for apps like DoorDash or Uber Eats. As long as you have something that qualifies as a business (i.e. pretty much anything that isn’t W-2 income), you’ll be eligible for a Chase Ink business card.

The main limitation these days with the Chase Ink cards has to do with the number of Chase business cards you currently have open. While most Chase credit cards limit signup bonuses to once every few years, Chase Ink cards do not have this limitation. Even if you’ve earned the bonus on a Chase Ink card before, strangely enough, you can still earn it again with no limitation.

In the past, it often seemed that people could get multiple Chase Ink cards without any issue. This is exactly what I did for years, opening up new Chase Ink cards whenever I needed to top up my Chase Ultimate Rewards Points. This past year, however, Chase seemed to tighten up their business card acceptance rate. These days, it seems that the number of Chase Ink cards you can get is heavily limited by the number of Chase Ink or other Chase business cards you already have. While there are no set rules, people on Reddit have conducted surveys and come up with a general idea of the percentage chances of approval based on the number of Chase Ink Cards you already have open.

Below are the estimated chances of getting approved for a new Chase Ink card based on the number of Ink Cards you already have (Source: Doctor of Credit):

- No Ink Cards = 87% chance of approval for a new Ink.

- 1 Ink Card = 68% chance of approval for a new Ink.

- 2 Ink Cards = 57% chance of approval for a new Ink.

- 3 Ink Cards = 18% chance of approval for a new Ink.

- 4 Ink Cards = 0% chance of approval for a new Ink.

From the data, it appears that the chances of getting approved for an Ink card are very high if you have no Ink cards already open and remain fairly good if you already have 1 or 2 Ink cards already open. However, it seems to become basically impossible to get an additional Ink card if you already have three or more Ink cards currently open.

In this case, my wife had two Chase Ink cards already open. So, the data told us it was about a 50/50 shot that she could get approved for a third Ink card.

My Chase Ink Unlimited Business Card Application Experience

So what is the application process like when applying for a business card like the Chase Ink Unlimited? Fortunately, the application process for a Chase Ink business card is pretty easy. If you already have a Chase account, you can log in to your account when you fill out your application, and it’ll fill out all of your personal information for you.

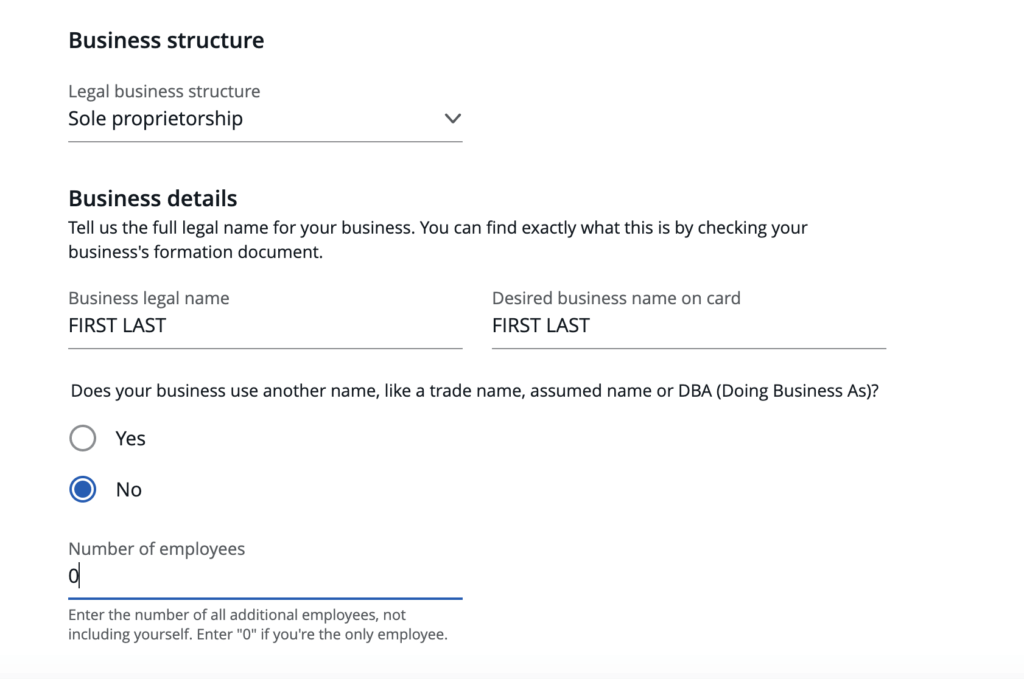

The parts of the application that are different with a Chase Ink card are the questions about your business. For example, in the application, you’ll get this question about your business structure.

Most people will be applying as a sole proprietorship – the only time you wouldn’t do that is if you have a separate, registered legal entity. In that case, you’d apply under that entity. As a sole proprietor, your business name will be your name, and you would select “no” under the question about whether you have a DBA.

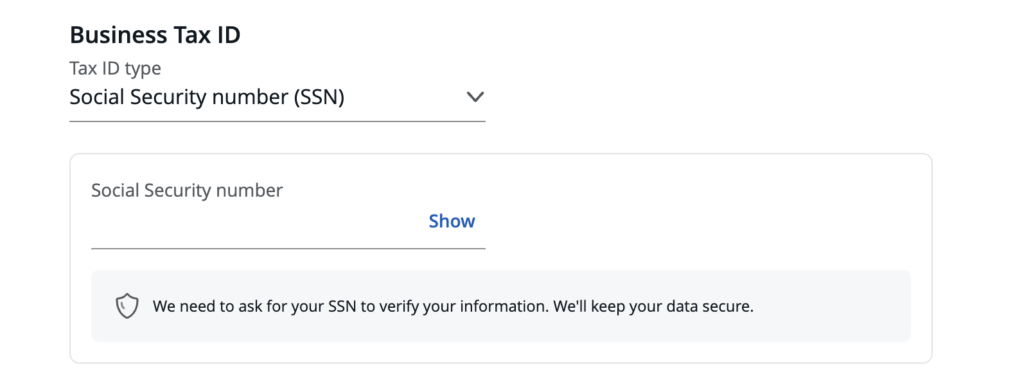

If you’re applying as a sole proprietor, you’ll also use your Social Security Number as your Business Tax ID.

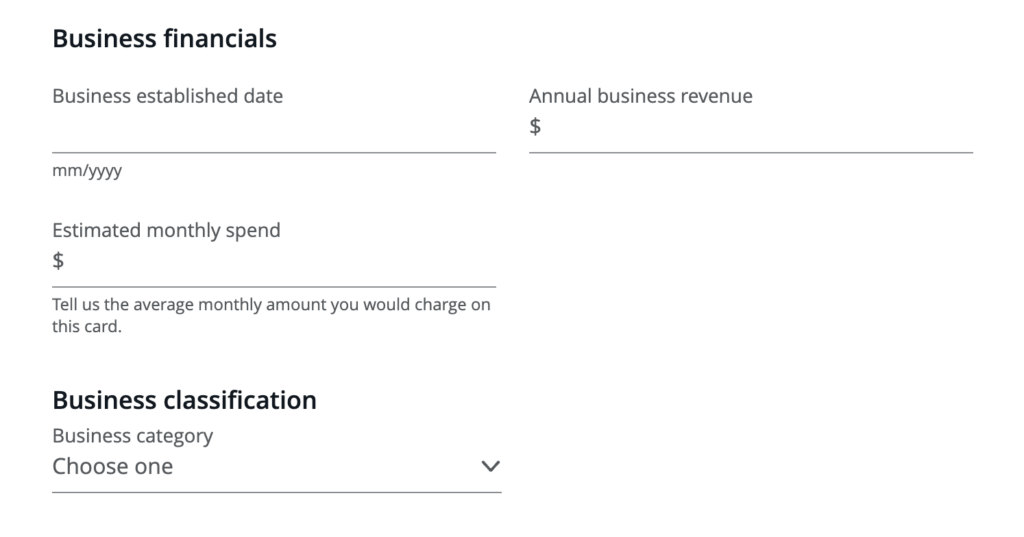

Finally, you’ll need to enter some information about when your business was established and what your annual revenue is. This is something that you can estimate, especially if you have a relatively new business. My general advice is to say your business is at least 1 year old and has a business revenue of at least $1,000. That being said, Chase doesn’t have a hard minimum of how old your business needs to be or what the minimum annual revenue is. From my experience, though, having a 1-year-old business and at least $1,000 of revenue seems to always work for me.

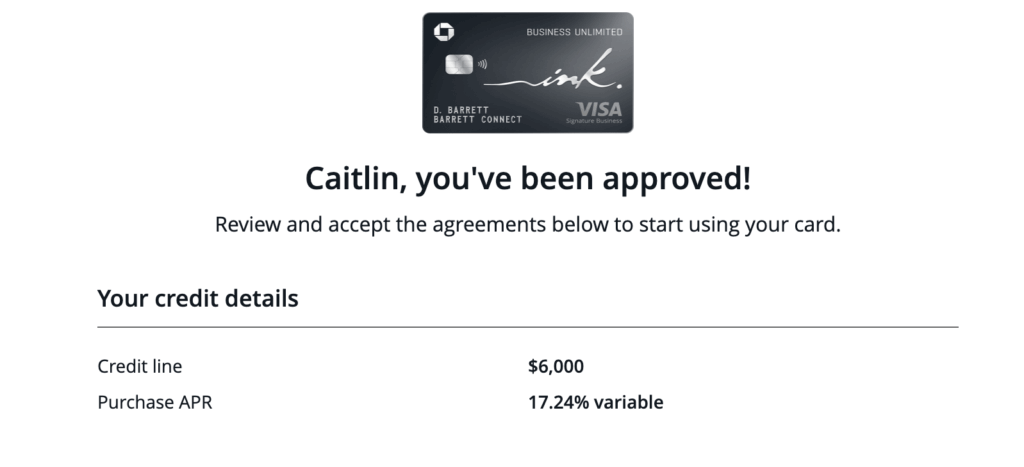

In this case, we applied for the Chase Ink Unlimited for my wife as a sole proprietor, using our rental property as the business (this is what we always use when applying for business credit cards). Typically, the application goes into pending status when applying for a new Chase Ink card and then is automatically approved a few days later, but to my surprise, we were instantly approved on this application. Huzzah!

My Long-Term Chase Ink Strategy

Going forward, my plan is to continue trying to get new Chase Ink cards every 4 to 5 months, applying for a new one: (1) whenever a decent amount of time has passed between my Chase applications, and (2) whenever I have two or fewer Chase Ink cards open. What constitutes a decent amount of time is going to be based primarily on vibes, but I’ll probably be aiming for 3-6 months between Chase cards. In general, this shouldn’t be a problem, as I’m usually able to get cards from other banks to hold me over while I’m between cards.

Between my wife and me, that should hopefully result in us opening at least 2 Chase Ink cards per year, with potentially as many as 6 Ink cards in a year, depending on how things align. The most likely scenario is that we end up getting around 3 Chase Ink cards most years, which should usually net us between 225,000 and 250,000 Chase Ultimate Rewards points.

The Chase Ink Cards also have some value beyond the signup bonus. In particular, I’m a fan of the Chase Ink Unlimited since it offers 1.5 points per dollar spent on any purchase with no annual fee. This makes it a solid overall card to keep in my wallet when needed.

Final Thoughts

It’s nice that my wife was instantly approved for a new Chase Ink Unlimited, especially since, as of the time I’m writing this, Chase has a heightened signup bonus on the card.

Chase business cards are still a little harder to get than they used to be, but it’s still possible to rack up a lot of Chase Ultimate Rewards points by targeting these cards. Assuming things don’t change, I should continue to target these cards as needed and hopefully, continue to rack up more Chase Ultimate Rewards Points.

Hi, The fine print on the offer details says “The new cardmember bonus may not be available to you if you have ever had this card or any other Chase for Business card without an annual fee.” Is this new language or did they always have that and still gave out bonuses to repeat cardholders? Thanks.

Unfortunately, they added that language recently and the whole Chase Ink train may be coming to an end. That being said, when you apply, before your application goes through, you will get a pop up saying that you aren’t eligible for the bonus if you aren’t eligible for the bonus under that language, so there’s no risk in applying (i.e. Chase will tell you if you aren’t eligible for the bonus before your application goes through).

Hi. I read this in the offer details fine print…”The new cardmember bonus may not be available to you if you have ever had this card or any other Chase for Business card without an annual fee.” Is this new language or did it always say that and they never deny the bonus? Thanks.

What is the process of closing them? Do you have to talk to Chase on the phone every time?

Do you open those 3 cards and then close them and then reopen the same ones again the following year? Is that how you are able to keep opening cards? by opening and closing them shortly after? It doesn’t affect your credit?

A couple things here. First, most business credit cards don’t appear on your personal credit report, so opening and closing them doesn’t do anything to your credit report as they never show up. In this case, the Chase business cards don’t appear on my credit report, so it doesn’t matter that I open and close them after a year.

Second, opening and closing new cards in itself doesn’t negatively impact your credit score. It’s important to understand what goes into your credit score and what closing a card does, but the short of it is that closing a card doesn’t hurt your score unless you have so little credit that it dramatically reduces your available credit.

A bit beyond what I’m willing to write in a comment, but this gives me a good idea for a post about how a credit score actually works!