Diversification is the bedrock of good financial principles. As the saying goes, you never want to keep all of your eggs in one basket.

This all makes logical sense. The world is a complicated place full of unknowns. And since none of us can see into the future the best we can do is go into the future as prepared as we can be. Diversification, when you think about it, is basically the art of creating backup plans. We don’t know what the world will throw at us on any given day, but if one thing doesn’t work out, we can at least have other options.

I like to have a lot of backup plans in place. When I quit my job a few years ago to work for myself, I gave myself a bunch of backup options in case things didn’t work out. And just as I have backup plans for my career, I also have backup plans when it comes to my money.

One area where I like to have a lot of different backup plans is with my emergency fund. Instead of one emergency fund, I have multiple layers of emergency funds, each working on top of the other. Here are the three types of emergency funds I have and how they all work together.

The Traditional Emergency Fund

The first layer of my emergency fund is what you’d call your traditional emergency fund. This is simply money I keep in the bank. If something goes wrong, I have money set aside that I can easily use.

The most straightforward place to keep your emergency fund is in a regular high-yield savings account. Ally, Discover, or Marcus by Goldman Sachs all have excellent high-yield savings accounts with no fees or minimum balance requirements. If you don’t want any hassle, you can put your emergency fund in any of these accounts and be perfectly fine.

Personally, I think the traditional emergency fund advice is a bit too boring for me. Plus, I don’t like keeping a huge amount of cash earning essentially no interest. Instead, I’ve opted to get the best of all worlds by utilizing a mega-high-yield savings account strategy. These are bank accounts that offer 3-5% interest, but come with some limitations and require some initial setup work that is a bit more involved compared to your traditional savings accounts.

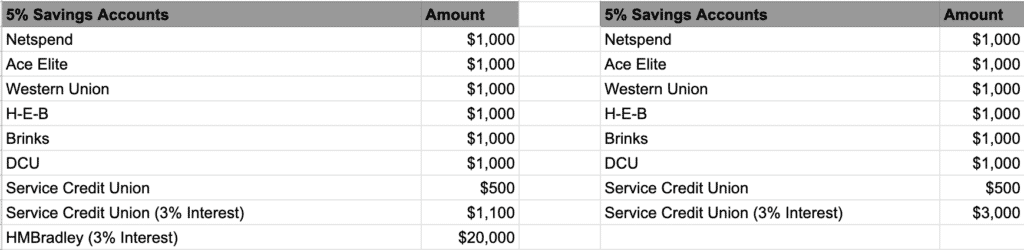

Between me and my wife, we have 17 different bank accounts earning 3-5% interest. Importantly, these are all FDIC-insured accounts, so there’s no risk of loss. In a way, my emergency fund also doubles as a sort of bond allocation in my overall portfolio.

Here’s a list of all of my different emergency fund bank accounts:

The things to note here:

- Netspend, Ace Elite, Western Union, H-E-B, and Brinks are all part of the Netspend family of savings accounts and are capped at $1,000 in each account earning 5% interest. I have 5 of these accounts and my wife has 5 of them.

- DCU earns 6.17% on up to $1,000. I have one for me and one for my wife.

- Service Credit Union has two good savings accounts – one that offers 5% interest on up to $500 and another that earns 3% interest on up to $3,000.

- HMBradley has a 3% interest savings account, but it does require a monthly direct deposit to activate the 3% interest. The key thing about HMBradley is that they give you 3% interest on up to $100,000.

- Porte is another potential option for 3% interest on up to $15,000, although I don’t personally use them at the moment.

There’s a lot that goes into these mega-high-yield savings accounts, and I’ve written a couple of long posts that detail how these accounts work. Definitely give them a read if you’re looking for a good emergency fund hack that most people don’t know about.

- Where To Get 5% Interest Savings Accounts Now That Insight Is Gone

- Netspend Account: The Ultimate Guide to a 5% Interest Savings Account

- DCU $20 Referral Bonus – Step By Step Guide (Plus A 6% Interest Savings Account)

- Getting More From My Emergency Fund With 3% and 5% Interest Savings Accounts

So, that’s the first layer of my emergency fund – the basic emergency fund. If you want to keep it simple, you can put your emergency fund into a traditional high-yield savings account. But if you want to supercharge it, then follow my emergency fund strategy.

The Side Hustle Emergency Fund

The second layer of my emergency fund is what I like to call my Side Hustle Emergency Fund. For most of us, the main purpose of our emergency fund is to serve as a buffer in the event of a job loss. A lot of other things that we think of as emergencies – cars breaking down, home repairs, etc – are really expected expenses that you probably should budget for. The time you really need an emergency fund is when you’ve lost your income and need money to hold you over until your income returns.

A side hustle emergency fund does exactly that, providing a way for you to earn income and buffer yourself against income loss. So what exactly is a side hustle emergency fund? I basically think of it as all of the income-generating activities you have outside of your day job. The key is to set up these side hustles before you need them because when things get tough, you don’t want to find yourself scrambling to find a side hustle or spend time ramping up.

What makes the side hustle emergency fund interesting is that it basically gives you a sort of income floor that you can use to stretch your traditional emergency fund a bit further. If you have a six-month emergency fund, for example, being able to bring in $1,000 or $2,000 per month could allow your traditional emergency fund to last a few extra months or even longer, depending on how much you need to spend each month.

Making an extra $1,000 in a month isn’t difficult to do either. That’s about $33 per day. In today’s world, anyone can make an extra $33 per day, especially if you’ve prepared in advance.

The Credit Card Emergency Fund

The final layer of my emergency fund includes points and miles I’ve earned from credit cards. Most people don’t think of points and miles as money, but that’s really what they are. These are currencies that have an actual cash value. Indeed, the points and miles I currently have are easily worth between $10,000 and $20,000. That’s a lot of value I have sitting in my rewards balances.

Not all points and miles are created equally, however. Some are easier to turn into cash or cash equivalents compared to others. Still, at worst, you can use them for flights and hotels, which are things you might need if you’re in a pinch. And in many cases, if you absolutely need to, you can turn them into cash.

Take my own example of how I’ve been converting my points to cash. My Chase Sapphire Reserve currently allows me to cash out my Chase Ultimate Rewards points at 1.5 cents per point for groceries, restaurants, and home improvement stores. This isn’t a normal benefit, but they’ve had this feature since last year. So, for nearly a year now, I haven’t had to pay for groceries or restaurants.

If you found yourself in a tight spot, having a stash of credit card points can make a big difference and allow you to stretch your traditional emergency fund longer if needed.

Final Thoughts

I like having different layers of my emergency fund. It gives me comfort to know that I have money in the bank, money coming in if I need it, and points and miles that I can turn into money as needed.

Is it necessary to “diversify” your emergency fund like this? I’d say no – it’s not necessary. If you want to keep things simple, that’s totally fine My own system sort of happened by accident. But it’s one that works out well for me.

Love the article! After reading, I’m trying to get a DCU account and don’t meet their eligibility criteria (despite living and working in MA/NH). Any advice?

You can qualify by making a $10 donation to Reach Out For Schools.

Great points there! In today’s world with so many amazing options out there, it’s best to diversify your funds. Also, like you mentioned, it brings down the risk by a big margin. Thanks for sharing.

If anyone can access Canvas Credit Union, they have a decent reverse tier account option too.

Totally agree. No matter how secure any job seems, it scares the crap out of me to have all my eggs in one basket. I hadn’t thought of credit card points as an emergency fund before, but it’s a good point. And there are other resources that can be tapped too in a pinch–like home equity and retirement accounts (although these are only available to people who have already built this kind of stuff up, not those just starting out, obviously). Options equal peace of mind.