Thanksgiving is now behind us and with its passing comes the official start of the holiday season. I’ve always thought it helpful around this time of the year to remember how fortunate most of us are. If you’re reading this, chances are that you live in a developed country. You probably also make a decent income and have some education under your belt. If you’re smart, you might even be able to save up enough money one day so that you never have to work again. Most people in the world aren’t lucky enough to have the luxury of thinking about financial independence, let alone actually achieving it.

This is why it has always struck me as a bit ridiculous when I see people with good jobs complaining that they don’t make enough to get ahead. Sure, making more money is probably better than making less money. And some cities are definitely more expensive to live in than others.

But I have a problem when people who make well above a median income tell me that they’re barely getting by. The vast majority of people in the US don’t make the huge sums of money we seem to think are necessary in order to live. If someone making above a median income says they can barely get by, then what’s happening to the other 50% or more of the population? Are they all living a destitute life because they don’t have the huge house, fancy car, and private school education that some people say they simply must have?

In many ways, spending is sort of a bit like water. It basically just fills up whatever vessel you have. As your income grows, it’s easier to fill up that income with increased spending. It’s why a doctor or lawyer can make an amazing income, yet somehow feel like they’re just skating by.

So this post is a reminder to everyone out there as we go through the holiday season. Count your blessings. You probably make more than you think. You just need to keep some perspective when it comes to your income.

Household Income Distribution In The US

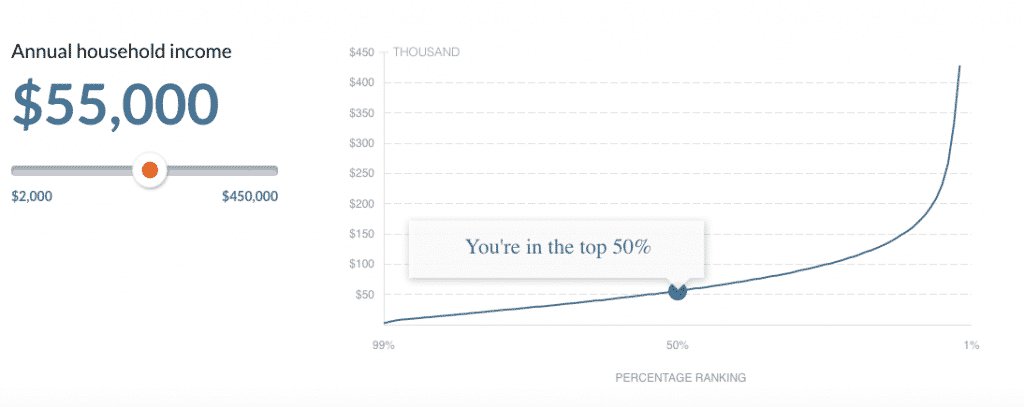

CNN Money has a great calculator that tells you where your income ranks in the United States. You slide the income bar to the left or right, and it tells you where that annual household income ranks in the United States based on percentile.

For example, an annual household income of around $55,000 per year puts you squarely in the middle of the pack when it comes to income. Fifty percent of American households make more. Fifty percent make less.

To some people, a $55,000 per year income would be amazing (I know when I graduated from college back in 2009, anyone who found a job paying that much was really lucky). To others, a $55,000 household income doesn’t even seem livable. There are people out there making twice as much that swear that it isn’t possible to live on less.

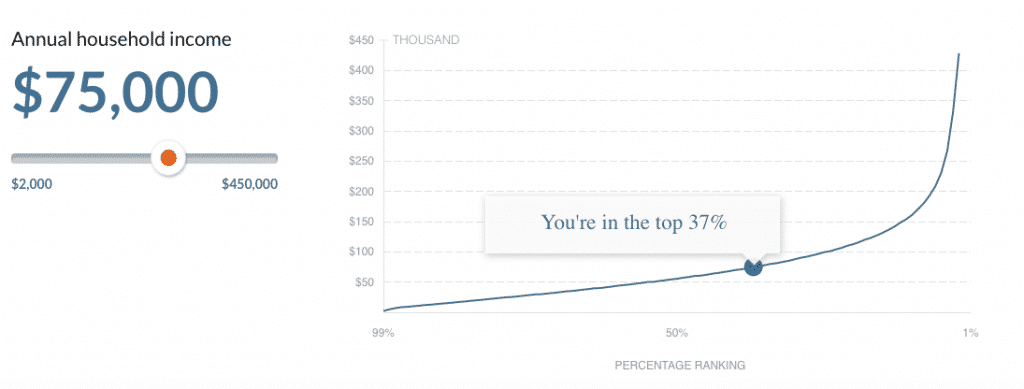

The important thing in my opinion is to maintain some perspective. Just look at how well you’re doing if you’re making what some people would consider pretty pedestrian incomes. $55,000 puts you in the middle of the pack. But an income of $75,000 puts you right up there near the top third of incomes. This household is doing pretty darn well when you compare them to the general population.

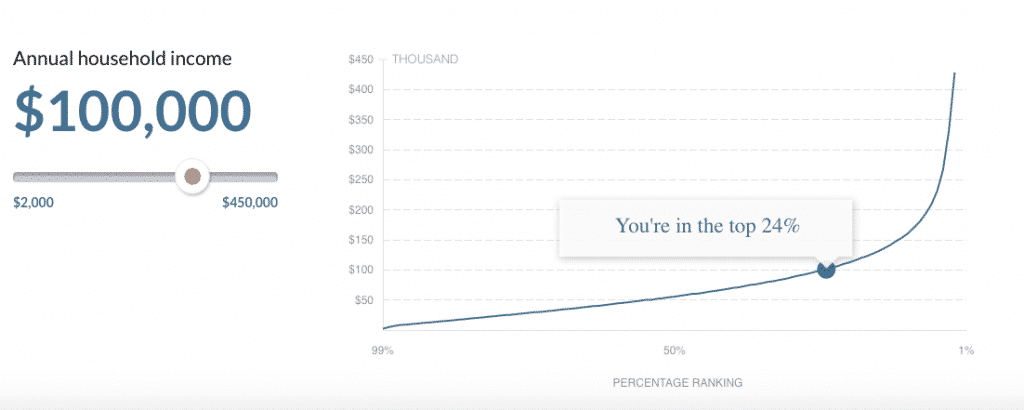

A household making $100,000 per year is doing even better. They’d be firmly in the top quarter of the US population when it comes to income. Pick 100 random people in the US, and they’ll be making more than 75 of them.

It’s important to keep some perspective when it comes to your income. A pretty normal salary means you’re doing better than most of the population. And if you’re doing that well, what’s stopping you from getting ahead?

You Can Probably Live On Less Because Others Are Living On Less Too

Lawyers, doctors, and other high-income professions have a pretty bad habit of comparing themselves to one another. With all that money being thrown around, they end up losing perspective. Rather than realizing how lucky they are to have the things they have, they get into an inevitable comparison game with other people in their profession. Some colleague has a huge house and a fancy car, so that means I need that stuff too. That’s how you can end up making an amazing salary, yet feel like you have no money.

So just take a step back. Really look at what you make and how you’re living. Most people don’t live in a huge house or a luxury apartment. Most don’t have a fancy car. But even without this stuff, most regular people are probably doing okay.

I don’t make the biggest income in the world anymore. But I’m fortunate enough to make a good salary that puts me well above the median income. It’ll only get higher once my wife finishes her residency and starts earning some income.

But I still remember to keep my perspective when it comes to income. If the median household is making $55,000 per year, surely I should be able to live off that amount. At a minimum, I probably don’t need to live off more. If I do spend more, it’s because I want to, not because I need to.

Perspective is part of the reason I was able to pay off my student loans quickly. When I was making six figures, I didn’t live as if I made six figures because I knew that most people didn’t make that kind of money. If I just lived like a normal person, I could use all of that extra money to pay off my loans.

So, if you ever have trouble wondering how you can live on less, just remember one thing. There are probably a lot of people out there that make a lot less money than you do. If they can live on less money, you can probably live on less money too.

Keep your income in perspective. Compare yourself to the right people. Be content with what you have. Then you’ll probably realize you make a lot more than you think.

So many folks just lack perspective. This is why so many immigrants and people who’ve traveled abroad hustle harder and tend to go further is b/c they realize so much opportunity here, they don’t take it for granted!

Exactly right. My parents were both immigrants who hustled a ton, so I think they must have subconsciously instilled that perspective in me.

I definitely agree that many people can’t get by only because they’re living beyond their means. My salary isn’t high, but I could easily live comfortably if I weren’t buried in student loan debt (trying to have it paid off by 2018). In the meantime, I’m not buying a house, getting a car loan, or taking on other forms of debt even though numerous people have told me that that’s what “normal” people do.

The great thing is that you’re going after that debt, and just by doing that, you’re proving that you can live on much less. Imagine what that’ll mean when your income goes up in the future? You’ll be able to save a ton and still live totally fine.

SO TRUE. I think we also view a lot of things as “needs” that are really just luxuries, and that skews our view of our income. Also because we see the way other people live through rose colored glasses – Oh they just went on a cruise! Hey they just bought a brand new TV! – and don’t see all the work that those people did to get there.

Interestingly, we never know whether those people did the work to get there. Lots of folks just keeping up appearances despite having no money.

What a refreshingly sober article! Thank you, Mr. FP. Americans have little idea of what real poverty is. Check out a YouTube video called, “Children of the Dump.” It’s about children living in a dump in Cambodia. Now that’s poverty. The average American is a one-percenter compared to most of the world. If he or she realized this, there would be a lot less griping and a lot less mindless spending.

I’ll definitely check that video out when I get a chance. No doubt, most Americans have it really good. Ms. FP and I went to Guatemala last year on a dental service trip and people live just completely different lives there.

Was also really interesting to see how different people handle dental care there. They don’t have painkillers to give them and very basic numbing. Yet, everyone just grits through it and is fine afterwards. Meanwhile, Ms. FP here deals with patients who have one tooth pulled and then scream that they need vicadin and all sorts of stuff.

You hit the nail on the head – so many people are living on a lower budget that any claims of not being able to live on less are false. It’s unwillingness to live on less. I find myself in this trap in regards to housing. I live in a tiny but still expensive apartment and hear myself say I couldn’t possibly find a place for less in Silicon Valley but really, I’m just unwilling to commute too far or find a place that would allow a couple with a big dog as their roommates (which not many people are into versus a single person). Great post!

That’s right Julie. This is exactly how my lawyer friends do it. They say they can’t find a place any cheaper or that they want to live close to work or any other myriad of excuses for why they can’t live in a place that isn’t as nice. It’s totally fine, but it’s a choice. The good thing is that you’ve paid off all your loans and have a great salary. You can have that luxury. And I know you still live as if you’re making less, which is what a lot of people just don’t do.

If you’re above the median income, you can certainly live on less. Lots of people do it. People just don’t choose to live on less and for some reason choose to foolishly put themselves deep in debt

It really tough because we all compare ourselves to the people we live around. If you’re living in an upper middle class neighborhood, there’s an expectation that most people have to meet. That’s how a family making $100k a year can think they don’t make enough to live well. Tell that to some family making the median income and ask how they’re able to live then.

Always a great reminder. I think it’s very easy to forget how lucky some of us are because we work and hang out with people very similar to us. So if you’re spending time with people that have the same income/lifestyle (or even people that are better than you), it just feels like you’re “in the middle.”

That’s so true about the people you hang around with. When I was at a big law firm, everyone simply had to live in a luxury apartment. There was always some reason why it simply wasn’t possible to live in a more affordable place. You really just start defining your needs based on how everyone around you lives.

Thanks for this perspective. It’s important to keep in mind – especially around this time of year as expenses can continue to rise if you aren’t careful. But it’s also easy to forget. So I appreciate the illustration of how different salaries fit in with the average household income. Thanks again!

Glad you enjoyed it Jay! I think if you keep that perspective in mind, it’s definitely much easier to live on less.

Love your overall message– many of us really COULD live on less (and arguably, should). Since we’ve been paying off our $600k of student loan debt, we have been pleasantly surprised how easy it can be to create and stick to a budget. (though it seems impossible when you haven’t started)

We all definitely could live on less! Also I can’t wait until you guys pay off all that debt! It’ll be so awesome!

I agree with both the intent and the numbers of the article. Still I can’t help but wonder how the average income distribution is by age group. Of course I’m crushing the majority of my fellow Americans, they’ve barely started their careers and I’m two decades into mine!

It’s like the cops who have been on patrol for 30 years and lord it over the 5 year cops. “Yes, of course you know more than me…you’ve had 25 years to do it!”

That’s definitely a good point Jack! No doubt, income distribution varies based on age group. I know as a millennial, I was without a doubt a top 1 percenter for a 26 year old. The other 26 year olds who started big law with me were also 1 percenters. You’d think as a 1 percenter, it’d be easy to get rid of all your loans in a few year. But no one did! Why is that?

Here’s where perspective came into play for me. I paid off my loans, obviously, by living on less than I earned and using the remainder to pay off debt. The way I saw it, other people my age weren’t living like they were making six figures a year, so why did I need to?

In contrast, a lot of young lawyers simply feel that they NEED to spend that money. They just deserve it! That’s why they end up getting an expensive, luxury apartment, buying fancy clothes, expensive vacations when they get the chance, etc.

When I started working, I must have lived in the crappiest apartment out of every young lawyer in my firm. My apartment didn’t even have a name for it and it didn’t have any amenities. It was a totally fine apartment, but it wasn’t a luxury apartment. How come I could live in a normal apartment that would be perfectly fine for any 26 year old, yet others simply HAD to live in an expensive luxury apartment with a pool and a gym?

I think that was my hope to get across. All about that perspective. If a new grad is doing fine on 30k a year, and you’re fortunate enough to be an engineer or something making 60k a year, why not just live like a normal person and save half, and live off a normal income? Other people are doing it already out of necessity. I guess my thought is that you probably “need” less than you think and you are probably making more than you think if you compare yourself to the right people.

Hope that made sense Jack!

Nope. It absolutely made sense. Starting out my professional career in the Marine Corps Infantry, I had an early refresher into how much I need. I was attached to a light armored recon unit and spent most of my time living in Iraq with essentially six other guys in a large armored truck. By the time I deployed to Africa and was given a partition in the barracks that was six by 6 ft.² i felt like I was unaccountably rich.

Now thanks to law enforcement, with a family of four each person has over 400 sq feet to themselves (technically). So I absolutely agree and support your thesis!

Thank you for this important reminder. I am often confronted by just how differently my family spends money, in comparison to others in my profession. They are always buying newer and nicer, for image and status. Meanwhile, I haven’t purchased hardly any new clothing in three years. We drive paid off vehicles from 2006 and 2007 while they finance leases on new ones. Money is a tool. You’re trading your time for money. Use it to buy a better life, instead of meaningless stuff!

All about thinking about what matters to you. There’s a lot of stuff that we probably say we simply “need,” but do we really need it? If we did, how come other people don’t need it?

I wrote a while ago about how I use my mattress to give me perspective. The mattress I sleep on now cost more than my annual income when I first started working. Annual. Whenever I feel the faintest urge to whine about my finances, I go for a quick lie down and some much needed perspective.

Oh man, I just took a gander at your mattress post and holy crap, that’s an expensive mattress! Easy way to get some perspective there! (On a side note, I have two good mattresses that were sent to me for free because I’m a good Airbnb host! They’re those mattresses that get shipped to you in a box – tons of these type of companies out there. So was lucky enough to get to upgrade my old mattresses for free!).

I can’t help be reminded of the stories last year about a janitor who amassed a fortune of $8M. He left $6M to his city’s library and hospital. People were stunned.

Great post FP. I especially like your advice about keeping it all in perspective.

Thanks Mrs. Groovy! I think we can all be pretty happy with what we have if we keep that perspective in mind. I remember that janitor story. It was pretty wild!

“You can probably live on less because others are living on less too.” If we could just nail this into everyone’s brains we would be out of a job! Great post!

I think I’d be cool with everyone living on this philosophy!

A lot of people tend to get the lifestyle inflation bug as their salaries increase and struggle to be able to scale back once that happens.

I tend to think that material possessions become the focus and savings gets put on the back-burner. My brother is in that exact situation. He and his wife make excellent money, but other than their 401(k) plans, they have no savings… but live a great life for the time being! 🙂

The good news is that he sees where he’s at and they are working to scale things back and live a more modest lifestyle. If you can put together the high paying jobs with a somewhat frugal lifestyle, that’s like the ultimate combination!!

— Jim

That’s great that your brother is figuring that out. Really, if he has trouble cutting back at all, just ask him to check out what percentile his income is at. Then ask himself, if he needs everything he has, how are other people making do?

This is very true. Think of all the luxuries that have turned into “necessities” over the past several years. Cable plans with over 300 channels, plus Netflix, etc. Cell phones that are a mini computer. With rates being low, many have gotten into the mindset that they need a house with several thousand (yes thousand) more square feet than they actually need. If you can afford these things and still save a large percentage of your income, then great. The problem is most people are sacrificing savings to buy these things.

It’s definitely a mindset thing. Gotta remember what we really “need” in order to live vs. what we’re paying for because we want it.

Great post FP! I like the water analogy you used!

Right? I really do think that a lot of us just fill up our spending to match our income, then tell ourselves we couldn’t possibly make do without that income. Funny, we all didn’t always make whatever incomes we have now. And we we’re probably doing fine then too.

Good reminder FP – I have thought about this a lot lately, we know so many people that waste all their hard work by spending everything they earn and then some, then on the flip side you see people raising a family on an average income and still finding a way to save. Anyone can do this, just need some perspective.

Exactly right. That’s why it’s always annoyed me when I see people making six figures or more saying they can’t possibly live on less. If that were true, how does everyone else do it?

I remember a little while ago reading something that said you needed to make at least $80k per year or something to live comfortably in the Twin Cities. Their sample budget had people spending 5k per month on necessities. So that must mean I’m living destitute since I’m not anywhere close to that amount of spend per month. Funny, I don’t feel that way.

You’re so right FP. I’ve always been a “good saver” – compared to my peer group, but when I realized that so many are living on so much less, it encouraged me to take another look at my expenses and see what I might be able to slash so that i can reach my financial goals faster.

Right? I know that’s how I keep my perspective. If other people are making do with $50k a year household income, surely those of us making double that should be able to still live like we’re making a $50k per year income.