When I look back at my investing life, one of my biggest regrets is just not getting started sooner. It’s really kind of a shame when I think about it. I didn’t start investing until I was 27 years old, almost a decade after I had graduated from high school. That’s years of potential growth that I can never get back. It gets worse when you consider that I graduated from college in 2009, right when the market was at its bottom. If I had started investing back then, even just a little bit, I could be killing it right now.

Of course, I was a student for most of my 20s, so it’s not like I was swimming in cash. But I also worked part-time during the school year and full-time during the summer, not to mention the fact that I was privileged enough to have parents who could afford to pay for my tuition, rent, and food. Other than going out with friends, I basically had no expenses during those early adult years. In other words, I could have easily saved something.

The funny thing, it’s not that I didn’t want to invest or that I didn’t know it was something I should do. One of my formative personal finance books was The Automatic Millionaire, a book I picked up back when I was in high school. It set the foundation for the personal finance principles I follow today – pay yourself first, make saving automatic, and invest for the long term.

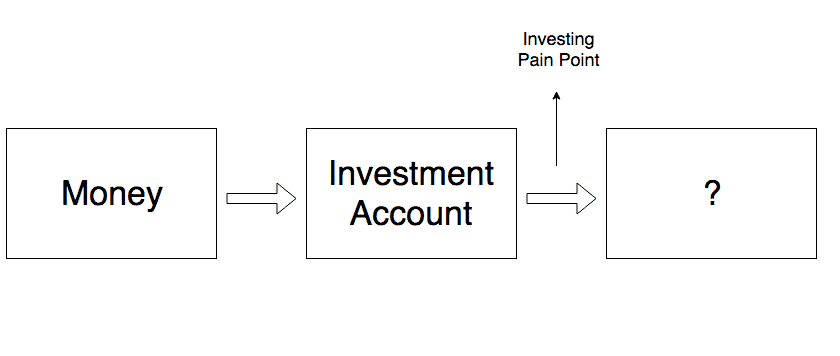

The problem is, even after reading that book, I never actually got around to the whole investing thing. I figured out how to open an investment account and I even put some money into it. But there was a part of the sequence that a newbie like myself couldn’t figure out – the part where you actually have to invest the money.

In today’s post, I want to address a question that I often get asked – why is it that I’m always suggesting that new investors use robo-advisors? It’s a fair question and one that puzzles a lot of people. After all, investing doesn’t have to be complicated. It really shouldn’t be that hard to just tell someone to open an account at Vanguard and put their money into a few index funds.

For me, it really comes down to one thing. Robo-advisors remove that pain point when it comes to investing – the part where you actually have to invest your money. It’s the pain point that stopped me in my tracks and caused me to start my investing life a decade later. If robo-advisors had existed back then, I’m pretty confident I would have gotten a huge head start in my investing career.

My Lost Investing Years

Even though I didn’t start investing until I was 27, I actually opened up my first Roth IRA when I was 18 or 19 years old. The problem for me was that I didn’t make it all the way to the end.

Here’s what happened to me when I started my first Roth IRA:

- I opened up a Roth IRA using E-Trade (it was the only brokerage company I knew)

- I deposited a few hundred bucks into my Roth IRA

- It sat there for a while since I didn’t know I was supposed to do something else.

It was that last step that I didn’t understand. I understood how to put money into the account, but investing the money – the most important thing I needed to do – was a mystery to me. I obviously know what I would have done in hindsight, but as a teenager, I didn’t know what ETFs or mutual funds were. To be honest, I didn’t even really understand what stocks were. No one had ever taught me this stuff. And I knew so little that I didn’t even know what I didn’t know.

So, even though I opened up a Roth IRA when I was 18 or 19, the small amount of money that I saved just sat there, uninvested, doing nothing. I never added more to it since I didn’t understand what I was doing. Eventually, I clicked around and figured out how to buy some shares of stock and I went ahead and invested the few hundred bucks I had into Borders stock. There wasn’t any real reason for me to do that – I just liked Borders and the share prices were so low that I thought it would surely increase in value at some point.

You all know what happened to Borders next. I never put another cent into that account. 10 years later, I started up my second Roth IRA. But instead of 10 years of growth, I was starting at zero.

Friction and the Investing Pain Point

The biggest barrier when it comes to investing, I think, is fighting the friction that comes with it. There’s that point that you can call the “investing pain point.” That’s the part that comes after you put money into your investment accounts, but before you actually get it invested. Opening a retirement account and putting money into it is the easy part. But you have to do more.

If you want to get a better understanding of what I mean by the investing pain point, just think about the difference between a savings account and an investment account. Ask any young person out there (or ask anyone really) and the vast majority of them will probably have a savings account. They might even have some money saved away in it. But ask that same person about their investment accounts and there’s a high likelihood that they won’t know what you’re talking about.

The reason why people have savings accounts, I think, is because bank accounts are easy. There’s no pain point. You open up your savings account, move money into it, and that’s it. You’re done.

I know it sounds so simple that it seems stupid for me to even claim that this factor holds people back with investing. But it’s a real thing that I personally experienced. It’s why I opened up a Roth IRA back when I was a teenager, then did nothing with it for almost 10 years. I’m confident I’m not the only person that’s faced this problem as well.

Robo-Advisors Solve The Friction And Investing Pain Point Problem

If robo-advisors had existed back when I was in college, I probably would have gotten a 9 or 10-year head start on my financial independence journey.

It’s my own personal experience that shapes my belief here. And when anyone asks me how to get started investing, I always direct them to whatever robo-advisor they feel like using. Betterment, Wealthfront, WiseBanyan, M1 Finance. Any of them are fine.

Below are some of my final thoughts about why I think robo-advisors are a legit way to start investing:

It Removes The Investing Pain Point. The key with robo-advisors is that they make investing seem the most like a bank account. You put money into the account and then you just walk away. When someone is just starting out investing, they need as little friction as possible.

The Fees Won’t Kill You. Generally, fees for most robo-advisors will be around 0.25% That’s very reasonable in my mind. There are also robo-advisors that don’t charge any management fees, which takes away that objection completely. A Vanguard Target Date Retirement Fund is going to have a 0.15% expense ratio. You’ll probably end up with 0.3% to 0.35% as an overall expense ratio if you use most robo-advisors. Yeah, you’re paying more for a robo-advisor, but if the difference is getting someone investing vs. not investing at all, that’s well worth the cost. And that small difference in fees is NOT going to be the reason someone can’t hit their savings goals.

It Makes Sure You Do Things Right. When I first started investing, my big fear was doing something wrong (I ended up doing everything wrong anyway, but that’s beyond the point). Robo-advisors have the benefit of making sure you invest right, even if you know absolutely nothing.

It Gets You Started In A Way That Isn’t Terrible. When it comes to investing, it’s so important to get started. But more importantly, it’s important to get started correctly. When things seem too confusing, the thing a lot of people do is walk into some financial advisor’s office and ask them to do the investing for them. That’s exactly what my brother did. With no idea of what to do with his money, he walked into an Edward Jones office and had them do his investing for him. All of those funds are now invested in actively managed mutual funds that carry a 1% expense ratio and a 5.75% front load. He messed up to start his investing career, and now his option is to either keep it there and pay those high fees, or sell it all, take the tax hit now, and reinvest it again somewhere else.

No, the robo-advisor route isn’t the best option for everyone. It’s not even the optimal way to invest (the optimal option would be to DIY it all yourself with Vanguard).

But we all make value judgments about what’s worth our time and what isn’t. The fact is, most people aren’t going to spend the time to learn even basic information about investing. They aren’t going to learn about asset allocations or mutual funds or ETFs or any of that stuff. So if a robo-advisor is going to get someone over that last hump, it’s worth the cost.

I know it would have been worth it for me. Starting out my investing career at 18 vs. 27 would have made a huge difference.

I wrote this post in response to some questions I’ve received about why I tell people to use robo-advisors. I know many will disagree. Feel free to share your thoughts. How’d you figure out how to start investing? What do you do with your friends and family members that are new to investing?

One of the many things that deter young people from saving is lack of know-how. The fact that they don’t know where to start means that they end up with regrets later since they failed to start saving early.

My first investments, aside from a company-sponsored 401(k), was an IRA with Vanguard. I think I had the money in a total market fund for a while. I didn’t really know what I was doing but had read some books that gave me more understanding that some people just coming out of college.

I’m fairly neutral on the subject of robo advisors. I don’t want to pay the fees myself, plus I like having control to make my own decisions. But I think they’re a good option for some people.

You are way ahead of most people. If you had told me back then to invest in a total market fund, I wouldn’t have known what that even meant. Robos aren’t for everyone – I just know they would have been a big service for me back in the day.

I would love to see a simple calculation/estimation of how investing even a little bit per month over those 9/10 years would have added up.

Well, I think during that period, returns were an average of about 5% since there was that big crash in the middle. $2,000 a year would have been very easy for me to do, even as a student. So it’d be about $23k today at that rate. That’s double what I have in my Roth IRA now, with pretty minimal saving.

The thing is, I suspect that if I had started investing back then, I’d probably have been motivated to try to max things once I saw the money going in there. So I bet it would have been more.

Why do you feel robo advisors are better than low price target date funds?

To me, it comes down to that last pain point – the part where you have to choose to invest the money. I like robos because they take away that last step – you put the money into the account and then its automatically invested for you correctly. If I go and tell mybrother to open an account at Vanguard and invest in a Target Date Fund, he will literally have no idea what that means. I’d have to sit with him and click the buttons for him. But if I tell him to go open an account at Wealthfront and put money into it, he do that.

Ultimately, it’s a value judgment. Target Date funds cost more than doing the same thing yourself. But we make the value judgment that its worth it because it makes it easier. In my mind, I’ve made the value judgment that robos are worth it just because of how they make investing really feel like just putting money into a bank account.