The start of April means it’s tax time here in the Financial Panther household. As I’ve been gathering up all my tax documents, I thought it’d be helpful to share with you exactly what I made in 2016 via the sharing economy.

Without a doubt, 2016 was my biggest side hustle year. Altogether, I pulled in a total of $14,181.43 by taking advantage of sharing economy apps like Airbnb, DogVacay, and Postmates! That’s a pretty surprising number to me, especially considering the fact that I spent essentially no money in startup costs and that I made this money by doing things that I was already doing anyway.

The key thing about this type of income is that, for the most part, anyone can do it! A lot of people in the online space detail the type of money they made through side hustling. Most of the time, much of their side income comes from writing or writing-related endeavors. This makes sense of course. Folks in the online space tend to be writers and content creators. It’s natural that much of their side income would come from doing something they’re already good at.

The thing is, making money from writing is often not all that helpful for someone who’s trying to make some side money right away. I do think writing and blogging are terrific avenues to make money, but there are no guarantees and unless lightning strikes, it’s likely going to be a slow process before you can begin earning significant money from it. It’s also important to remember that not all of us are natural writers or have that skill in our wheelhouse. I think we can all be content creators for sure. But not all of us were born to write.

That’s why I think this post can be a really useful source of information for anyone out there who’s wondering how they can make some extra money immediately. Being able to utilize the sharing economy is the way I make most of my side hustle income. And the great thing is that these side hustles are a low-risk endeavor. It doesn’t cost anything to get started. The sharing economy is one of the few ways you can start up your own business without spending anything to get started.

These side hustles also don’t have to take up too much of your time. All you have to do is monetize the things you’re already doing. I have a full-time and pretty demanding job during the day. Yet I was still able to incorporate these side hustles into my life without losing a ton of my time.

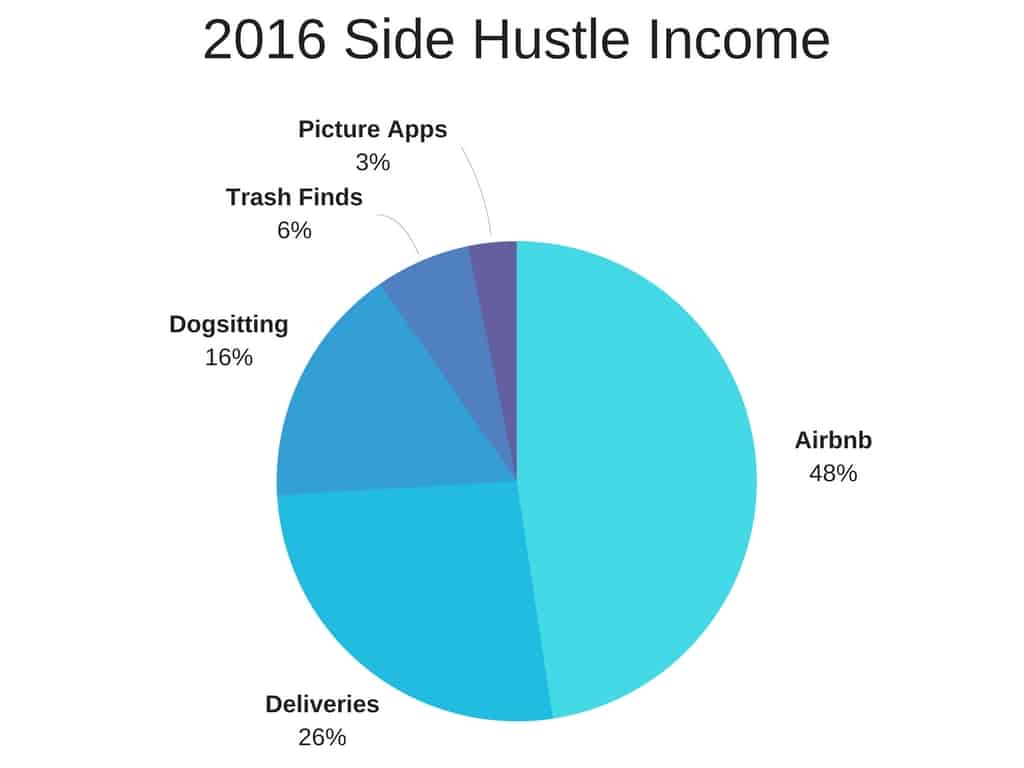

- Airbnb – $6,762

- Delivery Apps – $3,736.13

- Dogsitting – $2,312

- Selling Trash Finds – $906

- Picture Apps – $465.30

Total – $14,181.43

Here’s a chart breaking out each of these earnings by percentage:

You can see that about half of my side hustle income in 2016 came from Airbnb, with the remaining half coming from a combination of doing deliveries, dog sitting, and selling trash. Let’s break it down a little bit more.

Airbnb: $6,762

The biggest source of my side hustle income in 2016 comes from Airbnb. For most of us, our house is the most expensive thing that we own. It’s sort of fitting that it should generate the most income.

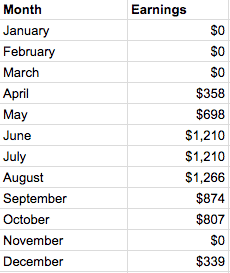

Here’s what my 2016 Airbnb earnings looked like, broken down by month:

Bringing in almost $7,000 from a spare room in my house is a pretty decent chunk of change. If I were to rent out the room to a traditional roommate, I’d bring in about $500 to $600 per month. That would also come with the downside of actually having to live with a roommate for an entire year. Instead, by utilizing Airbnb, I’m basically able to monetize my home while maintaining the flexibility of having the house to myself when I want it.

As a side hustle, Airbnb works particularly well if you don’t need the money in order to live. Our household can afford our mortgage without any problem. Since we don’t “need” the money, I have a lot of flexibility to block off days when I don’t want guests and to be a bit more particular about the guests that I allow into my house. The Airbnb income is really just icing on the cake for us – a way to make better use of our unused space.

Anyone Can Make Money With Airbnb

Airbnb is something that anyone who wants to make some extra income can do. If you own a home, I’m willing to wager that you probably have a spare room that sits unused most of the year. Why not try monetizing that room just to see if the Airbnb experience is worthwhile for you? The good thing is that renting out a room on Airbnb shouldn’t require you to spend any additional money on furniture. If you already have a guest room, you probably already have all the stuff you need to start hosting right away.

The flexibility to host when you want is why I’m a big Airbnb advocate. Take a look at my 2016 Airbnb earnings in graph form:

You can see the fluctuation in my earnings throughout the course of the year. I didn’t put my listing up until April, and even then, I was a little bit nervous so I only accepted a few people that month. As I got more comfortable, I decided to accept more guests. The vast majority of these guests were students coming into town for conferences or interviews.

You can then see the drop off that occurred in the last two months of the year. We had family coming to stay with us for November and December, so we ended up blocking off all of November and most of December so that we could have the house to ourselves. You don’t get that type of flexibility with a regular roommate situation.

My guess is that, for most people, the only time their guest room gets consistently used is around Thanksgiving and Christmas. Most other times, the room probably sits empty. Why not make a little money on what’s probably your largest asset?

Things To Think About If You Want To Start Hosting On Airbnb:

There are a few things to think about if you’re thinking about getting into the Airbnb world:

- What kind of guests are you looking for? I didn’t realize it at the time, but this is hugely important. We tend to think of Airbnb as a platform for vacationers, but in reality, there are way more than just vacationers looking to use Airbnb. Your location is going to determine what type of guest you get. I happen to get primarily students and young professionals staying at my house since I happen to live near a major college campus. If you’re thinking about starting up on Airbnb, try to think what type of people will be coming into your area and whether those are the type of people you’d be okay with having in your house.

- Airbnb guests are not the same as roommates. I’ve said in the past that an Airbnb guest is just not the same as a roommate because it’s a different mindset. Someone staying in your house as a visitor comes into your house knowing that they’re a guest. They tiptoe around. They’re much more respectful of your stuff. Just think about how you act when you stay at a friend’s house. That’s pretty much how people staying in my house treat my place. If you’re the type of person that hates having a roommate, remember that Airbnb guests are, in my opinion, way easier to get along with than a roommate. And the great thing is that, if you don’t like them, they’re going to be gone soon anyway.

- You don’t need a fancy place to do Airbnb. I live in a really old house and rent out a pretty tiny room. The room doesn’t come with its own bathroom or anything either. A lot of people figure that if they’re going to list their place up on Airbnb, it needs to be some fancy place. This just isn’t true. All you need to do is have a decently clean place for people to sleep and to be a nice, normal person.

- Consider the Masters Rule. If you’re still on the fence about doing Airbnb, my challenge to you is to try renting out a room for 14 days of the year. That’s only about 2 days per month, which I think anyone can do. The great thing is that, if you rent out your house or a room on Airbnb for 14 days or less, you’ll pay zero federal taxes on that income. It’s a little-known tax break that anyone can take advantage of these days. And it’s one of the few ways to earn completely tax-free income.

Related:

- Earn Tax Free Airbnb Income With The Masters Rule

- Making Money With Airbnb: Why I Rent Out Our Guest Room

Postmates/Caviar/DoorDash/Uber Eats: $3,736.13

Getting into the delivery game is one of the more unique things I’ve done and honestly, is the side hustle that I have the most fun doing. Maybe it’s the game like aspect of it. I really enjoy turning on the delivery apps and getting sent on a little bike mission. Plus, it’s not often that a lawyer works as a delivery person in their spare time. It helps to keep me humble.

The great thing about doing deliveries is the fact that I’m able to get paid to bike around town. As a side hustle, I think doing deliveries on a bike is preferable to driving for Uber or Lyft. Most of us with day jobs spend 8 hours or more per day hunched over a computer. Instead of spending more time sitting, I think it makes sense to get out on a bike after work and get a little bit of exercise.

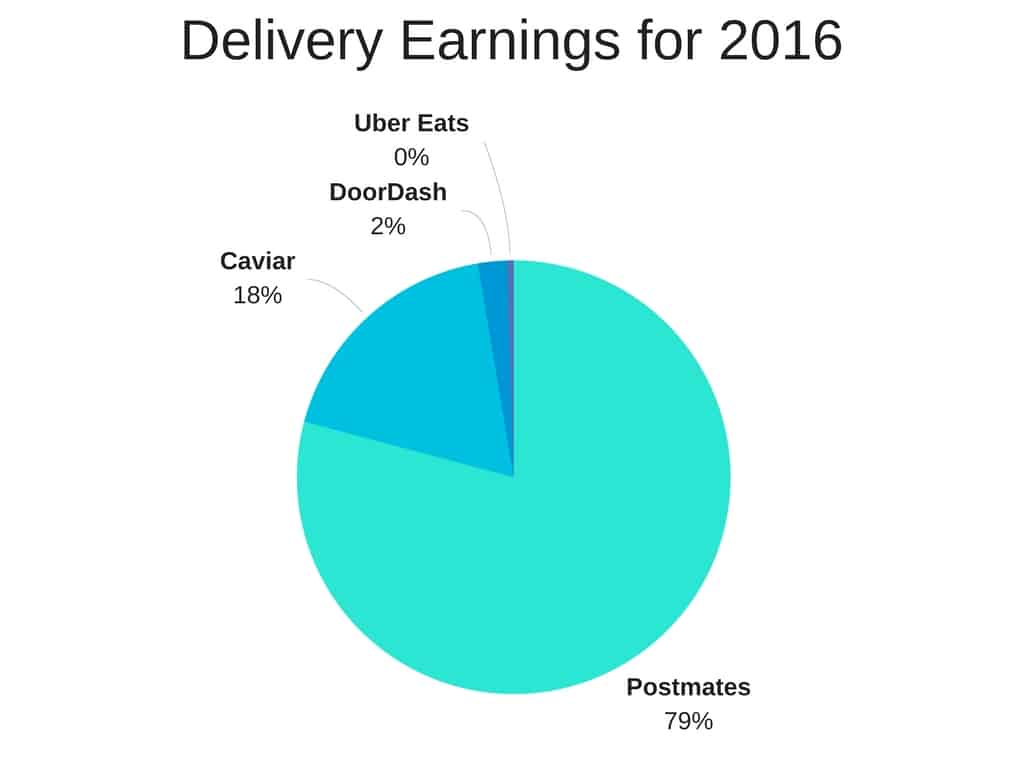

Here’s the breakdown of my earnings in 2016 on each delivery platform:

- Postmates – $2,956.48

- Caviar – $679.97

- Doordash – $82.17

- Uber Eats – $17.51

Total – $3,736.13

Being able to stack multiple platforms is key to keeping yourself busy doing deliveries. The good thing is that it doesn’t take much work to get signed up on each platform. Postmates, for example, doesn’t even require you to attend an onboarding session anymore. Uber Eats only required me to go to the office just to activate my account. And once you’re set up on a platform, all you really need to do is make a delivery on that platform every once in a while to make sure that you don’t get deactivated.

Here’s a chart breaking down my delivery earnings by percentage earned on each of these platforms:

The main reason for the big differences in earnings has to do with how long I’ve been on the platform. I signed up for Postmates back in October of 2015 and did Postmates deliveries throughout 2016. Hence, why it accounted for a disproportionately large share of my delivery earnings. It also helped that back in October, I referred my fiance to Postmates and had her do 30 deliveries in order to snag a $500 referral bonus.

Caviar is another platform that I really liked and it was actually my first foray into the bike messenger world. It opened up in the Twin Cities back in June of 2015, but unfortunately, it closed in this market back in June of 2016. As a result, the $600 I earned on Caviar represents my earnings up until it shut down.

Doordash and Uber Eats are both platforms that I only recently signed up for. At the moment, Doordash has a ton of potential and my plan for 2017 is to work in more Doordash orders. Out of all the delivery platforms, Doordash is definitely the one where I think significant money can be made. The main reason for this has to do with the way tips are completed in the app. Customers are asked to tip before their order is received. As a result, most customers tip, since they’re afraid that they’ll get bad service if they don’t tip. In contrast, with other delivery services, it’s much easier to stiff someone on a tip after you’ve already received your food.

Should You Do Deliveries?

If you’re the type of person who likes biking, then doing deliveries is an easy way to pull in a little bit of income while also exercising your biking muscles. You won’t get rich doing deliveries, but when you consider the fact that you’re getting paid to essentially exercise, it makes doing deliveries on your bike much more valuable.

Making $50 a week doing a few hours of biking is easily doable. If you do that all year, that’s an extra $2,500 a year or so. That’s significant money. And as a bonus, you’ll be getting a ton more exercise compared to most people.

If you’re interested in signing up to do deliveries, consider using my referral codes:

- Postmates – Unknown referral bonus. Typically requires completing 30 deliveries within 30 days to qualify for a bonus.

- DoorDash – Unknown referral bonus. Typically requires doing 50 deliveries within 30 days, which makes it hard to earn if you’re just doing this as a side hustle.

- Caviar – Unknown referral bonus.

- Uber Eats – Very easy bonus to get. All you have to do is make 10 deliveries to get a $100 bonus on top of your delivery earnings. I think it’s worth signing up to snag the easy $100 bonus.

Related:

- My Postmates Side Hustle: Getting Paid To Bike Around Town

- Is It Possible To Make Over $50 Per Hour As A Bike Messenger?

DogVacay/Rover: $2,312

Anyone who owns a dog knows that, no matter what, your dog takes work. Every morning, I have to wake up and feed my pup and take her out on a walk. And in the evenings, I have to make sure I’m back home in time to feed her and let her out again.

By utilizing the sharing economy, you can essentially monetize your dog ownership tasks. If you already have a dog, it doesn’t add much work to take care of a second dog every once a while. That’s why dog sitting has worked out really well for our household. Our dog gets a puppy friend to play with. And we get to make additional money doing the dog care tasks we’re already doing anyway.

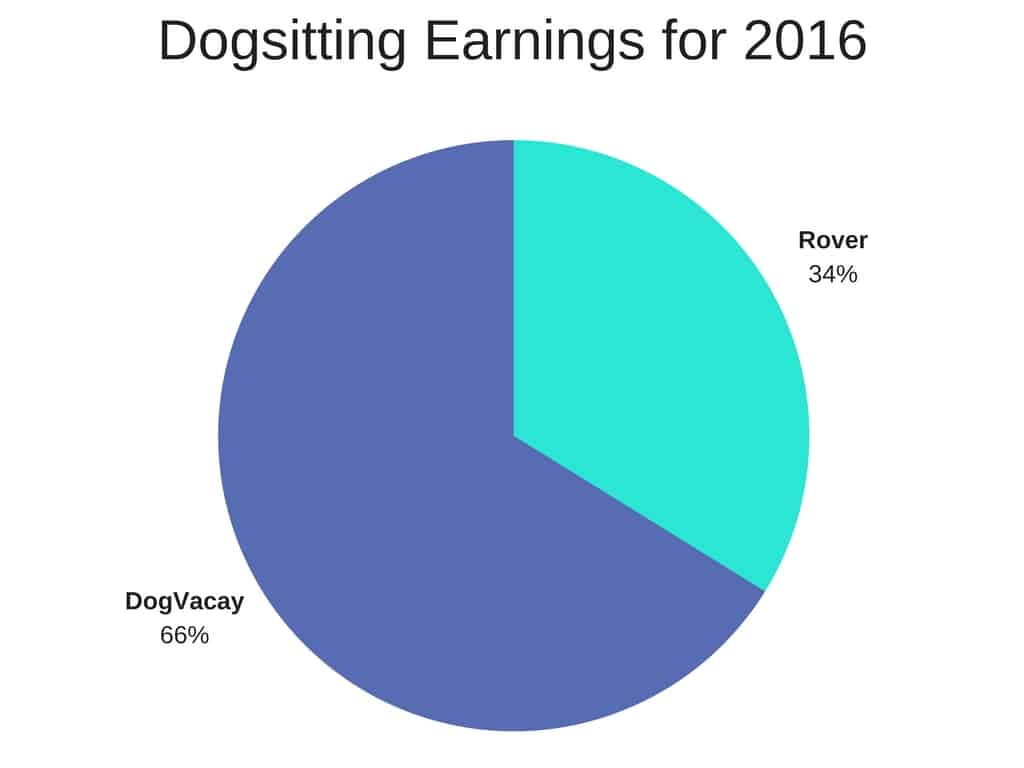

Here’s the breakdown of my dog sitting earnings for 2016:

- DogVacay – $1,530

- Rover – $782

Total – $2,312

As you can probably see, DogVacay was the much bigger performer this year. For whatever reason, my listing continues to drop in Rover and I can’t figure out how to drum up business on that platform. I suspect that 2016 will continue to see more DogVacay requests.

This is one of the reasons platform stacking is so important when using these sharing economy platforms. You never know what might happen on any particular platform, so it’s a good idea to get as many eyes on your listing as possible by getting your listing put up everywhere.

I find dog sitting fun and it’s something that anyone who already owns a dog can probably do. This is especially true if you have a dog that already gets along well with others. In a situation like that, you’re not really adding on any additional work. Taking care of two dogs is really no different than taking care of one. Plus, I get to watch dogs that look like this:

Related:

Trash Finds: $906

I’m thoroughly convinced that I could sell around $1,000 worth of trash finds every year. Even after I moved away from that magic dumpster, I was still able to find a ton of trash to sell, mainly because of all the trash the college kids threw out during the moving season last August.

If you don’t think there’s a lot of trash out there, my advice is to keep an eye out. I guarantee there’s perfectly good furniture getting thrown out in your city every month. People are just wasteful. It really shocks me to see how much perfectly good stuff people throw out every day.

In hindsight, I feel a little bad about my own trash history. Back when I graduated from college, I definitely ended up throwing away a bunch of perfectly good furniture instead of trying to sell it or give it away. A lot of it has to do with laziness. Most of us don’t plan ahead very well. Much of it also has to do with not understanding the value of our stuff. When we see something as trash, we assume no one else would possibly want it. You’d be wrong to think that. My experience selling stuff I find in the trash shows that there are a ton of people out there willing to buy our stuff.

Being able to make nearly $1,000 from stuff I literally found in the trash is pretty amazing. Just take a look at some of the awesome stuff I found in 2016:

In terms of logistics, I sell all of my trash finds on platforms like Craigslist or OfferUp. If I find something small, I’ll list it up on eBay as well. The key with selling trash finds is to try to meet at a public place near your house. Most people on Craigslist or OfferUp will flake out, so you don’t want to waste your time meeting someone in a spot that forces you to travel. I always tell people to meet me at a gas station down the street from my house and then to text me when they get there. That way, it’s on them to show up and I don’t risk wasting my time on a no-show.

Ultimately, for me, selling trash finds is motivated by a mix of profit motive and trying to do my part to prevent waste. I feel pretty good knowing that I’m saving a perfectly good piece of furniture from ending up in a landfill. If I can make a little income from it too, all the better.

Related:

Picture Apps: $465.30

If you’ve been following along with my side hustle reports, you might notice that I’ve never talked about these “picture apps” before. To be honest, I’ve basically been forgetting about these apps because of the small payouts I receive each time. Surprisingly, though, once I added up my earnings, it actually ended up being a significant sum of money that I can’t ignore. So I figure I’d better share it with you.

GigWalk/EasyShift/Field Agent

I use three picture apps that help me to make a bit of extra money. The three apps are:

- GigWalk

- EasyShift

- Field Agent

They all work in pretty much the same way. Companies often want to audit stores to make sure that their products are being properly displayed. Each of these apps typically lists a bunch of gigs that are available on a map. At each store that has a gig, you basically take pictures as instructed and then upload them in their respective apps.

Here’s an example of the type of picture that I’ve been asked to take in the past:

In this case, my guess is that these wine companies were looking to make sure that their wines were being properly displayed in the store.

The one thing about these apps is that you have to take the pictures in secret. Most stores prohibit customers from taking pictures. If they catch you, they’ll often kick you out of the store. I’ve personally only been kicked out of one store in my life. Most of the time, I’m able to take my pictures pretty secretly.

As a side hustle, it’s not possible to survive off these. And I don’t think it’s worthwhile to travel to do any of these gigs. I basically use these apps to make a quick buck if I happen to be near a store with a gig opportunity. For example, there’s a liquor store near my house that often has these type of gigs available. If I happen to see it, I’ll usually just swing by the store on my way home from work. Or if I’m out doing deliveries, I’ll sometimes go into a store if I happen to be near one. Each gig pays a really small amount – usually somewhere around $3 to $7 per gig.

These are small amounts that don’t look like much. But surprisingly, they add up over the course of a year. Check out what I made on each of these apps in 2016:

- GigWalk – $61.50

- EasyShift – $153.80

- Field Agent – $95

You need to be careful about which gigs you pick, though. EasyShift tends to have the most gigs, but they often have gigs that take way too long and are basically impossible to complete without being caught by a store employee. At this point, I know which ones to avoid, but I’ve had frustrating experiences going into a store and realizing that the gig was basically impossible to complete. Field Agent and GigWalk both tend to have easy to complete gigs that take a few minutes to complete. I always think those are worth doing if you happen to see one nearby.

WeGoLook

I’ve also been doing the occasional gig using an app called WeGoLook. The concept for WeGoLook is pretty interesting. Basically, when someone gets into an accident, an insurance company will need someone to go and take pictures of the damage or accident scene. Instead of dispatching a claims adjuster to go to the scene, WeGoLook instead finds random people like me to go do it. Generally, it takes me about 15 minutes to take the pictures. Payouts for each gig ranges from $20 to $25.

Again, these aren’t huge amounts of money and I don’t think it’d be worth traveling to take these pictures. However, if the place is nearby, I’ll often just grab the gig and take the pictures. Last year, for example, I accepted a WeGoLook gig to take pictures of a fence at a store near my house. Someone had apparently driven into it and the insurance company needed a claims adjuster to head out there and take photos of the damage. Biking over there only took me 10 minutes and it only took me 5 minutes to take pictures of the damage. With a payout of $25, I figured it was worth the time.

Another time, I accepted a gig to take photos of a random intersection out in the burbs. Since Ms. FP and I wanted to get in a long bike ride, we figured, why not bike to this intersection? Remember that screaming Kevin doll I found at a yard sale last year? I found that because I happened to be on this long bike ride. If I hadn’t been doing a WeGoLook gig, I’d never have stumbled onto that random yard sale.

My total earnings in WeGoLook for 2016 ended up being $155. Not bad for a random picture app.

Takeaways

Okay, this is a pretty massive post. If you made it this far, good for you! If not, just look at what I earned and consider these three takeaways:

1. It’s Possible To Make Decent Money From Day One In The Sharing Economy

Blogging is a great way to make money, but it takes a ton of work, a little bit of luck, and a lot of time. If you need to make money now, blogging is probably not going to do it for you. Like any business, you’re going to have to work for nothing and operate at a loss for at least a little bit before you can start making some decent money. Not all of us want to or can afford to do that.

That’s why the sharing economy is so great. You can make money immediately. Just look at me. I made $14,000 in 2016 using just the stuff I already have! This is money that I think anyone can make. While it might not seem like you’re making a lot of money at any given time, when you add up what you earn, it can surprise you. An extra $14,000 in a year is no joke. And you can start getting to that figure immediately.

2. Figure Out How To Monetize Things You’re Already Doing

The key to side hustling using the sharing economy is to not spend too much time spinning your wheels. Instead, use the sharing economy to monetize things you’re already doing.

That’s why I love my method of side hustling. It doesn’t really feel like I’m doing any additional work. Biking is something I already do. It makes natural sense for me to get paid while I do it. The same is true of dog sitting or renting out a room on Airbnb. I already have to keep my house clean for myself. It really doesn’t add much work to keep my house clean for an Airbnb guest.

All you need to know is that I work pretty long hours as an attorney. If these gigs required a ton of extra work, it wouldn’t be possible for me to do them.

3. Just Get Started

The real benefit of the sharing economy is that it allows you to start your own business without having to commit to it. Most side businesses will require you to spend a significant amount of money at the outset. As a result, you’re taking on a bit of risk. If a side hustle isn’t working out, at a minimum, you have to recoup your costs or be okay with taking a loss.

With the sharing economy, all of that risk disappears. You don’t need a business plan or to figure out how to get your inventory. Just list up a room on Airbnb, put up a listing on DogVacay or sign up to do some deliveries. If you find out a side hustle isn’t for you, all you have to do is quit doing it. At most, you lose a little bit of your time.

I’m still a little bit shocked at how much I was able to make in 2016 on top of my regular day job income. For a lot of people, an extra $14,000 could be game changing. Just imagine what you could do with that type of extra money. You just need to get started!

How’d you make your extra income in 2016? What do you think you could do with an extra $14,000? Do you make any extra income using the sharing economy?

Well done! I will show this to anyone who’s negative about their income or job. If a lawyer dude can take on all these side jobs then theres no excuse.

Keep it up 🙂

Thanks! And yep, if a lawyer dude like myself can do this stuff and make extra money on the side, anyone can do it. Plus, this stuff is fun!

Nice article. Thanks for the read.

Do these side hustles fall under a business umbrella, allowing you to contribute to a solo 401K?

That would make some of these things much more attractive given the progressive nature of the income tax for those on the punitive end of the scale.

Yep. They’re all under my own sole proprietorship basically. The only thing that stinks is that I can’t put my Airbnb earnings into a Solo 401k because it’s technically “passive” income that falls under Schedule E. Basically, my Airbnb earnings are treated as rental income

Check out my article on how I set up my Solo 401k if you’re interested in learning more about my experience setting up a Solo 401k.

I like your advice to figure out how to monetize things you’re already doing. I lived in NYC for a little while and I mystery shopped there. It worked out really well with my schedule and there were often listings right around where my subway stop for work was, so I’d spend 5 minutes shopping, 10 minutes filling out the survey after and make a few dollars and get a free meal or something.

I think mystery shopping is usually a pretty pointless side gig because of the time spent vs money made ratio, but in that particular situation, it often worked out well for me!

Yep, I agree about the mystery shopping as well. I only those picture apps (which is basically the same as mystery shopping), when I happen to be around the area with the store. I never go out of my way to do them because it’s not worth it. It’s an easy enough thing to do though if you are in the area.

$906 selling other people’s trash is phenomenal! Way to go, FP!

Thanks! Not only is it just free money, but it’s also saving the environment and preventing waste. A double benefit!

That’s fantastic! Thanks for sharing FP. There are some I’ve never heard of before. I’m going to have to check out some of these when I have some more free time.

Glad you enjoyed it! You might not have as much time as a resident to do this type of stuff, but key is that there are opportunities out there to make a little bit of side income without a ton of work.

This is so cool. I’m amazed at how many opportunities there are to make money creatively and not having to be shackled to a 9-5 job.

It’s pretty nuts! And remember, this is money I’m making on top of my full time job! And I already work 9+ hours a day in my day job! Think about how much could potentially be made if I had more free time on my hands.

You’re so right about the door dash tip! I always feel bad not leaving a good tip because it’s given in advance and they still have my food. Thanks for sharing your side hustles and I love your ideas!

Thanks J! Here’s a little secret for you – The Doordash delivery person (dasher, as we call them) doesn’t even see the tip until after we give you the food. In theory, you can stiff us and we wouldn’t even know it! But don’t do it though. We need those tips!

Wow, this is a really impressive side income. What amazes me is how much related apps you have in the States. In Europe we’re really behind…

I imagine that there are more regulatory pressures in most of Europe that make these type of apps more difficult to launch. The US is much more lax in its workers rights laws.

The other reason I’ve heard to limit air bnb to a few days a year is home owners insurance. My insurance actually disallows running a business out of the home except where income is less then 5k a year… Check your insurance first. Even if Airbnb covers you you’d hate to have standard home owners reject you when the renter isn’t present over such a loophole.

Yeah, that’s a good point. So does that mean you couldn’t get a traditional roommate if you needed one? I imagine that’s running a “business” too, right?

Great work on the side income for 2016! Mine was basically zero. I can partially blame it on the fact that the sharing economy really hasn’t reached my small city. We don’t even have Uber or Lyft yet. In due time I’m sure.

Oh bummer! Didn’t think about it, but it’s true that a lot of this sharing economy stuff really only works in big cities. Although, things like Airbnb, DogVacay, and even those picture apps should still be at least viable in a small city. But yeah, didn’t think about that rural factor.

This is so helpful! I have applied for taskrabbit and Uber to try and juice up my side hustle! For females, Tradesy is awesome, my girlfriend has sold over $500 in 3 months of old clothes, bags, shoes, etc. Doesn’t seem to be a viable male counterpart yet!

Thanks for the very thorough post and best of luck hustlin!

Thanks! I’ve been wanting to do Taskrabbit, since it seems right up my alley of weird stuff to do, but they don’t have it in my market. Bummer! I’ll have to check out Tradesy. My fiance (soon to be wife) has a ton of clothes that I’d love to get rid of. Then again, I have a ton of crap too that I should probably start working on clearing out.

I’m going to start trying Airbnb. I have an extra apartment just sitting there, and it seems to be a waste of good side income. I don’t rent it out because I live there every once in a while, but short term rentals would be nice.

Wow, tell me more about this extra apartment! Do you mean you literally have an entire apartment that sits empty? Do you pay a mortgage on it? Seems like it’d make a ton of sense to try your hand out in the short term rental market. I will note that renting out a place you don’t live in takes a bit more logistical work, since you’re obviously not on site to handle questions or clean the place up.

I signed a one year rent on a studio apartment (dumb decision), but soon I bought my own place so I still have a few months left of the rent. Subcontracting is harder in Sydney. Oddly enough here, most contracts either last 6 months or 12 months. So not many people are willing to rent a place for 3-4 months.

Ah. Yeah, I know a lot of people that have gotten caught in the paying rent in two places situation. Typically, if you’re renting, you’re probably not going to be allowed to rent it out on Airbnb too per the terms of your lease. I can’t say whether I’d recommend doing that or not. You’ll have to consider the risk vs. reward in that type of situation.