As we start a new year, I thought I’d issue probably the easiest call to action out there – the 52 Week Money Challenge. This is by no means an advanced money concept. Still, I think it’s a good thing for anyone to do, no matter where you are in your financial journey. We all should have some money set aside for emergencies. And the 52 Week Money Challenge is an easy way to keep that emergency fund topped off each year.

I first learned about this challenge a few years ago when I started getting interested in personal finance. You have to start somewhere and I was looking for ways to push myself just a little bit more. When you’ve got money coming in, it’s pretty easy to get lazy with your paycheck. Even if you think you’re saving money, a lot of it can slip through your fingers if you don’t put it to use somewhere else.

The 52 Week Money Challenge itself is pretty straightforward. Save a little bit of money each week and gradually increase the amount saved by one dollar every week. The idea is that by the end of the year, you’ll have a decent stash of money saved away without even trying.

The great thing is that the 52 Week Money Challenge is totally automated. All you need to do is take a few minutes to set it up once at the beginning of the year, and then you don’t have to think about it for the rest of the year. The computers take care of it all for you! I love seeing my emergency fund slowly grow each year without me even realizing it.

So with the new year, my challenge for you is to take the 52 Week Money Challenge.

The Normal 52 Week Money Challenge

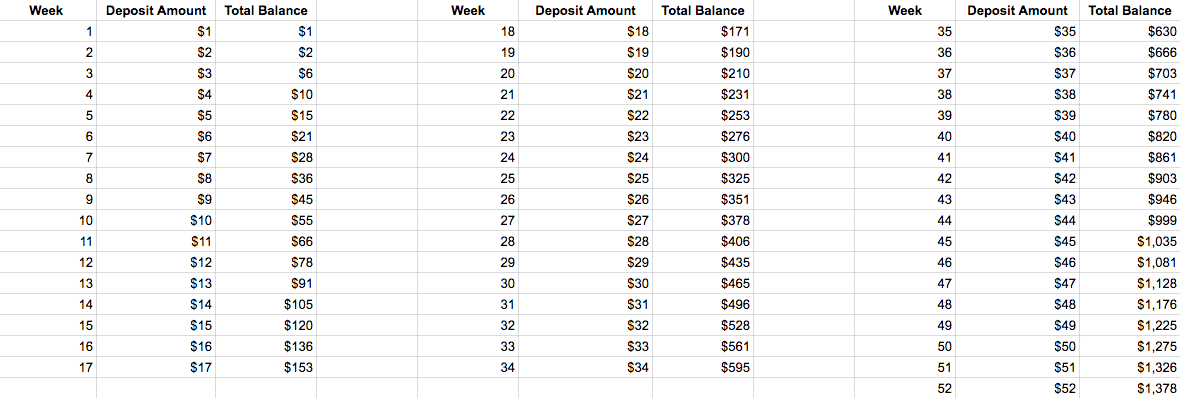

The normal way to do the 52 Week Money Challenge is through what you could call a gradual build-up. In week 1, you save $1. In week 2, you save $2. Week 3, you save $3. And so on and so on. By the time you get to week 52, you’ll be putting away $52 for the week. When you add it all up, that’s a cool $1,378 over the course of a year.

Take a look at the below spreadsheet to see the 52 Week Money Challenge in action.

If you want to do it the normal way, that’s totally fine. I’m personally not a big fan of doing it this way though. It seems to take way too long and doesn’t seem all that efficient. Why save only $10 in the first month when you can definitely save much more?

Plus, doing it this way puts unnecessary strain on yourself as the year progresses. I prefer balancing things out over the year. I feel like I notice the money disappearing even less if it’s the same amount being deducted, every week, without fail.

The Way I Recommend Doing The 52 Week Money Challenge

Instead of doing the 52 Week Money Challenge in the normal way, I instead divide $1,378 by 26. The number 26 represents the number of paychecks I receive in a year. Most of you probably get paid in the same bi-weekly manner.

$1,378 divided by 26 means you need to save $53 every two weeks in order to complete the challenge. That’s only $3.78 per day! I think every person reading this has the ability to save $53 every two weeks without even thinking about it. Would you even notice if your paycheck was $53 less each time?

Setting up the 52 Week Money Challenge is a simple thing to do. Take whatever savings account you use and automate it to deduct $53 every two weeks from your checking account.

I use Ally Bank and have it set up so that every 2 weeks, Ally withdraws $53 from my checking account and sends it to a savings account. The 2-week periods line up with my paychecks. Each time my paycheck hits my checking account, I’ve already got $53 getting deducted from it. I don’t even notice the money leaving my account since it’s coming out at the same time that I’m getting paid.

Set It Up Once And Do It Forever

Obviously, the 52 Week Money Challenge isn’t going to make you rich. But what it does do is set a floor for what you’ll save each year. We all need that emergency fund. If you’re still building it up, then putting away $1,378 automatically is a good way to get started.

Even if you have a full emergency fund, saving an extra $1,378 isn’t a bad idea. We all have emergencies and my guess is that, over the years, you’ll start dipping into that emergency fund. Isn’t it much easier to keep that emergency fund slowly growing, with minimal work, instead of having to scramble to refill it if something happens?

I’ve been doing this challenge for half-a-decade now and I plan to keep doing it for the rest of my life. It’s a low-impact way for me to save some extra money each year, without even noticing it.

If you really don’t want to store that extra money away in an emergency fund, that’s fine too. Just find something else to put that money into. The point is to keep it doing this challenge forever, automatically.

And of course, if you’re saving more money, keep doing that too! The point is that the 52 Week Money Challenge sets a floor. No matter what happens, you’ll automatically save $1,378 by the end of the year.

It’s been years since I first started the 52 Week Money Challenge. And I don’t even notice I’m doing it anymore.

If you’re looking for ways to save more money, check out some additional apps I use that help me squeeze a little bit more into my savings every month:

- Dobot is a free app I use that monitors my checking account and automatically saves small amounts for me each week that it thinks I can afford to spare. It’s a great way to save more money without thinking about it. You can read my full review of Dobot here: Dobot App Review: A Legit Free Alternative To Digit.

- Peak is another free app I use that monitors my daily transactions and rounds my transactions to the nearest dollar. It then saves the spare change for me in a separate savings account. You can read my full review of Peak here: Peak Money App Review: A Free Goal-Based Savings App.

Have you done the 52 Week Money Challenge? Do you put your own spin on it?

We’ve had a few posts on the site about the 52 week money challenge, but I hadn’t heard of this twist. Two other ways we’ve proposed doing it is backwards (start saving the big amounts while you are motivated early on in the year as well as doing it “randomly” where you cross off an amount each week depending on how much you feel like saving.

Backwards is definitely a good way to do it, and the bingo style of the 52 week challenge is great too. Really, any challenge is great. Just gotta make a point to push yourself!

I’ve never heard of the 52 week money challenge but it looks fun and I will definitely. be starting on Sunday. Thanks for the awesome tip.

Hope you and your family have an awesome 2017!!!

Thanks MSM! It’s just an easy way to save some extra money. Happy new year and see you in 2017!

Have you ever thought about investing your emergency fund or do you keep it in cash? The return on the $53 deposits every 2 weeks compounding with some index fund dividends looks really nice over a 5,10,30 year period. Investing my emergency fund starting 6 years is one of the better decision I’ve made – it’s up about $28,000 more than if I would have left it as cash in my ally account. I’ve always considered my Roth IRA contributions as a potential back up emergency fund if I really needed it. Just a thought! Great challenge – I personally automate my savings across 4 different accounts that build from your escalation approach highlighted here.

Great question! I’m don’t like investing my emergency fund because I think of it more as insurance and I just feel more comfortable with it sitting as cash. One thing I do though is to keep it in FDIC insured savings accounts that earn 5% interest. This is something I learned from the churning folks, but basically, if you open up prepaid debit cards, you can put away around $10k in FDIC insured savings earning 5%. It doesn’t compound at 5% mind you, but it does beat inflation every year at minimum. And it’s still completely liquid.

It’s definitely going to be the subject of a future post.

And up 28k on your emergency fund? You must have a ton of money in emergency savings!

Great idea! And I love that you just use the money for your emergency fund.

I’m a huge fan of automated anything. What you don’t see you won’t miss. (Thus works for food too. Ice cream is only in the house during weekends.

Ice cream is in my house everyday!

Hey, you should try Digit. That’s a very easy way to save and it’s in a different account. The money is out of sight, out of mind. Really cool.

Happy New Year!

I love Digit! Been using it for almost 2 years now! It’s definitely an app I recommend to people as well. Just another easy way to keep money flowing out of your checking account and into savings. Happy New Year Joe!

FP, I like the 52-week challenge idea. Any way to gamify savings is an advantage to most people. We want to do fun things, not sacrifice.

What will you do with your $1378?

I always just put the $1,378 into my emergency fund. My emergency fund is enough for me to survive right now, but I would like to see it higher.

Yeah I really need to stop getting into money fights. 🙂 I’m a big fan of automatic savings and paying yourself first. Great idea splitting it up based on when you get paid. Like you said, if you have things set up correctly, you won’t even notice the money missing from your paycheck. What’s more, your lifestyle will adjust to the lower pay which is a good thing.

That’s the great thing! I just set it up once a long time ago and I never mess with it. Every year, without fail, that’s $1,378 saved away. I obviously save much more on top of that, but I’ve at least set up a floor that I’ll always reach no matter what.