There’s an interesting thing that happens when you stop paying attention to what the market is doing . . . nothing.

I gave up on following market news a while ago because, frankly, it made me way too angry. Every article would always be the same – some guy predicting a big market crash for whatever year was coming up. It seems like the best way to make a name for yourself is to just keep predicting recessions and market crashes. Even if you’re wrong, no one seems to care – you just make up some excuse for why you were wrong and continue making more predictions. Then, when you finally do get it right, you get to go on every news show and be the financial seer that predicted the last big crash!

Maybe I need to start doing that…

In all seriousness though, downturns, crashes, and recessions do happen – there’s no way around that. The problem is that these big predictions are what sells to the masses and as a result, this is what people see when they’re scrolling around the internet reading financial news. It has the unfortunate effect of confusing and scaring people so that they ultimately do nothing.

You can see this in action just by scrolling through online forums. Over the past few years, I’ve increasingly seen more and more questions on Reddit and other forums from new investors asking if they should hold off on investing and wait for the next market downturn. Indeed, if you go back all the way to 2013, you’ll see people asking this same question – things were too high even back then. Everyone is just so scared that the day they start investing will be the day that everything comes crashing down.

The simple, straightforward advice I give is always the same. No, you don’t need to wait because, more likely than not, you cannot predict where the market is going.

But even more importantly, on a practical level, it really doesn’t matter what the market does at any given point because you’re going to be investing in small chunks over a long period of time anyway – likely hundreds of times over the course of your life. Sometimes the market will be up. Sometimes it’ll be down. But you’re never risking it all at once, at least not when you think about how investing works on a practical level.

We All Dollar-Cost Average By Necessity

There’s this big fear that most people have where they think they’ll invest their money into the market and lose it all. The solution to this problem has always been to dollar cost average your way into the market.

The general concept behind dollar-cost averaging is fairly simple. You basically take a lump sum, break it up into smaller pieces, and invest those small pieces on a regular, consistent basis over a period of time. If you have $100,000 to invest, rather than investing it all at once and risking a big loss if the market is on the decline, we instead might divide that $100,000 by 12 months and invest the same amount each month. If the market goes down, we’re investing small amounts as the market drops – buying each share at a cheaper price and reducing our potential losses. And if the market goes up, we’re doing the same, investing as the market goes up.

Over the long run, dollar-cost averaging does worse when compared to lump-sum investing. This makes logical sense when you think about it. The market tends to go up more often than it goes down, so in general, if you dollar-cost average, you’ll more likely be investing as the market goes up, rather than as it goes down. As a result, most people would benefit more by investing everything they have at once, rather than dollar-cost averaging their way into the market.

People who are worried about the market being too high right now are essentially thinking in terms of lump-sum investing. They’re afraid that they’ll put in their money now and see it drop. But the nature of income doesn’t work like that. Even though many of us might make $1 million or more over the course of our lives, none of us gets it all at once. Instead, we get it in small amounts. And on a practical level, we can only invest small amounts each time.

In short, this means two things when it comes to investing: (1) you probably don’t have hundreds of thousands to invest all at once, and (2) you’re probably looking at an investment time horizon that’ll stretch decades, with hundreds of smaller investments over that period of time.

I think of this as basically dollar-cost averaging by necessity. We’re all just breaking up our investing into little chunks over a long period of time. That’s actually a great thing because once we understand this, we can let go of our fear of losing all of our money. If the market tanks, we’ll still keep investing our income week-by-week, month-by-month. And if the market goes up, we’re still doing the same thing. Each investment is going in at a different point in time. None of it is going in all at once.

No One Invests Once And Never Again

The fact that very few of us have huge sums to invest all at once leads me to my second point about why I tend not to worry about where the market is at the time I invest.

None of us is just going to invest once and then never invest again.

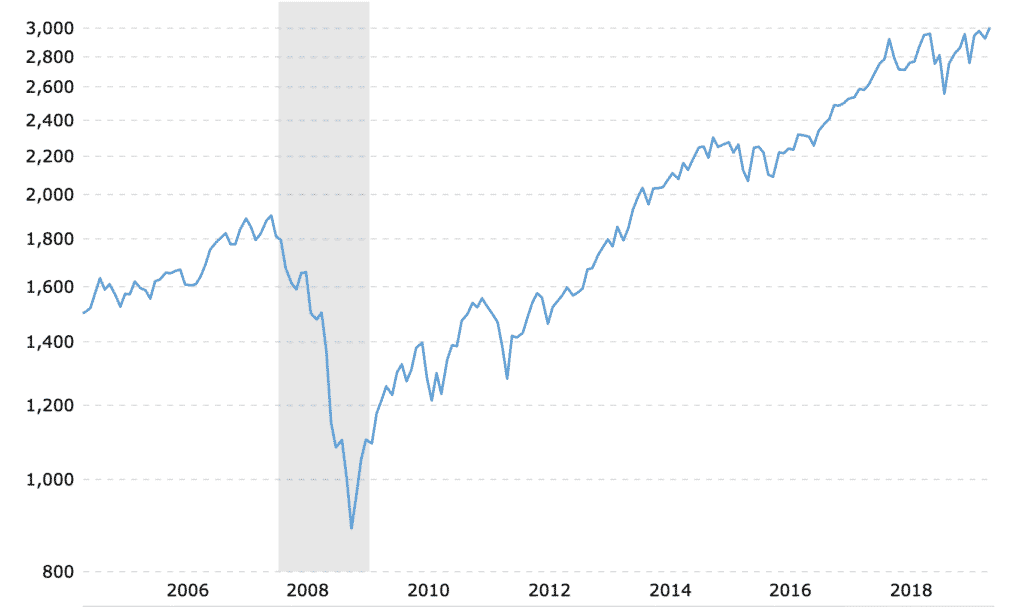

This seems to be a big fear that people have – that they start investing, the market tanks, and they lose everything. If you look at the S&P 500 in 2007, that definitely would seem scary. Indeed, if you started your investing career at the top, you’d have seen that money drop by almost 50%.

But unless you got super spooked by the financial crisis, you didn’t just invest at the top and then stop investing forever. Instead, assuming you stayed the course and kept your job, you probably just kept investing regularly as you got paid.

You’ve got small amounts invested at the top, but you’ve also got money invested in the middle and at the bottom. Some of your money went down a lot. Some of it went down just a little bit. And some of your money might even grow from the day you put it in.

If you invest today and the market crashes tomorrow, that’s not the end of your investing career. You’re going to be investing again later, dollar-cost averaging into the market out of necessity because that’s how money and income works.

You don’t just invest once. Instead, you invest hundreds of times.

You Have A Long Investing Horizon

So is the market too high? Is the next big crash coming? I have no idea. What I do know is that, for practical purposes, it really doesn’t matter.

Yes, it’s better to invest when prices are low, but 10 years from now, 20 years from now, or 30 years from now, what will these prices look like? If we believe that the future is bright, then it stands to reason that these prices might look very low in the future.

It’d matter more if we only invested huge lump sums every once in a while. But we don’t. Even those of us looking to retire early are still likely to have an investing time horizon of a decade or more where we are regularly putting money into our investments. If we’re investing 12-26 times per year, that’s hundreds of different prices we’ll pay for our stocks and bonds.

Some of those prices will be higher and some will be lower. But the beauty of this is that our investments are going to be spread out over time, which reduces our risk over the long term. We’ve really got time on our side here.

Now, if you hit the jackpot and win a million dollars all at once, then you can be worried. But until then, if you’re investing using your income like 99% of us do, then you really don’t have a lot to worry about. Just keep that income coming in and remember that you’re not actually putting it all on the line right now. There’s always going to be more money coming in.

While DCA every month may be a good idea, what about the minimum fees you have to pay to brokerages? You’ll be spending too much money on fees instead of having the money actually working for you. What I plan to do is dropping $10k every year (I’m just a student.) since only that way will paying the fee make sense. What are your thoughts on this?

You shouldn’t pay any fees to invest besides paying expense ratios, which is unavoidable. Don’t use any brokerage that charges you a fee to invest. Vanguard is free. Roboadvisors like M1 Finance are also free.

There is a phrase that encapsulates much of what you wrote: “It is not timing the market, it is ‘time in’ the market.” In other words, get as much of your money into the market as soon as possible. I didn’t DCA. I didn’t set aside a certain amount per time period for investing. Instead, I would just repeatedly move money into a mutual fund ASAP. Frequently, I would just do a month-on-month comparison. For example, I would look to see what my balance was last month after the rent check cleared vs. this month after the rent month cleared. If this month’s balance was higher, I would take the difference and invest it in the market. Similarly, any bonuses I received went into the market. Some months, I would be running behind schedule compared to the previous month so I wouldn’t invest.

What I have found since the “Trump tax cuts” is that my investments are throwing off so much interest and dividend that I need to increase my payroll withholding to cover the income taxes on my investments. That lowers my take home pay to the point where I am running a “deficit” every month. “Deficit” in this context means my take-home pay is not covering my living expenses. That’s because my dividends & interest are incurring increased taxes but I still have the dividends & interest to help pay my expenses. However, the rate of my new investments has slowed down. I look upon this as a bit of trial run for retirement. I need to tap my portfolio to cover a portion of my living expenses.

The way you moved money into the market over your lifetime is exactly why I’m not too worried about where the market is. You bought in at so many different price points that ultimately, it really doesn’t matter when you went in – just that you went in. Thats my thought anyway.