One of the more confusing questions some Dashers have about DoorDash is whether your DoorDash acceptance rate matters.

DoorDash keeps track of several metrics for each Dasher. These include your customer rating, your acceptance rate, your completion rate, and your on-time and early delivery rate. Customer ratings undoubtedly matter (DoorDash specifically states that if your customer rating gets too low, you risk deactivation). Completion rate also matters. DoorDash makes clear that you can be deactivated if your completion rate falls too low.

Acceptance rate is another matter, however. The fact is, your acceptance rate does not matter. Your acceptance rate can be as low as you want and you do not risk deactivation. The only thing that would make it matter is if you want Top Dasher status (which, in my view, isn’t worth getting for most people).

In this post, we’ll go over what the DoorDash acceptance rate is and why it does not matter.

What Is The DoorDash Acceptance Rate?

DoorDash tracks several metrics in the Dasher app, one of which is your acceptance rate. The acceptance rate is the number of orders you accepted out of your last 100 delivery requests. So, if you have a 50% acceptance rate, that would mean you accepted 50 out of your last 100 delivery requests.

Note that your acceptance rate is different from your completion rate. The completion rate refers to the number of delivery requests you accept that you also complete (i.e. successfully deliver). Your completion rate will drop if you accept a delivery and then do not complete the order because you canceled it or something else stopped you from completing it.

It’s important to keep the distinction between these two metrics in mind. That’s because your completion rate does matter. But your DoorDash acceptance rate unequivocally does not matter.

Your DoorDash Acceptance Rate Does Not Matter

I hope I’ve made it clear. Your DoorDash acceptance rate does not matter. DoorDash also makes this very clear in its Dasher policies.

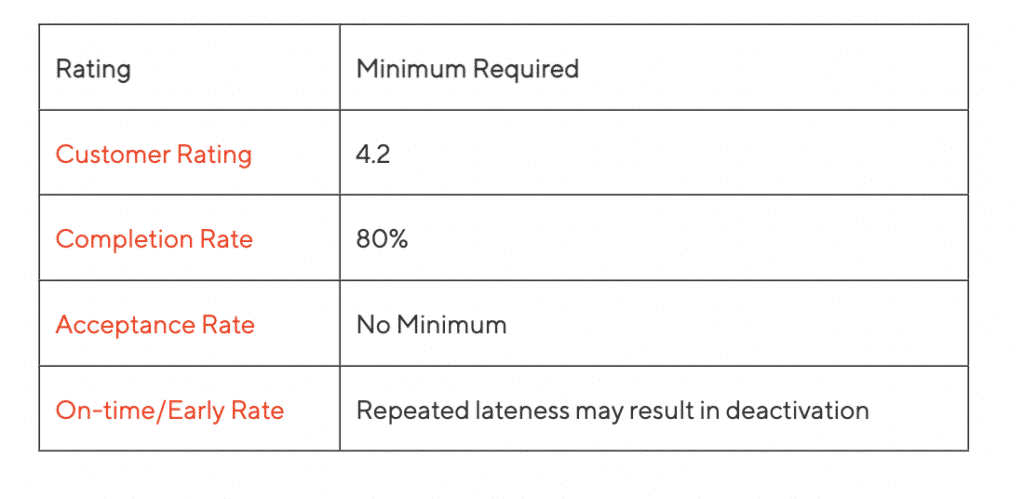

Indeed, on their website, they have this chart that tells you the minimum requirements for each metric.

As you can see, DoorDash explicitly states that there is no minimum acceptance rate required. This makes logical sense too. Dashers are independent contractors, which means they have the right to accept or reject any delivery requests sent their way. DoorDash has to do this because if they don’t, they risk having too much control over Dashers and having Dashers classified as employees. They do not want to do this, so that’s why there’s no minimum acceptance rate required and why Dashers are free to accept or reject any delivery requests sent to them.

In contrast, DoorDash can make your completion rate matter because once you’ve accepted an order, you have essentially agreed to complete the order. If you don’t complete it, it’s similar to a breach of contract, since you accepted the order, and then decided not to do it.

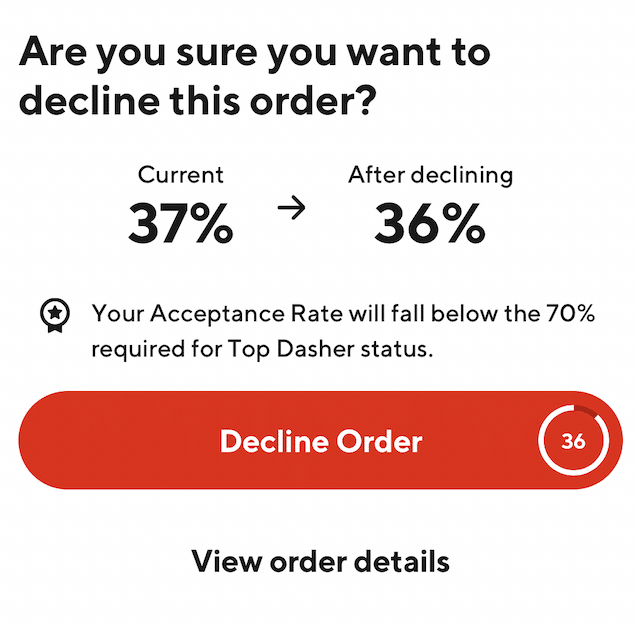

The only time your acceptance rate does matter is if you are trying to get Top Dasher status. To qualify for Top Dasher status, you need to maintain high customer ratings (4.7 or higher) and a high completion rate (95% or higher). You also have to maintain an acceptance rate of 70% or higher.

The reason why I don’t think Top Dasher status is worth getting is because of this acceptance rate requirement. If you’re accepting 70% of orders, you’re likely accepting orders that aren’t worth doing or aren’t profitable for you. When you’re a Dasher, you’re basically a small business. You need to act like one and only accept orders that make sense for you.

That being said, there could be times when Top Dasher status is necessary. If you’re in a market where the benefits of Top Dasher status make sense (specifically if you’re in a market where you usually can’t Dash Now unless you schedule yourself in advance), then maybe you need to maintain a high acceptance rate.

But for the vast majority of people, Top Dasher status won’t be worth it, which means the DoorDash acceptance rate does not matter.

DoorDash Priority Orders

There is one wrinkle that was recently introduced with DoorDash, although it’s unclear how it impacts your orders and ability to earn money with DoorDash.

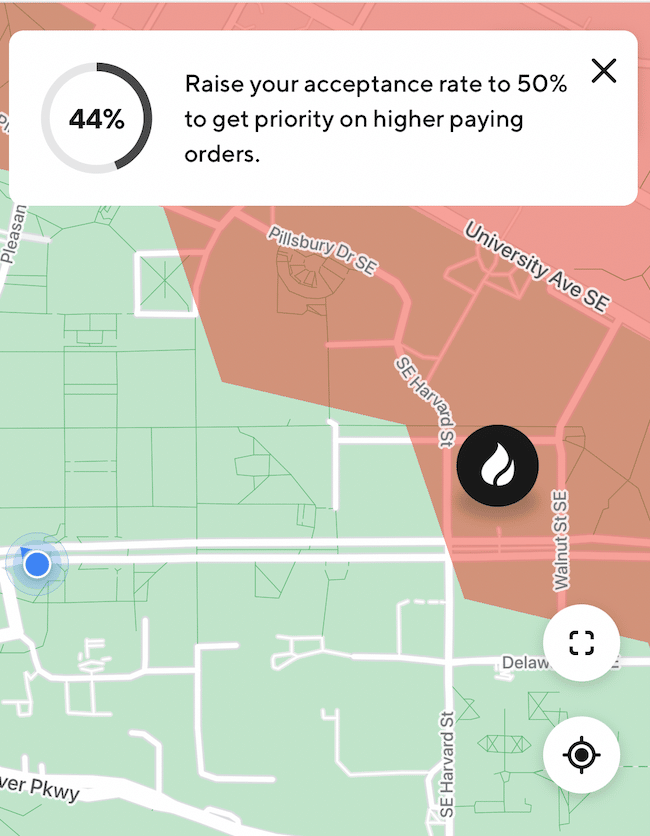

DoorDash now has a program that gives eligible Dashers priority access to higher-paying orders. DoorDash says that these orders all pay $2 or more per mile. To get priority access to these orders, you need to have a customer rating of at least 4.5 and an acceptance rate of 50% or higher.

DoorDash specifically states that “[i]f there are multiple Dashers nearby who can take on one of these offers, we will break the tie in favor of prioritized Dashers like you.”

I rarely have an acceptance rate above 50%, so I don’t usually qualify for priority orders.

Whether this matters or not is unclear. Personally, I don’t look at orders based on how much they pay per mile, but rather at how fast I can complete them. Even low-paying orders can be worthwhile if I can complete them fast enough. For example, here’s a YouTube Short of me completing a low-paying order that was still worthwhile because of how fast I could complete it.

Since I do DoorDash on a bike, I think this likely won’t impact me too much and I still won’t be aiming to improve my acceptance rate. It can be annoying though that DoorDash keeps pushing the acceptance rate and using tactics like showing you how far your acceptance rate will decline if you reject an order.

If you want more info about the priority status program, DoorDash has more info about the program here.

Final Thoughts

My DoorDash acceptance rate typically hovers around 20-30%. At times, I’ve had my acceptance rate fall into the single digits and have never had any issues with my Dasher account.

I do this because I’m picky with my orders. I only want to accept profitable orders that are worthwhile for me. As a result, if I see an order that I don’t think is worth doing, I’ll reject it and wait for another one. I recommend you do the same too and don’t worry about your DoorDash acceptance rate.

That being said, if you are concerned about your acceptance rate being too low, DoorDash will often send offers to eligible Dashers with the option to reset their acceptance rate. It can be worth doing if gaining access to the Top Dasher program or priority access matters to you.

For more information about resetting your DoorDash acceptance rate, check out my post: DoorDash Reset Acceptance Rate (Should You Do It?).

I door dash in a car and I still 100% agree that acceptance rate doesn’t matter. My acceptance rate is always under 20%, yet I only take orders that are over $2 per mile and a minimum of $6.

For example, let’s say there are four dashers in the same area – dasher A with a 100% acceptance rate, dasher B with a 70% acceptance rate, dasher C with a 50% and dasher D with a 20%. Let’s also say that all four are the same distance from the restaurant.

An order comes in for $2 for 10 miles. If door dash gives priority for higher paying orders to dashers with a 50% acceptance rate, then hypothetically, this order should go to dasher D first, since D has the lowest acceptance rate. Obviously, D will decline this order. It will then go to dasher C. At 50% acceptance rate, C might accept….(Duh)… but if C declines, the order will go to B who may or may not accept, and then finally to A who will happily accept this POS order.

A is now gone 10 miles away from the restaurant, making dasher B the “highest priority” dasher. Let’s say another crap order comes in, $3 for 11 miles. Dasher D will decline. Dasher C will now accept to keep their 50% acceptance rate.

Dashers A and C are now gone, leaving B and D at the restaurant. Another order comes in for $2 for 12 miles. Dasher D declines again. Dasher B takes it.

Dasher D is now the only one at the restaurant, while the other three are gone at least 10 miles away. D happily declines more crap orders until a juicy $8 for 1.1 miles comes in. Dasher D takes it and returns while the other three are still busy talking their original orders. D declines more crap and takes another $15 for 2 mile order.

Finally, the other three dashers return to the restaurant and pick up all the crappy orders that Dasher D declined while they were gone. Rinse and repeat.

Even if, on the off chance that good orders come in first, giving A, B, and C priority, D will still sit there and decline crap. That crap will be offered to A, B, and C as soon as they come back.

I see absolutely no reason to take any crappy orders ever. I’ll let someone else do that while I take good orders. Have fun taking all the garbage I declined.

When my Acceptance Rate reached 70%, I got more orders and more higher paying ones. I dash the same times and days each week. I’ve been dashing 6 weeks. Lastly, it’s easy to exceed the 70% when you’re getting a lot of high paying orders and several high paying orders are stacked. I am averaging $30-40 an hour now.

Recently, my acceptance rate has risen above 70% and I seem to be getting cherry orders now. Up until a few days ago, I thought acceptance rate didn’t matter. Now, I’m of a different mind.

Your comment is more valuable than the article, so thanks! Someone who does doordash on a bike is not qualified to write this article because most people drive cars and it’s completely different situation.

Good info for someone just starting out with the app…got me wondering though..wish you’d have been more specific, given examples, re: what makes an order appealing to you as a Dasher. Is it distance? I believe you dash using a bicycle, but since I’ll be in a car, would I consider gas cost the most important or does amt/cost of total order factor in?

No doubt, I’m overthinking it! You’ve had such phenomenal success… I’m excited for the possibilities.

Thanks again,

Adrienne

I do not agree. It’s well known that your acceptance rate affects the quality of the orders presented to you. Therefore in order to receive these carrot on a stick orders one is forced to accept low paying orders to maintain eligibility. The notion that you can refuse orders without repercussions is false. The article mentions pilot program, it’s no longer a pilot and it’s totally unfair and certainly not indicative of a independent contractor employment arrangement. Furthermore the mathematics used to determine the acceptance rate is seriously flawed. Recently I began dash at 68% acceptance completed 11 deliveries with no refusals (100% acceptance of 11 offered) dash ended with my acceptance rate now at 70% how is that possible?

68% and you accepted all 11 orders just for your AR to rise to 70%? Mind you if you decline one single order the AR will drop by 1-2%. To makes matters even worse is that Support can never explain this without reading off the website. Idk what’s worse, the runaround or terrible support agents

Well it’s possible since -I believe- they use kind of a “rolling scale”.

Imagine the last 100 orders are on a wheel and you are side by side accepting one at time so each order will then take the place of one on the wheel. Every time you accept one it takes place of next in line. If they are going in the order of the last 100 like they say if you decline 1 out of 100 you may very well have to complete 99 orders to then bump that declined order of the wheel. If every 50 orders you decline 1 you may have to do 24 before bumping the one off the wheel…They don’t just take an average every time you complete an order. This is my theory and I hope I explained it right.

I have been noticing since reaching Platinum that Door dash is toggling or shutting off my acceptance rate at times. I call it being stuck in which I have to write a long summary after chat to explain what is going on. They swear its not stuck. But another customer service told me that it was. Funny how when you complain it gets fixed immediately. I feel like they shut off or toggle when they want you to lose percentage to take the bad ones because no one else will. I wish they were more honest with this system as I have done days in a row at 100% only to be stuck which happens around 72% in my case when I should be up to 90% plus. It is so not fair when you work so hard. They need to take their drivers that are out there working hard seriously! So far so good this week, but we shall see. LOL

In “Gig Economy”