Welcome to Part 3 of my series detailing how I invest in my employer-sponsored retirement plans. Today, we’re going to look at the exact funds I contribute to in each of my employer sponsored retirement plans. If you haven’t already, be sure to check out Part 1, where I discuss my general investing philosophy, and Part 2, where I discuss the different types of employer-sponsored retirement plans.

For those of you that don’t know, back in June 2016, I switched jobs (taking a $50,000 pay cut in the process). I ended up rolling over all of my 401(k) contributions from my prior employer into my new employer’s 457 plan. Then I needed to figure out how to put my money to work.

Through my employer, I have access to three types of retirement plans:

- A 457 Plan

- A Defined Contribution Pension Plan

- An HSA

All together, that’s a little over $30,000 per year I can put away into tax-advantaged retirement savings! (As of 2017). Here’s how I invest those contributions.

457 Plan

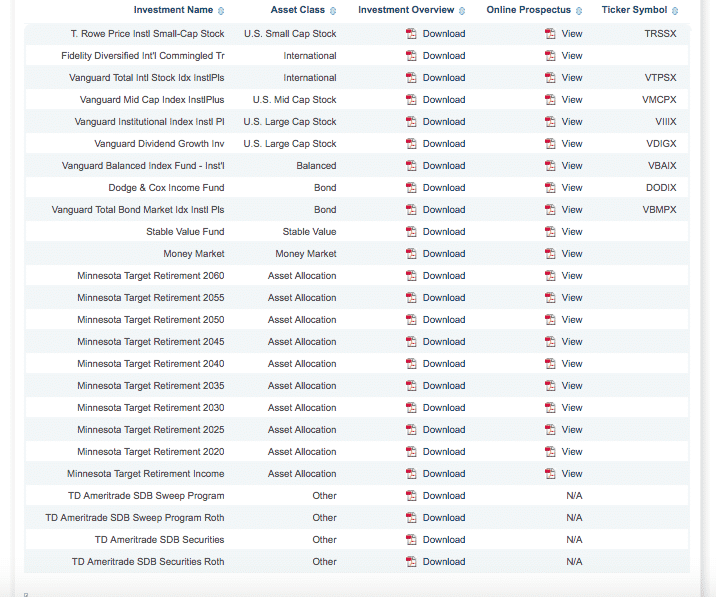

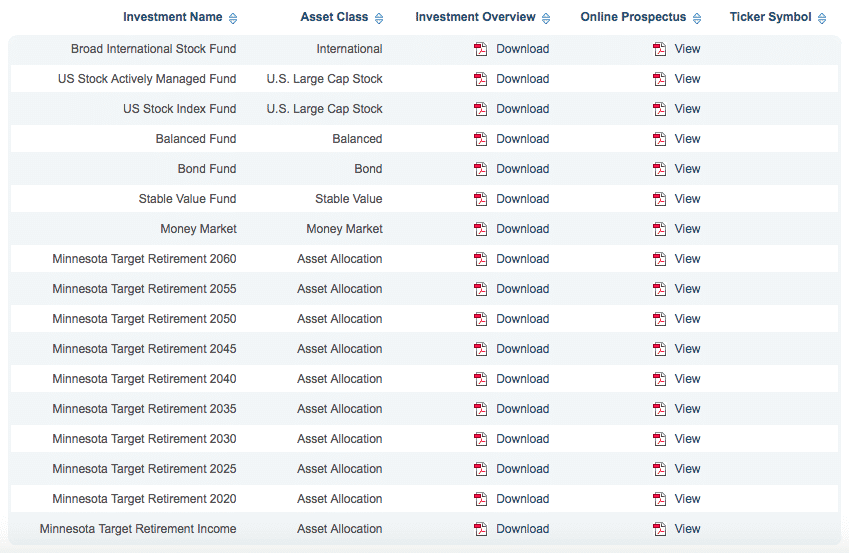

The first step when choosing investments is to look at what my choices are. Here’s a look at the fund options in my 457 Plan:

These are actually pretty good options. If I wanted to make things super easy, going with one of the Target Retirement Funds would be totally fine. Especially good is the fact that those funds only have a 0.12% expense ratio, which is really low cost. If you have no idea what you’re doing or just want to make things really simple, a low-cost Target Retirement Fund is completely appropriate.

I’m a bit more of a do-it-yourselfer though, so I opted to pick my own funds. I’m also a big believer in equities over the long term, and since I think I have the stomach to withstand a few market corrections, I’m okay going with a 100% equity portfolio. This is really key. If you’re going with an aggressive asset allocation, you have to keep telling yourself not to mess with your investments. Otherwise, you’re going to end up losing money.

Large Cap Investments

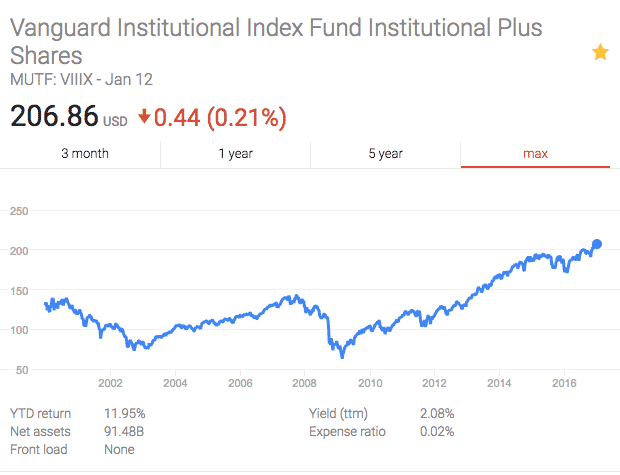

Immediately, my eye gets drawn to the Vanguard options (your eye should also get drawn to anything Vanguard!). And the meat of my portfolio goes to the Vanguard Institutional Index Fund (VIIIX).

This fund is basically designed to track the S&P 500, which is the benchmark that almost everyone uses when thinking about their returns. What makes this fund really good are the super low costs. The fund has an expense ratio of just 0.02%, which is just crazy low. If I really wanted to, I could probably put 100% of my contributions into this fund and be perfectly fine. I allocate 40% of my 457 contributions here.

Mid-Cap Investments

There are studies out there that say weighting into other, more risky asset classes, results in higher yield over the long term. This makes intuitive sense if you think about it. The riskier the asset, the more return I should be able to get. Otherwise, why would I (or anyone else) ever invest in it, right?

The key, of course, is to get the right level of risk. That’s why mid-cap and small-cap funds are a nice addition to your portfolio. You still get safety in being invested in a ton of companies, but you’re also invested in companies that have the potential to grow faster compared to traditional large-cap companies.

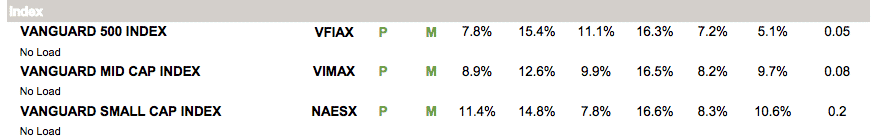

In terms of my options, again, I’m drawn to Vanguard, so right away, I’m looking at the Vanguard Mid Cap Index (VCMPX).

This is a terrific fund with an expense ratio of just 0.05%, which basically makes it a no-brainer in my book. I allocate 12% of my 457 contributions into this fund.

Small-Cap Investments

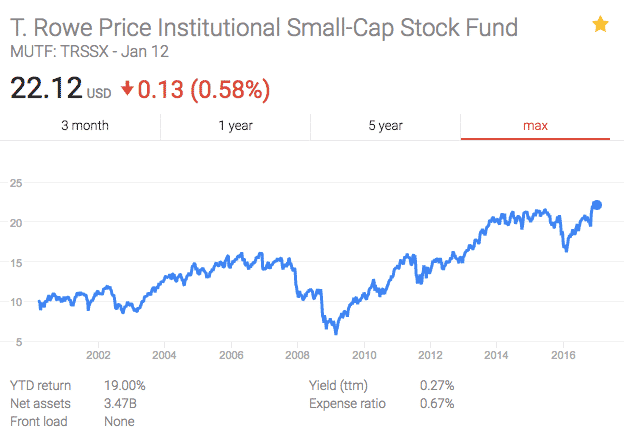

When it comes to small cap, I don’t have a ton of choices because, for some reason, my employer doesn’t offer Vanguard small cap options, even though it offers Vanguard everywhere else. Without a Vanguard option, I’ve instead just opted to go with the T. Rowe Price Institutional Small Cap Fund (TRSSX).

The expense ratio for this fund isn’t great at 0.67%. There’s also another problem with this fund. According to the prospectus, it’s an actively managed fund. Yikes!

I’m still sticking with this fund for a few reasons. First, there are some arguments out there that active management is more acceptable in the small cap space due to an “inefficient small cap market.” Second, I do like tilting some of my investments towards small cap simply because it tends to outperform large cap over the long term, resulting in greater returns. Third, small cap is a pretty small part of my portfolio, so I think it’s okay to have a bit of money invested in this way. It probably won’t make or break me, is my guess. I put 8% of my portfolio into small cap.

International Investments

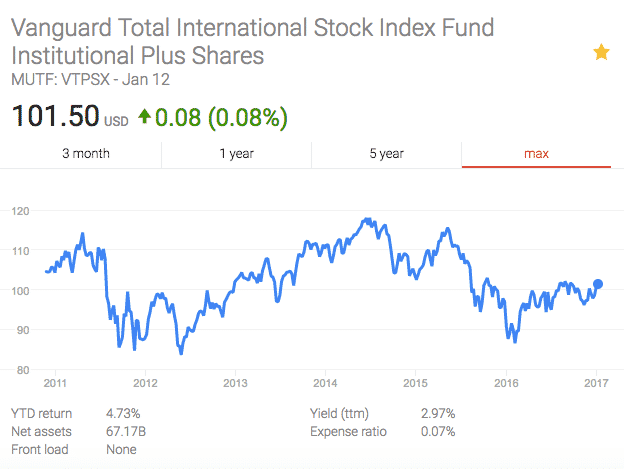

With 60% of my 457 contributions invested in domestic funds, I thought it made sense to throw some of my contributions into international funds. International funds aren’t a necessity for sure, but there is research out there which suggests that adding an international allocation can increase returns and reduce volatility.

For my international allocation, it’s no surprise – I go right to the Vanguard Total International Stock Index Fund (VTPSX).

With a 0.07% expense ratio, this is a very cheap fund. I put 40% of my 457 plan contributions here.

After it’s all said and done, my 457 allocation looks like this:

- Large Cap (VIIX) = 40%

- Mid Cap (VCMPX) = 12%

- Small Cap (TRSSX) = 8%

- International (VTPSX) = 40%

92% of my allocation has an expense ratio of less than 0.07%, which I think is pretty darn good.

Pension

A bonus that I get with my job is access to a defined contribution pension, which essentially acts as another retirement account for me. I’m required to put 5.5% of my salary into it and my employer throws in 6%. What this means is that, even with maxing out my 457 plan, I still get to put in another 11.5% of my salary into another tax-advantaged plan. Gotta love those sweet government benefits.

My pension has far fewer options to invest in, although that can sometimes be a good thing in order to avoid decision paralysis. Here’s a look at what my choices are for my pension plan:

These funds aren’t available to the public, so unfortunately, I don’t have any ticker symbols for them.

Like my 457 plan, I could just go with a Target Retirement Fund. My only problem with the Target Retirement Funds are that they allocate about 10% into bonds and I’d rather go with the 100% equity portfolio since I feel like I’ve learned enough over the years to handle the volatility.

Of these choices, my eye is immediately drawn to the first three funds, which my plan lists as the three most aggressive funds.

The fund labeled US Stock Actively Managed Fund is obviously out since I don’t believe in active management. Still, at only a 0.22% expense ratio, I could go for it if I really wanted to and I wouldn’t feel so bad.

The Broad International Stock Fund is also out. I already have a pretty high amount of international exposure in my 457 plan, so I don’t think I need any more over in this bucket.

Instead, I decided to contribute 100% of my pension contributions to the US Stock Index Fund. According to the prospectus, the fund invests in over 2000 stocks and is designed to replicate the Russell 3000 index. Most importantly, the entire fund is passively managed. Basically, this is just a total stock market index fund, much like Vanguard’s Total Stock Market Index Fund. And the expense ratio for the fund is only 0.02%, making it a super cheap choice. I’m putting my money here and just forgetting about it.

Health Savings Account

Finally, I thought I’d mention how I’m investing in my Health Savings Accounts (HSA). My employer contributes $800 a year into my HSA, so it makes sense for me to use it and snag the free money. At first, the options were terrible, but a few months ago, my HSA provider randomly decided to add three Vanguard funds. Score!

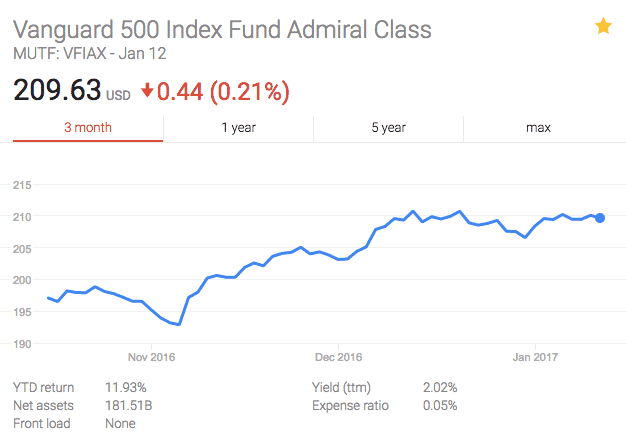

Since I only opened up my HSA in 2016, I don’t have a ton invested into it yet. For now, I’ve just put 100% of my allocation into the Vanguard 500 Index (VFIAX).

This is an S&P 500 index fund, and honestly, it’s probably enough to get me to the finish line if I wanted. I’ll probably just leave it like this for the foreseeable future, although I may add some small cap and mid cap exposure as I start putting more money into it.

Takeaways

Are my choices perfect? I have no idea. People love to argue about every little tiny detail of your portfolio. I say it’s fine to be close enough. It’s not all that productive to try to optimize every tiny piece of your portfolio, and really, it’s probably not even possible.

In the end, the main thing is to have a high savings rate and to keep your costs decently low. The funds I chose basically do that and I’m pretty happy with how I’ve allocated my contributions. Now I just need to keep putting money away and stop over analyzing things. The worst thing you can do is to mess with your investments too much. Just set up your contributions, rebalance it a few times a year (I automatically rebalance once per quarter), and leave it be!

With that said, I’m still open to suggestions if anyone sees a way to improve what I’m doing here.

How do you invest in your employer-sponsored retirement plans?

Related Reading:

How I Invest In My Employer Sponsored Retirement Plans, Part 1: My Core Investing Philosophy

How I Invest In My Employer Sponsored Retirement Plans, Part 2: Know Your Plans

I’m in a target retirement fund – 2045. I’m very nervous about the thought of re balancing myself and this fund does it automatically to more conservative investments as you approach your retirement year. I guess the drawback is perhaps higher fees, but I do get some peace of mind.

Btw, it’s a great benefit that your employer contributing to your HSA….these costs are only going up!

Target Retirement Fund is a totally great choice! No pain at all. All you have to do is just keep throwing money into it and you’ll be great! Fees might be a little higher, but as long as they are still reasonable, I wouldn’t worry too much. Fees do matter, sure, but what matters more is getting money saved.

I am pretty happy with those HSA contributions for sure!

Good points about adding Mid and Small Cap to your portfolio. Currently, I’m 100% invested in a Vanguard total stock market index fund. Once I’m debt free and can start contributing significantly more to my 401k/Roth I will add some Mid/Small and International to my portfolio.

People love to spend time optimizing and debating perfect asset allocations. I plan to set it and forget it and spend time focusing on making more money! Hopefully that works out for me 🙂

I think it’ll work out well. Going total market fund is obviously a perfectly good and easy asset allocation that you can’t mess up with. And considering the fact JLCollins says its the right move, I would say it’s well approved by the experts!

YESSSSSSSSSSSS! I loved reading this FP. Love the 100% equities. I’ve been riding 100% for the past 7 years and probably won’t dial back until I’m 40 (so 8+ years). The best decision you made hear from my standpoint is the 40% in VTPSX. International + Emerging markets are a significantly better value than the US equities market. A big mistake I see people making is not investing enough in international. Great call! You are so lucky you get Vanguard option. AND THAT 11.5% PENSION…. WHAT? I’m heading NORTH! Thanks for sharing.

How much to put into that international allocation is definitely something that a lot of people seem to debate these days. I think having something in there for sure makes sense, and considering I can snag it for so cheap, it makes sense to have it. And yeah, that pension plan is pretty awesome.

100% equities! Wow, ballsy!

I think in your case, since you’re still working and don’t need to rely on it as an income stream that works for you. Good thing you’re indexing and not picking individual stocks (when you said you like to pick you own funds, I initially thought you meant individual stocks) Let’s hope the ride doesn’t get too crazy with Trump as president…

Oh, I don’t play that individual stock game. I’m way too dumb to figure that stuff out! Indexing all the way for me!

I think given the fact that I’m still working and investing significant chunks, going 100% equities is okay simply because I get a natural smoothing out of volatility with my regular contributions. If/When the market drops, it’ll hurt just a little less since I’m throwing more money in to replace my losses. Plus, JLCollins says young folks like us can go 100% equities during the wealth acquisition phase of our investing career. If I ever do reach FI like you, I’ll probably copy you and go with something like a 60/40 split.

I invest similarly in my 457 plan as I have some of the same options. I used to have the international fund but got rid of it. I hate timing the market and it might be another time that I bought high and sold low but international fund was underperforming. JL Collins mentioned that he didn’t think international exposure was necessary since most big US companies are multinational companies. I’m pretty sure I just used that as an excuse though. Sometimes I can’t help but tinker with it. I also have a small amount in bonds because I was thinking this bull market was long in the tooth and when I thought about going with 100% equities we got this new PEOTUS…and I’m a little worried about the uncertainty.

It can be frustrating that international hasn’t been getting great returns lately. I am a huge JLCollins fan, so I totally get why international isn’t necessarily a required asset class. My thought though is that it provides helpful diversification since international outperforms US about half the time – at least from some studies I’ve seen.

No doubt this bull market can’t last forever, but really, for someone like me who’s just starting out their investing journey, a correction is probably what I need. Folks who started their first jobs during the 2008 crash did pretty darn well if they stuck it out. For myself, I’m just sticking with my plan and trusting that companies will continue to innovate and grow. 10 years ago, the world looked very different from what it looks like now. It’ll be crazy to think what the world will look like in another 10 years.

Your employee pension plan is great. That is a real nice savings vehicle in addition to your 401(k) and HSA.

How much time did you spend researching the specific funds you wanted to invest in?

The pension thing is something I didn’t even know was a benefit, but it’s really awesome for super savers like myself. You can really do a lot of damage.

To be honest, I didn’t do a ton of research beyond just reading the prospectus that my employer gave us. Basically it was just a matter of crossing off all the high fee options, and going for the lowest cost ones that were in the asset classes I wanted.

Holy crap, FP! I love it. Way to kick ass. Were I your age, I would do the exact same thing. One hundred percent equities. Save a lot, watch fees, and don’t panic–that’s the key to successful investing. The future looks bright, my friend. Congrats.

Thanks Mr. Groovy! Always like getting your groovy approval!

Thanks for spreading the word FP! I too am a huge believer in the passive machine index with minimal fees. Many of my former coworkers think I’m insane and are currently investing with an active investor charging them something along the lines of 2-4% with a “guaranteed” return of 12%. His catchphrase was somewhere along the lines of “if you don’t eat, I don’t eat” and would lower his fee if the guarantee’d rate wasn’t met.

I said it was snake oil and wished my buddies luck. Time will tell, but I’m happy trusting a cheap version of “Skynet” that’s just set up to track the market. Lost a good friend (absurdly in my view) over the difference, but I do wish him well, I just don’t want to put cash in the same place!

It just seems so crazy to me that people still go for those type of investments. One thing is that us personal finance dorks are pretty entrenched in our world, so we often forget that the majority of people don’t think the same way as we do.

My 401(k) only has one low-cost fund in it right now (Vanguard Target Retirement 2055 – VFFVX) so for the time-being, I have everything in that.

My Roth IRA is almost all Vanguard Total Stock Market ETF (VTI).

I’m now looking at investing in my HSA so your post was pretty well-timed. The problem I have is that even though they’ve switched everything to Vanguard funds, they’re charging ridiculous fees:

VBIRX Vanguard Short-Term Bond Index Adm 0.13%

VIIIX Vanguard Institutional Index Instl Plus 0.42%

VBMPX Vanguard Total Bond Market IDX Instl Plus 0.44%

VEMPX Vanguard Extended Market IDX Instl 0.45%

VIGIX Vanguard Growth Index I 0.47%

VIPIX Vanguard Inflation-Protected Sec Instl 0.47%

VTPSX Vanguard Total Intl Stock IDX Instl Plus 0.47%

VMVAX Vanguard Mid-Cap Value Index Adm 0.48%

VSIAX Vanguard Small Cap Value Index Adm 0.48%

VSMAX Vanguard Small Cap Index Adm 0.48%

VVIAX Vanguard Value Index ADM 0.48%

VGSNX Vanguard REIT Index Instl 0.50%

VMIAX Vanguard Materials Index Adm 0.50%

VEMIX Vanguard Emerging Mkts Stock IDX Instl 0.52%

VTABX Vanguard Total Intl Bd IDX Adm 0.54%

VTINX Vanguard Target Retirement Income Inv 0.54%

VTWNX Vanguard Target Retirement 2020 Inv 0.54%

VTHRX Vanguard Target Retirement 2030 Inv 0.55%

VFIFX Vanguard Target Retirement 2050 Inv 0.56%

VFORX Vanguard Target Retirement 2040 Inv 0.56%

VTTSX Vanguard Target Retirement 2060 Inv 0.56%

VWIAX Vanguard Wellesley Income Admiral 0.56%

I’m thinking of putting most everything in Vanguard Institutional Index Fund (VIIIX), but notice how mine charges 0.42% as opposed to the 0.02% you’re getting… bastards!! 🙂

Kind of sucks don’t you think?

— Jim

This is the one thing I’ve noticed with HSAs, they’re pretty expensive. I actually went with Fidelity initially for my HSA and opted to forego payroll deductions into my HSA because the funds offered by my employer tied HSA provider were so crappy. Even with Fidelity, they charged 48 bucks a year as an administrative fee, which is fine if you have a decent amount of money invested, but is a really high expense when you’re just starting out.

Do you know if your HSA has administrative fees as well? Mine charges us $18 a year. If the fee isn’t so bad, I’d still probably just go with VIIIX, even at the rip-off price they’re giving you, simply because you can avoid FICA taxes on whatever you contribute. Assuming you max out your HSA at $3400, you save yourself about $268 in taxes. That’s an immediate return right there that at least makes up for the higher expenses. And as far as I know, there’s no other way to avoid the FICA taxes.

Excellent point about the tax savings – I forgot about that one!!

I did get charged an administrative fee until my balance was high enough that they waive it. I think I will go the VIIIX route… though I’ll probably wait for a bad market day before I jump in. 🙂

Great blog post!!

— Jim

Thanks for the transparency and detail on what you are investing in! Very interesting read!

Question for you on the HSA. I know you’ve mentioned that you are pretty healthy and don’t have to go to the doctor too often, but what is your plan if you do end up going to the doctor? Will you use the money in the HSA, or will you pay out of pocket and keep the HSA invested? Are you holding back any cash in your HSA or are you investing it all? My employer now offers an HSA, so I’m thinking through the best way to use it.

The plan at the moment is to pay out of pocket and keep the HSA money invested. MY HSA provider requires us to keep $1000 on the side as cash before allowing us to invest, so it’s pretty significant cash drag, but I also see it as a backup, medical emergency fund.

Honestly, if you’re young and in good health, I think HSAs are the way to go. For me, it really makes a lot of sense since I never go to the doctor and my significant other is a dentist. I already get free teeth cleanings and things like that, for example.

Do a little research into your HSA to figure out what type of investment options you have. The real value in the HSA comes if you’re already able to max out all of your other retirement accounts because then you’re snagging yourself some extra tax-advantaged space. One thing I’ve noticed is that HSAs are often expensive with administrative costs, from what I’ve seen, so you need to aim to get a lot of money in there quickly in order to try to minimize the costs.